Confluent: Powering Real-Time Data Streaming at Scale

Deep Dive into $CFLT: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Confluent: Company overview

About Confluent

Confluent, Inc. is a U.S. technology company founded in 2014 by Jay Kreps, Jun Rao, and Neha Narkhede, the original creators of Apache Kafka at LinkedIn. Headquartered in Mountain View, California, Confluent went public on June 24, 2021, with an IPO price of $36 per share. The company provides a real-time data streaming platform designed for scalable data processing. Its product portfolio includes Confluent Cloud (fully managed Kafka), Confluent Platform, Apache Flink services, WarpStream, and Stream Governance tools. As of 2023, Confluent serves over 4,300 customers, including 70% of Fortune 500 companies. The company reported $711.9 million in revenue for FY 2023 and a net loss of $269.3 million.

Company Mission

Confluent’s mission is to enable real-time data streaming at scale, helping businesses make immediate, data-driven decisions. By delivering a platform for streaming data across applications, Confluent allows organizations to respond rapidly to market shifts, customer behavior, and emerging trends. The company emphasizes simplicity, scalability, and reliability to support digital transformation and competitive agility.

Sector

Confluent operates in the information technology sector, specifically in data streaming and real-time analytics. It plays a critical role in enabling generative AI, a key area of investor focus. Confluent’s solutions are used across financial services, retail, technology, manufacturing, healthcare, automotive, telecommunications, and gaming industries. It trades on the NASDAQ under the ticker CFLT with a market capitalization of approximately $7.6 billion as of April 2025. The stock has declined -28.84% over the past year and -17.58% over the last three years.

Competitive Advantage

Confluent’s advantage lies in the scalability and reliability of its platform, designed to process high data volumes with low latency. It offers customizable streaming solutions, built on open-source Apache Kafka, enhancing integration and developer adoption. Strategic partnerships with major cloud providers support cloud-native deployment. A robust ecosystem of tools and connectors increases platform utility, and a team of Kafka experts ensures advanced support and continuous innovation.

Total Addressable Market (TAM)

Confluent’s TAM is projected to reach $100 billion by 2025. In 2022, Oppenheimer estimated the TAM at $51.6 billion, forecasting a 14% CAGR to $98.4 billion by 2027. Based on 2024 revenue projections, Confluent holds only about 1.3% market share, highlighting substantial room for growth.

The global streaming analytics market was valued at $27.84 billion in 2024 and is expected to grow to $176.29 billion by 2032, representing a 26.0% CAGR. Growth is fueled by the expansion of AI and machine learning, increased demand for real-time data processing, and widespread adoption of Big Data technologies.

Valuation

$CFLT Confluent is trading at a Forward EV/Sales multiple of 5.5, below the median of 8.7. The company's Forward EV/Sales multiple is at historically low levels relative to its past valuations.

