Duolingo: Scaling EdTech with Massive Market Potential — But Can AI Disrupt It?

Deep Dive into $DUOL: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Duolingo: Company overview

About Duolingo

Duolingo was founded in 2011 by Luis von Ahn and Severin Hacker at Carnegie Mellon University. The idea began in 2009, shortly after von Ahn sold reCAPTCHA to Google. Duolingo launched its private beta on November 27, 2011, attracting 300,000+ users to the waitlist. By its public release on June 19, 2012, the number had grown to 500,000. Now a publicly traded company on NASDAQ, Duolingo has evolved into a global edtech leader, offering 100+ courses across 41 languages. In 2024, Duolingo generated $748 million in revenue, marking a 40.8% YoY increase.

Company Mission

Duolingo aims to make language learning accessible, effective, and enjoyable for all. Its mission is built around free education, regardless of a user’s location or background. By combining gamification with science-backed learning principles, Duolingo makes language learning feel like play—but with real progress. Interactive lessons, spaced repetition, and in-app incentives keep users engaged while reinforcing retention.

Sector

Duolingo operates in the online education sector, focusing on language learning technology. Duolingo is also entering adjacent verticals like math and music, tapping into the broader $6 trillion global education spend.

Competitive Advantage

Duolingo's strength lies in its freemium model, enabling massive reach with a frictionless onboarding experience. Super Duolingo and Duolingo Max offer ad-free learning and advanced features. Its signature gamified experience drives habit formation through points, leaderboards, and level progression. Adaptive learning tailors content to each user’s pace and proficiency. AI powers rapid content creation and personalization—tools like Video Call with Lily are exclusive to premium subscribers.

User engagement is a standout metric. Duolingo reports 103 million Monthly Active Users, with 32% engaging daily. The app has been downloaded over 950 million times. With gross margins of 73.13%, Duolingo operates with best-in-class efficiency for a consumer edtech business. Social features help users stay motivated, creating a flywheel effect that supports growth and retention.

Total Addressable Market (TAM)

Duolingo operates in a $220 billion total addressable market (TAM), encompassing the broader digital learning and education technology space. The company currently holds just 0.5% market share, leaving substantial room for expansion.

The global language learning market is valued at $61 billion, expected to grow to $115 billion by 2025. Within this, the online language learning segment is projected to reach $47 billion, growing at a 26% CAGR. The direct-to-consumer language learning TAM is estimated at $115 billion.

The broader e-learning market was worth $305.97 billion in 2023 and is forecast to reach $1.52 trillion by 2033, growing at a 17.35% CAGR. The professional certification market is also expanding, from $6.76 billion in 2025 to $8.92 billion by 2029, with a 7.18% CAGR. Global education spending sits at around $6 trillion, offering long-term potential through category diversification.

Duolingo’s Max subscription tier, launched in 2024, is already contributing 6% of revenue, powered by AI features. The company has clear upside from international expansion in underserved markets and cross-selling into adjacent educational categories. With a current ARPU of $2.50, there is room for a 20x monetization improvement when compared to leading mobile app peers.

Given its small footprint, rapidly growing digital education market, and multiple growth levers, Duolingo is positioned to capture a much larger share of its $220B+ TAM in the years ahead.

Valuation

$DUOL is currently trading at a Forward EV/Sales multiple of 15.9, which is above the median of 9.75. In January 2023, the multiple dropped to 5 due to concerns about competition from ChatGPT and potential disruption from AI. By June 2025, it had peaked at 22.5.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$DUOL Duolingo trades at a Forward P/E of 118.4, with revenue growth of +37.7% YoY in the last quarter.

The EPS growth forecast for 2026 is 48.9%, with a P/E of 128.2 and a PEG ratio of 2.6.

