HubSpot Q2 2024 Earnings Analysis

Dive into $HUBS HubSpot’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$637.2M rev (+20.4% YoY, +23.1% LQ) beat est by 2.9%

↗️GM (85.0%, +1.5 PPs YoY)🟢

↗️Operating Margin* (17.2%, +3.1 PPs YoY)🟢

↗️FCF Margin (14.4%, +3.2 PPs YoY)

↗️EPS* $1.94 beat est by 19.0%🟢

*non-GAAP

Subscription

↗️$623.8M Subscription rev (+20.5% YoY); 97.9% of Rev

↗️GM* (88.1%, +1.6%pp YoY)🟢

Key Metrics

↗️Deferred Revenue $712.72M (+21.0% YoY)

➡️Billings $648M (+20.0% YoY)🟡

↘️Average Rev Per Customer $11,215 (-2% YoY)

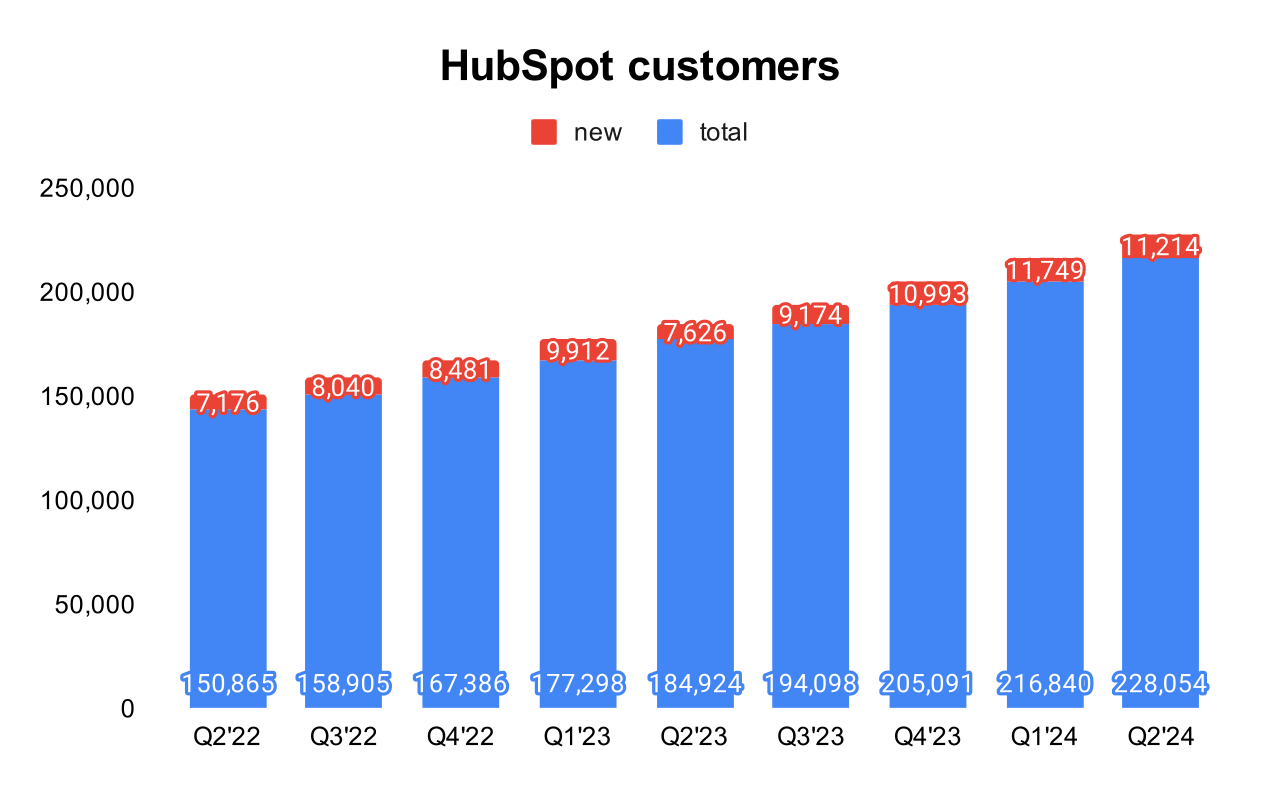

Customers

➡️228,054 customers (+23.0% YoY, +11214)

