Financial Results:

↗️$217.2M rev (+24.6% YoY, +26.4% LQ) beat est by 2.4%

↗️GM* (76.9%, +4.8%pp YoY)

↗️Operating Margin* (-1.5%, +21.6%pp YoY)

↗️FCF Margin (-14.6%, +32.9%pp YoY)

↗️EPS* $0.05 beat est by 150.0%

*non-GAAP

Key Metrics

➡️DBNR 120% (120% LQ)

➡️RPO $0.84B (+13.0% YoY)🟡

↗️Billings $232M (+32.0% YoY)🟢

Customers

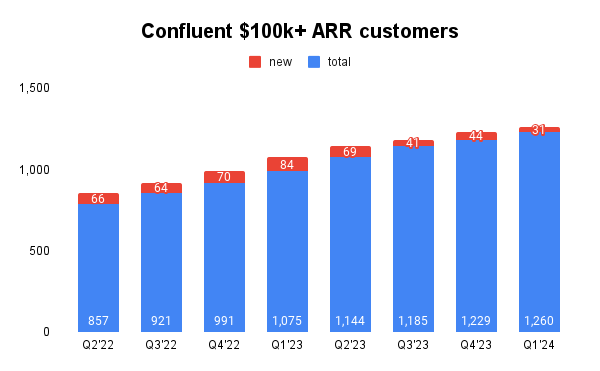

➡️1,260 $100k+ customers (+17.0% YoY, +31)🔴

Operating expenses

↗️S&M*/Revenue 44.0% (41.0% LQ)

↗️R&D*/Revenue 23.8% (21.6% LQ)

↗️G&A*/Revenue 10.6% (9.6% LQ)

↘️Net New ARR $16M ($52 LQ)

↗️CAC* Payback Period 84.1 Months (28.1 LQ)

Dilution

↗️SBC/rev 47%, +6.0%pp QoQ

↘️Basic shares up 7.7% YoY, -0.1%pp QoQ🔴

↗️Diluted shares up 20.0% YoY, +0.6%pp QoQ🔴

Guidance

➡️Q2'24 $229.0 - $230.0M guide (+21.3% YoY) in line with est

↗️$957.0M FY guide (+23.2% YoY) raised by 0.7% beat est by 0.5%

Key points from Confluent’s First Quarter 2024 Earnings Call:

New Products

Tableflow: A significant new feature that integrates with Confluent Cloud, enabling the transformation of data streams into structured tables in cloud object storage using Apache Iceberg. This integration aims to simplify access to real-time data across various systems, reducing complexity and the need for multiple data silos.

Apache Iceberg: Apache Iceberg is becoming the de facto standard for open analytic tables on top of cloud object storage systems like S3. It has gained support across various systems, including AWS Athena, Redshift, Google’s BigQuery, and Snowflake.

Flink: The general availability of Confluent Cloud for Apache Flink was announced, which enhances the ability to handle stream processing at scale. Flink is integrated into Confluent’s cloud and on-premise offerings, catering to different customer needs regarding data processing and analytics.

Governance Tools: New governance capabilities were introduced to enhance data security and compliance, aiding customers in managing data more effectively across their enterprises.

Consumption Model

Confluent has shifted its sales focus towards a consumption-based model, emphasizing incremental consumption and new customer acquisition rather than upfront commitments. This change aims to align sales incentives with customer usage, promoting a more flexible and scalable approach to customer growth and retention.

Data Streaming

Confluent continues to innovate in the data streaming space, with Kafka at the core of its offerings. The integration of new technologies like Flink and Tableflow with Kafka underlines Confluent’s commitment to enhancing real-time data processing capabilities and supporting complex data workflows in diverse operational environments.

Generative AI (GenAI)

Confluent discussed the role of its data streaming platform in supporting GenAI applications, particularly through the concept of retrieval augmented generation (RAG). This involves enriching AI models with real-time, contextual data to improve accuracy and functionality. The platform’s ability to integrate and manage real-time data streams makes it a critical component in the deployment of sophisticated AI-driven applications.

Confluent Cloud

Growth and Performance: Confluent Cloud revenue grew by 45% to $107 million, representing the majority of the subscription revenue and is the fastest-growing offering of Confluent.

Customer Expansion: Confluent Cloud has seen substantial customer growth, with a notable increase in high-quality customer acquisitions. This growth is driven by the new focus on consumption-based sales strategies and efficient system implementations.

Future Outlook

Confluent projects continued revenue growth with total revenue expected to reach approximately $957 million, driven by both Confluent Platform and Cloud services. Subscription revenue is anticipated to grow significantly.

Management comments on the earnings call.

New Products:

Jay Kreps: "Our relentless pace of product innovation was on full display with 15 major customer-facing features and pricing performance optimizations announced across both events."

Jay Kreps: "Tableflow is more than just a connector... with Tableflow we can make that integration far deeper."

Customers:

Jay Kreps: "With an increased focus on new logo growth, we added 160 customers to our total customer count, our largest sequential growth since Q1 2023."

Confluent Cloud:

Rohan Sivaram: "Our Cloud performance was driven by the ramp in consumption from select customers added in recent quarters and we started seeing stabilization of new use case expansion in our existing customer base."

Consumption Model:

Jay Kreps: "In Q1, we launched our consumption transformation... We oriented our sales compensation for cloud towards incremental consumption and new logo acquisition."

Rohan Sivaram: "We’ve made a lot of changes with respect to processes, systems... and some of the early data points... showed up in our cloud performance for the quarter."

Macro Environment:

Jay Kreps: "These results reflect our team’s strong execution amid a still uncertain but stabilizing macro environment."

Jay Kreps: "I think we’ve seen overall a stabilization. I would say the focus for a lot of our customers over the last year was really heavy focus on cost optimization... but really only the most necessary things and I do think that’s picked up a little bit."

Future Outlook:

Jay Kreps: "I’ve never been more excited or confident in Confluent’s ability to capture the lion’s share of the data streaming platform market."