Google Q1 2025 Earnings Analysis

Dive into $GOOG $GOOGL Google’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$90,234M rev (+12.0% YoY, +11.8% LQ) beat est by 1.0%

↗️Gross Margin (59.7%, +1.4 PPs YoY)🟢

↗️Operating Margin (33.9%, +2.3 PPs YoY)🟢

↗️FCF Margin (21.0%, +0.1 PPs YoY)

↗️Net Margin (38.3%, +8.9 PPs YoY)🟢

↗️EPS $2.81 beat est by 40.5%

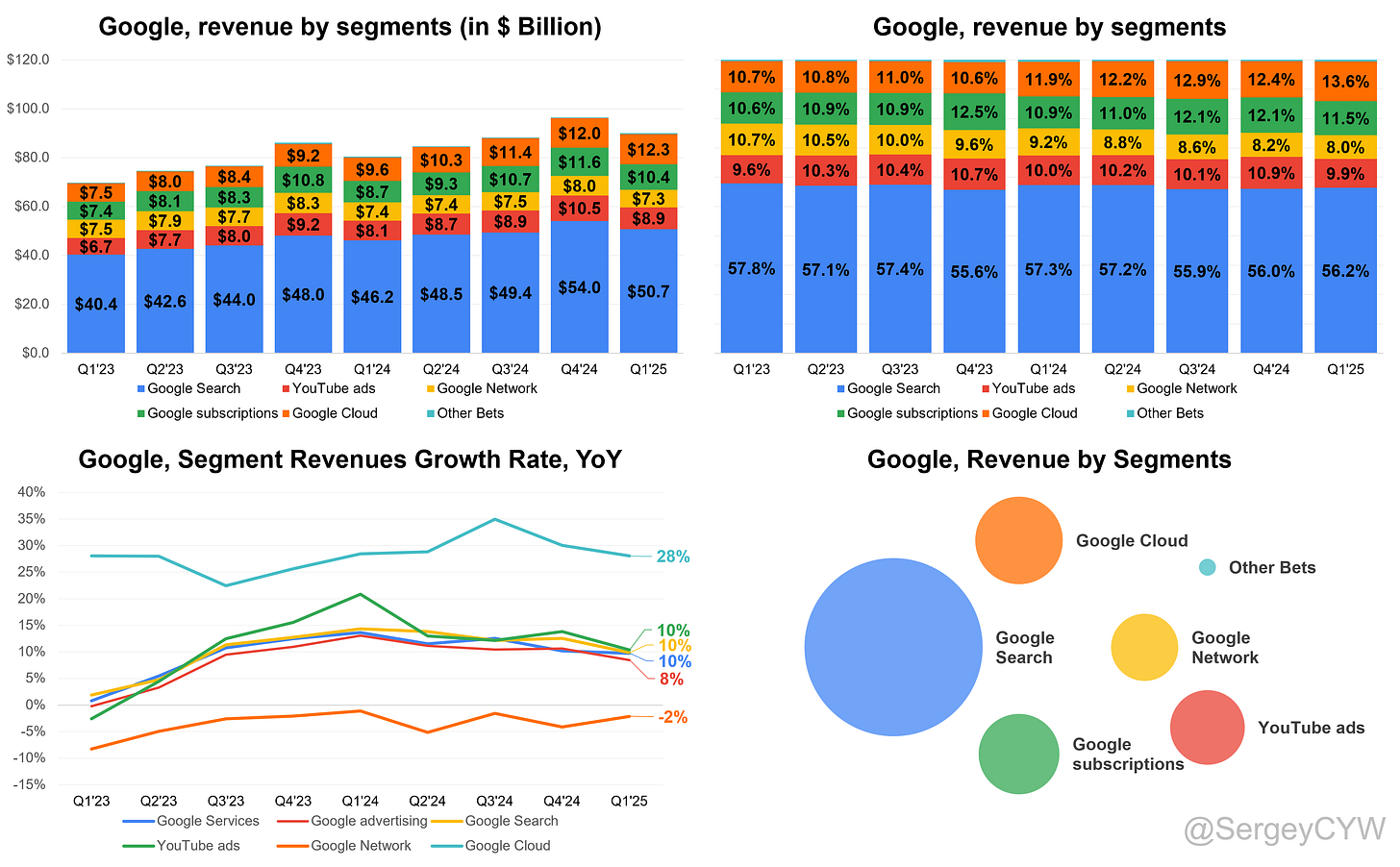