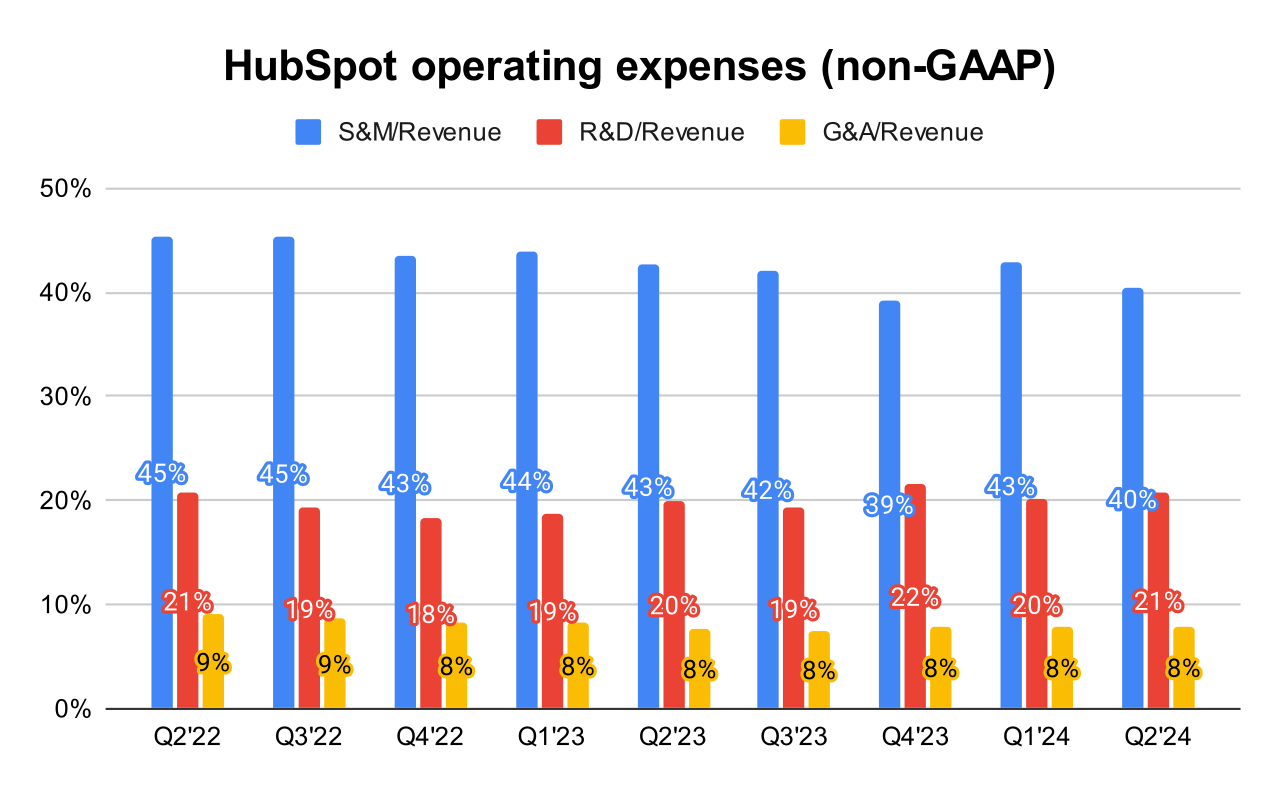

Operating expenses

↘️S&M*/Revenue 40.4% (-2.4 PPs YoY)

↗️R&D*/Revenue 20.8% (+0.8 PPs YoY)

↗️G&A*/Revenue 8.0% (+0.2 PPs YoY)

