Gitlab Q3 2024 Earnings Analysis

Dive into $GTLB GitLab’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$196.0M rev (+30.9% YoY, +30.8% LQ) beat est by 4.3%

↘️GM* (91.0%, -0.3 PPs YoY)🟡

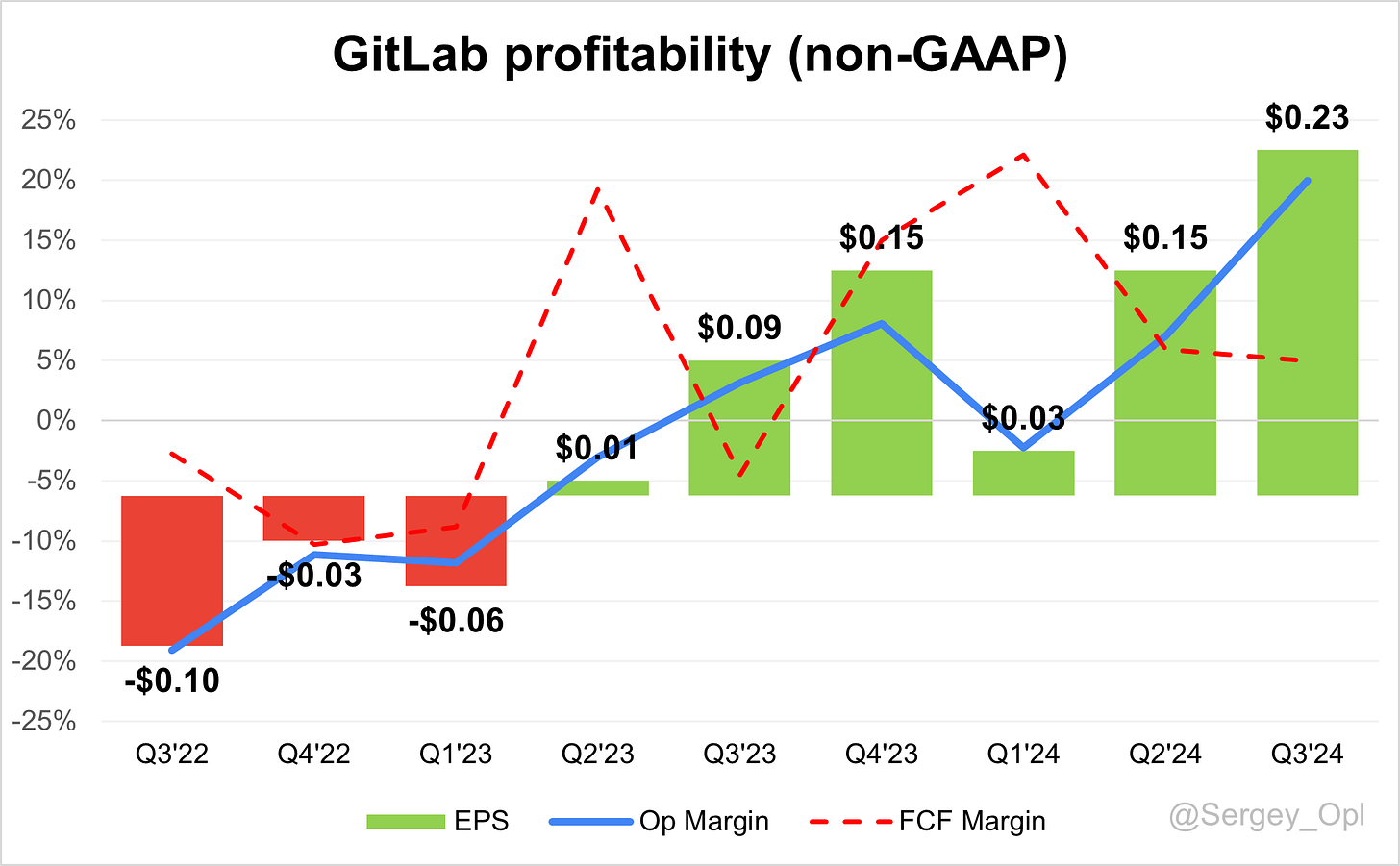

↗️Operating Margin* (19.9%, +16.8 PPs YoY)🟢

↗️FCF Margin (4.9%, +9.4 PPs YoY)

