Financial Results:

↗️$169.2M rev (+33.3% YoY, +33.3% LQ) beat est by 2.0%

↘️GM* (90.6%, -0.2%pp YoY)

↗️Operating Margin* (-2.2%, +9.6%pp YoY)

↗️FCF Margin (22.1%, +31.0%pp YoY)🟢

↗️EPS* $0.03 beat est by 175.0%

*non-GAAP

Key Metrics

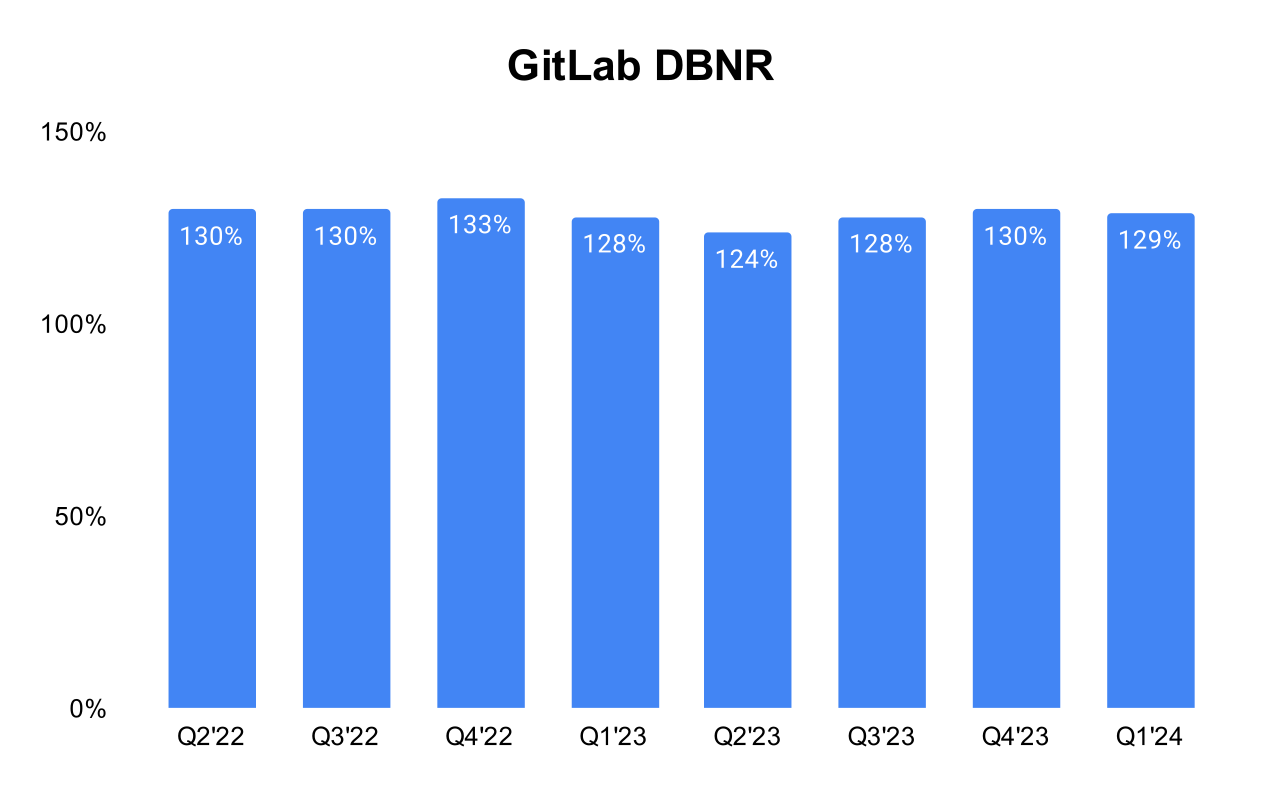

↘️DBNR 129% (130% LQ)

↗️RPO $0.68B (+48.0% YoY)

