CrowdStrike: Expanding Leadership in Cybersecurity with $116B+ Market Opportunity

Deep Dive into $CRWD: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

CrowdStrike: Company overview

About CrowdStrike

CrowdStrike, is a U.S.-based cybersecurity company founded in 2011 and headquartered in Austin, Texas. It specializes in endpoint security, threat intelligence, and cyberattack response through its cloud-native Falcon platform. The company went public in June 2019 at an IPO price of $34.00. For fiscal year 2025, CrowdStrike reported $3.95 billion in revenue and employed 10,118 people. It serves over 23,000 enterprise customers across 176 countries, including 65% of Fortune 500 companies. CrowdStrike has been involved in major investigations such as the 2014 Sony Pictures hack and the 2015–16 Democratic National Committee cyberattacks.

Mission and Vision

The company's mission is to stop breaches and deliver advanced cybersecurity solutions globally. It invests heavily in innovation, with $460.7 million allocated to R&D in FY 2024. CrowdStrike promotes a cloud-native approach, a customer-first culture, and ethical cybersecurity practices.

Industry Position

CrowdStrike holds a strong position in the endpoint protection market, consistently ranked in the Gartner Magic Quadrant. It has a 12.4% share of the endpoint security market and 5.9% in cloud security. The Falcon platform processes over 1.8 trillion signals daily, maintaining 99.8% threat detection accuracy and sub-250 millisecond response times.

Competitive Advantage

The company’s core advantage is its cloud-native, single-agent architecture, which enables deployment of 28 interoperable modules without additional integration or system reboot. The Falcon Flex licensing model has generated over $500 million in deal value within three quarters. High adoption continues, with a 95% year-over-year increase in deals involving eight or more modules in Q1.

Total Addressable Market (TAM)

CrowdStrike's total addressable market (TAM) has increased fivefold since its IPO, reaching $116 billion in 2025, up from $76 billion. The company expects TAM to grow to $225–250 billion by 2028–2029, implying a CAGR of 21–22.8%. Key drivers of this expansion include the organic growth of the cybersecurity industry and CrowdStrike’s expansion into adjacent markets.

Newer offerings, such as cloud security, identity protection, SIEM, and Charlotte AI, already contribute $850 million or 28% of recurring revenue, with triple-digit growth rates. Management targets $10 billion in annual revenue by FY2031, a figure supported by current market share and momentum. The company's entry into high-growth categories like SIEM, data protection, and security automation provides a long runway for future expansion.

Valuation

$CRWD is trading at a Forward EV/Sales multiple of 18.2, close to the median of 18.5. After the July 19 incident, both the stock price and valuation multiple declined significantly. However, at the beginning of 2025, the valuation fully recovered to its 2024 peak, as the market had priced in that the impact of the incident was behind the company. This assumption proved incorrect, and following the Q4 earnings report, the stock saw a substantial correction.

It’s also worth noting that CrowdStrike has historically traded at a premium, supported by high valuation multiples.

$CRWD CrowdStrike trades at a Forward P/E of 106.5, with revenue growth of +25% YoY in the last quarter.

The EPS growth forecast for 2026 is 26.2%, with a P/E of 81.8 and a PEG ratio of 3.1.

The EPS growth forecast for 2027 is 14.5%, with a P/E of 64.8 and a PEG ratio of 4.4.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts' revenue growth forecast for $CRWD in 2025 is +23%. Considering this forecast, CrowdStrike is trading at a premium based on the P/S multiple, which appears fair when compared to other companies in the cybersecurity sector. Whether the current high premium is justified will be explored below.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Economic Moats enable companies to remain stable during crises and support long-term revenue growth.

Economies of Scale

CrowdStrike benefits from strong economies of scale through its cloud-native architecture. The Security Cloud processes over 6 trillion events per week and stores more than 15 petabytes of data. With over 23,000 enterprise customers, fixed costs are spread efficiently across a large base. The platform offers a lower Total Cost of Ownership (TCO) compared to competitors by consolidating cybersecurity functions into a unified solution, reducing both software spend and operational overhead. As new customers and modules are added, incremental costs remain minimal relative to revenue, contributing to margin expansion and improving unit economics over time.

