Gitlab Q1 2025 Earnings Analysis

Dive into $GTLB GitLab’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$214.5M rev (+26.8% YoY, +29.1% LQ) beat est by 0.9%

↘️GM* (90.2%, -0.5 PPs YoY)🟡

↗️Operating Margin* (12.2%, +14.4 PPs YoY)

↗️FCF Margin (48.5%, +26.4 PPs YoY)🟢

↗️EPS* $0.17 beat est by 13.3%

*non-GAAP

Key Metrics

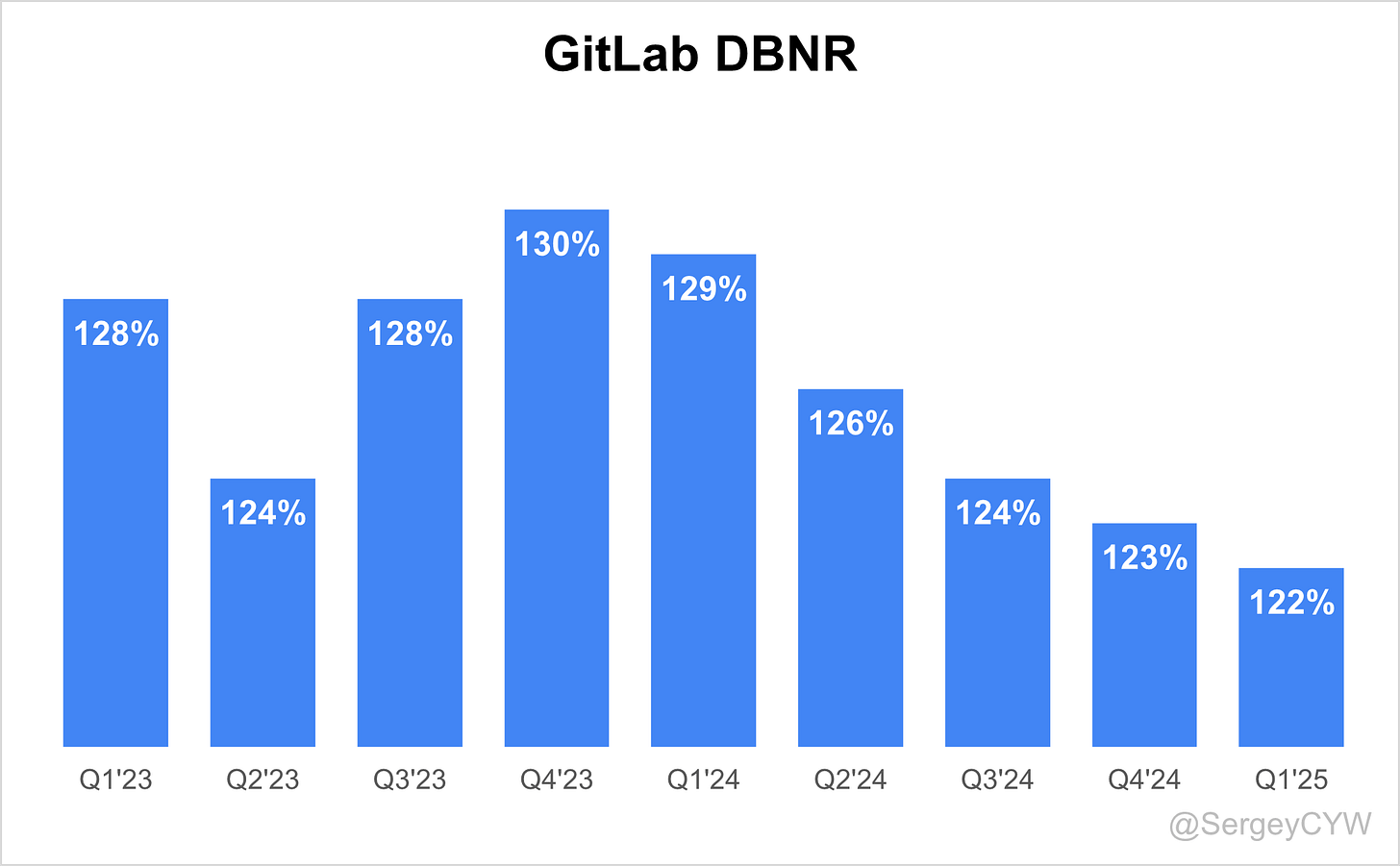

↘️DBNR 122% (123% LQ)

