Global-e Online Q3 2024 Earnings Analysis

Dive into $GLBE Global-e’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$176.0M rev (+31.7% YoY, +26.0% LQ) beat est by 4.0%

↗️GM* (46.7%, +2.4 PPs YoY)

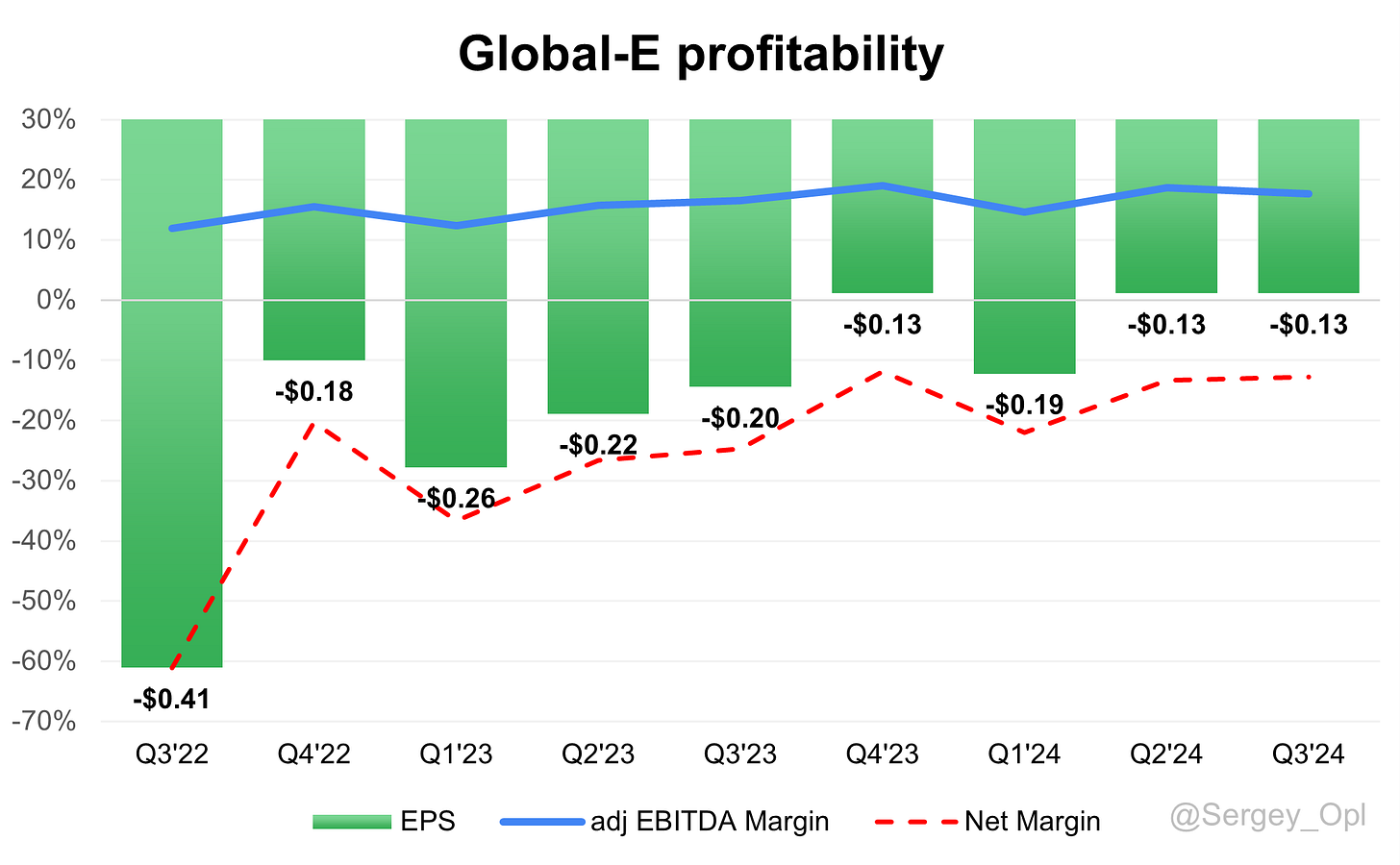

↗️EBITDA Margin* (17.7%, +1.1 PPs YoY)

