Datadog Q4 2024 Earnings Analysis

Dive into $DDOG Datadog’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

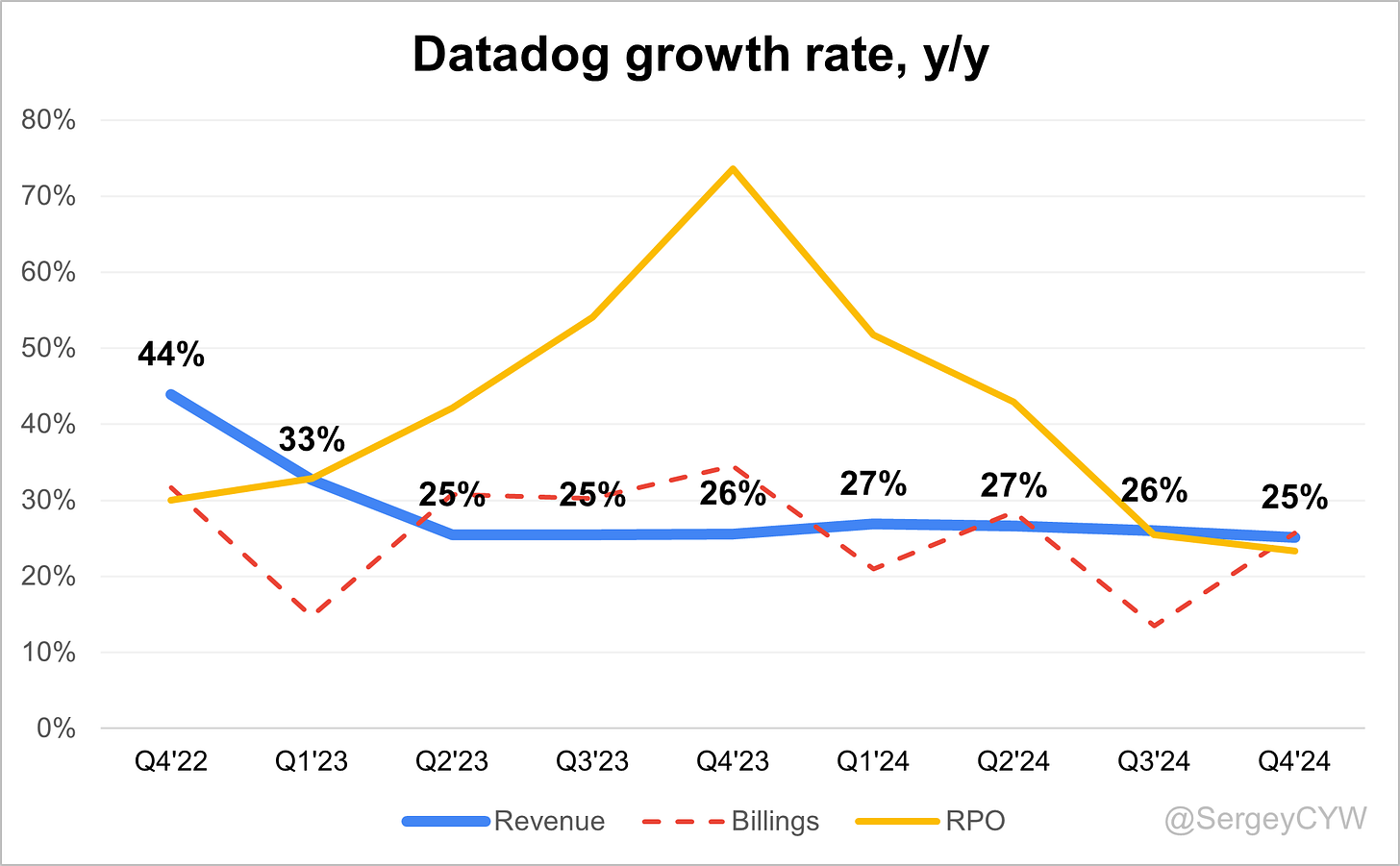

↗️$737.7M rev (+25.1% YoY, +26.0% LQ) beat est by 3.7%

↘️GM* (81.7%, -1.7 PPs YoY)🟡

