CrowdStrike Q4 2024 Earnings Analysis

Dive into $CRWD CrowdStrike’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$1,059M rev (+25.2% YoY, +28.5% LQ) beat est by 2.5%

↘️GM* (77.9%, -0.3 PPs YoY)🟡

↘️Operating Margin* (20.5%, -4.7 PPs YoY)🟡

↘️FCF Margin (22.7%, -10.8 PPs YoY)🟡

↘️Net Margin (-8.7%, -15.1 PPs YoY)🟡

↗️EPS* $1.03 beat est by 21.2%

*non-GAAP

Revenue By Segments

Subscription

↗️Subscription Revenue $1,008M (+26.7% YoY)

↗️GM* (80.2%, +0.0 PPs YoY)

Professional Services

➡️Professional Services Revenue $50M (+1.6% YoY)🟡

↘️GM* (31.6%, -14.1 PPs YoY)

Key Metrics

↘️DBNR Net Retention Rate 112% (115% LQ)

➡️DBGR Gross Retention Rate 97% (97% LQ)

➡️ARR $4.24B (+23.5% YoY, +224 net new ARR)🟡

↗️RPO $6.50B (+41.3% YoY)

➡️Billings $1,591M (+17.3% YoY)🟡

Customer Engagement with Multiple Modules

↗️% of customers using 5+ Modules (67%, 66% LQ)

↗️% of customers using 6+ Modules (48%, 47% LQ)

↗️% of customers using 7+ Modules (32%, 31% LQ)

↗️% of customers using 7+ Modules (21%, 20% LQ)

Regional Breakdown

↘️United States $714.4M rev (+24.4% YoY, 67% of Rev)

↗️Europe, Middle East, and Africa $168.4M rev (+27.3% YoY, 16% of Rev)

↘️Asia Pacific $107.9M rev (+24.6% YoY, 10% of Rev)

↗️Other $67.8M rev (+30.6% YoY, 6% of Rev)

