Duolingo Q4 2024 Earnings Analysis

Dive into $DUOL Duolingo’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$209.6M rev (+38.8% YoY, +40.0% LQ) beat est by 2.2%

↘️GM* (71.9%, -1.2 PPs YoY)🟡

↗️Operating Margin* (25.0%, +3.0 PPs YoY)

↗️FCF Margin (41.9%, +9.9 PPs YoY)

↘️Net Margin (6.6%, -1.4 PPs YoY)🟡

↘️EPS* $0.32 missed est by -34.7%

*non-GAAP

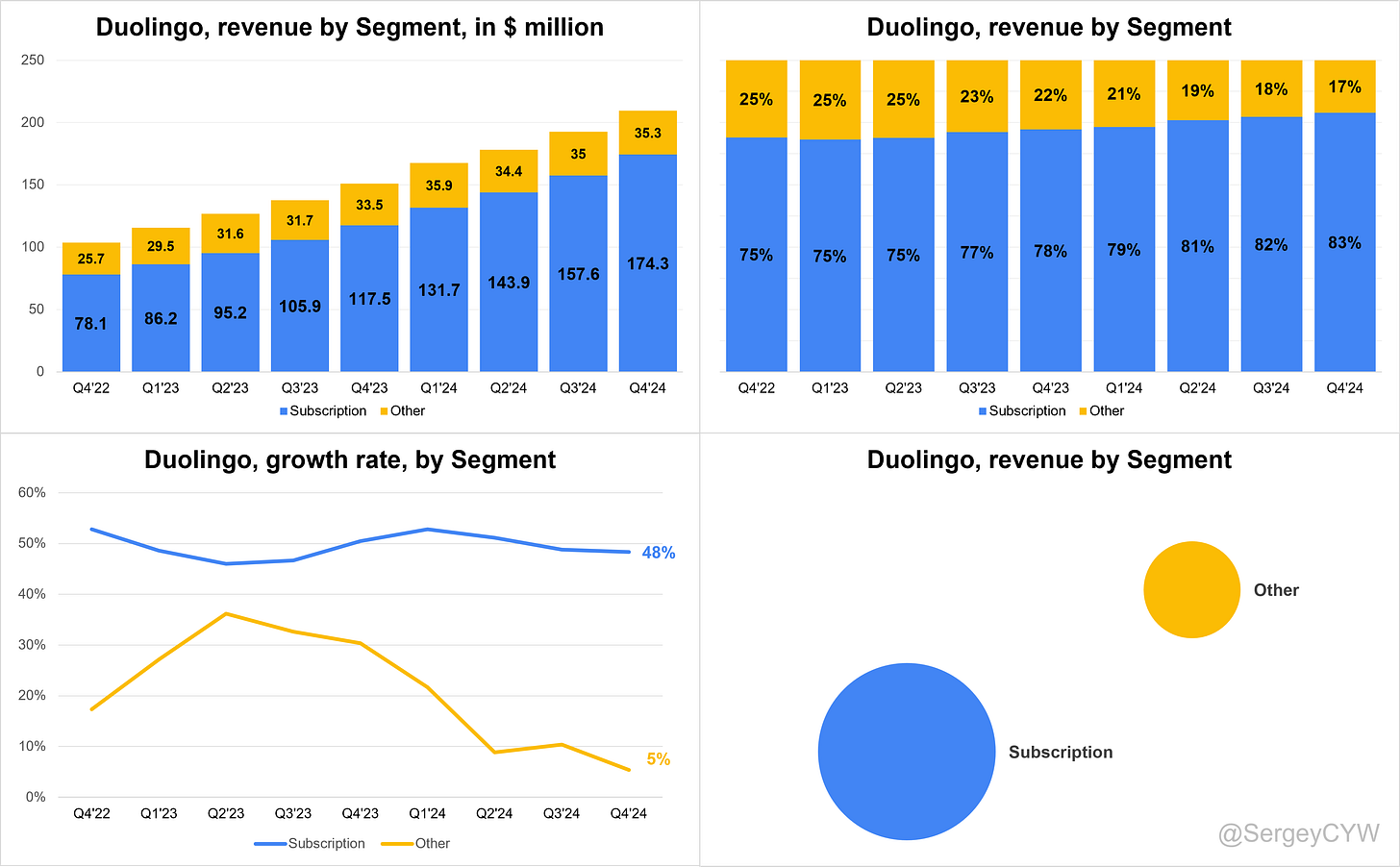

Segment Revenue

↗️Subscription $174.3M rev (+48.3% YoY)

