CyberArk Q1 2025 Earnings Analysis

Dive into $CYBR CyberArk’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$317.6M rev (+43.3% YoY, +40.9% LQ) beat est by 4.1%

↗️GM* (84.6%, +0.7 PPs YoY)

↗️Operating Margin* (18.1%, +3.2 PPs YoY)

↘️FCF Margin (30.1%, -0.1 PPs YoY)🟡

↗️Net Margin (3.6%, +1.1 PPs YoY)

↗️EPS* $0.98 beat est by 25.6%🟢

*non-GAAP

Revenue By Type

Subscription

➡️$250.6M rev (+60.4% YoY, +61.7% LQ)

↘️Gross Margin (79.6%, -7.0 PPs YoY)

Maintenance and Professional Services

➡️$67.0M rev (+7.4% YoY, +2.5% LQ) 🟡

↘️Gross Margin (62.4%, -3.9 PPs YoY)

Key Metrics

➡️Billings $317M (+30.7% YoY)🟡

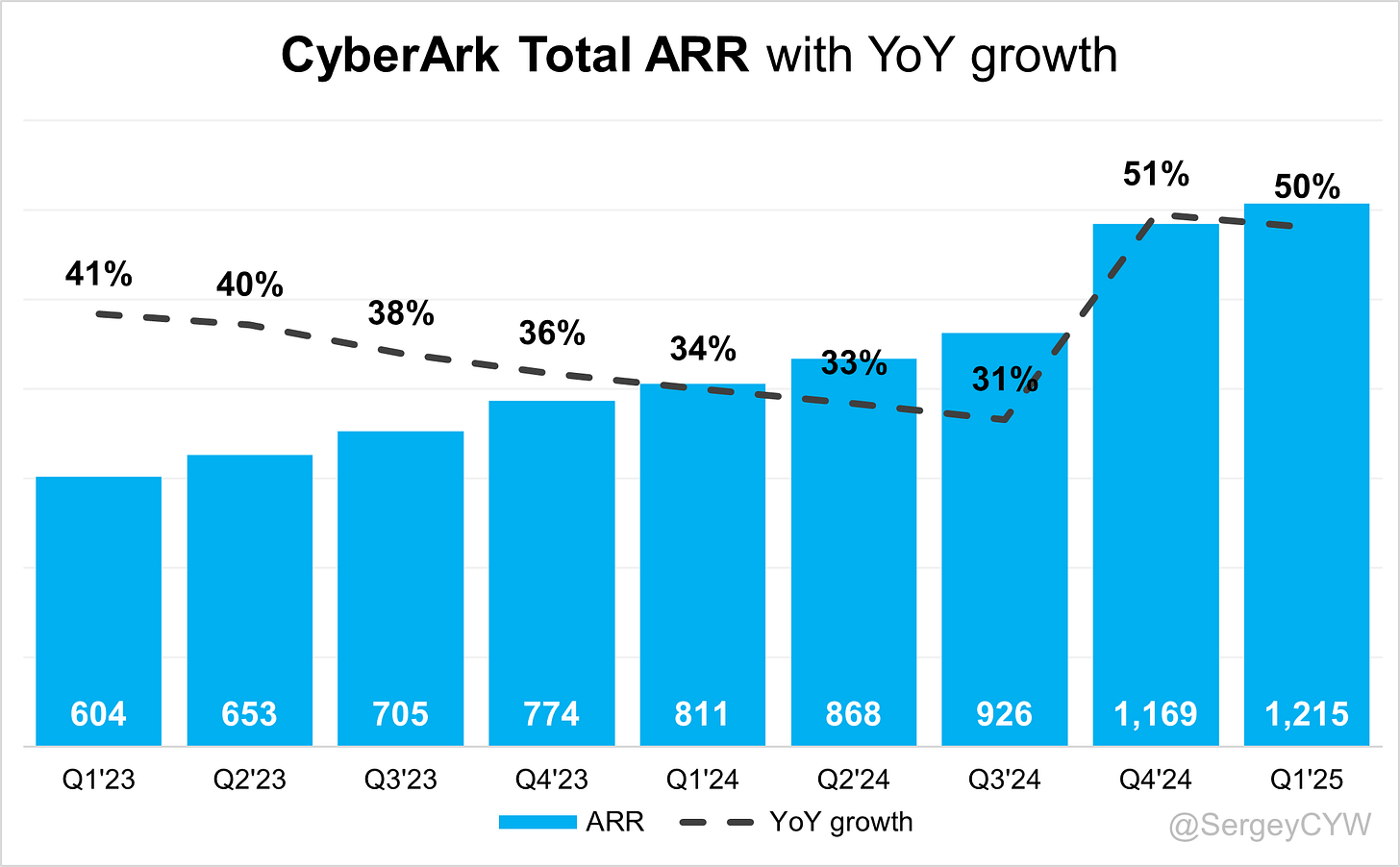

↗️ARR $1,215M (+49.8% YoY)

