Google Q4 2024 Earnings Analysis

Dive into $GOOG $GOOGL Google’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↘️$96,469M rev (+11.8% YoY, +15.1% LQ) missed est by -0.2%🔴

↗️Gross Margin (57.9%, +1.2 PPs YoY)

↗️Operating Margin (32.1%, +4.6 PPs YoY)

↗️FCF Margin (25.7%, +16.6 PPs YoY)

↗️Net Margin (27.5%, +3.5 PPs YoY)

↗️EPS $2.15 beat est by 0.9%

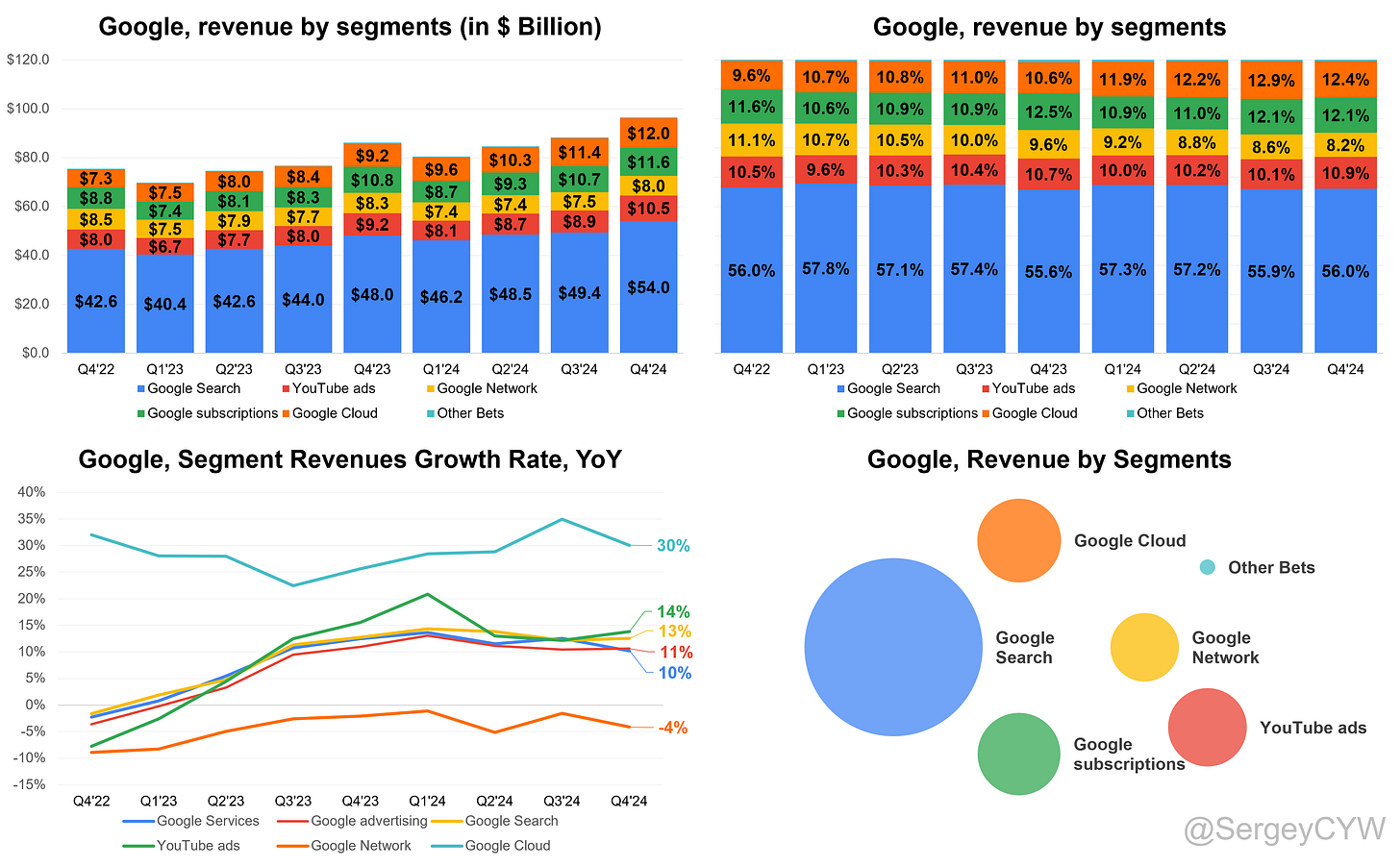

Segment Revenue

↗️Google Search $54,034M rev (+12.5% YoY)🟢

↗️YouTube ads $10,473M rev (+13.8% YoY)🟢

↘️Google Network $7,954M rev (-4.1% YoY)🟡

➡️Google advertising $72,461M rev (+10.6% YoY)🟡

➡️Google subscriptions $11,633M rev (+7.8% YoY)🟡

➡️Google Services $84,094M rev (+10.2% YoY, 39.0% Op Margin)🟡

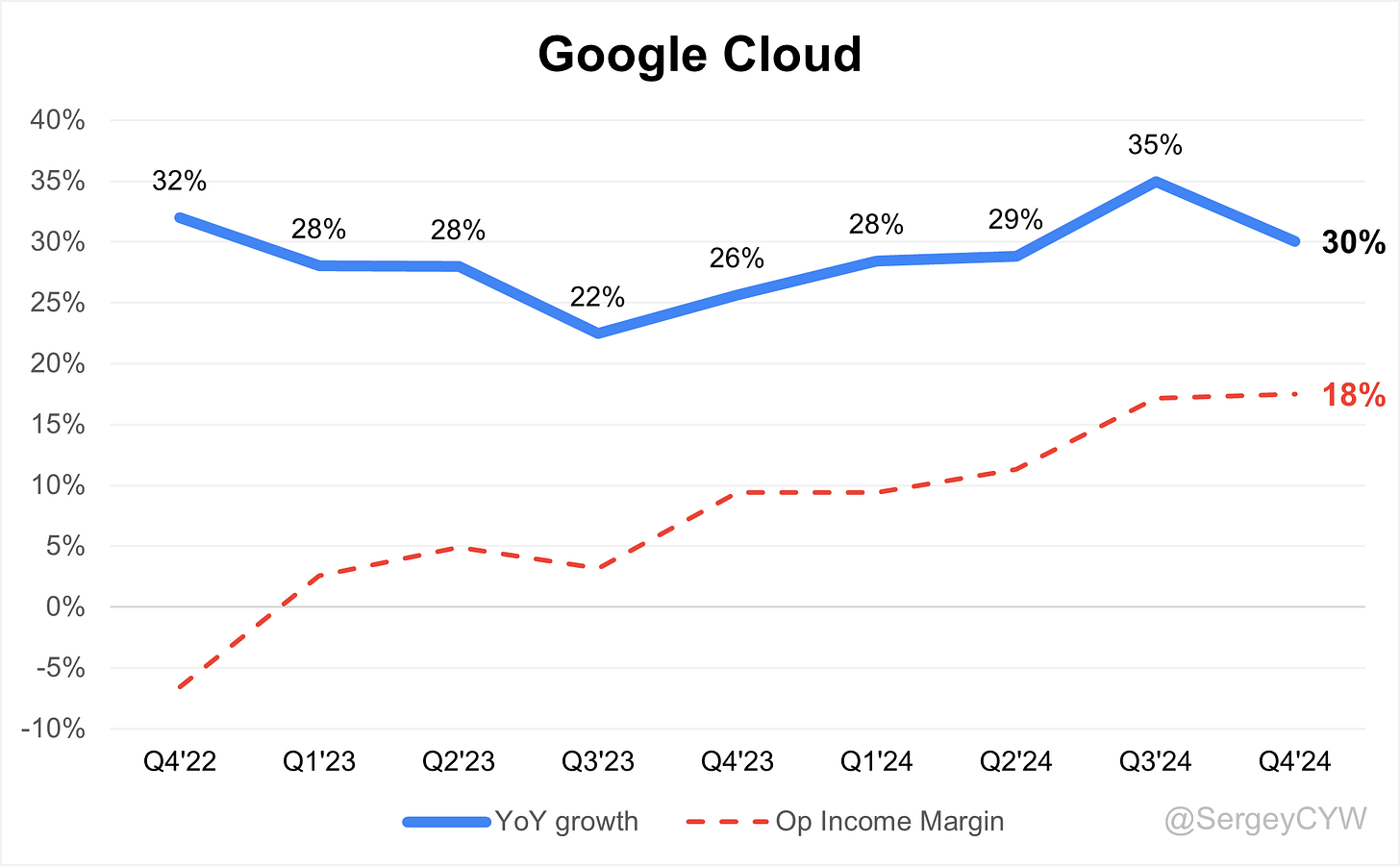

↗️Google Cloud $11,955M rev (+30.1% YoY, 17.5% Op Margin)

↘️Other Bets $400M rev (-39.1% YoY, -293.5% Op Margin)🟡

Revenue by Geography

↗️United States $47,375M (+12.8% YoY, 49.1% of Rev)

↗️EMEA $28,184M (+12.7% YoY, 29.2% of Rev)

➡️APAC $15,156M (+8.4% YoY, 15.7% of Rev)

➡️Other Americas $5,734M (+10.8% YoY, 5.9% of Rev)

Operating expenses

↘️S&M/Revenue 7.6% (-1.3 PPs YoY)

↘️R&D/Revenue 13.6% (-0.4 PPs YoY)

