CrowdStrike Q3 2024 Earnings Analysis

Dive into $CRWD CrowdStrike’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$1,010M rev (+28.5% YoY, +31.8% LQ) beat est by 2.8%

↗️GM* (77.9%, +0.1 PPs YoY)

↘️Operating Margin* (19.3%, -3.1 PPs YoY)🟡

↘️FCF Margin (22.8%, -7.6 PPs YoY)🟡

↘️Net Margin (-1.7%, -5.1 PPs YoY)🟡

↗️EPS* $0.93 beat est by 14.8%

*non-GAAP

Key Metrics

↘️DBNR 115% (120% LQ)

➡️ARR $4.02B (+27.4% YoY, +153 net new ARR)🟡

↗️RPO $5.40B (+45.9% YoY)🟢

↗️Billings $1,113M (+35.4% YoY)🟢

Customer Engagement with Multiple Modules

↗️% of customers using 5+ Modules (66%, 65% LQ)

↗️% of customers using 6+ Modules (47%, 45% LQ)

↗️% of customers using 7+ Modules (31%, 29% LQ)

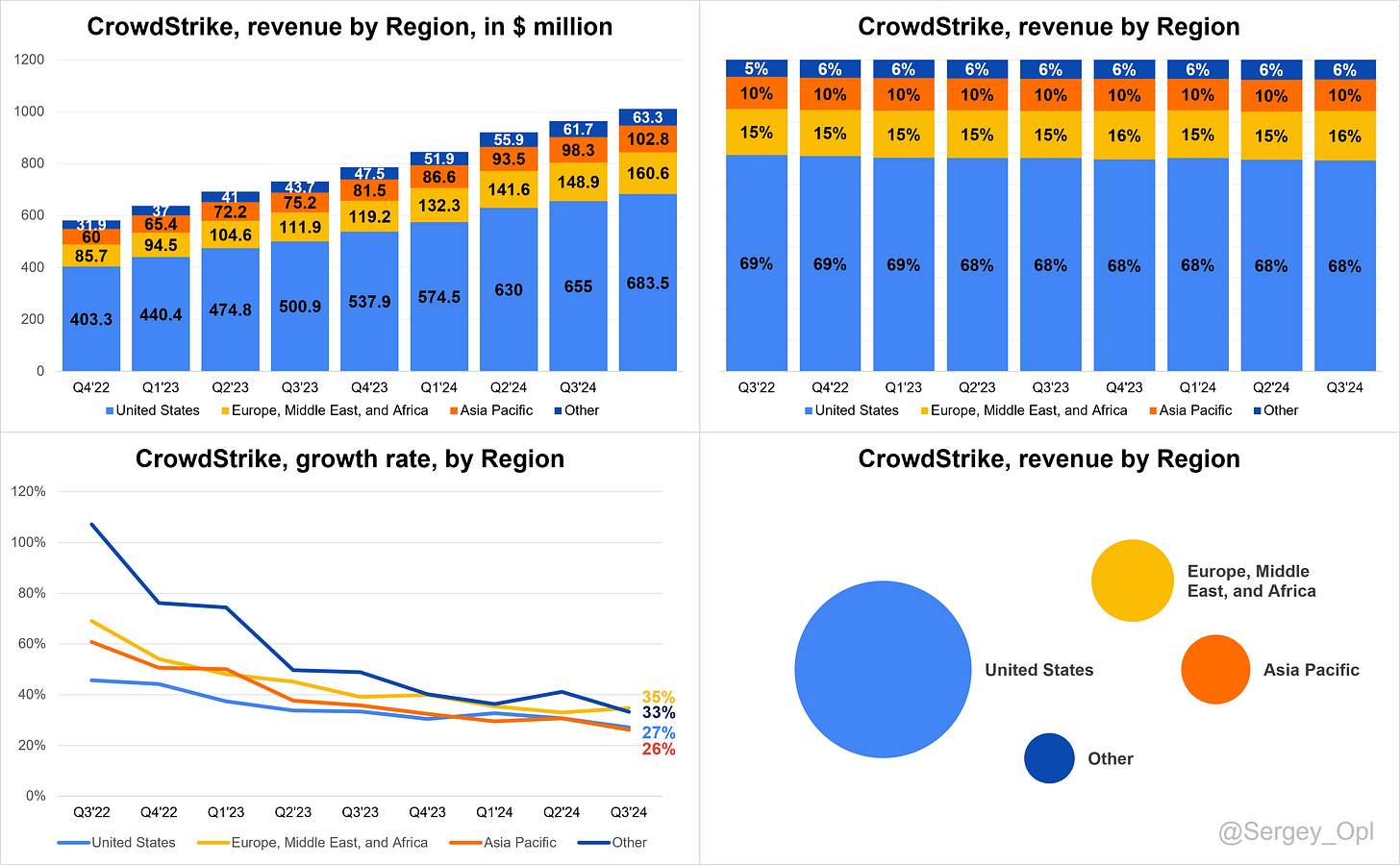

Regional Breakdown

↘️United States $683.5M rev (+27.1% YoY, 68% of Rev)

↗️Europe, Middle East, and Africa $160.6M rev (+34.7% YoY, 16% of Rev)

↘️Asia Pacific $102.8M rev (+26.1% YoY, 10% of Rev)

↗️Other $63.3M rev (+33.3% YoY, 6% of Rev)