The EPS growth forecast for 2027 is 46.7%, with a P/E of 86.1 and a PEG ratio of 1.8.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast $DUOL's revenue growth at +35.9% in 2025 and +26.9% in 2026. Based on these projections, Duolingo appears fairly valued when comparing its EV/Gross Profit (EV/GP) multiple to other SaaS companies.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Economic Moats enable companies to remain stable during crises and support long-term revenue growth.

Economies of Scale

Duolingo demonstrates strong economies of scale that create significant competitive advantages. With over 103 million monthly active users, the company benefits from massive data collection that enables superior AI-driven personalization through models like Birdbrain, which predicts user success likelihood for exercises. This scale allows Duolingo to develop unique AI competencies in language learning that smaller competitors cannot match.

The company's cost structure reflects these economies of scale, with sales and marketing expenditure representing only 12% of revenue at $27 million. This demonstrates how little Duolingo relies on paid user acquisition compared to competitors, as its viral marketing and word-of-mouth growth become more efficient at scale. The platform's ability to translate content through crowdsourcing is another scale advantage - an estimated 1 million active users can translate Wikipedia into Spanish in just 80 hours.

Network Effects

Duolingo exhibits moderate to strong network effects across multiple dimensions. The platform benefits from both direct and indirect network effects that strengthen as the user base grows. Direct network effects occur as more users create positive feedback loops, bringing in additional users through social proof and community engagement.

The indirect network effects are particularly powerful - as more users join, there's greater availability of translators for business services, attracting more companies to purchase translation services. This creates a virtuous cycle where business needs allow Duolingo to offer more relevant content in additional languages, thereby attracting even more users. The company's discussion features and community elements foster user interaction and help establish ties between learners, though these social features remain less developed than pure network effect platforms.

Brand Strength

Duolingo possesses an exceptionally strong brand that serves as a formidable economic moat. The company leads its category in the US with 53% brand awareness, sitting 24 percentage points above its nearest competitor and 27 percentage points above the competitor average. Brand awareness has grown from 49% to 53% between February 2024 and January 2025.

The brand's conversion metrics are particularly impressive, with 83% conversion from awareness to consideration compared to the 73% competitor average. The Duo owl mascot, created in 2011, has become a cultural phenomenon that resonates especially well with millennials and Gen Z users. Duolingo's viral marketing campaigns, such as the "Duo Owl fakes his own death" campaign, generated 17 billion impressions globally without significant media spending, demonstrating the brand's organic reach and engagement power.

Intellectual Property

Duolingo maintains a moderate intellectual property moat through various protected assets. The company's mobile application is protected by multiple IP rights including copyright, patents, utility models, and trade dress protection. All rights linked to Duolingo's invention, branding, software, and images are protected with IP rights, including the iconic Duo owl character which has specific copyright protections.

However, the core concept of gamified language learning is difficult to patent comprehensively, and competitors can develop similar methodologies. Duolingo's proprietary AI algorithms and adaptive learning technology represent more defensible IP assets, particularly the machine learning models that optimize lesson difficulty and timing. The company's data advantage from millions of users also creates a form of trade secret protection around user behavior insights.

Switching Costs

Duolingo faces relatively weak switching costs compared to enterprise software or financial services. Users can easily download competing language learning apps without significant financial penalties, as the core product is free. The annual subscription cost of $59.99-$87.99 depending on region represents a modest financial commitment that doesn't create substantial switching barriers.

However, Duolingo does benefit from psychological and habitual switching costs. Users invest significant time building learning streaks and progress through courses, creating emotional attachment to their achievements. The gamification elements, including XP points, leagues, and achievement badges, create mild switching costs as users would lose their accumulated progress. The company's high user engagement and habit-forming design help retain users, but these switching costs remain relatively low compared to other software categories.

Duolingo has a narrow to moderate economic moat, driven by strong brand recognition and economies of scale. Its large user base fuels AI development and keeps acquisition costs low. While network effects and intellectual property add support, low switching costs limit defensibility. Overall, Duolingo’s viral marketing and data advantages provide a solid foundation for long-term competitiveness.