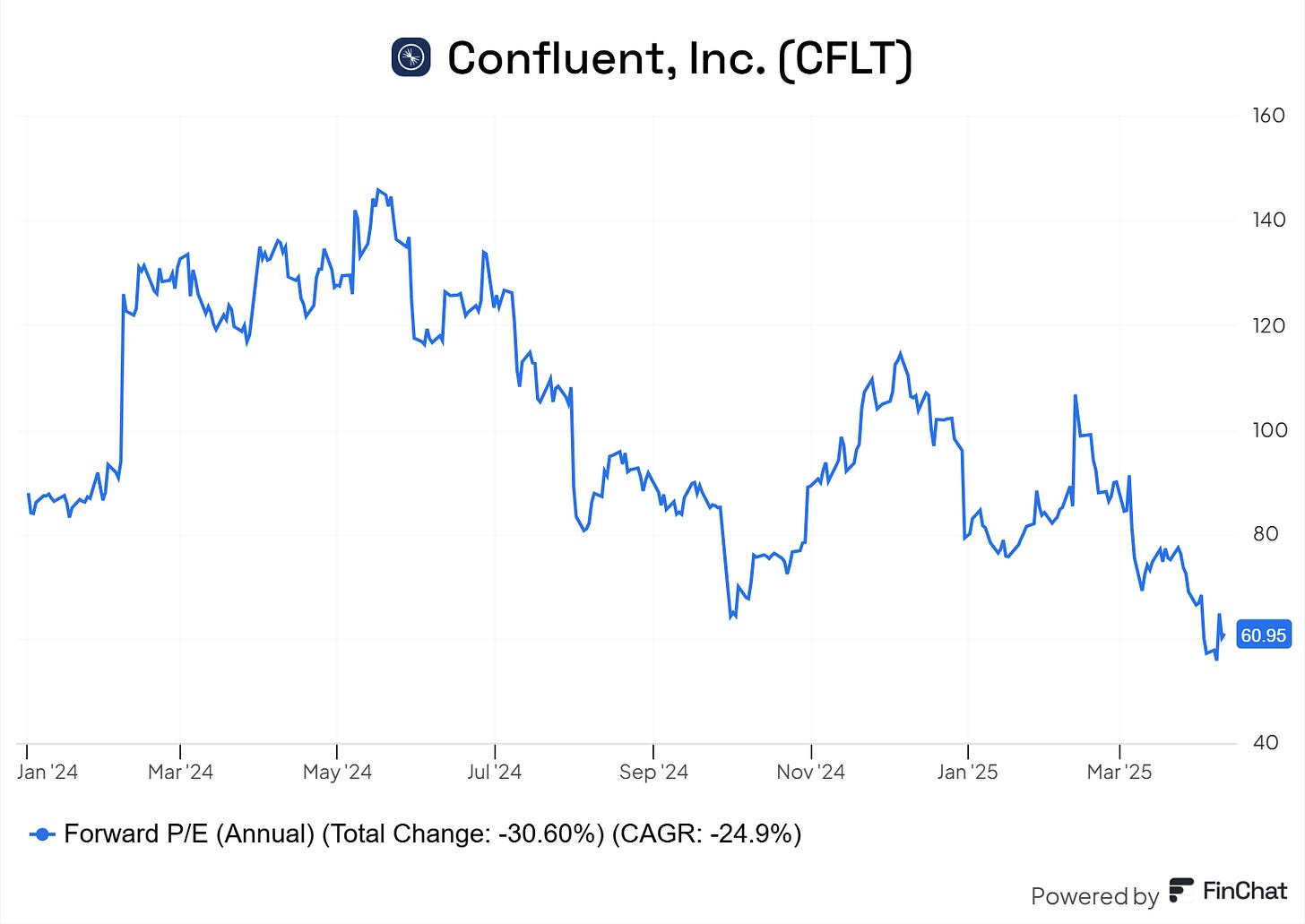

$CFLT Confluent trades at a Forward P/E of 60.9. In 2023, the company became profitable on a non-GAAP EPS basis and is in an earlier stage of growth.

The EPS growth forecast for 2026 is 39.3%, with P/E of 58.8, 2026 PEG ratio of 1.5.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

$CFLT analysts forecast 23.3% revenue growth for 2025 and 20.8% for 2026. Based on these projections, the company’s P/S multiple suggests it is undervalued compared to other Big Data companies.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Confluent has established several competitive advantages that contribute to its economic moat in the data streaming market. Let's analyze each type of moat and its relative strength.

Economies of Scale

Confluent processes 2.5 trillion events per day, allowing it to distribute fixed costs, particularly its $138.4 million R&D investment in 2023 (22% of total revenue), across a growing customer base of over 4,500 enterprise clients. However, the company reported a net loss of $215.6 million in 2023, and its operating margin remains negative at -55.3%, indicating that scale benefits have not yet translated into profitability. Despite holding approximately 35% market share in the data streaming platform segment, continued high investment in growth limits the operational leverage typically expected at scale.

Network Effect

Confluent demonstrates a moderate to strong network effect as its platform becomes more valuable with increased users, data sources, and applications. With over 120 real-time data connectors and adoption by 75% of Fortune 500 companies, the platform’s utility rises as usage expands. The company’s net revenue retention rate of 118% reflects strong customer expansion, with multi-product users achieving net retention substantially above 130%. However, the network effect is constrained compared to platforms with direct user-to-user interaction and may plateau once a certain customer penetration is reached.

