Datadog Q1 2025 Earnings Analysis

Dive into $DDOG Datadog’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$761.6M rev (+24.6% YoY, +25.1% LQ) beat est by 2.9%

↘️GM* (80.3%, -2.9 PPs YoY)🟡

↘️Operating Margin* (21.9%, -5.0 PPs YoY)🟡

↗️FCF Margin (32.1%, +1.5 PPs YoY)

↘️Net Margin (3.2%, -3.7 PPs YoY)🟡

↗️EPS* $0.57 beat est by 35.7%

*non-GAAP

Key Metrics

➡️DBNR 119% (119% LQ)

↗️RPO $2.31B (+33.5% YoY)🟢

➡️Billings $748M (+21.0% YoY)🟡

Customers

➡️30,500 customers (+8.9% YoY, +500)🔴

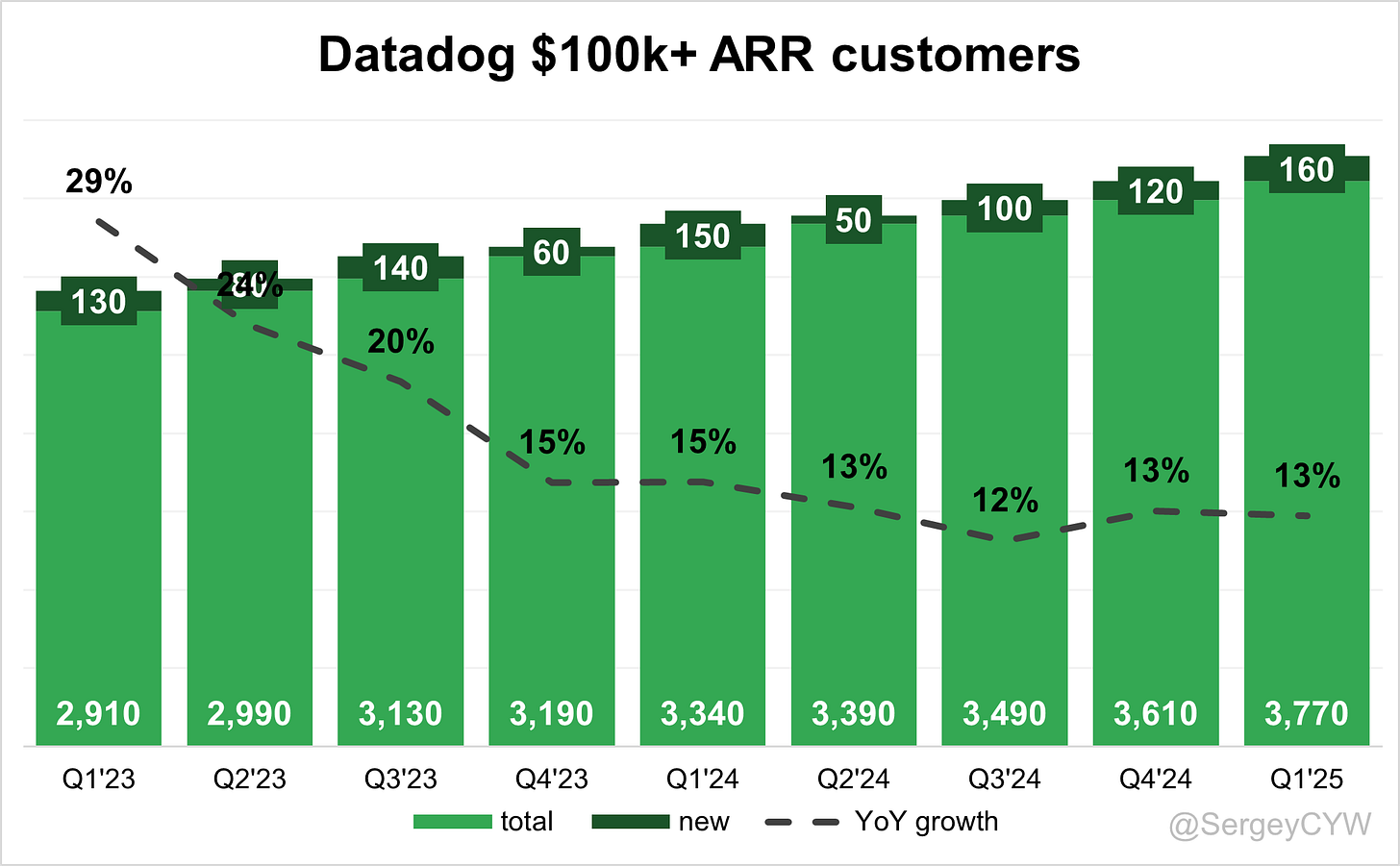

↗️3,770 $100k+ customers (+12.9% YoY, +160)