↗️RPO $0.96B (+40.2% YoY)🟢

↗️Billings $222M (+35.4% YoY)🟢

Customers

➡️10,104 customers (+12.6% YoY, +211) 🟡

➡️1,288 $100k+ customers (+25.7% YoY, +59) 🟡

Operating expenses

↘️S&M*/Revenue 39.9% (-4.1 PPs YoY)

↘️R&D*/Revenue 23.8% (-0.9 PPs YoY)

↘️G&A*/Revenue 14.3% (-10.0 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $12M (-42.6% YoY)

↗️CAC* Payback Period 85.5 Months (+40.5 YoY)🟡

↘️R&D* Index (RDI) 1.09 (-0.11 YoY)🟡

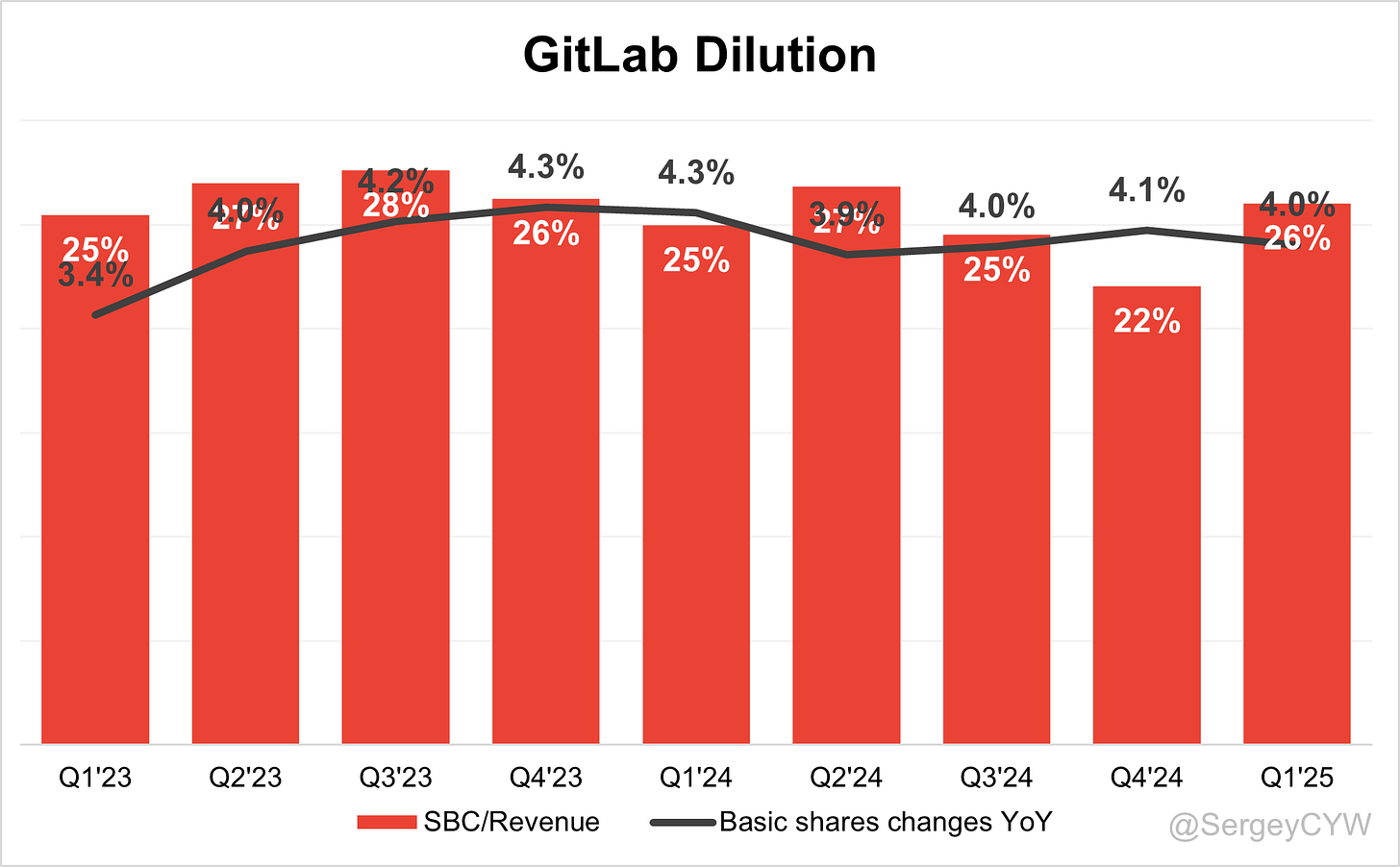

Dilution

↗️SBC/rev 26%, +4.0 PPs QoQ

↘️Basic shares up 4.0% YoY, -0.1 PPs QoQ🟡

↘️Diluted shares up 7.6% YoY, -1.0 PPs QoQ🔴

Guidance

➡️Q2'25 $226.0 - $227.0M guide (+24.0% YoY) in line with est

➡️$936.0 - $942.0M FY guide (+23.7% YoY) in line with est

Key points from GitLab’s First Quarter 2025 Earnings Call:

Financial Performance

GitLab delivered strong Q1 FY2026 results with revenue of $214.5 million, up 27% year-over-year. Adjusted free cash flow reached a record $104.1 million, representing a 49% FCF margin.

Non-GAAP operating income rose to $26.1 million from a $3.8 million loss a year ago, translating to a 12.2% margin—a gain of approximately 1,400 basis points. Gross margin remained stable at 90%. GitLab ended the quarter with $1.1 billion in cash and investments, enabling continued investment in innovation and GTM expansion.

GitLab 18 Platform

GitLab 18 introduced key enhancements across DevOps, Security, and AI. Highlights include centralized artifact management, faster and more secure CI/CD pipelines, and improved content discovery.

Security upgrades added compliance frameworks, vulnerability dashboards, and AI-based false positive reduction. The platform also began leveraging its unified data store to create a contextual knowledge graph, enhancing both human and agent decision-making.

