Datadog: Scaling Cloud Observability and Security

Deep Dive into $DDOG: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Datadog: Company overview

About Datadog

Founded in 2010 and headquartered in New York City, Datadog provides a cloud observability and security platform. Its software solutions cover infrastructure monitoring, APM, log management, digital experience monitoring, database monitoring, network monitoring, and cloud security. Datadog went public on NASDAQ on September 19, 2019, with an IPO price of $27 per share.

Mission

Datadog enables organizations to monitor, optimize, and secure their entire technology stack. Its real-time insights empower businesses to make data-driven decisions and improve user experiences.

Sector

Datadog operates in the Technology sector under Software - Application. It serves a rapidly growing market of enterprise and mid-market customers demanding cloud-based observability and security solutions.

Competitive Advantage

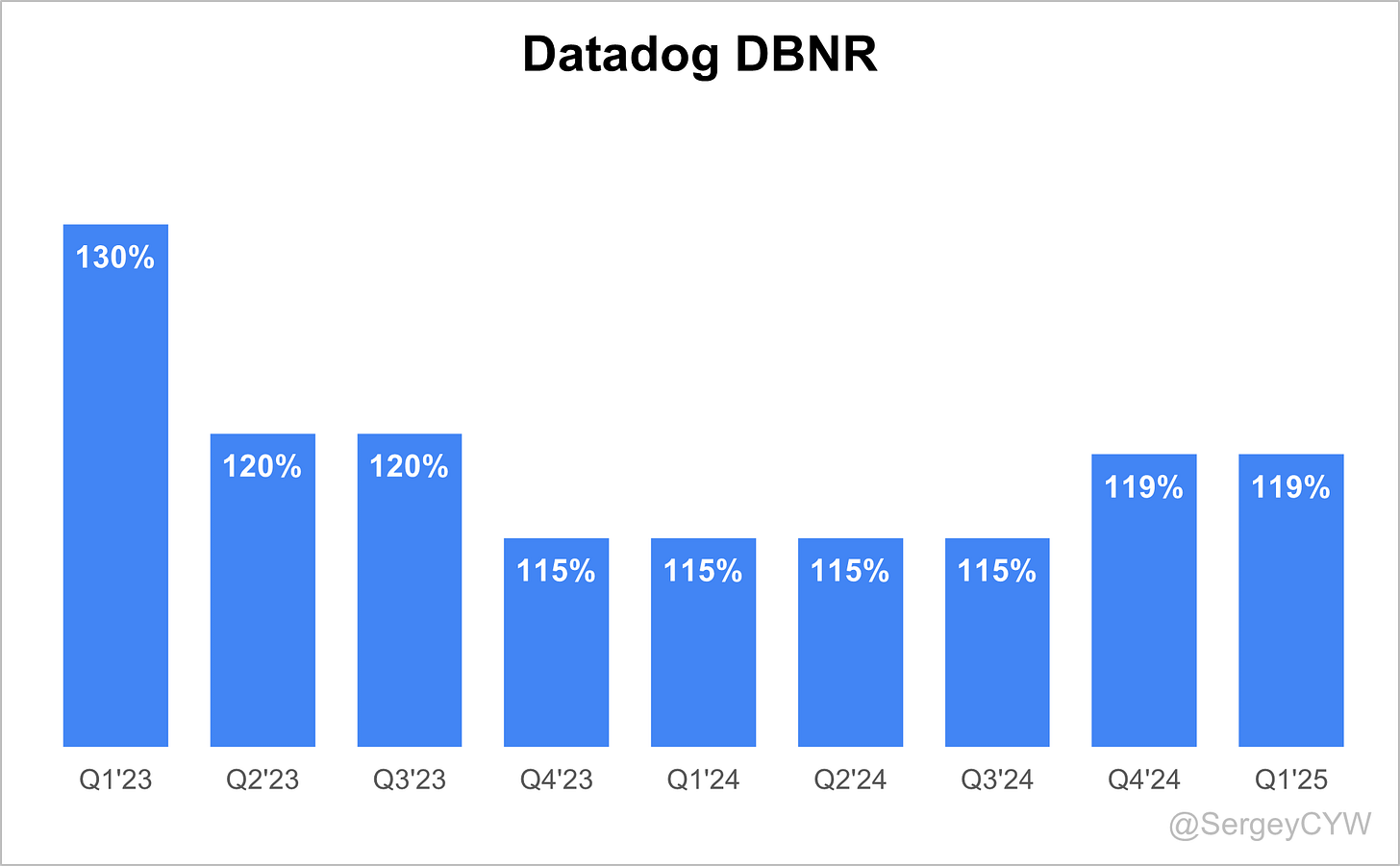

Datadog’s unified observability platform integrates infrastructure monitoring, APM, log management, and cloud security into a single solution. It offers over 800 built-in integrations, more than any competitor, ensuring comprehensive system visibility. With an 81.7% non-GAAP gross margin and 30,000 global customers, including 3,610+ customers generating over $100K in ARR, Datadog maintains a 119% net revenue retention rate. Its AI-driven analytics, real-time insights, and scalability further solidify its leadership in cloud observability.

Total Addressable Market (TAM)

Datadog’s total addressable market (TAM) is projected to reach $58 billion to $62 billion by 2026, driven by strong demand for its core observability platform and expanding presence in adjacent markets like cloud security and AI-driven solutions.

BMO Capital estimates Datadog’s core TAM at $24 billion by 2026, scaling up to $58 billion when including adjacent verticals. DA Davidson projects the observability market to grow to $62 billion. Gartner valued the cloud observability market at $51 billion in 2023, with a CAGR of 11% through 2027. Gartner also pegged cloud security’s TAM at $21 billion in 2023, with a projected CAGR of 16%. Datadog’s overall TAM is expected to grow at a 10.9% CAGR.

The shift from on-premise to cloud infrastructure continues to fuel adoption. As enterprises modernize operations, Datadog’s cloud-native architecture positions it to capture long-term tailwinds. Expansion into adjacent markets, including cloud security and AI, further widens the opportunity. The May 2025 acquisition of Eppo enhances capabilities in AI and product analytics, reinforcing Datadog’s position in applied intelligence.