Network Effect

CrowdStrike’s network effect is one of the most powerful in cybersecurity. Its cloud-scale AI leverages crowdsourced threat data from its global customer base to improve real-time protection across the entire platform. The Threat Graph makes over 150 million indicator-of-attack decisions per minute and stops more than 75,000 breaches annually. When a threat is detected in one environment, all customers benefit instantly. With each new customer, platform utility increases, reinforcing a self-reinforcing security loop. This network effect is significant and scales with growth, creating a durable competitive advantage.

Brand Advantage

CrowdStrike is a recognized leader in endpoint protection, serving 65% of Fortune 500 companies. Despite a major outage in July 2024 that impacted 8.5 million Windows devices, the company retained its client base, underlining its brand resilience. CrowdStrike maintains leadership positions in industry benchmarks, including Gartner’s Magic Quadrant. The Falcon platform is often a default inclusion in enterprise RFPs, especially for cloud-native security solutions. The brand moat is moderate to strong, though competitive pressure in the sector remains high.

Intellectual Property

CrowdStrike’s technological foundation is protected by a growing intellectual property portfolio. The company holds numerous patents, with new ones granted as recently as June 2024, covering key areas like AI-driven threat detection and endpoint protection. The Falcon platform and Threat Graph are proprietary assets that differentiate the company from competitors. Backed by a robust R&D investment of $460.7 million in FY 2024, the IP advantage is solid, though the fast-moving nature of cybersecurity reduces the longevity of technical advantages.

Switching Costs

CrowdStrike’s unified architecture and modular platform design create high switching costs. Customers use an average of nearly five modules, and 21% of customers deploy eight or more. Migrating away would require replacing multiple integrated systems, retraining staff, and absorbing significant downtime and cost. The platform’s impact is reflected in a 98% gross retention rate and 125.3% net retention rate, indicating both low churn and strong expansion. These switching costs represent one of CrowdStrike’s most defensible moat characteristics, locking in long-term customer value.

CrowdStrike’s economic moat combines economies of scale, network effects, brand strength, intellectual property, and high switching costs, securing its position in the cybersecurity market and supporting long-term growth.

Revenue growth

$CRWD's revenue growth slowed to 25% YoY, impacted by the July 19 incident, down from 32% YoY in Q2 2024. However, the company exceeded its Q4 forecast by 2.2%. If it delivers a similar beat in Q1, revenue growth would reach 22.8%, indicating further deceleration.

ARR growth slowed to 23.5% YoY, falling below revenue growth. RPO growth, on the other hand, was significantly stronger at +41.3% YoY. Billings growth decelerated to 17.3% YoY, coming in below revenue growth.

Segments and Main Products.

CrowdStrike operates through two primary segments: Subscription and Professional Services. The Subscription segment includes global cloud-based endpoint protection and threat intelligence services sold on a recurring basis. Professional Services provides consulting and training to help customers implement, manage, and optimize their security operations.

Falcon Platform

CrowdStrike’s flagship Falcon platform is a cloud-native, single-agent architecture delivering real-time detection and automated protection. It combines enriched telemetry and threat intelligence with behavioral analysis to identify and stop breaches efficiently. Falcon enables rapid deployment, low overhead, and immediate time-to-value across global infrastructures.

Falcon Endpoint Security

Falcon Endpoint Security protects endpoints—laptops, desktops, and servers—using unified next-generation antivirus, endpoint detection and response (EDR), IT hygiene, threat hunting, and intelligence. This all-in-one agent approach delivers continuous and comprehensive breach prevention.

Falcon Cloud Security

Falcon Cloud Security offers a cloud-native application protection platform (CNAPP). It includes breach prevention, workload protection, and cloud security posture management (CSPM). The solution integrates both agent-based and agentless protection across all major cloud providers and operating systems.