Enterprise customers including Thales, Siemens, and Scania contributed to GitLab 18—setting a quarterly record for customer-driven development. GitLab continues to serve complex, regulated environments, but some customers require more time to adopt AI workflows, which will require ongoing education and demos.

GitLab Duo

GitLab Duo saw a 35% QoQ increase in first-time customer purchases. Duo Chat and Code Suggestions are now bundled in Premium and Ultimate, enabling broader AI adoption.

Duo Enterprise was extended to Premium to meet demand for self-hosted models and expanded lifecycle coverage. GitLab confirmed Duo Enterprise was not a primary driver of Ultimate upgrades, helping expand TAM without impacting tier economics.

Notable success metrics include:

R+V Insurance achieved 35% faster test generation and 25% quicker RCA and code explanations

Volkswagen Digital Solutions reported productivity gains via Duo and Amazon Q

Highmark Health adopted Duo Enterprise to scale AI across technical teams

GitLab competes in a noisy AI tools market but maintains differentiation with full lifecycle integration, LLM neutrality, and open extensibility.

Duo Workflow

Duo Workflow, GitLab’s agentic AI solution, is in private beta and will enter public beta this summer with GA expected in winter. The beta expanded from six to dozens of participants.

82% of surveyed users reported being satisfied or very satisfied. Workflow enables multi-agent collaboration and performs multistep tasks like code refactoring and planning with traceable execution.

Adoption will depend on clear pricing, integration strategy, and education around agent-based development. Workflow strengthens GitLab’s competitive position in autonomous software delivery.

GitLab Ultimate

Ultimate now accounts for 52% of total ARR. It was included in 8 of the top 10 Q1 deals and is growing as a share of new customer lands.

