Mercado Libre: Leading LatAm’s Digital Economy Through E-Commerce and Fintech Synergy

Deep Dive into $MELI: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

MercadoLibre: Company overview

About Mercado Libre

Mercado Libre is a leading technology company operating online marketplaces for e-commerce and financial services in Latin America. Incorporated in the United States and headquartered in Uruguay, the company has established itself as a dominant force in the region's digital economy. In the first quarter of 2025, it reported a net revenue of $5.9 billion, a 37% year-over-year increase, with a net income of $494 million. The company plans to expand its workforce by 33% in 2025, adding nearly 28,000 new jobs to surpass 112,000 employees across Latin America.

Company Mission

The company's mission is to democratize commerce and financial services in Latin America. This objective guides its strategy of providing innovative technological solutions to transform the lives of millions of people. By creating an inclusive ecosystem, Mercado Libre aims to empower entrepreneurs, consumers, and small and medium-sized businesses, fostering economic growth and social inclusion throughout the region.

Sector

Mercado Libre operates within the e-commerce and fintech sectors across 18 countries in Latin America. Its business is built on several interconnected units, including the Mercado Libre Marketplace, its core e-commerce platform; Mercado Pago, a comprehensive digital payments and financial services solution; Mercado Envios, a logistics network that shipped over 1.2 billion items in 2024; and Mercado Credito, its lending platform. This diversified model allows it to address multiple facets of the digital economy.

Competitive Advantage

Mercado Libre's primary competitive advantage is its deeply integrated ecosystem, which creates powerful network effects. The synergy between its commerce and fintech platforms drives user adoption and retention. Its fintech arm, Mercado Pago, has evolved into a digital bank, serving more than 60 million monthly users and processing $197 billion in payments in 2024. The vast amount of user data generated across its platforms gives Mercado Credito a significant edge in credit underwriting, enabling it to offer loans with lower acquisition costs and risk compared to traditional banks.

Total Addressable Market (TAM)

Mercado Libre operates within a $1 trillion Total Addressable Market (TAM) in Latin America, focused on e-commerce and fintech. The market is expanding rapidly, fueled by rising internet penetration and a strong consumer shift toward online platforms.

Latin America's e-commerce market alone is projected to hit $769 billion by 2025. With e-commerce penetration at just 11%, there's a significant gap compared to developed markets. Today, physical retail still accounts for 85% of total retail spending in the region—an opening Mercado Libre is aggressively targeting.

From 2024 to 2033, the Latin American e-commerce market is expected to grow at a 10.85% CAGR, expanding from $1.45 trillion to $3.26 trillion. The growth story here is not just compelling—it's just getting started.

Valuation

$MELI MercadoLibre is trading at a Forward EV/Sales multiple of 4.3, significantly below the average of 6.9 and near the valuation lows of 2019 and 2020. At the beginning of 2024, the Forward EV/Sales was 3.7.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$MELI MercadoLibre is trading at a Forward P/E multiple of 45.8.

The EPS growth forecast for 2026 is 38.6%, with a P/E of 48.8 and a 2025 PEG ratio of 1.2.

The EPS growth forecast for 2027 is 35.5%, with a P/E of 35.3 and a 2027 PEG ratio of 1.0.

Based on the PEG multiple, MercadoLibre is trading in the undervalued category.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts' revenue growth forecast for $MELI in 2025 is +33.8%, and in 2026 +24.6%. Considering this forecast, the valuation based on the EV/Sales multiple appears to be undervalued compared to other companies in the Fintech sector.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

MercadoLibre has built a powerful competitive moat. Its very strong economies of scale are driven by a proprietary logistics network and MELI Air. High switching costs lock in users through a deeply integrated ecosystem of services.

Economies of Scale

Mercado Libre has developed very strong economies of scale through its expansive logistics infrastructure and proprietary technology platforms. The company operates its own fulfillment network, Mercado Envios, which shipped over 1.2 billion items in 2024. Its logistics capabilities include proprietary airline operations through MELI Air, enabling faster and more reliable deliveries while reducing dependency on third-party carriers. In Q1 2025, the company processed 492 million items sold, representing a 28% year-over-year increase. The scale advantages create significant barriers to entry, as evidenced by Mercado Libre's dominance with $34 billion GMV versus $8 billion for Americanas and 667.7 million monthly visits compared to 169 million for Amazon in Latin America. The company's planned $9.2 billion investment in Brazil and Mexico for 2025 further reinforces its scale advantages.

