Duolingo Q1 2025 Earnings Analysis

Dive into $DUOL Duolingo’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$230.7M rev (+37.7% YoY, +38.8% LQ) beat est by 3.5%

↘️GM* (71.1%, -1.9 PPs YoY)🟡

↘️Operating Margin* (25.8%, -0.3 PPs YoY)🟡

↘️FCF Margin (44.6%, -2.2 PPs YoY)🟡

↘️Net Margin (15.2%, -0.9 PPs YoY)🟡

↗️EPS* $0.72 beat est by 35.8%🟢

*non-GAAP

Segment Revenue

↗️Subscription $191.0M rev (+45.0% YoY)

Key Metrics

➡️Total Bookings $271.6M (+37.5% YoY)🟡

↗️Subscription Bookings $232.2M (+43.8% YoY)

↗️Billings $272.9M (+38.0% YoY)

➡️10.3M Paid Subscribers +39.2% YoY, +0.8)

↗️130.2M Monthly Active Users (MAUs) +33.4% YoY, +14)🟢

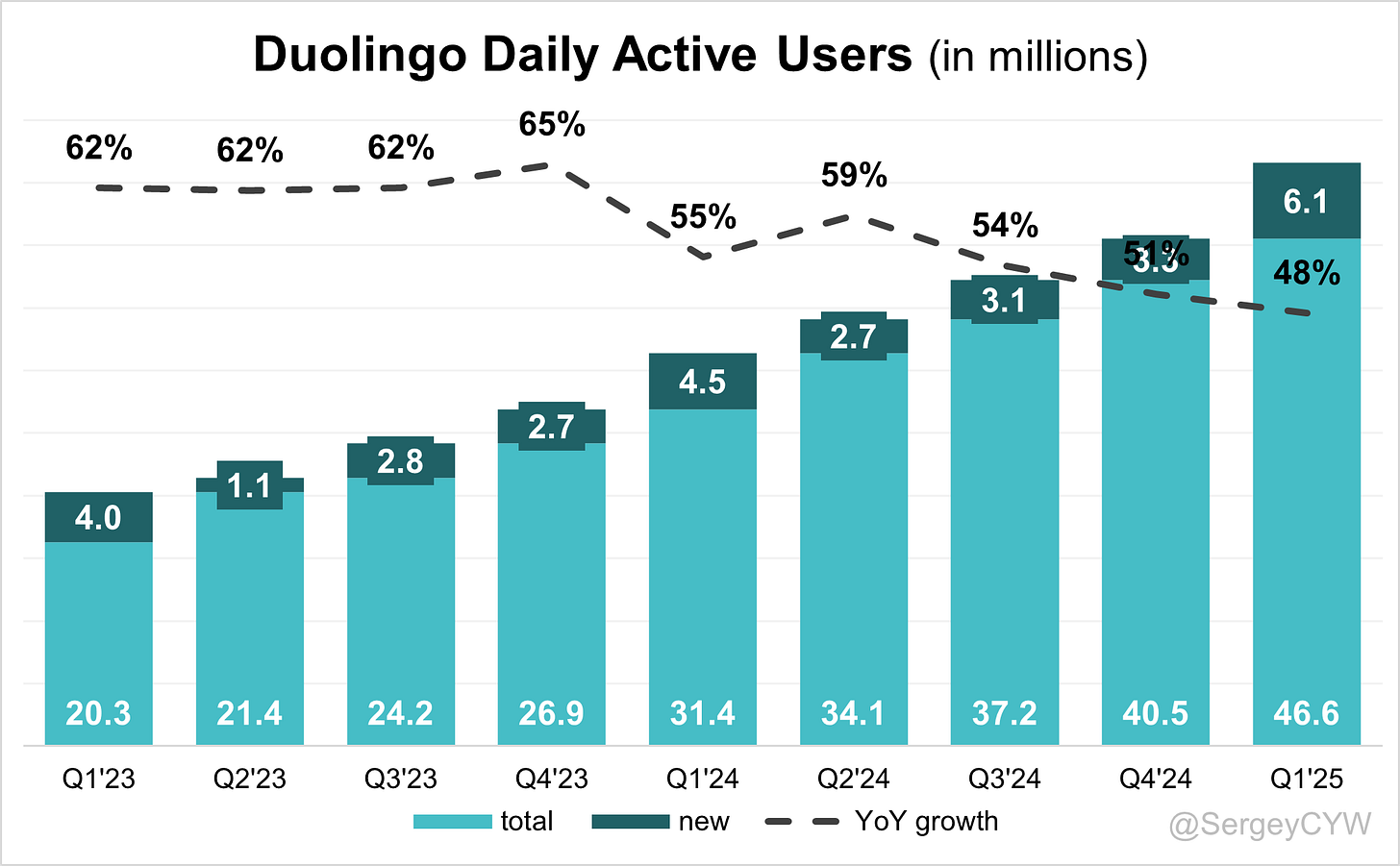

↗️46.6M Daily Active Users (DAUs) +48.4% YoY, +6)🟢

Operating expenses

↘️S&M*/Revenue 10.8% (-0.3 PPs YoY)

