Google: Dominating Search, Expanding in AI and Cloud

Deep Dive into $GOOGL: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Google: Company overview

About Google

Google, trading under ticker $GOOGL, operates as the world's leading search engine and digital advertising platform. It processes billions of search queries daily through its proprietary PageRank algorithm. Over time, Google has evolved into a broad technology ecosystem covering cloud computing, artificial intelligence, mobile operating systems, and hardware products. Its leadership position is sustained by ongoing innovation, especially in AI and machine learning.

Company Mission

Google’s mission is to organize the world’s information and make it universally accessible and useful. Its vision aims to provide access to the world’s information in one click. This utilitarian focus drives product development, ensuring that tools serve global user needs efficiently. Since its founding in 1998, the mission has remained consistent and underpins all strategic decisions.

Sector and Market Position

Google operates in the technology sector, with core focus areas in digital advertising, cloud computing, and artificial intelligence services. It dominates the global search market through its sophisticated relevance ranking algorithm. As of 2025, CEO Sundar Pichai has made AI the company’s top strategic focus. The Gemini AI platform, particularly Gemini 2.5 Pro, has led the LMArena leaderboard across all categories. Its seventh-generation TPU, Ironwood, delivers 42.5 exaflops per pod, making it 10 times more powerful than previous generations.

Competitive Advantage

Google’s competitive edge lies in its vast data infrastructure and deep AI integration. Its Elo scores have improved by over 300 points since the first Gemini Pro release, signaling rapid advancements. The company’s infrastructure supports faster and more cost-effective model deployment. AI integration across Google’s entire ecosystem, including search, cloud, and productivity tools, forms a high barrier to entry. Services such as Google Translate, AI assistants, and mapping technologies enhance global accessibility, extending user reach across language and location boundaries.

Total Addressable Market

Google’s TAM spans several high-growth sectors.

The global digital advertising market is projected to grow from $843.48 billion in 2025 to $1.43 trillion by 2029, with 14% CAGR. Google is the largest contributor. Google’s Q1 2025 advertising revenue reaching $66.9 billion, up 8% year-over-year.

The artificial intelligence market is Google’s fastest-growing segment. Global market size hit $757.58 billion in 2025 and is projected to expand to $3,680.47 billion by 2034, with a 19.20% CAGR. North America leads this expansion with a 19.22% CAGR. The Gemini AI platform positions Google to capture substantial share as enterprise adoption of AI scales.

Google Cloud represents a rapidly expanding TAM segment, and is projected to reach $1.40 trillion by 2030, growing at a 16.8% CAGR from 2023 to 2030. Google Workspace segment alone is valued at approximately $12 billion, with an expected 18.5% CAGR through 2033. Adoption of cloud-based tools continues to accelerate as businesses prioritize digital transformation and remote work capabilities.

Market Position and Growth Trajectory: Google’s diversified TAM strategy reduces reliance on any single revenue stream. Its dominance in search provides a strong foundation for adjacent market expansion. AI, with projected nearly 20% annual growth through 2034, is the most significant catalyst. Across all sectors, Google is positioned within multi-trillion-dollar markets with sustained, long-term growth potential.

Valuation

$GOOGL is trading at a forward EV/Sales multiple of 5.1, roughly in line with the sector median of 4.8. For context, the valuation peaked at around 7 in 2021, but dropped to as low as 3.4 in early 2023 due to concerns about Google Search’s competitive position.

Powered by FinChat.io — get 15% off with affiliate link for Compounding Your Wealth readers.

$GOOGL trades at a forward P/E ratio of 18.6, significantly below the sector median of 23.2, with 12% YoY revenue growth in the latest quarter.

EPS growth for 2025 is forecasted at 22.6%, resulting in a 2025 PEG ratio of 0.8.

For 2026, EPS growth is projected at 16.9%, with a forward P/E of 16.8 and a 2026 PEG ratio of 0.9.

Powered by FinChat.io — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast $GOOGL revenue growth of +13.7% in 2025 and +10.5% in 2026. Based on this outlook, the valuation using the P/E multiple appears undervalued compared to other Big Tech companies.

