Confluent Q4 2024 Earnings Analysis

Dive into $CFLT Confluent’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$261.2M rev (+22.5% YoY, +25.0% LQ) beat est by 1.9%

↗️GM* (78.9%, +1.4 PPs YoY)

↘️Operating Margin* (5.2%, -0.1 PPs YoY)🟡

↗️FCF Margin (11.1%, +7.9 PPs YoY)🟢

↗️Net Margin (-33.7%, +10.4 PPs YoY)

↗️EPS* $0.09 beat est by 80.0%

*non-GAAP

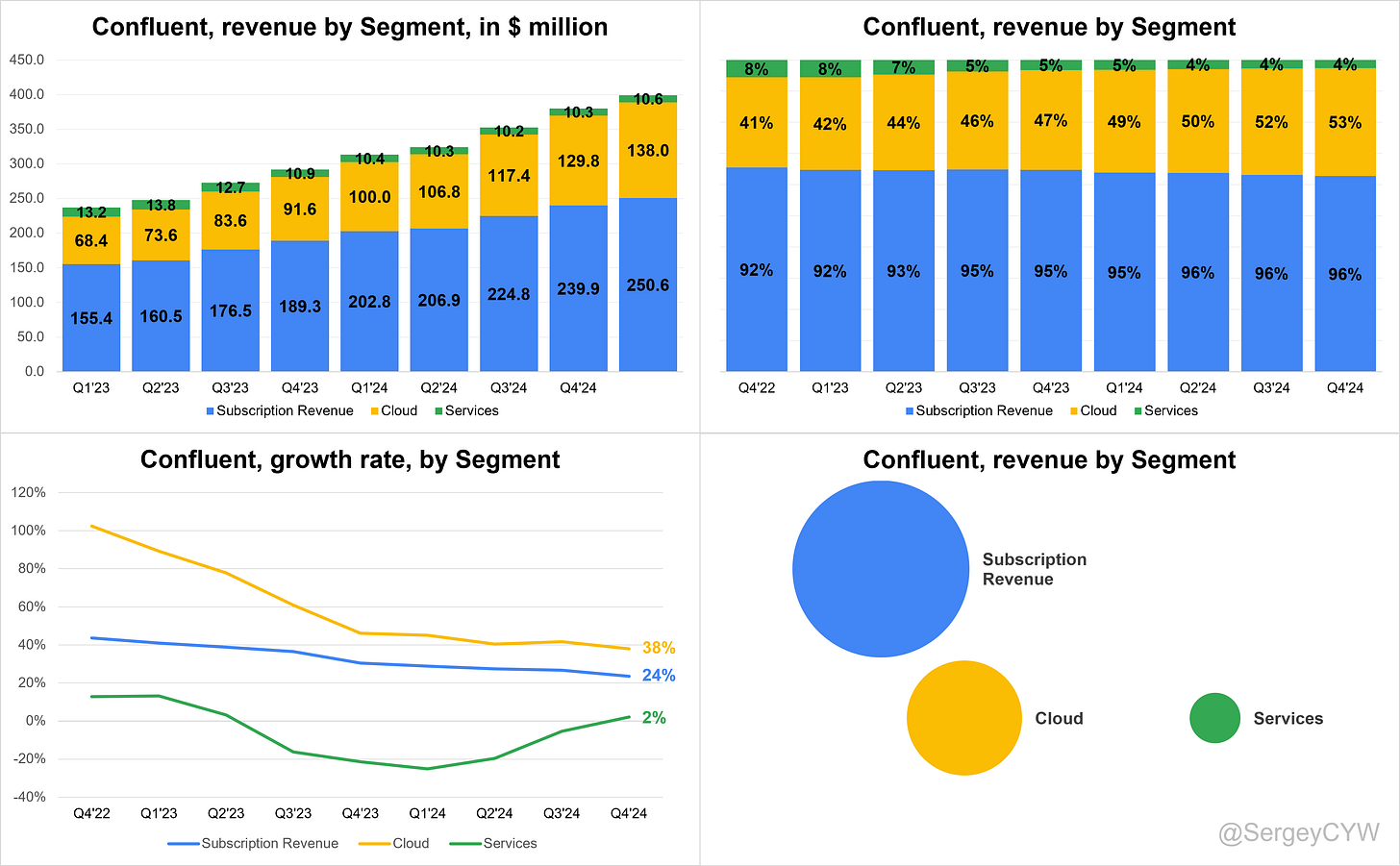

Revenue by Segment

↗️Subscription Revenue $250.6M rev (+23.6% YoY, 96% of Rev)