↘️R&D*/Revenue 22.0% (-0.1 PPs YoY)

↘️G&A*/Revenue 12.5% (-1.2 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $67M (+17.6% YoY)

↗️CAC* Payback Period 4.6 Months (+0.2 YoY)🟡

↗️R&D* Index (RDI) 1.49 (+0.12 YoY)🟢

Dilution

↘️SBC/rev 13%, -0.8 PPs QoQ

↘️Basic shares up 5.1% YoY, -0.1 PPs QoQ🔴

↗️Diluted shares up 3.4% YoY, +4.7 PPs QoQ

Guidance

↗️Q2'25 $238.5 - $246.5M guide (+36.0% YoY) beat est by 3.5%

↗️$987.0 - $996.0M FY guide (+32.5% YoY) raised by 1.8% beat est by 1.6%

Key points from Duolingo’s First Quarter 2025 Earnings Call:

Financial Performance

Revenue reached $230.7M, up +37.7% YoY and +38.8% QoQ, beating estimates by 3.5%. Non-GAAP operating margin was 25.8%, down 30 bps YoY. Free cash flow margin declined 2.2 points YoY to 44.6%. Non-GAAP net margin was 15.2%, down 90 bps YoY. EPS of $0.72 beat consensus by 35.8%. Duolingo remains structurally profitable despite near-term margin compression from Max.

Language App Growth

Daily Active Users rose +49% YoY, compounding on prior years of +60% growth. Mature markets like the U.S. and Japan remain strong. Duolingo continues to attract new users while reactivating existing ones through UX improvements and viral campaigns. The “Duo fake death” campaign alone generated 1.7B impressions at minimal cost.

Course Expansion

Duolingo added 48 new language pairings in under 12 months using AI, compared to 100 pairings over the prior 12 years. This includes new combinations like Korean for Portuguese speakers. Course completion and engagement are improving due to broader language availability.

English Learner Penetration

English learners make up ~50% of Duolingo’s base, below the global average of 80%. Although intermediate and advanced English content has been launched, perception remains that Duolingo is only for beginners. Word-of-mouth is expected to gradually change this over time.

Duolingo Max

Max now accounts for 7% of subscribers. It drives platform LTV through AI features such as Roleplay, Explain My Answer, and the upgraded 3D Video Call with Lily. Max shows higher adoption among English learners and contributed significantly to Q1 performance.

Gross margins for Max are lower due to high GenAI costs, but backend optimization and model pricing improvements are expected to improve margins in H2 2025. In India, Max is priced at $70/year, which management plans to reduce as costs decline.

Super Duolingo

Super remains the mid-tier subscription. In Q1, pricing was raised for new users in select markets after successful A/B tests. No changes were made to tier packaging, but low-cost Max features like Explain My Answer may be tested in Super or the free tier. Super continues to be the main conversion base for Max upgrades.

Ad Monetization

Ad revenue is supported by free-tier users across all subjects. Every completed lesson shows ads unless the user subscribes. New verticals like Math, Music, and Chess are expected to grow DAUs and support ad revenue growth. Ads remain a smaller contributor relative to subscriptions.

Duolingo English Test (DET)

DET remains strategically important, especially in Japan and India. It supports Duolingo’s B2B credibility and complements advanced English content. The challenge lies in growing awareness and institutional acceptance in a market dominated by legacy providers.

Math, Music, and Chess

Math and Music now exceed 3M DAUs and are growing faster than the language segment. All content is AI-generated. Duolingo plans to quadruple Math content in the near term. Chess will launch in May 2025 on iOS, and all subjects are monetized via the existing subscription model.

While these verticals are early in their revenue contribution, they show high engagement potential. Growth depends on DAU expansion over the next 12–18 months.

AI-Generated Content

Duolingo built 48 new courses in 12 months using AI. Most content creation is now nearly 100% automated, enabling faster launches and lower costs. AI now empowers non-coders to prototype full subject curricula. Math content is expected to expand significantly using the same pipeline.