Network Effect

Mercado Libre benefits from an exceptional network effect across its integrated ecosystem. The platform serves over 218 million active users and 1 million active sellers across 18 countries. In Q1 2025, unique buyers reached almost 67 million, with new buyer growth sustaining the highest levels since early 2021. The network effect operates through a self-reinforcing flywheel where more buyers attract more sellers, which in turn attracts more buyers. This dynamic is amplified across Mercado Libre's integrated services including e-commerce, payments through Mercado Pago with 64 million monthly active users, logistics, and credit services. The interconnected nature of these services maximizes customer lifetime value and creates powerful synergies that strengthen the overall platform.

Brand Strength

Mercado Libre possesses a very strong brand that has achieved remarkable recognition globally. In 2025, the company secured the 50th position in the Kantar BrandZ ranking of the world's 100 most valuable brands, with a brand value of $49.8 billion, representing 52% growth compared to 2024. It is the only Latin American company in the global Top 100 and was named one of the TIME100 Most Influential Companies of 2025. The brand's strength is evidenced by reaching all-time highs in brand preference across key markets including Brazil, Mexico, Argentina, and Chile. Founded in 1999, Mercado Libre's first-mover advantage helped establish strong brand equity and trust, making it the most recognized e-commerce brand in Latin America.

Intellectual Property

Mercado Libre has built strong intellectual property capabilities through proprietary platforms, algorithms, and data infrastructure. The company leverages advanced machine learning and vast consumer data to deliver personalized experiences, optimize logistics, and enhance credit models. Its intellectual property portfolio includes proprietary technology for fraud prevention and payment processing within Mercado Pago. The company operates a comprehensive Brand Protection Program (BPP) that enables intellectual property rights holders to report infringements, demonstrating its commitment to protecting both its own and third-party intellectual property. The continuous investment in technology and data analytics creates a knowledge moat that provides deeper insights into local markets than foreign competitors can match.

Switching Costs

Mercado Libre has created strong switching costs for both buyers and sellers through its deeply integrated ecosystem. For sellers, the platform provides marketplace access, payments, logistics, financing, and advertising services, making it costly and time-consuming to rebuild operations elsewhere. The MELI+ loyalty program, launched in 2020, further increases switching costs by offering free shipping, content bundles including Disney+ and Deezer, and cashback benefits. For enterprise-level implementations, switching costs for specialized e-commerce technology platforms range between $1.2 million to $4.5 million. Buyers face switching costs through stored transaction history, reviews, preferences, and integrated fintech features like stored payment information and credit history. The convenience of shopping, payments, and credit services within one ecosystem creates significant friction for users considering alternatives.

Mercado Libre has a wide and defensible economic moat, anchored by very strong economies of scale through its proprietary logistics network and massive investments. Its network effect is exceptional, driven by over 218M users and 1M sellers within a tightly integrated ecosystem. The brand is globally recognized, valued at $49.8B and ranked among the world’s top 100. Intellectual property and switching costs are strong, supported by advanced tech, user data, and enterprise-level stickiness.

Revenue growth

Revenue growth for $MELI MercadoLibre accelerated to 37% YoY, up from 35% in Q3 2024.

In Q1 2024, the company announced changes to its revenue calculation and began providing adjusted data starting from Q1 2023. Revenue growth remains at a high level, although the company does not provide revenue guidance for the next quarter.

Segments and Main Products

MercadoLibre operates through two main segments: Commerce (56% of revenue) and Fintech (44%).

Marketplace drives the core business, with third-party sales (46%) and first-party sales (10%) across multiple categories.

Mercado Pago handles 26% of revenue, offering digital payments both on and off-platform.

Mercado Envios powers logistics, shipping 1.1B+ items annually with its own infrastructure, including MELI Air.