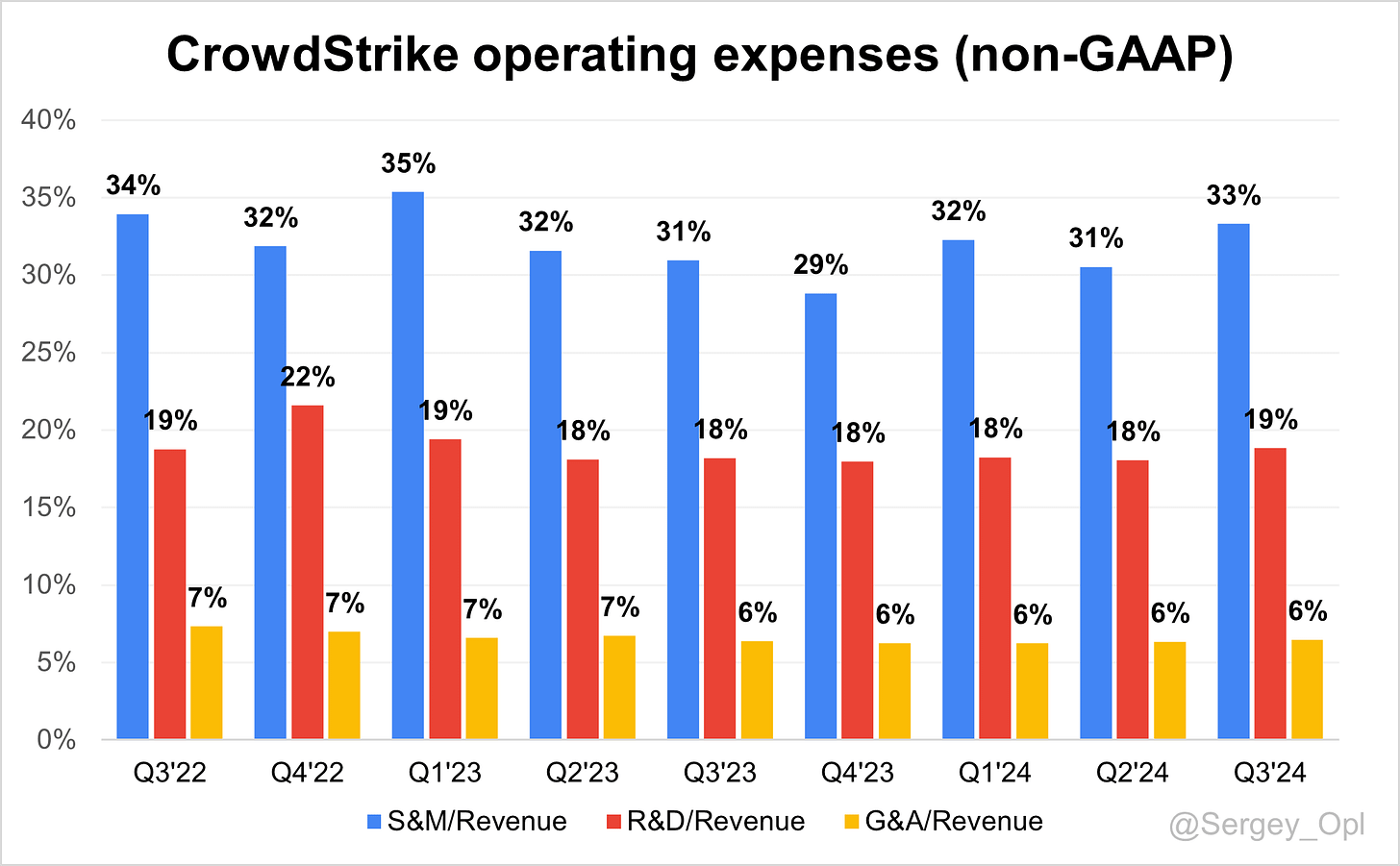

Operating expenses

↗️S&M*/Revenue 33.3% (+2.3 PPs YoY)

↗️R&D*/Revenue 18.8% (+0.6 PPs YoY)

↗️G&A*/Revenue 6.5% (+0.1 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $153M (-31.4% YoY)

↗️CAC* Payback Period 29.4 Months (+13.4 YoY)🟡

↘️R&D* Index (RDI) 1.48 (-0.46 YoY)🟡

Dilution

↘️SBC/rev 21%, -0.2 PPs QoQ

↗️Basic shares up 2.6% YoY, +0.1 PPs QoQ

↘️Diluted shares up 0.7% YoY, -3.1 PPs QoQ🟢

Guidance

➡️Q4'24 $1,028.7 - $1,035.4M guide (+22.1% YoY) in line with est

↗️$3,923.8 - $3,930.5M FY guide (+28.5% YoY) raised by 0.7% beat est by 0.7%

Key points from CrowdStrike’s Third Quarter 2024 Earnings Call:

Financial Performance

CrowdStrike achieved significant milestones in Q3 FY25, with ARR surpassing $4 billion, reflecting 27% YoY growth. Total revenue exceeded $1 billion for the first time, driven by subscription revenue of $962.7 million, up 31% YoY. Free cash flow was $231 million, representing 23% of revenue, and contributing to a "rule of 51" on a free cash flow basis.

Gross margin remained stable at 78%, while non-GAAP operating margin stood at 19%, leading to non-GAAP net income of $234.3 million ($0.93 per diluted share). Operating expenses increased to $591.7 million from $436.1 million in the prior year due to strategic investments in R&D and customer support.

Impact of July 19th Incident

The July 19th incident caused $25 million in ARR headwinds, due to extended sales cycles, which were 15% longer YoY, and customer commitment packages (CCPs). ARR also saw $26 million in contraction, linked to transferability rights exercised by a federal distributor.

Despite these impacts, over half of the delayed deals were closed by quarter-end. The company's transparent and proactive response transformed the disruption into a trust-building opportunity, maintaining strong customer relationships.

Product Innovations

CrowdStrike introduced advanced AI-powered solutions and expanded its platform integration. Falcon Cloud Security added runtime protection and integrated Adaptive Shield, solidifying its position as the only platform delivering end-to-end cloud security across code, data, SaaS, and runtime environments.

Charlotte AI

Charlotte AI automated detection triage and operational workflows, achieving triple-digit growth in Q3. Efficiency gains included reducing situational report generation time from four days to one hour. Leveraging Threat Graph and curated threat data, Charlotte AI set new standards for proactive and autonomous security outcomes.