↗️Net Margin (-12.8%, +11.9 PPs YoY)

↗️EPS -$0.13 beat est by 13.3%

*non-GAAP

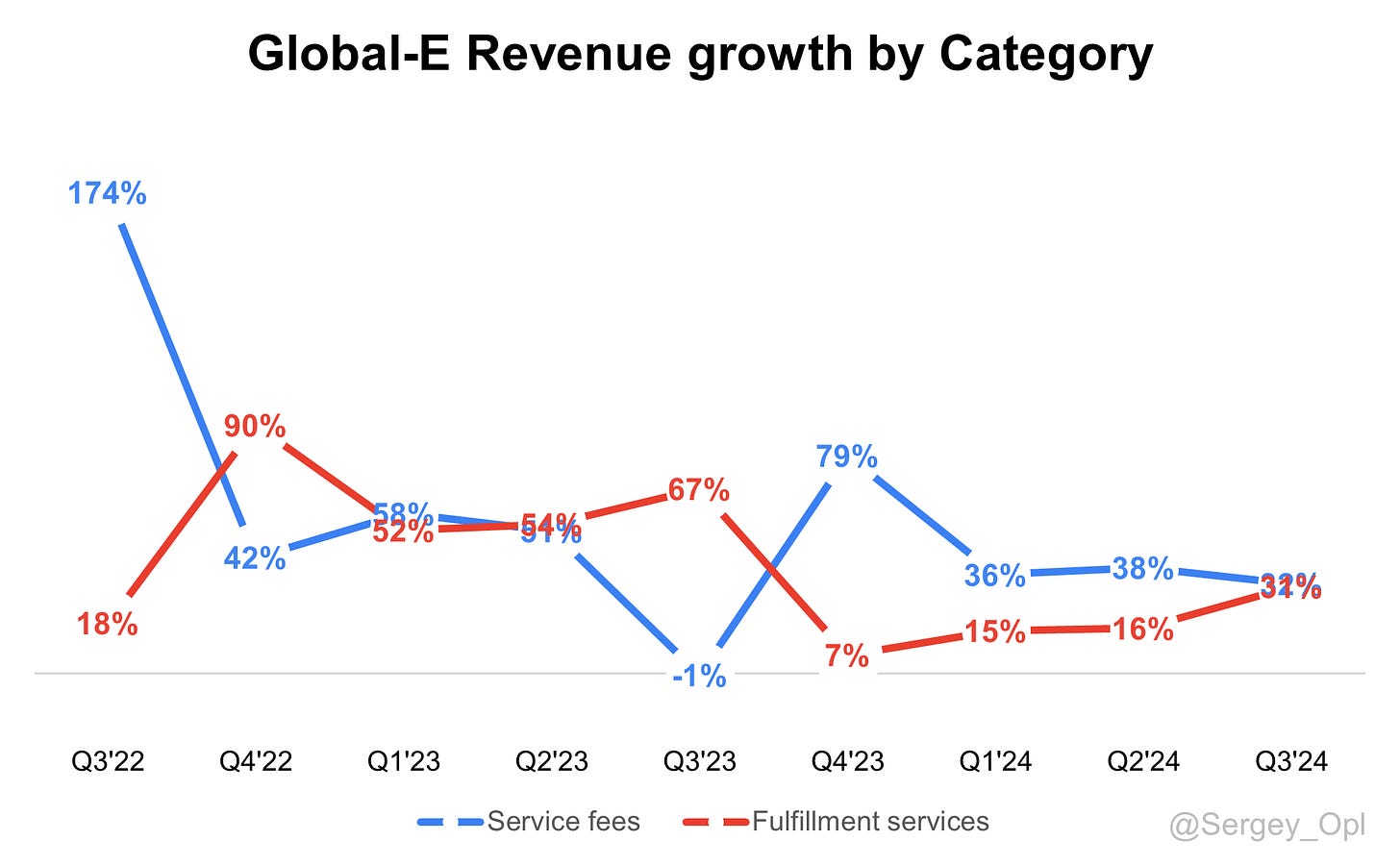

Revenue by Category

↗️Service fees $82.6M rev (+32.2% YoY, 46.9% of Rev)