Falcon Exposure Management

CrowdStrike’s Falcon Exposure Management delivers advanced vulnerability assessment, including Network Vulnerability Assessment. This solution is displacing legacy systems at scale and is on track to contribute $300 million in annual recurring revenue.

Falcon Identity Protection

Identity Protection secures access controls and user identities to prevent risks from credential-based attacks and insider threats. Recent enhancements include support for Microsoft Entra ID, broadening its protection capabilities in enterprise environments.

Charlotte AI

Launched in 2023, Charlotte AI is a conversational AI assistant embedded in Falcon. It enables security analysts to perform tasks up to 75% faster, saving an average of 2 hours daily. It uses natural language processing to enhance workflow automation and accessibility for all skill levels.

Next-Gen SIEM

Introduced in 2025, CrowdStrike’s Next-Gen SIEM modernizes security information and event management. Built with cloud-native architecture and AI, it enables real-time detection, petabyte-scale investigations, and high-speed threat hunting. CrowdStrike also established a Services Partner Program to support enterprise migrations from legacy SIEM systems to this platform.

Main Products Performance in the Last Quarter

$CRWD Revenue by Segment: 95% of the company’s revenue comes from Subscription, while 5% is from Professional Services.

Subscription revenue growth slowed to +27% YoY in Q4, with the gross margin remaining high at 80.2%.

Professional Services showed signs of recovery, growing +2% YoY after a decline in Q3 2024, although the gross margin decreased to 32%.

Falcon Platform Performance

Falcon remains CrowdStrike’s primary growth engine. The company ended FY25 with $4.24B in ARR, driven by $224M in net new ARR during Q4, surpassing expectations. Gross retention was 97%, while 67% of customers now use five or more modules. The Falcon Flex subscription model is increasing deal sizes and accelerating deployment. In Q4, CrowdStrike added over $1B in new Falcon Flex account value, bringing total deal value to $2.5B, up 80% QoQ and 10x YoY. Major wins included a global financial firm, a university hospital system, and a transportation company that replaced multiple vendors, boosting ARR by 67%.

Charlotte AI Adoption

Charlotte AI, launched in 2023, is scaling rapidly. It was included in over 100 Q4 deals and is now a core tool in AI-native SOC operations. One financial firm reduced task time from 20–30 minutes to 10–15 seconds using Charlotte. High usage among senior analysts underscores its effectiveness. Charlotte is increasingly bundled into Falcon Flex, improving upsell efficiency.

Next-Gen SIEM Momentum

CrowdStrike’s Next-Gen SIEM surpassed $330M in ARR, growing 115% YoY. Adoption is broad, including a major U.S. airline replacing legacy AV and QRadar systems. The platform is now integral to Falcon and a strategic priority for global system integrators (GSIs), contributing to 40% YoY GSI business growth, approaching $1B. Partners like Accenture and Deloitte are scaling Falcon practices.

Product Innovation

Exposure Management is a standout product, with visibility toward $300M in ARR, enabled by full-stack attack surface monitoring. New capabilities include network-based scanning, replacing legacy tools with CrowdStrike’s single-agent solution.

The Falcon Shield product, rebranded from Adaptive Shield, was added to rate cards within 20 days and is seeing early demand, though Q4 ARR impact remains minimal.

CrowdStrike Financial Services (CFS) closed $140M in FY25 deals, enabling longer-term, larger contracts.

Marketplace Growth

CrowdStrike reported over $1B in AWS Marketplace sales in 2024, up from $1B cumulative a year earlier. Revenue from Google Cloud Marketplace reached $150M in its first year.

AI and Automation Efficiency

Internal AI tools saved employees over one full workday per month, equating to 24,000+ work weeks annually.

Charlotte AI cuts alert fatigue by using 50% fewer compute resources, enabling 2x faster threat detection.

Autonomous agents handle triage, response, and analysis, powered by NVIDIA’s Llama Nemotron models, improving detection accuracy and reducing false positives.

Falcon and NVIDIA’s accelerated computing deliver real-time defense against 51-second breakout attacks.