↗️EPS* $0.23 beat est by 53.3%🟢

*non-GAAP

Key Metrics

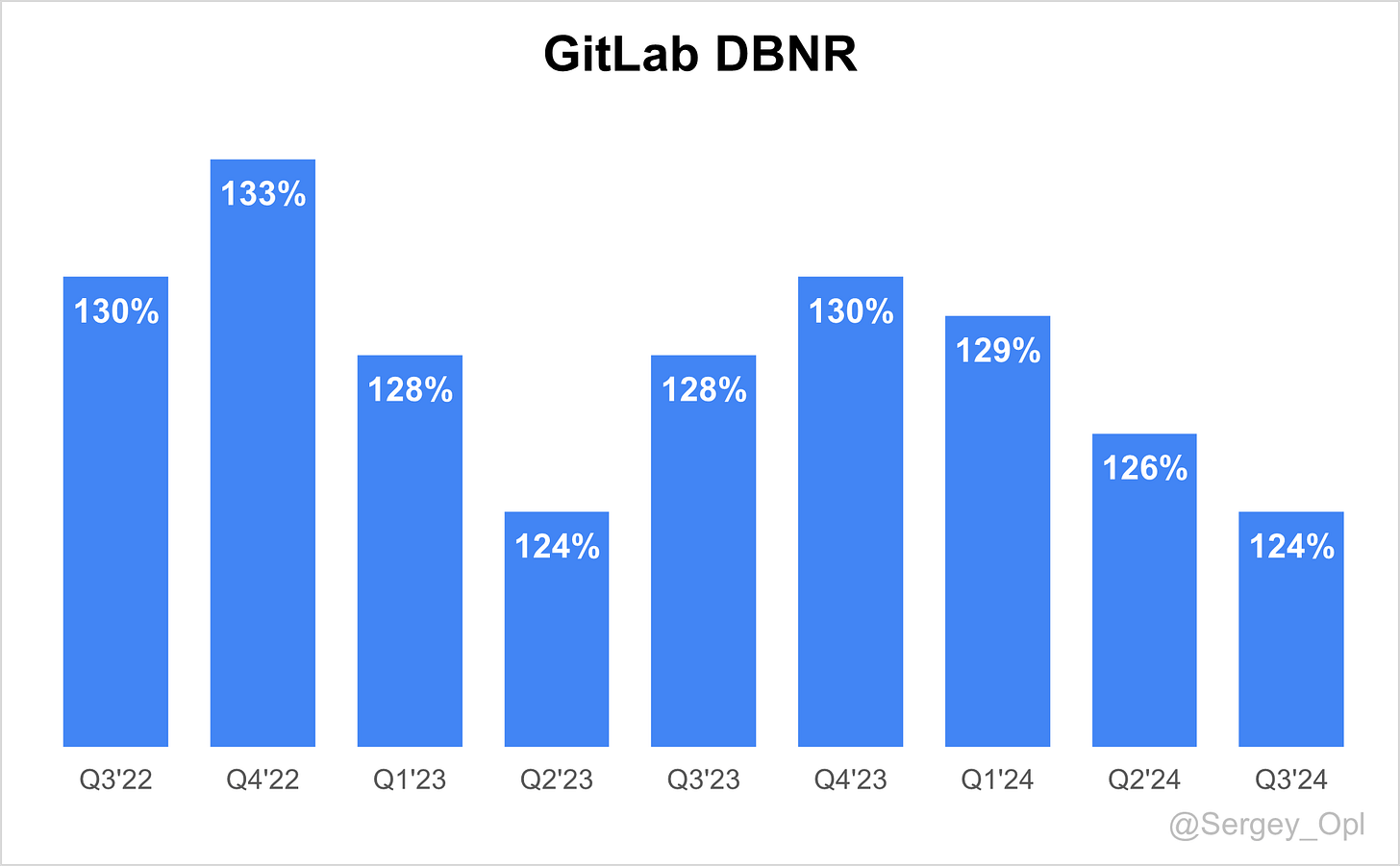

↘️DBNR 124% (126% LQ)

↗️RPO $0.81B (+48.1% YoY)

➡️Billings $216M (+30.6% YoY)🟡

Customers

➡️9,519 customers (+16.4% YoY, +205)

↗️1,144 $100k+ customers (+30.9% YoY, +68)