➡️Other $35.3M rev (+5.4% YoY)🟡

Key Metrics

↗️Total Bookings $271.6M (+42.2% YoY)🟢

↗️Subscription Bookings $236.5M (+49.9% YoY)🟢

↗️Billings $271.9M (+42.1% YoY)🟢

↗️9.5M Paid Subscribers +43.9% YoY, +0.9)🟢

➡️116.7M Monthly Active Users (MAUs) +32.0% YoY, +4)

↗️40.5M Daily Active Users (DAUs) +50.6% YoY, +3)

Operating expenses

↘️S&M*/Revenue 11.1% (-0.7 PPs YoY)

↘️R&D*/Revenue 22.8% (-1.4 PPs YoY)

↘️G&A*/Revenue 13.0% (-2.1 PPs YoY)

Quarterly Performance Highlights

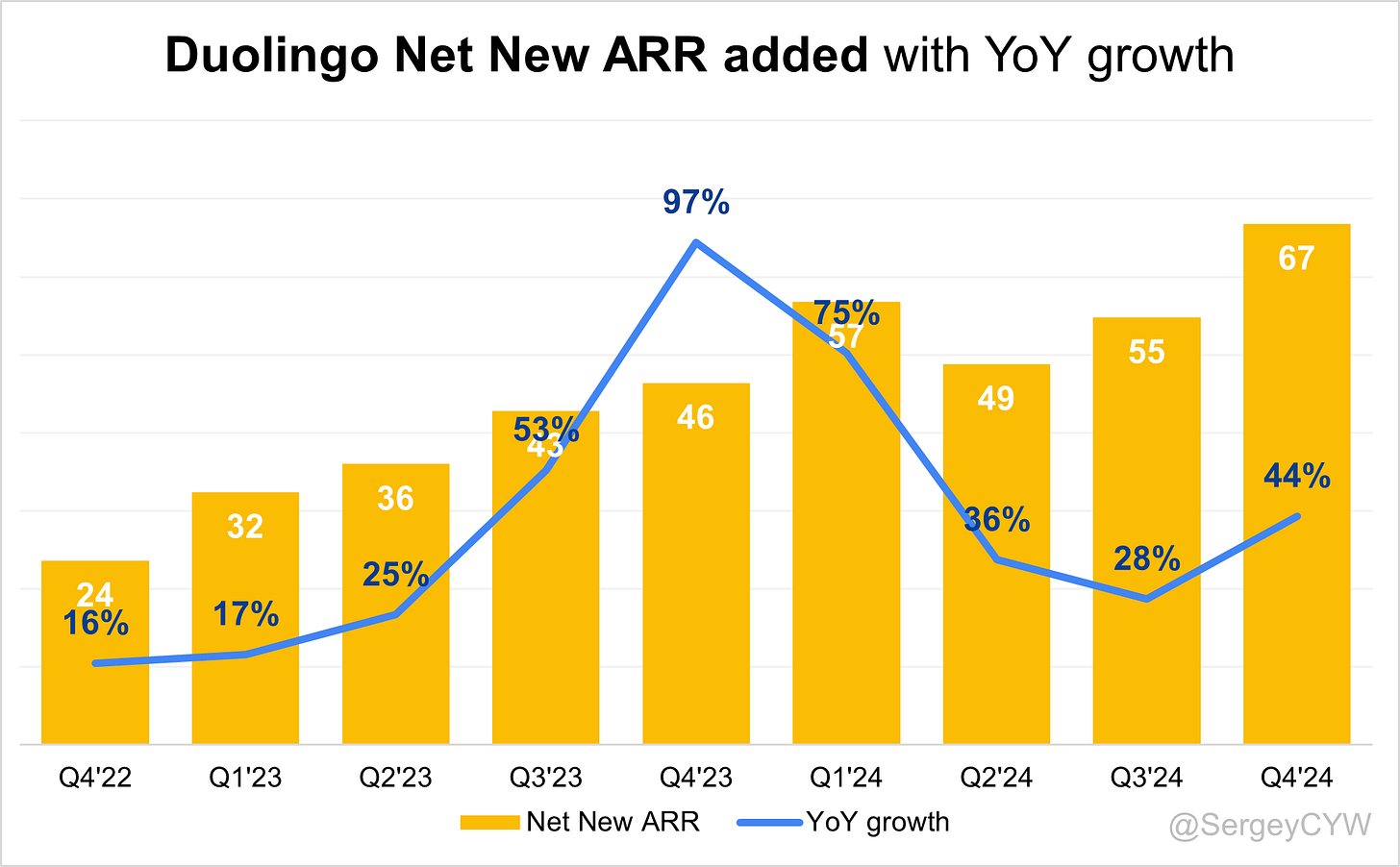

↗️Net New ARR $67M (+44.0% YoY)

