Datadog Q3 2024 Earnings Analysis

Dive into $DDOG Datadog’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$690.0M rev (+26.0% YoY, +26.7% LQ) beat est by 3.9%

↘️GM* (81.1%, -1.2 PPs YoY)🟡

↗️Operating Margin* (25.1%, +1.2 PPs YoY)

↗️FCF Margin (29.5%, +4.3 PPs YoY)

↗️EPS* $0.57 beat est by 42.5%🟢

*non-GAAP

Key Metrics

➡️DBNR 115% (115% LQ)

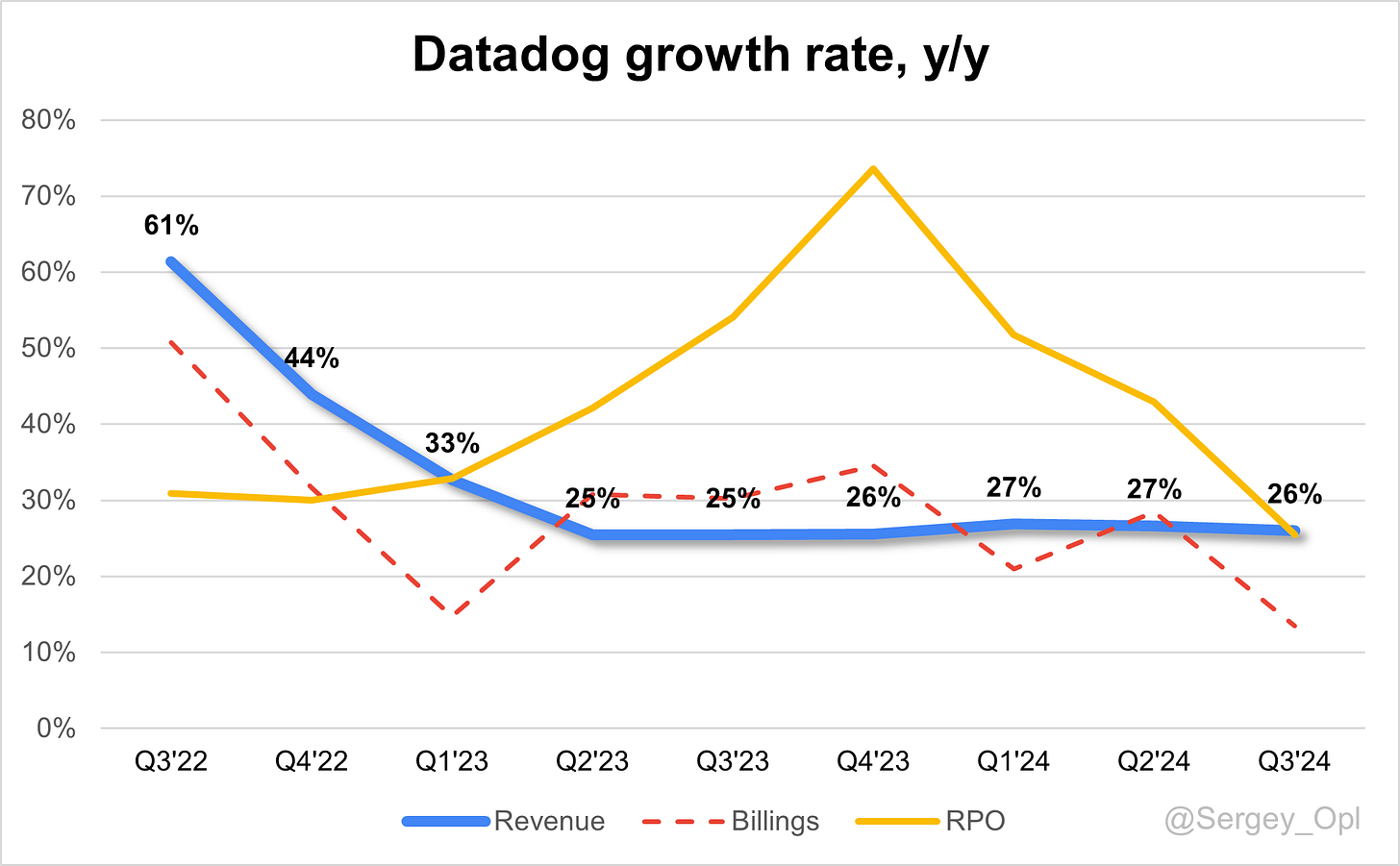

➡️RPO $1.82B (+25.5% YoY)🟡

➡️Billings $689M (+13.5% YoY)🟡

Customers

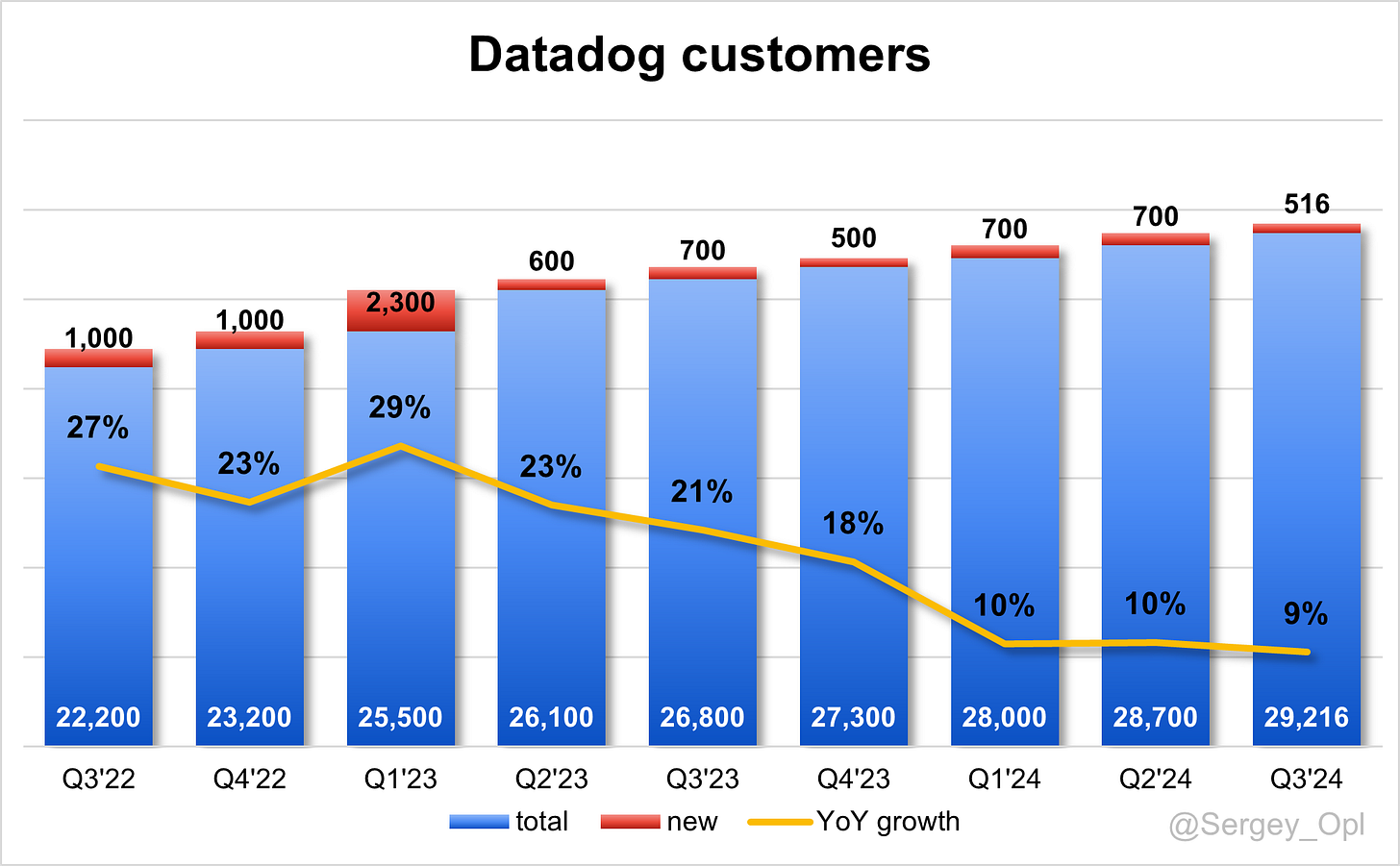

➡️29,216 customers (+9.0% YoY, +516)

➡️3,490 $100k+ customers (+11.5% YoY, +100)

Platform Adoption

➡️% of customers using 2+ products (83%, 83% LQ)

➡️% of customers using 4+ products (49%, 49% LQ)

↗️% of customers using 6+ products (26%, 25% LQ)

↗️% of customers using 8+ products (12%, 11% LQ)

Customers using products

➡️14,316 customers 4+ (+16.1% YoY, +253)

➡️7,596 customers 6+ (+35.0% YoY, +421)

➡️3,506 customers 8+ (+63.5% YoY, +349)

Operating expenses

↘️S&M*/Revenue 22.6% (-0.7 PPs YoY)

↘️R&D*/Revenue 28.3% (-0.2 PPs YoY)

↘️G&A*/Revenue 5.2% (-1.5 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $179M (+17.5% YoY)

↘️CAC* Payback Period 13.0 Months (15.1 LQ)

Dilution