Operating expenses

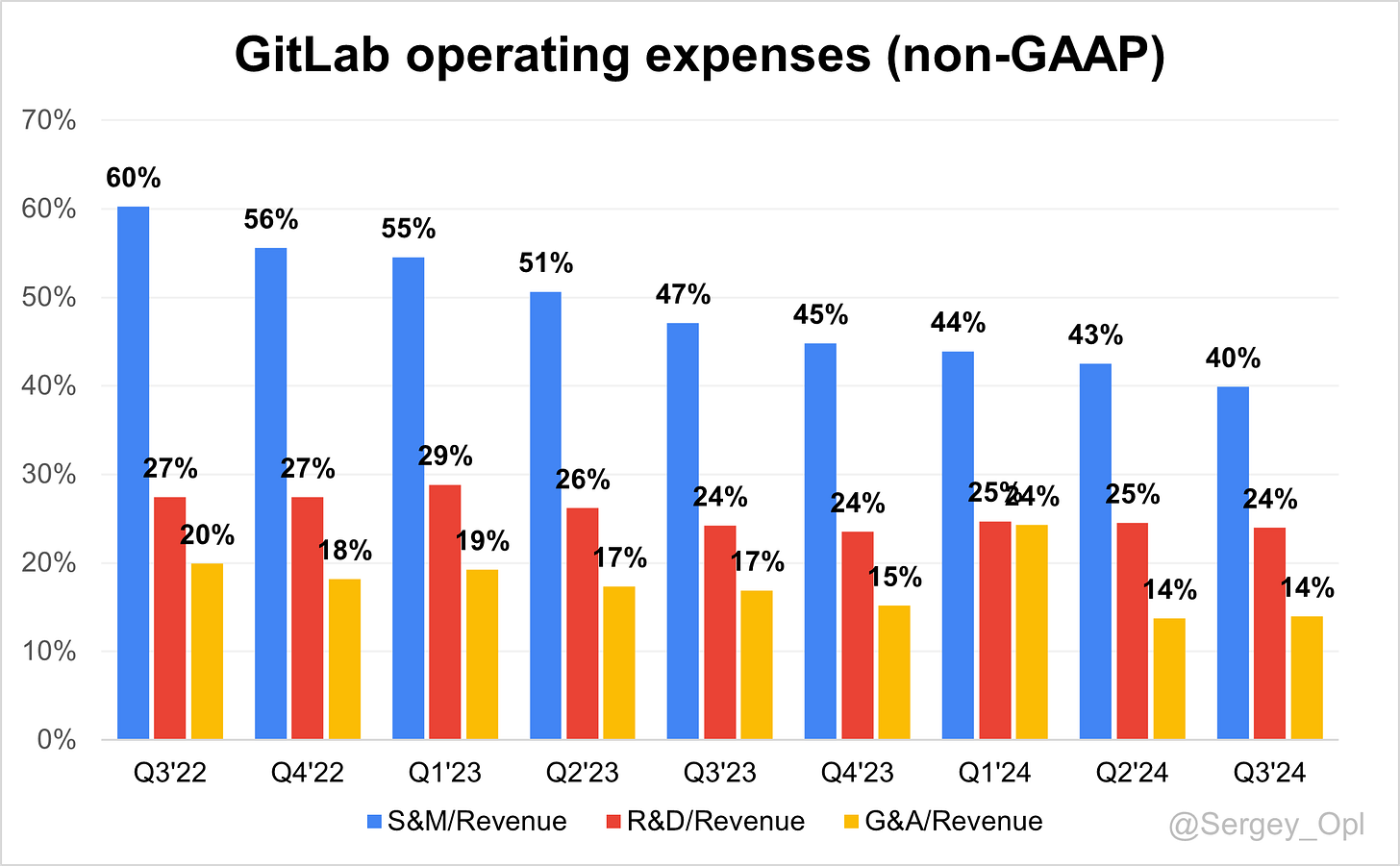

↘️S&M*/Revenue 39.9% (-7.2 PPs YoY)

↘️R&D*/Revenue 24.0% (-0.2 PPs YoY)

↘️G&A*/Revenue 13.9% (-3.0 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $54M (+32.7% YoY)

↘️CAC* Payback Period 19.1 Months (-3.9 YoY)🟢

↗️R&D* Index (RDI) 1.17 (+0.05 YoY)🟢

Dilution

↘️SBC/rev 25%, -2.3 PPs QoQ

↗️Basic shares up 4.0% YoY, +0.1 PPs QoQ

↘️Diluted shares up 7.9% YoY, -0.3 PPs QoQ🔴

Guidance

↗️Q4'24 $205.0 - $206.0M guide (+25.5% YoY) beat est by 0.6%

↗️$753.0 - $754.0M FY guide (+29.9% YoY) raised by 1.3% beat est by 1.2%

Key points from GitLab’s Third Quarter 2024 Earnings Call:

Financial Performance

GitLab reported 31% YoY revenue growth, reaching $196 million, exceeding guidance by 4.6%. For FY 2025, total revenue is projected to grow 30% YoY, with guidance of $753–$754 million.