↗️Cloud $138.0M rev (+38.0% YoY, 53% of Rev)

↘️Services $10.6M rev (+2.1% YoY, 4% of Rev)

Key Metrics

➡️DBNR 117% (117% LQ)

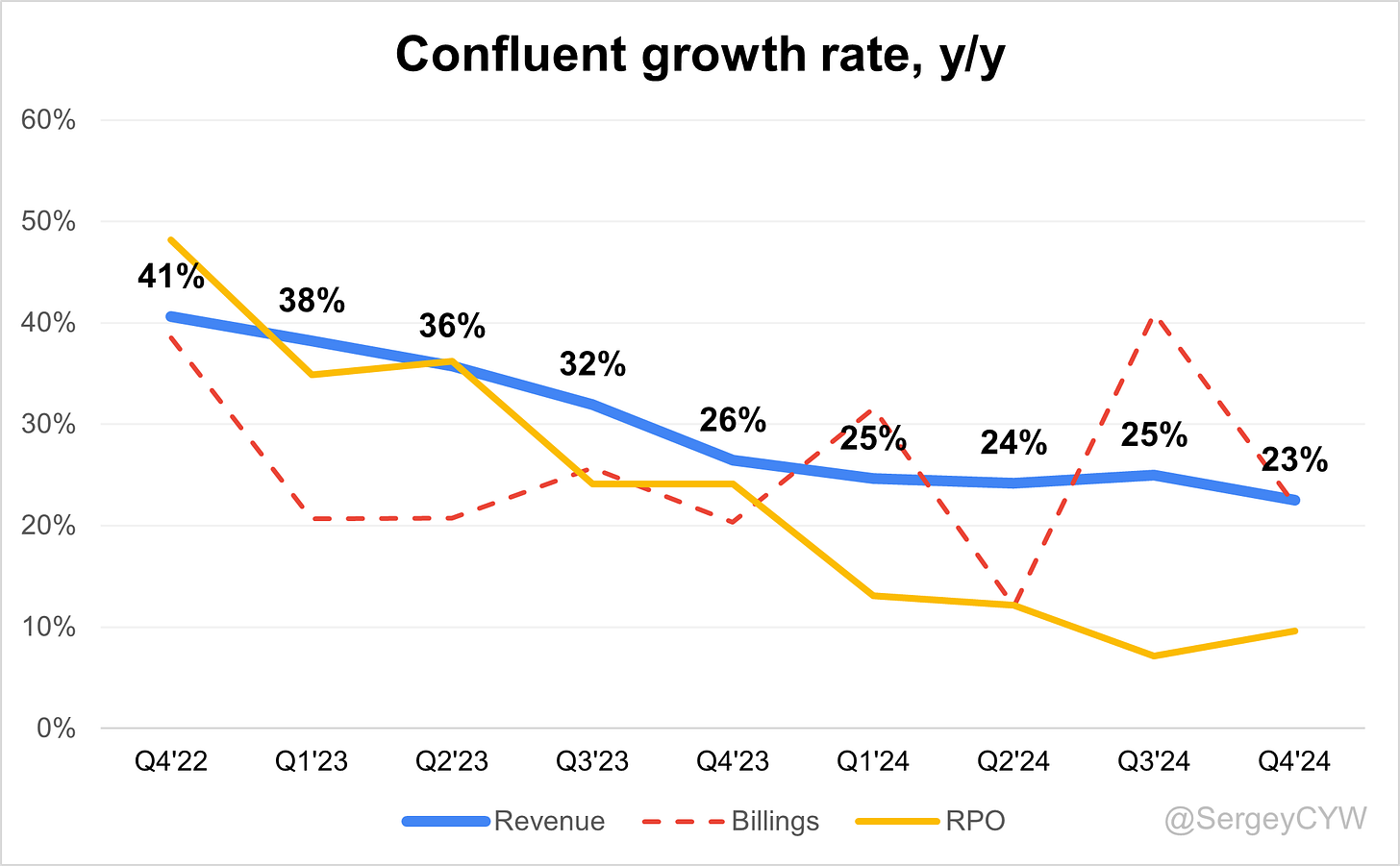

➡️RPO $1,008.60M (+9.6% YoY)🟡

➡️Billings $296M (+22.1% YoY)🟡

Customers

➡️1,381 $100k+ customers (+12.4% YoY, +35)

↗️194 $1M+ customers (+22.8% YoY, +10)

Operating expenses

↗️S&M*/Revenue 41.8% (+0.8 PPs YoY)

↗️R&D*/Revenue 22.5% (+0.9 PPs YoY)

↘️G&A*/Revenue 9.3% (-0.3 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $44M (-15.3% YoY)