Segment Revenue

➡️Google Search $50,702M rev (+9.8% YoY)🟡

➡️YouTube ads $8,927M rev (+10.3% YoY)🟡

↘️Google Network $7,256M rev (-2.1% YoY)🟡

➡️Google advertising $66,885M rev (+8.5% YoY)🟡

↗️Google subscriptions $10,379M rev (+18.8% YoY)🟢

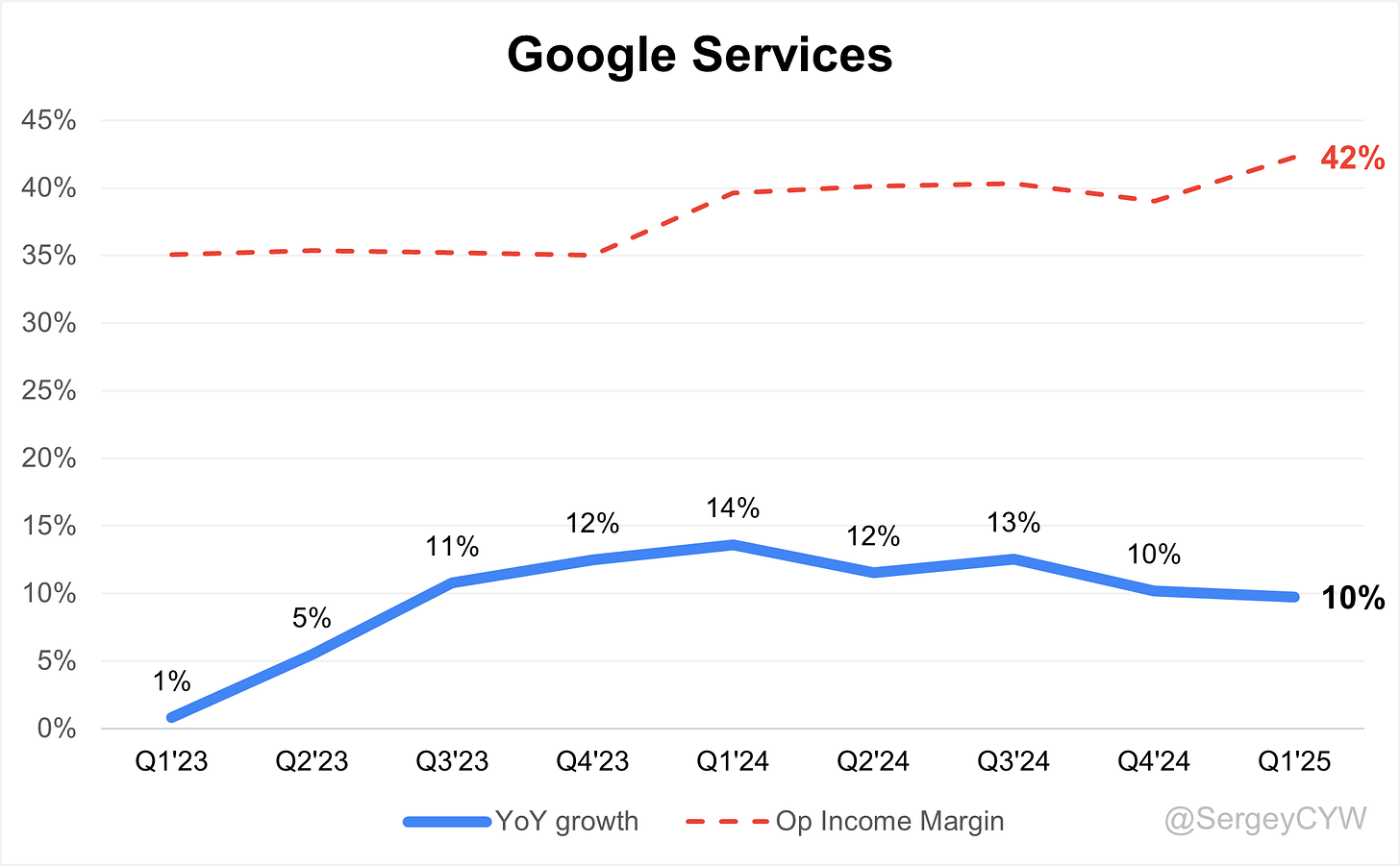

➡️Google Services $77,264M rev (+9.8% YoY, 42.3% Op Margin)🟡

↗️Google Cloud $12,260M rev (+28.1% YoY, 17.8% Op Margin)