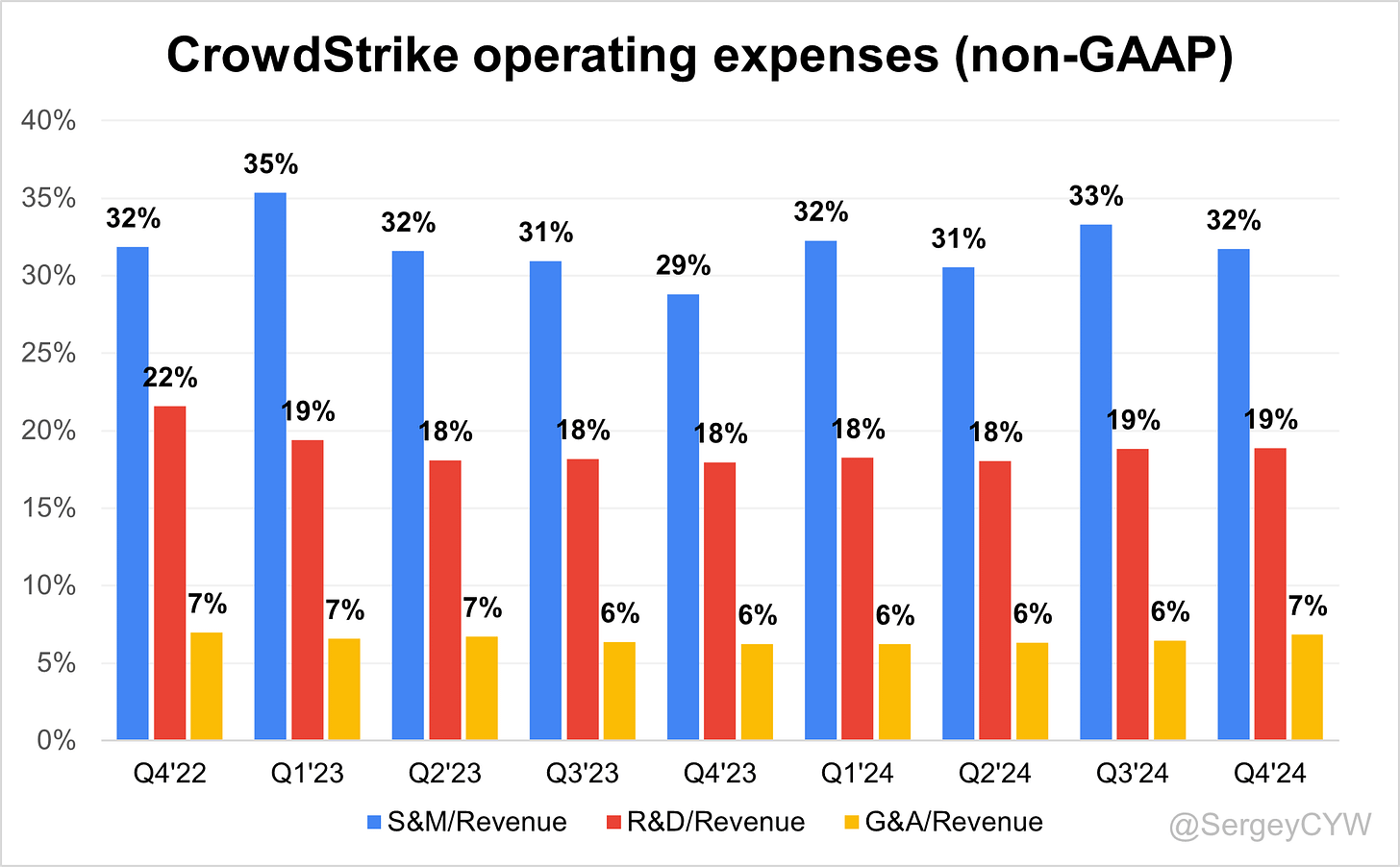

Operating expenses

↗️S&M*/Revenue 31.7% (+2.9 PPs YoY)

↗️R&D*/Revenue 18.9% (+0.9 PPs YoY)

↗️G&A*/Revenue 6.8% (+0.6 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $224M (-20.5% YoY)

↗️CAC* Payback Period 23.1 Months (+9.8 YoY)🟡

↘️R&D* Index (RDI) 1.37 (-0.31 YoY)🟡

Dilution

↗️SBC/rev 26%, +5.1 PPs QoQ

↘️Basic shares up 2.5% YoY, -0.1 PPs QoQ

↗️Diluted shares up 2.2% YoY, +1.4 PPs QoQ

Guidance

➡️Q1'25$1,100.6 - $1,106.4M guide (+19.8% YoY) in line with est

➡️$4,743.5 - $4,805.5M FY guide (+20.8% YoY) in line with est

Key points from CrowdStrike’s Fourth Quarter 2024 Earnings Call:

Financial Performance

CrowdStrike closed Q4 FY 2025 with $224 million in net new ARR, surpassing expectations. Ending ARR reached $4.24 billion, reflecting 23% YoY growth. Q4 free cash flow was $240 million, contributing to a record $1.07 billion in annual free cash flow, 27% of revenue. Gross retention remained high at 97%, showing strong customer loyalty.

Total Contract Value (TCV) hit $6 billion, up 40% YoY. Subscription revenue exceeded $1 billion in Q4, growing 27% YoY. FY 2025 operating income was $837.7 million, 21% of revenue. Non-GAAP net income reached $987.6 million, or $3.93 per diluted share, up 31% YoY.

FY 2026 guidance projects $4.74-$4.8 billion in revenue, 20%-22% YoY growth. Non-GAAP operating margin is expected to improve in H2 FY 2026, with free cash flow margin forecasted to exceed 30% by FY 2027.

July 19 Incident & Customer Commitment Program

The Customer Commitment Program (CCP), introduced after the July 19 incident, provided $80 million in ARR value in FY 2025, including $56 million in Q4. While concerns arose about its financial impact, the effect on revenue was minimal and led to increased module adoption.

With CCP concluded, CrowdStrike expects ARR reacceleration in H2 FY 2026, as contracts renew at full value without discounts. Management foresees a positive impact on operating margin and free cash flow.

Charlotte AI

Charlotte AI is automating SOC operations, cutting incident triage time from 20-30 minutes to 10-15 seconds. Customer adoption is strong, with Level 1 analysts achieving Level 3 proficiency. Senior analysts are also increasing usage, leveraging advanced prompts for deeper insights.

Charlotte AI is fully integrated into Falcon’s ecosystem, enhancing incident resolution, threat detection, and security automation. As AI adoption grows, Charlotte AI is expected to drive platform stickiness and competitive differentiation.