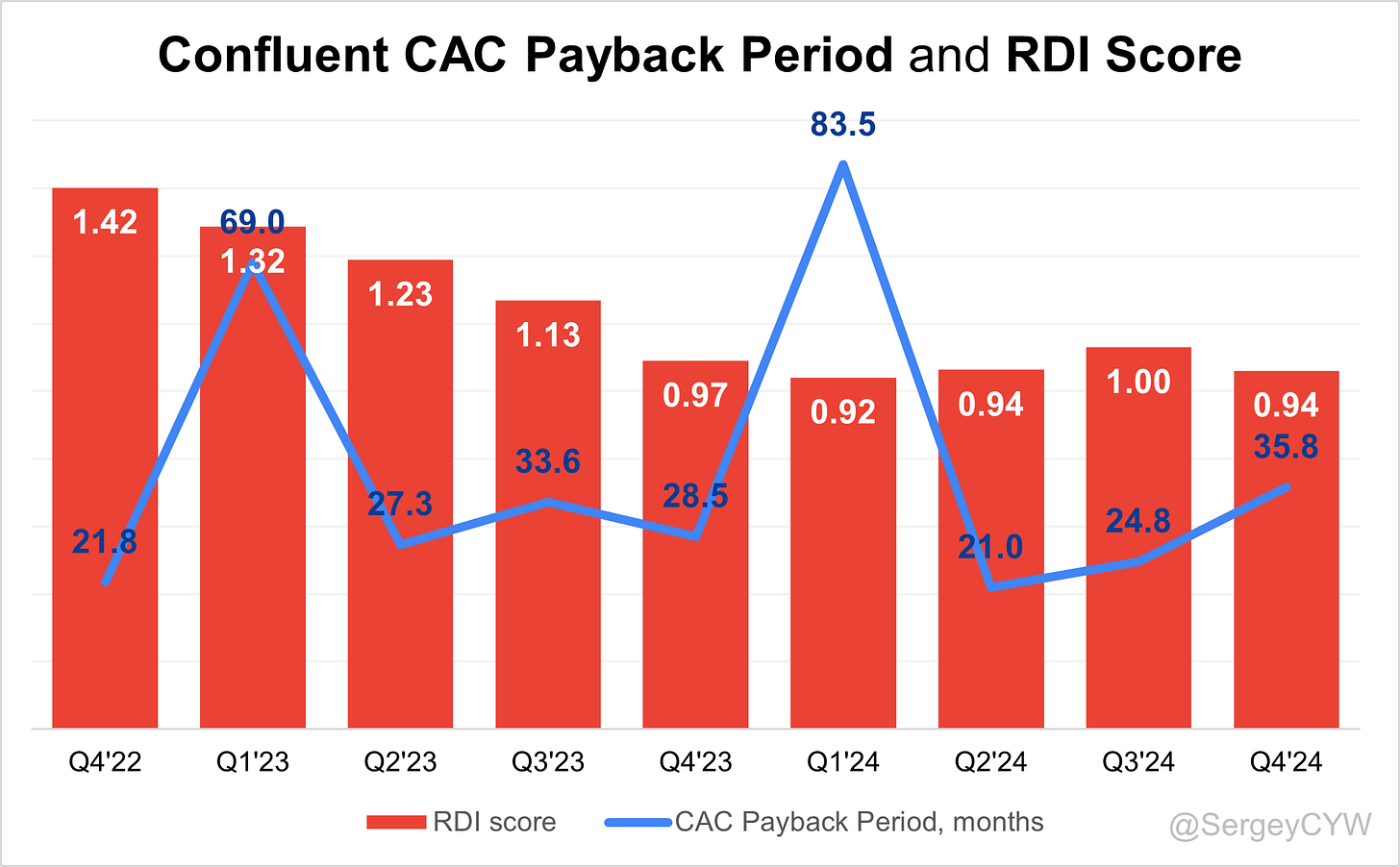

↗️CAC* Payback Period 35.8 Months (+7.3 YoY)🟡

↗️R&D* Index (RDI) 0.94 (-0.03 YoY)🟡

Dilution

↗️SBC/rev 41%, +0.5 PPs QoQ

↘️Basic shares up 6.6% YoY, -0.2 PPs QoQ🔴

↗️Diluted shares up 5.8% YoY, +3.9 PPs QoQ🟡

Guidance

↗️Q1'25 $253.0 - $254.0M guide (+16.7% YoY) beat est by 0.6%

↗️$1,117.0 - $1,121.0M FY guide (+16.1% YoY) beat est by 0.6%

Key points from Confluent’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Confluent exceeded all guided metrics in FY 2024, with subscription revenue reaching $922.1 million, up 26% YoY. Q4 subscription revenue grew 24% YoY to $250.6 million, driven by 38% YoY growth in Confluent Cloud revenue to $137.9 million. Confluent Cloud now contributes 55% of total subscription revenue, up from 49% YoY. Confluent Platform revenue grew 10% YoY to $112.7 million, driven by enterprise adoption in regulated industries. Non-U.S. revenue grew 26% YoY to $107.5 million, outpacing domestic growth.

Non-GAAP operating margin rose to 5.2% in Q4, marking the third consecutive profitable quarter. Free cash flow margin expanded to 11.1%, reflecting increased operational efficiency.

For FY 2025, Confluent forecasts subscription revenue of $1.117B–$1.121B, growing 21%-22% YoY. Non-GAAP operating margin is expected to reach 6%. Cloud revenue mix is projected to rise one percentage point per quarter, exiting the year at 59%-60% of total subscription revenue.

Product Innovations