↘️Other Bets $450M rev (-9.1% YoY, -272.4% Op Margin)🟡

Revenue by Geography

↗️United States $43,964M (+13.5% YoY, 48.7% of Rev)

➡️EMEA $25,923M (+9.0% YoY, 28.7% of Rev)

➡️APAC $14,854M (+11.8% YoY, 16.5% of Rev)

↗️Other Americas $5,233M (+12.5% YoY, 5.8% of Rev)

Operating expenses

↘️S&M/Revenue 6.8% (-1.1 PPs YoY)

↗️R&D/Revenue 15.0% (+0.2 PPs YoY)

↗️G&A/Revenue 3.9% (+0.2 PPs YoY)

Headcount

↗️185,719 Total Headcount (+2.7% YoY, +2396 added)

Dilution

↗️SBC/rev 6%, +0.1 PPs QoQ

↗️Basic shares down -1.9% YoY, +0.2 PPs QoQ🟢

↗️Diluted shares down -1.9% YoY, +0.1 PPs QoQ🟢

Key points from Google’s First Quarter 2025 Earnings Call:

Financial Performance

Alphabet reported $90.2B in revenue, up +12% YoY and +14% in constant currency. Operating income rose +20% YoY to $31.0B, with operating margin expanding to 33.9%, an increase of +2.3 percentage points. Net income increased +46% YoY to $34.5B, while EPS climbed +49% YoY to $2.81. Free cash flow reached $19.0B in Q1 and $74.9B over the trailing twelve months.