Falcon Flex

Falcon Flex simplifies multi-module adoption, enabling customers to commit to long-term spending while flexibly adding security modules. In Q4 FY 2025, Falcon Flex contributed $1 billion in new deal value, growing 80% QoQ, reaching $2.5 billion in cumulative contracts, a 10x YoY increase.

Customers deploying 9+ modules on average. A major transportation company consolidated three vendors under Falcon Flex, increasing ARR by 67%. Over 60% of Falcon Flex deal value has already been deployed, accelerating ARR growth and product adoption.

Falcon Cloud Security

ARR surpassed $600 million, growing 45% YoY, fueled by demand for runtime protection and AI-native cloud security. Enterprises are consolidating cloud security spending, favoring Falcon Cloud Security over multi-vendor approaches.

A global financial services firm signed an eight-figure Falcon Flex deal, replacing a network security vendor’s multi-cloud security offering. CrowdStrike expects continued growth in FY 2026, focusing on expanding next-gen cloud security capabilities.

Falcon Identity Protection

ARR exceeded $370 million, driven by increasing identity-based threats—now 79% of all breaches, up from 40% in 2019. The Adaptive Shield acquisition, now rebranded as Falcon Shield, strengthens on-prem, SaaS, and cloud identity protection.

Early adoption is strong, with Falcon Flex customers requesting immediate access. A state university hospital system replaced a competitor’s identity security solution in a seven-figure deal, citing lower false positives and improved analytics.

Next-Gen SIEM

ARR reached $330 million, growing 115% YoY, making it the fastest-growing CrowdStrike segment. A major U.S. airline replaced IBM QRadar SIEM with Falcon Next-Gen SIEM in a seven-figure deal, citing ease of use, faster deployment, and AI-driven automation.

GSIs such as Accenture, Deloitte, and Wipro are scaling Falcon SIEM practices, contributing to $1 billion in annual partner-driven sales, up 40% YoY. Next-Gen SIEM is expected to become a core growth driver, replacing costly, outdated legacy SIEMs.

Exposure Management Expansion

CrowdStrike is disrupting vulnerability management, integrating AI-driven risk prioritization and attack surface management. Falcon Exposure Management has a line of sight to $300 million in ARR, with early wins from a global shipping firm, a radio network, and a healthcare provider in Asia-Pacific.

Customers are attaching Exposure Management to Falcon Flex contracts, accelerating adoption and cross-sell opportunities.

Marketplace & Partner Success

CrowdStrike surpassed $1 billion in AWS Marketplace sales in one year, up from $1 billion lifetime sales in October 2023. Google Cloud Marketplace sales exceeded $150 million in its first year.

The GSI partner business neared $1 billion, growing 40% YoY, as Accenture, Deloitte, Infosys, and others expanded Falcon services. MSSP partnerships contributed 15% of new business, increasing SMB penetration.

Customer Growth & Large Deals

The customer base grew 30% YoY, exceeding 74,000 organizations. Q4 saw record deal activity, including 20+ deals above $10 million, 350+ above $1 million, and 2,300+ above $100,000.

A global financial firm replaced a legacy network security vendor’s cloud solution in an eight-figure Falcon Flex deal.

A major U.S. airline replaced IBM QRadar SIEM with Falcon Next-Gen SIEM.

A state university hospital secured independent budget to deploy Falcon Identity, citing lower false positives.

A transportation firm consolidated three security vendors, increasing ARR by 67%.

DBNRR Decline & Revenue Normalization

Dollar-Based Net Retention Rate (DBNRR) declined to 112%, impacted by longer contract durations, Falcon Flex adoption, and CCP-related pricing adjustments. Despite short-term effects, higher module adoption and renewals should stabilize DBNRR in FY 2026.

Net new ARR declined 1% YoY in Q4, adjusting for $56 million in CCP ARR. Gross retention remains strong at 97%, showing minimal customer churn.

Challenges & Strategic Investments

CrowdStrike is balancing growth investments with profitability, prioritizing AI automation, cloud security, and platform resiliency. H1 FY 2026 margins may be impacted, but expansion is expected in H2 FY 2026 and FY 2027.