Brand

Confluent has built a strong enterprise brand anchored by its founding team, including CEO Jay Kreps, and its origin from Apache Kafka. The brand is trusted among technical leaders, evidenced by high-profile customers such as Goldman Sachs, Uber, JPMorgan Chase, and Netflix. With 99.99% platform reliability, Confluent’s brand is associated with performance and innovation. However, brand recognition is primarily limited to enterprise and developer audiences. It lacks the broad market influence of more consumer-facing tech brands and does not yet command premium pricing power solely based on brand strength.

Intellectual Property

Confluent holds 47 active patents related to data streaming and maintains strong technical differentiation through enhancements to Apache Kafka. However, as Kafka is open-source, the core technology remains accessible to competitors, limiting exclusivity. Confluent’s edge lies more in its continuous R&D investment—22% of revenue in 2023—and deep domain expertise rather than in patent protection alone. Its innovation cadence, rather than proprietary barriers, sustains its competitive edge.

Switching Costs

Switching costs are Confluent’s most defensible moat. Enterprise customers typically sign contracts exceeding $100,000, with 6–9 month sales cycles and deep integration into mission-critical systems. Migrating away involves re-architecting infrastructure, retraining teams, and risking major operational disruptions. Confluent’s gross retention rate exceeds 90%, reflecting how difficult and costly it is for organizations to leave once embedded. This lock-in provides strong pricing power and long-term revenue stability, as customers become reliant on Confluent as the backbone of their real-time data infrastructure.

Confluent's economic moat is anchored by very strong switching costs, driven by deep infrastructure integration and high retention. The company benefits from moderate economies of scale and intellectual property, though open-source roots limit exclusivity. A strong brand among enterprise clients and a moderate to strong network effect support platform growth, but broader market penetration remains a challenge. Despite processing 2.5 trillion events daily and holding 35% market share, negative margins indicate scale efficiencies are not yet fully realized.