Platform Adoption

➡️% of customers using 2+ products (83%, 83% LQ)

↗️% of customers using 4+ products (51%, 50% LQ)

↗️% of customers using 6+ products (28%, 26% LQ)

↗️% of customers using 8+ products (13%, 12% LQ)

Customers using products

➡️15,555 customers 4+ (+18.2% YoY, +555)

↗️8,540 customers 6+ (+32.6% YoY, +740)

↗️3,965 customers 8+ (+41.6% YoY, +365)

Operating expenses

↗️S&M*/Revenue 23.4% (+0.0 PPs YoY)

↗️R&D*/Revenue 29.6% (+1.7 PPs YoY)

↗️G&A*/Revenue 5.4% (+0.4 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $95M (+10.1% YoY)

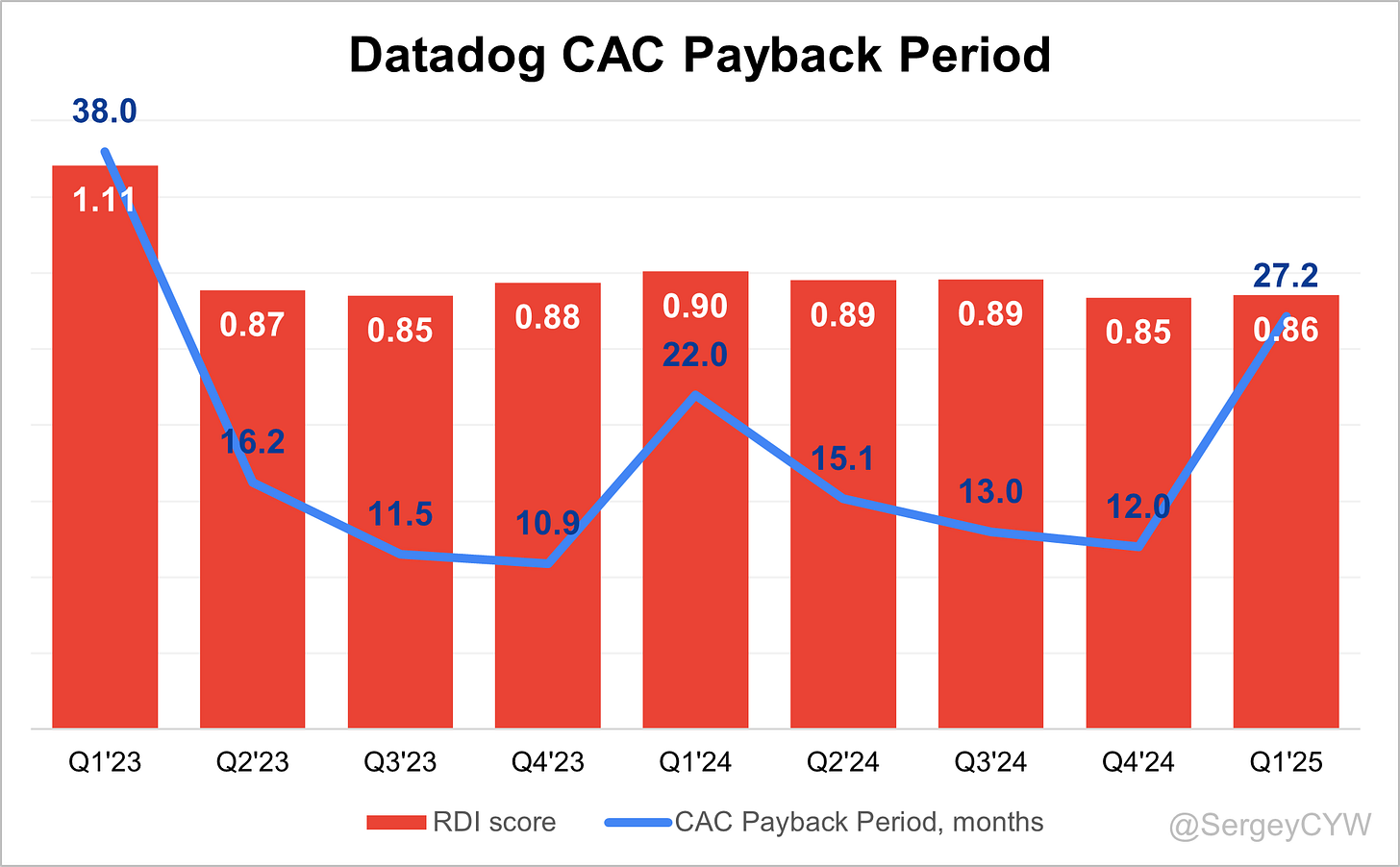

↗️CAC* Payback Period 27.2 Months (+5.2 YoY)🟡

↘️R&D* Index (RDI) 0.86 (-0.05 YoY)🟡

Dilution

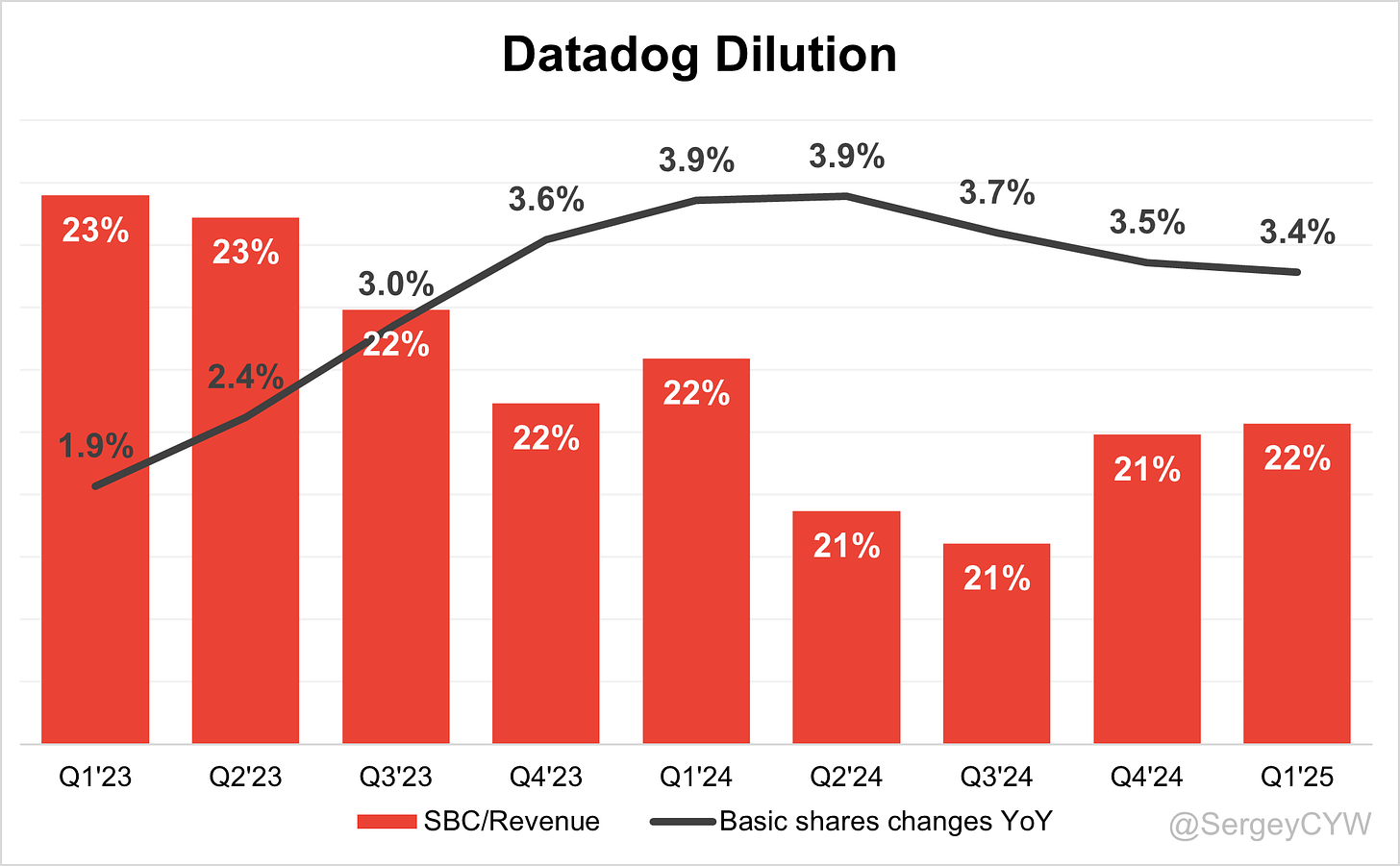

↗️SBC/rev 22%, +0.1 PPs QoQ

↘️Basic shares up 3.4% YoY, -0.1 PPs QoQ

↘️Diluted shares up 2.0% YoY, -0.3 PPs QoQ

Guidance

↗️Q2'25 $787.0 - $791.0M guide (+22.3% YoY) beat est by 2.5%

↗️$3,215.0 - $3,235.0M FY guide (+20.1% YoY) raised by 1.3% beat est by 1.2%

Key points from Datadog’s First Quarter 2025 Earnings Call:

Financial Performance

Revenue reached $762M, up +25% YoY and +3% QoQ, exceeding guidance. EPS (non-GAAP) was $0.57, beating estimates by +35.7%. Free cash flow stood at $244M (32% margin), indicating strong capital efficiency. Operating income was $167M with a 21.9% margin, down from 27% YoY due to higher cloud costs and expanded R&D. Billings rose +21% YoY to $748M. RPO totaled $2.31B, up +33% YoY, with current RPO up +30%.