➡️Billings $164M (+21.0% YoY)🟡

Customers

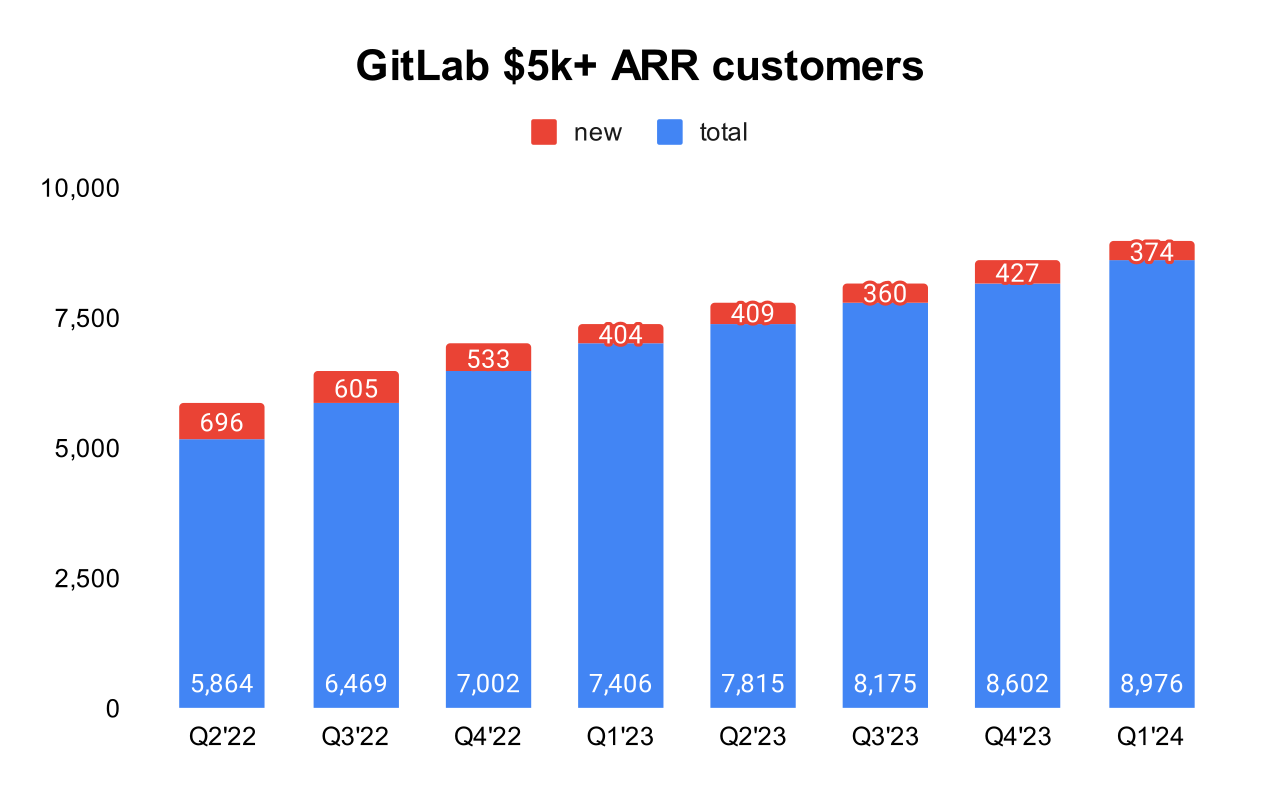

➡️8,976 customers (+21.0% YoY, +374)

➡️1,025 $100k+ customers (+35.0% YoY, +70)

Operating expenses

↘️S&M*/Revenue 43.9% (44.8% LQ)

↗️R&D*/Revenue 24.7% (23.5% LQ)

↗️G&A*/Revenue 24.3% (15.2% LQ)

↘️Net New ARR $22M ($56 LQ)

