Datadog Q2 2024 Earnings Analysis

Dive into $DDOG Datadog’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

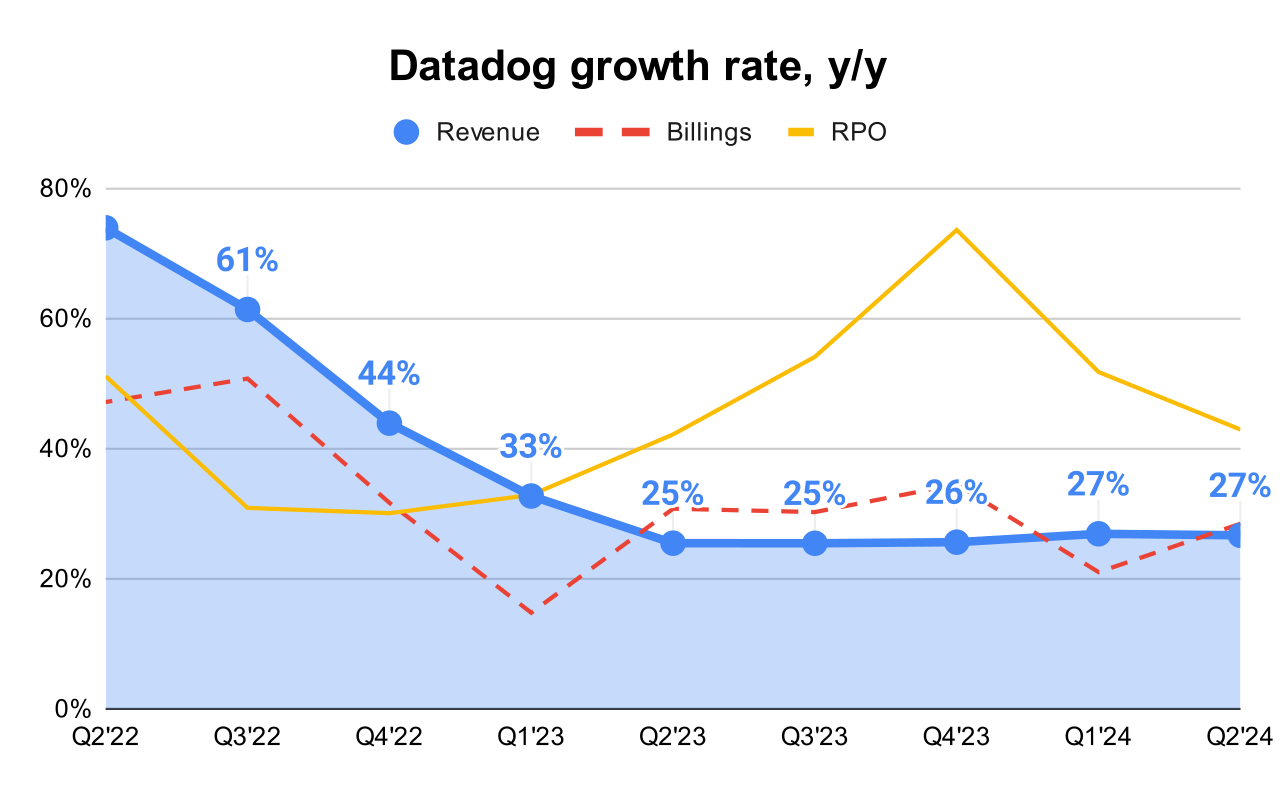

↗️$645.3M rev (+26.7% YoY, +26.9% LQ) beat est by 3.3%

↗️GM* (82.1%, +0.8 PPs YoY)

↗️Operating Margin* (24.4%, +7.8 PPs YoY)

➡️FCF Margin (22.3%, -5.5 PPs YoY)🟡

↗️EPS* $0.53 beat est by 43.2%

*non-GAAP

Key Metrics

➡️DBNR 115% (115% LQ)

↗️RPO $1.79B (+43.0% YoY)

↗️Billings $667M (+28.0% YoY)🟢

Customers

➡️28,700 customers (+10.0% YoY, +700)

➡️3,390 $100k+ customers (+13.0% YoY, +50)🔴

Platform Adoption

↗️% of customers using 2+ products (83%, 82% LQ)

↗️% of customers using 4+ products (49%, 47% LQ)

↗️% of customers using 6+ products (25%, 23% LQ)

↗️% of customers using 8+ products (11%, 10% LQ)

Operating expenses

↗️S&M*/Revenue 24.3% (+0.8 PPs YoY)

↘️R&D*/Revenue 28.0% (-3.1 PPs YoY)

↘️G&A*/Revenue 5.3% (-0.4 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $136M (+22.6% YoY)

↘️CAC* Payback Period 15.1 Months (22.0 LQ)

Dilution

↘️SBC/rev 21%, -1.2 PPs QoQ

↗️Basic shares up 3.9% YoY, +0.0 PPs QoQ

↘️Diluted shares up 10.7% YoY, -0.8 PPs QoQ🔴

Guidance

↘️Q3'24 $660.0 - $664.0M guide (+20.9% YoY) missed est by -0.3%🔴

↗️$2,620.0 - $2,630.0M FY guide (+23.3% YoY) raised by 0.8% beat est by 0.6%

Key points from Datadog’s Second Quarter 2024 Earnings Call:

Product Innovations

LLM Observability:

Datadog announced the general availability of LLM observability, which is designed for application developers and machine learning engineers. This product allows users to monitor, troubleshoot, and secure LLM applications efficiently, helping accelerate the deployment and reliable operation of AI applications in production environments.

