Financial Results:

↗️$145.9M rev (+24.0% YoY, +32.6% LQ) beat est by 3.0%

↗️GM* (45.3%, +3.9%pp YoY)🟢

↗️adj EBITDA Margin (14.6%, +2.3%pp YoY)

↗️Net Margin (-22.0%, +14.7%pp YoY)

↗️EPS -$0.19 beat est by 13.6%

*non-GAAP

Revenue by Category

↗️Service fees $68.3M rev (+35.6% YoY, 46.8% of Rev)

➡️Fulfillment services $77.6M rev (+15.4% YoY, 53.2% of Rev)🟡

Key Metrics

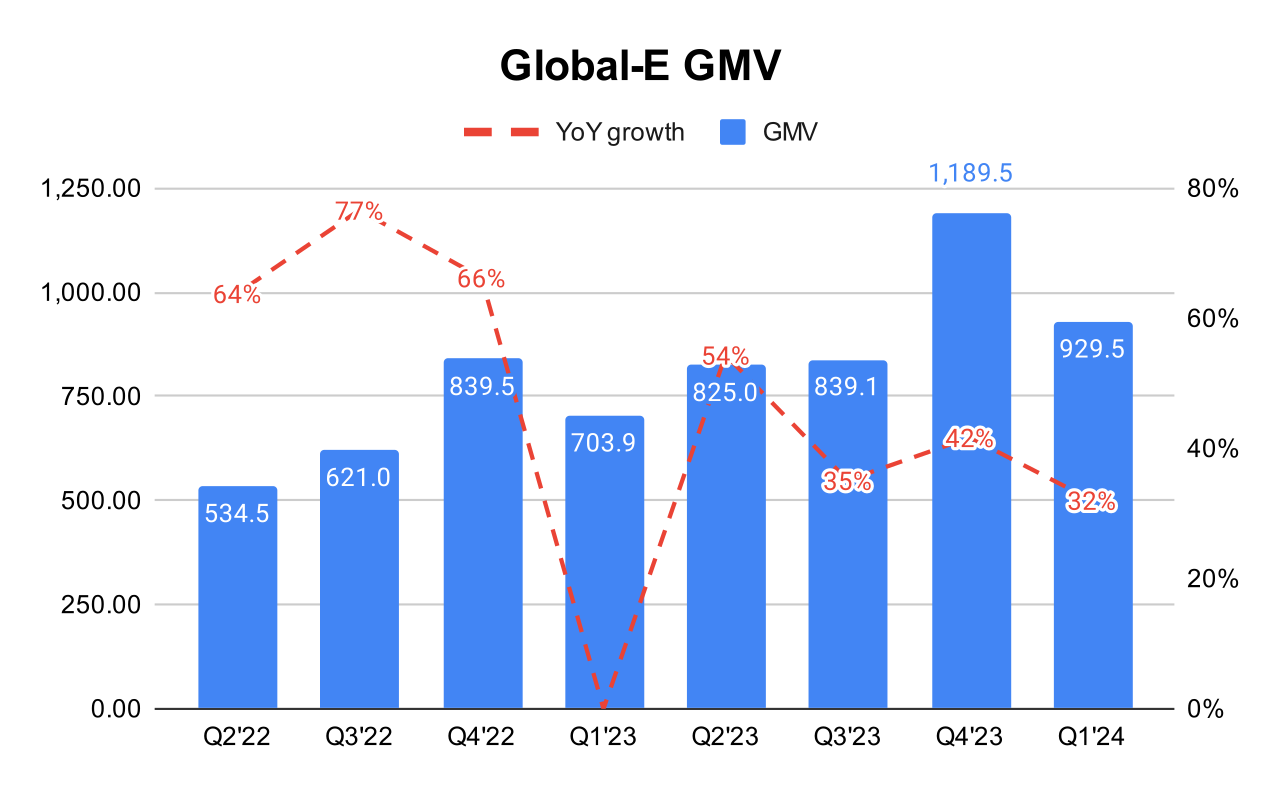

↗️GMV $929.51B (+32.1% YoY)

