Financial Results:

↗️$4,333M rev (+42.7% YoY, +41.9% LQ) beat est by 11.7%

↘️GM (46.7%, -3.9%pp YoY)

↗️Operating Margin (12.2%, +1.0%pp YoY)

↗️FCF Margin (31.5%, +6.1%pp YoY)

↗️Net Margin (7.9%, +1.3%pp YoY)

↘️EPS $3.97 missed est by -35.4%🔴

Revenue By Segment

Commerce

↗️$2,496M Commerce Revenue (+48.9% YoY, +112.6%FX-Neutral)

↘️385M Successful Items Sold (+25.0% YoY, -28)🔴

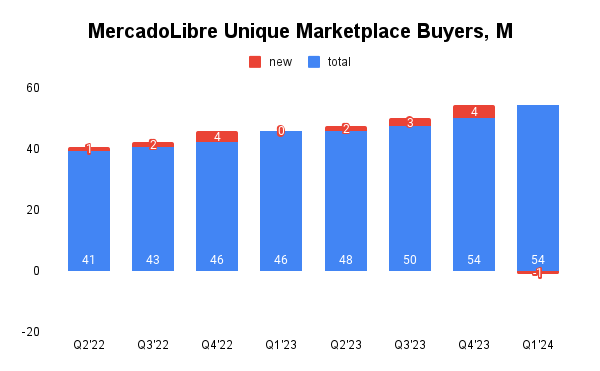

↘️54M Unique Marketplace Buyers ( +16.0% YoY, -0.9)🔴

➡️$11,365M GMV (+20.0% YoY, +71.0%FX-Neutral)

↗️Commerce Take Rate (22.0%, +3.7%pp QoQ,+4.2%pp YoY)🟢

Fintech

➡️$1,837M Fintech Revenue (+35.0% YoY, +73.7%FX-Neutral)

➡️$40,727M TPV (+10.0% YoY, +10.0%FX-Neutral)

➡️49 Fintech Monthly Active Users (+37.6% YoY, +3.2)

↗️Fintech Take Rate (4.5%, +1.3%pp QoQ,+0.8%pp YoY)🟢

Credit Portfolio

↗️$4,448M Credit Portfolio (+45.9% YoY)

↗️Credits NPL 15-90 (9.3%, +1.1%pp QoQ)🟡

↘️Credits NPL >90 (17.9%, -0.8%pp QoQ)🟢

↗️Credits NPL >15 (27.2%, +0.3%pp QoQ)🟡

Operating expenses

↗️S&M+Provision for doubtful accounts/Revenue 19.7% (19.4% LQ)

↘️R&D/Revenue 10.6% (16.1% LQ)

↘️G&A/Revenue 4.3% (4.7% LQ)

Dilution

↗️Basic shares up 0.9% YoY, +1.1%pp QoQ🟢

↘️Diluted shares down -1.0% YoY, -0.4%pp QoQ🟢

Key points from MercadoLibre ’s First Quarter 2024 Earnings Call:

Fintech and Commerce Performance:

Both sectors showed strong growth, particularly in Brazil and Mexico, which helped offset some of the challenges faced in Argentina.

The fintech sector saw significant growth in the credit portfolio and the expansion of services like the acquiring business.

Advertising Business:

MercadoLibre's advertising business experienced strong growth, reaching record levels of GMV penetration across all markets where the company operates.

The increase in ad penetration rates (from 1.6% to 1.9%) suggests an actual improvement in adoption rather than just a shift due to changes in GMV in Argentina.

There were several product improvements, especially in algorithms and search result placements, contributing to revenue growth.

Mercado Pago Performance:

Noteworthy performance in Brazil and Mexico, with significant sequential growth in the acquiring business and a solid credit growth portfolio which surpassed $4.4 billion.

Mercado Pago issued 1.5 million cards during the quarter, and the Total Payment Volume (TPV) reached $1.9 billion, growing 173% from last year.

Credit NPLs:

There was a noted decline in the 90-day NPL rate, although early delinquency rates increased due to a shift towards riskier credit cohorts.

The changes in credit strategy are aligned with better risk forecasting and pricing adjustments to manage the higher risk.

Challenges in Argentina:

Argentina faced a challenging economic environment, affecting consumer demand and leading to revenue growth that was high in nominal terms but below inflation.

The FX-neutral growth in Argentina was slower, impacting overall performance.

MercadoLibre noted that its marketplace in Argentina remains resilient despite the downturn.