FedRAMP High Authorization

Falcon achieved FedRAMP High Authorization, extending access to federal agencies and critical infrastructure. The platform covers 26 authorized offerings, including endpoint, cloud, identity, SIEM, and data protection, and meets NIST SP 800-53 Rev 5 standards.

Network Vulnerability Assessment Expansion

Falcon now supports real-time, agentless scanning of network devices. It eliminates the need for hardware scanners and replaces legacy tools with AI-prioritized risk scoring based on real-world attacker behavior.

Critical vulnerabilities are reduced by up to 98%, and Falcon Fusion SOAR automates remediation. Customers can scan up to 10% of assets free.

Partner Ecosystem Growth

CrowdStrike launched a Services Partner Program to support Falcon Next-Gen SIEM adoption. It offers training, certification, and deployment incentives for GSIs, MSPs, and MSSPs. Early participants include Deloitte and Wipro, helping clients modernize security operations through AI-driven, real-time detection and response. The program aims to accelerate Falcon adoption and deliver measurable security outcomes.

Revenue by Region

The United States accounts for 67% of total revenue, making it CrowdStrike’s largest market, with revenue growing +24% YoY in Q4.

The EMEA region contributes 16% of total revenue and is growing at +27% YoY.

The APAC region contributes 10%, with a growth rate of +25% YoY.

Revenue from Other regions makes up 6% of total revenue and is growing at +31% YoY.

Revenue growth in EMEA, APAC, and Other regions is outpacing the company's overall revenue growth rate.