Mercado Credito contributes 17% of revenue, offering buyer financing and seller loans backed by behavioral data.

Mercado Ads boosts visibility via sponsored listings and display ads.

Mercado Shops lets SMBs build online storefronts, leveraging MELI’s full stack—Latin America’s Shopify alternative.

Main Products Performance in the Last Quarter

$MELI MercadoLibre's revenue breakdown by segment: The Commerce segment has grown from 53% to 56% of total revenue over the past two years. Meanwhile, Fintech now accounts for 44%, up from 41% in Q4 2024.

Commerce segment

$MELI's Commerce revenue reached $3,303 million in Q1 2025, growing +32.3% YoY or +57.4% FX-neutral. While growth has slowed over the last two quarters, it remains at a very high level. In Q1, commerce revenue grew slightly slower than total revenue.

Successful sold items totaled 492 million, a +28% YoY increase.

GMV (Gross Merchandise Volume) reached $13,330 million, growing +17% YoY or +40% FX-neutral. Since commerce revenue is growing faster than GMV, this suggests MercadoLibre is generating more revenue per unit of goods sold.

The Commerce Take Rate rose to 24.8% in Q1, up +2.8 percentage points YoY, continuing to serve as a key revenue driver for the e-commerce segment.

$MELI’s unique marketplace buyers reached 66.6 million, up +24% YoY. Q4 is typically a seasonally strong quarter, so a Q1 dip in new buyers is expected. This time, the decline was only -0.7 million, which is better than the same period last year.

GMV grew 126% YoY in Argentina, with items sold up 52%, signaling both macro stabilization and execution strength. Growth was supported by stronger demand, more competitive pricing, financing, and improved selection. Mexico’s marketplace continued to grow over 25% in unique buyers, though tech vertical underperformed due to aggressive pricing by competitors and selection gaps. 1P GMV rose 102% YoY, driven by tech-enabled automation in buying, pricing, and onboarding.

Supermarket category accelerated to 65% YoY growth, outperforming all other categories. 1P supermarket now contributes more heavily, with better unit economics than 3P due to efficiency in warehouse logistics and higher ad revenue from manufacturers. Marketplace share and brand preference hit all-time highs in Brazil, Mexico, Argentina, and Chile.

Fintech segment

$MELI MercadoLibre's Fintech segment reported $2,632 million in revenue for Q1 2025, with YoY growth accelerating to +43.3%. FX-neutral growth came in at +73.3%, slightly lower than prior levels but still very strong. This marks a significant acceleration from +20.8% in Q3 2024. Note that since Q1 2024, the company has adjusted its Fintech revenue calculation method.

TPV (Total Payment Volume) reached $58,303 million, growing +43% YoY or +72% FX-neutral, closely tracking the Fintech segment’s revenue growth.

Total Payment Transactions hit 3,344 million, a +38.3% YoY increase.

The Fintech Take Rate was 4.51%, stable YoY but up +0.26 percentage points QoQ. This includes revenue from payment processing, digital wallets, loans, and cross-border transfers.

MercadoLibre's Fintech Monthly Active Users reached 64.3 million, up +31% YoY, with 3.1 million new users added in Q1 2025—a strong addition in line with Q1 2024.

Monthly active users grew 30%+ YoY, reaching 64 million in Q1 2025. In Brazil, Mercado Pago turned yellow, aligning with MercadoLibre’s broader ecosystem. A 120% of CDI yield promo was launched in Brazil to boost deposits and user engagement. Fintech penetration and adoption are rapidly increasing in Mexico, where digital banking remains underdeveloped.

In Argentina, assets under management rose 69% YoY, and the fintech unit delivered both high growth and profitability. Strong adoption of the super-yielding account and increased usage of digital wallets and cards supported user engagement. More than 20–30% of GMV in key markets is now paid using Mercado Pago funds or credit products.