↗️Subscription ARR $1,028M (+65.5% YoY)

Operating expenses

↘️S&M*/Revenue 45.8% (-1.5 PPs YoY)

↗️R&D*/Revenue 24.7% (+0.4 PPs YoY)

↘️G&A*/Revenue 11.9% (-0.1 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $46M (+24.3% YoY)

↗️CAC* Payback Period 45.1 Months (+4.5 YoY)🟡

↗️R&D* Index (RDI) 1.65 (+0.49 YoY)🟢

Dilution

↗️SBC/rev 15%, +0.1 PPs QoQ

↗️Basic shares up 16.9% YoY, +2.7 PPs QoQ🔴

↗️Diluted shares up 7.3% YoY, +5.2 PPs QoQ🔴

Guidance

↗️Q2'25 $312.0 - $318.0M guide (+40.2% YoY) beat est by 1.4%

➡️$1,313.0 - $1,323.0M FY guide (+31.7% YoY) raised by 0.4% in line with est

Key points from CyberArk’s First Quarter 2025 Earnings Call:

Financial Performance

CyberArk delivered a strong Q1 2025, with total revenue of $317.6M, up +43.3% YoY and +40.9% sequentially, exceeding guidance by 4.1%. Annual Recurring Revenue (ARR) reached $1.215B, growing approximately +21% YoY, with $46M in net new ARR. $5M came from the Zilla Security acquisition.

Non-GAAP operating income was $57.5M, yielding an 18.1% margin (+3.2pp YoY). EPS reached $0.98, exceeding estimates by 25.6%. Free Cash Flow totaled $95.5M, with a 30.1% margin, despite increased headcount from Venafi and Zilla. CyberArk ended the quarter with $776M in cash after spending $165M on the Zilla acquisition.

FY25 guidance was raised to $1.313B–$1.323B in revenue (+32% YoY), $221M–$229M in non-GAAP operating income, and $3.73–$3.85 in EPS. Adjusted Free Cash Flow is projected at $300M–$310M, or 23% margin, net of $42M in IP tax and $15M in CapEx.

Privileged Access Management

PAM remains the foundation of CyberArk’s initial engagements, now increasingly embedded in multi-product deals. Customers are adopting Just-in-Time (JIT) and Zero Standing Privilege (ZSP) controls to manage risks.

PAM was central in large Q1 deals across software and financial services, where CyberArk was chosen for its unified platform over point solution competitors. Integration of PAM with policy automation, session management, and credential controls enhances platform value.

No new PAM modules were introduced in Q1, but continued architectural integration strengthens CyberArk’s competitive edge.

Identity Security

Identity Security is now a strategic imperative. CyberArk added ~200 new accounts in Q1, with 50% of new logos purchasing multiple products.

The platform secures human, machine, and AI identities with contextual privilege and lifecycle management. The company is expanding its control plane with growing demand for unified governance.

CISOs at RSA and Impact confirmed a shift toward consolidating identity tools under a unified architecture. Early wins replacing legacy IGA vendors validate this trend.

Endpoint Privilege Management

CyberArk expanded its EPM footprint through cloud-native deployments, securing SaaS admins, developers, and employees.

A notable Q1 use case involved a U.S. healthcare provider deploying EPM, Secure Workload Access, and Secrets Hub in a multi-solution expansion.

EPM adoption supports CyberArk’s strategy to enforce least privilege without hindering productivity. The challenge remains replacing fragmented legacy endpoint tools.

Cloud Security

CyberArk is gaining momentum in multicloud environments. Q1 featured strong adoption of Secure Workload Access, integrating identity-aware access and secrets management for VMs and containers.

Cloud modules were deployed by healthcare and developer-focused customers. Cloud-specific revenue wasn’t disclosed, but the success was reflected in the increase of multi-product deals.

CyberArk continues to address competition from legacy cloud access tools through native integrations and simplified onboarding.

DevOps Security

CyberArk’s DevOps solutions delivered strong results, led by Secrets Hub and its integration into modern CI/CD environments.

One U.S. enterprise closed a multi-6-figure expansion, adopting PAM, EPM, and Secrets Management to secure developer workflows.

Tighter integration between Secure Workload Access and Secrets Hub creates unique differentiation. The main challenge is driving awareness among DevOps teams still relying on open-source secrets management.

Machine Identity

Machine-to-human identity ratio increased to 80:1, up from 45:1 YoY, highlighting rapid growth.

Venafi was included in 9 of the top 10 Q1 deals, driving adoption of certificate lifecycle management and PKI.