Bits.ai Expansion:

Bits.ai, Datadog’s built-in AI copilot, received significant updates. Initially capable of summarizing incidents and answering questions, it now includes features for autonomous investigations. This enhancement allows Bits.ai to proactively surface key information and perform complex tasks, such as investigating alerts and coordinating incident response.

Introduction of Toto:

Toto is Datadog's first foundational model for time series forecasting. It delivers state-of-the-art performance on relevant benchmarks. The success of Toto is attributed to the quality of Datadog's training datasets, which underscores the company's unique ability to incorporate AI models that significantly improve operational efficiencies for customers.

FlexLogs:

The general availability of FlexLogs was announced, which advances Datadog’s "logs without limits" approach. This feature allows customers to scale storage and compute independently, optimizing cost efficiency significantly.

Log Workspace for Log Analysis:

Log Workspace is a new advanced analytics feature that enables users to connect datasets, build and visualize complex queries, and create reusable composable views and reports. It targets customers transitioning from legacy log management tools, offering them a sophisticated analysis capability.

Data Jobs Monitoring:

This feature targets data engineers working with Spark and Databricks workloads. It helps detect and fix issues while optimizing the cost and performance of data jobs. It represents an expansion of Datadog's data observability suite, complementing existing tools for monitoring data streams and providing visibility into data lakes and warehouses like Snowflake.

Key Customer Wins

Largest New Logo Win:

Datadog secured its largest-ever new logo win with a multi-year deal valued in the tens of millions of dollars with one of the largest banks in South America. This customer transitioned to Datadog for end-to-end observability and expected to manage and predict observability costs better.

Travel Management Company:

A seven-figure annualized land deal was signed with one of the world’s largest travel management companies. This company chose Datadog to replace an expensive and complex commercial log management tool, anticipating significant savings and a more stable observability solution.

Security Software Company:

Another seven-figure annualized land deal was secured with a security software company. This customer switched to Datadog, replacing one commercial and two open source tools, to improve incident detection and expects to save $500,000 annually.

European Central Bank:

A seven-figure annualized expansion was signed with a leading central bank in Europe. This customer, initially a client three years ago, has increasingly adopted Datadog as it moves more applications to the cloud.

American Insurance Company:

A large American insurance company expanded its use of Datadog to become the enterprise-wide observability provider. This expansion is expected to save the customer over $1 million annually in tool costs.

Online Gambling and Entertainment Platform:

A high seven-figure annualized expansion was agreed with a leading online gambling and entertainment platform. This long-term customer uses Datadog across various operational areas and has adopted 19 products on the Datadog platform.

Platform Adoption:

The data indicates that Datadog's platform strategy continues to resonate well in the market. The increasing adoption of multiple products by customers underscores the coherence and attractiveness of integrating multiple monitoring and security capabilities within a single platform.

Notable advancements in digital experience monitoring, specifically in Synthetics and Real User Monitoring (RUM), both achieving over $100 million in ARR.

Leadership:

Yanbing Li joined as Chief Product Officer, bringing extensive experience from VMware, Google, and Aurora. David Galleries joined as Chief People Officer, bringing over 20 years of HR experience from companies like Wells Fargo and Walmart.

Future Outlook:

The emphasis will remain on driving digital transformation and cloud migration, with a significant focus on expanding AI capabilities and infrastructure optimization.

The overall business environment remains similar to the previous quarter, with customers generally growing their cloud usage while some continue to be cost-conscious.

Management comments on the earnings call.

Customers:

Olivier Pomel, CEO: "First, we landed our largest ever new logo win, a multi-year deal with total contract value into the tens of millions of dollars with one of the largest banks in South America."

Olivier Pomel, CEO: "Next, we signed a seven-figure annualized land deal with one of the world's largest travel management companies. This company was using a commercial log management tool but found it expensive and complex to support."

Olivier Pomel, CEO: "We also signed a seven-figure annualized expansion with a leading central bank in Europe. This institution became a Datadog customer three years ago to enable its ambitious plan to move half of its applications to the cloud over a couple of years."

Leadership:

Olivier Pomel, CEO: "I’d like to welcome two new leaders to our team. Yanbing Li is joining us as our Chief Product Officer... And David Galleries is joining us as our Chief People Officer. It will help us drive the next chapter of growth and scale at Datadog."

Future Outlook:

Olivier Pomel, CEO: "We are seeing continued experimentation with new technologies including next-gen AI, and we believe this is just one of the many factors that will drive greater use of the cloud and next-gen infrastructure."

Olivier Pomel, CEO: "In terms of competition, we see a lot of excitement around AI technologies. Our customers are telling us that they are leveling up on AI and ramping up experimentations with the goal of delivering additional business value with AI, and we can see them doing this."

Thoughts on Datadog ER $DDOG :

🟢Pros:

+ Revenue growth stabilizing at +26.7% YoY.

+ Dollar-Based Net Retention (DBNR) remains strong at ~115%.

+ Billings are growing 28.4% YoY, and Remaining Performance Obligations (RPO) grew by +43% YoY, faster than revenue.

+ The company is increasing margins and profitability on a YoY basis.

+ Beat revenue guidance by 3.4%.

+ The percentage of customers using 2+, 4+, 6+, and 8+ products increased from the last quarter.

+ Net New ARR is growing 22.6% YoY.

+ Investment in R&D is bigger than in S&M; the company pays great attention to the development of new products.

+ A large number of new and updated products were introduced.

+ The management team was strengthened.

🔴Cons:

- Diluted shares up 10.7% YoY.

- Weak customer growth (+50 >$100K customers); the share of >$100K customers is now 87%. Since the company is focused on attracting large customers, the more important metric is the use of 6+ and 8+ products by customers.

🟡Neutral:

+- Stock-Based Compensation (SBC)/revenue is 21%.

+- 700 new total customers added, the same as in Q1 2024.