↘️SBC/rev 21%, -0.3 PPs QoQ

↘️Basic shares up 3.7% YoY, -0.3 PPs QoQ

↘️Diluted shares up 1.8% YoY, -8.9 PPs QoQ

Guidance

➡️Q4'24 $709.0 - $713.0M guide (+20.6% YoY) in line with est

↗️$2,656.0 - $2,660.0M FY guide (+24.9% YoY) raised by 1.1% beat est by 1.1%

Key points from Datadog’s Third Quarter 2024 Earnings Call:

Financial Performance

In Q3 2024, Datadog reported revenue of $690 million, marking a 26% year-over-year growth and surpassing guidance. Free cash flow was $204 million with a strong 30% margin, and operating income reached $173 million for a 25% operating margin, up from 24% a year ago. Gross margin slightly declined to 81.1% from 82.1% in the previous quarter, with management confident in maintaining healthy margins through ongoing optimizations and improved agreements with cloud providers.

RPO Growth and Billing Trends

Remaining performance obligations (RPO) were $1.82 billion, a 26% increase year-over-year. Adjusted for contract duration changes, RPO growth would have been in the high-30s percentage range. Billings for Q3 reached $689 million, up 14% year-over-year; adjusted billing growth over the trailing twelve months aligned with revenue growth in the mid-20s percentage range, supporting Datadog's focus on revenue consistency as a key performance indicator.

Commitment to Product Innovation

Datadog's growth is driven by significant investment in product innovation across observability, security, and incident management. In Q3, Datadog expanded its product suite to strengthen automation, multi-cloud monitoring, and security integration capabilities, which resonated strongly with enterprise clients.

Launch of LLM Observability

Datadog launched LLM Observability, providing end-to-end visibility into large language models (LLMs) and enabling AI-driven application monitoring. Early users report major troubleshooting improvements, resolving latency and quality issues in minutes instead of hours. AI-related products now contribute approximately 6% to ARR, reflecting the growing role of AI-native solutions.

Introduction of Datadog On-Call

Datadog introduced Datadog On-Call, a cloud service management tool for incident response. Designed initially as a feature, On-Call quickly garnered strong demand as a standalone solution for alerting, paging, and resolution, positioning it as an entry point for clients in need of efficient incident response workflows.

