Gitlab Q4 2024 Earnings Analysis

Dive into $GTLB GitLab’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$211.4M rev (+29.1% YoY, +30.9% LQ) beat est by 2.7%

↘️GM* (91.2%, -0.4 PPs YoY)🟡

↗️Operating Margin* (17.7%, +9.6 PPs YoY)

↗️FCF Margin (29.4%, +14.4 PPs YoY)🟢

↗️EPS* $0.33 beat est by 94.1%🟢

*non-GAAP

Key Metrics

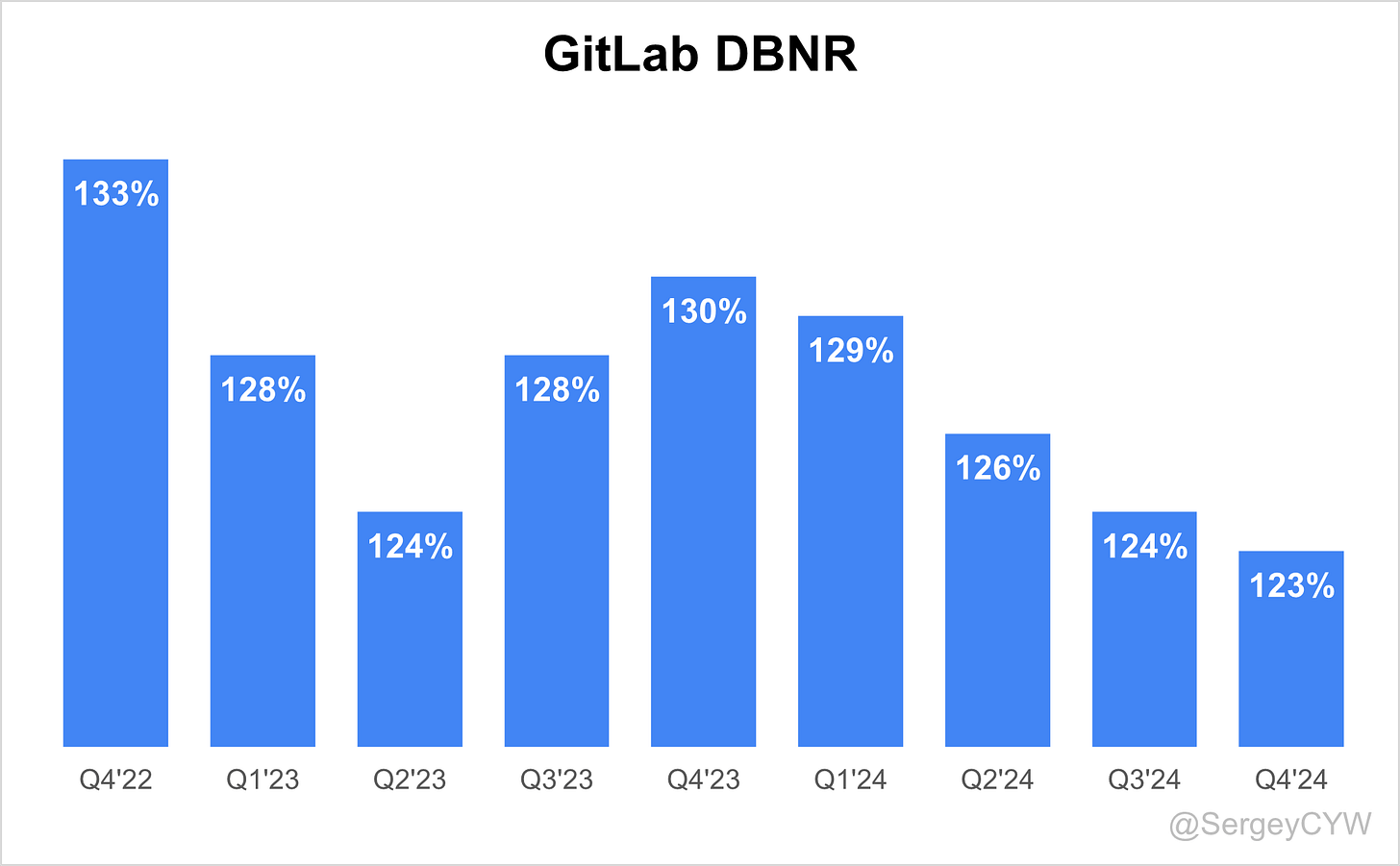

↘️DBNR 123% (124% LQ)