Rising enterprise AI adoption is accelerating demand for observability and security. Datadog’s unified platform enables customers to monitor, secure, and act on data across modern cloud stacks.

Large customer growth remains a strong indicator of traction. In Q4 2024, Datadog reported 462 customers generating over $1 million in ARR, up from 396 a year prior. By Q1 2025, 83% of customers were using two or more products, reflecting high retention and cross-sell effectiveness.

Product innovation is driving expansion. New tools like App Builder and On-Call are gaining adoption. Interest in Datadog’s security monitoring offerings is growing as organizations look for more integrated, AI-powered observability platforms.

Valuation

$DDOG Datadog is trading at a Forward EV/Sales multiple of 12.7, significantly below the average of 16.2 and near its lowest valuation multiples levels based in 2020.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$DDOG Datadog trades at a Forward P/E of 76.8.

The EPS growth forecast for 2026 is 22.9% (while revenue growth is projected at +18.9%), with 2026 PEG ratio of 3.3.

The EPS growth forecast for 2027 is 33.6%, with P/E of 60.7, 2027 PEG ratio of 1.8.

Datadog is in the early stages of growth and reinvests most of its profits into further expansion through investments in R&D and S&M.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast revenue growth of +18.9% for $DDOG next year, making it one of the highest projected growth rates in the segment, following $SNOW and $PLTR.

Considering the projected revenue growth for next year, the valuation based on the EV/S multiple appears fair.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Datadog has built a durable competitive advantage in cloud monitoring primarily built on high switching costs, network effects, and intangible assets such as its brand and proprietary technology. These advantages provide meaningful protection in the highly competitive cloud observability market.

Switching Costs

Datadog's strongest moat is high switching costs. Its unified platform integrates infrastructure monitoring, APM, log management, and security, becoming deeply embedded in customers’ IT environments. Migrating to a competitor involves significant cost, operational disruption, staff retraining, and historical data migration. This deep integration creates a sticky product portfolio that secures a stable and recurring revenue base.

