Google Q3 2024 Earnings Analysis

Dive into $GOOG $GOOGL Google’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$88 268M rev (+15,1% YoY, +13,6% LQ) beat est by 2,3%

↗️Operating Margin (32,3%, +4,5 PPs YoY)

↘️FCF Margin (20,0%, -9,5 PPs YoY)🟡

↗️Net Margin (29,8%, +10,2 PPs YoY)

↗️EPS $2,12 beat est by 15,2%

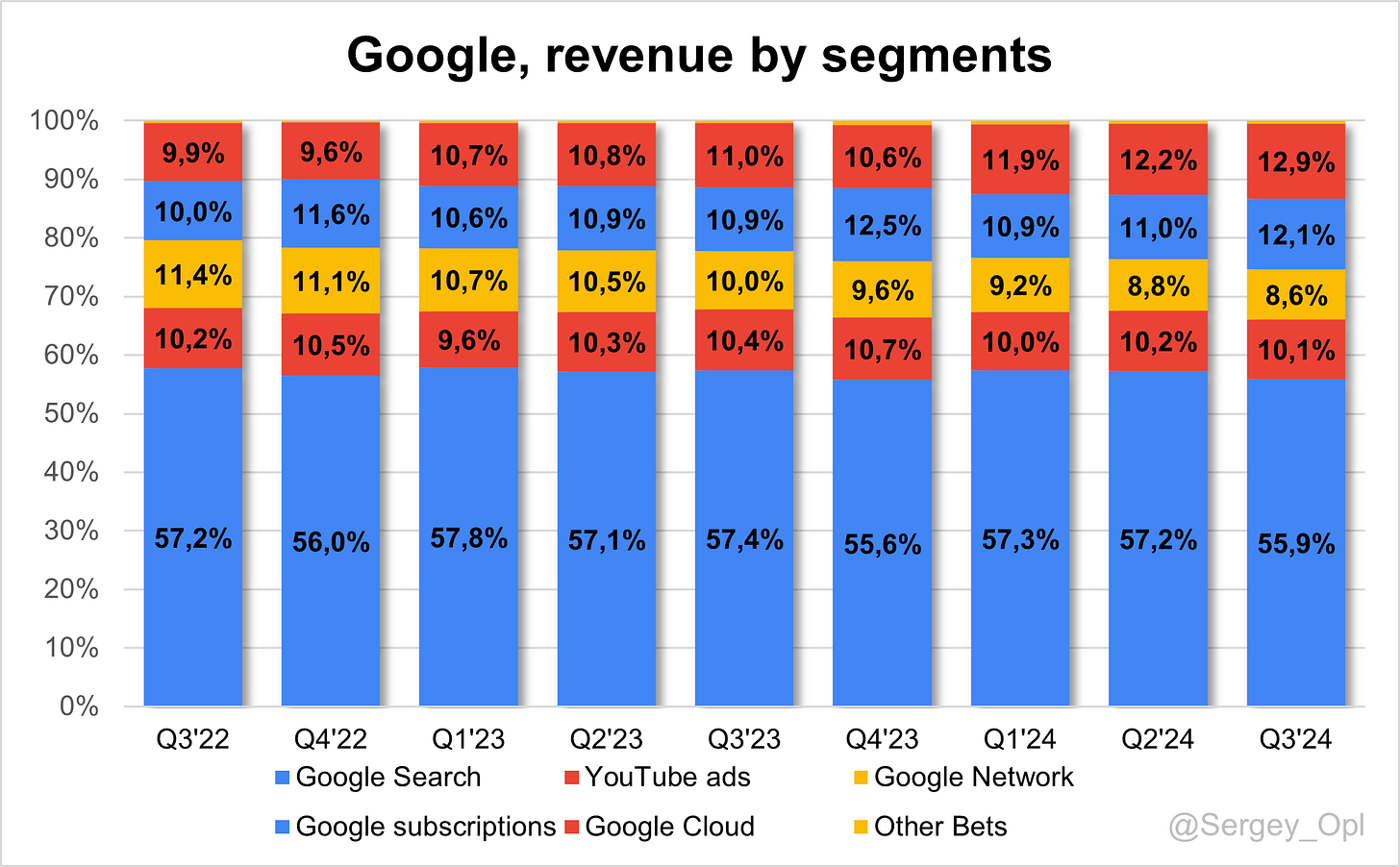

Segment Revenue

➡️Google Search $49 385M rev (+12,2% YoY)🟡

➡️YouTube ads $8 921M rev (+12,2% YoY)🟡

↘️Google Network $7 548M rev (-1,6% YoY)🟡

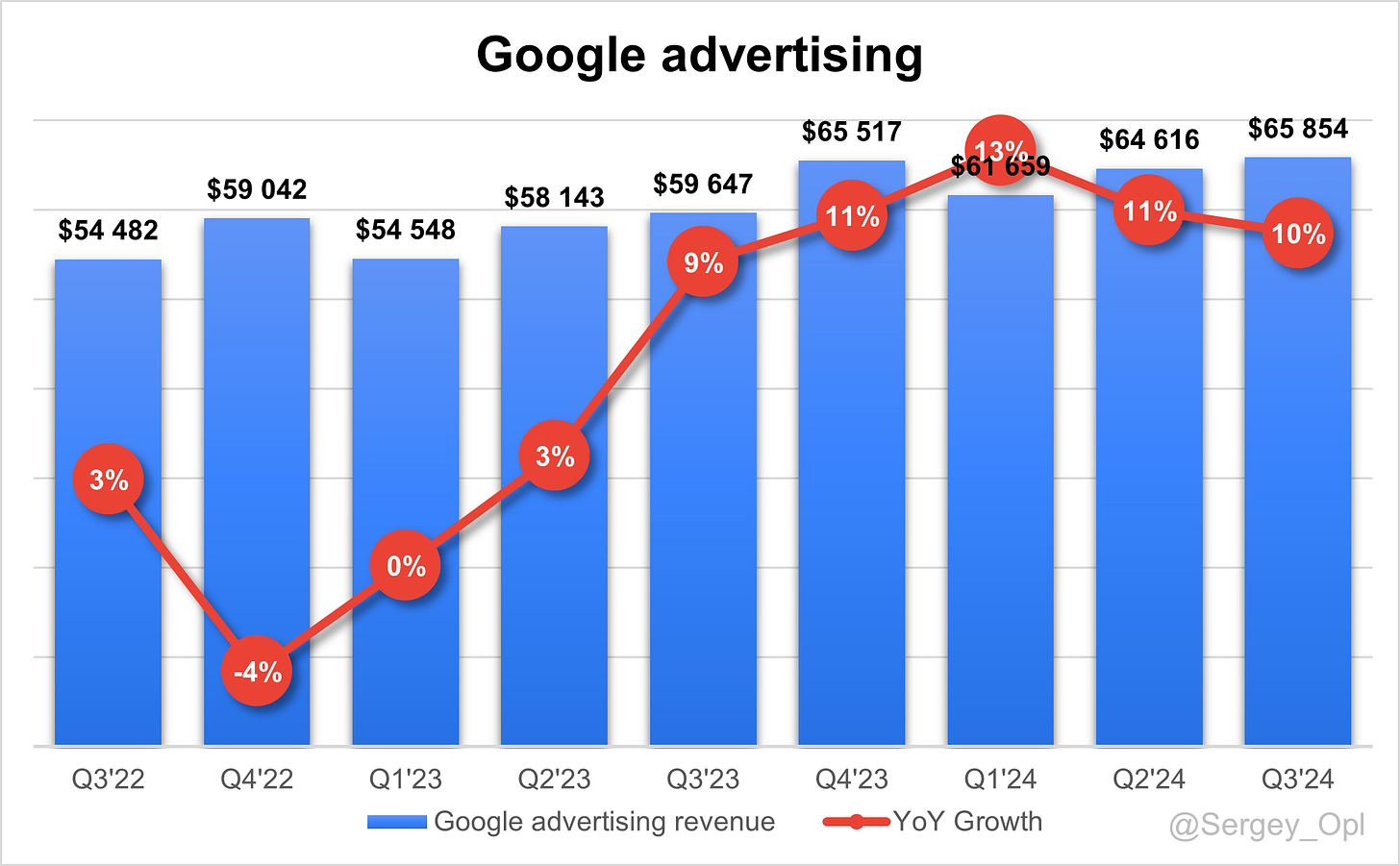

➡️Google advertising $65 854M rev (+10,4% YoY)🟡

↗️Google subscriptions $10 656M rev (+27,8% YoY)🟢

➡️Google Services $76 510M rev (+12,5% YoY, 40,3% Op Margin)🟡

↗️Google Cloud $11 353M rev (+35,0% YoY, 17,1% Op Margin)🟢

↗️Other Bets $388M rev (+30,6% YoY, -287,6% Op Margin)🟢

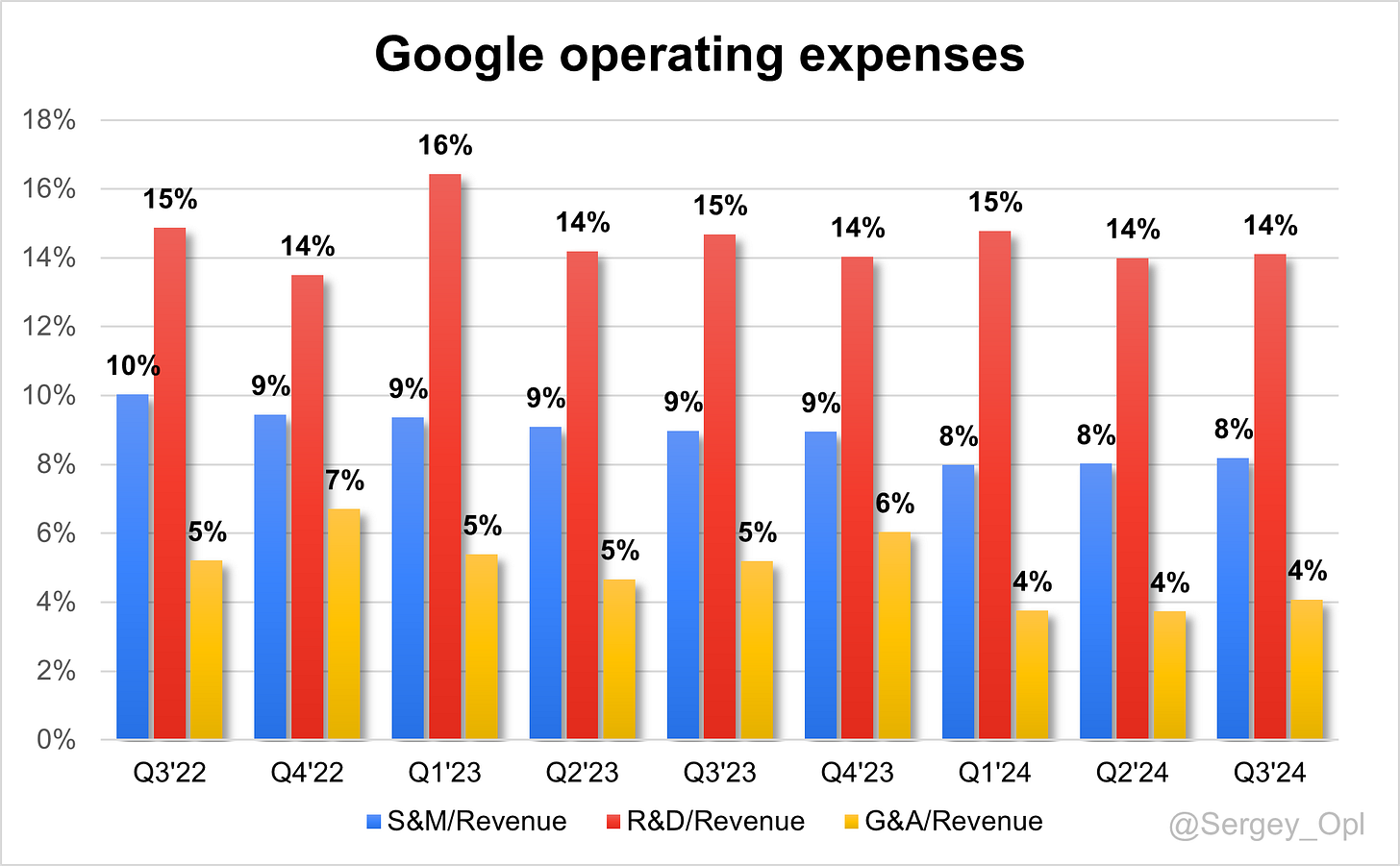

Operating expenses

↘️S&M/Revenue 8,2% (-0,8 PPs YoY)

↘️R&D/Revenue 14,1% (-0,6 PPs YoY)

↘️G&A/Revenue 4,1% (-1,1 PPs YoY)

Headcount

↗️181 269 Total Headcount (-0,6% YoY, +1687 added)

Dilution