↗️RPO $0.95B (+40.2% YoY)

↗️Billings $283M (+31.5% YoY)🟢

Customers

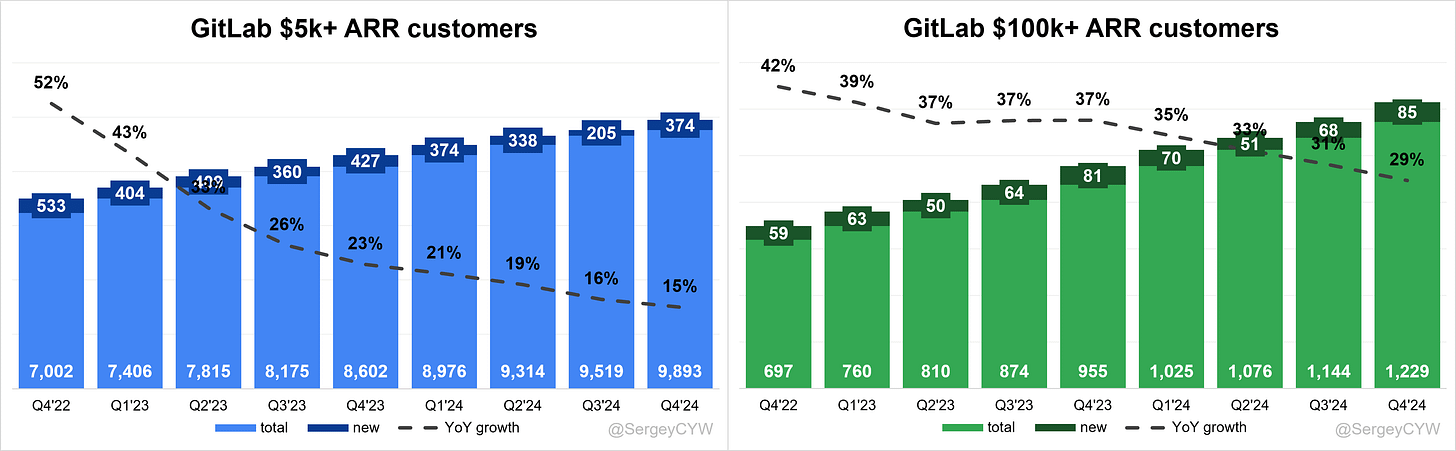

➡️9,893 customers (+15.0% YoY, +374)

↗️1,229 $100k+ customers (+28.7% YoY, +85)🟢

Operating expenses

↘️S&M*/Revenue 37.9% (-6.9 PPs YoY)

↘️R&D*/Revenue 22.4% (-1.1 PPs YoY)

↘️G&A*/Revenue 13.2% (-2.0 PPs YoY)

