Gitlab Q2 2024 Earnings Analysis

Dive into $GTLB GitLab’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$182.6M rev (+30.8% YoY, +33.3% LQ) beat est by 3.2%

↘️GM* (90.7%, -0.4 PPs YoY)🟡

↗️Operating Margin* (7.1%, +10.1 PPs YoY)

↘️FCF Margin (5.9%, -13.3 PPs YoY)🟡

↗️EPS* $0.15 beat est by 50.0%🟢

*non-GAAP

Key Metrics

↘️DBNR 126% (129% LQ)

↗️RPO $0.75B (+51.0% YoY)🟢

↗️Billings $203M (+42.0% YoY)🟢

Customers

➡️9,314 customers (+19.0% YoY, +338)

➡️1,076 $100k+ customers (+33.0% YoY, +51)

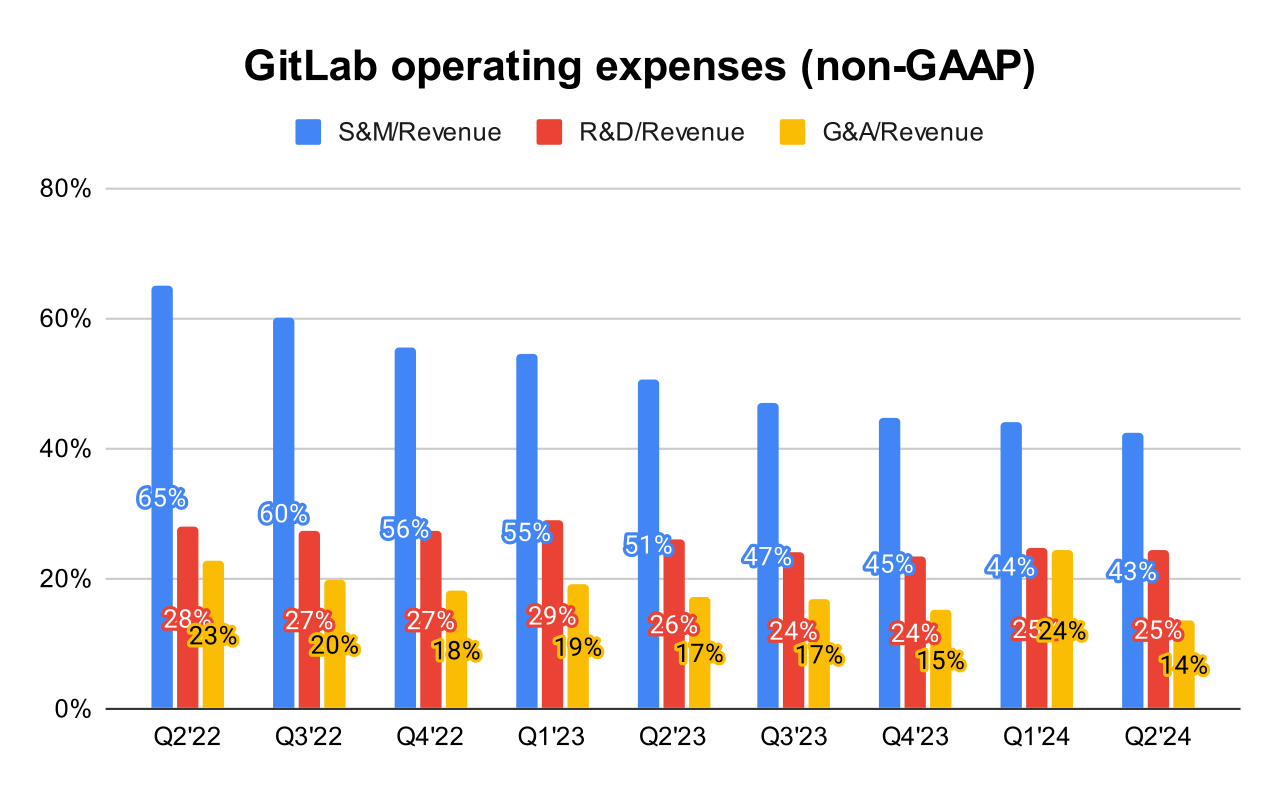

Operating expenses

↘️S&M*/Revenue 42.5% (-8.1 PPs YoY)

↘️R&D*/Revenue 24.5% (-1.7 PPs YoY)

↘️G&A*/Revenue 13.7% (-3.6 PPs YoY)

