Financial Results:

⬆️$589.6M rev (+25.6% YoY, +25.4% LQ) beat est by 3.7%

⬆️GM* (83.4%, +2.9%pp YoY)🟢

⬆️Operating Margin* (28.3%, +10.6%pp YoY)🟢

⬆️FCF Margin 34.1%, +13.6%pp YoY)

⬆️EPS* $0.55 beat est by 25.0%🟢

*non-GAAP

Customers

➡️3,190 $100k+ customers (+15.0% YoY, +60) 🟡

➡️396 $1M+ customers (+25.0% YoY, +79)

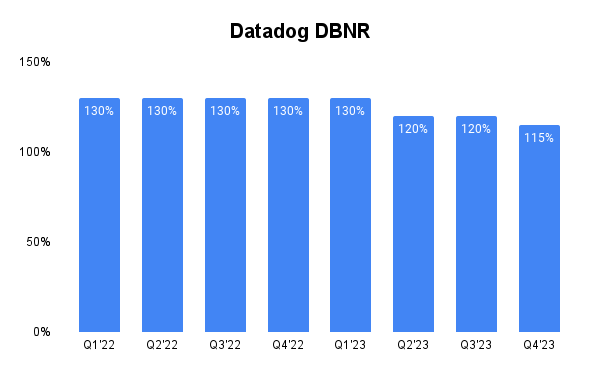

↘️DBNR 115% (120% LQ)

⬆️RPO $1.84B (+74.0% YoY)🟢

⬆️Billings $723M (+35.0% YoY)🟢

⬆️% of customers using 2+ products (83%, 82% LQ)

⬆️% of customers using 4+ products (47%, 46% LQ)

⬆️% of customers using 6+ products (22%, 21% LQ)

⬆️% of customers using 8+ products (9%, 8% LQ)

Operating expenses

↘️S&M*/Revenue 22.4% (23.3% LQ)

↘️R&D*/Revenue 27.7% (28.5% LQ)

↘️G&A*/Revenue 5.1% (6.7% LQ)

⬆️Net New ARR $168M ($152 LQ)

↘️CAC* Payback Period 10.9 Months (11.5 LQ)

Dilution

↘️SBC/rev 22%, -0.8%pp QoQ)

⬆️Dilution at 3.6% YoY, +0.6%pp QoQ)

Guidance

⬆️Q1'24 $591.0M guide (+22.7% YoY) beat est by 0.9%

➡️$2,575M FY guide (+21.0% YoY)

Key points from Datadog's Fourth Quarter 2023 Earnings Call:

Strong Financial Performance:

Datadog reported a revenue of $590 million for Q4 2023, a 26% year-over-year increase, with free cash flow of $201 million and a free cash flow margin of 34%.

Customer Growth:

The company ended the quarter with approximately 27,300 customers, including 3,190 customers with an ARR of $100,000 or more and 396 customers with an ARR of $1 million or more.

Notably, 42% of the Fortune 500 are now Datadog customers, up from 37% last year. However, the median ARR for these Fortune 500 customers is still under $0.5 million, indicating a significant opportunity for growth as these enterprises continue their cloud migration journeys.

Strategic Bookings:

Datadog experienced strong bookings in Q4, including the signing of multiyear deals and its first-ever nine-figure TCV deal, signaling deepening relationships with large customers.

Platform Adoption:

83% of customers were using two or more Datadog products, with significant growth in the adoption of newer products outside of core observability.

Focus on Innovation:

Datadog released over 400 new features and capabilities in 2023, including advancements in observability, APM, log management, cloud security, and AI/LLM observability.

Optimization Trends:

The intensity of usage optimization by customers, which had been a concern in previous quarters, appears to have dissipated, indicating a positive sign for future growth.

Outlook for 2024:

While remaining conservative in their guidance, Datadog's management is optimistic about the long-term growth driven by digital transformation, cloud migration, and AI adoption.

The company observed that the intensity of optimization activities by customers has dissipated compared to previous quarters. This suggests a potentially improving macro environment where customers are moving from a cost-optimization focus to potentially focusing on growth and investment.

Investment in Growth:

The company plans to accelerate hiring in R&D and sales and marketing to support future growth while maintaining financial discipline.

Security Product Adoption:

Over 6,000 customers are now using one or more Datadog security products, highlighting the expanding role of Datadog in the cloud security space.

Management comments on the earnings call.

Product Innovations:

"Throughout the year, we kept innovating at a fast pace, going broader and deeper into the problems we solve for our customers." - Olivier Pomel

"We released over 400 new features and capabilities during 2023." - Olivier Pomel

"In the Generative AI and LLM space, we continue to add capabilities to Bits AI, our natural language incident management copilot." - Olivier Pomel

Security Product Adoption:

"For infrastructure security and application security, this tends to be the DevOps teams that start buying with some involvement of the security teams on their end. For our cloud SIEM product, the buyer tends to be the security team." - Olivier Pomel

NextGen AI:

"Today, about 3% of our ARR comes from NextGen AI native customers, but we believe the opportunity is far larger in the future as customers of every industry and every size start deploying AI functionality in production." - Olivier Pomel

Competitors:

"On the competition side, there's no real change. I think I would say very boring from a competitive perspective in that the situation is pretty much the same as it was last quarter and the quarter before." - Olivier Pomel

Leadership:

"First of all, I'd like to welcome Sara Varni to the team, as our new Chief Marketing Officer. Sara brings more than 15 years of marketing experience centered around developers and enterprise software, and we really look forward to her leadership in this pivotal role." - Olivier Pomel

Guidance and Optimization Trends:

"Our guidance philosophy remains unchanged. As a reminder, we base our guidance on trends observed in recent months and apply conservatism on these growth trends." - David Obstler

"We also note that the greater intensity of optimization we've seen over the past six quarters appears to have dissipated. For the last couple of quarters, we have discussed with you a cohort of customers who are optimizing. In Q4, this cohort's usage grew at a faster pace than the broader customer base." - Olivier Pomel

"We continue to believe digital transformation and cloud migration are long-term secular growth drivers of our business and critical motions for every company to deliver value and competitive advantage." - Olivier Pomel

Thoughts on Datadog ER $DDOG :

🟢Pros:

+ Revenue increased by +25.6% YoY, indicating stabilizing revenue growth.

+ DBNR remains strong at ~115%.

+ RPO grew by +74% YoY.

+ RPO and billings are growing faster than revenue.

+ The company is increasing margins and profitability.

+ Beat Q3 revenue guidance by 3.8%.

+ The percentage of customers using 2+, 4+, 6+, and 8+ products increased from the last quarter.

+ The company has one of the lowest Customer Acquisition Cost (CAC) Payback Periods in the IT space.

+ The company plans to increase investment in R&D, which will enhance its competitive position in the market.

+ Management notes the macroeconomic environment is now better, and optimization activity is diminishing.

🟡Neutral:

+- Stock-Based Compensation (SBC)/revenue is 22%, and dilution is 3.6%.

+- Weak customer growth (+60 >$100K customers), but this metric is less relevant because the company targets larger clients, and the share of >$100K clients now is 86%.