Confluent Q2 2024 Earnings Analysis

Dive into $CFLT Confluent’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$235.0M rev (+24.2% YoY, +24.6% LQ) beat est by 2.2%

↗️GM* (77.5%, +2.5%pp YoY)

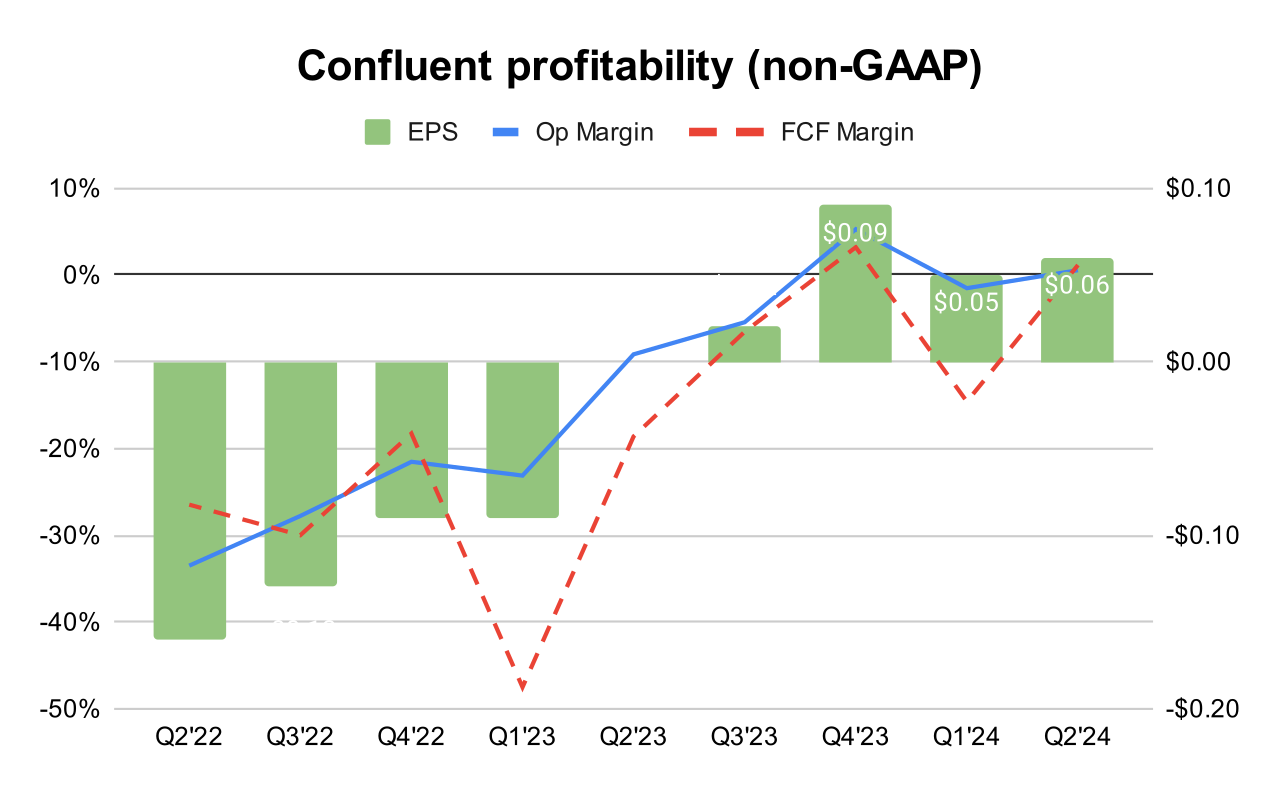

↗️Operating Margin* (0.6%, +9.7%pp YoY)

↗️FCF Margin (1.1%, +19.8%pp YoY)

↗️EPS* $0.06 beat est by 20.0%

*non-GAAP

Key Metrics

↘️DBNR 118% (120% LQ)

➡️RPO $887.80M (+12.0% YoY)🟡

➡️Billings $216M (+12.0% YoY)🟡

Customers

➡️1,306 $100k+ customers (+14.0% YoY, +46)

Operating expenses

↘️S&M*/Revenue 41.5% (44.0% LQ)

↗️R&D*/Revenue 25.4% (23.8% LQ)

↘️G&A*/Revenue 10.0% (10.6% LQ)

↗️Net New ARR $71M ($16 LQ)

↘️CAC* Payback Period 21.0 Months (83.5 LQ)

Dilution

↘️SBC/rev 45%, -2.9%pp QoQ

↘️Basic shares up 7.2% YoY, -0.4%pp QoQ🔴

↘️Diluted shares up 4.4% YoY, -15.6%pp QoQ

Guidance

↘️Q3'24$233.0 - $234.0M guide (+23.4% YoY) missed est by -0.8%🔴

↘️$910.0M FY guide (+24.8% YoY) missed est by -0.7%🔴

Key points from Confluent’s Second Quarter 2024 Earnings Call:

Consumption Model:

Confluent has largely completed the transformation towards a consumption-based model. This change aims to enhance customer acquisition rates and the quality of new customers.