Analysts expect solid revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Google (Alphabet Inc.) continues to demonstrate one of the most formidable economic moats in the technology sector as of 2025, with multiple layers of competitive advantages that create substantial barriers to entry. The company's dominance across search, advertising, cloud services, and AI infrastructure stems from a combination of scale advantages, network effects, brand strength, intellectual property, and switching costs that work synergistically to protect its market position.

Economies of Scale

Google’s scale remains its strongest competitive edge, significantly enhanced in 2025 by AI infrastructure investments. The company operates custom-built, highly efficient data centers that are 1.8x more energy efficient than standard setups, with a PUE of 1.10 vs. the 1.58 industry average.

New innovations like the AI Hypercomputer and Ironwood TPUs improve AI performance and cost-efficiency. With over 2 million miles of fiber, 33 subsea cables, 202 network edge locations, and 3,000+ CDN sites, Google’s operational efficiency and reach are unmatched—creating a self-reinforcing loop of lower costs and better performance.

Network Effects

Google holds an 89.62% global search engine market share as of January 2025, with AI Overviews reaching 1.5 billion users monthly. The introduction of a patented token-based search index incorporating predictive personalization has made replication by competitors even more difficult.

Its growing AI developer ecosystem (4M+ developers using Gemini) and 20x surge in Vertex AI usage create additional network effects that further entrench Google’s dominance.

Brand Strength

In 2025, Google ranks third in global brand strength (score: 94.7) and second in brand value at $578B, just behind Apple. Its brand is still synonymous with internet search and strengthens user engagement across products like Gmail, Maps, and Android.

Though users primarily stay for quality rather than loyalty, the brand supports product adoption and talent attraction, especially with AI-powered tools like Gemini now deeply embedded across the ecosystem.

Intellectual Property

Google now leads the global race in generative AI patents, surpassing IBM, and shares the top spot in agentic AI patents in the U.S. alongside Nvidia.

17% of all AI-related patent filings in the U.S. are now in generative AI, with filings up 56% year-over-year. Google’s search algorithm, proprietary codebase, and quantum computing advances (e.g., Willow chip) form a defensive moat that’s nearly impossible to breach.

Switching Costs

While physical switching costs are low, behavioral and data-driven switching costs have increased. Personalized experiences from Google’s token-based index use signals like location and behavior history, making comparable experiences hard to find elsewhere.

Enterprise customers face higher integration costs, and yet have accepted Workspace price increases in 2025 (e.g., $8.40 for Business Starter, up from $7.20), partly due to value from AI tools like Gemini.

Still, regulatory pressure and alternatives like ChatGPT present new risks to these switching cost advantages.

Google’s moat remains wide and durable, with scale and network effects as its primary shields. Strategic investment in AI infrastructure, patents, and ecosystem integration have made it even harder to challenge.

However, AI-native competitors and global regulators could test Google’s long-held defensive walls in the coming years.

Revenue growth

$GOOGL’s revenue growth slowed from +15% YoY in Q3 2024, then stabilized at +12% in Q1 2025. While Google doesn’t provide revenue guidance for the next quarter, it’s worth noting that the company beat analyst estimates by 1.0% in Q1.

Segments and Main Products

Alphabet operates through three primary reportable segments that drive its $90.2 billion quarterly revenue as of Q1 2025 The company's business structure reflects its evolution from a search-focused entity to a diversified technology conglomerate spanning advertising, cloud computing, and experimental ventures.

Google Services represents Alphabet's dominant revenue engine, generating $77.3 billion in Q1 2025, accounting for approximately 87% of total company revenue. The segment encompasses Google's core advertising business through Search, YouTube, Gmail, Google Maps, and Google Play, alongside subscription services like YouTube Premium, YouTube TV, and Google One. Search remains the cornerstone product, with AI Overviews now serving 1.5 billion monthly users and driving continued growth in the "Search and other" category, which alone produced $50.7 billion in quarterly revenue. YouTube operates as a critical component within Google Services, generating $8.93 billion in advertising revenue during Q1 2025 while contributing to Alphabet's milestone of surpassing 270 million paid subscriptions across all services.