Network Effect

With over 30,500 customers as of March 2025, Datadog benefits from a powerful network effect. The platform processes trillions of metrics, logs, and traces, improving its AI-driven analytics. This growing dataset enhances platform intelligence for all users, making it hard for competitors to match its data advantage.

Brand

Datadog has a strong brand in IT monitoring and observability. Recognized for innovation and financial strength, the company earned a spot on the Forbes Global 2000 list in 2025. Its high-profile customers—including Samsung, NASDAQ, Shell, and Toyota—reinforce its reputation for trust and reliability.

Intellectual Property

Datadog holds significant intellectual property through patents and proprietary technology. The 2025 launch of Bits AI—a suite of AI agents for site reliability, development, and security—showcases its advanced automation capabilities. These agents are tightly integrated into Datadog’s ecosystem, enabling automated problem resolution beyond passive monitoring. Built on a unique dataset and modular architecture, this platform is difficult to replicate.

Economies of Scale

While not the primary moat, Datadog benefits from economies of scale. A large customer base allows efficient allocation of R&D, infrastructure, and go-to-market resources. This supports rapid innovation, especially in areas like AI and LLM observability, giving it an execution edge over smaller competitors.

Revenue growth

$DDOG Datadog's revenue growth has remained stable since Q2 2023 at around 25%, with +24.6% YoY growth in Q1 2025. RPO growth accelerated to 33.5% YoY, outpacing revenue growth.

Billing growth slightly slowed to +21.0% YoY, coming in below revenue growth. However, seasonality and Q1 softness in billings have been consistent over the past three years.

Based on the forecast for next quarter, if the company exceeds its guidance by 2.8%, as it did in Q1, Q2 revenue growth would reach 26.2%, indicating a noticeable acceleration in growth.

Segments and Main Products.

Segments

Datadog operates across six core segments: Infrastructure Monitoring, Application Performance Monitoring (APM), Log Management, Security Monitoring, Synthetic Monitoring, and Network Performance Monitoring. These services provide real-time visibility, threat detection, performance optimization, and network diagnostics across cloud and on-prem environments.

Main Products

Key products include the Datadog Agent, Real User Monitoring (RUM), Dashboards & Visualization, Incident Management, and 800+ integrations with AWS, Azure, GCP, CI/CD tools, and more. These tools deliver deep insights, user experience data, and unified incident response.

Security & SIEM

Datadog’s Security & Cloud SIEM solution integrates real-time threat detection, automated workflows (300+), and customizable rules (400+). It supports 750+ integrations, 15+ months of data retention, and aligns with the MITRE ATT&CK framework for proactive security management.

Multi-Cloud Monitoring

Supports unified monitoring across AWS, Azure, GCP, and Alibaba Cloud. Provides synchronized dashboards, host/container visualizations, and serverless monitoring, enabling centralized visibility across complex multi-cloud environments.

Main Products Performance in the Last Quarter

Infrastructure Monitoring

Core platform adoption remains strong. Over 30,500 total customers, up from 28,000 YoY. Platform use deepening: 83% use 2+ products; 51% use 4+; 28% use 6+; 13% use 8+. Enterprise clients are increasingly consolidating tools into Datadog. One major U.S. car manufacturer adopted 13 products across hybrid stacks. Infrastructure spans on-prem, cloud, and IoT, driving cross-product traction. No significant performance headwinds reported.

Application Performance Monitoring (APM)

Continues to be a foundational driver. Used in multi-product deployments. Notably, a leading next-gen AI company is replacing a commercial APM tool with Datadog’s solution. A returning insurtech client also cited better ease-of-use, reduced alert fatigue, and more integrated workflows as reasons for switching back. Expansion remains consistent with overall growth in large deals and increasing use across business units.

Log Management

Key acceleration in Flex Logs. ARR crossed $50 million in just six quarters, fastest ramp for any product in company history. Customers adopting Flex Logs ultimately spend more across the platform. Strong displacement of competitors underway. Customers like a major U.S. tech supply firm and a top insurer are consolidating 7+ tools, including commercial log tools, saving over $1M annually. Flex Logs also enables better cost control and data use efficiency.