Profitability improved significantly, with a 13.2% non-GAAP operating margin, an increase of over 1,000 basis points YoY. Non-GAAP operating income rose to $25.9 million, compared to $4.7 million in Q3 FY 2024. Adjusted free cash flow reached $9.7 million, compared to a negative $6.7 million in the prior year.

Gross margins remained at 91%, even with SaaS revenue now representing 29%, a 44% YoY increase. Efficiency metrics such as dollar-based net retention rate (DBNR) at 124%, total RPO growth of 48% YoY to $811.8 million, and current RPO growth of 39% to $515.2 million underscore the strength of GitLab’s financial model.

Product Innovations

GitLab introduced Advanced SAST, an acquisition-based technology, providing accurate vulnerability detection while minimizing false positives. Integrated into GitLab’s platform, it enhances the developer experience by streamlining security processes.

The company also unveiled GitLab Duo Workflow, built on Agentic AI, to transform AI interactions from reactive to proactive. This innovation supports end-to-end lifecycle management, integrating AI capabilities seamlessly for tasks such as planning, coding, and deployment.

GitLab Duo

GitLab Duo has delivered productivity gains of up to 50% for customers. The product offers two tiers: Duo Pro, for AI-powered coding assistance, and Duo Enterprise, which extends AI capabilities across the software development lifecycle. Duo accounted for 25% of net ARR in deals where it was included.

Customers such as Emirates adopted Duo Pro for security-focused AI tools, while a U.S. government agency purchased 2,000 Duo Enterprise licenses for secure, offline use of self-hosted AI models. GitLab Duo's ability to address compliance needs has positioned it as a preferred choice for regulated industries.

GitLab Ultimate

GitLab Ultimate, now 48% of total ARR, is driving growth and efficiency for enterprises. In Q3 FY 2025, 50% of bookings included Ultimate. It has become an essential tool for enterprises to consolidate multiple solutions, enhancing security, compliance, and cost savings.

Notable wins include Indeed, which reported a 79% increase in daily pipeline activity and 20% cost savings after upgrading from Premium to Ultimate. A global supermarket chain using Ultimate saved 90 minutes per developer per day and cut costs by $10–$15 million annually.

Ultimate also drives GitLab Dedicated adoption, requiring this subscription tier to provide fully managed solutions. The partnership with AWS enhances Ultimate's capabilities for cloud-integrated compliance.

AI Innovations

GitLab is advancing Agentic AI, emphasizing proactive AI capabilities integrated into the software lifecycle. GitLab Duo Workflow allows autonomous AI agents to perform complex tasks, leveraging GitLab’s unified data store for accurate context and actions.

GitLab’s support for self-hosted AI models in Duo Enterprise strengthens its position among compliance-focused organizations. Partnerships, such as with AWS, have expanded GitLab's AI ecosystem, offering integrated development solutions for cloud users.

GitLab 17

GitLab 17 delivers enhanced security, compliance, and automation features. The focus is on embedding actionable insights earlier in the development cycle, allowing faster time-to-market. It reduces complexity by consolidating multiple point solutions, driving higher efficiency for users.

DevSecOps Market Leadership

GitLab estimates the DevSecOps market at $40 billion, with most enterprises still relying on fragmented DIY solutions. GitLab's platform consolidates tools, saving costs and improving efficiency. A large insurance company reduced costs by $2 million annually by replacing four point solutions with GitLab Ultimate. Customers like LATAM Airlines and Prometheus Group have similarly streamlined operations using GitLab.

GitLab Dedicated

GitLab Dedicated offers managed, compliant, and secure solutions. Customers such as Smartsheet and Blackstone use it to lower maintenance costs and improve visibility. GitLab’s public sector performance set records, with progress on FedRAMP Moderate certification unlocking further government growth opportunities.

New Customers and Expansions

GitLab secured notable customers in Q3 FY 2025:

LATAM Airlines adopted GitLab Ultimate and Duo Enterprise for cost reduction and productivity.