Revenue growth

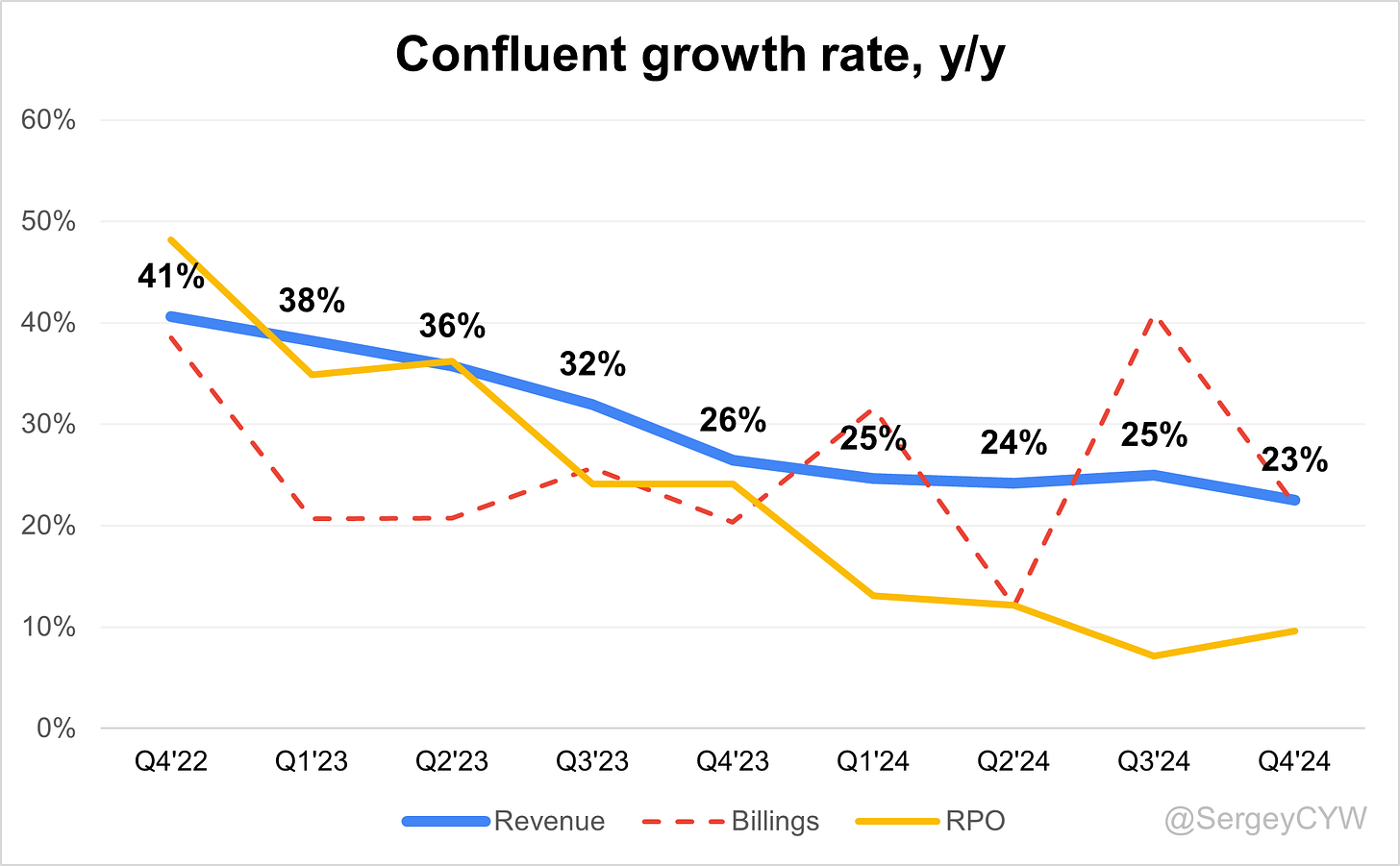

$CFLT Confluent's revenue growth slightly slowed to 22.5% YoY. Based on the forecast for the next quarter, if the company beats its guidance by 1.9%, as it did in Q4, growth would reach 24.2%, indicating a potential acceleration in revenue growth.

RPO is growing slower than revenue at +9.6% YoY, and billings are also below revenue growth, increasing +22.1% YoY.

Segments and Main Products

Confluent operates in the Data in Motion segment, enabling organizations to manage, process, and analyze data as it's created for real-time analytics, monitoring, and event-driven applications. The company provides Enterprise Data Infrastructure as a foundational platform for robust, scalable systems handling data integration, processing, and distribution. Confluent has developed Cloud-Native Solutions tailored specifically for organizations seeking managed services in cloud environments. The Proactive Security and Compliance segment incorporates features ensuring businesses maintain regulatory compliance while safeguarding data integrity and privacy.

Main Products

Confluent Cloud represents the company's fully-managed, cloud-native SaaS offering available across major cloud providers including AWS, GCP, and Microsoft Azure. The platform features a pay-as-you-go model allowing customers to scale without upfront costs. Confluent Cloud generated $491.87 million in revenue for 2024, accounting for 51.07% of total revenue with impressive 41% year-over-year growth.

Confluent Platform serves as the company's enterprise-ready, self-managed software offering designed for deployment on-premise or across public and private cloud environments. The platform is cloud-agnostic and supports multicloud strategies. Revenue from Confluent Platform comes primarily through licensing and post-contract support (PCS), with PCS growing significantly faster than licensing. Combined subscription revenue from both platforms reached $922.09 million in 2024, representing 95.73% of total revenue.

Professional Services comprise a smaller but strategic segment of Confluent's business, generating $41.55 million in 2024 and accounting for 4.31% of total revenue. Services revenue experienced a -13.15% year-over-year decline, indicating a potential shift in focus toward higher-margin subscription offerings or customers becoming more self-sufficient with the platform.

Main Products Performance in the Last Quarter

$CFLT Revenue by Segment: 96% of the company’s revenue comes from subscriptions, which include Confluent Cloud (53% of total revenue), Confluent Platform – PCS (33%), and Confluent Platform – License (10%). Professional Services account for 4% of total revenue.

Subscription revenue growth remained strong at +23.6% YoY in Q4.

The highest growth came from Confluent Cloud, which grew +38% YoY.