Security Monitoring & SIEM

Security products now used by 7,500+ customers, 25% of Datadog base. Over 50% of Fortune 500 clients are active security customers. Full-stack suite includes Cloud SIEM, workload protection, app/API defense, and Sensitive Data Scanner. 1,000+ paying customers already on Code Security, which spans from dev to production and across first and third-party code. Security use cases are integrated with observability, breaking down silos and increasing attach rates.

Synthetic Monitoring

Not explicitly detailed in Q1 call. However, expanding automation efforts such as Bits AI, workload automation, and proactive issue remediation suggest continued relevance. Product announcements expected at DASH user conference.

Network Performance Monitoring

No separate metrics disclosed, but inferred to be part of broader platform growth. Strong enterprise adoption, consolidation of toolsets, and hybrid infrastructure support signal ongoing relevance. Likely bundled with broader infrastructure and APM offerings.

Multi-Cloud Monitoring

Growth driven by hybrid and multi-cloud environments. One large U.S. carmaker managing on-prem + multiple cloud + IoT stacks is consolidating observability across business units using Datadog. Demand signals seen globally. New data center in Australia launched to meet local residency and privacy requirements. Strategy aligns with large enterprise needs and regulatory compliance.

Product Innovations & Updates

Bits AI and App Builder enable workload automation and lay the foundation for future auto-remediation, shifting operations from reactive to autonomous.

In Security, Code Security now has over 1,000 paying customers, covering vulnerabilities across first-party and open-source code. Cloud SIEM and infrastructure scanning expand runtime protection. Sensitive Data Scanner identifies and redacts PII across logs, traces, and LLM prompts.

Datadog acquired Eppo, a next-generation feature management and experimentation platform. It accelerates software releases while managing risk. Essential for validating AI-generated code and measuring product impact.

Metaplane enhances Datadog’s data pipeline observability. It integrates with existing tools like Data Streams Monitoring, Spark Job Monitoring, and Database Monitoring, ensuring data quality for enterprise AI workloads.

The company is scaling observability, automation, and security for the AI-native era. New capabilities support the deployment, monitoring, and protection of intelligent systems at scale.

In AI Observability, Datadog introduced AI Agent Monitoring, LLM Experiments, and the AI Agents Console. Decision paths are tracked in real time to surface latency spikes, misused tools, and infinite loops. LLM Experiments validate prompt, model, and code changes using production data. The AI Agents Console tracks ROI, usage, permissions, and compliance risks.

AI Security enhancements include AI-powered Code Security with automated remediation. LLM Observability now includes toxicity and behavior monitoring. Cloud Security detects misconfigurations and unauthorized access based on frameworks like NIST AI. Sensitive Data Scanner prevents PII exposure during AI training. Bits AI Security Analyst autonomously triages alerts, investigates threats, and delivers contextual resolutions.

For Engineering, DevOps, and Security, Datadog launched Bits AI SRE, Bits AI Dev Agent, and Bits AI Security Analyst. These agents operate on unified task systems powered by real-time telemetry. APM Investigator and Proactive App Recommendations surface latency issues, performance bottlenecks, and optimization opportunities.

The new Internal Developer Portal (IDP) is the first powered by live observability data. It delivers real-time service mapping, dependency tracking, and ownership context. Developers execute Self-Service Actions and meet internal standards using Scorecards, while Engineering Reports provide actionable insights on reliability, delivery velocity, and compliance.

In Log Management, Archive Search now enables querying cold storage without re-indexing. Flex Frozen offers up to 7 years of in-platform log retention, ideal for audit-heavy environments. CloudPrem enables on-premises log storage for customers with strict data residency requirements, while retaining Datadog’s UI and workflows.

Market Leader

$DDOG Datadog has been recognized as a Leader in the Gartner Magic Quadrant for Observability Platforms for the fourth consecutive year, underscoring its consistent execution and visionary approach in the rapidly growing observability market. This accolade reflects Datadog's ability to innovate and adapt to customer needs, offering robust monitoring and analytics capabilities that enhance operational efficiency and performance tracking across various sectors.

