Global-e Online Q1 2025 Earnings Analysis

Dive into $GLBE Global-e’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

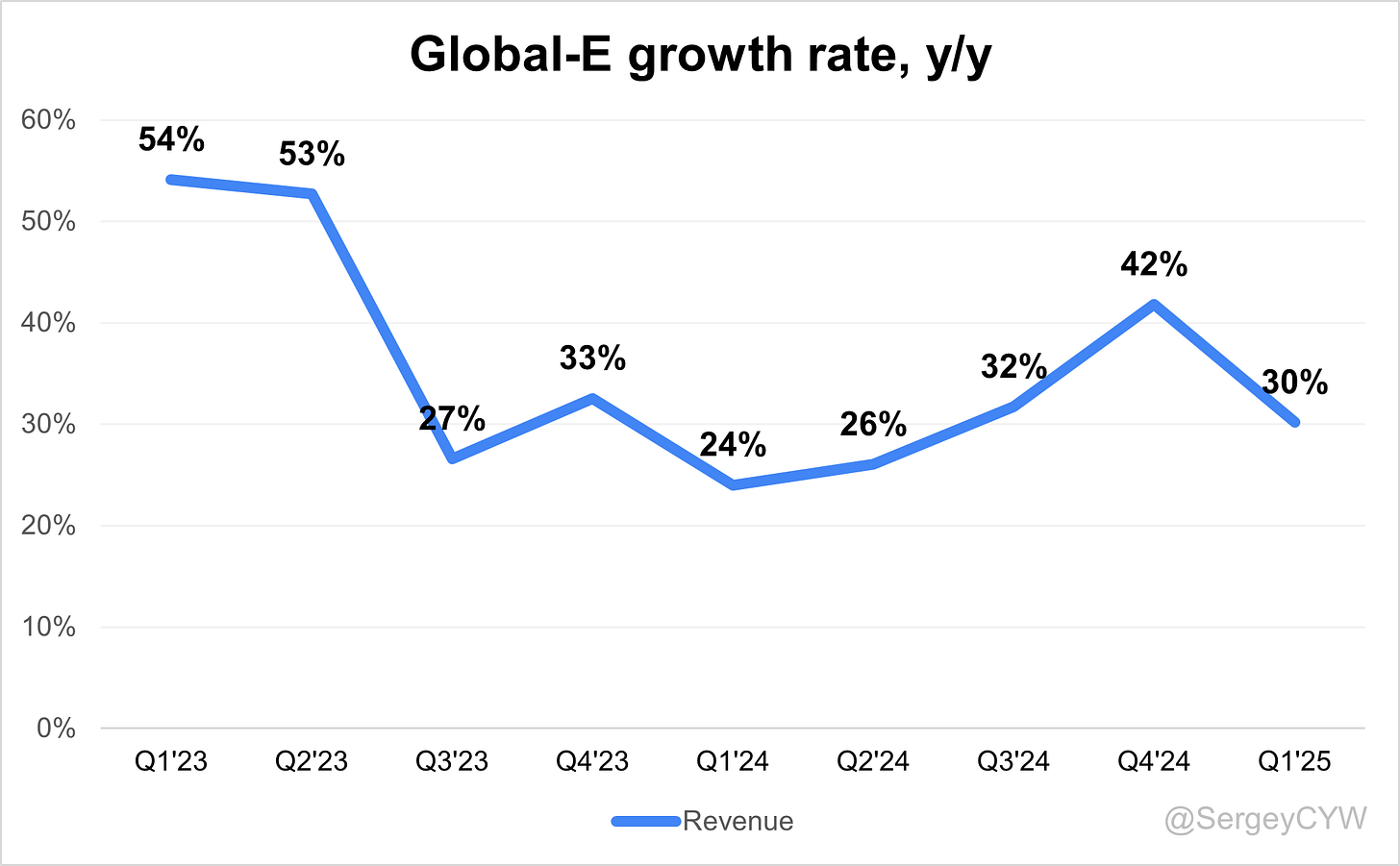

↗️$189.9M rev (+30.2% YoY, +41.8% LQ) beat est by 1.0%

↗️GM* (45.4%, +0.1 PPs YoY)