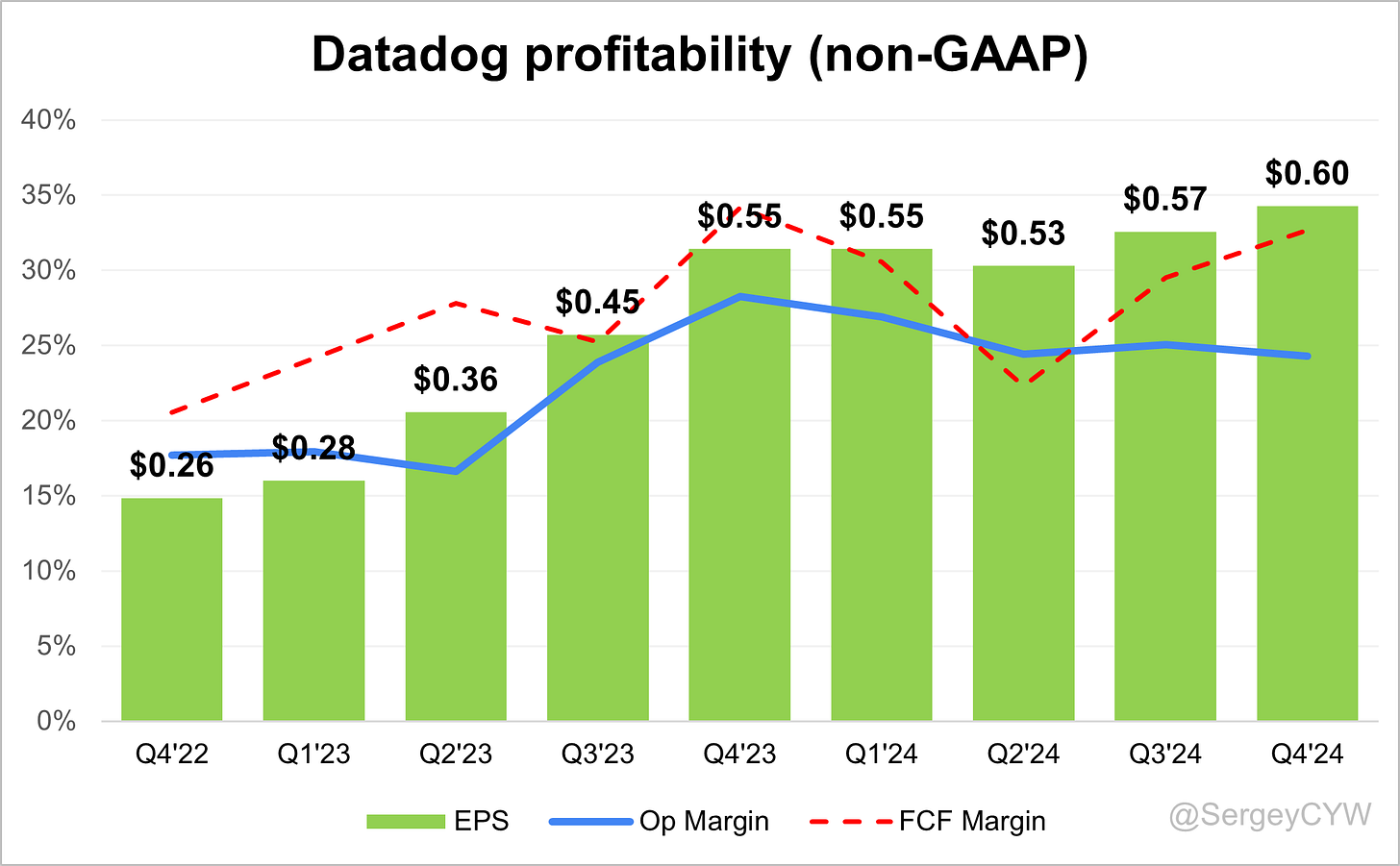

↘️Operating Margin* (24.3%, -4.0 PPs YoY)🟡

↘️FCF Margin (32.7%, -1.5 PPs YoY)🟡

↘️Net Margin (6.2%, -3.0 PPs YoY)🟡

↗️EPS* $0.60 beat est by 39.5%🟢

*non-GAAP

Key Metrics

↗️DBNR 119% (115% LQ)