Confluent expanded its Data Streaming Platform (DSP) with 200+ new features across Connect, Process, and Govern. Tableflow, a key innovation, bridges operational and analytical systems by making real-time data available in structured tables using Apache Iceberg and Delta Lake. It replaces batch-oriented pipelines, enabling real-time AI model updates, fraud detection, and customer personalization.

The company introduced Enterprise Clusters, Freight Clusters, and WarpStream, optimizing pricing and packaging to serve cost-sensitive, high-throughput workloads and expand market reach.

Confluent Cloud Growth

Confluent Cloud grew 38% YoY in Q4, outpacing the overall business. Customers use it for real-time AI, analytics, and mission-critical operations. DSP components within Confluent Cloud, including Connect, Process, and Govern, now account for 13% of cloud revenue, growing significantly faster than overall cloud.

The company strengthened pricing and packaging with Enterprise Clusters, Freight Clusters, and WarpStream, optimizing performance, cost efficiency, and security. Win rate against cloud service providers (CSPs) remains above 90%, reinforcing Confluent’s position as the most scalable managed Kafka solution.

DSP Expansion

Confluent transitioned from pure Kafka-based streaming to a full-stack DSP, integrating connectors, real-time processing, and governance. DSP-related cloud consumption is growing significantly faster than overall cloud, driven by enterprise adoption.