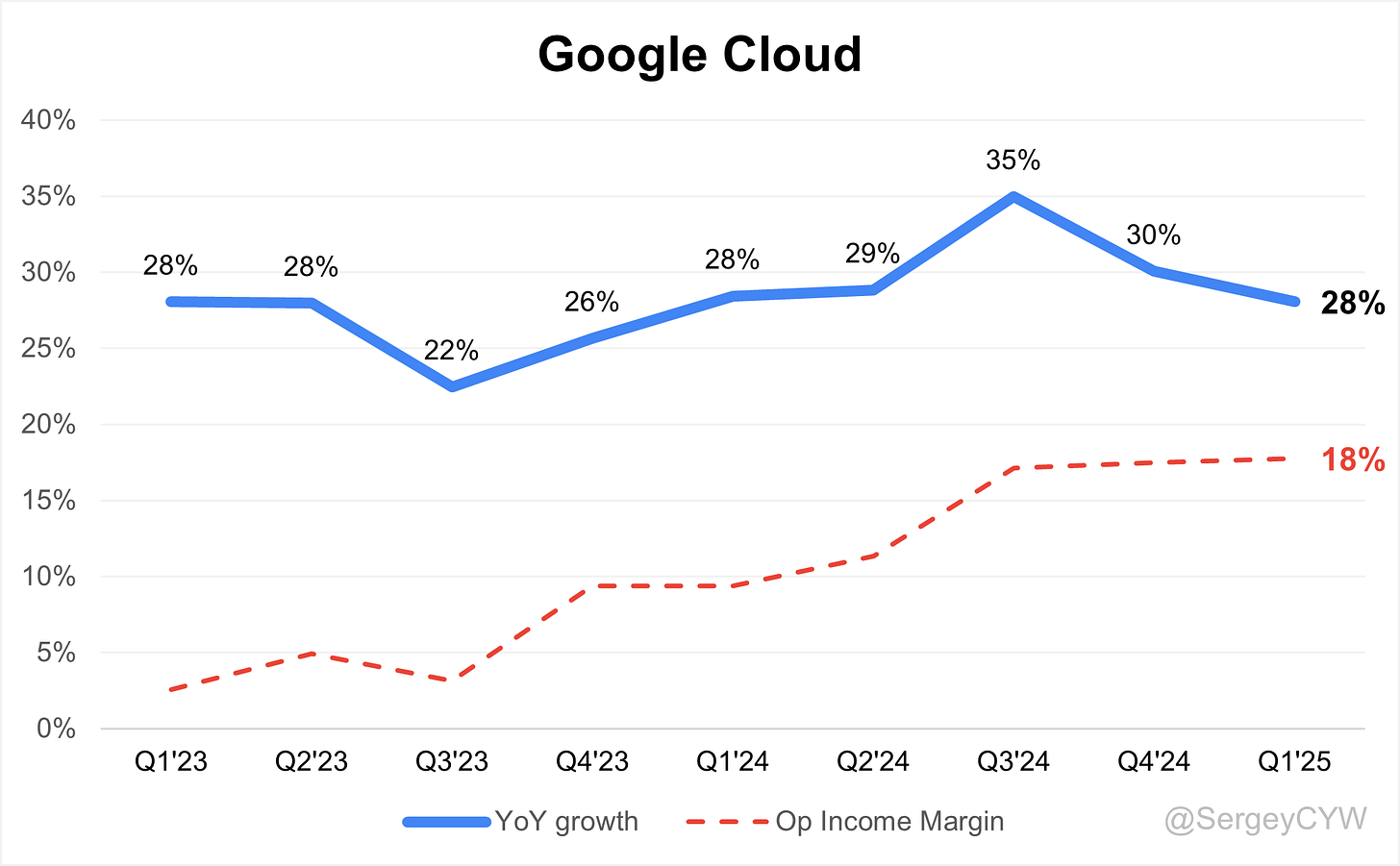

Google Cloud

Revenue increased +28% YoY to $12.3B, with GCP growing faster than the segment average. Operating income rose from $191M to $2.2B, lifting margin from 9.4% to 17.8%. Growth was driven by AI training, inference, and productivity workloads.

Key product launches included the Agent Development Kit and Agent Designer, both enabling deployment of AI agents across 100+ enterprise systems. Vertex AI now provides access to 200+ foundation models, including Gemini 2.5 Pro, 2.5 Flash, and models from Anthropic and Meta.

Google Distributed Cloud and sovereign AI are gaining traction in regulated markets. Over 500 enterprises showcased outcomes at Cloud Next, including Verizon, KPMG, and Lowe’s. Google Agent Space is now used for internal enterprise search and workflow automation.

Cloud growth may vary quarter to quarter due to infrastructure supply constraints. Full-year revenue growth will depend on server and data center deployment.

Google Search

Search and Other revenue rose +10% YoY to $50.7B, led by financial services (especially insurance), retail, healthcare, and travel.

AI Overviews expanded to 140 countries in 15+ languages, now reaching 1.5B+ monthly users. Monetization is consistent with traditional search. Circle to Search is active on 250M+ devices, up +40% QoQ, while Lens usage increased by +5B queries since October.

Search handles over 2B daily users and 5T annual queries. Lens shopping grew +10%, largely from new users. AI is increasing commercial queries and monetizable opportunities.

A regulatory change to the de minimis exemption will create a 2025 ad revenue headwind, primarily impacting APAC retailers. AI competition is intensifying, and sustaining monetization from advanced features remains a key challenge.

Gemini

Gemini 2.5 Pro is widely regarded as the industry’s leading AI model, with advances in reasoning, coding, and science. The lighter 2.5 Flash variant improves cost and latency.

Gemma 3, a smaller open model, has been downloaded 140M+ times. New models Imagine 3 and Vio2 enhance image and video generation capabilities.

Gemini is embedded across 15+ products, each with 500M+ users, including Search, Android, and Workspace. Standalone Gemini app has 35M DAUs, with adoption increasing following product improvements.

Over 30% of Google’s code commits now include AI assistance. Gemini is also integrated in Workspace, delivering 2B+ monthly AI assists, and in development tools like Gemini API and AI Studio.

While product usage is growing, Gemini lags ChatGPT in standalone traction. Monetization outside ads remains early-stage. Google is operating multiple AI experiences (Gemini app, Search, AI Mode), which may dilute engagement.

YouTube

Ad revenue grew +10% YoY to $8.9B, driven by both Direct Response and Brand Advertising. Shorts engagement rose +20% YoY. YouTube Premium and Music subscribers surpassed 125M.

Over 20B videos are hosted on the platform, with 20M+ uploads per day. The platform marked its 20th anniversary and leads U.S. TV streaming watch time per Nielsen. Podcast MAUs now exceed 1B.

Reservation-based ad revenue more than doubled YoY, with improved brand effectiveness. Toyota’s campaign with creator Zach King lifted brand awareness +25%.