Quarterly Performance Highlights

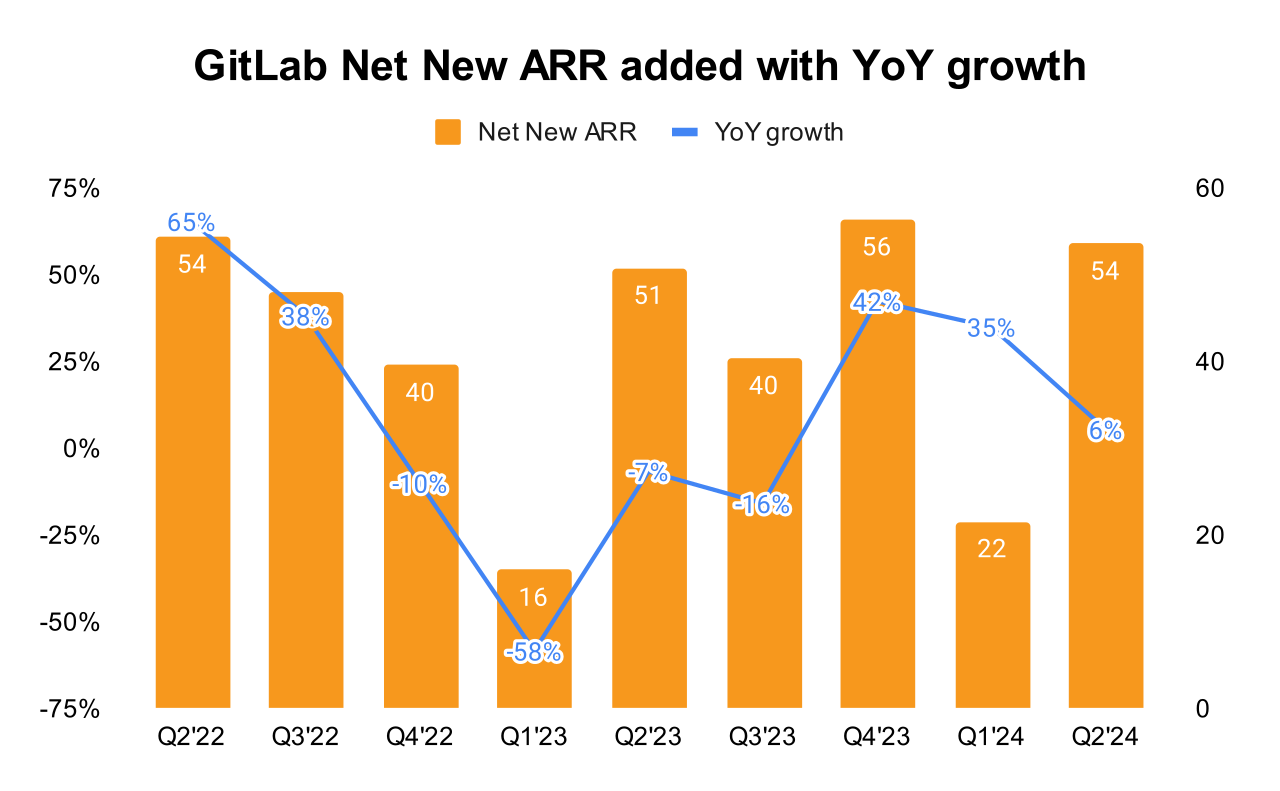

↗️Net New ARR $54M (+5.5% YoY)

↘️CAC* Payback Period 18.3 Months (45.0 LQ)

Dilution

↗️SBC/rev 27%, +1.8 PPs QoQ

↘️Basic shares up 3.9% YoY, -0.3 PPs QoQ

➡️Diluted shares up 8.3% YoY🔴

Guidance

➡️Q3'24 $187.0 - $188.0M guide (+25.3% YoY) in line with est

↗️$742.0 - $744.0M FY guide (+28.1% YoY) raised by 0.9% beat est by 0.9%

Key points from GitLab’s Second Quarter 2024 Earnings Call:

Financial Performance:

GitLab reported a significant 31% year-over-year increase in revenue, reaching $183 million. This growth was driven by both new customer acquisitions and expansions among existing clients.

There was a substantial improvement in the non-GAAP operating margin, which increased by over 1300 basis points year over year to 10%.

GitLab Duo:

GitLab Duo has demonstrated significant efficiency gains for customers, reducing time spent on toolchain operations and speeding up lead times and vulnerability detection. Customers have reported meaningful productivity improvements and enhanced security features with GitLab Duo, suggesting it's becoming a critical component in GitLab's offerings to drive business outcomes.

GitLab 17:

GitLab 17 introduced GitLab dual workflow, an autonomous agent that enhances the software development lifecycle by taking more initiative on its own. This represents a move toward more proactive AI features, aiming to automate and streamline development tasks further.

AI Integrations Across the Platform:

GitLab is focusing on integrating AI throughout the software development lifecycle (SDLC), not just in code generation. This strategy aims to provide tangible results by aligning AI solutions with business goals, improving security, and measuring benefits comprehensively.