Confluent Platform – PCS grew +13% YoY, Confluent Platform – License increased +9% YoY, and Professional Services grew +2% YoY.

Confluent Platform

Confluent Platform revenue grew +10% YoY to $112.7M, contributing 45% of subscription revenue. Growth remained stable in regulated sectors like telecom and banking where enterprise-grade streaming is critical. Momentum came from multiyear contracts and migrations from open-source Kafka. However, growth is slower relative to Confluent Cloud, which is scaling faster with broader consumption models.

Confluent Cloud

Confluent Cloud revenue surged +38% YoY to $137.9M, now representing 55% of subscription revenue, up from 49% last year. DSP consumption made up ~13% of cloud revenue and is expanding significantly faster than core cloud. Win rates remained >90% against cloud-native and startup competitors. The company added 840 net new customers in FY24, nearly 2x the previous year, reflecting strong product-market fit and frictionless consumption onboarding.

DSP Expansion

Connect, Process, and Govern components are powering a third wave of growth. DSP now contributes ~13% of Confluent Cloud revenue and is growing 3x faster than the overall cloud business. Tableflow, integrated with Delta Lake and Unity Catalog, bridges operational and analytical data, enabling real-time table views through open formats like Apache Iceberg. Key accounts such as Zazzle, Citizens Bank, and a leading European grocery delivery company are driving DSP adoption. DSP’s modularity supports enterprise AI and analytics use cases with high ROI.

Kafka Evolution

Kafka remains core to Confluent’s strategy to “soak up the world’s Kafka.” Enhancements like Enterprise Clusters and Freight Clusters have expanded the serviceable addressable market, unlocking price-sensitive, high-throughput workloads. Legacy migrations, particularly from telco and financial services, underline Confluent’s strength in replacing brittle streaming infrastructure with a managed, scalable alternative.

Apache Flink

Fully managed Apache Flink is now embedded in Confluent Cloud. Customers such as Zazzle use it to cut processing costs and enhance personalization. Grocery delivery firms leverage Flink to orchestrate real-time logistics and inventory. The Flink engine, now serverless, supports real-time joins, filters, and aggregations—transforming it into a co-equal growth driver alongside Kafka. Adoption spans retail, automotive, and logistics, with broad production usage ramping steadily.

WarpStream Expansion

WarpStream, acquired to target latency-tolerant, high-scale environments, has been adopted exclusively by digital-native customers including Elastic and Cursor. Switching from Redpanda delivered ~10x cost savings and superior throughput. Combined with Freight Clusters, WarpStream enhances Confluent’s positioning in observability, analytics, and IoT, providing a lower-cost, secure deployment model that expands the platform’s reach and improves flexibility. Both offerings play a key role in capturing workloads constrained by prior cost inefficiencies.

Product & Innovation Highlights

Over 200 DSP features were introduced in 2024, including Stream Governance, new Connectors, expanded Flink integrations, and Tableflow GA. Tableflow emerged as the flagship innovation, projecting real-time event streams as queryable tables using open formats. It allows analytics systems like Databricks and Snowflake to consume streaming data directly, while also enriching stream processing with historical context for more intelligent applications.

Confluent’s deeper integration with Databricks enables seamless bi-directional connectivity with Delta Lake, expanding visibility across operational and analytical estates. Joint go-to-market efforts include co-selling, co-marketing, and technical enablement—positioning Confluent as a neutral, cross-cloud streaming layer.

The platform supports real-time AI architecture by injecting fresh context into inference workflows. Confluent now plays a critical role in enabling agentic AI, where continuous data flows replace static batch pipelines for decision-making at run time.

Strategic storage price reductions improved elasticity. Short-term revenue impact was offset by increased usage, expanding long-term monetization. Internal telemetry confirms broader adoption across both new and existing accounts. Confluent’s pricing model is now optimized to drive long-term revenue expansion via frictionless scaling.

The architecture now supports a real-time unified data fabric. Tableflow exposes streaming data as persistent structured tables, allowing enterprises to replace batch ETL with a continuously updating, queryable data layer. This enables both stateful analytics and AI inference—solidifying Confluent’s role as the backbone of modern data infrastructure.