↘️CAC* Payback Period 5.8 Months (-0.5 YoY)🟢

↗️R&D* Index (RDI) 1.41 (+0.03 YoY)🟢

Dilution

↘️SBC/rev 7%, -8.1 PPs QoQ

↗️Basic shares up 5.3% YoY, +0.5 PPs QoQ🔴

↘️Diluted shares down -5.6% YoY, -7.9 PPs QoQ🟢

Guidance

➡️Q1'25 $220.5 - $223.5M guide (+32.5% YoY) in line with est

↗️$962.5 - $978.5M FY guide (+29.7% YoY) in line with est

Key points from Duolingo’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Duolingo’s Q4 2024 results showed total bookings up 42% YoY and revenue increasing 39% YoY. Adjusted EBITDA margin reached 25.7%, a strong improvement from breakeven at IPO. Daily active users (DAUs) hit 40M, up 51% YoY, but MAU growth slowdown.

2025 guidance projects 25% YoY bookings growth, with subscription bookings rising 31%. Revenue growth may slow due to FX headwinds and expense timing. Hiring and AI investments will impact near-term profitability.

Duolingo Max and Family Plan

Duolingo Max accounts for 5% of subscribers, driven by AI-powered Video Call, which English learners use twice as often as other users. Max penetration is highest in Japan, where users are more willing to pay for AI features.

Family Plan adoption reached 23% of subscribers, showing higher retention and lifetime value (LTV). Subscription bookings rose 31% YoY, supported by new Max subscribers and Super Duolingo upgrades.

High AI costs remain a challenge, but Duolingo expects inference costs to decline over time. Regional pricing adjustments may follow, particularly in lower-income markets like India, where Max’s $70/year price limits adoption.

Ad Revenue Decline

Ad revenue fell due to lower external ad volume and weaker revenue per mille (RPMs). Duolingo is shifting focus to higher-margin subscription revenue, using in-app promotions for Super Duolingo and Max to drive conversions.

Duolingo English Test

Duolingo English Test (DET) remains stable, benefiting from global demand for online proficiency exams. No major innovations or growth figures were reported. Future expansion may come from institutional adoption, but DET is not a top investment priority.

In-App Purchases & B2B Partnerships

In-app purchases (IAPs) generate incremental revenue through gamification features like streak freezes and extra hearts. Subscription growth remains the primary focus.

B2B partnerships remain an untapped market. Unlike competitors Babbel and Rosetta Stone, Duolingo has no corporate training solution, limiting its ability to enter enterprise markets.

Math & Music Expansion

Math and music DAUs reached 3M, growing faster than language courses. AI is accelerating content creation, particularly in math, where models now generate problems and explanations at scale.

Duolingo is expanding math content from grades 3-5 to K-12 and possibly college-level. Math and music monetize through ads and subscriptions, but revenue impact remains limited for now.

AI Investment, Gross Margin and EPS Decline

AI is powering content generation, learning personalization, and real-time features like Video Call. Duolingo is prioritizing innovation over cost optimization, leading to higher short-term expenses.

AI costs remain high, particularly for Video Call, but are expected to decline over time. AI-driven features increase LTV and engagement, justifying the investment.

Gross margin is expected to drop by 170 bps in 2025, with a 300 bps decline in H1 due to AI costs. Margins should recover in H2 as cost efficiencies improve.

EPS missed estimates due to higher AI and hiring expenses. Adjusted EBITDA margin is expected to expand nearly 200 bps to 27.5% in 2025, but net margin may remain under pressure.

Product Development

Duolingo is scaling Max’s conversational AI, improving Lily’s interactivity, and expanding intermediate-level courses. Faster content production is allowing for more frequent course updates.

Pricing and ARPU Growth

ARPU increased YoY, driven by higher Max and Family Plan adoption. Instead of price hikes, growth is coming from shifting users to higher-tier plans.