Emirates chose GitLab for its AI-powered, compliance-centric developer tools.

OxBlue and Prometheus Group selected GitLab to improve security and efficiency.

Existing customers expanded adoption. Indeed increased pipelines by 79%, reduced hardware costs by 20%, and consolidated tools after upgrading to Ultimate. USAA shortened incident response times from one month to one hour, while a global supermarket chain saved $10–$15 million annually with GitLab Ultimate.

Strategic Partnerships

GitLab’s collaboration with AWS has introduced integrated solutions, combining GitLab Duo and Amazon Q. Initially available to self-managed customers, the offering plans to expand to SaaS, supporting GitLab’s mission to simplify secure software development.

Management Transition

Bill Staples succeeded Sid Sijbrandij as CEO. Staples, previously CEO at New Relic, brings deep experience in developer platforms and operational leadership. Sijbrandij remains as Executive Chair, ensuring continuity during this transition. Staples emphasized engaging with customers and partners to further GitLab’s market position.

Future Outlook

GitLab sees significant room for growth, with most enterprises in early stages of DevSecOps adoption. For Q4 FY 2025, GitLab expects revenue of $205–$206 million, reflecting 25–26% YoY growth, and non-GAAP net income per share of $0.22–$0.23. For the full year, non-GAAP operating income is projected at $69–$70 million.

GitLab focuses on driving AI adoption, increasing enterprise penetration, and leveraging toolchain consolidation to capture its share of the expanding market. The company is well-positioned to deliver sustainable growth and long-term value.

Management comments on the earnings call.

Product Innovations

Sid Sijbrandij, Executive Chair

"Advanced SAST is a key enhancement that reduces false positives and seamlessly integrates into the development lifecycle, allowing developers and security teams to focus on what truly matters."

GitLab Duo

Brian Robbins, Chief Financial Officer

"GitLab Duo is driving significant productivity gains, with up to 50% improvements reported by some customers. Duo Enterprise, in particular, is a game-changer for regulated industries with its self-hosted AI capabilities."

AI

Bill Staples, Chief Executive Officer

"We see AI transforming software development beyond reactive tools to proactive, autonomous agents. GitLab's end-to-end platform gives AI the context it needs to act effectively across the entire software lifecycle."

DevSecOps

Sid Sijbrandij, Executive Chair

"The DevSecOps market is still in its early stages, with most enterprises relying on fragmented DIY solutions. GitLab’s platform consolidates tools, improving efficiency and delivering rapid ROI."

Competitors

Brian Robbins, Chief Financial Officer

"Customers are replacing point solutions with GitLab’s integrated platform, achieving significant cost savings and productivity gains. This consolidation is a key driver of growth in the highly competitive DevSecOps market."

Customers

Sid Sijbrandij, Executive Chair

"Customers like LATAM Airlines and USAA are seeing transformative results with GitLab Ultimate, whether it's saving millions annually, reducing manual tasks, or consolidating toolchains for greater efficiency."

Strategic Partnerships

Brian Robbins, Chief Financial Officer

"Our partnership with AWS strengthens GitLab’s ecosystem by combining GitLab Duo with Amazon Q, creating a powerful joint offering for secure and efficient software development."

Future Outlook

Bill Staples, Chief Executive Officer

"We are entering a transformative period where GitLab can unlock tremendous value for our customers, leveraging AI, partnerships, and platform consolidation to drive sustainable growth."

Thoughts on GitLab ER $GTLB:

🟢 Pros:

Revenue rose +30.9% YoY, slightly accelerating from 30.8% in the previous quarter. If the company similarly beats by 4.3%, growth in the next quarter will be 31.1%, indicating revenue growth acceleration.

Strong DBNR at 124%, slightly down from 126% last quarter, but still at a very high level.

The company is increasing margins and profitability.

FY guidance was raised by 1.3%.

Strong next-quarter guidance suggests further revenue growth acceleration.

Growth in RPO and Billings has slightly slowed after last quarter's acceleration, with Billings growing in line with revenue, and RPO growing faster than revenue.

Added +68 $100k+ ARR customers, more than in Q3 last year.

Achieved nearly a record New ARR: +53.6, growing 33% YoY.

GitLab is strengthening its collaboration with AWS.

🔴 Cons:

SBC as a percentage of revenue is high at 25%. Diluted share count increased 7.9% YoY.

🟡 Neutral:

The number of $5k+ customers added was weak at +205, the lowest level since the IPO.