↘️SBC/rev 7%, -0,4 PPs QoQ

↗️Basic shares down -2,3% YoY, +0,3 PPs QoQ🟢

↘️Diluted shares down -2,2% YoY, -0,1 PPs QoQ🟢

Key points from Google’s Third Quarter 2024 Earnings Call:

Financial Overview

Alphabet’s Q3 2024 results showcased robust growth, achieving a 15% YoY increase in consolidated revenue (16% in constant currency). Google Services reported 13% revenue growth, primarily driven by a 12% increase in both Search and YouTube Ads, with financial services (particularly insurance) and retail as key contributors. Google Cloud’s revenue soared 35% YoY to $11.4 billion, reflecting strong momentum in GCP and AI-focused products, as well as ongoing efficiency initiatives that lifted Google Cloud's operating margin to 17%. Alphabet’s consolidated operating margin reached 32%, underscoring the success of its optimized cost structure. The quarter’s free cash flow was $17.6 billion, contributing to a trailing twelve-month total of $55.8 billion.

AI-Powered Search and Gemini Integration

Alphabet continues to innovate in Google Search with new AI-driven features. Enhancements like AI overviews, Circle to Search, and Lens capabilities are reshaping the user experience by allowing more complex and multimodal queries. With AI overviews available in over 100 countries, Alphabet is achieving higher engagement as users increasingly interact with its Gemini-powered search ecosystem. Lens handles over 20 billion visual searches monthly, further advancing Alphabet’s ecosystem of AI-based functionality.

YouTube Enhancements and AI Video Innovations

YouTube’s product suite has been significantly enhanced with Gemini-powered features that increase content understanding and user engagement. AI-driven content recommendations personalize the viewer experience, and YouTube Shorts, which now accounts for over 70 billion daily views, is seeing monetization gains that continue to narrow the gap with traditional long-form video. New creator tools and advanced ad placements aim to strengthen engagement for both creators and advertisers on the platform.

Cloud Innovations and Enterprise Solutions

Google Cloud continues to focus on deploying advanced AI solutions across infrastructure, cybersecurity, and data analytics. The Vertex AI platform has seen API usage grow 14x over six months, and BigQuery’s machine learning operations surged by 80%, reflecting substantial enterprise adoption. Google Cloud’s cybersecurity products, such as Mandiant, have seen a fourfold increase in usage, underscoring the strong demand for AI-powered threat detection. Cloud also introduced new customer engagement tools for major clients like Volkswagen, enhancing customer interaction across digital and physical channels.

Waymo and Autonomous Vehicle Expansion

Waymo, Alphabet’s autonomous vehicle unit, has established itself as a leader in the AV space, with over 1 million fully autonomous miles driven weekly and more than 150,000 paid rides. Recent partnerships with Uber and Hyundai are expanding Waymo’s market presence into new regions, including Austin and Atlanta. Waymo’s sixth-generation autonomous system has improved cost efficiency without compromising safety, setting a solid foundation for future commercial deployment.