Market Leader

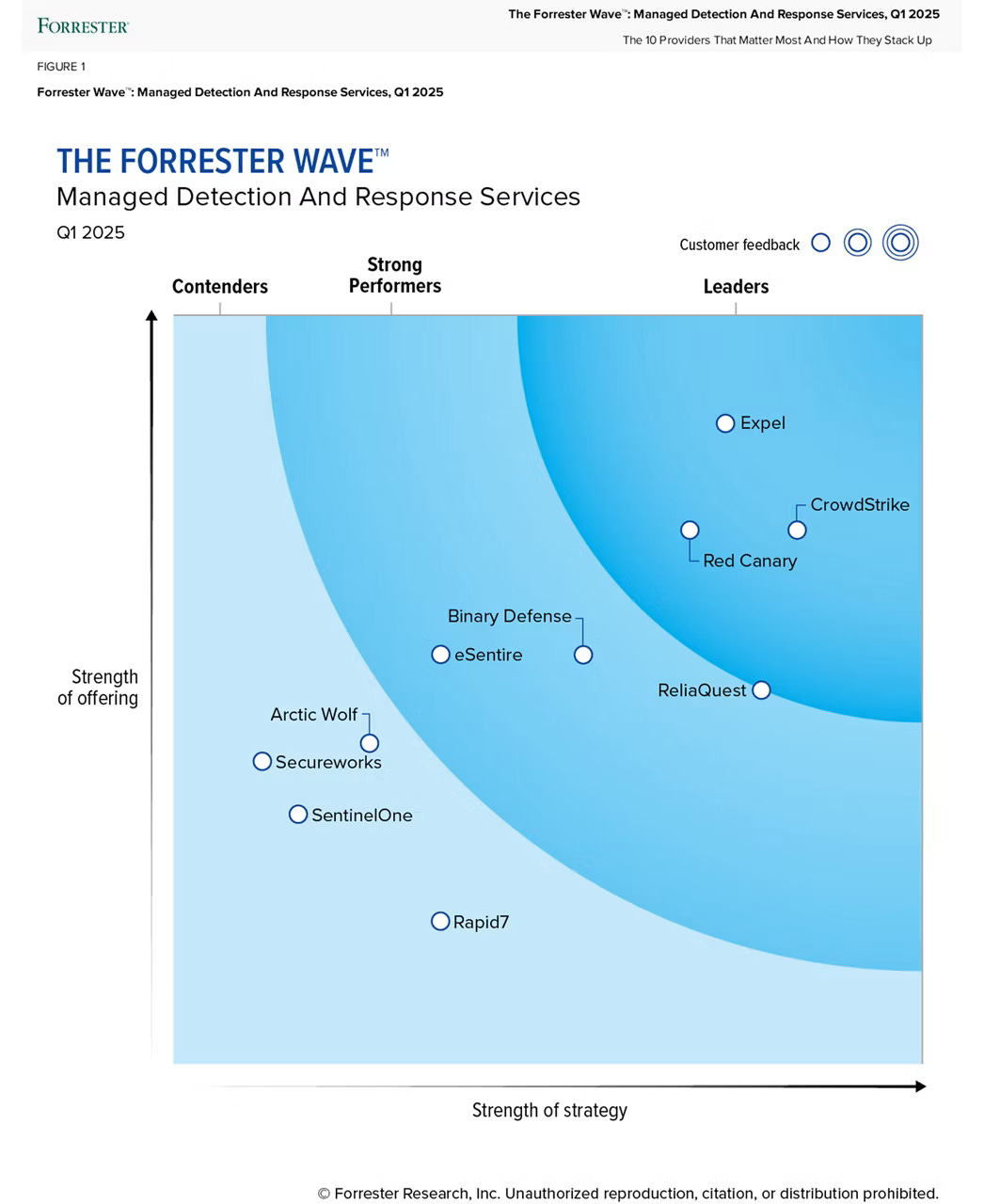

CrowdStrike was named a Leader in The Forrester Wave: MDR Services, Q1 2025, receiving the highest Strategy score and top marks in Detection Surface, Threat Hunting, and Investigation.

Its Falcon Complete Next-Gen MDR reduces over 40 hours of manual work per week through AI automation and achieves 98% decision accuracy. Charlotte AI Triage enhances multi-layered threat detection across endpoints, identity, and cloud.

Independent evaluations underscore CrowdStrike’s operational advantage, with detection speeds reported up to 11x faster than peers. Recognition in Gartner Peer Insights, Frost & Sullivan, and KuppingerCole further reflects strength in managed detection and response.

Impact of July 19th Incident

CrowdStrike’s July 19th incident prompted the rollout of a Customer Commitment Program (CCP), which played a key role in preserving customer trust and accelerating platform adoption. The program was structured primarily through additional product offerings and Falcon Flex subscriptions, rather than service credits or time extensions.

Total ARR associated with CCP packages reached $80M for FY25, with $56M recognized in Q4. Despite initial expectations, the impact on Q4 revenue was well below the $30M guidance, described as de minimis, showcasing effective containment of revenue disruption.

Incident-related costs affected Q4 free cash flow by approximately $22M, and CrowdStrike expects $73M in cash outflows in Q1 FY26 tied to outage-related costs and $43M from flexible payment terms offered during the program. GAAP net loss in Q4 included $21M in direct incident-related expenses, with the remaining tied to one-time employee and sales team incentives.

From a customer behavior standpoint, churn and contraction remained in line with historical norms. Gross retention stayed elevated at 97%, indicating the incident did not materially damage customer relationships. Instead, customers accelerated adoption of key modules—particularly cloud and identity—within CCP packages, laying the groundwork for future upsell and renewal.

As CCP concludes, CrowdStrike anticipates net new ARR reacceleration in the second half of FY26. Discounts tied to the program will expire, and customers already deploying CCP modules are positioned for renewal and expansion. Management emphasized that the program enhanced long-term platform commitment and contributed to record Falcon Flex growth.

Operationally, the company increased investment in platform resiliency, aiming to convert response efforts into a competitive differentiator. The July incident became a catalyst for strengthening enterprise trust, refining sales execution, and scaling innovation across AI-native security architecture.

Customers

$CRWD CrowdStrike has stopped publishing data on the total number of customers. The company is now focused on attracting larger customers, as it operates a multi-product platform, and the total number of customers is no longer considered a key metric. Instead, the trend in customers using multiple Falcon platform modules is more important. The number of customers using 5+, 6+, 7+, and 8+ modules has increased compared to the previous quarter by 1 percentage points sequentially.