Revenue growth

$DUOL's revenue growth slightly slowed to +37.7% YoY in Q1. However, based on the guidance for next quarter, if the company delivers a similar +3.2% beat as in Q1, revenue growth could accelerate to +42.7% in Q2. Growth remains at a very high level.

Billings growth slightly declined to +38.0% YoY, still outpacing revenue growth.

Segments and Main Products

Duolingo personalizes its platform by segmenting users based on demographics, goals, and learning behavior—tailoring content for beginners, advanced learners, career-focused users, and casual learners to boost retention and outcomes.

The core app offers 100+ courses in over 40 languages, combining speaking, reading, writing, and listening. As of 2025, it has 110 million Monthly Active Users, making it the most-used educational app globally.

Duolingo Max, launched in 2023 and powered by GPT-4, includes advanced AI tools like “Explain My Answer” and “Roleplay.” It's now used by 15% of daily active users, with full financial impact expected in 2025.

Super Duolingo, the standard paid tier, reached $607.5M in 2024 subscription revenue, more than 2x since 2021, with 20% of paying users on Family Plans.

Beyond languages, Duolingo expanded into math and music, and its English Test—accepted by 5,500+ institutions—brought in $45M in 2024. The company also experiments with brand storytelling through ventures like Duo’s Taqueria.

Main Products Performance in the Last Quarter

$DUOL Revenue by Segment: 83% of Duolingo’s revenue comes from subscriptions, while the remaining 17% is generated from other sources such as advertising, the Duolingo English Test, and in-app purchases. In Q1, Duolingo stopped disclosing detailed revenue figures for these non-subscription segments.

Subscription revenue growth remained strong at +45% YoY, slightly down from +48% in Q4. Growth in other segments is recovering, reaching +11% YoY in Q1, but still significantly lags behind subscription revenue growth.