Falcon Flex

Falcon Flex closed 150+ deals, representing $600 million+ in deal value, enabling rapid platform adoption. Customers using Flex adopted an average of nine modules, with some reaching 14 modules, and spent significantly more than traditional contracts.

The model's flexibility allowed seamless integration of new modules like Adaptive Shield, creating larger contract sizes and driving long-term ARR growth. The incident temporarily lengthened sales cycles but did not deter Falcon Flex’s momentum.

Falcon Cloud Security

Falcon Cloud Security secured multiple eight-figure deals, including with a Fortune 50 retailer and a unicorn AI company. Customers highlighted its comprehensive coverage, operational efficiency, and ability to address AI-related risks. Enhanced by Adaptive Shield, Falcon Cloud Security delivered unmatched runtime protection across multi-cloud and hybrid cloud estates.

Falcon Identity Protection

Falcon Identity Protection expanded its coverage to include Microsoft Entra ID and integrated Adaptive Shield for SaaS Security Posture Management (SSPM). A Fortune 500 travel customer replaced legacy systems with CrowdStrike's platform, showcasing its ability to secure complex identity landscapes.

Challenges remain in converting organizations reliant on entrenched legacy systems, but increasing integration across Falcon modules is driving adoption.

Next-Gen SIEM

Next-Gen SIEM grew net new ARR by 150% YoY, reaching multi-hundred-million-dollar scale. The platform differentiated itself with unmatched speed, scalability, and cost efficiency, supplemented by AI-powered features like parsers and alert triage.

An eight-figure deal with a Fortune 500 manufacturer replaced a hyperscaler SIEM and multiple legacy solutions, reducing inefficiencies and solidifying CrowdStrike's leadership in the next-gen SIEM market.

Acquisition

The acquisition of Adaptive Shield enhanced the Falcon platform with SSPM capabilities, expanding its cloud and identity security coverage. Adaptive Shield complements previous acquisitions like Bionic and Flow, reinforcing CrowdStrike’s leadership in comprehensive cybersecurity.

Customer Engagement

CrowdStrike’s gross retention rate remained high at 97%, with 20% of subscription customers using eight or more modules. The company generated significant pipeline momentum through events like Falcon and Falcon Europe, demonstrating its commitment to customer engagement and innovation.

The July 19th incident tested customer loyalty but became an opportunity for CrowdStrike to demonstrate resilience and transparency. Customers recognized the company’s swift response and reinforced their trust through larger investments, as evidenced by strong dollar-based net retention rates (DBNRR) of 115%. The company successfully converted temporary disruption into deeper customer relationships.

Customer Success Stories

Healthcare: A national healthcare provider signed an eight-figure, seven-year deal, leveraging Falcon Complete, identity protection, and next-gen SIEM.

Retail: A Fortune 50 retailer adopted Falcon Cloud Security, improving multi-cloud efficiency and reducing alert fatigue.

Mid-Market: Corporate sales for SMBs had the best quarter ever, driven by competitive takeouts through Falcon Flex.

Large Customer Wins

A Fortune 500 travel leader expanded its investment by $15 million, adopting six additional modules through Falcon Flex.

A unicorn AI company added Falcon Cloud Security modules, consolidating multiple vendors in an eight-figure expansion deal.

A Fortune 500 manufacturer replaced a hyperscaler SIEM with CrowdStrike’s next-gen SIEM, securing an eight-figure contract.

Customer Commitment Packages

CCPs contributed to retaining and expanding customer relationships, with 66% of customers adopting at least five modules. CCP-related deals focused on adding modules rather than extending time, enhancing customer trust and platform stickiness.

Market Expansion

Strategic partnerships with Fortinet and AWS fueled growth. 70% of new subscription revenue came from partner-sourced deals. Deal registrations rebounded significantly post-incident.

Challenges

Extended sales cycles and CCP deployments created $30 million in ARR and subscription revenue impact for Q4. Limited visibility into customer behavior added uncertainty.