Customer Success Stories

A European financial services firm deployed Charlotte AI and reduced host and user activity triage time from 20–30 minutes to just 10–15 seconds. The solution proved instrumental in increasing SOC efficiency and operational speed.

A major U.S. airline replaced both legacy antivirus and QRadar SIEM with CrowdStrike’s Next-Gen SIEM. The ease of data ingestion, unified console, and incident workbench were decisive in the transition. The deal was valued in the seven-figure range and demonstrated CrowdStrike’s ability to consolidate legacy infrastructure.

A large state university hospital system adopted the Falcon platform in a seven-figure deal after discarding a competitor’s identity product due to false positives. Falcon’s operational superiority in identity protection secured an independent budget allocation from the CISO.

Customers using Falcon Flex are surpassing their demand plans ahead of schedule. Flex customers are now deploying an average of more than 9 modules, with 60%+ of deal value already deployed. Internal feedback confirms strategic stickiness and rapid time-to-value, especially in cloud, identity, and AI-driven modules.

Exposure management is gaining traction with quick replacements of legacy vulnerability vendors. Notable wins include a multinational shipping line, a digital radio network, and a healthcare provider in Asia Pacific. Customers are integrating the capability seamlessly via Falcon Flex, accelerating time-to-value.

Large Customer Wins

A large transportation company consolidated three vendors—cloud, SIEM, and endpoint—into Falcon Flex, resulting in a 67% increase in ARR. This deal reflects the compounding effect of Falcon Flex in multi-product displacements and long-term ARR growth.

A global financial services holding firm committed to an eight-figure, multi-year Falcon Flex deal, displacing a multi-platform cloud offering from a network security competitor. Decision drivers included seamless management, superior runtime protection, and single-console operations.

CrowdStrike closed over 20 deals exceeding $10M, 350 deals over $1M, and 2,300 deals over $100K in Q4 alone. Falcon Flex and GSI channel leverage were pivotal in landing high-value enterprise accounts. New customer growth remains robust, contributing 10–11% annually to ARR expansion.

Falcon Flex is now deployed across $2.5B in total deal value, up 80% QoQ, indicating rapid enterprise adoption. CrowdStrike’s execution across global financials, healthcare, airlines, and logistics is driving top-tier wins and platform standardization.

The AWS Marketplace hit $1B in annualized sales, a sharp acceleration from its $1B lifetime milestone just 15 months prior. The Google Cloud Marketplace generated $150M in its first year, highlighting CrowdStrike’s pull across hyperscaler ecosystems.

Retention

$CRWD CrowdStrike reported a decline in Dollar-Based Net Retention Rate (DBNRR) to 112%, which is below the 117% median for the SaaS companies I monitor. The decline was driven by longer contract durations, the impact of the July 19 incident, increased adoption of Falcon Flex, and CCP-related pricing adjustments.

Despite these short-term factors, higher module adoption and renewals are expected to stabilize DBNRR in 2025.

However, the gross retention rate remains high at 97%, indicating that there was no significant customer churn following the July 19 incident.

ARR Growth

$CRWD CrowdStrike's Annual Recurring Revenue (ARR) growth is slowing, reaching +23% YoY in Q4, which is below the company’s revenue growth. CrowdStrike expects ARR growth to reaccelerate in the second half of 2025 as CCP renewals return to full pricing.

Net new ARR

$CRWD CrowdStrike added $224 million in net new ARR in Q4 2024, reflecting a -21% YoY decrease. However, the decline was smaller than in the previous quarter, which can be seen as a positive trend. The drop in net new ARR was influenced by the July 19 incident and was -1% YoY in Q4 when adjusted for $56 million in CCP ARR.