Quarterly Performance Highlights

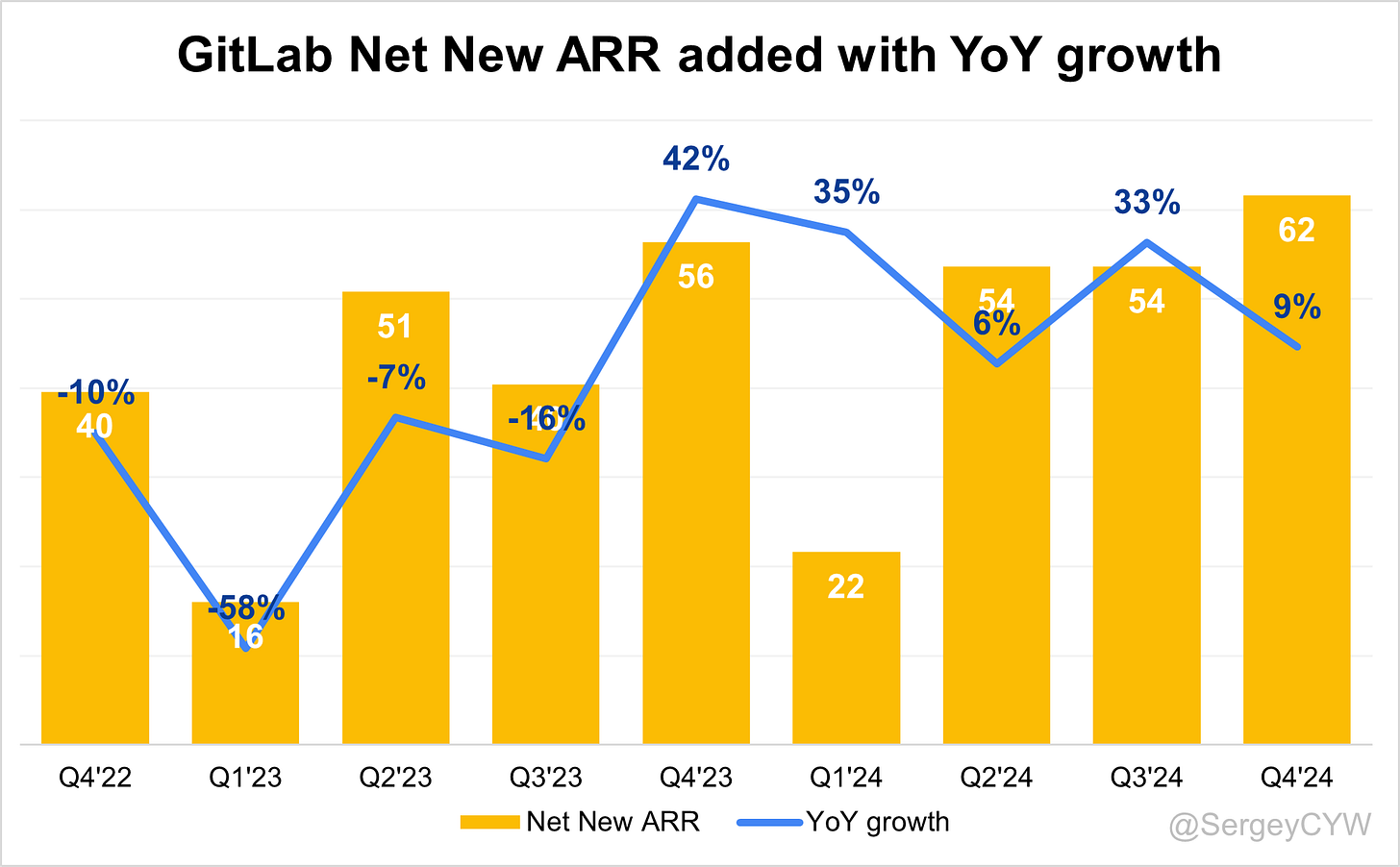

↗️Net New ARR $62M (+9.2% YoY)