Infrastructure Monitoring

Datadog signed a 7-figure deal with a major U.S. automaker covering hybrid, IoT, and multi-cloud infrastructure. The client adopted 13 products, replacing over a dozen legacy tools. Datadog’s infrastructure offering continues to be foundational across complex environments, including AI inference workloads.

Application Performance Monitoring

APM was central in several multi-product expansions, including a 7-figure deal with an AI startup that replaced a third-party APM tool. APM supports observability across logs, traces, and metrics and plays a growing role in monitoring AI-generated applications. Scaling for inference environments remains a technical focus.

Flex Logs Adoption

Flex Logs reached $50M ARR in six quarters, Datadog's fastest product ramp. It enables cost-effective ingestion and serves as a catalyst for broader platform adoption. A returning insurtech customer signed a 6-figure deal, citing improved usability and cost control. Flex Logs is key in displacing legacy logging solutions.

Database Monitoring

Database Monitoring nears $50M ARR, growing +60% YoY, adopted by over 5,000 customers. Built by a team of 10–15 engineers, the product integrates into Datadog's data observability portfolio, supporting modern data pipelines and AI inputs. It monitors query performance, health, and cost.

Security & SIEM

Security products serve 7,500+ customers, or ~25% of the base, with over 50% of Fortune 500 using Datadog’s DevSecOps tools. A U.S. health insurer expanded to 17 products, reducing MTTR from hours to minutes. Another customer saved $1M annually by consolidating seven tools with 11 Datadog products. Security remains a key growth vector, supported by new features like agentless scanning.

AI Products

AI-native customers now account for 8.5% of ARR, up from 6% QoQ and 3.5% YoY. They drove 6 points of YoY revenue growth. Over 4,000 customers use AI-related integrations. LLM observability adoption has doubled in 6 months. Datadog's largest customer is AI-native, introducing concentration risk, though the base includes 10+ $1M+ AI customers.

Product Innovation

Database Monitoring and new LLM monitoring tools further expand platform coverage. Automation features like Bits AI support auto-remediation. Integration across logs, traces, and security is deepening.

Go-To-Market

Signed 11 $10M+ TCV deals in Q1, up from 1 YoY. Dollar value of new logos grew +70% YoY, despite flat count. Sales rep headcount rose 25% YoY, with enterprise reps up 30%+. International sales rep growth reached mid-30s% YoY. New reps ramp efficiently due to targeted GTM execution.