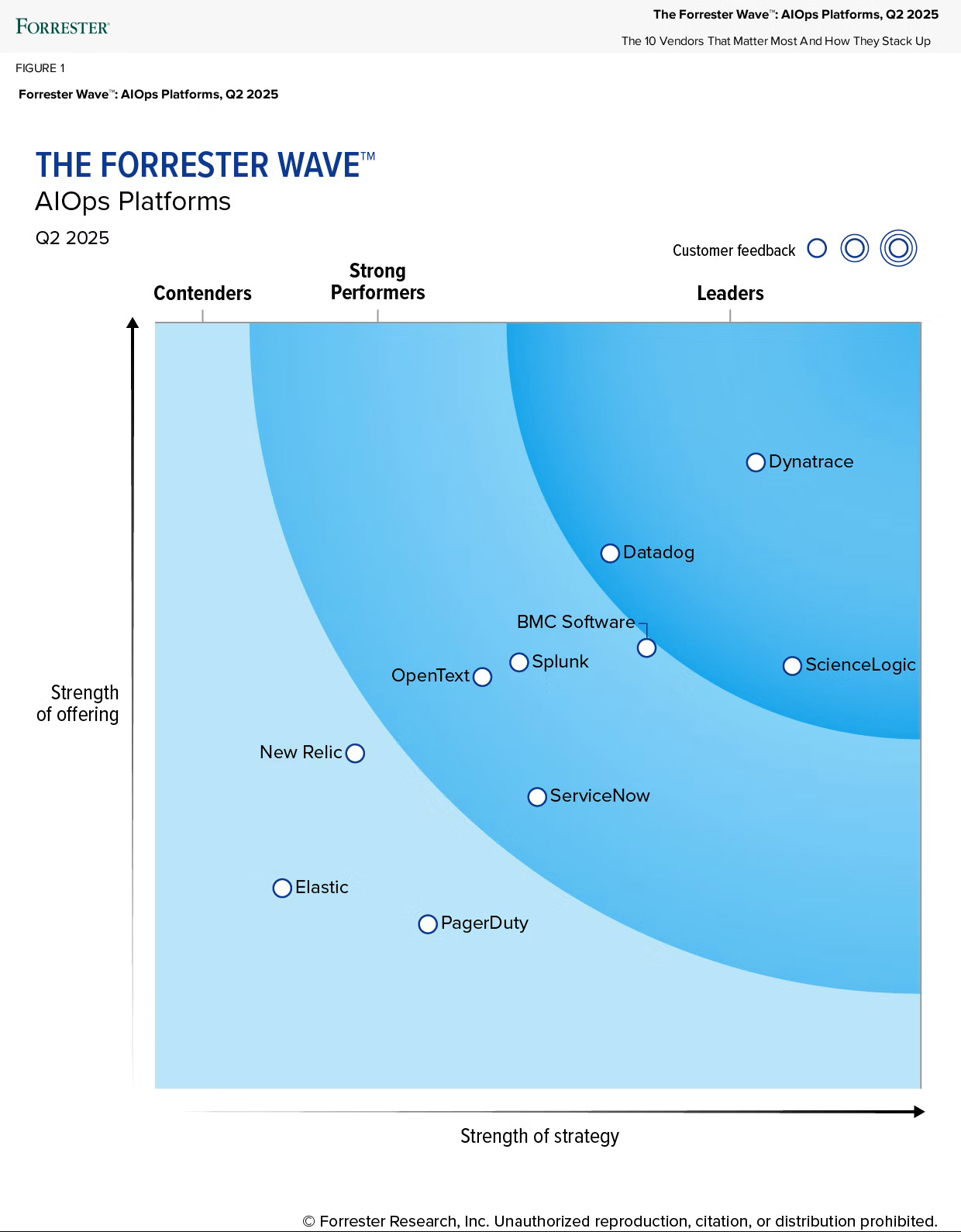

Datadog has been named a Leader in the Forrester Wave: AIOps Platforms, Q2 2025, recognizing its AI-powered platform for observability, security, and automation. The system ingests trillions of telemetry data points every hour, enriched with unstructured semantic data—from chat, code, and documentation—to provide complete system context.