↘️G&A/Revenue 4.6% (-1.5 PPs YoY)

Headcount

↗️183,323 Total Headcount (+0.4% YoY, +2054 added)

Dilution

↘️SBC/rev 6%, -0.6 PPs QoQ

↗️Basic shares down -2.1% YoY, +0.2 PPs QoQ🟢

↗️Diluted shares down -2.0% YoY, +0.2 PPs QoQ🟢

Key points from Google’s Fourth Quarter 2024 Earnings Call:

Alphabet Q4 2024 Earnings Review

Financial Performance

Alphabet reported Q4 2024 revenue of $96.5 billion, up 12% YoY, with full-year revenue at $350 billion (+14% YoY). Operating margin expanded to 32%, a 4.6 percentage point increase YoY. Net income rose 28% to $26.5 billion, with EPS up 31% to $2.15. Free cash flow for the year reached $72.8 billion.

Google Services generated $84.1 billion in revenue (+10% YoY), driven by Search (+13%) and YouTube Ads (+14%). Black Friday and Cyber Monday each contributed over $1 billion in ad revenue.

Google Cloud revenue grew 30% YoY to $12 billion, with GCP expanding faster than Cloud overall. Operating income for Cloud improved to $2.1 billion, with margins increasing from 9.4% to 17.5%.

Alphabet returned nearly $70 billion to shareholders, including $15 billion in share repurchases and $2.4 billion in dividend payments in Q4.

AI and Product Innovation

Gemini AI is integrated across seven Alphabet platforms with over 2 billion users, accelerating engagement in Search, YouTube, Cloud, and productivity apps. AI-driven tools like Gemini Live, Deep Research, and the 2.0 Flash model continue to expand usage.

Google’s VEO-2 and Imagine 3 lead AI-generated video and image technology. The Gemini app, launched in late 2023, has doubled developer adoption to 4.4 million in six months.

Google Assistant’s AI integration is advancing through Project Astra, enabling real-time multimodal interactions.

Google Cloud Growth

Google Cloud exited 2024 with an annual revenue run rate of $110 billion, surpassing its $100 billion target.

AI and data analytics adoption are driving enterprise demand, with first-time cloud commitments more than doubling YoY. Strategic deals include Mercedes-Benz, Citi, MercadoLibre, and Wayfair, with multi-year contracts exceeding $1 billion.

Cloud infrastructure capacity expanded 8x over 18 months, supporting AI workload growth. AI-powered cybersecurity, data analytics, and Vertex AI adoption surged, with 5x YoY customer growth and 20x AI model usage increase.