Partnerships with Databricks and Jio Platforms accelerate adoption. DSP is positioned as the core data layer for AI-driven analytics, making real-time AI workflows scalable and accessible.

Apache Flink Adoption

Flink is becoming critical for real-time decision-making, replacing legacy batch processing. Major enterprise use cases include:

Zazzle: Implemented Flink for real-time personalization, reducing storage and compute costs.

European grocery delivery service: Uses Flink to optimize order tracking, improving logistics efficiency.

Fortune Global 100 telecom provider: Integrated Flink for real-time network analytics, optimizing 5G and fiber deployment.

Despite strong adoption, Flink awareness needs expansion beyond early adopters. Confluent is driving this through feature development, cloud integrations, and enhanced go-to-market strategies.

Kafka Evolution

Confluent continues to expand beyond open-source Kafka with fully managed, enterprise-grade streaming solutions. Win rate against CSPs and startups exceeds 90%, reinforcing its leadership.

Enterprise adoption is shifting from self-managed Kafka to Confluent Cloud and DSP:

Total customers: 5,800, adding 840 net new customers YoY.

$100K+ ARR customers: 1,381, accounting for 90% of revenue.

$1M+ ARR customers: 194, growing 23% YoY.

To maintain momentum, Confluent is focusing on TCO advantages, security, and ease of scaling, leveraging strategic partnerships.

WarpStream Expansion

Acquired in 2024, WarpStream is gaining traction among digital-native companies requiring high-throughput, cost-effective streaming solutions. Every WarpStream deal since acquisition has been with a digital-native customer, including those migrating from RedPanda due to:

10x cost savings in infrastructure.

Higher scalability for real-time data processing.

Long-term success will depend on maintaining differentiation from CSP-native solutions while enhancing performance, reliability, and security.

AI and Streaming

AI-driven applications are fueling real-time data streaming demand. Key use cases:

Data Preprocessing for AI Models: Low-latency ETL pipelines for AI training and inference.

Real-Time AI Decision-Making: Instantaneous fraud detection, predictive analytics, and automation.

Flink and Tableflow are playing key roles in AI-powered enterprises. AI companies like Cursor and OpenAI are among Confluent’s fastest-growing customers.

Large Customer Wins

Confluent expanded its enterprise customer base in Q4, securing major deals across industries.

Citizens Bank: Migrated from open-source Kafka to Confluent DSP, achieving:

30% IT cost reduction.

$1.2M annual savings from 15% fewer fraud false positives.

40% faster loan processing.

Zazzle: Uses Flink for real-time personalization, cutting storage and compute costs.

European grocery delivery service: Integrated Flink for real-time order tracking, optimizing driver logistics.

Fortune Global 100 telecom provider: Streams real-time data from 70,000+ U.S. cell towers, improving network reliability and 5G planning.

New Enterprise Customers

Confluent secured multiple Fortune 500 clients in Q4:

Top five video gaming company – Uses DSP for real-time player analytics.

Leading sports media outlet – Streams live sports analytics.

Fortune 100 pharmaceuticals company – Enhancing drug research and supply chain visibility.

Global cruise operator – Optimizing onboard customer experiences.

European airline – Leveraging real-time flight and customer service operations.

Strategic Partnerships

Databricks: Integrated Tableflow with Delta Lake & Unity Catalog, enabling seamless real-time AI-driven data sharing.

Jio Platforms (India): Confluent Cloud now available on Jio Cloud Services, expanding real-time AI adoption in a high-growth market.

Future Outlook

2025 will be "The Year of DSP." Key growth priorities:

Scaling DSP adoption as cloud DSP consumption outpaces overall cloud growth.

Expanding financial services, AI, and high-throughput enterprise workloads.

Driving international expansion, focusing on Asia and Europe.

Enhancing AI capabilities, solidifying Confluent as the go-to real-time AI platform.

With a $1B+ revenue run rate and increasing AI-driven data demand, Confluent is positioned for strong, long-term growth.