Global Expansion of AI Infrastructure and Data Centers

Alphabet continues its international expansion by investing in AI infrastructure across key global regions. In Q3, Alphabet announced new data center projects totaling over $7 billion, with nearly $6 billion allocated to U.S. facilities and additional sites planned in Thailand and Uruguay. These centers will enhance Alphabet’s AI processing and data capabilities, enabling faster and more efficient service delivery worldwide.

CapEx and R&D Investments

Q3 capital expenditures reached $13 billion, focusing on AI infrastructure and server upgrades, including custom-built TPUs and GPUs. This balanced allocation reflects Alphabet’s commitment to scaling its AI capabilities as demand grows. New global data center investments, including $7 billion in projects this quarter, reinforce Alphabet’s strategy to support robust processing power and storage for its expanding AI ecosystem. The company anticipates similar CapEx levels in Q4 and further investments in 2025, albeit with a potentially lower YoY increase.

Research and development expenses rose 11% YoY, driven by higher compensation and increased AI-related investments. Google’s R&D continues to prioritize advancements in Gemini models and AI-driven solutions for Google Cloud, with significant applications in BigQuery, Vertex AI, and cybersecurity.

Future Outlook

Alphabet’s growth strategy centers on expanding its AI capabilities, scaling Google Cloud, and strengthening YouTube’s market position. The company’s AI infrastructure investments and Gemini model developments are expected to drive sustained momentum, particularly within Google Cloud, where enterprise adoption remains strong. Waymo’s autonomous technology also shows significant revenue diversification potential, with partnerships and a growing customer base supporting its future trajectory.

Looking ahead, Alphabet expects CapEx to increase in 2025 to support AI-driven priorities, while cost-optimization efforts are projected to sustain operating margin expansion. With regulatory scrutiny ongoing, including the DOJ investigation into search contracts, Alphabet remains focused on defending its competitive practices. Positioned for long-term shareholder value, Alphabet’s strategic investments in AI, cloud infrastructure, and autonomy reinforce its outlook for continued growth and innovation.

Management comments on the earnings call.

Google Cloud

Sundar Pichai, CEO

“Our technology leadership and AI portfolio are helping us attract new customers, win larger deals, and drive 30% deeper product adoption with existing customers.”

Anat Ashkenazi, CFO

“The Cloud business demonstrated robust growth this quarter, with a 35% increase in revenue driven by demand for AI infrastructure and generative AI solutions.”

Product Innovations

Sundar Pichai, CEO

“New features in Lens and Circle to Search are transforming the user experience, allowing people to ask more complex questions and engage with search in new ways. This leads to users coming to search more often for more of their information needs, driving additional search queries.”

Philip Schindler, Chief Business Officer

“We continue to see the potential of AI to supercharge search. With Circle to Search, we are seeing higher engagement, particularly among users aged 18 to 24, helping us connect people with more relevant ads that enhance the user experience.”

AI and Gemini

Sundar Pichai, CEO

“We are uniquely positioned to lead in the era of AI because of our differentiated full-stack approach to AI innovation, which combines advanced infrastructure, leading-edge research, and global reach through products and platforms that touch billions of users worldwide.”

Anat Ashkenazi, CFO

“Our capital investments continue to focus on advanced AI infrastructure, supporting Gemini’s development and deployment. As we expand our data center capacity, we are prepared for increased investment levels going into 2025.”

International Growth

Philip Schindler, Chief Business Officer

“Our recently announced strategic partnership with Vodafone Group spans AI, Android, Ads, and digital services, bringing Google technology to over 330 million customers across Europe and Africa.”

Sundar Pichai, CEO

“As we expand our AI infrastructure from the U.S. to Thailand and Uruguay, we’re also driving clean energy investment in these markets, including our purchase agreement with small modular reactors for carbon-free power.”

Challenges and Future Outlook

Sundar Pichai, CEO

“We plan to vigorously defend our business practices as the Google vs. DOJ case progresses. Our commitment to innovation and user choice remains at the core of our success as users continue to choose Google for the quality of the product.”

Anat Ashkenazi, CFO

“As we look forward, we are working to balance investments in AI and other growth areas with cost discipline. We see opportunities to further optimize our operations to support these strategic priorities.”