Capacity constraints remain a challenge as demand for AI compute power outpaces supply. Alphabet is addressing this with a $75 billion CapEx investment in 2025, focusing on servers, data centers, and networking.

Vertex AI Expansion

Vertex AI experienced 20x YoY growth, hosting 200+ foundation models. Major clients WPP, Mondelez, and Radisson Hotels use it for automated data analysis and AI-driven engagement.

The launch of Gemini 2.0 Flash, a low-latency, high-efficiency model, is set to drive further adoption, with broad developer availability in Q1 2025.

Google Agent Space, an AI-powered enterprise assistant, enables businesses to synthesize and analyze multimodal data. Demand for AI compute power continues to rise, prompting rapid expansion in data center and TPU capacity.

Search AI Integration

Google Search generated $54 billion in Q4 (+13% YoY). AI Overviews, now available in 100+ countries, are increasing search engagement and monetization, with ads performing at near-parity with traditional search ads.

Circle to Search, deployed on 200 million Android devices, is expanding search volume. Google Lens now handles 20 billion visual search queries per month, with the majority being incremental.

Google Shopping was rebuilt with AI, driving a 13% increase in daily active users YoY in the U.S.. AI-powered deal-finding tools and product briefs enhance the shopping experience.

YouTube Monetization

YouTube delivered $10.5 billion in Q4 ad revenue (+14% YoY), driven by Shorts, Connected TV (CTV), and podcast integration. Shorts’ monetization rate increased 30 percentage points YoY, with 15% of Shorts viewing on CTV.

YouTube Partner Program now supports over 3 million creators. Monthly podcast watch time surpassed 400 million hours on TV devices, making YouTube the top podcast platform in the U.S.

VEO-2, an AI-driven video model, will launch for YouTube creators in 2025, unlocking new monetization opportunities. AI-powered discovery tools enhance podcast engagement, driving further growth.

Gemini AI Adoption

Gemini AI is now the backbone of Alphabet’s AI ecosystem, integrated across seven platforms with 2 billion users. The Gemini app on iOS has seen strong traction, increasing adoption.

New AI features, Gemini Live and Deep Research, expand interactive and generative AI applications. Subscription-based monetization remains the primary strategy, though native ad integration is being explored for long-term revenue growth.

Waymo Expansion

Waymo completed 4 million paid trips in 2024, averaging 150,000 trips per week. Expansion plans include Austin and Atlanta in 2025, followed by Miami in 2026.

International expansion is underway, with Waymo vehicles arriving in Tokyo for their first overseas trials. The sixth-generation Waymo Driver will significantly reduce hardware costs, enhancing scalability.

Regulatory hurdles and adoption challenges persist, impacting profitability and large-scale commercial deployment.

Global AI Infrastructure

Alphabet is expanding AI and cloud infrastructure, adding 11 new cloud regions and data centers globally. Seven subsea cable projects will improve international connectivity.

Google’s data centers are now 4x more energy-efficient than five years ago, reducing AI compute costs and supporting global demand.

Capital Investments

CapEx for 2025 is set at $75 billion, focusing on servers, data centers, and networking. Q4 CapEx reached $14 billion, reflecting AI infrastructure expansion.

Alphabet is optimizing headcount, real estate footprint, and AI-driven operational efficiency to manage costs while scaling AI initiatives.

Challenges and Future Outlook

Alphabet faces short-term revenue headwinds, including:

Foreign exchange impact: Strengthening USD will create higher Q1 2025 revenue headwinds.

Leap year impact: One fewer revenue day in Q1 2025 compared to Q1 2024.

Tough YoY ad comparisons: Financial services ad surge in 2024 will create a more difficult YoY comparison in 2025.

Despite near-term pressures, AI advancements, cloud growth, and product innovation position Alphabet for long-term revenue expansion.

AI-driven efficiencies in Search, Cloud, and YouTube will optimize profitability, while expanded cloud capacity should accelerate GCP revenue growth in 2025.

With strong AI infrastructure investments, expanding cloud capacity, and aggressive monetization of AI-driven products, Alphabet remains on track for sustained double-digit revenue growth.

Management comments on the earnings call.