Recent wins include Efecoden, Technosilda, Premise Health, and SGK. Key expansions came from American Family Insurance and the FBI. Ultimate bundles AI tools like Duo and Workflow with security and compliance, positioning it as GitLab’s full-featured enterprise solution.

Higher Ultimate landings slightly compress expansion opportunity, contributing to a DBNRR of 122%, down from historical 130%+ levels. Premium remains the more common entry point, supporting GitLab’s land-and-expand motion.

GitLab Dedicated

GitLab Dedicated achieved FedRAMP Moderate Authorization, unlocking growth in public sector and compliance-heavy industries.

Key Q1 wins:

Forvia Hella adopted Dedicated and Duo Enterprise to streamline R&D

NatWest expanded to 17,000 Dedicated users and 6,000 Duo Enterprise seats, achieving a 20% increase in deployment frequency

Dedicated enhances GitLab’s presence in government, finance, and defense but requires higher-touch onboarding and carries elevated delivery costs due to compliance demands.

Product Innovation

GitLab released over 100 innovations in the past year for Premium, with more in Ultimate. Enhancements focus on:

Secure, high-speed pipelines

Integrated vulnerability management

Agentic AI capabilities

A unified knowledge graph

Extensibility and LLM model neutrality

These upgrades reinforce GitLab’s position as an AI-native DevSecOps platform.

Strategic Partnerships

GitLab deepened integration with Amazon Web Services, embedding Amazon Q AI agents into its platform. Early adopters like Volkswagen Digital Solutions report reduced context switching and faster deployment cycles.

GitLab is a select global sponsor for AWS Summits, strengthening joint GTM execution and increasing enterprise visibility.

Customers and Expansion

GitLab serves 10,104 customers with ≥$5K ARR, accounting for 95%+ of total ARR. It has 1,288 customers ≥$100K ARR, up 26% YoY.

Logo growth was flat, impacted by churn and contraction in SMBs around the $5K threshold. GitLab emphasized revenue growth over logo count. Key enterprise wins and expansions included:

NatWest: 17,000 Dedicated users + 6,000 Duo Enterprise seats; 20% faster deployments

Supermicro: Upgraded from Free to Premium + Duo Pro; targeting 2x feature velocity

R+V Insurance: 35% faster test gen, 25% faster RCA with Duo Enterprise

Highmark Health: Adopted Duo Enterprise to scale AI across teams

Forvia Hella: Uses Duo daily for secure, fast development cycles

American Family Insurance and FBI: Expanded use of GitLab Ultimate

AI-Powered Platform (unnamed): Selected GitLab over GitHub for unified DevSecOps + Duo Enterprise

Retention Trends

DBNRR was 122%, driven by:

80% seat expansion

15% tier upgrades

5% yield increase

The decline from 130%+ levels reflects more customers initially landing in Ultimate and some macro-driven churn in lower-end accounts. Management expects fluctuations to continue based on renewal mix.

Competitive Landscape

Customers actively test AI code tools like GitHub Copilot, Cursor, and Windsurf. GitLab maintains its edge by managing the entire software lifecycle, not just code generation.

Duo interoperates with these tools, and GitLab continues to support a model-neutral, open, and extensible architecture. Integration across planning, testing, and deployment remains a unique advantage.

Execution and Challenges

Q1 results showed a “skinny beat,” attributed to a higher SaaS revenue mix and back-end deal linearity. No macro deterioration was cited, but procurement cycles and deal timing were noted as watch points.

Execution remains consistent, but SaaS mix can skew revenue recognition timing relative to bookings.

Guidance and Outlook

Q2 FY2026 guidance:

Revenue: $226M–$227M (+24% YoY)

Non-GAAP Operating Income: $23M–$24M

EPS: $0.16–$0.17

Full-year FY2026 guidance:

Revenue: $936M–$942M (+24% YoY)

Operating Income: $117M–$121M

EPS: $0.74–$0.75

Outlook assumes continued macro caution. GitLab maintained prior guidance despite strong Q1 bookings, reflecting a conservative posture.