Integration with DemandGen and PMax is optimizing asset placement across YouTube, Gmail, Discover, and GDN. AI-generated creatives are improving campaign reach.

Competition from TikTok remains strong in short-form video. Monetization of podcasts and global Premium adoption are still developing. Advertising macro conditions were stable, though management flagged early caution.

Waymo

Waymo now operates 250K+ paid rides per week, a +5x YoY increase. Services expanded to Silicon Valley, with launches planned for Atlanta (2025) and Washington D.C. (2026).

Rides through Uber are active in Austin and expanding. Waymo is developing a partner-driven model with OEMs and fleet maintenance providers.

Autonomous capabilities include airport access and freeway driving, improving ride experience and service scalability.

Management is building toward long-term viability but has not disclosed revenue or unit economics. Future monetization could include licensing, operations, or consumer ownership. Regulatory and capital challenges remain.

Product Innovations

AI-first transformation is evident across platforms. Google released Gemini 2.5 Flash, Imagine 3, and Vio2 to power image and video generation.

Agent frameworks, including the Agent Development Kit and Agent Designer, support AI integration across enterprise systems.

Vertex AI now includes 200+ models. Workspace provides over 2B AI assists monthly, including Gmail summaries and Docs enhancements.

CapEx and Infrastructure

CapEx reached $17.2B in Q1, primarily for servers and data centers. Full-year CapEx remains guided at $75B, up from $50–55B in 2024.

Depreciation rose +31% YoY and will accelerate due to ongoing infrastructure deployment. Investments support scale across Cloud, DeepMind, and core services.

Challenges

Alphabet cited macro uncertainty and regulatory risk. The de minimis exemption change will pressure ad revenues, especially in APAC.

Cloud supply constraints may create revenue variability depending on infrastructure deployment. High CapEx continues to pressure margins via depreciation.

Buybacks and Dividend

Share repurchases totaled $15.1B in Q1, with $2.4B in dividends paid. The Board approved a $70B buyback program and increased the quarterly dividend by +5%.

Cash and marketable securities stood at $95B at quarter-end.

Future Outlook

Alphabet expects continued investment in infrastructure and moderate headcount growth in strategic areas. Depreciation will remain elevated.

Management aims to offset margin pressures through productivity, AI-enabled efficiencies, and disciplined capital allocation.

Focus areas for long-term growth include AI agents, Gemini, autonomous mobility, and enterprise cloud. Key product updates will be showcased at Google I/O, Brandcast, and Marketing Live.

Management comments on the earnings call.

Product Innovations

Sundar Pichai, Chief Executive Officer

"We rolled out Gemini 2.5, our most intelligent AI model, which is achieving breakthroughs in performance and it's widely recognized as the best model in the industry."

"All 15 of our products with a half a billion users now use Gemini models... making it super easy to use AI for a wide range of tasks just by using their camera, voice or taking a screenshot."

Philip Schindler, Chief Business Officer

"More businesses big and small are adopting AI-powered campaigns, and the deployment of AI across our Ads business is driving results for our customers and for our business."

Google Cloud

Sundar Pichai, Chief Executive Officer

"At Cloud Next, we announced major innovations and over 500 companies shared the business results they are achieving by working with us."

"We were the first cloud provider to offer NVIDIA's groundbreaking B200 and GB200 Blackwell GPUs and will be offering their next generation Vera Rubin GPUs."

Anat Ashkenazi, Chief Financial Officer

"We exited the year specifically with more customer demand than we had capacity. That was the case this quarter as well."

"We want to make sure we ramp up to support customer needs and customer demands... while continuing to drive efficiency and productivity throughout the business."

Google Search

Sundar Pichai, Chief Executive Officer

"AI is one of the most revolutionary technologies for enabling and expanding our information mission... we see it growing the number and types of questions we can answer."

"Building on the positive feedback for AI Overviews, in March we released AI Mode… with more advanced reasoning, thinking and multimodal capabilities."

Philip Schindler, Chief Business Officer

"Q1 marked our largest expansion to date for AI Overviews, both in terms of launching to new users and providing responses for more questions."

"For AI Overviews overall, we continue to see monetization at approximately the same rate, which gives us a strong base on which we can innovate even more."

Gemini

Sundar Pichai, Chief Executive Officer

"With 2.5 Pro and Flash, I think we are well positioned. We are seeing tremendous reception from developers, enterprises and consumers too."