➡️RPO 2.27B (+23.4% YoY)

↗️Billings $908M (+25.7% YoY)🟢

Customers

↗️30,000 customers (+9.9% YoY, +784)

↗️3,610 $100k+ customers (+13.2% YoY, +120)

➡️462 $1M+ customers (+16.7% YoY, +66)

Platform Adoption

➡️% of customers using 2+ products (83%, 83% LQ)

↗️% of customers using 4+ products (50%, 49% LQ)

➡️% of customers using 6+ products (26%, 26% LQ)

➡️% of customers using 8+ products (12%, 12% LQ)

Customers using products

↗️15,000 customers 4+ (+16.9% YoY, +684)

➡️7,800 customers 6+ (+29.9% YoY, +204)

➡️3,600 customers 8+ (+46.5% YoY, +94)

Operating expenses

↗️S&M*/Revenue 23.5% (+1.1 PPs YoY)

↗️R&D*/Revenue 28.7% (+1.0 PPs YoY)

↗️G&A*/Revenue 5.2% (+0.2 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $191M (+13.4% YoY)

↗️CAC* Payback Period 12.0 Months (+1.1 YoY)🟡

↘️R&D* Index (RDI) 0.85 (-0.03 YoY)🟡

Dilution

↗️SBC/rev 21%, +0.9 PPs QoQ

↘️Basic shares up 3.5% YoY, -0.2 PPs QoQ

↗️Diluted shares up 2.3% YoY, +0.5 PPs QoQ

Guidance

➡️Q1'25 $737.0 - $741.0M guide (+20.9% YoY) in line with est

↘️$3,175.0 - $3,195.0M FY guide (+18.7% YoY) missed est by -1.7%🔴

Key points from Datadog’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Datadog’s Q4 2024 revenue reached $738 million, a 25% YoY increase, exceeding guidance. Free cash flow was $241 million, with a 33% margin. Operating income stood at $179 million, delivering a 24% operating margin, down from 28% in Q4 2023.

RPO grew 24% YoY to $2.27 billion, with normalized growth in the mid-30s% range. Billings rose 26% YoY to $908 million, reflecting continued contract momentum. Gross margins remained strong at 81.7%, slightly down from 83.4% in Q4 2023, but improving from 81.1% in Q3 2024.

Sales and marketing expenses increased 31% YoY, while R&D spending rose 29% YoY, reflecting investment in growth. The company ended the year with $4.2 billion in cash, strengthened by a $1 billion convertible note issuance.

Product Innovations

Over 400 new features were launched in 2024, enhancing Datadog’s observability and security capabilities. Kubernetes Auto Scaling, Oracle Cloud Infrastructure (OCI) Monitoring, and OpenTelemetry support expanded its platform integration.

Event Management and Case Management consolidated alerts and automated workflows, improving incident response. OnCall launched with strong demand, addressing IT scheduling challenges.

FlexLogs, designed for cost-efficient log retention, entered general availability, capturing demand from enterprises optimizing log management.

AI Integration

AI-driven observability expanded, with Beats AI launching for Incident Management and Autonomous Investigations. LLM Observability was enhanced to monitor AI workloads.

AI-native customers contributed 6% of Q4 ARR, doubling from 3% in Q4 2023 and driving five percentage points of revenue growth. While some optimized spending at renewals, AI observability remains a long-term opportunity.

Observability

Three core observability products—Infrastructure Monitoring, Log Management, and APM & Error Tracking—each surpassed $750 million in ARR. Infrastructure Monitoring remained the largest contributor, exceeding $1.25 billion in ARR.

