Financial Results:

⬆️$163.8M rev (+33.3% YoY, +32.5% LQ) beat est by 3.5%

⬆️GM* (91.5%, +1.5%pp YoY)🟢

⬆️Operating Margin* (8.1%, +19.2%pp YoY)🟢

⬆️FCF Margin (15.0%, +25.3%pp YoY)

⬆️EPS* $0.15 beat est by 87.5%🟢

*non-GAAP

Key Metrics

⬆️DBNR 130% (128% LQ)🟢

⬆️RPO $0.67B (+55.0% YoY)🟢

⬆️Billings $215M (+35.0% YoY)🟢

Customers

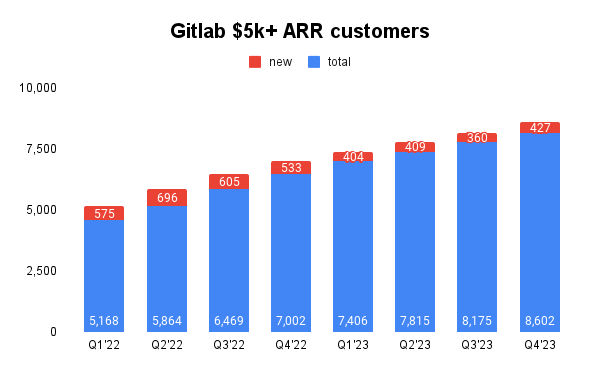

➡️8,602 customers (+23.0% YoY, +427)

⬆️955 $100k+ customers (+37.0% YoY, +81)🟢

Operating expenses

↘️S&M*/Revenue 44.8% (47.1% LQ)

↘️R&D*/Revenue 23.5% (24.2% LQ)

↘️G&A*/Revenue 15.2% (16.9% LQ)

⬆️Net New ARR $56M ($40 LQ)

↘️CAC* Payback Period 16.4 Months (23.0 LQ)

Dilution

↘️SBC/rev 26%, -1.3%pp QoQ

⬆️Dilution at 4.3% YoY, +0.1%pp QoQ🟡

Guidance

⬆️Q1'24 $166.0M guide (+30.8% YoY) beat est by 2.6%

➡️$731M FY guide (+26.0% YoY) missed est by -0.1%🔴

Key points from Gitlab Fourth Quarter 2023 Earnings Call:

Financial Highlights:

GitLab reported strong performance in the fourth quarter, with a 33% revenue growth year-over-year. The company reported significant growth in Total Contract Value (TCV) and Customer Relationship Pricing Optimization (cRPO), with a 55% year-over-year growth in total Remaining Performance Obligations (RPO).

Significant Customer Growth:

GitLab now has 96 customers with an Annual Recurring Revenue (ARR) over $1 million, an increase from 63 customers a year ago. This growth is attributed to large enterprises standardizing on GitLab for speed, productivity, and security needs.

Focus on Security and Compliance:

Security and compliance are central to GitLab's platform, setting it apart from competitors. Innovations in this area include secure source scope management, security scanning, and GitLab Dedicated, which caters to customers needing data isolation and residency requirements.

Introduction of GitLab Duo:

The company introduced GitLab Duo, an AI offering that integrates AI throughout the software development lifecycle, enhancing efficiency and security.

It aids teams in writing code faster while ensuring it is secure and of high quality, and fix vulnerabilities more effectively.

Expansion of Enterprise Agile Planning:

GitLab expanded its platform to include Enterprise Agile Planning, attracting users outside of software engineering and contributing to the platform's appeal.

Strategic Appointments:

The addition of Sabrina Farmer as Chief Technology Officer is announced, bringing extensive experience from Google.

Guidance for FY 2025:

GitLab provided guidance for the first quarter of FY 2025, expecting total revenue of $165 million to $166 million, and full-year revenue of $725 million to $731 million. The guidance reflects the company's optimism and less conservative approach towards its future performance.

Challenges:

The company acknowledges challenges related to customer buying behavior and the impact of economic conditions on spending environments. However, GitLab remains optimistic about normalization in buying behavior and its ability to continue delivering customer value.

Management comments on the earnings call.

Product Innovations

"Today, I'd like to discuss our progress this quarter in three key areas. First is our security and compliance capabilities...Second is our AI offering, GitLab Duo, which integrates AI throughout the software development life cycle. And third is our Enterprise Agile Planning offering..." - Sid Sijbrandij

AI and GitLab Duo

"AI helps teams write more code faster. But more code isn't better if it's not secure and high quality. That's why GitLab Duo helps teams not only write code but also understand code and fix vulnerabilities more effectively." - Sid Sijbrandij

Security

"Let's start with security and compliance. These are at the heart of our platform and set us apart from the competition." - Sid Sijbrandij

"Customers come to GitLab to replace security point solutions. With most point solutions, code isn't scanned at the time it's written that causes friction for developers and increases the time required to find and fix vulnerabilities." - Sid Sijbrandij

Competitors

"We're winning deals against GitHub because we have the most comprehensive platform. In security and compliance, only we have DAST the dynamic scanning, the container scanning, the API security and the compliance management..." - Sid Sijbrandij

Customers

"We now have 96 customers with ARR over $1 million, up from 63 one year ago." - Sid Sijbrandij

"T-Mobile recently moved 25,000 projects into GitLab over just two months and increased their security scans to hundreds of thousands per month." - Sid Sijbrandij

Guidance

Brian Robins: "First, we are entering our third year as a public company...I expect our guidance philosophy to be less conservative this year than in the first two years. We want to communicate the right expectations and are sharing guidance accounting for the current environment...For the full year FY 2025, we expect total revenue of $725 million to $731 million, representing a growth rate of approximately 26% year-over-year. We expect a non-GAAP operating income of $5 million to $10 million."

"While the spending environment remains cautious, we believe we are starting to see buying behavior normalize with accelerated adoption of our DevSecOps platform." - Brian Robins

Leadership

"Finally, on the leadership side, we're excited to welcome to Sabrina Farmer as Chief Technology Officer. Sabrina has 25 years of experience and joins us from Google..." - Sid Sijbrandij

Thoughts on Gitlab ER $GTLB :

🟢Pros:

+ Revenue rose by +33.3% YoY; according to Q1 guidance, revenue growth will be accelerating.

+ DBNR at 130%, up from 128%.

+ Company increasing margins and profitability.

+ RPO and Billings growth are accelerating and growing faster than revenue.

+ Added a record number of $100k+ and $1M+ ARR customers.

+ Added record Net New ARR; New ARR growth YoY was accelerated.

+ New product, GitLab Duo, could contribute to future revenue growth.

+ The management team is strengthened by the experienced Sabrina Farmer, Chief Technology Officer.

🔴Cons:

- SBC/rev at 28%, dilution at 4.3% YoY.

🟡Neutral:

+- FY guidance missed est. by ~1%.

+- Missed EBITDA guidance.

+- Beat Q4 revenue estimates by 3.7%.