Google Cloud has emerged as Alphabet's fastest-growing segment, achieving $12.3 billion in revenue during Q1 2025 with a robust 28% year-over-year growth rate. The segment provides infrastructure and platform services, data analytics, collaboration tools, and enterprise applications to business customers. Google Cloud Platform services generate revenue through consumption-based fees, while Google Workspace collaboration tools operate on subscription models. The segment has achieved profitability with over $4 billion in operating income across the first three quarters of 2024, marking a significant milestone in Alphabet's cloud computing ambitions.

Other Bets encompasses Alphabet's experimental and emerging technology ventures, including autonomous driving company Waymo, life sciences subsidiary Verily, internet services provider GFiber, and various research initiatives through X. The segment generated $1.2 billion in revenue but reported an operating loss of approximately $3.3 billion during the first nine months of 2024. Other Bets represents Alphabet's long-term investment strategy in transformative technologies, though individual businesses within the segment remain not individually material to overall company performance.

Alphabet-level Activities capture corporate-wide initiatives including AI-focused research and development, philanthropic activities, and shared corporate costs. The category includes development costs for general AI models like Gemini, corporate finance and legal expenses, and charges associated with employee severance and office space optimization. Revenue hedging activities and certain fines and settlements also fall under Alphabet-level activities, reflecting the company's centralized approach to managing enterprise-wide functions and strategic investments.

Main Products Performance in the Last Quarter

Google Search rose 10%, a deceleration from 13% last quarter, and slightly below total revenue growth.

YouTube Ads increased 10%, also slowing from 14% in Q4’24, and again, trailing overall company growth.

Google Network contracted -2%, a slight improvement from -4%, but still a consistent drag on top-line performance.

Google Subscriptions rebounded to +19%, up sharply from 8% in Q4'24, and now significantly outpacing total revenue.

Overall, Google Services posted +9.8% growth, roughly in line with the +10.2% growth in Q4 2024. The operating margin increased to 42.3%.

Google Cloud posted +28% growth, down from 30% in Q4’24, but remains the fastest-growing segment, more than 2x the overall growth rate. Operating margin improved to 18%.

Strength remained in Cloud and Subscriptions, while Search and YouTube decelerated modestly. Network ads continue to underperform.

Google Search

Search delivered double-digit revenue growth, led by strong performance in financial services, especially insurance, followed by retail, healthcare, and travel. AI Overviews usage has scaled to 1.5 billion users/month, with continued rollout across 40 countries and 15 languages. Monetization from AI Overviews remains at approximately the same rate as traditional queries, signaling stable ad performance even with AI integration.

Circle to Search is now on 250 million+ devices, with usage up 40% QoQ. Lens visual searches rose by 5 billion since October. AI Mode, currently in Labs, is showing high engagement, with queries 2x longer than typical search queries. AI is expanding the types of questions Google can handle and increasing overall query volume.

Google Services

Revenue reached $77.3 billion, up 10% YoY, supported by growth in Search, YouTube Ads, and subscriptions. Operating income grew 17% to $32.7 billion, with margin expansion to 42.3%. Subscription revenue climbed 19% to $10.4 billion, driven by YouTube Premium and Google One. Total subscriptions across platforms now exceed 270 million.

Despite TAC (traffic acquisition costs) pressure, the shift from network revenue toward direct Search improved gross margins. TAC was $13.7 billion, up 6%, with network ads revenue falling 2% YoY. Google's internal efficiency efforts, especially in headcount and infrastructure, helped sustain profitability.

YouTube

Ad revenue increased 10% YoY to $8.9 billion, led by Direct Response, followed by brand advertising. YouTube Music and Premium surpassed 125 million subscribers globally, including trials. Shorts saw 20%+ growth in engaged views, and TV remains the primary YouTube device in the U.S., holding the #1 spot in watch time for the past two years (Nielsen).

The Shorts monetization gap is narrowing, especially in the U.S. YouTube’s 20th anniversary was marked by continued platform dominance, with creators uploading 20 million videos/day and a total library of 20 billion+ videos. Podcast monthly actives surpassed 1 billion. Reservation-based ad business more than doubled YoY, indicating stronger traction in branded partnerships.