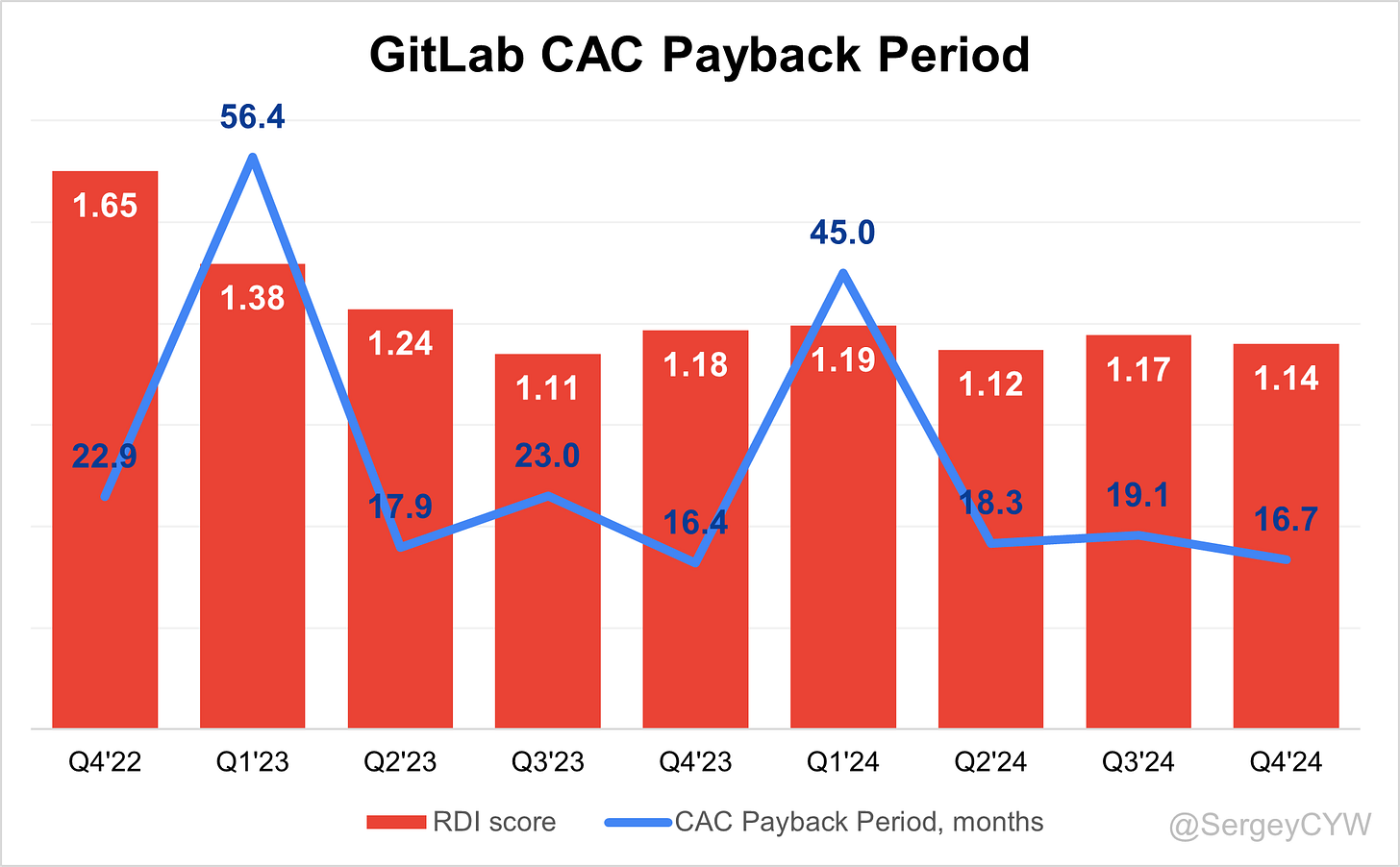

↗️CAC* Payback Period 16.7 Months (+0.3 YoY)🟡

↘️R&D* Index (RDI) 1.14 (-0.04 YoY)🟡

Dilution

↘️SBC/rev 22%, -2.5 PPs QoQ

↗️Basic shares up 4.1% YoY, +0.1 PPs QoQ🟡

↗️Diluted shares up 8.6% YoY, +0.7 PPs QoQ🔴

Guidance

➡️Q1'25 $212.0 - $213.0M guide (+25.6% YoY) in line with est

↗️$936.0 - $942.0M FY guide (+23.7% YoY) beat est by 24.6%

Key points from GitLab’s Fourth Quarter 2024 Earnings Call:

Financial Performance

GitLab delivered strong financial results in Q4 FY2025, with revenue reaching $211.4 million, a 29% YoY growth, exceeding expectations. For the full year, revenue increased 31% to $759.2 million, driven by enterprise expansion.