The integration of AI is designed to help GitLab's platform deliver faster software development, enhance security, and improve collaboration among developers, security experts, and operations teams.

Expanding Customers:

GitLab added significant new customers such as Delaware North and Gilt Mortgage, which contributed to their revenue growth.

Existing customers continued to expand their usage of GitLab's services, reflecting strong customer satisfaction and the value derived from GitLab's offerings.

Customer Success Stories

State of Washington Public Disclosure Commission:

Reported improvements in developer productivity and effectiveness due to GitLab Duo, allowing their teams to focus more on substantive work rather than toolchain operations.

Barclays:

Adopted GitLab Duo along with additional Ultimate licenses, rolling it out to thousands of developers to enhance their development process with AI capabilities integrated within the same platform.

F5:

A multi-cloud application security and delivery company that adopted GitLab Duo to drive improved developer experience and productivity. Developers in F5’s pilot program reported that GitLab’s AI capabilities were easy to use and significantly boosted their productivity.

KeyBank:

Adopted GitLab Duo to enhance developer productivity, resolving pipeline issues six times faster. KeyBank chose GitLab Duo as their first approved AI technology due to its focus on transparency and privacy.

Lockheed Martin:

By consolidating on GitLab, Lockheed Martin managed to run CI pipeline builds 80 times faster, retired thousands of legacy CI servers, and reduced time spent on system maintenance by 90%, indicating significant increases in efficiency and productivity.

Materials Science Innovator:

Utilized GitLab’s enterprise agile planning add-on in combination with GitLab Ultimate to centralize planning tools into a single platform, improving visibility across the business.

National Oceanic and Atmospheric Administration (NOAA):

Upgraded from GitLab Premium to Ultimate for enhanced security and compliance features, also purchasing GitLab Duo to improve developer productivity.

Snowflake:

Migrated to GitLab Dedicated for source code management, CI, and security for their corporate environment, benefiting from the security of a single-tenant environment along with the comprehensive features of GitLab’s platform.

Economic Environment:

GitLab's leadership acknowledged the cautious macroeconomic environment and its impact on customer spending, indicating that businesses are more financially conservative in their technology investments.

Market Positioning:

GitLab prides itself on being vendor-agnostic, which is a key differentiator from competitors like GitHub that are tied to specific cloud providers (GitHub is owned by Microsoft). This independence allows GitLab to integrate with any cloud provider and use the best available AI models without bias.

Future Outlook:

Projecting that AI's role in the SDLC will grow substantially, from current adoption levels to much broader implementation by 2027. This includes GitLab's focus on moving from reactive to proactive AI tools, enhancing automation, and increasing developer productivity.

Management comments on the earnings call.

Product Innovations:

Sid Cibrandy, CEO: "We continue to deliver strong results that reflect our team's focus on customers, helping them realize faster time to value and customer-specific business outcomes... And with AI integrated throughout the software development lifecycle, GitLab customers can take those gains even further."

Competitors:

Sid Cibrandy, CEO: "Today we're the only non-hypercloud that's a leader according to Gartner. And that's because of two things, because you need a great model and you need a great context. We're vendor agnostic. Today, we use the best model on the market for cogeneration, Entropic Cloud 3.5. And context-wise, we know more of what a user is working on and what they've worked on in the past. Because we got the broadest platform, we have the most context and better context leads to better AI answers. So together with that, we feel comfortable in competing."

Customers:

Sid Cibrandy, CEO: "Our customers are excited about the meaningful productivity and security benefits of GitLab Duo, which has demonstrated up to 90% reduction in time spent on toolchain operations, 50% faster lead time and 50% faster vulnerability detection."

Challenges:

Brian Robbins, CFO: "In today's cautious macroeconomic environment, technology needs to deliver quick time to value while solving complex, impactful problems. That is what our AI-powered DevSecOps platform does."

Thoughts on Gitlab ER $GTLB :

🟢Pros:

+ Revenue rose by +30.8% YoY; if the company similarly beats by 3.2%, the growth in the next quarter will be 29.6%, indicating revenue growth stabilization.

+ Strong DBNR at 126%, decreased from 129% last quarter.

+ Company increasing margins and profitability.

+ Increased FY guidance by 0.9%.

+ Strong next quarter guidance.

+ Growth in RPO and Billings has accelerated and is growing faster than revenue.

+ Added +51 $100k+ ARR customers, more than in Q2 last year.

+ Added nearly record New ARR: +53.6, growth 6% YoY.

+ GitLab recognized as a Leader in the 2024 Gartner Magic Quadrant for AI code assistant.

🔴Cons:

- SBC/rev at 27%. Diluted share count up 8.3% YoY.

🟡Neutral:

+- Weak number of $5k+ Customers added, the lowest level since the IPO.