Financial Results:

↗️$845M rev (+32.6% YoY, +35.3% LQ) beat est by 0.7%

↗️GM* (78.2%, +2.8%pp YoY)

↗️Operating Margin* (25.2%, +10.2%pp YoY)

↗️FCF Margin (33.5%, +0.6%pp YoY)

↗️EPS* $0.95 beat est by 15.9%🟢

*non-GAAP

Key Metrics

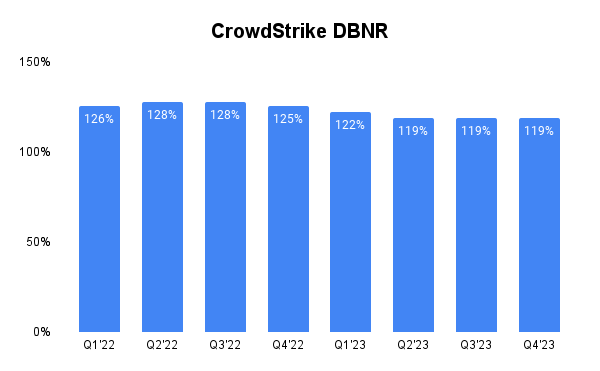

➡️DBNR 119% (119% LQ)

↗️ARR $3.44B (+34.2% YoY, +282 net new ARR)🟢

↗️RPO $4.60B (+36.6% YoY)🟢

↗️Billings $1,356M (+38.8% YoY)🟢

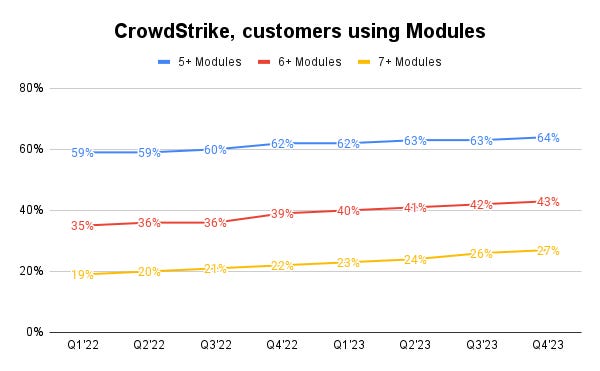

Customer Engagement with Multiple Modules

↗️% of customers using 5+ Modules (64%, 63% LQ)

↗️% of customers using 6+ Modules (43%, 42% LQ)

↗️% of customers using 7+ Modules (27%, 26% LQ)

Operating expenses

↘️S&M*/Revenue 28.8% (30.9% LQ)

↘️R&D*/Revenue 18.0% (18.2% LQ)

↘️G&A*/Revenue 6.2% (6.4% LQ)

↗️Net New ARR $282M ($223 LQ)

↘️CAC* Payback Period 13.3 Months (16.0 LQ)

Dilution

↗️SBC/rev 21%, +0.5%pp QoQ

↗️Dilution at 2.5% YoY, +0.1%pp QoQ

Guidance

↗️Q1'24 $905.8M guide (+30.8% YoY) beat est by 0.7%

↗️$3,989M FY guide (+30.5% YoY) beat est by 1.2%

Key points from CrowdStrike Fourth Quarter 2023 Earnings Call:

Record Performance:

CrowdStrike reported outstanding Q4 results, surpassing expectations with record metrics, including a net new Annual Recurring Revenue (ARR) of $282 million, an operating margin of 25%, and a free cash flow representing 33% of revenue. The company saw substantial platform adoption, with over 250 deals exceeding $1 million in value. Deals incorporating eight or more modules more than doubled year-over-year, signaling a trend towards consolidation and deeper engagement with CrowdStrike's solutions.

Strategic Focus:

The company prioritizes a unified-platform, single-agent approach in cybersecurity. This strategy simplifies vendor consolidation, enhancing the efficiency and effectiveness of cyber defense.

Product Innovations:

CrowdStrike has broadened its product range beyond endpoint protection, witnessing significant growth in cloud security, identity protection, and next-generation SIEM solutions, all of which are quickly gaining customer traction. Noteworthy advancements in its Falcon platform include new AI capabilities, Falcon for IT, and Charlotte AI, accompanied by the flexible Falcon Flex licensing model.

Strategic Acquisitions:

The purchase of Flow Security is emphasized as a key move to bolster CrowdStrike's cloud security capabilities, especially in cloud data runtime security.

Competitive Advantage with Charlotte AI:

CrowdStrike's AI-native platform and extensive cyber threat dataset grant a significant competitive advantage, enabling predictive capabilities and advanced threat prevention. The company's AI-driven cybersecurity approach, underpinned by a vast threat data collection, powers effective and accurate AI models for predicting and preventing attacks. The introduction of Charlotte AI to the Falcon platform aims to further bolster cybersecurity operations through automation and the application of generative AI.