Cross-product adoption increased, with 50% of customers using four or more products, up from 47% YoY, and 26% using six or more, up from 22% YoY.

Security & SIEM

Over 7,000 customers adopted Datadog security products, with Cloud SIEM gaining traction among enterprises replacing legacy solutions.

Large customer wins included:

U.S. Financial Institution: A seven-figure deal, replacing legacy logging tools with FlexLogs for cost savings and improved observability.

Fortune 100 Oil & Gas Company: Expanded to 14 Datadog products, achieving $10M+ in annual cost savings.

U.S. Federal Health Insurance Provider: Transitioned to Cloud SIEM and FlexLogs, replacing a costly SIEM tool.

Multi-Cloud Monitoring

Datadog expanded support for AWS, Azure, GCP, and OCI, adding Amazon SQS, MongoDB, and Kubernetes Security Posture Management monitoring.

A Fortune 100 oil and gas company signed a seven-figure deal to modernize its infrastructure while migrating thousands of on-prem hosts to the cloud, reducing operational disruptions by $10M+ annually.

RPO & Billings Growth

RPO grew 24% YoY, with mid-30s% normalized growth. Billings rose 26% YoY, driven by record bookings exceeding $1 billion in Q4.

Revenue recognition is usage-based, meaning billings growth does not immediately impact revenue. However, record bookings signal future revenue expansion as customers scale usage.

Customer Growth

Datadog ended Q4 with 30,000 customers, with key growth in high-value segments:

3,610 customers with $100K+ ARR (+13% YoY)

462 customers with $1M+ ARR (+16.7% YoY)

45% of Fortune 500 companies use Datadog, up from 42% in 2023

Median ARR from Fortune 500 customers remains below $500K, presenting significant expansion potential.

Large Customer Wins

A major U.S. financial institution replaced four observability tools with FlexLogs and Observability Pipelines, reducing costs and reinvesting in observability.

A Brazilian retail company adopted Datadog’s observability stack in a seven-figure deal, improving e-commerce performance and increasing app store ratings.

A Fortune 100 oil and gas company expanded to 14 Datadog products, saving $1M+ annually on monitoring costs and $10M+ through improved incident resolution.

A U.S. federal health insurance provider moved to Cloud SIEM and FlexLogs, achieving significant cost savings and regulatory compliance improvements.

Challenges

Large customers optimized spending at contract renewals, negotiating volume discounts, particularly in log management and observability.

Cloud migration pacing slowed, partly due to AI infrastructure capacity constraints at hyperscalers, affecting observability demand timing.

Competition in logs and SIEM remains strong, but FlexLogs and Cloud SIEM adoption continues to expand.

Conservative Guidance

Q1 2025 Expectations:

Revenue: $737M - $741M (+21% YoY)

Operating Income: $162M - $166M (22% margin)

EPS: $0.41 - $0.43

Full-Year 2025 Outlook:

Revenue: $3.175B - $3.195B (+18% - 19% YoY)

Operating Income: $655M - $675M (21% margin)

EPS: $1.65 - $1.70

Guidance remains cautious, reflecting measured revenue forecasts, factoring in customer spending trends and potential AI volatility.

Future Outlook

Datadog is positioned for long-term growth, with digital transformation, cloud migration, and AI adoption driving demand.

Investments in FlexLogs, Cloud SIEM, AI Observability, and OnCall are expected to drive incremental revenue in 2025.

Datadog will scale go-to-market efforts, expand in international markets, and strengthen enterprise penetration.

While enterprise cost optimizations and cloud migration pacing may create near-term variability, strong multi-product expansion, record RPO growth, and high retention rates signal a solid foundation for long-term profitability.

Management comments on the earnings call.

Product Innovations

Olivier Pomel, Co-Founder and Chief Executive Officer

"We released over 400 new features and capabilities this year, spanning observability, security, and AI-driven automation. Our teams continue to innovate at a rapid pace, ensuring that we provide customers with the most comprehensive monitoring and analytics solutions available. We are committed to expanding our platform and delivering deeper insights across cloud and on-prem environments."