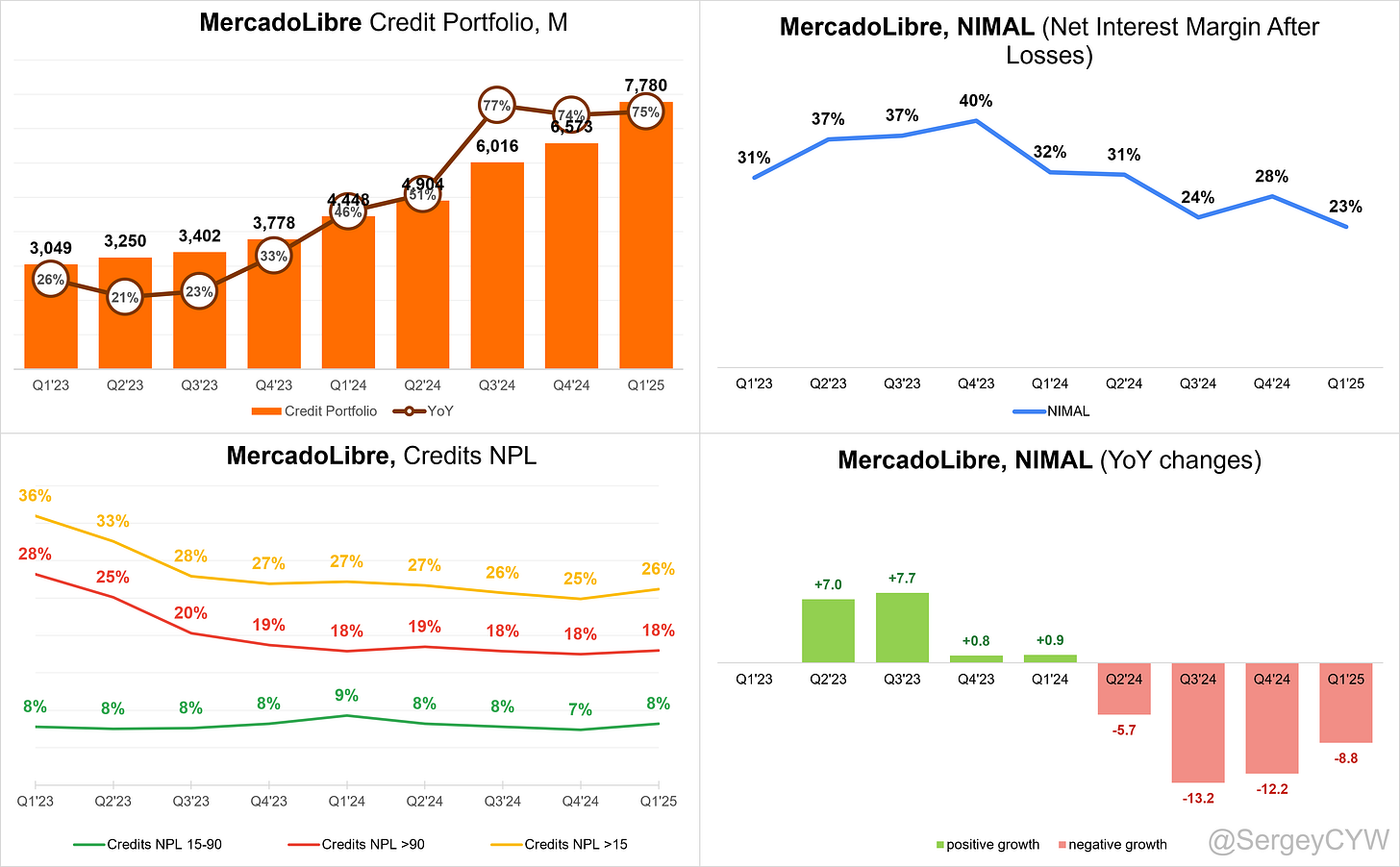

Credit Portfolio

$MELI MercadoLibre's Credit Portfolio reached $7,780 million, growing +75% YoY. In the event of economic deterioration in Latin America, especially in Argentina, the credit portfolio could present elevated risk, making it crucial to monitor NPLs (non-performing loans).

NPLs represent loans in default and are a key indicator of the credit business's health. MercadoLibre extends financing to both consumers and merchants.

NPLs 15–90 days overdue are at 8%, down 1 percentage point YoY, but up +1pp QoQ.

NPLs over 90 days are at 18%, flat QoQ.