Falcon Cybersecurity Platform:

Falcon is presented as the sole platform offering single-agent technology that caters to a broad spectrum of cybersecurity and IT needs, marking it as the simplest and quickest deployment option. Its integrated approach facilitates seamless vendor consolidation, leading to enhanced outcomes and substantial Total Cost of Ownership (TCO) savings for clients.

Market Dynamics:

CrowdStrike focuses on delivering unmatched value through its integrated platform rather than competing solely on price. Despite a challenging macroeconomic environment, the company has maintained stable pricing, leveraging its value proposition to attract and retain clients, underscoring the significance of TCO over upfront costs.

Customer Feedback:

Clients have expressed high satisfaction with CrowdStrike's platform, praising its deployment ease, comprehensive coverage, and the advantages of consolidating multiple cybersecurity tools into one solution. Feedback has been overwhelmingly positive, with many keen on deploying the Falcon platform and adopting additional modules for their ease of use, superior outcomes, and lower TCO. CrowdStrike has reported record deal volumes, indicating strong demand and adoption across various sectors. Partnerships, including those with Dell and Pax8, have contributed to its growth and expansion to a wider customer base.

Future Outlook:

CrowdStrike plans to accelerate its hiring in FY 2025, focusing on innovation and go-to-market strategies to scale the business towards achieving a $10 billion ARR goal in the next five to seven years.

Management comments on the earnings call.

Product Innovations and AI

"Building on my founding vision, CrowdStrike is the only single platform, single agent technology in cybersecurity that solves use cases well beyond endpoint protection." - George Kurtz

"Our single platform is open. Our single platform is data-centric, AI native, and scalable, delivering immediate times of value." - George Kurtz

"Embedded in the Falcon platform is a virtuous data cycle where we collect cybersecurity's very best threat intelligence data, build and train robust preventative and generative models, and protect CrowdStrike customers with community immunity." - George Kurtz

"We're incredibly excited to announce that Falcon for IT and Charlotte AI are generally available. Our customers are also excited about the GenAI productivity gains from Charlotte AI." - George Kurtz

Competitors

"Unified by our focused mission, we stop breaches. My gratitude to all CrowdStrikers on a job well done. Our execution and discipline across the business, coupled with overwhelmingly positive market feedback, gives me strong conviction in our fiscal year 2025 momentum." - George Kurtz

"Leaving stitched together point products and PowerPoint platforms behind, CrowdStrike customers realize the benefits of superior outcomes and lower TCO." - George Kurtz

"In stark juxtaposition, what CrowdStrike customers tell us is that, when you build the right single data-centric AI platform, deliver the right frictionless native solution, and architect the right go-to-market organizations purchase because they need more, receive more, and understand how cybersecurity transformation saves them time and money." - George Kurtz

Customers

"Falcon replaced an OS security vendor, a legacy AV vendor, and a next-gen vendor. We eliminated multiple Microsoft consoles and multiple agents to a single console, single agent, and single platform of Falcon." - George Kurtz

"Our application of GenAI makes cybersecurity predictive and accessible for all skill levels. It's all on one platform, one agent, and one integrated workflow." - George Kurtz

"A global financial services giant replaced their Palo Alto Prisma Cloud products in a large seven-figure deal. The Palo Alto cloud security products required separate management consoles and separate agents because cloud security is on a separate Palo Alto platform altogether." - George Kurtz

Revenue Growth and Future Expectations

"Our achievements in fiscal year 2024 represent another high watermark for CrowdStrike. Through our consistent focus on execution, we have efficiently scaled the business, growing ending ARR by over 10 times from our IPO in fiscal year 2019." - Burt Podbere

Thoughts on CrowdStrike ER $CRWD :

🟢 Pros:

+ Revenue rose by +32.6% YoY.

+ RPO, total calculated billings, and ARR are growing faster than revenue.

+ Record Net New ARR added (+282M, +28% YoY).

+ Customers are using more modules (5+, 6+, and 7+ modules +1pp QoQ).

+ Use of 8+ modules more than doubled.

+ DBNR stabilizing at 119%.

+ Company increasing margins and profitability.

+ Beat Q4 revenue guidance by 0.6%.

+ FY guidance for 30.5% revenue growth.

+ Next Q guidance for 7.2% QoQ revenue growth.

+ Purchase of Flow Security to improve capabilities in cloud data runtime security.

+ Advancements in its Falcon platform include new AI capabilities, Falcon for IT, and Charlotte AI, accompanied by the flexible Falcon Flex.

🟡 Neutral:

+- SBC/rev at 20.9%, dilution at 2.5% YoY.