In lower-income regions, pricing remains an issue. India’s $70/year Max pricing is a barrier, but adjustments may come as AI costs drop.

International Growth

Latin America grew 80% YoY, showing room for expansion even in mature markets.

Asia remains underpenetrated, with Japan, Korea, India, and China offering growth potential. Duolingo is improving re-engagement strategies, as resurrected users have lower retention than new users.

Asia remains the biggest opportunity, but China presents regulatory challenges, limiting Duolingo Max availability due to OpenAI restrictions.

Competitive Landscape

Duolingo leads digital language learning, but faces competition from Babbel, Rosetta Stone, and Busuu in corporate learning. AI-powered rivals, including ChatGPT-based models, are emerging threats.

Duolingo is leveraging AI at scale through Video Call and automated content generation. Gamification, brand strength, and AI-driven personalization provide a competitive moat.

Strategic Priorities for 2025

Grow subscriptions by expanding DAUs, Max conversion, and Family Plan adoption.

Enhance AI-powered learning tools, focusing on Video Call and content automation.

Expand math and music offerings with AI-driven content.

Optimize pricing in lower-income regions.

Maintain disciplined investment while expanding EBITDA margins to 27.5%.

Short-term margin pressure is expected, but Duolingo remains focused on sustained growth, profitability, and expansion beyond language learning.

Management comments on the earnings call.

Product Innovations

Luis von Ahn, Co-Founder & CEO

"We experiment relentlessly to improve user experience and monetization. Through gamification, social features, and our social-first marketing, we’ve scaled our reach, converted more free users into subscribers, improved learning outcomes, and maintained strong profitability."

Luis von Ahn, Co-Founder & CEO

"We are focused on making our AI-powered assistant, Lily, more dynamic and interactive. The goal is to create an experience where users genuinely want to engage with her, making language learning feel more like a conversation with a friend rather than just another lesson."

Duolingo Plus and Duolingo Max

Luis von Ahn, Co-Founder & CEO

"Our Q4 outperformance was largely driven by stronger-than-expected Duolingo Max subscriptions, including upgrades from current Super subscribers, and by continued momentum in our Family Plan, particularly during the first few days of our New Year’s promotion."

Matt Scarruppa, Chief Financial Officer

"Max incurs marginal AI costs to drive its features like Video Call, but its higher pricing more than offsets these costs, driving increased lifetime value and gross profit, adjusted EBITDA, and free cash flow."

Luis von Ahn, Co-Founder & CEO

"Most of our AI costs are tied to Video Call, and they scale based on Max subscriber growth. We’re prioritizing using the latest AI models to deliver a high-quality experience rather than focusing on cost optimization at this stage, though we are confident these costs will come down over time."

Math & Music

Luis von Ahn, Co-Founder & CEO

"Our expansion into math and music is progressing well, with these subjects now reaching 3 million daily active users. Both categories are growing faster than our core language-learning courses, demonstrating the opportunity to build beyond our initial focus."

Luis von Ahn, Co-Founder & CEO

"We are leveraging AI to accelerate content generation in math, making it easier to scale our curriculum. Historically, generating new math content has been slow because exercises must be designed specifically for each concept, but large language models are now enabling us to create new material at an unprecedented rate."

AI

Luis von Ahn, Co-Founder & CEO

"AI and automation tools are allowing us to expand content and courses faster than ever before. This will help us reach more learners globally and provide more advanced learning opportunities."

Matt Scarruppa, Chief Financial Officer

"We expect a temporary 170 basis point year-over-year impact on gross margin due to the mix effect of AI-driven costs, particularly for Max. However, as we work to improve AI cost efficiencies, we anticipate margin expansion in the second half of the year."

Competitors

Luis von Ahn, Co-Founder & CEO

"We are seeing strong adoption of AI-powered language learning features, which differentiates us from other language-learning platforms. Our focus on gamification and AI-driven personalization gives us a competitive edge against traditional edtech players and new AI-driven competitors."

Paid Subscriber Growth

Luis von Ahn, Co-Founder & CEO

"Since our IPO, we’ve added 30 million daily active users and over 80 million monthly active users. We've nearly tripled bookings and gone from breakeven to a 25.7% adjusted EBITDA margin in 2024, all while increasing our paid subscriber base."