Multi-Cloud Monitoring with Oracle Cloud Integration

Datadog expanded multi-cloud capabilities with Cloud Infrastructure Monitoring for Oracle Cloud in Q3. This integration allows clients to monitor Oracle Cloud alongside AWS, Azure, and other platforms within Datadog's unified interface, enhancing multi-cloud visibility and supporting infrastructure health across diverse environments.

AI Integration

Datadog’s AI-focused offerings increased to 6% of ARR, up from 4% in Q2 and 2.5% a year ago. The adoption of Datadog's LLM observability tools underscores demand from clients moving machine learning and AI models into production, with Datadog’s real-time monitoring reducing investigation times significantly. Management expects continued growth in inference workloads as enterprises increasingly deploy production AI applications.

Observability

The observability sector remains a core strength, with Datadog’s infrastructure monitoring, APM suite, and log management products generating over $2.5 billion in ARR. Platform adoption is strong, with 83% of customers using two or more products, 49% using four or more, and 12% using eight or more. Datadog continues to receive industry recognition as a leader, including in Gartner’s 2024 Magic Quadrant for observability platforms.

Security

Datadog’s security products, notably Cloud SIEM, are gaining traction, with Datadog On-Call contributing to demand for incident management and paging. Out of Datadog’s 23 products, 15 have surpassed the $10 million ARR mark, with security offerings like Cloud SIEM and Cloud Security Management increasingly critical. New security features are expected to launch soon, further strengthening Datadog's unified security platform.

Customer Growth and Success Stories

Datadog’s customer base grew to 29,200 in Q3 2024, up from 26,800 a year ago, with high-value customers (ARR of $100,000+) rising to 3,490, collectively generating 88% of ARR. This growth highlights Datadog’s success in deepening relationships with enterprise clients.

Large Customer Wins

Significant enterprise wins in Q3 include a seven-figure annualized deal with a leading e-commerce company in India, enabling cost efficiency through Datadog’s unified observability. A six-figure contract with a U.S. federal agency supports their cloud migration with eight Datadog products, including Cloud SIEM and Cloud Security Management. Additionally, a seven-figure annualized contract with a large American financial services firm replaced their previous monitoring solution with Datadog's Real User Monitoring to reduce downtime, while a European airline adopted Datadog’s platform to support a large-scale AWS migration, achieving improvements in mean-time-to-resolution.

Customer Success and Retention Metrics

Datadog maintains low churn rates and a high gross revenue retention rate in the mid-to-high 90s, underscoring the platform’s critical role for clients. Enterprise clients with over 5,000 employees demonstrate the strongest growth, contributing to a net revenue retention rate in the mid-110s. Datadog’s appeal across all segments supports its expanding footprint and reinforces its value proposition.

Macroeconomic Conditions

Despite economic pressures, Datadog saw steady demand for cloud and DevOps solutions throughout 2024. Clients continue to prioritize digital transformation, with Datadog’s revenue retention in the mid-to-high 90s reflecting the essential nature of its products. Growth trends remain robust among large enterprises, which tend to be less affected by economic shifts.

Future Outlook

For Q4 2024, Datadog projects revenue of $709 million to $713 million (20-21% year-over-year growth) and a 23% operating margin. Fiscal 2024 guidance expects revenue between $2.656 billion and $2.66 billion, a 25% year-over-year increase, with non-GAAP operating income anticipated at $658 million to $662 million. Looking ahead to 2025, Datadog plans to expand investments in product innovation, engineering, and sales, with particular emphasis on under-penetrated markets, including India and the U.S. federal sector.

Management comments on the earnings call.

Product Innovations

Olivier Pomel, Co-Founder and CEO

"Our focus on product innovation remains central to our growth strategy. We're investing substantially to enhance capabilities across observability, security, and incident management, which are resonating strongly with enterprise customers. Our expanded product suite this quarter reinforces our commitment to keeping our platform at the forefront of automation and multi-cloud monitoring."