Google Cloud

Revenue rose 28% YoY to $12.3 billion, outpacing the segment's historical trend. Operating income hit $2.2 billion, and margin expanded to 17.8%. Growth was driven by core infrastructure and AI products. Cloud Next saw 500+ customer case studies. Demand is outpacing capacity, which may impact quarterly growth until more deployments arrive in late 2025.

Vertex AI now supports 200+ foundation models, including Gemini 2.5 Pro, Flash, and open-source models like LLaMA4 and Anthropic. AI Agent tools (Agent Development Kit and Agent Designer) are central to Google's cloud agent strategy. Workspace now delivers 2 billion+ AI assists monthly, across Gmail and Docs.

Gemini

Gemini 2.5 Pro is Google's most advanced model, topping benchmarks in reasoning, coding, science, and math. Gemini 2.5 Flash was launched to balance cost and quality, supporting use cases needing speed. Gemini models now power all 15 of Google’s products with 500M+ users each.

Gemini DAU was 35 million, as revealed during a trial, a modest number compared to AI Overviews' 1.5 billion reach. However, momentum is increasing thanks to the rollout of features like Gemini Live and Canvas, with strong user engagement. AI Studio and Gemini API users have grown 200%+ YTD.

Gemma open models reached 140 million downloads. Google continues investing in robotics and health AI, including AI Coscientists and AlphaFold, now used by 2.5 million+ researchers.

Waymo

Waymo is now delivering 250,000+ paid passenger rides/week, up 5x YoY. Service expanded to Silicon Valley and Austin, with Atlanta launch expected summer 2025 and Washington D.C. and Miami in 2026. Partnership with Uber is driving scaled adoption in new markets.

Focus areas include airport access and freeway driving, with partnerships for fleet maintenance and OEM support developing. Waymo is not yet tied to a fixed business model; licensing, ride-hailing, and ownership options remain open as the technology scales.

Innovations and Product Updates

Gemini 2.5 Pro and Flash drive AI model performance. Ironwood, the 7th-gen TPU, offers 10x compute power over prior TPUs with 2x energy efficiency, tailored for inference at scale. Google became the first cloud provider to support NVIDIA B200, GB200 Blackwell, and upcoming Vera Rubin GPUs.

AI tools are now embedded into Ads: PMax, DemandGen, and Asset Recommendations improved conversion efficiency. DemandGen with product feeds delivered 2x more conversions per dollar YoY. Royal Canin saw 2.7x higher conversion rate and 70% lower CPA from integrated campaigns.

Google also launched Imagine 3 and VO2 for advanced image and video generation, and Chirp and Lyria for audio use cases.

Wiz - Largest Acquisition in Alphabet History

Google is acquiring Wiz, a cloud security startup, for $32 billion, marking its largest acquisition to date. The deal strengthens Alphabet’s position in cybersecurity, aligning with its AI and cloud priorities. The Wiz acquisition is part of Alphabet’s broader $75 billion CapEx plan for 2025, focused on scaling AI and cloud infrastructure.

Wiz is a cloud-native application protection platform (CNAPP). Its capabilities include full-stack protection across multi-cloud environments—AWS, Azure, GCP—and on-premise systems. Integration will reinforce Google Cloud’s end-to-end security, addressing rising customer demand for robust protection across hybrid infrastructure.

The acquisition supports Alphabet’s push into sovereign AI and regulated industries, where data residency and compliance are critical. Wiz’s architecture enables security deployments that meet jurisdiction-specific requirements, positioning Google Cloud to better serve sectors like finance, healthcare, and government.

Wiz will enhance the security framework underpinning Gemini AI, Google’s core platform for AI agents and enterprise automation. Integrating Wiz into Vertex AI, Workspace, and Distributed Cloud will provide enterprise clients with built-in security and support AI deployment in sensitive environments. Google Cloud gains critical capabilities that directly support its long-term growth and differentiation.

Revenue by Region

Let’s take a look at $GOOGL’s revenue by region. The U.S. remains the largest contributor at 49% of total revenue, EMEA accounts for 29%, APAC 16%, and Other Americas make up the remaining 6%.