Future Direction

GitLab’s strategy centers on becoming the leading AI-native DevSecOps platform. The focus is on agentic AI, lifecycle-wide automation, and deep platform extensibility.

Duo Workflow and GitLab 18 showcase this evolution. The company views the AI boom as a long-term catalyst: more code, more coders, more lifecycle needs. With a strong cash position, robust cash flow, and accelerating innovation, GitLab is positioned to expand its enterprise footprint and capitalize on the generative AI transformation.

Management comments on the earnings call.

Product Innovations

Bill Staples, Chief Executive Officer

“We aspire to be the world’s best AI-native DevSecOps platform, unlocking step-function productivity improvements by redefining the software engineering experience through human and agent collaboration.”

Bill Staples, Chief Executive Officer

“One of the things that distinguishes us is our vibrant co-creation ecosystem. April set an all-time record for customer contributions to our platform. This collaborative model delivers real-world value, accelerates our feature velocity, and ensures innovations match enterprise requirements.”

Bill Staples, Chief Executive Officer

“We’ve introduced over 100 innovations in the past year for premium customers, and even more for Ultimate, across security, DevOps speed, and AI—focusing on performance, security, and deep integration across the software lifecycle.”

GitLab 18

Bill Staples, Chief Executive Officer

“With GitLab 18, we are centralizing artifact management, optimizing CI/CD pipelines, and embedding AI contextually across the platform. These enhancements ensure customers can easily collaborate and drive maximum ROI from their GitLab investment.”

Bill Staples, Chief Executive Officer

“I’ll introduce our bold new vision along with the innovation we’re building and the roadmap ahead at our GitLab 18 launch event on June 24.”

GitLab Duo

Bill Staples, Chief Executive Officer

“GitLab Duo is becoming a daily asset for customers. Duo Chat and Code Suggestions are now included in Premium and Ultimate to eliminate friction. We want GitLab to be the most obvious and accessible solution for every engineer experimenting with AI.”

Bill Staples, Chief Executive Officer

“We made Duo Enterprise available to Premium customers because we saw demand for self-hosted models and lifecycle-wide AI. This unlocks more of the market without risking Ultimate upgrades—Duo Enterprise hasn’t been a significant upgrade driver historically.”

Bill Staples, Chief Executive Officer

“Our integrated AI approach offers an ideal starting point and a clear upgrade path to higher usage tiers like Duo Pro, Duo Enterprise, and Duo Workflow.”

GitLab Ultimate

Bill Staples, Chief Executive Officer

“Ultimate now represents 52% of total ARR, with eight of our ten largest Q1 deals including Ultimate. More customers are choosing Ultimate at the start, validating our strategy and the demand for embedded security and AI capabilities.”

Bill Staples, Chief Executive Officer

“Premium and Ultimate work as a one-two punch. Premium is a compelling entry point, and Ultimate provides a strong upgrade path as organizations scale.”

Competitors

Bill Staples, Chief Executive Officer

“Our customers are openly testing multiple AI tools side-by-side—Copilot, Cursor, Windsurf—but all of those tools are focused on code creation. GitLab plays a critical role in what happens next: testing, validation, security, packaging, deployment.”

Bill Staples, Chief Executive Officer

“I’m not concerned about competition. We see GitLab Duo win in side-by-side evaluations with top-tier alternatives, and our broader lifecycle coverage gives us structural differentiation.”

Customers

Bill Staples, Chief Executive Officer

“Supermicro doubled the size of their software team and upgraded from free to GitLab Premium and Duo Pro. Their goal is a 2x acceleration in feature development for AI infrastructure.”

Bill Staples, Chief Executive Officer

“NatWest expanded to 17,000 Dedicated users and added 6,000 Duo Enterprise seats. Over the past 12 months, they’ve seen a 20% improvement in deployment frequency.”

Bill Staples, Chief Executive Officer

“R+V Insurance reported 35% faster AI-assisted test generation and 25% faster root cause analysis with Duo Enterprise, validating our lifecycle-integrated AI approach in a regulated environment.”