Revenue by region

↗️United States $72.1M rev (+29.0% YoY, 49.4% of Rev)

➡️United Kingdom $41.3M rev (+9.4% YoY, 28.3% of Rev)🟡

↗️European Union $26.3M rev (+25.0% YoY, 18.1% of Rev)

↗️Israel $0.3M rev (+40.4% YoY, 0.2% of Rev)🟢

↗️Other $5.8M rev (+117.0% YoY, 4.0% of Rev)🟢

Operating expenses

↗️S&M*/Revenue 38.2% (31.0% LQ)

↗️R&D*/Revenue 13.8% (9.8% LQ)

↘️G&A*/Revenue 5.7% (6.3% LQ)

Dilution

↘️SBC/rev 6%, -0.6%pp QoQ

↘️Share count up 2.2% YoY, -1.0%pp QoQ

Guidance

↘️Q2'24 $162.5 - $168.5M guide (+19.0% YoY) missed est by -2.9%🔴

➡️$733.0 - $773.0M FY guide (+32.1% YoY) raised by 0.3% in line with est

Key points from Global-e’s First Quarter 2024 Earnings Call:

Market Expansion

Global Client and Brand Launches: Global-e reported numerous new client launches, including major brands such as Donna Karan, DKNY, Heydude by Crocs, and Golf Wang in the U.S. In Europe and Asia, brands like Marc-Cain, Carla Zampatti, and La Senza launched or expanded their use of Global-e's platform.

Expansion in Existing Accounts: The company continued to deepen its relationships with existing clients by expanding into new markets and launching additional brands under existing client umbrellas, such as Adidas and the COTY group.

Shopify Markets Pro: Significant growth was highlighted in the integration with Shopify Markets Pro, which continues to attract a large number of merchants. This partnership is critical for expanding Global-e’s reach and capabilities, enhancing their ability to serve a wider array of e-commerce businesses effectively.

Macro Environment

Global-e noted that the macroeconomic conditions had been slightly more favorable than anticipated, which helped in achieving better-than-expected financial results. However, they also recognized the ongoing volatility and unpredictability in global markets, which could affect consumer behavior and spending.

Challenges

Dependency on Large Client Launches: The second half of the year's growth is heavily dependent on the successful launch of large clients, which if delayed, could impact the overall growth and financial performance.

Borderfree Integration: The migration of Borderfree clients to the Global-e platform has been slower than anticipated, although those migrated have shown positive results. This integration is crucial for realizing expected improvements in performance and customer satisfaction.

Management comments on the earnings call.

Future Outlook

Amir Schlachet, Co-Founder & CEO: "We remain confident in our ability to uphold our plans for the remainder of the year, as is reflected in our updated guidance for the full year of 2024. Most notably, the large client launches planned for the second half of the year are on-track and Shopify Markets Pro continues to amass merchants at the planned pace."

Ofer Koren, CFO: "We continue to benefit from the growth of Global E-Commerce, which is back to its pre-COVID long-term pattern, taking share from brick-and-mortar retail, and the continued focus of merchants of direct-to-consumer while there is still uncertainty regarding consumer demand, which remains volatile."

Market Expansion

Nir Debbi, Co-Founder & President: "The large projects are currently on track... it's projects that are already deep into the project phase of it in order to launch in Q3 and early Q4... So we do have high confidence that it is happening."

Product Innovations

Nir Debbi, Co-Founder & President: "We continue to work according to our roadmap, developing enhancements and features towards Shopify Markets Pro, and we continue to roll those out. I think over the next few quarters, we will see a gradual rollout of all the key elements, we are working towards and we expect that to continue and accelerate the growth in the coming quarters of the solutions adoption."

Customers

Amir Schlachet, Co-Founder & CEO: "During Q1, we continue to experience strong demand for our services across all markets we operate in. Q1, so many renowned brands go-live with Global-e services... With dozens of other brands going live and with robust integration and sales pipelines, we believe we can continue on our growth path into the future, as more and more merchants put emphasis on global direct-to-consumer sales."