Revenue growth in the U.S. accelerated to +13% YoY, slightly outpacing overall growth. Other Americas and APAC grew in line with total revenue at +12% YoY, showing a slight acceleration compared to Q4 2024. Meanwhile, EMEA significantly underperformed, with revenue growth slowing to +9% YoY in Q1 2025.

Profitability

Over the past year, $GOOGL has improved its margins:

Gross margin increased from 58.3% to 59.7%.

Operating margin rose from 31.6% to 33.9%.

Net margin increased from 29.4% to 38.3%.

Free cash flow margin rose from 20.9% to 21.0%.

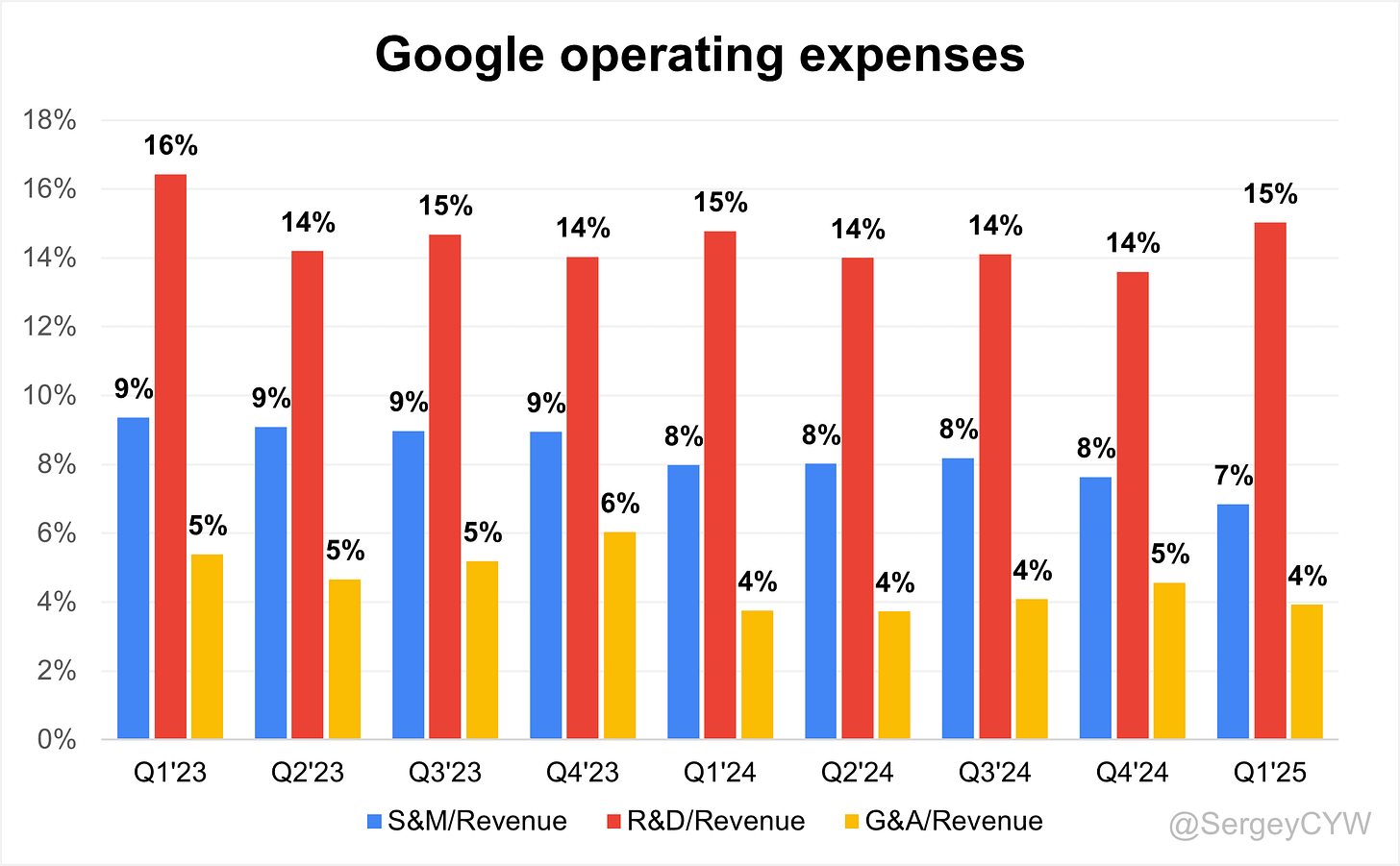

Operating expenses

$GOOGL operating expenses have decreased over the past two years, primarily due to a reduction in S&M spending, which declined from 9% to 7%. R&D expenses also decreased slightly, from 16% to 15%, but remain high as the company continues to invest in future growth. It’s worth noting that R&D spending remains higher than S&M. G&A expenses decreased to 4%.

CapEx and Infrastructure investments

CapEx reached $17.2B in Q1, primarily for servers and data centers. Full-year CapEx remains guided at $75B, up from $50–55B in 2024.

Depreciation rose +31% YoY and will accelerate due to ongoing infrastructure deployment. Investments support scale across Cloud, DeepMind, and core services.

Balance Sheet

$GOOGL Balance Sheet: Total debt stands at $28.5 billion, while Google holds $95.3 billion in cash and cash equivalents, far exceeding its liabilities and reflecting a healthy balance sheet.

Dilution

$GOOGL Shareholder Dilution: Google’s stock-based compensation (SBC) expenses have declined to 6% of revenue, a relatively low level for software companies.

Shareholder dilution remains well-controlled, with the weighted-average number of basic common shares outstanding decreased by -1.9% YoY. Google continues to return capital to shareholders through a combination of dividends and share repurchases.

Alphabet repurchased $15.1 billion in shares during Q1 2025. The Board of Directors approved a new $70 billion share repurchase authorization.

Alphabet paid $2.4 billion in dividend payments during Q1 2025, and declared a 5% increase in the quarterly dividend.

Conclusion

$GOOGL has been highly innovative, with significant R&D investments surpassing Sales & Marketing expenses. Google’s moat remains wide and durable, with scale and network effects as its primary competitive advantages. Strategic investments in AI infrastructure, patents, and ecosystem integration have made it even more difficult to challenge.