Strategic Partnerships

Bill Staples, Chief Executive Officer

“Our partnership with AWS includes technical integration with Amazon Q, which enables agent-based automation within GitLab. Early adopters like Volkswagen Digital Solutions are seeing significant productivity gains.”

Bill Staples, Chief Executive Officer

“This alliance goes beyond tech—we’re a select global sponsor of AWS Summits, extending GitLab’s enterprise reach and accelerating GTM momentum.”

Challenges

Brian Robbins, Chief Financial Officer

“We saw a slightly more back-end weighted linearity in Q1 and a greater mix of SaaS, which impacts the revenue recognition timing. But there were no surprises—execution remained strong.”

Brian Robbins, Chief Financial Officer

“At the low end of the market, we’re seeing some price sensitivity, especially among SMBs and the lower mid-market. That affected customer additions, but did not materially impact revenue.”

Bill Staples, Chief Executive Officer

“We’re in a period of fluctuation. Customers are still figuring out how best to use AI tools, and many are buying more than one solution to run side-by-side bake-offs. That experimentation is expected.”

Soft Guidance

Brian Robbins, Chief Financial Officer

“There has been no change in guidance philosophy. We are maintaining our assumptions around the macro environment as cautious but steady.”

Brian Robbins, Chief Financial Officer

“Our revenue guidance for Q2 and FY26 remains at 24% YoY growth, and we continue to assume the same macro conditions we've operated in since April.”

Future Outlook

Bill Staples, Chief Executive Officer

“AI is creating more code and more code creators, and that only helps GitLab. Every one of those new contributors will still need a secure, compliant platform to test, package, and deploy software.”

Bill Staples, Chief Executive Officer

“We’re building Duo Workflow to drive the next era of productivity. Developers are already delegating multi-step tasks to AI agents and seeing properly committed code with confidence. That’s the future of software delivery.”

Brian Robbins, Chief Financial Officer

“We generated over $104 million in adjusted free cash flow in Q1—a record—and ended the quarter with $1.1 billion in cash and investments. That gives us tremendous flexibility to invest in AI and platform growth while maintaining profitability.”

Thoughts on GitLab Earnings Report $GTLB:

🟢 Positive

Revenue of $214.5M grew +26.8% YoY, but slowing from +29.1% growth rate in Q4 2024, beating consensus by 0.9%

EPS of $0.17 exceeded expectations by 13.3%

Free Cash Flow Margin reached a record 48.5% (+26.4pp YoY)

Operating Margin rose to 12.2% (+14.4pp YoY)

RPO of $0.96B, up +40.2% YoY

Billings grew to $222M, up +35.4% YoY

Duo customer growth accelerated +35% QoQ

Ultimate tier reached 52% of ARR, with 8 of top 10 deals

GitLab 18 introduced major upgrades, including AI-powered compliance, artifact management, and knowledge graph

GitLab Dedicated gained FedRAMP Moderate Authorization, unlocking public sector momentum

Over 100 product enhancements launched in the past year

Strategic partnership with AWS expanded, including Amazon Q integration

🟡 Neutral

Gross Margin of 90.2%, down 0.5pp YoY

DBNRR at 122%, down from 123% LQ

Premium remains the most common entry point despite Ultimate growth

S&M/Revenue at 39.9%, down 4.1pp YoY

Public beta for Duo Workflow expected in summer, GA in winter

Customer adoption lag in AI workflows noted, requiring education and demos

SBC/Revenue increased to 26%, +4pp QoQ

🔴 Negative

Net New ARR of $12M, down -42.6% YoY

10,104 customers (+12.6% YoY, +211 QoQ) and 1,288 $100K+ customers (+25.7% YoY), weak new customers addition

CAC Payback Period increased to 85.5 months, up +40.5 YoY

R&D Index (RDI) dropped to 1.09, down 0.11 YoY

Diluted shares up 7.6% YoY, dilutive to long-term equity holders

Logo growth impacted by SMB churn near $5K ARR threshold

“Skinny beat” attributed to SaaS mix and back-end weighted linearity

Future expansion runway pressure from higher initial Ultimate lands

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.