Quarterly Performance Highlights

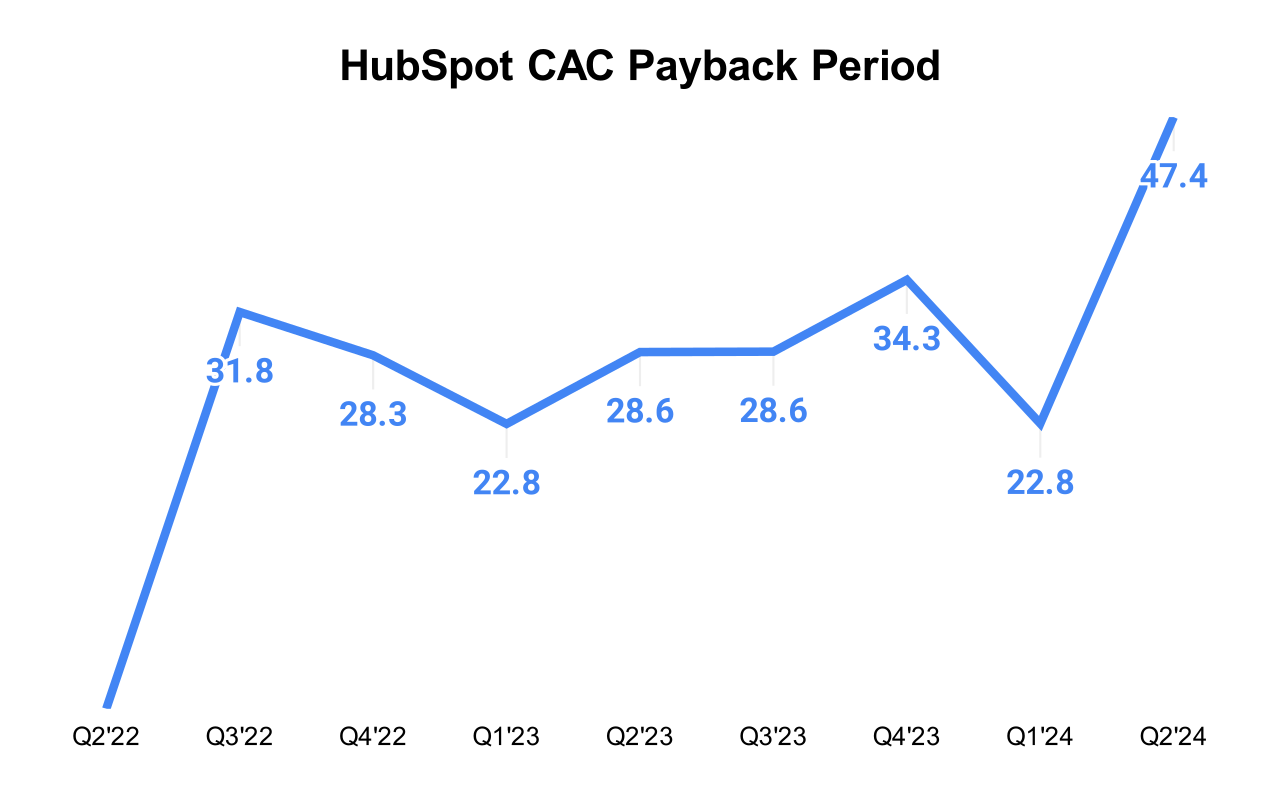

↘️Net New ARR $80M (-28.5% YoY)

↗️CAC* Payback Period 47.4 Months (22.8 LQ)

Dilution

↗️SBC/rev 20%, +2.2 PPs QoQ

↘️Basic shares up 2.6% YoY, 0.0 PPs QoQ

↘️Diluted shares up 2.4% YoY, -0.7 PPs QoQ

Guidance

➡️Q3'24 $646.0 - $647.0M guide (+16.0% YoY) in line with est

↗️$2,567.0 - $2,573.0M FY guide (+18.4% YoY) raised by 0.5% beat est by 0.4%

Key points from HubSpot’s Second Quarter 2024 Earnings Call:

Financial Performance:

HubSpot reported a revenue growth of 21% year-over-year in constant currency.

Operating margin increased by 270 basis points year-over-year to 17%, reflecting operating leverage from the company's strategic initiatives.

Net income was $104 million, with free cash flow at $92 million, representing 14% of revenue.