App Store Payments

Recent U.S. rulings could allow off-platform payment. Duolingo will test web payment flows to reduce App Store fees, which currently represent a major share of COGS. However, increased friction could reduce conversion, and any changes will be data-tested.

Product Features

The 3D upgrade to Lily’s Video Call enhances user interaction. Future updates will include contextual backgrounds and immersive role-play. These innovations aim to increase time-on-platform, retention, and referrals.

Pricing Strategy

Duolingo tests pricing by region and tier. Super prices were raised in select regions in Q1. Max features with lower delivery costs may be moved to lower tiers. Strategy remains centered on price elasticity and data-driven decision-making.

Gross Margin Trends

Gross margin declined 200 bps YoY in Q1, better than the expected 300 bps. Full-year guidance remains at -150 bps YoY, with -50 bps projected in Q2 before margin expansion resumes in H2. Margin pressure stems from GenAI cost in Max.

ARPU Expansion

ARPU is rising due to tier upgrades from Super to Max and regional price increases. Family and annual Max plans are under evaluation. Tier migration remains a key LTV driver.

International Growth

More than 50% of bookings come from outside the U.S. Duolingo expanded its localized offerings through AI-generated language pairs. Japan is a high-conversion market supported by regional campaigns, including a local TV ad for Max.

In contrast, monetization in India and LATAM is constrained by pricing sensitivity. Price reductions are planned as AI costs fall. Global DAU growth of +49% YoY remains broad-based, with no signs of saturation.

Competitive Landscape

New entrants like Speak, Preply, and Google are introducing AI-driven learning tools. Duolingo’s first-mover advantage, brand scale, and proprietary datasets offer a defensible moat. Max’s 3D video features and AI pipeline continue to set it apart from freemium rivals.

Key Challenges

Low-GDP markets limit monetization potential. Duolingo will lower Max pricing in these regions once model costs fall. Brand perception as a beginner tool persists, slowing English learner conversion despite new content. Institutional adoption of DET remains gradual.

Regulatory shifts may reduce App Store commissions, but user friction could offset gains. All adjustments will be data-validated through experimentation.

Long-Term Outlook

Duolingo expects gross margin recovery in H2 2025. AI remains central to product development, driving faster feature releases and lower content costs. Key initiatives include immersive Max features, Math content expansion, and the Chess launch.

The company’s broader vision is to become a multi-subject education platform, centered on high-retention disciplines with global demand and long learning curves. Language remains the core, but AI enables strategic expansion into lifelong learning.

Management comments on the earnings call.

Product Innovations

Luis von Ahn, Co-founder and Chief Executive Officer

"We’re going to have a whole world for Lily where she can start pretending she’s your taxi driver or something. The idea is to practice as much language as possible and increase engagement. The more we increase engagement, the more people will tell their friends they should get Duolingo Max."

Luis von Ahn, Co-founder and Chief Executive Officer

"We’re building subjects that hundreds of millions of people want to learn and that take a long time to master. And they’re also good for the world—math, music, chess—these are skills that make people smarter and better equipped for life."

Luis von Ahn, Co-founder and Chief Executive Officer

"Two people who were not engineers and didn’t play chess were able to create an entire chess prototype using AI. That’s what the future of our development looks like—fast, creative, and scalable."

Duolingo Max

Luis von Ahn, Co-founder and Chief Executive Officer

"Max is proving particularly valuable for English learners. They’re showing more interest in Max features like video call with Lily, and their Max adoption is above the 7% platform average."

Matt Skarupa, Chief Financial Officer

"When we run our A/B tests, we’re optimizing for platform LTV. We found enough incrementality in Max to make it LTV-positive, and that’s why we launched it."

Matt Skarupa, Chief Financial Officer

"We’re on track to improve Max’s gross margin as generative AI costs decline and we run further backend optimizations in the second half of the year."

Luis von Ahn, Co-founder and Chief Executive Officer

"In India, Max is priced at around $70 per year, which is too high. As model prices come down, we’ll adjust that—probably in a few months."

Super Duolingo

Luis von Ahn, Co-founder and Chief Executive Officer

"We tested a price increase for new users of Super in some regions last quarter and have rolled out the increase based on positive test results."

Matt Skarupa, Chief Financial Officer

"We haven’t moved features between tiers yet, but some Max features like ‘Explain My Answer,’ which are less costly to run, could be tested in Super or even in the free tier."

Ad Revenue

Luis von Ahn, Co-founder and Chief Executive Officer

"We monetize our other subjects—math, music, and chess—the same way we monetize language. If you're not subscribed, you’ll see ads after lessons, and that supports our freemium model."

AI-Created Content

Luis von Ahn, Co-founder and Chief Executive Officer

"We added 48 new language courses in a year using AI. Before this, it took us twelve years to create the first hundred courses."