Total NPLs over 15 days stand at 26%, down 1pp YoY, but up +1pp QoQ.

The most concerning category is NPLs >90 days, which had previously spiked to 30% in Q3 and Q4 2022, but have since improved to 18%. Overall, NPL trends are stable to positive, which is encouraging given the credit portfolio’s growth.

NIMAL (Net Income Margin After Logistics) is a key internal metric for tracking profitability after logistics costs—critical in e-commerce. NIMAL declined to 23% in Q1 2025, its lowest level in the past two years. Despite a 9pp drop YoY, the margin remains above 20%, indicating solid operational efficiency.

The primary driver behind NIMAL's decline is MercadoLibre’s active shift toward higher-quality, lower-risk borrowers—which, in my view, is a positive strategic move. However, it also reflects the intensifying competition in the Latin American e-commerce market, where margin trade-offs are becoming more common to defend market share and long-term growth.

Credit portfolio rose 75% YoY, with improving asset quality. In Argentina, loan book grew 4x YoY in USD terms, and profitability improved thanks to falling interest rates and low delinquency. Argentina now represents double the share of the credit portfolio compared to last year. In Brazil, first payment defaults on credit cards hit an all-time low, with better scoring and move up-market.

The company is selectively tightening credit issuance in Brazil and Mexico, focusing on higher-quality users while scaling credit card operations. Credit cards are gaining share, now comprising a greater share of the portfolio despite lower NIMAL. Funding is primarily via third-party warehouse facilities; MercadoLibre tactically increased the share of loans funded with its own cash in Brazil this quarter.

Product Innovations and Updates

Mercado Pago underwent a full rebrand, adopting a yellow identity to reinforce ecosystem unity. UI was redesigned for a more bank-like experience, moving away from super app layout to more intuitive navigation. New branding rolled out in Mexico, Chile, and soon Brazil.

AdTech expansion is progressing: display ad revenue more than doubled, and brand ads accelerated, with broader availability beyond top brands. Mercado Play launched on TV, extending the ad inventory beyond the marketplace. Ad business crossed $1 billion in annual revenue, with continued GMV-based penetration gains.

In logistics, no major shift in footprint strategy. Focus remains on scaling fulfillment to match growth. Logistics CapEx as % of revenue remains stable YoY.

Credit card to launch in Argentina in 2H 2025. Based on Brazil and Mexico playbooks, expected to significantly deepen user engagement.

Revenue by Region

$MELI generates 52% of its total revenue from Brazil, making it MercadoLibre’s largest market, though revenue growth slowed significantly to +20% YoY in Q1.

Argentina contributes 23% of total revenue, with the highest growth rate at +125% YoY. This marks a strong rebound after a sharp -21% YoY decline in Q1 2024.

Mexico accounts for 21% of total revenue, but growth has slowed to +26% YoY.

Revenue from Other Countries represents 4%, growing a solid +41% YoY.

Revenue growth in Argentina and Other Countries is now outpacing overall company growth. Following the stabilization of Argentina’s economic situation, management’s strategic focus on this market appears to be the right call—Argentina now stands out as one of the most promising regions for MercadoLibre.