↗️EBITDA Margin* (16.6%, +2.0 PPs YoY)

↘️FCF Margin (-38.2%, -0.4 PPs YoY)🟡

↗️Net Margin (-9.4%, +12.6 PPs YoY)

↗️EPS -$0.11 beat est by 18.9%

*non-GAAP

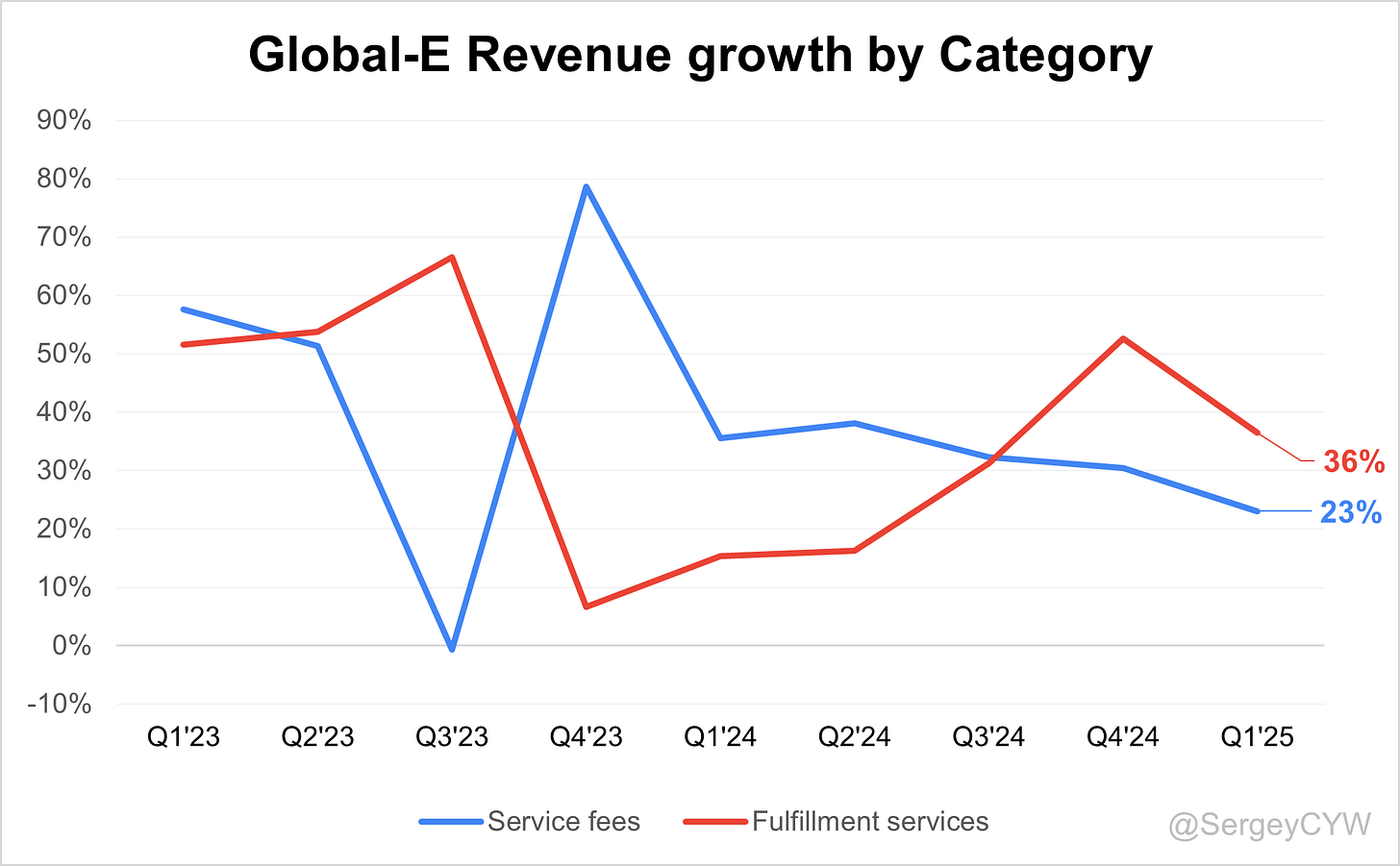

Revenue by Category

➡️Service fees $84.0M rev (+23.0% YoY, 44.2% of Rev)🟡

↗️Fulfillment services $105.9M rev (+36.4% YoY, 55.8% of Rev)