Duolingo Language Learning App

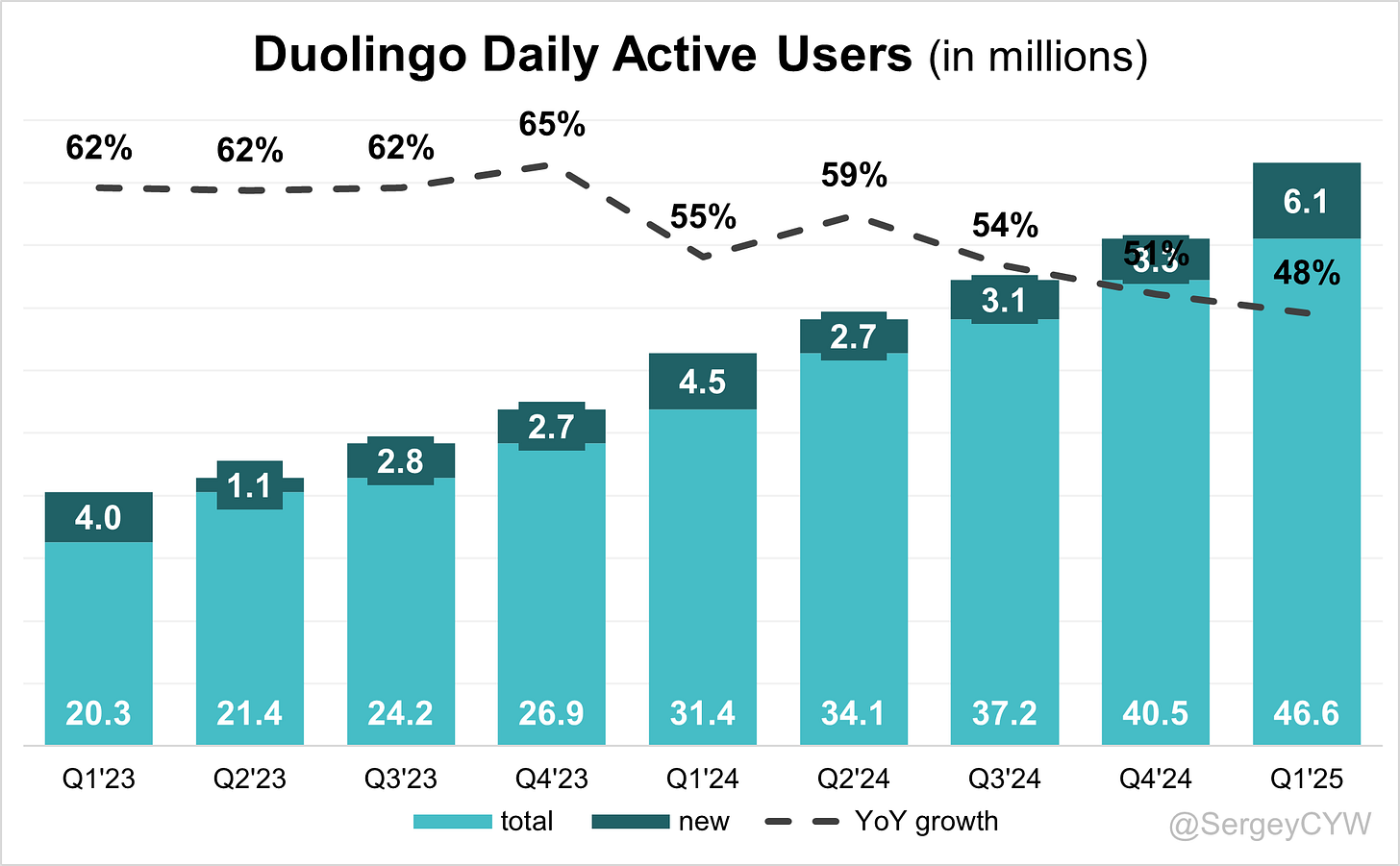

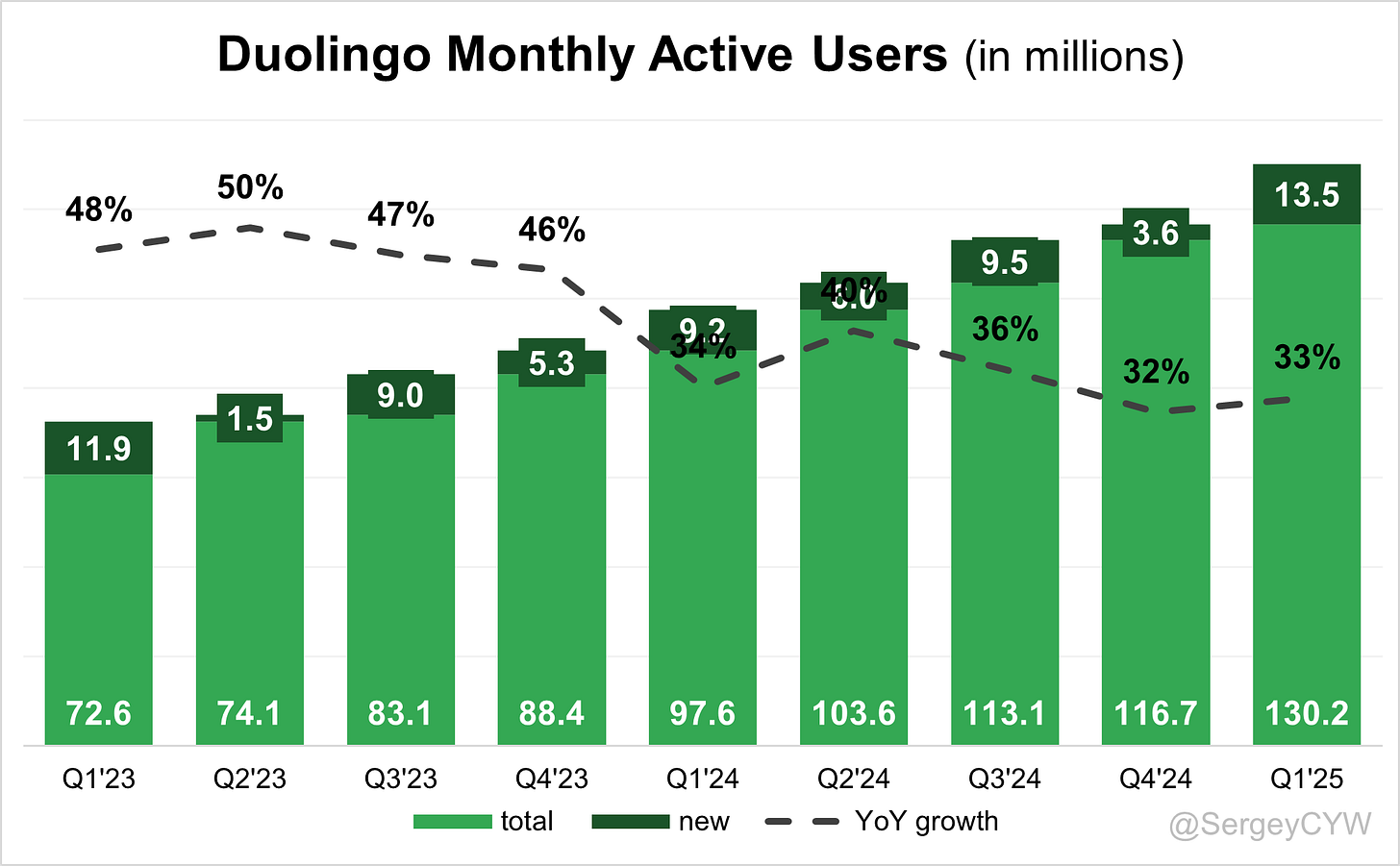

Daily Active Users (DAUs) grew 49% year-over-year, following two consecutive quarters of 60%+ growth. Mature regions continue to post some of the fastest growth rates, showing no signs of saturation. The platform now has 130 million active users, tapping into a global language learning market estimated at 2 billion learners. Growth drivers include consistent product improvements, highly engaging user experience, and viral social media marketing campaigns, like the Duo owl “faking his death” campaign that reached 1.7 billion impressions at minimal cost.

New account additions are strong across all regions. English learners now represent around 50% of the user base, still below the global average of 80%. However, this segment is growing faster than others, driven by recent improvements to intermediate and advanced English content.

Duolingo Max

Max accounts for 7% of total subscribers, driven by both new users and upgrades from Super subscribers. English learners are overrepresented in Max, converting at higher rates than non-English learners, largely due to the appeal of AI-powered tools like Video Call with Lily. Max users show strong early retention and are incremental to the overall platform LTV.

Gross margins for Max remain dilutive compared to Super due to AI cost, but improvements are underway. New generative AI models and backend optimizations are expected to improve gross margin in H2 2025. The company plans to lower Max pricing in lower-GDP markets like India (currently $70/year) once unit economics allow.

Super Duolingo

Super remains the core paid tier, with recent price increases tested and implemented for new users in certain markets. The team continues to A/B test pricing and packaging across geographies. No changes yet to feature tiering, but Duolingo is evaluating moving certain lower-cost AI features like Explain My Answer to Super or even Free.

Upgrades from Super to Max contributed to Q1 outperformance, suggesting strong price-to-value perception.

Ad Revenue

Ad monetization contributed positively to Q1 gross margin, with a “slight benefit” helping beat internal expectations. The ad business remains a smaller segment, but efficiently complements freemium user monetization. No significant changes to ad strategy or expansion noted.

Duolingo English Test (DET)

No specific financial updates disclosed this quarter. However, DET likely continues to benefit from expanded global reach and increased brand credibility. English learning remains a core growth opportunity, especially in emerging markets where English proficiency unlocks employment and education.