Future Outlook

Management reaffirmed its $10 billion ARR target by FY 2031. Net new ARR reacceleration in H2 FY 2026 will drive growth into FY 2027, with 23% non-GAAP operating margins and 30%+ free cash flow margins projected.

Strong AI-driven cybersecurity adoption, expanding cloud security, and deepening enterprise consolidation trends position CrowdStrike for long-term category leadership.

Management comments on the earnings call.

Product Innovations

George Kurtz, Chief Executive Officer and Founder

"Our innovation engine enables us to be a consolidating force for secure AI. Seven modules are each now individually over $300 million in ending ARR, demonstrating the power of our innovation in driving record adoption and Falcon’s multi-act platform opportunity that continues to drive growth."

Burt Podbere, Chief Financial Officer

"Our investments in AI are driving significant internal efficiencies, enabling our teams to focus on high-value activities across the business. By automating the hours of manual work involved in these tasks, we can deliver new efficiencies in the business while continuing to execute on growth initiatives."

AI Leadership

George Kurtz, Chief Executive Officer and Founder

"AI experimentation is just starting to evolve into AI outcomes. Businesses and governments across the globe are looking for their AI investment to yield both improved efficiencies and novel outputs. At our company, we're requiring every team and function to leverage the power of AI. We expect these investments to play critical top- and bottom-line roles on our path to $10 billion in ARR."

"Winning the AI war requires the very best data and a battle-tested innovation engine. The democratization of destruction—AI in the hands of more adversaries—intensifies the market need for our solutions. No one else has the dataset we’ve curated, making our data liquid gold for creating new, agentic models for continuously improving protection."

Charlotte AI: AI-Driven Security Automation

George Kurtz, Chief Executive Officer and Founder

"Charlotte AI has been very useful for our customers. It does summarization of activity on hosts and users in 10 to 15 seconds, which would have taken analysts 20 to 30 minutes to do manually. This is transforming how SOC teams operate, allowing analysts to focus on higher-value security tasks."

"We initially built Charlotte AI for Level 1 analysts, but interestingly, we are seeing that Level 3 analysts are using it even more because they understand how to prompt it effectively and extract deeper insights."

Falcon Flex: Enabling Faster Security Adoption

George Kurtz, Chief Executive Officer and Founder

"Falcon Flex was born out of customer demand, wanting to consolidate more with us and create a flexible way to procure more modules. It opens the entire product catalog up to our customers, enabling them to adopt new modules seamlessly without going through a procurement cycle."

"The success of Falcon Flex is evident—customers are adopting more than nine modules on average, and total deal value has grown 10 times year over year. This model deeply resonates with customers as well as our ecosystem partners."

Falcon Cloud Security: Leading in AI-Powered Cloud Security

George Kurtz, Chief Executive Officer and Founder

"Cloud security has never been more important. The market for cloud security is rapidly consolidating, with customers looking for an integrated end-to-end platform where the sum of the parts is greater than the individual pieces. This is the promise on which Falcon Cloud Security delivers."

Competitive Advantage

George Kurtz, Chief Executive Officer and Founder

"We are cybersecurity’s AI-native agentic platform that stops the breach. Our greatest asset is our role as the creator of cybersecurity’s richest data. Falcon is purpose-built to win the AI war with market-leading protection."

"Customers who previously relied on next-gen EDR vendors found their solutions insufficient in real-world threat environments. We saw an uptick in incident response engagements in Q4, where organizations using a competitor’s technology were breached, and we stepped in to remediate."

Customer Success & Large Wins

George Kurtz, Chief Executive Officer and Founder

"Businesses are speaking with their wallets, investing in our solutions to secure their futures today. We closed new records in every total deal value segment—20+ deals greater than $10 million, 350+ deals greater than $1 million, and over 2,300 deals greater than $100,000—all in Q4."

"We continue to see strong platform adoption across industries. A major U.S. airline replaced its legacy QRadar SIEM with Falcon Next-Gen SIEM, citing ease of use, incident workbench capabilities, and superior threat intelligence."

Strategic Partnerships & Marketplace Success

George Kurtz, Chief Executive Officer and Founder

"We were the first cybersecurity ISV to cross $1 billion in deal value on AWS Marketplace in a single calendar year, setting a new standard for ecosystem execution. Customers are increasingly using cloud marketplaces to simplify security procurement, and we are leading the charge."