Key Metrics

↗️GMV $1,242.51B (+33.7% YoY)

Revenue by region

↗️United States $100.6M rev (+39.4% YoY, 53.0% of Rev)

➡️United Kingdom $41.7M rev (+1.1% YoY, 22.0% of Rev)🟡

➡️European Union $33.5M rev (+27.3% YoY, 17.7% of Rev)🟡

➡️Israel $0.4M rev (+26.9% YoY, 0.2% of Rev)🟡

↗️Other $13.7M rev (+134.3% YoY, 7.2% of Rev)

Operating expenses

↘️S&M*/Revenue 32.9% (-5.3 PPs YoY)

↘️R&D*/Revenue 12.9% (-0.8 PPs YoY)

↘️G&A*/Revenue 4.1% (-1.6 PPs YoY)

Dilution

↗️SBC/rev 5%, +1.0 PPs QoQ

↗️Basic shares up 1.9% YoY, +0.2 PPs QoQ

↘️Diluted shares up 1.9% YoY, -4.2 PPs QoQ

Guidance

➡️Q2'25 $204.0 - $211.0M guide (+23.5% YoY) in line with est

➡️$917.0 - $967.0M FY guide (+25.1% YoY) in line with est

Key points from Global-E’s First Quarter 2025 Earnings Call:

Financial Performance

Global-e GMV reached $1.243B, up +34% YoY. Total revenue was $189.9M, increasing +30% YoY and exceeding guidance midpoints. Adjusted gross profit was $86.3M with a 45.4% non-GAAP margin. Adjusted EBITDA rose +48% YoY to $31.6M, at a 16.6% margin. Net loss narrowed to $17.9M, primarily due to $37M Shopify warrant amortization. Cash and equivalents stood at $445M.

Service Fees

Service fees revenue totaled $84.0M, up +23% YoY, but below GMV growth. The decline in take rate was driven by the Ted Baker UK/EU distributor bankruptcy and increased GMV share from lower-margin enterprise clients such as Harrods and Manchester United. Global-e also absorbed post-shipping duties due to tariff volatility, affecting revenue yield. Management expects service fee margins to remain stable through 2025.

Fulfillment Services

Fulfillment revenue grew +36.4% YoY to $105.9M, accounting for 55.8% of total revenue. Growth outpaced GMV and service fees, driven by favorable merchant mix and increased adoption of Global-e’s logistics. Strong contributions came from enterprise launches such as Adidas Hong Kong, Atletico Madrid, and Bandai Namco. No capacity constraints were reported. Margin expansion is expected from scale efficiency.

E-commerce Platform

A new three-year agreement with Shopify consolidated previous 1P and 3P terms. On the 1P side, Global-e remains the exclusive merchant-of-record for Shopify Managed Markets Pro, with future rollouts integrating Shopify Payments for acquiring. This will reduce reported revenue but improve S&M efficiency and bottom-line economics. On the 3P side, Global-e becomes a preferred partner, retaining exclusive access to key features and benefiting from enhanced commercial terms. No material client losses were reported.

Logistics Innovation

Global-e launched its 3B2C model, enabling brands to import goods as B2B intra-company transfers and conduct local B2C sales, lowering import duties. This approach avoids the need for full multi-local infrastructure. The rollout targets tariff-sensitive regions such as the U.S., where 3% of GMV is exposed to goods from China/Hong Kong previously covered by the $800 de minimis. Several merchants are set to launch under this framework in H2 2025.

Smart Insights

A new merchant portal was introduced featuring real-time sales dashboards and funnel analytics tools. These self-service BI features help merchants track performance across geographies and SKUs, enabling faster decisions amid shifting tariffs and global regulations. Improved visibility supports merchant retention and platform stickiness.

Borderfree.com Traction

Contribution from Borderfree.com rose to over 4% of participating merchants’ revenue, up from ~2.5–3%. Management aims to exceed 5% soon, with a long-term target of 5–10%. The portal continues to scale as a value-added demand-gen channel.