LLM Observability

Olivier Pomel, Co-Founder and CEO

"With LLM Observability, we’re providing customers with essential end-to-end visibility into AI-driven applications, especially large language models. The ability to monitor performance and identify issues within minutes has been a game-changer for early adopters, and this is just the beginning. AI-focused products now contribute around 6% to ARR, underscoring the significant role of AI-native solutions in our portfolio."

Datadog On-Call

Olivier Pomel, Co-Founder and CEO

"Datadog On-Call was initially designed to integrate within our ecosystem, but demand has quickly grown for it as a standalone solution. It’s now a critical entry point for customers in need of efficient incident response workflows, positioning us to offer an even more comprehensive end-to-end incident resolution solution."

AI Integration

Olivier Pomel, Co-Founder and CEO

"AI-focused offerings have shown strong traction, now making up 6% of our ARR. We're seeing increased adoption from customers looking to bring AI and machine learning models into production environments. Real-time monitoring and observability are proving essential as companies move from testing to fully deployed AI applications."

Customer Success

Yuka Broderick, Senior Vice President of Investor Relations

"Our customer base expanded to 29,200 this quarter, with high-value clients growing by over 11%. This highlights our effectiveness in deepening relationships and addressing complex observability and security needs at scale, as companies continue investing in digital transformation."

Security

Olivier Pomel, Co-Founder and CEO

"Security remains a cornerstone of our innovation strategy. With several products surpassing $10 million in ARR, our Cloud SIEM and other security-focused tools are becoming increasingly vital. As we continue to enhance our security offerings, our unified platform is well-positioned to meet the needs of enterprises seeking robust cloud security."

Observability

Olivier Pomel, Co-Founder and CEO

"Observability is core to what we do, with products like infrastructure monitoring and APM collectively generating over $2.5 billion in ARR. Our platform adoption metrics highlight our success in allowing customers to scale observability across diverse use cases, helping them modernize applications in the cloud."

Challenges

David Ochsler, Chief Financial Officer

"The current macroeconomic environment is driving customers to be more cost-conscious, but they continue to prioritize investments in digital transformation. We’re maintaining a careful approach to guidance, focusing on stable revenue retention and aiming to deliver consistent growth as we navigate these challenges."

Future Outlook

Olivier Pomel, Co-Founder and CEO

"Our outlook for Q4 and beyond reflects a prudent approach. We see significant opportunity ahead, particularly as we expand in under-penetrated markets like India and the U.S. federal sector. Investment in product innovation and capacity building will be key as we drive sustainable growth into 2025 and beyond."

Thoughts on Datadog ER DDOG :

🟢Pros:

+ Revenue growth is stabilizing at +26.0% YoY. If the company beats the forecast by 3.9%, as it did in Q3, the growth in Q4 could reach 25.7%.

+ Dollar-Based Net Retention (DBNR) remains strong at ~115%.

+ The company is improving margins and profitability on a YoY basis.

+ Beat revenue guidance by 3.9% and raised the full-year forecast by 1.1%.

+ The percentage of customers using 6+ and 8+ products increased from the last quarter.

+ Net New ARR is growing 17.5% YoY.

+ Investment in R&D is higher than in S&M, indicating a strong focus on developing new products.

+ The management team was strengthened.

🔴Cons:

- Billings are growing at 14% YoY, significantly below the rate of revenue growth.

🟡Neutral:

+- Gross Margin declined to 81.1% from 82.3% a year earlier.

+- Remaining Performance Obligations (RPO) grew by +25.5% YoY, which is slower than revenue. However, management noted that adjusted for contract duration changes, RPO growth would have been in the high 30% range. cRPO grew by 27-29%, meaning that adjusted RPO and cRPO growth exceeded revenue growth.

+- Only 510 new total customers were added, with +100 new >$100K customers; >$100K customers now make up 87% of the customer base. Since the company is focused on attracting large customers, a more important metric is the increase in customers using 6+ and 8+ products.

+- Weighted-average number of common shares is up 3.7% YoY.

+- Stock-Based Compensation (SBC) as a percentage of revenue is 21%.