Math & Music

Combined, these newer subjects have over 3 million DAUs, growing faster than language learning. While small relative to core business, these verticals are monetized through ads and subscriptions. Monetization structure is the same as language learning: free tier supported by ads, paid tiers for an ad-free experience.

The investment cost is minimal—Math was built by two engineers—but potential upside is meaningful. Additional content is in development, with AI quadrupling math content in the next quarter.

Innovations & Product Updates

Duolingo released 148 new language courses in one year—previously took 12 years to build the first 100. These are not new languages, but new combinations of existing languages with new base languages (e.g., Korean for Portuguese speakers). This coverage now reaches most major markets.

Chess will be launched in the app in the coming weeks, first on iOS, then Android. Built by two non-engineers using AI, chess is expected to drive new user growth, particularly in mobile-first markets. Like other subjects, it will be monetized through the existing subscription model.

Video Call with Lily is being upgraded with 3D avatars, increasing engagement and retention. Users are already spending more time with Lily than with traditional lessons. A/B testing is underway to measure its impact on subscription conversions.

The company is AI-first. All content for new subjects is now created almost 100% with AI. AI allows faster product development, new feature creation, and internal efficiencies across the org. All employees are expected to automate tasks using AI tools, with a vision for 100% of employees to code with AI.

Competition from Large Language Models (LLMs)

Duolingo addressed the competitive dynamic from LLM-based offerings such as Google’s recent AI-powered language tools and startups like Speak and Preply. Despite new entrants and AI-native platforms gaining attention, Duolingo maintains a first-mover advantage due to deep integration of AI within its core products and processes.

Luis von Ahn emphasized that the company is not simply reacting to competitors, but leading in practical AI applications. The platform’s generative AI features—including Roleplay, Explain My Answer, and Video Call with Lily—continue to evolve, driving significant differentiation. Notably, the Video Call feature now includes a 3D avatar and contextual environments, significantly boosting engagement. English learners are adopting Max at higher rates, signaling growing competitive strength even in core use cases like English conversation.

In summary, Duolingo views AI and LLMs not as external threats, but as core to its product differentiation and margin improvement strategy. Its hybrid model of creativity, lean experimentation, and internal AI productivity tools creates an agile response to competitive pressure—while reinforcing defensibility in a fast-evolving market.

Key Metrics

$DUOL Duolingo has surpassed 10 million paid subscribers, a major milestone for the company, with +39% YoY growth. It added 0.8 million new paid subscribers in the quarter, marking a strong increase, close to a record addition.

$DUOL Duolingo reported 46.6 million Daily Active Users in Q1 2025, reflecting strong +48% YoY growth. The platform added 6.1 million new daily users during the quarter, marking a record quarterly increase.

$DUOL Duolingo reported 130.2 million Monthly Active Users in Q1 2025, showing a strong acceleration in growth to +33% YoY. The platform added 13.5 million new MAUs during the quarter, marking its largest quarterly increase in the past two years.

The DAU/MAU ratio is a critical engagement metric that reflects the percentage of monthly users who use the platform daily. A high ratio indicates strong platform stickiness and high user retention.

This metric also serves as a leading indicator for subscription conversion, as more engaged users are more likely to upgrade. It highlights the impact of Duolingo’s AI-driven personalization, which keeps users returning regularly.

A consistently strong DAU/MAU ratio signals Duolingo’s competitive strength in the language learning market and its ability to maintain long-term user engagement at scale.

Net new ARR

$DUOL Duolingo added $67 million in net new ARR in Q1 2025, reflecting a 18% YoY increase. This marks the highest quarterly net new ARR addition to date, same with Q4 2024.

CAC Payback Period and RDI Score

$DUOL's return on S&M spending was 4.6 months, which remains significantly better than the 26.9-month median for the SaaS companies I track and ranks among the best in the category.