Management comments on the earnings call.

Product Innovations

Jay Kreps, Co-Founder and Chief Executive Officer

"Tableflow is one of the most exciting and powerful additions to our data streaming platform. It allows Confluent to act as the bridge between operational systems that run the business and analytical platforms like Athena, BigQuery, Databricks, and Snowflake that extract valuable insights. Historically, operational and analytical systems operated in separate silos, leading to outdated and incomplete data. Tableflow eliminates these inefficiencies, providing real-time, structured data across enterprises."

Jay Kreps, Co-Founder and Chief Executive Officer

"No other vendor is as intensely focused as us on building and delivering a complete data streaming platform. Over time, as more parts of our platform are used, a virtuous cycle of adoption drives stickiness and more growth. A complete data streaming platform reduces complexity and provides substantial ROI for our customers."

Confluent Cloud

Jay Kreps, Co-Founder and Chief Executive Officer

"We continue to see stable consumption and use case expansion across our large customer base, driving robust growth in our cloud business. Our success is driven by the strong demand for fully managed real-time data streaming, as enterprises increasingly transition from self-managed Kafka to Confluent Cloud for scalability, reliability, and lower total cost of ownership."

Rohan Sivaram, Chief Financial Officer

"Cloud revenue mix continues to increase, and we expect this trend to persist, with Confluent Cloud representing approximately 59% to 60% of total subscription revenue by Q4 2025. Our success in cloud adoption reflects the growing enterprise shift toward managed services and real-time AI-driven workloads."

DSP (Data Streaming Platform)

Jay Kreps, Co-Founder and Chief Executive Officer

"We are building the third wave of growth by delivering a complete data streaming platform that connects, processes, and governs data continuously in motion. Our mission is to provide organizations with real-time, trustworthy, and discoverable streams of data that can be consumed anywhere in their business. This is how enterprises unlock the true potential of streaming data."

Jay Kreps, Co-Founder and Chief Executive Officer

"There has been an evolution of what's expected in the streaming world. It’s no longer just about moving streams of data—it’s about a comprehensive set of real-time capabilities that enable organizations to maximize the value of their data. We are at the forefront of delivering this transformation."

AI

Jay Kreps, Co-Founder and Chief Executive Officer

"AI applications are fundamentally changing how businesses operate, and the need for real-time data has never been greater. The first wave of AI use cases focused on chatbots and data retrieval, but now we are seeing enterprises apply AI to real-time streams of data. This shift is unlocking new possibilities in automation, decision-making, and operational efficiency."

Jay Kreps, Co-Founder and Chief Executive Officer

"AI is moving from batch processing to real-time inference. Companies are no longer just training models offline; they are applying their AI models to live data streams in production. This is where Confluent’s data streaming platform plays a critical role in delivering real-time insights and decision-making capabilities."

Customers

Jay Kreps, Co-Founder and Chief Executive Officer

"We continue to see strong enterprise adoption, with approximately 5,800 customers and growing. Our ability to support mission-critical workloads across industries, from financial services to retail, healthcare, and technology, reinforces the strength of our platform. The trend is clear—organizations are embracing real-time data streaming to power their most important applications."

Rohan Sivaram, Chief Financial Officer

"The momentum in large customer adoption is evident. Our $100K+ ARR customers now represent approximately 90% of our revenue, while our $1M+ ARR customer count grew by 23% year over year. These metrics validate our ability to expand within existing accounts and drive multi-year growth."

Competitors

Jay Kreps, Co-Founder and Chief Executive Officer

"Our win rate against cloud service provider offerings and smaller startups remains well above 90%. This underscores the strength of our data streaming platform, which provides outstanding performance, reliability, flexibility, and favorable total cost of ownership. We have built a highly differentiated product that continues to outcompete alternatives in the market."

Strategic Partnerships

Jay Kreps, Co-Founder and Chief Executive Officer

"We are thrilled to announce an expanded partnership with Databricks. This collaboration will bring together Confluent’s complete data streaming platform with Databricks’ data intelligence platform to empower enterprises with real-time AI-driven decision-making. Our integration with Delta Lake and Unity Catalog will ensure seamless real-time data interoperability across operational and analytical systems."