Luis von Ahn, Co-founder and Chief Executive Officer

"Now we can regenerate and improve course content quickly because the AI pipeline is in place. This means our Spanish course, for example, will get even better—faster."

Luis von Ahn, Co-founder and Chief Executive Officer

"Nearly all of our content is now created automatically. This cuts costs and time, and allows us to scale content in every subject."

App Store

Luis von Ahn, Co-founder and Chief Executive Officer

"We saw the Epic ruling and of course we’re going to test something. But the App Stores have been good partners in terms of ease of payment, and removing that could reduce conversion."

Matt Skarupa, Chief Financial Officer

"Payments to Apple and Google are a major part of our COGS. If we could take a portion of that off-platform and retain conversion, it would definitely be accretive to gross margin."

Competitors

Luis von Ahn, Co-founder and Chief Executive Officer

"We believe we’re far ahead of everyone else in AI for learning. Large language models apply directly to what we teach, and we’re moving faster than the rest of the industry."

Matt Skarupa, Chief Financial Officer

"Everything we’re doing is aimed at increasing platform LTV, not chasing subscriber share. That focus is what will allow us to stay ahead, even as others move into the space."

International Growth

Matt Skarupa, Chief Financial Officer

"We’re a global business. More than half of our bookings come from outside the U.S., and the value-to-price ratio we offer is compelling in every geography."

Luis von Ahn, Co-founder and Chief Executive Officer

"In Japan, for example, we ran a TV campaign that featured the video call with Lily, and the region has very strong conversion rates."

Challenges

Luis von Ahn, Co-founder and Chief Executive Officer

"The perception that Duolingo is just for beginner English learners still lingers. We’ve added intermediate and advanced content, but changing that perception takes time—probably years, not months."

Matt Skarupa, Chief Financial Officer

"Some English learners are in low-GDP countries where conversion rates are lower. But we’re encouraged by how Max is resonating with them, especially with features like Lily."

Future Outlook

Matt Skarupa, Chief Financial Officer

"We reaffirm full-year gross margin guidance of a 150 basis point decline, with sequential pressure in Q2 before margin improvement in the second half of the year."

Luis von Ahn, Co-founder and Chief Executive Officer

"We’re going all-in on AI. We’ve told every employee to learn how to build with it. The future of our company is AI-first, and we’re investing aggressively in that direction."

Thoughts on Duolingo Earnings Report $DUOL:

🟢 Positive

• Revenue grew to $230.7M, up +37.7% YoY, beating estimates by 3.5%

• EPS reached $0.72, up +35.8% vs. consensus

• Subscription revenue rose to $191.0M, up +45.0% YoY

• Paid subscribers hit 10.3M, up +39.2% YoY

• DAUs reached 46.6M, up +48.4% YoY; MAUs rose to 130.2M

• Billings grew to $272.9M, up +38.0% YoY

• Net new ARR grew +17.6% YoY to $67M

• R&D Index increased to 1.49, up +0.12 YoY

• FY25 revenue guidance raised to $987–996M (+32.5% YoY)

• Max adoption reached 7% of subs, with strong English learner uptake

• 48 AI-generated courses launched in 12 months vs. 100 over 12 years

• Math & Music DAUs surpassed 3M, growing faster than language

• Japan conversion strong; localized TV campaign for Max launched

• S&M, R&D, and G&A as % of revenue all declined YoY

• Dilution moderated: SBC/revenue fell to 13%, down -0.8 pps QoQ

🟡 Neutral

• Gross margin declined to 71.1%, down -1.9 pps YoY, but better than expected

• Operating margin dropped to 25.8%, down -0.3 pps YoY

• FCF margin fell to 44.6%, down -2.2 pps YoY

• Max margins remain low due to GenAI costs; improvement expected H2’25

• Pricing tested across regions; Super price raised for new users

• DET remains strategically important but contribution not broken out

• India and other low-ARPU regions show slower monetization; price cuts planned

• Course expansion includes pairings like Korean for Portuguese speakers, but English learner adoption still lags global trends

• CAC payback period rose to 4.6 months, up +0.2 YoY

• Net margin declined to 15.2%, down -0.9 pps YoY

🔴 Negative

• Max remains priced at $70/year in India, limiting growth in key market

• Perception as beginner tool slows English learner upgrades despite new content

• Institutional adoption of DET remains slow vs. legacy competitors

• App Store fees still a major COGS item; testing off-platform flow may reduce conversions

• Diluted share count up +3.4% YoY, a +4.7 pps QoQ increase

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.