The Platform AI engine detects performance issues automatically, requiring no manual setup. Agentic AI delivers fast, intelligent root cause analysis and resolution. Event correlation eliminates noise by linking third-party alerts, events, and changes into a single, actionable signal. Automation tools enable immediate response to disruptions and allow teams to build apps that enforce best practices at scale.

Datadog has been named a Leader in the inaugural Gartner Magic Quadrant for Digital Experience Monitoring (DEM), recognizing its comprehensive DEM solution, which includes Synthetic Monitoring, Real User Monitoring (RUM), Product Analytics, Session Replay, and Error Tracking for browser and mobile applications.

Customers

$DDOG Datadog added +160 new customers spending >$100K in Q1 2025, which is higher than average over the past two years, with a growth rate of 13% YoY.

However, it’s important to note that this cohort now constitutes >87% of the total and is no longer classified as large customers. Datadog is currently focusing on targeting even larger customers by expanding the number of products available on its platform.

Large Customer Wins

Datadog signed 11 deals with total contract value (TCV) above $10 million in Q1 2025, a sharp increase from just one in the same quarter last year. This marked an inflection in enterprise deal flow, driven by platform consolidation and broad product adoption.

A leading U.S. automaker entered a seven-figure deal to unify observability across a hybrid environment spanning on-prem, multi-cloud, IoT, and mobile. The deployment began with 13 Datadog products, replacing over a dozen tools across dozens of business units.

A major Latin American bank signed a seven-figure annualized contract to streamline operations and enable department-level autonomy. The deal started with six Datadog products, replacing three existing observability tools.

A top U.S. tech supplies company consolidated seven commercial tools into 11 Datadog products, including Cloud SIEM, in a deal expected to save over $1 million per year in engineering time and revenue protection.

A leading next-gen AI company expanded its usage across five Datadog products, replacing a commercial tool for APM and log management. This reflects Datadog’s growing role as the default observability platform for AI-native workloads.

Customer Success Stories

Tecsys reported a 69% reduction in alert incidents after implementing Datadog’s Event Management. The company replaced redundant alerts with consolidated, actionable incidents, simplifying the workload for its Site Reliability Engineers and improving operational efficiency. This highlights the impact of Datadog’s event correlation and AIOps capabilities on real-world reliability engineering.

A major U.S. health insurer expanded its Datadog deployment to support millions of customers across dozens of business units. After rollout, one internal team reduced mean time to resolution (MTTR) from 3–4 hours to 3–4 minutes, attributing the improvement directly to Datadog’s platform.

An insurance technology firm returned to Datadog after using a competing observability tool that introduced manual workflows, high operational overhead, and user fatigue. The company cited ease of use and native cost management tools like Flex Logs and Cloud Cost Management as key reasons for switching back.

Customers adoption

$DDOG Datadog is focusing on large customers by expanding the number of products available on its platform. A key metric for evaluating customer adoption of new products is the usage of 2+, 4+, 6+, and 8+ products.

Over the last quarter, the percentage of customers using 4+ products increased by 1 percentage point, 6+ products increased by 2 percentage point, and 8+ products also increased by 1 percentage point.

The growth in customers using 8+ products was 42% YoY, and the growth in customers using 6+ products was 33% YoY, both outpacing revenue growth. Addition of new customers using 6+ and 8+ products at record level.

Retention

$DDOG Datadog's Dollar-Based Net Retention Rate (DBNRR) for the last quarter grew to 119% and remains at a high level, slightly above the 117% median for the SaaS companies I monitor.

Net new ARR

$DDOG Datadog added $95M in net new ARR in Q1 2025, representing 10% YoY growth—the highest net new ARR addition for a Q1, which is typically a seasonally weak quarter for the company. Net new ARR growth has rebounded following the slowdown experienced at the end of 2022 and the beginning of 2023.