The combined Total Addressable Market (TAM) across Google's core segments now exceeds $2.2 trillion. Google’s diversified TAM strategy reduces reliance on any single revenue stream. Its dominance in Search provides a strong foundation for expansion into adjacent markets. AI, with projected ~20% annual growth through 2034, is the most powerful growth catalyst. Across all sectors, Google is positioned within multi-trillion-dollar markets with sustained, long-term growth potential.

$GOOGL has a highly diversified business. Search and YouTube both grew 10% YoY, while Subscriptions rebounded strongly at +19%. Cloud remains a standout, growing 28% YoY — slightly behind Microsoft Azure, but still among the fastest-growing hyperscalers, with expanding margins.

Google is also investing in new initiatives like Waymo (robotaxis) and Gemini (generative AI).

Revenue growth stabilized at +12.0% YoY in Q1 2025, compared to +11.8% in Q4 2024.

In Q1, Google announced substantial infrastructure investments to maintain its competitive edge and expand its economic moat:

CapEx reached $17.2B in Q1, primarily allocated to servers and data centers. Full-year CapEx guidance stands at $75B, up from $50–55B in 2024.

Valuation based on both forward P/S and forward P/E appears undervalued relative to other Big Tech companies, especially considering the 2025 revenue growth forecast of +13.7% YoY.

The balance sheet remains very strong.

The main investor concern around Google is the potential disruption of its core Search segment by generative AI. However, the reality tells a different story:

ChatGPT launched publicly on November 30, 2022, and since then, Google Search has not lost revenue — it continues to grow steadily at around +10% YoY.

Google's recent initiative to integrate AI-generated results directly into Search is aimed at strengthening its position and retaining leadership in this key segment.

Google is acquiring Wiz in Q1, a cloud security startup, for $32 billion, marking its largest acquisition to date. The deal strengthens Alphabet’s position in cybersecurity, aligning with its AI and cloud priorities.

Meanwhile, the Waymo robotaxi division continues to show strong momentum, and it could become a meaningful new revenue stream for the company in the future.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.