Rohan Sivaram, Chief Financial Officer

"Our partnership with Jio Platforms marks a significant expansion into one of the world’s fastest-growing digital economies. By making Confluent Cloud available on Jio Cloud Services, we are accelerating the adoption of real-time data streaming across India’s AI and next-generation application development landscape."

Challenges

Jay Kreps, Co-Founder and Chief Executive Officer

"The broader enterprise transition from batch-oriented data pipelines to real-time streaming still requires significant education and market awareness. While early adopters recognize the benefits of real-time data, many organizations are just beginning to explore the shift. Our focus is on driving this transformation through product innovation, customer success, and strategic partnerships."

Rohan Sivaram, Chief Financial Officer

"We continue to optimize our pricing and packaging strategy to ensure we meet the diverse needs of our customers. The introduction of Enterprise Clusters, Freight Clusters, and WarpStream has expanded our serviceable market, but it also requires continuous alignment with evolving customer requirements. Balancing growth with efficiency remains a key focus for us."

Future Outlook

Jay Kreps, Co-Founder and Chief Executive Officer

"2024 was a transformational year for us, setting the foundation for our long-term success. With our transition to a consumption-driven go-to-market model, the expansion of our Data Streaming Platform, and the acceleration of AI-driven real-time data applications, we expect 2025 to be a year of strong, durable growth."

Rohan Sivaram, Chief Financial Officer

"Given our strong foundation, we expect to begin reaping the benefits in 2025. Our objective is to continue expanding our leadership in data streaming while driving efficiency and profitability. With a revenue run rate exceeding $1 billion and accelerating cloud adoption, we are well-positioned for sustainable long-term growth."

Thoughts on Confluent Earnings Report $CFLT:

🟢 Positive

Revenue: $261.2M (+22.5% YoY, +25.0% QoQ), beating estimates by 1.9%.

Subscription Revenue: $250.6M (+23.6% YoY), making up 96% of total revenue.

Cloud Revenue: $138.0M (+38.0% YoY), now 53% of total revenue.

Non-GAAP EPS: $0.09, beating estimates by 80.0%.

Free Cash Flow Margin: 11.1%, up 7.9 PPs YoY.

Enterprise Customers:

$100K+ ARR customers: 1,381 (+12.4% YoY, +35 QoQ).

$1M+ ARR customers: 194 (+22.8% YoY, +10 QoQ).

Strategic Partnerships: Expanded with Databricks and Jio Platforms, enhancing AI and cloud adoption.

FY 2025 Guidance: Subscription revenue forecast $1.117B–$1.121B (+16.1% YoY), beating estimates by 0.6%.

🟡 Neutral

Gross Margin: 78.9%, up 1.4 PPs YoY but not a major shift.

RPO: $1,008.6M (+9.6% YoY), indicating solid backlog but slower growth.

Billings: $296M (+22.1% YoY), maintaining steady business momentum.

Operating Margin: 5.2%, down 0.1 PPs YoY, showing slight pressure on profitability.

R&D Spend: 22.5% of revenue (+0.9 PPs YoY), reflecting investment in future innovation.

Sales & Marketing Expense: 41.8% of revenue (+0.8 PPs YoY), indicating higher acquisition costs.

🔴 Negative

Net New ARR: $44M, down 15.3% YoY, suggesting slower expansion within existing accounts.

Customer Acquisition Cost (CAC) Payback Period: 35.8 months, up 7.3 months YoY, signaling longer time to profitability on new customers.

Share Dilution:

Basic shares up 6.6% YoY, slightly improved QoQ (-0.2 PPs).

Diluted shares up 5.8% YoY, accelerating QoQ (+3.9 PPs).

Stock-Based Compensation (SBC): 41% of revenue, up 0.5 PPs QoQ, putting pressure on GAAP profitability.

From a stock trading aspect focusing on the chart it looks really interesting.

https://thesetupfactory.substack.com/p/confluent