Product Innovations

Sundar Pichai, Chief Executive Officer

"We are rapidly shipping product improvements and seeing terrific momentum with consumer and developer usage. Our company is in a great rhythm and cadence, building, testing, and launching products faster than ever before. This is translating into product usage, revenue growth, and results."

Philip Schindler, Chief Business Officer

"We continue investing in AI capabilities across media buying, creative, and measurement. AI will revolutionize every part of the marketing value chain, and our customers are increasingly focused on optimizing their use of AI-driven solutions."

AI Leadership and Advancements

Sundar Pichai, Chief Executive Officer

"We have seven products and platforms with over two billion users, and all are using Gemini. Our AI investments are creating new experiences that will provide additional opportunities for monetization while improving efficiency across our technology stack."

Anat Ashkenazi, Chief Financial Officer

"We’re delivering AI solutions to customers at a rapid pace, building, testing, and launching products faster than ever before. At the same time, we are focused on driving efficiencies in how we operate the business to sustain long-term profitability."

Google Cloud Growth and AI Integration

Sundar Pichai, Chief Executive Officer

"Our sophisticated global network of cloud regions and data centers provides a powerful foundation for us and our customers. We are making significant AI-driven advancements across infrastructure, model capabilities, and developer productivity, strengthening our leadership in enterprise AI adoption."

Anat Ashkenazi, Chief Financial Officer

"Google Cloud continues to see strong revenue growth with double-digit expansion in both our core cloud offerings and AI-driven solutions. The demand for AI infrastructure is exceeding our available capacity, and we are investing aggressively to scale operations and meet customer needs."

Google Search Evolution and AI Overviews

Sundar Pichai, Chief Executive Officer

"We view AI Overviews as the next step in search evolution. The metrics are positive, and we are iterating on the experience to bring better models and expand to more queries. AI will unlock entirely new use cases and allow users to ask more complex questions that weren’t possible before."

Philip Schindler, Chief Business Officer

"People use search more with AI Overviews, and usage growth increases over time as users learn they can ask new types of questions. Younger audiences, in particular, appreciate the speed and efficiency of this new format, reinforcing our commitment to AI-powered search innovation."

YouTube Monetization and AI-Powered Content

Philip Schindler, Chief Business Officer

"We saw robust revenue growth at YouTube, driven by strong watch time across ad-supported and premium experiences. Shorts continues its ascent, with the monetization rate improving significantly, and we expect further progress in 2025."

"We are integrating AI to enhance content creation and advertising opportunities on YouTube. Our state-of-the-art AI video generation model, VEO-2, will empower creators to produce high-quality content at scale. This is an exciting moment for video innovation."

Gemini AI Expansion

Sundar Pichai, Chief Executive Officer

"Gemini 2.0’s advances in multimodal capabilities and native tool use are bringing us closer to our vision of a universal AI assistant. We are seeing strong adoption of Gemini-powered applications across consumer and enterprise use cases."

"We continue to see strong momentum for Gemini, particularly with the recent launch of our dedicated iOS app. AI-powered experiences are becoming integral to user interactions across our ecosystem, and we are focused on delivering innovative solutions at scale."

Waymo Autonomous Driving Expansion

Sundar Pichai, Chief Executive Officer

"Waymo made tremendous progress last year, safely serving over four million passenger trips. As we expand into new markets, we are also developing the sixth-generation Waymo Driver, which will significantly lower hardware costs and improve scalability."

Competitive Landscape

Sundar Pichai, Chief Executive Officer

"AI innovation is advancing rapidly across the industry, and competition is intensifying. We believe our full-stack approach—from AI infrastructure to model development—gives us a significant advantage in cost efficiency, performance, and scalability."

"Our Gemini models set a new standard in cost, performance, and latency efficiency. Compared to competitors, our AI models are optimized to deliver better cost-per-query economics, strengthening our position in both enterprise and consumer applications."

Strategic Partnerships and Enterprise Adoption

Philip Schindler, Chief Business Officer

"We are deepening our partnerships with leading enterprises, including Citi, Samsung, and Mercedes-Benz. These collaborations are expanding our AI and cloud capabilities, helping businesses enhance productivity, automate workflows, and drive digital transformation at scale."