Matt Scarruppa, Chief Financial Officer

"Our subscription bookings grew 31% year over year, driven by strong adoption of Duolingo Max and our Family Plan. We feel confident in our ability to continue increasing paid subscriber conversion through pricing experiments, content expansion, and product innovation."

International Growth

Luis von Ahn, Co-Founder & CEO

"One of the most exciting aspects of our growth is that it is not limited to new markets. Even in mature regions like Latin America, where we have been operating for years, we are still seeing 80% year-over-year growth, demonstrating that we are far from saturation."

Luis von Ahn, Co-Founder & CEO

"Asia remains our most underpenetrated region, offering significant growth opportunities. Markets like Japan, Korea, India, and China present vast potential, and we are scaling our marketing and localization strategies to capture these users."

Challenges

Luis von Ahn, Co-Founder & CEO

"Our biggest challenge with resurrected users is improving retention. Many users return after a long absence, and we need to ensure they stay engaged. One of the areas we are working on is adjusting difficulty levels based on how long someone has been away to provide a more tailored experience when they return."

Matt Scarruppa, Chief Financial Officer

"Foreign exchange headwinds and AI-driven cost structures are impacting our gross margins in the short term. However, we expect these pressures to ease in the second half of the year as cost efficiencies improve and AI model costs decline."

Future Outlook

Luis von Ahn, Co-Founder & CEO

"The market opportunity in language learning and other subjects remains substantial, and we are making strategic investments now to fuel growth for years to come. While this means a more moderate pace of profit growth compared to the exceptional levels of the past two years, we are still delivering margin expansion while building something even bigger."

Matt Scarruppa, Chief Financial Officer

"For 2025, we expect to expand our adjusted EBITDA margin by nearly 200 basis points to 27.5%, while continuing to invest in AI, product innovation, and international expansion. Our focus remains on balancing strong top-line growth with measured progress toward our long-term profitability targets."

Thoughts on Duolingo Earnings Report $DUOL:

🟢 Positive

Revenue reached $209.6M (+38.8% YoY, +40.0% QoQ), beating estimates by 2.2%.

Subscription revenue rose to $174.3M (+48.3% YoY), driving strong top-line growth.

Total bookings grew 42.2% YoY to $271.6M, with subscription bookings up 49.9%.

Paid subscribers increased 43.9% YoY to 9.5M, reflecting strong demand for Duolingo Max and Family Plan.

DAUs grew 50.6% YoY to 40.5M, showcasing continued engagement.

Operating margin expanded 3.0 PPs YoY to 25.0%, with free cash flow margin up 9.9 PPs to 41.9%.

Lower CAC payback period of 5.8 months (-0.5 YoY), improving cost efficiency.

R&D index increased to 1.41 (+0.03 YoY), showing continued product investment.

🟡 Neutral

MAUs increased 32.0% YoY to 116.7M, but growth slowed.

Guidance for Q1 2025 revenue ($220.5M - $223.5M, +32.5% YoY) and FY revenue ($962.5M - $978.5M, +29.7% YoY) was in line with estimates.

Ad revenue saw limited growth (+5.4% YoY) due to lower external ad volume and RPMs.

S&M expense declined to 11.1% of revenue (-0.7 PPs YoY), improving efficiency.

G&A expenses decreased as a percentage of revenue, improving profitability metrics.

Diluted shares outstanding dropped -5.6% YoY (-7.9 PPs QoQ), but basic shares increased 5.3% YoY.

Gross margin declined 1.2 PPs YoY to 71.9% due to high AI costs, particularly from Duolingo Max.

EPS of $0.32 missed estimates by -34.7%, impacted by AI investment and hiring.

🔴 Negative

Net margin fell 1.4 PPs YoY to 6.6%, reflecting near-term cost pressures.

India’s $70/year Max pricing is limiting adoption, with possible adjustments needed.

International expansion in China faces regulatory barriers, delaying Duolingo Max rollout.

Gross margin expected to decline further in H1 2025 (-300 bps) before recovering in H2.

Thanks for answering my previous question.

Overall strong numbers but decelerating revenue makes it harder to justify the premium valuation (although been less premium with the selloff).

I notice your summaries don’t really take valuation into account. Is that part of your evaluation process? Or perhaps a less important factor?

Great summary. Can you detail how did you calculate

↘️CAC* Payback Period 5.8 Months (-0.5 YoY)🟢

↗️R&D* Index (RDI) 1.41 (+0.03 YoY)🟢

Thank you!