"Our GSI business is nearing the billion-dollar milestone, growing north of 40% year over year. Leading GSIs like Accenture, Deloitte, HCL, and Infosys are investing in their Falcon Services practices, and we expect to see continued growth from these partnerships."

Challenges & Market Headwinds

Burt Podbere, Chief Financial Officer

"While we are seeing strong demand, we recognize that certain macroeconomic factors and budget constraints impact customer buying cycles. That said, our visibility is improving, and we expect net new ARR reacceleration in the second half of FY 2026 as we scale our go-to-market efforts."

"We are making strategic investments in key areas of the business, including AI-driven automation, cloud security, and platform resiliency. These investments will impact near-term margins, but we remain confident in our long-term profitability targets."

Impact of July 19th Incident & Customer Commitment Program

Burt Podbere, Chief Financial Officer

"Our customer commitment program was a proactive measure that not only strengthened our relationships with impacted customers but also resulted in significant platform adoption. Customers who engaged in these programs are now consuming more modules and are ahead of schedule in their demand plans."

"As we exit this program, we expect a positive impact on net new ARR reacceleration as customers renew at full value, one-time discounts drop off, and contracts are upsized and extended."

Future Outlook & Long-Term Growth

George Kurtz, Chief Executive Officer and Founder

"We are on track to reach our long-term goal of $10 billion in ARR by FY 2031. AI and automation will be foundational to the next wave of cybersecurity, and we are well-positioned as the category leader in AI-native security."

"In our AI-evolving world, cybersecurity will be an increasingly essential ingredient for life in the AI era. Now, more than ever, the world needs our company to stop breaches and protect the data that drives modern enterprises."

Burt Podbere, Chief Financial Officer

"We expect operating margin and free cash flow margin expansion in the second half of FY 2026, setting the foundation for further acceleration in FY 2027. We remain focused on delivering a 23% non-GAAP operating margin in FY 2027 as we quickly ramp to our target model by fiscal 2029."

Thoughts on CrowdStrike Earnings Report $CRWD:

🟢 Positive

Revenue: $1.06B (+25.2% YoY, +28.5% QoQ), beat estimates by 2.5%

Subscription Revenue: $1.01B (+26.7% YoY)

RPO: $6.50B (+41.3% YoY)

EPS: $1.03, beat estimates by 21.2%

Customer Growth: +30% YoY, 74,000+ organizations

Falcon Flex: $1B in new deal value, +80% QoQ, $2.5B cumulative contracts, +10x YoY

Falcon Cloud Security: $600M ARR, +45% YoY

Falcon Identity Protection: $370M ARR, +79% of breaches identity-based

Next-Gen SIEM: $330M ARR, +115% YoY (fastest-growing segment)

AWS Marketplace Sales: $1B in one year, Google Cloud Marketplace: $150M in first year

Global System Integrators (GSIs): Near $1B in annual sales, +40% YoY

Net New ARR Expected to Reaccelerate in H2 FY 2026 as CCP renewals return to full pricing

Targeting $10B ARR by FY 2031, with 23% non-GAAP operating margin and 30%+ free cash flow margins in FY 2027

🟡 Neutral

Gross Margin: 77.9% (slightly down -0.3 PPs YoY)

Operating Margin: 20.5% (-4.7 PPs YoY)

Free Cash Flow Margin: 22.7% (-10.8 PPs YoY)

Net New ARR: $224M, -20.5% YoY

Dollar-Based Net Retention Rate (DBNRR): 112% (down from 115% QoQ)

Billings: $1.59B (+17.3% YoY)

Customer Commitment Program (CCP): Contributed $80M ARR, impact minimal but led to higher Falcon Flex adoption

FY 2026 Guidance: $4.74B - $4.8B revenue (+20%-22% YoY), in line with estimates

🔴 Negative

Net Margin: -8.7%, -15.1 PPs YoY

S&M Expenses: 31.7% of revenue, +2.9 PPs YoY

R&D Expenses: 18.9% of revenue, +0.9 PPs YoY

Stock-Based Compensation (SBC): 26% of revenue, +5.1 PPs QoQ

CAC Payback Period: 23.1 months, +9.8 months YoY

Professional Services GM: 31.6%, -14.1 PPs YoY

Dilution: Basic shares up 2.5% YoY, Diluted shares up 2.2% YoY