Revenue Growth and Margin Improvement:

Confluent reported a solid performance with subscription revenue growing by 27% to $225 million. Confluent Cloud revenue increased by 40% to $117 million, and there was a positive non-GAAP operating margin, showing significant improvement from previous quarters.

Kafka Integration:

Confluent continues to integrate Kafka more deeply into its service offerings, particularly with the introduction of Apache Flink for stream processing. This integration aims to enhance Kafka's utility in handling large data streams efficiently.

Flink for Stream Processing:

Confluent has integrated Apache Flink into its offerings, expanding its capabilities in stream processing. Flink allows customers to process large streams of data more efficiently, which is crucial for real-time analytics and data-driven decision-making. The addition of Flink is seen as a key component in driving the adoption of Confluent’s data streaming products by enabling more complex data processing tasks.

Stream Governance:

Confluent has introduced governance features that ensure data quality and security, enabling customers like Vimeo to scale and share data streams safely.

Partnerships and Integrations:

Confluent has announced significant partnerships and integrations.

Examples include a top U.S. mortgage lender using generative AI to enhance customer interactions and a German e-commerce giant utilizing AI to manage call center volume spikes. Confluent’s platform plays a crucial role in these applications by facilitating real-time data integration and processing.

Generative AI:

Confluent is focusing on enabling real-time data flows to support generative AI applications. Real-time data is critical for AI applications to function effectively, providing the up-to-date information that AI models require to generate accurate outputs.

Confluent Cloud:

Confluent Cloud revenue grew by 40% to $117 million, reflecting strong demand and adoption of the cloud-based services.

The Cloud segment's improving margin profile is a key focus, indicating efforts to enhance profitability as the service scales.

Connect Confluent Program:

By Q2, the program had surpassed 40 technology and partner-built integrations, including major platforms like SAP, MongoDB, Imply, as well as services on Google Cloud and AWS.

Customers:

Confluent reported a significant increase in customer count, with a focus on acquiring high-quality accounts that show high potential for future expansion. The shift to a consumption-based model has also helped in landing newer customers earlier in their development cycles.

Future Outlook:

Confluent is confident in its strategic position and long-term growth prospects, especially with its comprehensive data streaming platform.

The company believes it is well-positioned to capture a significant share of the data streaming market, as data streaming is expected to be as important as databases in modern IT infrastructure.

Management comments on the earnings call.

Consumption Model:

Jay Kreps, CEO: "Overall, the vast majority of rollout towards our transformation to becoming consumption-oriented is complete, a step change in how we run our Cloud business. Though this new consumption motion lands them earlier in their journey, we believe over time, many of these customers will represent the next wave of high consumption accounts for us."

Customers:

Jay Kreps, CEO: "One success indicator for our transformation is new logo growth. I'm pleased to share that we increased our total customer count by 320 in Q2, double from the previous quarter and representing our largest sequential increase in two years. In addition to landing a higher volume of customers, we believe we have increased the quality."

Flink:

Jay Kreps, CEO: "Over the past year, we've made a series of innovations to build out the full set of capabilities of a data streaming platform, enabling us to capture the full life cycle data in motion. And as we progress along our consumption transformation, we will be better equipped than ever to rapidly acquire new customers, win new workloads, and fuel the adoption of our full set of product capabilities. Our rapid pace of innovation and ability to land high-quality customers who have the potential to consume more of our product leaves me more excited than ever about the long-term opportunity to capture the lion's share of the data streaming market."

Confluent Cloud:

Jay Kreps, CEO: "Confluent Cloud revenue grew 40% to $117 million, and non-GAAP operating margin was positive, representing approximately 10 percentage points of improvement. These results underscore the power of our data streaming platform and our relentless focus on delivering success for our customers."

Future Outlook:

Jay Kreps, CEO: "We remain as confident as ever in the strategic position of the company and the prospects for durable long-term growth. We have the industry-leading technology in an increasingly critical and relevant category that we believe will be as important as databases."

Rohan Sivaram, CFO: "Looking out longer term, we remain well-positioned to address our market opportunity. Over the last few decades, history in software has repeated itself many times that a platform approach wins. Our industry-leading data streaming platform is the only complete platform spanning stream, connect, process, and govern, enabling us to capture the full life cycle of data in motion at a lower TCO and delivering strong ROI to our customers."