Non-GAAP operating margin reached 18% in Q4, up 960 basis points YoY. For the full year, it was 10.2%, up 1,050 basis points YoY. Adjusted free cash flow surged 259% YoY to $120 million.

Net dollar-based retention rate (DBNR) stood at 123%, with seat expansion (75%), customer yield increase (15%), and tier upgrades (10%). Remaining performance obligations (RPO) grew 40% YoY to $945 million, while current RPO (CRPO) increased 35% YoY to $579.2 million.

GitLab now serves 9,893 customers generating at least $5,000 ARR, contributing 95% of total ARR. Customers with $100,000+ ARR increased 29% YoY to 1,229, and those with $1 million+ ARR grew 28% YoY to 123.

FY2026 guidance projects revenue of $936M–$942M (+24% YoY). Q1 FY2026 revenue is expected at $212M–$213M (+25% YoY), with non-GAAP operating income of $21M–$22M and EPS of $0.14–$0.15.

GitLab Duo

GitLab Duo outperformed expectations, accounting for one-third of ARR in deals where it was included. Barclays expanded to 20,000 seats of GitLab Ultimate and Duo Enterprise. Other enterprise deals included CACI, Capgemini, and NatWest.

Duo Enterprise is embedded across the software development lifecycle, offering AI-powered automation beyond code generation. Duo Workflow, GitLab’s AI-driven automation agent, entered private beta in Q4, with a public beta planned for mid-2026.

Competition is increasing from GitHub Copilot, Cursor, and Anthropic’s Claude Code. GitLab differentiates itself by integrating AI into security, compliance, and governance, providing a complete AI-powered DevSecOps platform.

GitLab Ultimate

GitLab Ultimate reached 50% of total ARR, reflecting strong demand for integrated security and compliance. Payback period is under six months, with ROI at 480% over three years.

New enterprise deals hit record levels, with the most first orders exceeding $100,000 ARR in company history. Zscaler selected GitLab after a competitive displacement, recognizing its ability to streamline onboarding and consolidate security. AWS Professional Services upgraded to GitLab Ultimate, reinforcing adoption among enterprise IT providers.

Growth challenges include competing against fragmented DevOps toolchains. FY2026 strategy focuses on enterprise expansion, accelerating value realization, and integrating Duo for AI-powered security.

GitLab Dedicated

GitLab Dedicated revenue grew 90% YoY in Q4, driven by demand for single-tenant SaaS solutions. Largest-ever first-order deal closed as enterprises seek cloud efficiency with on-premise-level security.

Growth was strong in financial services, embedded software, and government. Delta Airlines moved to Dedicated as part of cloud transformation, while NatWest expanded its Dedicated and Duo Enterprise investments.

The biggest challenge is convincing large self-managed customers to migrate to SaaS while ensuring compliance. Dedicated remains a key competitive advantage, being the only fully managed, single-tenant SaaS DevSecOps solution in the market.

AI Strategy and Market Position

GitLab’s AI-powered DevSecOps platform is uniquely positioned. Unlike GitHub Copilot and Cursor, GitLab integrates AI into every stage of development—from planning and security to deployment.

AI will increase both the number of developers and AI-generated code volume. GitLab ensures security, compliance, and governance at scale. Partnerships with AWS and Google Cloud further strengthen its AI capabilities.

Enterprise Growth

GitLab expanded large enterprise accounts in Q4, with 1,229 customers generating $100,000+ ARR (+29% YoY) and 123 customers contributing $1M+ ARR (+28% YoY).

The company closed its largest net ARR deal in history. New customer acquisitions hit a record, with the most first orders over $100,000 ARR.

Customer Wins

Anthropic selected GitLab Ultimate Self-Managed for secure, high-performance code management.

Zscaler adopted GitLab after a competitive displacement, consolidating its toolchain for efficiency, security, and compliance.

AWS Professional Services upgraded from free-tier to Ultimate, reinforcing GitLab’s strategic importance in enterprise DevSecOps.

Customer Success

Enterprises on GitLab’s platform see 15x faster time-to-market, 4x faster feature delivery, and 60% fewer manual tasks.