Customer Metrics

Total customers reached 30,500, up from ~28,000 YoY. 3,770 customers have $100K+ ARR, making up 88% of ARR. Usage deepened: 83% use 2+ products, 51% use 4+, 28% use 6+, 13% use 8+. New logo count remained flat, but average deal size rose +70% YoY.

Customer Wins

A U.S. automaker adopted 13 products in a 7-figure deal to unify hybrid observability. A Latin American bank replaced 3 tools with 6 Datadog products. A U.S. tech supplier replaced 7 tools, saving $1M+ annually, adopting 11 Datadog modules including Cloud SIEM. A health insurer expanded to 17 products, reducing MTTR to minutes. An insurtech returned with a 6-figure deal. A next-gen AI startup expanded with 5 Datadog products.

Acquisitions

Acquired Eppo (feature flags & experimentation) and Metaplane (data observability). Combined cost: $180M, with $110M in Q2 cash outflow. Revenue impact for FY25 expected to be minimal. Integration supports platform depth in product analytics and data quality.

Gross Margin

Gross margin declined to 80.3%, down -3pp YoY, due to cloud cost spikes and early-stage product scaling. Management is reallocating resources toward optimization and expects margins to stabilize within historical upper 70s to low 80s range.

Challenges & Macro

Despite macro uncertainty and tariff pressures, deal velocity and pipeline strength remained intact. Enterprise usage volatility was observed but not systemic. Customers now run tighter optimization cycles around renewals.

Outlook

Q2 revenue guidance: $787M–$791M (+22–23% YoY). FY25 revenue guidance: $3.215B–$3.235B (+20–21% YoY), raised by $40M. FY25 operating margin expected at 19–20%, lowered due to FX (+$15M), acquisitions (+$10M), and cloud costs. Capex remains 4–5% of revenue. Datadog sees long-term upside from cloud, digital, and AI transformation.

Management comments on the earnings call.

Product Innovations

Olivier Pomel, Co-Founder and Chief Executive Officer

"We are making progress on all of our AI initiatives, and you should expect more announcements in this area at DASH, our user conference, taking place in June."

"FlexLogs has achieved this milestone in six quarters, which is the fastest ramp we've seen to that level, and which echoes its value to customers, as well as the size of the log management market opportunity."

"Database monitoring has now been adopted by over 5,000 customers... and is growing 60% year over year."

"By adopting Flex Logs, our customers are adding new use cases at the right economics... and ultimately spend more on Datadog log management, as well as more on our overall platform."

Security Monitoring & SIEM

Olivier Pomel, Co-Founder and Chief Executive Officer

"Today, we are serving over 7,500 customers with our security products, or about a quarter of our total customer base. And over half of our Fortune 500 customers use our security products."

"Because we bring visibility to production workload, we are uniquely positioned to identify which vulnerabilities are most critical in production and break down silos between developers, DevOps, and security teams."

AI-Related Products

Olivier Pomel, Co-Founder and Chief Executive Officer

"We are seeing high growth in our AI cohort, as well as consistent and stable growth in the rest of the business."

"The number of companies using LLM Observability has more than doubled in the past six months."

"This moves a lot of the value from writing the code to observing it and understanding it in production environments, which is what we do."

"As customers move into production... there's more that we need to build both down the stack across the GPUs and up the stack across the agents."

David Obstler, Chief Financial Officer

"AI native customers contributed about six points of year over year revenue growth in Q1 versus about five points last quarter and about two points in the year ago quarter."

Customers

Olivier Pomel, Co-Founder and Chief Executive Officer

"We had a strong bookings quarter, with particularly strong execution in new logos and larger bookings."

"Our sales cycles haven’t been affected. Our pipelines are growing healthily."

"We welcome back an insurance tech customer... By returning to Datadog, they expect to benefit from Datadog ease of use and out of the box capabilities."

"One team estimated reductions in mean time to resolution from three to four hours, down to three to four minutes by using Datadog."

Acquisitions

Olivier Pomel, Co-Founder and Chief Executive Officer

"We acquired Eppo, a next generation feature management and experimentation platform... More broadly, we see automated experimentation as a key part of modern application development."