CAC Payback Period and RDI Score

$DDOG Datadog's return on Sales & Marketing (S&M) spending is 27.2. Q1 is typically a seasonally weak quarter for the company, and the average Customer Acquisition Cost (CAC) Payback Period remains at a healthy level compared to peers—the median for the SaaS companies I track is 20.8.

Datadog is usually a market leader in CAC Payback Period, as it allocates a larger portion of its spending to Research & Development (R&D) than to S&M, emphasizing innovation and frequent product launches.

The R&D Index (RDI Score) for Q1 stands at 0.86, slightly up from 0.85 in Q4, and although it is below the 1.2 median for the SaaS companies I monitor, it is still strong—well above the industry median of 0.7.

Datadog attracts customers through high R&D investment, focused on product improvements and new module launches. While increased R&D spending lowers the RDI Score, it enhances the company’s long-term competitive edge.

An RDI Score above 1.4 is considered best-in-class performance. The industry median of 0.7 highlights the importance of efficient R&D investment.

Profitability

Over the past year, $DDOG Datadog's margins have changed as follows:

Gross Margin decreased from 83.3% to 80.3%.

Operating Margin slightly decreased from 26.9% to 21.8%.

Free Cash Flow (FCF) Margin increased from 30.5% to 32.1%.

The company has been profitable under GAAP net income for the past seven quarters.

Operating expenses

$DDOG Datadog's non-GAAP operating expenses have decreased, driven by lower spending on Sales & Marketing (S&M) and General & Administrative (G&A).

S&M expenses declined from 25% two years ago to 23% of revenue in Q1 2025.

R&D expenses have remained high, currently at 30% of revenue.

Notably, Datadog is one of the few companies that spends more on R&D than on S&M, allowing it to continuously improve its product and launch new modules, expanding the overall platform.

G&A expenses have also declined and are now at 5%.

Balance Sheet

$DDOG Balance Sheet: Total debt stands at $1,877M, while Datadog holds $4,450M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

Dilution

$DDOG Datadog's stock-based compensation (SBC) expenses slightly decreased in the last quarter to 22% of revenue, down from 23% two years ago.

Shareholder dilution remains under control, with the weighted-average number of basic common shares outstanding increasing by 3.4% YoY. However, it's worth noting that dilution has risen from 1.9% in Q1 2023, though it has declined from 3.9% in Q2 2024.

Conclusion

$DDOG Datadog continues to drive innovation, launching multiple new products and updates in the last quarter. The company prioritizes R&D, with R&D expenses exceeding S&M expenses, which is important as it demonstrates the effectiveness of its investments, with customers increasingly adopting more of its products.

Leading Indicators

RPO growth of +33.5% exceeded revenue growth, accelerating from Q4.

Billings growth decelerated to +21.0%, which is slower than revenue growth and reflects seasonal weakness.

Adoption of 6+ modules increased by +1 percentage point QoQ, and 6+ modules increased by +2.

Key Indicators

Net Dollar Retention (NDR) at 119%.

CAC Payback Period worsened to 27.2 months, reflecting seasonal weakness, but the average CAC Payback remains one of the best among SaaS companies.

RDI Score stood at 0.86, slightly improved from Q4. While it remains below the median compared to other SaaS companies I track, Datadog’s strategy focuses on high R&D investments and growth through innovation.

The next quarter forecast suggests an acceleration in revenue growth to +26.0%. Strong leading indicators—such as RPO growth and a significant increase in customers using 6+ and 8+ modules—support continued revenue expansion.

The valuation based on Forward EV/Sales multiples appears reasonable, considering the company’s growth. Forward multiples are currently at levels last seen in 2020.

Datadog recently entered the security cloud SIEM market, launched LLM Observability (now in general availability), and acquired Eppo, a next-generation feature management and experimentation platform.

The company continues to strengthen its competitive advantage, consistently rolling out new products and updates. Its market leadership is reaffirmed by Gartner’s Magic Quadrants and Forrester Wave reports.

$DDOG is one of my top ten portfolio holdings. In January 2025, following a strong quarterly report, I slightly increased my position, and again in June 2025, due to a decline in valuation multiples. The position now stands at 8.2%.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.