Barclays expanded to 20,000 seats of GitLab Ultimate and Duo Enterprise, accelerating AI adoption.

Capgemini standardized on GitLab to modernize software engineering workflows.

Delta Airlines transitioned to GitLab Dedicated, aligning with its cloud transformation strategy.

NatWest expanded both GitLab Dedicated and Duo Enterprise, continuing its digital transformation.

CACI consolidated seven tools into GitLab, cutting security scan time by 13x and reducing toolchain admin costs by 90%.

Strategic Partnerships

GitLab expanded partner-driven growth, strengthening relationships with hyperscalers, system integrators, and IT providers.

AWS Partnership: AI-powered developer experience with Amazon Q’s AI agents, currently in beta.

Google Cloud Integration: AI-powered DevSecOps workflows and security scanning solutions.

Competitive Landscape

The AI-powered software development market is growing, with new entrants increasing competition.

GitHub Copilot, Cursor, and Claude Code lack full-stack DevSecOps capabilities. GitLab’s integrated AI-driven compliance and security features set it apart.

GitLab Dedicated remains a unique solution in highly regulated industries, reinforcing its competitive positioning.

Leadership Changes

Ian Stewart joined as Chief Revenue Officer (CRO), coming from Tricentis. His expertise in revenue growth and sales execution is expected to enhance GitLab’s enterprise go-to-market strategy.

David Henshall, former Citrix CEO, joined the Board of Directors, strengthening executive leadership.

Future Outlook

GitLab enters FY2026 focused on responsible growth, AI expansion, and market leadership.

Revenue is projected to grow 24% YoY, supported by enterprise expansion, AI adoption, and DevSecOps standardization.

Pricing benefits and Duo monetization will contribute incremental upside. Sales capacity, R&D investment in AI, and go-to-market efficiency remain key growth drivers as GitLab scales toward $1B+ in revenue.

Management comments on the earnings call.

Product Innovations

Bill Staples, Chief Executive Officer

"This year, our R&D investments will be made across three themes. The first is our core DevOps platform to help customers accelerate toolchain consolidation. The second is to build upon our differentiated security and compliance capabilities. And third, we’ll continue to drive AI innovation, including Duo Enterprise and Duo Workflow. Our goal here is to enhance and deliver world-class products in all three areas with clear monetization paths."

Brian Robbins, Chief Financial Officer

"We delivered both DuoPro code assistance and Duo Enterprise, injecting AI throughout the entire software development lifecycle. And we announced key integrations with Google and AWS. All of this sets us up for a strong FY2026, and I’m excited for the year ahead."

AI

Bill Staples, Chief Executive Officer

"AI represents an enormous opportunity for world transformation, and that transformation is driven by software. GitLab is at the heart of building software, and there’s no better place to be. AI is going to increase the number of software creators and the amount of code generated—both by humans and by AI models. That code must meet an organization’s quality, security, and compliance requirements, and GitLab’s platform provides all of that capability."

GitLab Duo

Brian Robbins, Chief Financial Officer

"This quarter, we were really pleased with the performance of Duo. It exceeded our expectations again this quarter. In deals that included Duo, about a third of the ARR came from Duo alone. The demand is clear, and we are seeing strong adoption among large enterprises."

Bill Staples, Chief Executive Officer

"AI models work when they’re fed the right context, and GitLab provides the best context when it comes to working with code. We have a full lifecycle set of capabilities, from planning and issue tracking to integration, packaging, and deployments. We also have world-class security tools. By building a knowledge graph that integrates all of this information, we can deliver AI-driven insights and automation throughout the software lifecycle."

GitLab Ultimate

Brian Robbins, Chief Financial Officer

"GitLab Ultimate now accounts for 50% of our total ARR, even after the price increase. The reason customers choose Ultimate is clear—it’s about security and compliance. With a payback period of under six months and an ROI of over 480% in three years, it’s a compelling value proposition. The enterprise segment is leading this adoption, with a record number of first orders over $100,000 in ARR this quarter."