"We also acquired Metaplane, a data observability platform... We believe that [data quality and freshness] are now becoming key enablers of the creation of new enterprise AI workload."

"We're very excited to welcome both the Metaplane and the Eppo teams... we have a lot to build together."

David Obstler, Chief Financial Officer

"We estimate that the GAAP purchase price from our Q2 acquisition activity will be about $180 million of which we estimate about $110 million to be paid in cash during Q2."

Gross Margin Decline

David Obstler, Chief Financial Officer

"Our cloud hosting costs rose more quickly than we expected in Q1, as we supported large growth spikes from some of our largest customers."

"While we expect some of the cost to support customers to persist, we are also focused on executing projects to improve our cloud cost efficiency and expect to realize savings throughout the rest of the year."

"In Q1, we did lean into investment, and we also had a little more of a spiky pattern from our customers... We feel like we can do a better job in provisioning."

Olivier Pomel, Co-Founder and Chief Executive Officer

"We get a certain range of margin we're comfortable with. I would say last year we were very comfortable... now we're getting a little bit less comfortable... and so we're shifting some resources towards optimization."

Challenges

Olivier Pomel, Co-Founder and Chief Executive Officer

"When you have 15 different people changing the code at the same time, all of these different changes come together... you understand the way the different pieces interact. That’s where Datadog comes in."

"There is definitely some potential volatility [in AI-native revenue], and we want to be careful... We’ve seen that movie before."

David Obstler, Chief Financial Officer

"We've always said we have some volatility... in this case, we've looked at it and it's sort of volatility of usage, but not a broad trend."

Future Outlook

Olivier Pomel, Co-Founder and Chief Executive Officer

"We continue to believe digital transformation and cloud migration are long-term secular growth drivers of our business."

"Now, more than ever, we feel ideally positioned to help customers of every size and in every industry to transform, innovate, and drive value for technology adoption."

David Obstler, Chief Financial Officer

"Our implied guidance in the second half of 2025 is roughly unchanged... We continue to apply a 21% non-GAAP tax rate for 2025 and going forward."

"We are well positioned to help our existing and prospective clients with their cloud migration and digital transformation journeys."

Thoughts on Datadog Earnings Report $DDOG:

🟢 Positive

Revenue rose to $761.6M, up +24.6% YoY, beating estimates by 2.9%.

EPS (non-GAAP) was $0.57, beating by +35.7%.

Free Cash Flow Margin reached 32.1%, up +1.5pp YoY.

RPO climbed to $2.31B, up +33.5% YoY.

Signed 11 $10M+ TCV deals, up from 1 YoY.

New logo dollar value rose +70% YoY, signaling stronger enterprise land motion.

AI-native cohort now contributes 8.5% of ARR, up from 6% QoQ and 3.5% YoY.

Flex Logs hit $50M ARR in 6 quarters—fastest product ramp in company history.

Database Monitoring reached $50M ARR, growing +60% YoY.

Platform adoption deepened: 51% of customers use 4+ products, 13% use 8+.

Security suite now used by 7,500+ customers, including 50%+ of Fortune 500.

🟡 Neutral

Operating margin fell to 21.9%, down -5.0pp YoY, due to rising infrastructure costs.

Gross margin declined to 80.3%, down -2.9pp YoY.

Net margin came in at 3.2%, down -3.7pp YoY.

DBNR remained flat at 119% QoQ.

S&M/revenue held steady at 23.4% YoY.

R&D Index (RDI) slightly down to 0.86, from 0.91 YoY.

CAC payback period extended to 27.2 months, up +5.2 YoY.

Revenue guidance for FY25 raised by $40M, now $3.215B–$3.235B (+20–21% YoY).

Customer count increased by only +500 QoQ, now 30,500 (+8.9% YoY).

🔴 Negative

Gross margin pressure from spiky cloud workloads and early-stage product scaling.

Operating leverage reduced by increased investments and acquisition-related costs.

AI-native concentration risk: largest customer now from AI cohort, introducing volatility potential.

FY25 operating margin guide lowered to 19–20% due to FX (+$15M), M&A (+$10M), and infra costs.