Strategic Investments:

MercadoLibre has made strategic investments in infrastructure, particularly in logistics, which have contributed to faster growth in specific target regions.

New Products:

Mercado Pago Credit Card. Issued 1,500,000 cards during the quarter. Total Payment Volume (TPV) reached $1,900,000,000, growing 173% from the previous year.

QR Code Network and Credit Transactions Interoperability. MercadoLibre has built a successful QR code network in Argentina.

Strategic Updates and Future Outlook:

Despite some macroeconomic challenges, particularly in Argentina, MercadoLibre's diversified business model and strategic focus on growth and efficiency have enabled it to maintain a strong market position and continue delivering shareholder value.

Mercado Envios:

Shipping revenues in such transactions are booked on a gross basis, with associated expenses booked in cost of revenue (rather than netted against revenue when acting as "Agent"). This had a positive impact of $293mn on net revenue and a negative impact of $308mn on cost of revenue, with a small net negative impact of $15mn on gross profit and income from operations and $10mn on net income.

Management comments on the earnings call.

Advertising Business:

"Our advertising business continues to grow nicely and reach record levels of GMV penetration in all of the markets where we operate." – Richard Cathcart

"We had a very strong quarter in ads. As you said, penetration went up 30 basis points Q on Q and revenues grew 64% in dollars year over year, almost 100% in constant currency." – Ariel Sharfstein

Argentina Challenges:

"Argentina was a headwind in terms of EBIT, partially compensated at the net income level because of the lower FX and lower taxes that we paid this quarter in Argentina." – Martin De Los Santos

"In Argentina, we face two things happening: the devaluation, which reduced the size of our business...and then we have the macro situation that obviously put some pressure in terms of consumption." – Martin De Los Santos

New Products:

"This quarter, we issued 1,500,000 Mercado Cargo Credit Cards and the TPV reached $1,900,000,000 growing 173% from last year." – Richard Cathcart

Competitors:

"We are the leading e-commerce platform in the region, which has significant potential for growth from new buyers and higher frequency as engagement and penetration of retail rise." – Richard Cathcart

Customers:

"By building the fastest and most extensive delivery network in the region and by offering the widest assortment and the best UX, we have become a natural destination for buyers and sellers." – Richard Cathcart

Credits NPL:

"We saw a continued decline in the 90-day NPL, but there was an increase in early delinquency, which you mentioned is partly because of a shift in the mix of the risk cohorts." – Martin De Los Santos

Commerce:

"In summary, in Q1, we delivered strong operational performance in commerce and fintech, both in Brazil and Mexico, which has offset the negative impact of a weak macro in Argentina and the peso devaluation in that country." – Richard Cathcart

Thoughts on MercadoLibre Earnings Report $MELI:

🟢 Pros:

+ MercadoLibre remains the preeminent e-commerce and fintech player in Latin America

+ Revenue increased by +42.7% YoY, accelerating from the previous quarter's +41.7% (includes positive impact of $293M from Mercado Envios)

+ GMV growth in Brazil and Mexico was solid +30% YoY

+ Strong FCF margin

+ Both commerce and fintech revenues showed acceleration

+ The take rates for commerce increased from the previous quarter

+ The fintech segment experienced strong growth in monthly active users

+ Credits NPL >90 is declining

🔴 Cons:

- High currency risks and the credit portfolio may become problematic (inflation in Argentina)

- Revenue in Argentina decline 22% YoY

- GMV declined -16% QoQ, +20 YoY (due to Argentina’s inflation)

🟡 Neutral:

+- Dilution at 0.9% YoY

+- Credits NPL >15 slightly increased from 26.9% in last quarter to 27.2%

+- The number of successful items sold on the Mercado Libre marketplace decreased by 7% quarter-over-quarter, indicating a more pronounced seasonal effect than observed in Q1 2023. Despite this overall decline, sales remained robust in specific markets, with Brazil recording a 32% YoY increase, Mexico a 28% rise, and Argentina experiencing a 4% decrease.

+- Number of marketplace buyers overall declined, reflecting varied performance across regions: a slight increase of 1.5% YoY in Argentina, and more substantial growth in Brazil and Mexico, up 18% and 25% YoY, respectively

+- Upon recalculating, the take rate for fintech services slightly decreased from 5% in Q1 2023 to 4.5%.

+- The gross margin for Q1 2023 experienced a modest decline due to elevated rates, yet displayed a slight improvement compared to the previous quarter. This analysis includes the adverse impact of $15 million from Mercado Envíos. Excluding this negative influence, the gross margin aligns with the level observed in the corresponding period of the previous year.