➡️Fulfillment services $93.4M rev (+31.2% YoY, 53.1% of Rev)🟡

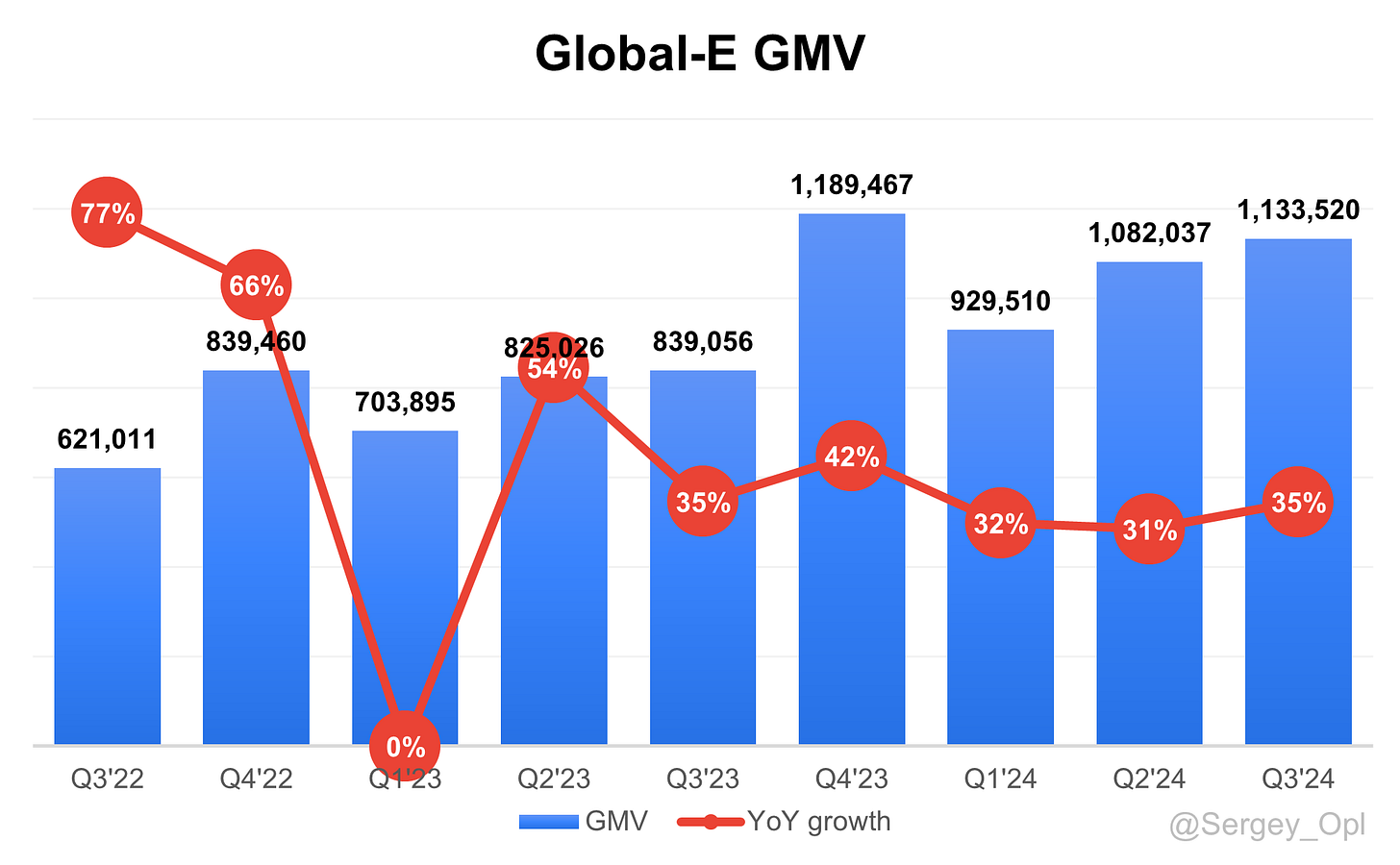

Key Metrics

↗️GMV $1,133.52B (+35.1% YoY)🟢

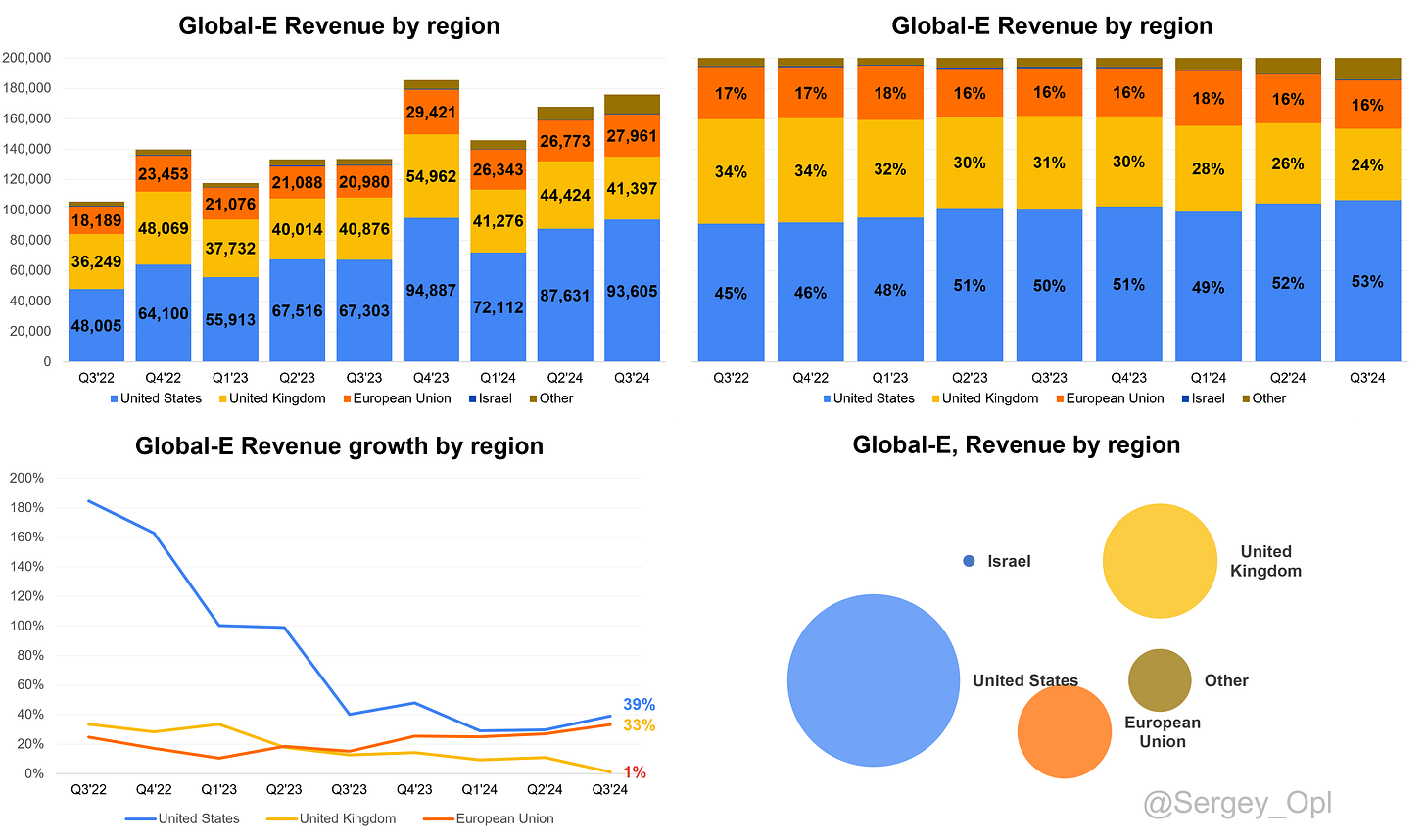

Revenue by region

↗️United States $93.6M rev (+39.1% YoY, 53.2% of Rev)🟢

➡️United Kingdom $41.4M rev (+1.3% YoY, 23.5% of Rev)🟡

↗️European Union $28.0M rev (+33.3% YoY, 15.9% of Rev)🟢

↘️Israel $0.4M rev (-22.2% YoY, 0.3% of Rev)🟡

↗️Other $12.6M rev (+224.3% YoY, 7.1% of Rev)🟢

Operating expenses

↘️S&M*/Revenue 34.7% (-4.6 PPs YoY)

↘️R&D*/Revenue 13.0% (-0.7 PPs YoY)

↘️G&A*/Revenue 4.4% (-2.9 PPs YoY)

Dilution

↘️SBC/rev 6%, -1.2 PPs QoQ

↗️Share count up 1.7% YoY, +0.1 PPs QoQ

Guidance

➡️Q4'24 $243.0 - $255.0M guide (+34.3% YoY) in line with est

↗️$732.9 - $744.9M FY guide (+29.6% YoY) raised by 1.2% beat est by 1.2%

Key points from Global-E’s Third Quarter 2024 Earnings Call:

Financial Performance