Merchant Growth

Enterprise adoption accelerated in Q1 with launches from Zimmermann, Diane von Fürstenberg, JW Anderson (LVMH), Bally Shoes, Atletico Madrid, and Thomas Pink. Notably, Adidas Hong Kong was described as one of the largest market activations to date. Q4 2024 launches such as Harrods and Manchester United are performing as expected. Management indicated a robust pipeline with additional enterprise launches expected in the coming quarters.

International Expansion

New merchant activations spanned key regions. In Asia-Pacific, launches included Sakai, Bandai Namco, and T2T Australia. In Europe, the company went live with Vive Footwear, JW Anderson, and Bally Shoes. In the U.S., Diane von Fürstenberg was added alongside broader account expansions.

Tariff Exposure

Roughly 3% of GMV is exposed to U.S.-bound shipments from China/Hong Kong under the removed $800 de minimis. Merchant behavior remains largely stable, though softness was noted for brands with heavier China-origin mix. The 90-day tariff pause between the U.S. and China may reduce near-term risk.

Outlook

Q2 2025 guidance includes GMV of $1.387B–$1.427B (+30% YoY), revenue of $204M–$211M (+23.5% YoY), and adjusted EBITDA of $35M–$39M (18% margin). FY 2025 guidance remains unchanged:

GMV: $6.19B–$6.49B (+30.5% YoY midpoint)

Revenue: $917M–$967M (+25% YoY midpoint)

Adjusted EBITDA: $179M–$199M

Free cash flow is expected to track or exceed adjusted EBITDA. GAAP profitability is anticipated starting Q2, as Shopify warrant amortization winds down and fully phases out by early 2026.

Management comments on the earnings call.

Product Innovations

Amir Schlachet, Co-Founder and Chief Executive Officer

“We see these effects as relatively short to mid-term in nature. Over the longer term, we believe this type of increased complexity in the global trade environment provides us with an opportunity to add further value to our existing merchants and to grow with new merchants.”

Nir Debbi, Co-Founder and President

“The first merchants are going to launch with our 3B2C solution within the coming weeks. This will enable them to enjoy a lower impact on the tariffs due to the better offering.”

Amir Schlachet, Co-Founder and Chief Executive Officer

“One clear example of that is our new 3B2C offering, developed in record time… enabling global brands to leverage their international footprint in order to partially offset costs due to tariffs.”

E-commerce Platform

Amir Schlachet, Co-Founder and Chief Executive Officer

“We have signed a new three-year strategic partnership agreement with Shopify… replacing our prior 3P and 1P agreements with a new streamlined and unified strategic agreement.”

Nir Debbi, Co-Founder and President

“Moving from the exclusivity to the preferred partner status… gives us exclusivity on certain key features on the 3P side, as well as alignment with Shopify on future feature releases.”

Ofer Koren, Chief Financial Officer

“Once [Shopify Payments] goes live, we will not record those elements as revenue. However, we do aim at seeing a positive impact on our sales and marketing expense… overall, we expect this model to have a limited impact on the bottom line.”

Logistics Management Services

Nir Debbi, Co-Founder and President

“We believe that some merchants would decide to go fully local and this is where our multi-local would be a good solution, and some merchants would not… according to their own specific parameters.”

Nir Debbi, Co-Founder and President

“The complexities, as we’ve seen historically in Brexit and other situations, actually drive merchants to look for solutions as they understand they don’t have enough flexibility within their own systems.”

Smart Insights

Amir Schlachet, Co-Founder and Chief Executive Officer

“Most notably, the new portal hosts two important tools for our merchants—a real-time sales dashboard and a funnel analysis dashboard… allowing them to track and analyze key e-commerce KPIs directly in the Global-e portal.”

Amir Schlachet, Co-Founder and Chief Executive Officer

“Such increased visibility and control are always important, but even more so now, as merchants need to be able to understand in real time the impact of various pricing and business decisions.”

Competitors

Nir Debbi, Co-Founder and President

“Globally has been the clear market leader in global e-commerce across basically all e-commerce platforms from Salesforce to Magento to Hybris and into Shopify, competing on a level playing field.”