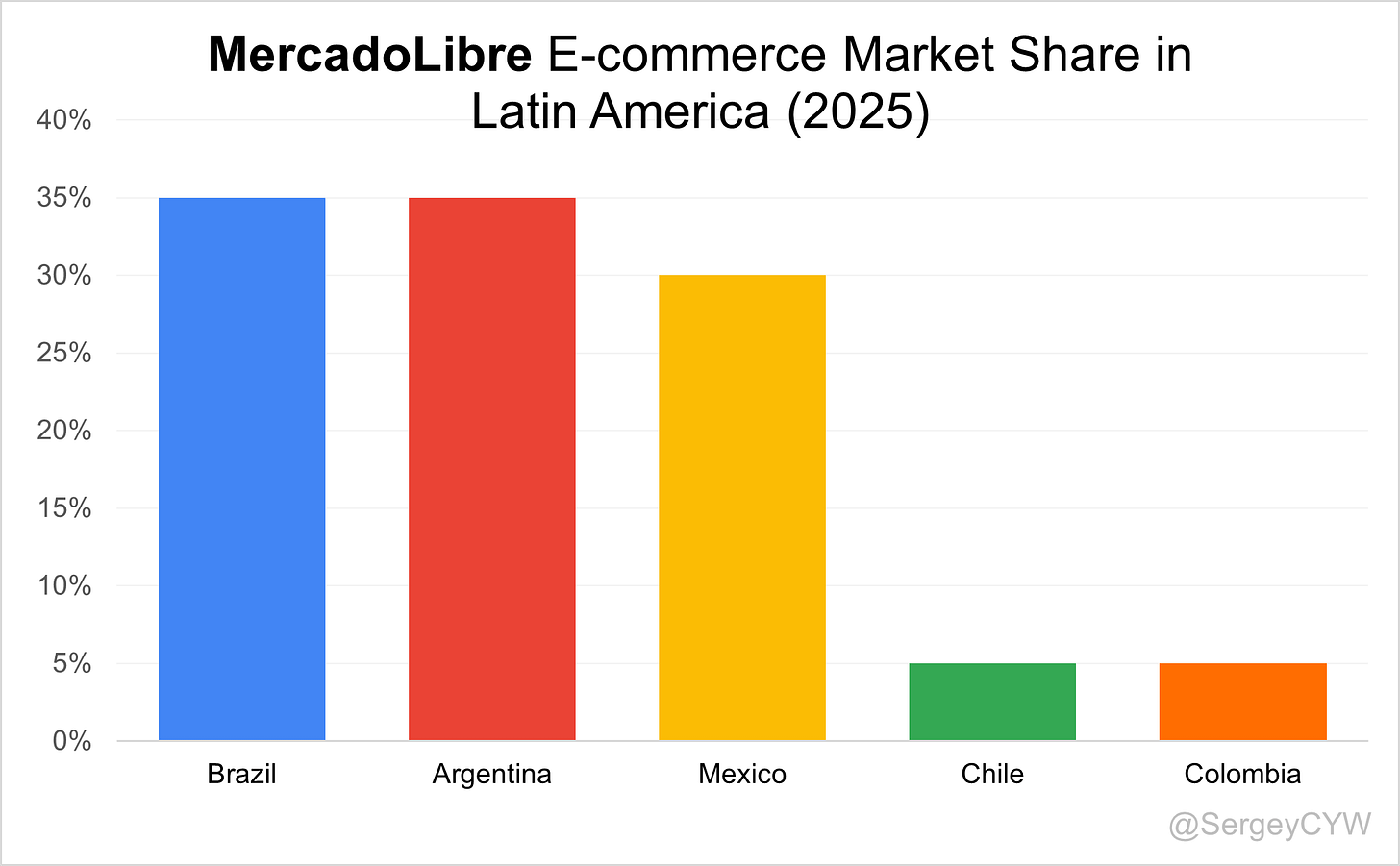

Market Leader

Mercado Libre is the dominant e-commerce player in Latin America, with a strong presence across key markets, though its position varies by country and is increasingly challenged by regional and global competitors.

Brazil

In Brazil—the largest e-commerce market in Latin America—Mercado Livre leads with a 35% market share, attracting over 237 million monthly website visits and more than 17 million active app users. This puts it significantly ahead of Amazon, which holds 16.3% of the market and has 179.5 million visits and 8.1 million app users. Shopee, with 10% market share, has surpassed Amazon in monthly visits, signaling potential shifts in user engagement. Despite competition, Mercado Livre remains the clear leader in Brazil.

Mexico

Mexico represents Mercado Libre’s second-largest market with 30% market share, behind Amazon’s 40%. While Amazon leads in traffic with 121.7 million monthly visits, Mercado Libre is actively expanding, with a $3.4 billion investment planned for 2025—aimed at logistics infrastructure and hiring 10,000 new employees. Walmart and Coppel, with 15% and 10% shares respectively, add to the competitive landscape.