CyberArk is capitalizing on the industry shift to 47-day certificate renewal mandates. Multiple 6-figure deals closed, including expansions in financial services and healthcare.

Secure Workload Access and Zero-Touch PKI further strengthened the machine identity portfolio. The challenge lies in large-scale operationalization across hybrid environments.

AI Agents

CyberArk introduced its Secure AI Agent Solution, with full rollout expected later in 2025. The platform applies privilege, lifecycle, and governance to AI identities.

The solution addresses both autonomous and human-directed agents. Early traction includes integration into Accenture’s AI Refinery, providing ready-to-use identity security for AI workflows.

CyberArk expects per-agent pricing to compress but overall deal sizes to grow with scale. Education remains a challenge, but the opportunity is long-term and material.

Product Innovation

New releases in Q1 included Zilla Provision and Comply modules, improving access reviews and provisioning speed.

Additional platform innovations included:

– Secure Workload Access

– Secure AI Agent Solution

– Certificate automation in response to lifecycle mandate

These strengthen CyberArk’s identity coverage across workforce, machines, and AI agents.

Platform Adoption

CyberArk’s platform motion accelerated. In Q1, 50% of new logos adopted multiple solutions. 9 of the top 10 deals were multi-product.

Average deal sizes grew YoY due to deeper product adoption and roadmap-based engagements.

A growing number of enterprises are aligning with CyberArk on three-year platform plans, replacing point solutions and fragmented identity tools.

Customer Wins

A U.S. enterprise software firm replaced a competing PAM vendor, adopting JIT, ZSP, and machine identity controls in a multi-6-figure deal.

A healthcare company expanded with Secure Workload Access, EPM, and Secrets Hub.

A Fortune 100 financial firm deployed Venafi for certificates and PKI.

PDS Health, a long-term customer, adopted Zero-Touch PKI.

A financial services firm replaced a legacy IGA vendor with Zilla, marking early success for the acquisition.

Cross-Sell Execution

Venafi and Zilla integrations are driving platform expansion. Pipeline is growing across regions, supported by certified partners.

A multi-6-figure IGA win with Zilla in Q1 demonstrated product-market fit and early traction.

CyberArk is successfully deepening wallet share in existing accounts while accelerating cross-sell into newer logos.

Competitive Landscape

Despite broader identity messaging at RSA, CyberArk remains differentiated with its unified platform spanning PAM, EPM, IGA, Secrets, and Machine Identity.

CSOs are prioritizing tool consolidation. CyberArk’s architecture supports that shift, while most competitors still offer single-function tools.

No signs of elevated pricing pressure or competitive erosion were observed in Q1.

Challenges

While Q1 performance was strong, FY25 guidance reflects macro conservatism due to tariff risk, BEAT tax (estimated at $17M–$20M), and general budget caution.

Management emphasized resilience in security spend but took a measured approach to outlook.

Outlook

CyberArk expects ARR to reach $1.41B–$1.42B by year-end, driven by continued cross-sell, machine identity scale, and early AI adoption.

With subscription ARR near 85%, operating leverage and free cash flow expansion are expected to remain strong.

CyberArk sees a long runway ahead as identity, cloud, and AI converge into a unified security architecture.

Management comments on the earnings call.

Product Innovations

Matt Cohen, Chief Executive Officer

“At Impact, we introduced new solutions and capabilities across human, machine, and AI identities.”

“We announced the availability of Zilla Provision and Comply modules. Since we closed the acquisition, customer feedback has been overwhelmingly positive, especially around how CyberArk and Zilla simplify access reviews and automate provisioning across modern environments.”

“We also launched our Secure Workload Access solution, which combines modern workload identity management with our secrets management capabilities to protect all non-human identities that matter.”

Matt Cohen, Chief Executive Officer

“To address the security challenges of AI agents, we introduced our Secure AI Agent solution, which integrates our platform capabilities with AI-specific discovery and context, privilege controls, policy automation, lifecycle management, and governance.”

Machine Identity

Matt Cohen, Chief Executive Officer

“When it comes to machine identities, a year ago, you heard us talk about a 45 to one ratio of machine to human identities. Today, it’s over 80, and that number is still rising rapidly.”

“Without an identity-first approach to securing machines, organizations leave a massive blind spot in their defenses.”

“The Certification Authority Browser Forum recently voted to reduce certificate lifespans from 398 days to just 47 days. This is driving strong urgency, and we’re seeing more traffic to our booth from this topic than any other at RSA.”

Erica Smith, Chief Financial Officer

“Venafi and secrets were included in nine of our top ten deals. We are executing on the cross-sell synergies, and pipeline continues to build.”