Olivier Pomel, Co-Founder and Chief Executive Officer

"Our new capabilities, including Kubernetes Auto Scaling, OpenTelemetry instrumentation, and OCI monitoring, demonstrate our ability to adapt to evolving infrastructure needs. Customers want a single, unified observability platform, and we continue to build out new functionalities that make Datadog the most complete solution for their cloud environments."

AI Integration

Olivier Pomel, Co-Founder and Chief Executive Officer

"We continue to see increased interest in NextGen AI, with more than 3,500 customers using at least one of our AI integrations. AI is reshaping infrastructure monitoring, and we are making significant investments to ensure our customers can effectively deploy and monitor AI workloads in production."

David Ochsler, Chief Financial Officer

"AI-native customers represented about 6% of our Q4 ARR, doubling from the year-ago quarter. While we anticipate continued AI-driven growth, we remain mindful of potential optimization and spending variability as AI workloads scale across industries."

Observability

Olivier Pomel, Co-Founder and Chief Executive Officer

"Even in our three core observability pillars—Infrastructure Monitoring, Log Management, and APM—there is still substantial room for growth. More than half of our customers do not yet buy all three, and we are focused on expanding adoption across the full observability stack."

Olivier Pomel, Co-Founder and Chief Executive Officer

"Our platform strategy continues to resonate in the market. We ended Q4 with 83% of customers using two or more products, 50% using four or more, and 26% using six or more. This expansion underscores the increasing reliance on our platform as organizations consolidate their observability needs with us."

SIEM and Security Expansion

Olivier Pomel, Co-Founder and Chief Executive Officer

"Security remains an area of significant growth for us. We now have more than 7,000 customers using one or more of our security products. The expansion of Cloud SIEM and code security reinforces our position as a trusted provider of observability and security solutions."

Olivier Pomel, Co-Founder and Chief Executive Officer

"We see increasing demand for security monitoring, and we have responded by launching new capabilities, including agentless scanning, Kubernetes Security Posture Management, and Cloud SIEM enhancements. Customers are looking for a unified observability and security approach, and we are well-positioned to deliver that."

Platform Expansion

Olivier Pomel, Co-Founder and Chief Executive Officer

"Our total ARR now exceeds $3 billion, a milestone that reflects the depth of adoption across industries. What’s exciting is that we’ve achieved this largely through the continued expansion of our initial core product, Infrastructure Monitoring, while also seeing strong growth in Log Management and APM."

Olivier Pomel, Co-Founder and Chief Executive Officer

"Fortune 500 penetration continues to grow, reaching 45% this quarter, up from 42% a year ago. However, the median ARR for our Fortune 500 customers is still under $500,000, meaning we have a massive opportunity to expand within our existing customer base."

Competition and Market Positioning

Olivier Pomel, Co-Founder and Chief Executive Officer

"We continue to outgrow cloud providers in core observability workloads, even as they benefit from AI-driven GPU sales. Our advantage lies in the depth and breadth of our platform, as well as our ability to integrate seamlessly across multi-cloud and hybrid environments."

Olivier Pomel, Co-Founder and Chief Executive Officer

"Log management is an area of particular strength for us, especially with the launch of FlexLogs. We see significant opportunities here, as the competitive landscape shifts following recent industry consolidations. Customers want scalable, cost-effective log solutions, and we are capturing that demand."

Customer Growth and Expansion

Olivier Pomel, Co-Founder and Chief Executive Officer

"We closed our best-ever quarter for bookings, surpassing $1 billion for the first time. This success reflects strong demand from both new and existing customers, as organizations continue to expand their adoption of our platform."

David Ochsler, Chief Financial Officer

"We ended Q4 with 30,000 customers, adding 800 net new customers during the quarter. More importantly, our high-value segments continue to grow, with 3,610 customers now at $100K+ ARR and 462 customers at $1M+ ARR."