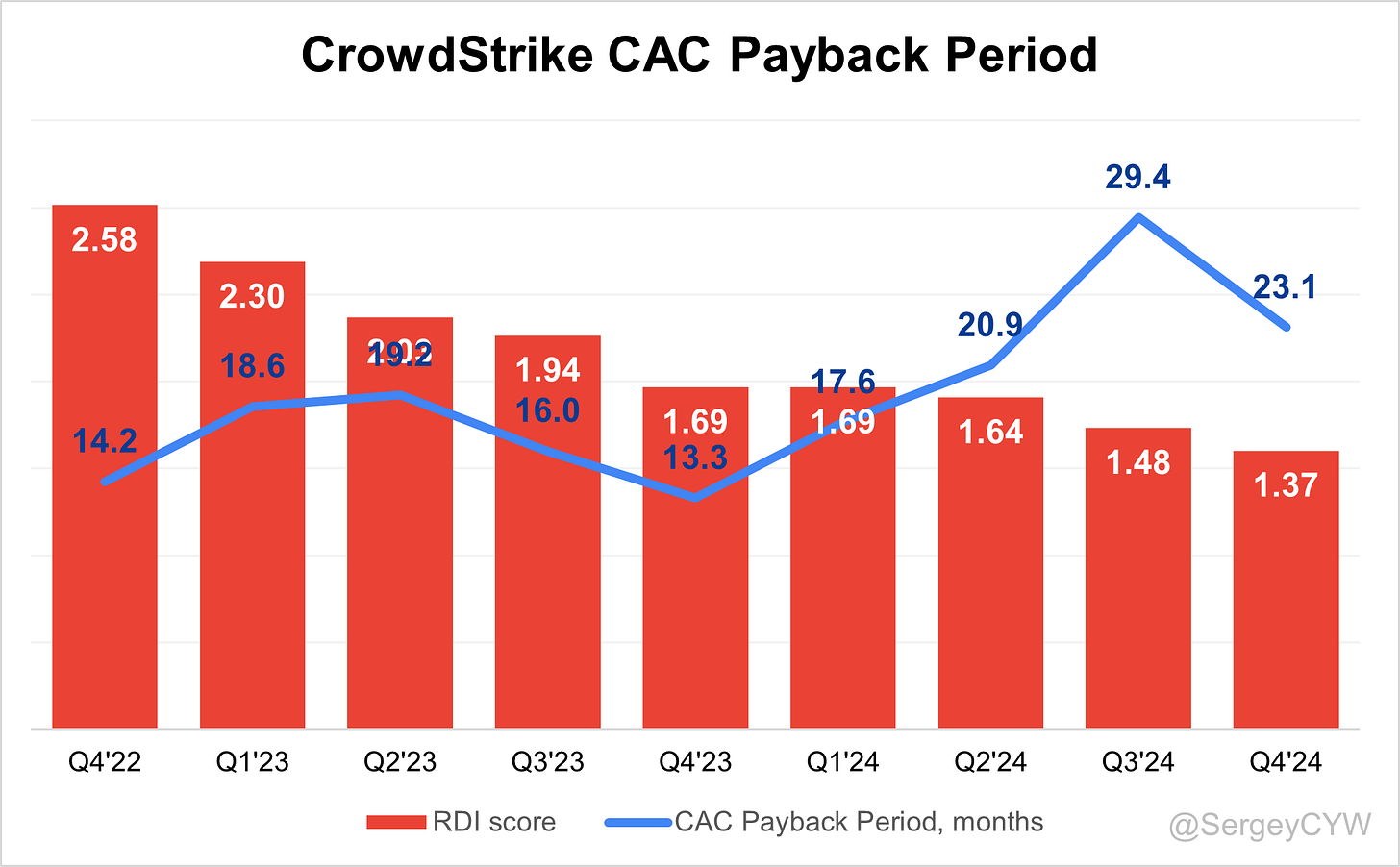

CAC Payback Period and RDI Score

$CRWD's return on S&M spending slightly improved compared to the previous quarter to 23.1 months, which remains slightly worse than the 20.8-month median for the SaaS companies I track.

The R&D Index (RDI Score) for Q4 stands at 1.37, a strong result compared to the 1.2 median of other SaaS companies I monitor, and significantly higher than the industry median of 0.7.