Nir Debbi, Co-Founder and President

“We feel quite confident on our competitive moat… we managed to build a robust capability and integration into Shopify that combined with our general scale and expertise gives us strong belief that we will maintain our leadership position.”

Merchants

Amir Schlachet, Co-Founder and Chief Executive Officer

“As our merchants experience day in and day out, now more than ever, with Global-e in place, they can have peace of mind during turbulent times. We have their back.”

Amir Schlachet, Co-Founder and Chief Executive Officer

“We not only notify [merchants], but we also take all the necessary steps—including rapid R&D developments and deployments if needed—to make sure they remain compliant at all times.”

Ofer Koren, Chief Financial Officer

“We have seen very nice ramp-up from the large new merchants already in Q4. And actually, we see very positive trade patterns with some of those merchants in Q1 as well.”

International Growth

Amir Schlachet, Co-Founder and Chief Executive Officer

“With the traction we are seeing in the pipeline, dozens of other brands going live, and expansions across our various geographies, we believe we can continue on our growth path towards our long-term targets.”

Nir Debbi, Co-Founder and President

“We are already over 4% of contribution that is generated by traffic coming out of borderfree.com. We expect it to cross the 5% mark, and long-term we believe it would create anything between 5% to 10% on average.”

Challenges

Ofer Koren, Chief Financial Officer

“We witnessed an increased level of uncertainty due to the current turmoil in global trade, caused by the changes in duty tariffs. But no clear directional impact at this stage, hence we are leaving our full-year 2025 guidance unchanged.”

Nir Debbi, Co-Founder and President

“We did bake some [of the Marks & Spencer disruption] into our Q2 guidance already… the global turmoil coming out of the changes in tariffs doesn’t make it any easier for merchants, and consumer sentiment is not at its peak.”

Nir Debbi, Co-Founder and President

“We are slightly below the historical averages for same-store sales, but generally we didn’t see any clear indication yet about the long-term impact of that change.”

Future Outlook

Ofer Koren, Chief Financial Officer

“Despite the higher uncertainty, we maintain our guidance for the full year and we believe that our performance will be within the guidance range.”

Amir Schlachet, Co-Founder and Chief Executive Officer

“Starting in Q2, we expect to move to GAAP profitability, as the amortization of the majority of the Shopify warrants will be done… we expect to be GAAP profitable also moving forward.”

Thoughts on Global-E Earnings Report $GLBE:

🟢 Positive

Revenue rose to $189.9M, up +30.2% YoY, beating estimates by 1.0%.

GMV reached $1.243B, growing +33.7% YoY.

Fulfillment revenue increased +36.4% YoY to $105.9M, now 55.8% of total revenue.

Adjusted EBITDA margin improved to 16.6%, up +2.0pp YoY.

EPS at -$0.11, beat estimates by 18.9%.

S&M expense ratio dropped to 32.9% of revenue, down -5.3pp YoY.

New strategic agreement with Shopify secures long-term position as a preferred partner with exclusive platform features.

Borderfree.com contribution exceeded 4% of merchant revenue, tracking toward 5–10% long-term.

New launches from brands including Adidas Hong Kong, Zimmermann, Diane von Fürstenberg, and Bandai Namco signal enterprise traction.

International expansion continues across Asia-Pacific, Europe, and North America.

🟡 Neutral

Service fees revenue rose to $84.0M, up +23% YoY, slower than GMV due to mix shift and Ted Baker distributor bankruptcy.

Free cash flow margin stood at -38.2%, down slightly -0.4pp YoY, reflecting seasonal dynamics.

United Kingdom revenue grew only +1.1% YoY, totaling $41.7M (22% of total).

Dilution metrics were modest: basic shares up 1.9% YoY, SBC/revenue rose +1.0pp QoQ.

🔴 Negative

Net margin remained negative at -9.4%, though improved +12.6pp YoY.

U.S.-bound GMV from China/Hong Kong (3% of total) exposed to increased tariffs due to de minimis removal; early signs of softness reported.

Reported revenue from Shopify’s Managed Markets to decline in future quarters due to migration to Shopify Payments, though economics improve.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.