"People are typing in roughly 2x longer queries compared to traditional search… and we are seeing positive feedback around its fast response time and ability to handle complex questions."

"Internally, over 30% of the code checked in involves people accepting AI solutions... and with newer models we are working on early agentic workflows."

YouTube

Philip Schindler, Chief Business Officer

"YouTube had strong growth in revenues across ads and subscriptions. Watch time growth remains robust, particularly in key monetization opportunity areas such as Shorts and living room."

"In Q1, the growth of our reservation-based ads business more than doubled year over year. Brands and creators continue to use the opportunities that collaborations and partnerships offer."

"Thanks to dozens of AI-powered improvements launched in 2024, businesses using DemandGen now see an average 26% year-on-year increase in conversions per dollar spent."

Waymo

Sundar Pichai, Chief Executive Officer

"The thing that excites me is I think we've been laser focused... on building the world’s best driver."

"Through our partnership with Uber, we expanded in Austin and are preparing for our public launch in Atlanta later this summer."

"It will also require a successful ecosystem of partners... we're already seeing strong rider satisfaction in cities like Austin."

Competitors

Sundar Pichai, Chief Executive Officer

"We are definitely seeing increased adoption and usage based on new features… and by many metrics, we have the best model out there now."

Anat Ashkenazi, Chief Financial Officer

"We continue to invest in long-term innovation… ensuring we have a very resilient long-term growth profile for the company."

Challenges

Anat Ashkenazi, Chief Financial Officer

"The significant increase in our investments in CapEx over the past few years will continue to put pressure on the P&L, primarily in the form of higher depreciation."

"We saw 31% year-on-year growth in depreciation from the increase in technical infrastructure assets placed in service."

"Changes to the de minimis exemption will obviously cause a slight headwind to our ads business in 2025 primarily from APAC-based retailers."

Future Outlook

Anat Ashkenazi, Chief Financial Officer

"We still expect to invest approximately $75 billion in CapEx this year… we’re looking at how do we make sure every dollar is used efficiently."

"We have a highly rigorous process to determine the demand behind it and the allocation of compute associated with our technical infrastructure investments."

Sundar Pichai, Chief Executive Officer

"The recent advances on the model frontier… I think that’s going to drive increased adoption as well."

"We recently organized ourselves better to capitalize on this momentum and I’m excited about our roadmap."

Thoughts on Google Earnings Report $GOOGL:

🟢 Positive

Revenue grew to $90.2B, up +12.0% YoY, beating estimates by +1.0%

EPS rose +49.0% YoY to $2.81, beating by +40.5%

Net margin expanded to 38.3%, up +8.9 PPs YoY

Google Cloud revenue surged +28.1% YoY to $12.3B, margin improved to 17.8%

FCF margin held strong at 21.0%, with Q1 free cash flow at $19.0B

Google subscriptions revenue climbed +18.8% YoY to $10.4B

YouTube ad revenue up +10.3% YoY to $8.9B, Shorts engagement up +20% YoY

Operating income increased +20% YoY to $31.0B, margin rose to 33.9%

Basic and diluted share count declined -1.9% YoY, supporting per-share metrics

$15.1B in buybacks and $2.4B in dividends returned to shareholders

Board approved new $70B buyback and +5% dividend increase

🟡 Neutral

Google Search revenue up +9.8% YoY to $50.7B, with steady monetization

Google Services revenue rose +9.8% YoY to $77.3B, 42.3% operating margin

R&D spend grew modestly to 15.0% of revenue, up +0.2 PPs YoY

Headcount increased +2.7% YoY to 185,719, adding +2,396 employees

Revenue by geography: U.S. +13.5% YoY, EMEA +9.0%, APAC +11.8%, Other Americas +12.5%

S&M spend reduced to 6.8% of revenue, down -1.1 PPs YoY

Stock-based comp/revenue rose slightly to 6.0%, up +0.1 PPs QoQ

🔴 Negative

Google Network revenue declined -2.1% YoY to $7.3B

Other Bets revenue fell -9.1% YoY to $450M, with -272.4% operating margin

Depreciation increased +31% YoY, pressuring margins

Cloud growth may face quarterly volatility due to infrastructure supply constraints

Regulatory headwind from de minimis exemption changes to impact APAC ad revenue in 2025

Standalone Gemini app DAUs at 35M, lags behind ChatGPT in direct engagement

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.