Sundar Pichai, Chief Executive Officer

"Google Cloud’s AI-powered solutions are driving significant customer adoption, with strategic enterprise deals surpassing $1 billion. The number of first-time cloud commitments doubled compared to last year, reflecting growing confidence in our technology."

International Growth and Infrastructure Expansion

Sundar Pichai, Chief Executive Officer

"We expanded our global AI and cloud infrastructure by adding 11 new cloud regions and data center campuses. Additionally, our investments in seven new subsea cable projects will enhance international connectivity, supporting growing demand for AI-driven workloads worldwide."

Challenges and Short-Term Headwinds

Anat Ashkenazi, Chief Financial Officer

"We anticipate some short-term revenue headwinds in Q1 2025 due to foreign exchange impacts, the leap year effect, and the normalization of financial services advertising. However, we remain confident in our ability to sustain long-term growth through AI-driven innovations and efficiency improvements."

"AI infrastructure demand continues to exceed supply, and we are making significant investments to scale our cloud and data center capacity. Our planned $75 billion in CapEx for 2025 reflects our commitment to meeting this demand and maintaining our leadership in AI infrastructure."

Future Outlook and Long-Term Growth Strategy

Sundar Pichai, Chief Executive Officer

"We are entering 2025 with strong momentum across our core businesses. AI is unlocking entirely new opportunities in search, cloud, and consumer experiences, and we are well-positioned to lead this next era of computing."

"As AI adoption scales, we expect continued expansion in cloud, advertising, and enterprise solutions. We are focused on driving innovation, increasing efficiency, and delivering long-term value for our customers and shareholders."

Thoughts on Google Earnings Report $GOOGL:

🟢 Positive

Revenue Growth: $96.5B (+12% YoY), full-year $350B (+14% YoY)

Operating Margin: 32.1% (+4.6 PPs YoY)

EPS: $2.15, beating estimates by 0.9%

Google Search Revenue: $54B (+12.5% YoY)

YouTube Ads Revenue: $10.5B (+13.8% YoY)

Google Cloud Revenue: $12B (+30.1% YoY), 17.5% Op Margin

AI Growth: Gemini AI integrated across 7 platforms with 2B+ users

Google Shopping: AI-driven redesign led to +13% increase in daily active users

Free Cash Flow: $72.8B, with a 25.7% FCF margin (+16.6 PPs YoY)

Shareholder Returns: $70B total, including $15B share repurchases and $2.4B dividends

Waymo Expansion: 4M+ paid trips, expanding to Austin, Atlanta (2025), Miami (2026), Tokyo trials started

Cloud Infrastructure: AI compute 8x capacity growth in 18 months

🟡 Neutral

Google Services Revenue: $84.1B (+10.2% YoY)

Google Subscriptions Revenue: $11.6B (+7.8% YoY)

APAC Revenue Growth: +8.4% YoY, lagging U.S. (+12.8%) and EMEA (+12.7%)

Basic Shares Outstanding: -2.1% YoY, slight +0.2% QoQ increase

Google Advertising Revenue: $72.5B (+10.6% YoY)

🔴 Negative

Total Revenue Miss: -$0.2% below estimates

Google Network Revenue Decline: $7.95B (-4.1% YoY)

Other Bets Revenue Drop: $400M (-39.1% YoY), -293.5% Op Margin

Operating Expenses Decline:

Sales & Marketing: 7.6% of revenue (-1.3 PPs YoY)

R&D: 13.6% of revenue (-0.4 PPs YoY)

G&A: 4.6% of revenue (-1.5 PPs YoY)

AI Compute Constraints: Demand exceeding available TPU and Cloud capacity

Short-Term Revenue Headwinds:

FX Impact: Strong USD affecting Q1 2025 revenue

Leap Year Effect: One fewer day in Q1 2025

Ad Market Normalization: Tough YoY comparison in financial services advertising

The market panicked for no reason, don't you think?

Good summary!!!