Future Outlook

CrowdStrike targets $10 billion ARR by FY2031 and 34-38% free cash flow margins by FY2029. Q4 FY25 revenue guidance is $1.03-$1.035 billion (+22% YoY), with non-GAAP EPS projected at $0.84-$0.86. Full-year FY25 revenue is expected to grow 28-29% YoY to $3.93 billion, with EPS of $3.74-$3.76.

Management comments on the earnings call.

Product Innovations

George Kurtz, Chief Executive Officer and Founder

“Our platform continues to lead the way with advanced AI-powered solutions, delivering end-to-end cloud security from code to runtime. By integrating Adaptive Shield into Falcon Cloud Security, we’ve solidified our position as the only provider addressing code, data, SaaS, and runtime security holistically.”

Charlotte AI

George Kurtz, Chief Executive Officer and Founder

“Charlotte AI represents a new frontier in proactive and autonomous security. By automating workflows, it reduces situational report times from four days to one hour, setting new standards for efficiency and operational excellence.”

Falcon Flex

Bert Podbere, Chief Financial Officer

“Falcon Flex has been a game-changer, enabling rapid platform adoption through its flexible licensing model. With over 150 deals closed in Q3, representing more than $600 million in total value, it’s driving long-term ARR growth and delivering unmatched flexibility to customers.”

Platform Adoption

George Kurtz, Chief Executive Officer and Founder

“Our customers are adopting more modules at a faster pace than ever before. This quarter, 20% of our customers adopted eight or more modules, reinforcing the stickiness and value of our platform for their security needs.”

Customers

George Kurtz, Chief Executive Officer and Founder

“Our transparent response to the July 19th incident turned a potential challenge into a trust-building opportunity. Customers have recognized our commitment to delivering the best outcomes, resulting in strong retention rates and larger investments in our platform.”

International Growth

George Kurtz, Chief Executive Officer and Founder

“Our international presence continues to expand, supported by key partnerships and events like Falcon Europe. Partner-sourced deals accounted for 70% of our new subscription revenue, underscoring the strength of our global ecosystem.”

Challenges

Bert Podbere, Chief Financial Officer

“While we faced headwinds from extended sales cycles and customer commitment packages, our ability to close over half of delayed deals by the end of the quarter highlights the resilience of our execution and the trust our customers place in us.”

Future Outlook

George Kurtz, Chief Executive Officer and Founder

“We remain focused on achieving $10 billion in ARR by FY2031. With an emphasis on innovation, platform adoption, and global expansion, we’re well-positioned to deliver long-term growth while driving value for our customers and stakeholders.”

Thoughts on CrowdStrike ER CRWD :

🟢 Pros:

Revenue rose by +28.5% YoY. If the company beats guidance in Q4 by 2.6%, as it did this quarter, revenue growth for Q4 will be 25.7%, indicating a deceleration in growth.

Billings and RPO increased by +35.4% and +45.9%, respectively, both outpacing revenue growth and accelerating compared to the previous quarter.

More customers are using additional modules, with adoption of 6+ and 7+ modules growing by +2pp QoQ.

Usage of 8+ modules reached 20% of subscription customers.

The company raised its FY revenue forecast by 0.7%.

Beat Q3 revenue guidance by 2.6%, marking the largest beat in the last two years.

Management noted that over half deals delayed from Q2 were closed in Q3.

🟡 Neutral:

ARR grew by +27.4%, below revenue growth.

Net New ARR added was weak at +153M (-31% YoY), impacted by the July 19 incident.

DBNR came in at 115%, down from approximately 120% earlier, temporarily impacted by the incident but reflecting customers' continued commitment to CrowdStrike. Gross retention remained strong at 97%, slightly down <0.5pp.

Non-GAAP gross margin remained flat YoY but declined compared to the previous quarter.

Operating margin declined YoY as the company increased S&M expenses to 33.3% of revenue.

Net margin turned negative due to July 19 incident-related costs of $33,922K. Without these costs, net margin would have been positive.

SBC/revenue was at 20.7%. Diluted shares increased by +0.7% YoY.