An RDI Score above 1.4 is considered best-in-class, and the low industry median highlights the importance of efficient R&D investment.

Profitability

Over the past year, $CRWD CrowdStrike has seen changes in its margins and profitability:

Gross Margin decreased slightly from 78.2% to 77.9%.

Operating Margin decreased from 25.2% to 20.5%.

FCF Margin declined from 33.5% to 20.6%.

Operating expenses

$CRWD Non-GAAP operating expenses slightly declined in the last quarter, with S&M spending decreasing to 32% from 33% in Q3 2024, returning to the level seen in Q4 two years ago. R&D expenses remain elevated at 19%, reflecting the company’s continued investment in future growth through the expansion of its cybersecurity platform. G&A expenses remained unchanged at 7%. CrowdStrike slightly increased its operating expenses following the July 19 incident.

Balance Sheet

$CRWD Balance Sheet: Total debt stands at $789M, while CrowdStrike holds $4,323M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

Dilution

$CRWD Shareholder Dilution: CrowdStrike’s stock-based compensation (SBC) expenses increased in the last quarter, reaching 26% of revenue, which is relatively high for SaaS companies.

Shareholder dilution remains at an acceptable level, slightly decreasing in Q4, with the weighted-average number of basic common shares outstanding increasing by 2.5% YoY.

Conclusion

The key event for $CRWD CrowdStrike was the July 19 incident, which impacted the company far less than initially expected. What mattered most to me was how the company responded—and in my view, it reacted excellently. CEO George Kurtz demonstrated strong leadership, and offering additional modules to customers for free was, in my opinion, the best approach. This strategy allowed customers to try new modules via CCP packages, which they are likely to continue using on a paid basis later. However, in the short term, this approach slowed revenue growth and the addition of net new ARR, as reflected in the Q4 results.

CrowdStrike is actively investing in future growth. Last quarter, the company launched several new products and issued numerous press releases.

Leading Indicators

• RPO growth of +41.3% significantly exceeded revenue growth

• Billings growth of +17.3% fell below revenue growth

• ARR growth reached +23.5%, also below revenue growth

• Net new ARR additions declined –21% YoY

Key Indicators

• Customer adoption increased by +1 percentage point QoQ across all cohorts

• Net Dollar Retention (NDR) decreased by 3 percentage points QoQ to 112%, though Gross Retention Rate remains strong at 97%

• CAC Payback Period improved from Q3 2024 to 23.1 months, slightly worse than the SaaS average

• RDI Score slightly declined to 1.37, but remains above the median for SaaS companies I track

The forecast suggests further revenue growth deceleration, though management expects growth to recover in the second half of 2025, supported by strong RPO growth. The current slowdown is primarily due to the CCP packages. According to management, customer relationships have only strengthened since the incident.

Management reaffirmed its $10 billion ARR target by 2030. They expect net new ARR reacceleration in H2 2025 to drive growth into 2026, projecting 23% non-GAAP operating margins and 30%+ free cash flow margins.

No customer migration to competitors has been observed. Reports from competitors like $PANW and $S in Q3 showed no significant customer gains or acceleration in RPO or billings. On the contrary, CrowdStrike’s RPO and billings growth accelerated in Q3—immediately following the incident—indicating customers were still eager to sign long-term contracts.

The valuation appears reasonable. While CrowdStrike trades at a premium relative to forward revenue growth estimates, I believe the premium is justified. The management’s response to the July 19 incident reinforced this view, and the results seen two quarters later confirmed that there was no meaningful customer churn. The Q4 report validated the stickiness of the Falcon platform and its wide moat, which strengthens CrowdStrike’s competitive position.

The TAM is substantial, expected to reach $116 billion by 2025, with a projected CAGR of 21.6% through 2029. The slowdown in revenue growth seen in Q4 and forecasted in Q1–Q2 2025 is likely temporary and directly related to the July 19 incident.

After the incident, I increased my $CRWD position as the stock price declined. Currently, $CRWD is one of my top 3 holdings, representing a 9.6% allocation.