The R&D Index (RDI Score) rose to 1.49 in Q1, a strong result compared to the 1.1 median of other SaaS companies I monitor, and significantly higher than the industry median of 0.7.

An RDI Score above 1.4 is considered best-in-class, and the low industry median highlights the importance of efficient R&D investment.

Profitability

Over the past year, $DUOL Duolingo has seen changes in its margins and profitability:

Gross Margin decreased from 73.0% to 71.1%.

Operating Margin slightly decreased from 26.1% to 25.8%.

FCF Margin slightly decreased from 46.8% to 44.6%.

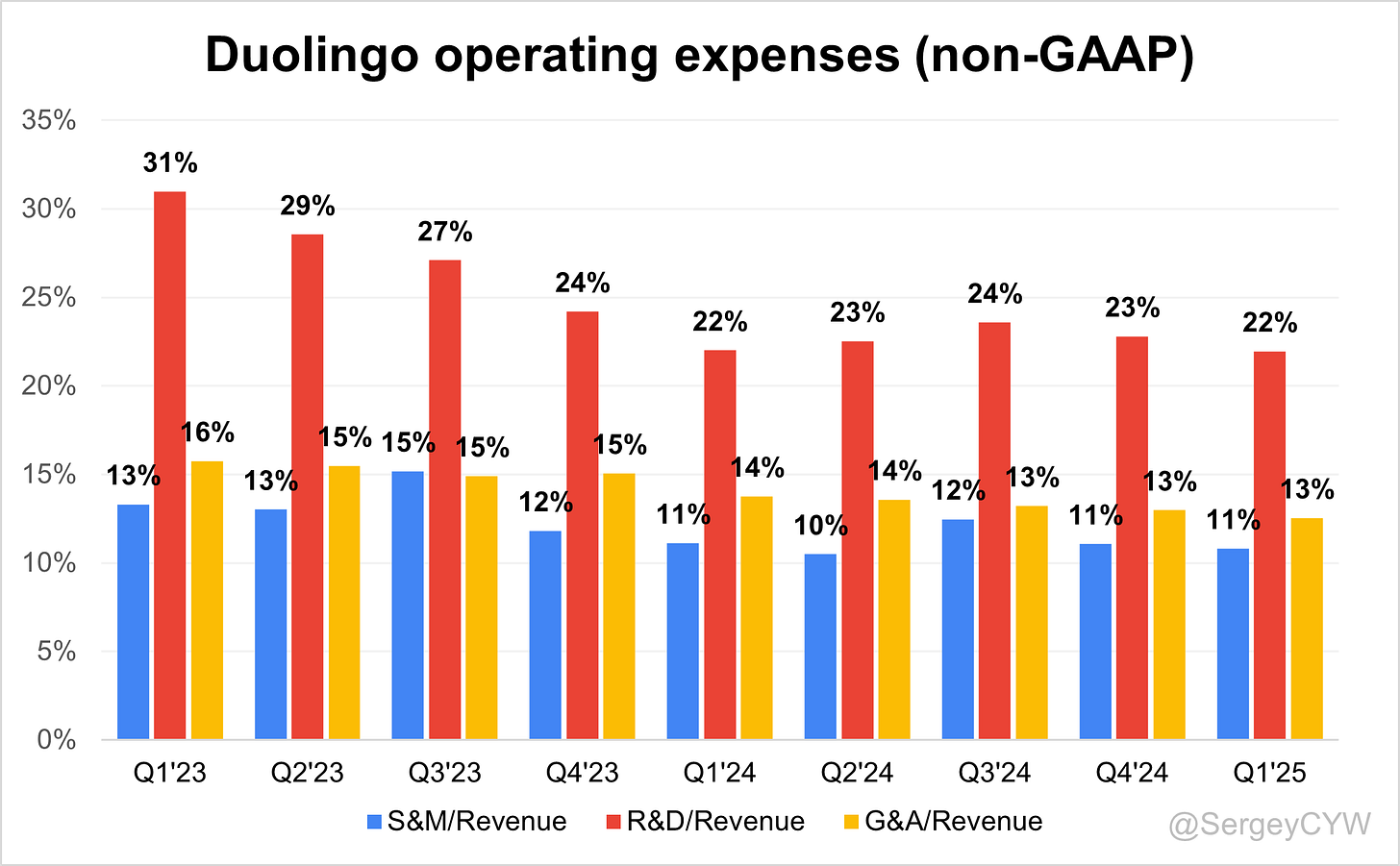

Operating expenses

$DUOL Non-GAAP operating expenses have significantly decreased over the past two years, driven mainly by reductions in Sales & Marketing (S&M) and R&D spending.

S&M expenses declined to 11%, down from 13%, while R&D expenses dropped from 31% to 22%. Despite the decline, R&D spending remains elevated, reflecting the company’s continued focus on platform expansion and innovation. Importantly, R&D still significantly exceeds S&M spending.

G&A expenses also slightly decreased to 13%.

Balance Sheet

$DUOL Balance Sheet: Total debt stands at $55 million, while Duolingo holds $999 million in cash and cash equivalents, far exceeding its total debt and ensuring a strong balance sheet with virtually no debt.

Dilution

$DUOL Shareholder Dilution: Duolingo’s stock-based compensation (SBC) expenses decreased in the last quarter to 13% of revenue, which is a relatively low level for SaaS companies.

However, shareholder dilution remains fairly high, with the weighted-average number of basic common shares outstanding increasing by 5.1% YoY in Q4.

Conclusion

It was a strong quarter for $DUOL. Duolingo continues to prioritize innovation, with R&D spending exceeding SG&A, reflecting its long-term growth focus. The company is leveraging Generative AI to scale content and deepen user engagement, with LLMs viewed as a key strategic advantage.

Duolingo Max, powered by GPT-4, is now used by 15% of daily active users, with full financial impact expected in 2025. The platform is also expanding into new features like chess and continues to experiment with brand storytelling through initiatives like Duo’s Taqueria.