Global-E reported Q3 2024 revenue of $176 million, up 32% YoY, exceeding guidance. Service fee revenue rose 32% YoY to $82.6 million, while fulfillment services revenue increased 31% YoY to $93.4 million. Gross Merchandise Value (GMV) reached $1.134 billion, a 35% YoY growth. Adjusted EBITDA grew 41% YoY to $31.1 million, achieving a 17.7% margin, up from 16.5% last year.

Non-GAAP gross margin improved to 46.8%, up from 44.4%, driven by operational efficiencies. Operating cash flow increased to $30.3 million, contributing to a robust cash position of $359 million. For Q4 2024, GMV growth is projected at 39% YoY at the midpoint, with revenue guidance between $243–$255 million (+34% YoY). FY 2024 GMV is forecasted at $4.76–$4.83 billion (+35% YoY), revenue at $732.9–$744.9 million (+30% YoY), and adjusted EBITDA between $135.2–$141.2 million, a 49% YoY growth.

Product Innovations

The Buy Online, Pickup In-Store (BOPIS) feature enables merchants to use physical stores as global fulfillment hubs. A U.S.-based merchant reported that 50% of Canadian e-commerce sales were fulfilled through local stores in the first month.

The Duty Drawback Program allows merchants to reclaim duties on returned goods, reducing costs. A new AI-based classification tool, powered by Large Language Models (LLMs), enhances the accuracy of customs code mapping, lowering operational complexity and improving efficiency.

Borderfree.com Launch

The Borderfree.com platform, part of Global-E's demand generation strategy, attracted over 200 merchants. The platform aims to connect international shoppers with brands, driving long-term revenue growth. Expenses associated with its launch are included in Q4 guidance, with meaningful revenue contributions expected in the future.

Market Expansion

New merchant launches spanned North America, Europe, and Asia-Pacific. In North America, brands like Dr. Martens, Victoria’s Secret, and Harrods joined the platform. Harrods implemented Global-E's multi-local strategy to cover both global and domestic e-commerce.

In Europe, Chopard, Longchamp, and Margaret Howell expanded Global-E's luxury portfolio. In Asia-Pacific, notable launches included RAGTAG (Japan) and Dimito (South Korea). The merchant pipeline for 2025 remains strong.