Competitors

Bill Staples, Chief Executive Officer

"There are a lot of tools in this space, and it seems like every day, a new one emerges. AI is the hot new technology trend, and we will continue to see rapid advancements. However, what sets GitLab apart is our platform. Unlike standalone AI code generation tools, we deliver AI-powered capabilities across the entire software development lifecycle. Our integrated DevSecOps platform provides a unique and powerful differentiator."

Customers

Bill Staples, Chief Executive Officer

"I spent most of my time this quarter meeting with more than fifty customers, including Booking.com and USAA, listening to how GitLab uniquely accelerates their teams’ ability to deliver secure software faster. The feedback is clear: our comprehensive platform approach drives enormous productivity and efficiency improvements with very clear ROI."

Brian Robbins, Chief Financial Officer

"Q4 was a strong quarter for our enterprise segment. We closed the largest net ARR deal in company history and had a record quarter of net new customers over $100,000 in ARR. This demonstrates the growing demand for our DevSecOps platform among large enterprises."

Strategic Partnerships

Bill Staples, Chief Executive Officer

"Partners are critical to our success in both landing and expanding with customers. This year, we will expand our relationships with services and consulting partners while continuing to invest in our hyperscaler relationships. Our integrated AI offering with AWS, announced at re:Invent, is an example of how we are collaborating to bring AI-powered DevSecOps to the enterprise market."

Challenges

Bill Staples, Chief Executive Officer

"I also heard the typical growing pains of a public company at our age and maturity—the desire to go faster with less friction so we can scale to become a defining generational company in our category. That’s why we put together a plan focused on adding more new paying customers, expanding customer value faster, and delivering innovation at a rapid pace."

Future Outlook

Bill Staples, Chief Executive Officer

"Looking forward, I am really energized by the opportunity ahead of us and excited for what FY2026 will bring. Consistent with the commitment we made at our IPO, we are prioritizing growth, and we’re doing that responsibly. We are investing in our go-to-market strategy, driving AI-led innovation, and ensuring that every part of the organization is focused on delivering value to customers."

Brian Robbins, Chief Financial Officer

"Q4 was a strong close to FY2025, setting the foundation for a promising FY2026. With continued demand for GitLab Ultimate, Dedicated, and Duo, we are confident in our ability to drive growth while maintaining operational efficiency. Our FY2026 guidance reflects a disciplined approach to scaling the business responsibly."

Thoughts on GitLab Earnings Report $GTLB:

🟢 Positive

Revenue reached $211.4M (+29.1% YoY), beating estimates by 2.7%.

Operating Margin improved to 17.7% (+9.6 PPs YoY).

Free Cash Flow Margin expanded to 29.4% (+14.4 PPs YoY).

EPS of $0.33 beat estimates by 94.1%.

RPO grew to $0.95B (+40.2% YoY), faster than revenue growth.

Billings reached $283M (+31.5% YoY).

$100K+ customers increased to 1,229 (+28.7% YoY, +85 new customers).

GitLab Ultimate now 50% of total ARR, driven by security and compliance demand.

GitLab Dedicated revenue grew 90% YoY, landing the largest first-order deal in company history.

AI investments driving adoption, with GitLab Duo outperforming expectations and contributing one-third of ARR in included deals.

CAC payback period at 16.7 months.

🟡 Neutral

DBNR is at 123% (down from 124% QoQ), but still at a high level.

R&D Index (RDI) at 1.14, down 0.04 YoY.

Q1'25 guidance of $212M-$213M (+25.6% YoY) in line with expectations.

SBC/revenue at 22%, declining 2.5 PPs QoQ but still dilutive.

🔴 Negative

Gross Margin declined slightly to 91.2% (-0.4 PPs YoY).

Basic shares increased by 4.1% YoY, while diluted shares increased 8.6% YoY, creating dilution concerns.

Self-managed customers hesitant to transition to SaaS, limiting GitLab Dedicated growth in some areas.

Increasing competition from GitHub Copilot, Cursor, and Claude Code could pressure AI-driven revenue expansion.