AI Agents

Matt Cohen, Chief Executive Officer

“AI agents are machine identities that act like or on behalf of humans, proliferating at machine scale, getting access to and granting privileges over critical infrastructure.”

“As we dive deeper into agentic approaches, it’s increasingly understood that securing AI agents is an identity security problem, not a data problem.”

“We partnered with Accenture, integrating our identity security platform with their AI Refinery to ensure secure adoption of emerging AI technologies at exponential scale.”

Competitors

Matt Cohen, Chief Executive Officer

“You see a lot of identity messaging across booths at RSA, but when you ask what use case they're solving, it’s often a narrow one.”

“Identity security can’t be solved in small increments. CSOs don’t need more tools; they need a platform that consolidates human and machine identity. We’re the only one in the market able to do that effectively.”

“We haven’t seen anyone growing in competitiveness at the moment. Our positioning remains consistent with prior years.”

Customers

Matt Cohen, Chief Executive Officer

“There’s not one customer conversation I have today that isn’t multi-product or multi-solution based. Even customers who start with one solution are working with us on a broader roadmap.”

“At Impact, I met with customers who’ve been with us for years—especially in financial services—who are now excited about the platform evolution and are asking how to migrate to it.”

Erica Smith, Chief Financial Officer

“In the first quarter, we signed about 200 new logos. Approximately half of new customers purchased two or more solutions at land.”

Platform Adoption

Matt Cohen, Chief Executive Officer

“Platform consolidation is now the core of every customer discussion. We talk about three-year roadmaps centered on architecture and long-term value, not just solving immediate needs.”

“Nine out of our top ten deals in Q1 were multi-solution, which speaks to how customers are adopting more of the platform over time.”

International Growth

Erica Smith, Chief Financial Officer

“We had strong organic and inorganic revenue growth across the platform in all regions. Particularly in EMEA, we saw healthy overall growth and stronger-than-expected demand for Venafi.”

Matt Cohen, Chief Executive Officer

“I got notes this morning about high attendance in our machine identity sessions at the European Impact events, which shows growing international momentum.”

Challenges

Erica Smith, Chief Financial Officer

“Our Q1 results were strong and pipeline remains solid, but given macro volatility and headlines around tariffs, we’ve taken a more prudent approach to full-year guidance.”

Matt Cohen, Chief Executive Officer

“When I talk to auto OEMs in Germany or manufacturers in the U.S., they’re worried about tariffs and macro trends. But once the conversation shifts to cybersecurity and identity, the concern fades—because it’s still a top priority.”

Future Outlook

Matt Cohen, Chief Executive Officer

“The Identity Security imperative is accelerating. Organizations must respond to an expanding threat landscape, and CyberArk is uniquely positioned to lead with our unified platform.”

“We’re executing with discipline and confidence. Our teams are differentiated, and we’re set up to deliver strong growth and durable profitability.”

Erica Smith, Chief Financial Officer

“We’re raising our full-year guidance. The strong execution and demand for our platform give us confidence in our ability to deliver sustained ARR growth, free cash flow, and margin expansion.”

Thoughts on CyberArk Earnings Report $CYBR:

🟢 Positive

Revenue rose to $317.6M, up +43.3% YoY, beating estimates by 4.1%

EPS (non-GAAP) was $0.98, exceeding estimates by +25.6%

ARR reached $1.215B (+49.8% YoY); Subscription ARR hit $1.028B (+65.5% YoY)

Operating Margin (non-GAAP) expanded to 18.1%, up +3.2pp YoY

R&D Index rose to 1.65, up +0.49 YoY

200 new customers added; 50% adopted multiple solutions

9 of top 10 deals were multi-product; platform adoption accelerating

Secure AI Agent Solution and Secure Workload Access introduced

Venafi included in 9 of top 10 deals; machine identity business scaling rapidly

FY25 revenue guidance raised to $1.313B–$1.323B (+32% YoY); EPS guidance raised to $3.73–$3.85

Billings grew +30.7% YoY to $317M

🟡 Neutral

Free Cash Flow margin held at 30.1%, down slightly -0.1pp YoY

Gross margin for subscription fell to 79.6%, down -7.0pp YoY

CAC Payback extended to 45.1 months, up +4.5 months YoY

Maintenance and services revenue grew +7.4% YoY, slower than subscriptions

S&M/revenue declined to 45.8%, improving efficiency

G&A/revenue flat at 11.9%, minimal change

🔴 Negative

Diluted shares rose +7.3% YoY; Basic shares up +16.9% YoY

SBC/revenue increased to 15%, up +0.1pp QoQ

Macro guidance remains cautious; BEAT tax impact estimated at $17M–$20M

Gross margin in professional services dropped -3.9pp YoY to 62.4%

No new standalone PAM modules launched in Q1 despite strong performance in category

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on Savvy Trader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.