While competition from ChatGPT, Speak, and Preply is rising, Duolingo maintains a first-mover advantage through deep AI integration in features like Roleplay, Explain My Answer, and Video Call with Lily.

Margins have declined in recent quarters, and short-term margin pressure is expected as the company prioritizes innovation. AI-related costs, particularly for Video Call, remain high but are expected to decline over time.

I view the company's decision to reinvest more of its profits as a positive move to strengthen its competitive advantage and expand its platform.

Leading Indicators

Billings growth of +38.0% YoY exceeded revenue growth.

Net new ARR addition increased +18% YoY, at record level.

Key Indicators

Paid subscriber additions at a record high, up +39% YoY.

DAU grew +48% YoY, and MAU increased +33% YoY, both with strong new user additions.

CAC Payback Period remains one of the best among SaaS companies at 4.6 months, far better than the sector average.

RDI Score rose to 1.49, above the median for SaaS companies I track.

Management issued a strong outlook for the next quarter, suggesting an acceleration in revenue growth, supported by robust key and leading indicators.

Valuation appears reasonable, having come down from the elevated multiples seen in May–June 2025. Given the expected high revenue growth, the current valuation looks well-justified.

Will LLM-based AI models disrupt Duolingo? It’s a fair question, but recent quarterly results show that Duolingo is effectively leveraging AI to strengthen its position and expand its TAM.

The TAM is massive—Duolingo operates in a $220 billion market, covering digital learning and edtech. The online language learning segment alone is projected to reach $47 billion, growing at a 26% CAGR. With recent expansion into math and music, Duolingo is also positioning itself within the broader $6 trillion education market.

Following the valuation reset in June 2025, I increased my position in $DUOL. It now represents 5.3% of my portfolio.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.