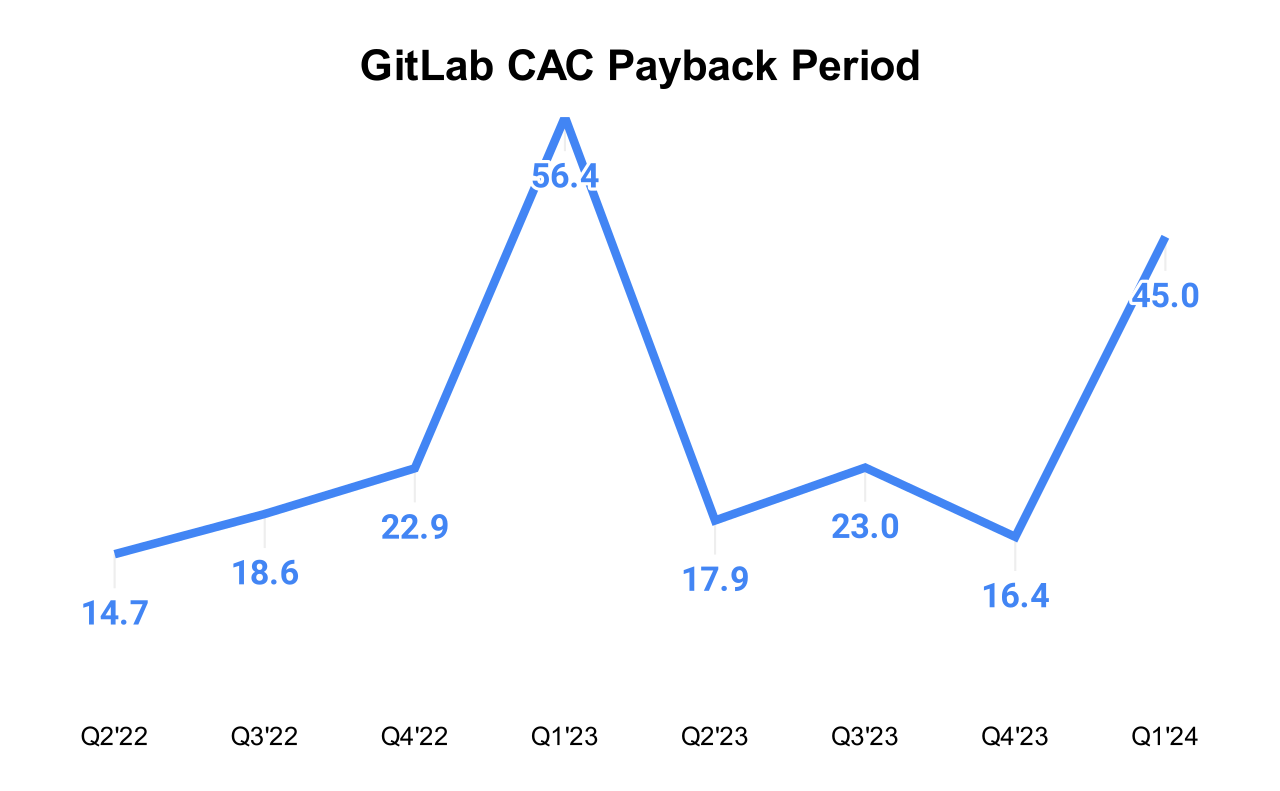

↗️CAC* Payback Period 45.0 Months (16.4 LQ)

Dilution

↘️SBC/rev 25%, -1.3%pp QoQ

↘️Share count up 4.3% YoY, 0.0%pp QoQ🟡

Guidance

➡️Q2'24 $176.0 - $177.0M guide (+26.4% YoY) in line with est

↗️$733.0 - $737.0M FY guide (+26.7% YoY) raised by 0.8% beat est by 0.5%

Key points from GitLab’s First Quarter 2024 Earnings Call:

Strong Financial Performance:

GitLab reported a 33% increase in revenue with a significant expansion in margins. For the first time, the company generated positive Q1 operating and adjusted free cash flow, reflecting improved operational efficiency.

AI Enhancements across the Platform:

GitLab is expanding its AI capabilities beyond coding to include planning, security, and operations, providing a holistic AI integration across the software development lifecycle.

GitLab Duo Pro: This new AI offering aims to increase productivity by assisting in coding and other development tasks.

GitLab Duo Chat: Introduced as a conversational AI interface, it allows users to interact naturally with GitLab, facilitating project status checks, planning assistance, code explanation, and test generation.

Launch of GitLab Duo Enterprise:

This upcoming product combines the developer-focused AI features of GitLab Duo Pro with additional enterprise-focused features to enhance team collaboration and speed.

It includes advanced security tools for root cause analysis and vulnerability resolution, which are especially appealing to enterprise clients.

Future versions will allow deployment of AI models in air-gapped (high-security) environments, further differentiating GitLab in the market.

Security and Compliance Enhancements:

GitLab continues to embed security earlier in the development process to meet growing demands for integrated security solutions.

The acquisition of Oxeye and intellectual property from Resilient aims to improve the platform’s static application security testing (SAST) and dynamic application security testing (DAST), and enhance vulnerability management and remediation capabilities.

GitLab Dedicated: This single-tenant SaaS solution provides data isolation and residency, catering to customers with strict compliance requirements, such as government or large enterprises.

Continuous Expansion of Platform Capabilities:

GitLab is focused on enabling customers to replace multiple point solutions with its more comprehensive platform, aiming to simplify technology stacks and reduce total cost of ownership.