Strategic Partnerships and Enterprise Expansion

Olivier Pomel, Co-Founder and Chief Executive Officer

"We see increasing opportunities in our partner ecosystem, particularly with cloud providers and channel alliances. Expanding our presence in large enterprises requires a multi-faceted approach, and we are investing in both direct sales and partner-driven engagements to maximize reach."

David Ochsler, Chief Financial Officer

"We are making strategic investments to scale our sales organization, particularly in underpenetrated geographies and larger enterprise accounts. The return on these investments is expected to materialize over the next one to two years, driving sustained revenue growth."

Challenges and Macroeconomic Considerations

David Ochsler, Chief Financial Officer

"While demand trends remain stable, we are mindful of continued cost-consciousness among some enterprise customers. In certain cases, we are seeing optimization efforts at contract renewals, though overall usage trends remain positive."

Olivier Pomel, Co-Founder and Chief Executive Officer

"We recognize that some AI-native customers are optimizing their spending, and we expect to see some volatility in usage growth from this cohort. However, we continue to view AI as a long-term growth driver for our platform."

Future Outlook

Olivier Pomel, Co-Founder and Chief Executive Officer

"We believe that digital transformation and cloud migration remain long-term secular trends that will continue to drive demand for our platform. Additionally, as AI adoption expands, the need for real-time observability, security, and log management will only grow."

David Ochsler, Chief Financial Officer

"Our guidance philosophy remains unchanged. We base our outlook on recent usage trends and apply a level of conservatism. While our long-term growth prospects remain strong, we are taking a measured approach in forecasting due to ongoing enterprise cost optimizations."

Olivier Pomel, Co-Founder and Chief Executive Officer

"We are just getting started. Our investments in sales capacity, R&D, and platform expansion position us well for sustained growth. While 2025 will be a year of continued execution, we remain focused on driving long-term value for customers, employees, and shareholders alike."

Thoughts on Datadog Earnings Report $DDOG:

🟢 Positive

Revenue grew +25.1% YoY to $737.7M, beating estimates by +3.7%.

EPS reached $0.60, exceeding forecasts by +39.5%.

Billings increased +25.7% YoY to $908M, signaling strong contract momentum.

Net New ARR rose +13.4% YoY to $191M, reflecting solid customer expansion.

DBNR improved to 119%, up from 115% last quarter, showing strong upsell potential.

Large customer growth: $100K+ customers up +13.2% to 3,610, $1M+ customers up +16.7% to 462.

FlexLogs & Cloud SIEM saw increased adoption, securing seven-figure enterprise deals in financial, oil & gas, and healthcare sectors.

Multi-cloud monitoring growth, with expanded integrations in AWS, Azure, GCP, and OCI.

Customer acquisition costs increased, with CAC payback period rising to 12.0 months (+1.1 YoY), but one of the better in class.

🟡 Neutral

Gross Margin declined -1.7 PPs YoY to 81.7%, but remained stable sequentially.

Operating Margin fell -4.0 PPs YoY to 24.3%, reflecting higher investments in R&D and sales expansion.

Free Cash Flow Margin dropped -1.5 PPs YoY to 32.7%, still maintaining strong profitability.

Platform adoption expanding: 50% of customers now use 4+ products, 26% use 6+, and 12% use 8+.

S&M expenses rose to 23.5% of revenue (+1.1 PPs YoY) as Datadog scaled its sales force and expanded global reach.

R&D spending increased to 28.7% of revenue (+1.0 PPs YoY), aligning with continued product innovation.

RPO grew +23.4% YoY to $2.27B, with mid-30s% normalized growth.

Diluted shares increased +2.3% YoY, impacting EPS growth.

🔴 Negative

Full-year 2025 revenue guidance of $3.175B - $3.195B (+18.7% YoY) missed estimates by -1.7%.

Cloud migration slowing due to AI infrastructure capacity constraints, impacting observability demand growth.

Enterprise cost optimizations resulted in some volume discounts at renewal, particularly in log management and security.

Net Margin declined -3.0 PPs YoY to 6.2%, reflecting higher expenses relative to revenue growth.