Argentina

In its home country, MercadoLibre holds a dominant 35% market share, maintaining leadership in a slower-growing e-commerce environment. Amazon follows at 20%, with local retailers like Fravega (15%), Garbarino (10%), and Musimundo (5%) making up the rest. Argentina's market is mature, with growth projected at just 0.5% CAGR through 2029, yet MercadoLibre's leadership remains solid.

Chile

Mercado Libre's presence in Chile is relatively limited at 5%, compared to Falabella’s 20.7% and Ripley’s 12%. Chile’s market is more traditional retail-driven, with local players leveraging strong physical footprints to maintain share. This makes it one of the few markets where Mercado Libre does not lead.

Colombia

In Colombia, Mercado Libre also holds a 5% market share, well behind Alkosto (20.7%) and Exito (20.6%). Amazon has a modest 8% share. While Colombia is forecasted to have the fastest e-commerce growth in Latin America (74% projected growth over four years), Mercado Libre is starting from a smaller base relative to competitors with stronger local operations.

Profitability

Over the past year, $MELI MercadoLibre has experienced changes in its margins:

· Gross margin remained unchanged at 46.7%.

· Operating margin increased from 12.2% to 12.8%.

· Free cash flow (FCF) margin decreased from 31.5% to 12.8%.

· Net margin significantly improved from 7.9% to 8.3%.

Operating expenses

$MELI MercadoLibre's operating expenses have slightly decreased due to reductions in R&D, and G&A spending. Sales & Marketing (S&M) expenses at same level 20% over the past two years.

R&D expenses were reduced from 12% to 9% of revenue, but remain at a high level, allowing the company to continue investing in innovation.

General & Administrative (G&A) expenses have decreased to 4%.

Balance Sheet

$MELI Balance Sheet: Total debt stands at $7,757 million, while MercadoLibre holds $9,590 million in cash on hand. This includes cash and cash equivalents, short-term investments, and customer funds held due to regulatory requirements and other restrictions.

The cash on hand exceeds total debt, so the balance sheet can be considered healthy.

Since the company offers various credit products, it's important to monitor repayment performance and credit quality.

Dilution

$MELI Shareholder Dilution: MercadoLibre's stock-based compensation (SBC) expenses are at a low 2% of revenue, which is notable for a high-growth company.

Shareholder dilution remains well-controlled, with the weighted-average number of basic common shares outstanding flat YoY.

Conclusion

MercadoLibre $MELI is a dominant player in Latin America, combining both fintech and e-commerce, and strengthening its position through high R&D investment, logistics expansion, and a growing credit portfolio. The company remains highly innovative with a strong, engaged management team.

Valuation appears attractive, with low Forward EV/Sales and reasonable Forward P/E multiples, supported by a durable competitive advantage. Management’s strategic bet on Argentina is paying off—following the stabilization of the economy, revenue in the region is now growing at triple-digit rates.

The share of Non-Performing Loans (NPLs) over 90 days has improved significantly since Q4 2022, as the company continues to stabilize credit quality—a trend that has also contributed to a decline in NIMAL.

While the commerce segment grew +32% YoY, slightly below overall revenue growth, it remains strong. Following a seasonally strong Q4, Q1 typically sees a dip in new Marketplace Buyers—yet the decline was smaller than in Q1 2024. GMV grew +17% YoY, accelerating from +8% in Q4 2024, and the commerce take rate increased to 25%, up significantly over the past two years. Successful items sold rose +28% YoY.

Fintech revenue growth accelerated to +43% YoY in Q1, now outpacing total revenue growth. TPV also grew +43% YoY, in line with fintech revenue. Fintech active user additions were strong, matching last year’s pace. The fintech take rate increased to 4.5%, the same as in Q1 2024. NIMAL declined to 23%, though it remains healthy.

Both segments are delivering strong, balanced growth, with robust fintech user additions and healthy Marketplace Buyer trends. The synergy between fintech and e-commerce is reinforcing MercadoLibre’s competitive position, while Mercado Envios (logistics) adds further strength to its e-commerce dominance.

MercadoLibre has a powerful brand, a wide economic moat, and operates in high-growth, underpenetrated Latin American markets.

At the end of 2024, I actively increased my position. $MELI now represents 9.0% of my portfolio and is among my top five holdings.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.