Merchant Relationships

Global-E achieved record merchant bookings in 2024. Key launches included Harrods, Victoria’s Secret, and Manchester United, highlighting the company's ability to handle large-scale enterprises. Successful migrations included L.L. Bean and Oscar de La Renta, who moved from the legacy Borderfree platform to leverage advanced solutions.

Sales cycles for enterprise clients now average six months, reflecting improved processes and Global-E’s credibility as a public entity.

Large Customer Wins

Harrods launched a fully localized platform for international and domestic e-commerce, aligned with their holiday season strategy.

Victoria’s Secret expanded across nearly all international markets, leveraging Global-E’s scalability.

Manchester United and Bayern Munich deepened penetration in the sports vertical with multi-local solutions. Dr. Martens and Billabong added strength in fashion and lifestyle verticals.

Shopify Managed Markets

Shopify Managed Markets contributed GMV within the forecasted $200–$300 million range for FY 2024. Feature enhancements, including order editing and new payment methods, are driving gradual adoption. The offering is expected to grow further in 2025.

Consumer Sentiment

Improved sentiment in September and October contributed to strong Q3 performance, particularly in Europe, which saw rising trading volumes after a low prior-year base. Sentiment remains volatile, and Q4 guidance reflects potential fluctuations.

Macro Environment

Rising interest rates and higher merchant costs challenge the broader retail environment. Global-E views trade barriers, including potential tariff increases, as opportunities to enhance its value proposition by simplifying cross-border complexities for merchants.

Challenges

The loss of Ted Baker, a high service fee account, slightly impacted revenue. Fulfillment take rates remain volatile, influenced by average order values (AOVs) and merchant mix. Consumer sentiment fluctuations remain a headwind.

Future Outlook

Global-E expects 30% GMV growth in 2025, supported by a robust merchant pipeline, expanded Shopify Managed Markets, and ongoing product enhancements. Adjusted EBITDA margins are projected to expand further, with free cash flow conversion slightly exceeding EBITDA levels.

The company's focus on scaling offerings and maintaining financial discipline positions it as a leader in global e-commerce enablement. Sustained growth is anticipated through innovation, operational efficiency, and strategic merchant relationships.

Management comments on the earnings call.

Product Innovations

Amir Schlachet, Co-Founder and CEO

"We continue to invest in transforming global e-commerce through innovative capabilities like Buy Online, Pickup In-Store and the Duty Drawback Program. These enhancements enable merchants to reduce operational complexity, improve efficiency, and deliver a superior shopping experience."

Merchant Relationships

Nir Debbi, Co-Founder and President

"Our record merchant bookings in 2024, including Harrods and Victoria’s Secret, reflect the trust leading brands place in our platform. By combining global expertise with a multi-local strategy, we empower merchants to scale efficiently across diverse markets."

Macro Environment

Ofer Koren, Chief Financial Officer

"Despite macroeconomic headwinds such as rising interest rates and fluctuating consumer sentiment, we remain focused on solutions that reduce costs and enhance efficiency for merchants, helping them thrive in challenging conditions."

Strategic Partnerships

Nir Debbi, Co-Founder and President

"Our expanded partnership with Shopify continues to grow as planned, delivering significant value to thousands of merchants. By integrating new features and capabilities, we strengthen our strategic alliances and broaden our impact."

International Growth

Amir Schlachet, Co-Founder and CEO

"Our robust geographic expansion in North America, Europe, and Asia-Pacific underscores the global demand for e-commerce solutions. By partnering with renowned brands like Harrods and Manchester United, we enable seamless cross-border trade and support international growth."

Challenges

Ofer Koren, Chief Financial Officer

"The loss of the Ted Baker account had a limited impact, but we are confident in our ability to maintain strong service fee revenue through a diversified merchant base and innovative solutions tailored to their needs."

Future Outlook

Amir Schlachet, Co-Founder and CEO

"We anticipate 30% GMV growth in 2025, driven by a strong merchant pipeline, continued product innovation, and expanding partnerships. With financial discipline and operational excellence, we are well-positioned to capture the immense opportunity in global e-commerce."