Customer Growth:

HubSpot reported an increase in its total customer count to 228,000, a growth driven by an addition of over 11,200 net new customers during the quarter.

The growth in customer numbers was attributed to the company’s continued focus on reducing friction for new users and improving the onboarding and product adoption processes.

HubSpot noted a strong presence of multi-hub and large deal momentum, indicating that more customers are adopting multiple HubSpot solutions, which suggests deepening customer engagement and reliance on HubSpot's integrated offerings.

Customer Consolidation:

Despite the challenging environment, HubSpot has observed a trend where businesses are consolidating their technological needs onto fewer platforms. This trend is benefiting HubSpot as it positions itself as a comprehensive solution provider.

Spring Spotlight Product Launches:

Notable enhancements were made to the Service Hub, which now supports both customer support and customer success teams on a unified platform. This update is significant as it aims to streamline operations and enhance user experience, making the Service Hub a more integrated and efficient tool for managing customer interactions.

Content Hub Launch:

A new product, Content Hub, was launched as part of the Spring Spotlight. This hub is designed as an AI-powered content marketing solution, helping marketers to create and manage content more effectively.

The Content Hub has seen a high attach rate, particularly due to its innovative AI features like content remix, AI blogs, and brand voice tools. These features allow users to repurpose content across different formats and platforms effortlessly, showcasing HubSpot’s commitment to leveraging AI to simplify and enhance marketing practices.

AI Integration Across Platforms:

HubSpot has embedded AI throughout its platform, enhancing various functions and hubs. This integration aims to provide users with actionable insights and personalized marketing at scale.

AI features are prominently used in the Content Hub, where they help in creating engaging and diverse content formats from existing materials, demonstrating a practical application of AI in everyday marketing tasks.

HubSpot AI is reported to help increase customer engagement by 25%.

Sensitive Data Support for Compliance:

HubSpot has developed features to help users manage sensitive data more effectively, supporting compliance with regulations like GDPR. This move is particularly important for expanding HubSpot’s usability in regulated industries such as healthcare and finance.

Strategic Pricing Changes:

HubSpot implemented pricing model changes, reducing the entry price point and removing seat minimums to encourage upgrades and expansions. Early signs show this strategy is beginning to pay off with improved customer volume offsetting lower initial average selling prices (ASPs).

Macro Environment:

The call highlighted that the broader macroeconomic environment remains challenging, with slower decision-making processes and increased scrutiny on spending decisions by businesses.

These conditions have prompted customers to be more cautious, often involving more stakeholders and requiring higher levels of approval for expenditures.

Future Outlook:

HubSpot plans to continue its investment in AI and product development to drive customer growth and retention. The focus is particularly on enhancing the AI capabilities within its various hubs to streamline operations and provide more value to users.

The company emphasized its commitment to solving for its customers by innovating its platform and prioritizing execution, which it believes will drive durable growth and long-term shareholder value.

Management comments on the earnings call.

Customers:

Yamini Rangan, CEO: "We delivered another quarter of operating margin growth... Total customers grew to 228,000 globally, driven by over 11,200 net customer additions in the quarter. I'm thrilled to see customers consolidating on HubSpot, the consistent focus on innovation and execution demonstrated by our teams, and the momentum we have in becoming the customer platform of choice for scaling companies."

Platform:

Yamini Rangan, CEO: "Our playbook for executing in any macro is clear. We solve our customers, help them grow by providing an AI-powered customer platform and drive the pace of innovation that can make it easy for customers to stay ahead. HubSpot excels when we know exactly who we are serving, and we have never been more clear."

Macro Environment:

Yamini Rangan, CEO: "Okay. On to the macro environment. We're seeing the same trends as last year and Q1, slower decision-making, more decision-makers involved and scrutiny on business case and value before spending. When decisions are made by committees, that often includes CEOs, CFOs, CROs, and many times require Board or BCP firm approval. The bar for buying continues to be high."

Future Outlook:

Yamini Rangan, CEO: "To close out, we have a large opportunity ahead of us, and we are well on our way to becoming the number one customer platform for scaling companies. Our pace of innovation is high and our focus on driving usage and value with our customer platform and AI is clear."