Upcoming Product Launches:

GitLab is preparing for the release of GitLab 17, which will include enhanced security scanning, governance controls, and a general availability of the CI/CD catalog, highlighting GitLab’s ongoing commitment to innovation and customer-centric development.

Customer Growth and Retention:

The company has a dollar-based net retention rate of 129%, indicating strong customer loyalty and satisfaction.

New customer acquisitions and upgrades to higher-tier services were driven by GitLab's enhanced security and compliance capabilities.

For example, a major US technology company and government contractor consolidated their tools onto the GitLab platform, leading to faster security scans and substantial savings in toolchain administration.

Go-to-Market Strategy:

Scaling Operations: As GitLab progresses towards the $1 billion revenue mark, it is evolving its go-to-market approach to better meet the needs of its expanding customer profile.

Industry Focus: There is a sharpened focus on industries with complex security and compliance needs, such as financial services.

Strategic Partnerships: Continued collaboration with major cloud providers like Google Cloud and AWS to facilitate cloud migration and distribution.

Resource Allocation: GitLab is investing in global field CTOs, solution architects, and expanding its services offering to ensure customer success post-sale.

Future Outlook:

The company remains focused on leveraging its full suite of DevSecOps tools to maximize customer value and market penetration.

GitLab's guidance for the full year includes the expected impact of its new AI products and other initiatives. The company expects the majority of the impact of its AI products to be seen in future fiscal years, not this year.

The company's revenue seasonality is expected to follow typical patterns, with the first quarter being seasonally weak and the fourth quarter being the strongest.

Management comments on the earnings call.

Product Innovations:

Sid Sijbrandij (CEO): "AI is quickly transforming the way software is delivered. With GitLab, our AI extends well beyond coding and development. Because we have the broadest platform, we uniquely enable our customers to also leverage AI for planning, security, and operations."

"GitLab Duo Pro has already delivered increases in productivity for customers... Our next AI add-on, GitLab Duo Enterprise, combines the developer-focused AI features of Gitlab Duo Pro with enterprise-focused features to help teams collaborate faster together."

Competitors:

Sid Sijbrandij (CEO): "If you look at the AI features, with Duo Pro where we were later than our main competitor. But I think we have a competitive offering now... We can use where we're really strong at, namely integrating security in Dev and Ops."

Customer Growth:

Sid Sijbrandij (CEO): "The value customers derived from GitLab comes through not only in our top-line growth, but also in our best-in-class dollar-based net retention rate of 129%. Both new customers, like financial services company [A&B] (ph), and existing customers, like NASA, Artemis, Carrefour, Indeed, and the FBI, understand the value of a platform that enables software development across the end-to-end lifecycle."

"A great example of this is a leading financial services company that decreased pipeline outages by 90% since deploying GitLab. And that has translated into hundreds of thousands of dollars in savings every year."

Future Outlook:

Sid Sijbrandij (CEO): "We're looking forward to next month's anticipated GitLab 17 product launch event... Many innovations are planned for GitLab 17 including enhanced security scanning and governance controls and the general availability of our CICD catalog."

Strategic Partnerships:

Sid Sijbrandij (CEO): On partnerships with Google Cloud and AWS: "Our partnerships with Google Cloud and AWS accelerate cloud migration for them, and we benefit from wider distribution... At Google Cloud Next, we announced our Google Console Integration. This helps our customers improve developer experience and decrease contact-switching across GitLab and Google Cloud."

Thoughts on Gitlab ER $GTLB :

🟢Pros:

+ Revenue rose by +33.3% YoY, revenue growth rate is stabilizing.

+ Strong DBNR at 129%.

+ Strong FCF margin at 22%.

+ Increased FY guidance by 0.8%.

+ Strong next quarter guidance.

+ RPO and cRPO are growing faster than revenue.

+ Added strong number of $1M+ ARR customers.

+ New ARR growth 35% YoY.

+ New product release, announced GitLab 17.

+ Expanded partnerships with Google Cloud and AWS.

🔴Cons:

- SBC/rev at 25%. Share count up 4.3% YoY.

🟡Neutral:

+- Operating margin became negative due to G&A spending increase.

+- Gross margin slightly declines from last quarter.

+- Beat Q4 revenue estimates by 1.9%.

+- Billings growth rate decline from last quarter and Billings growing slower than revenue.