Revenue by Region

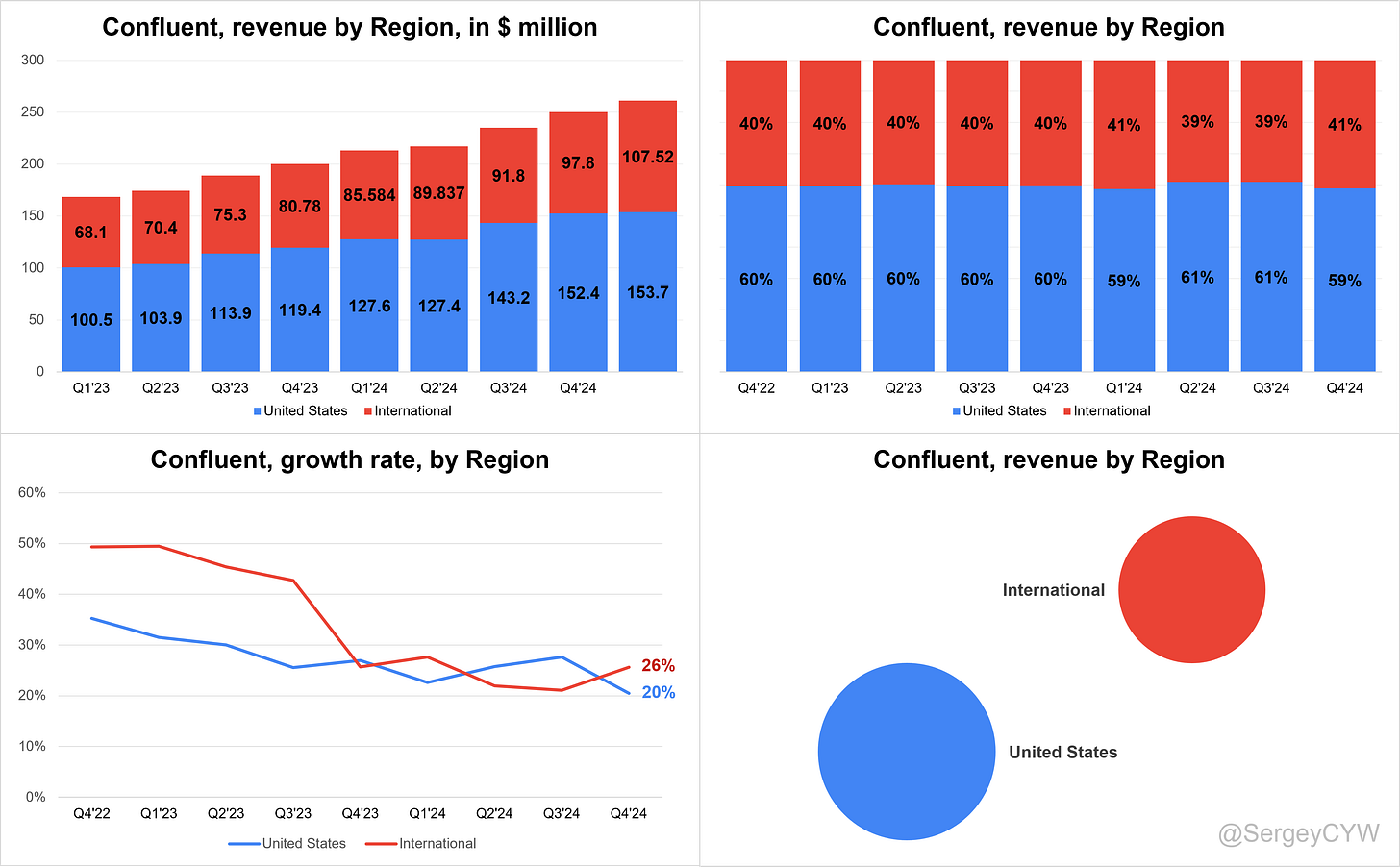

The United States accounts for 59% of total revenue, making it Confluent’s ($CFLT) largest market, with revenue growing +20% YoY in Q4.

International revenue accounts for 41% of total revenue and is growing at a faster pace of +26% YoY.

Market Leaders

$CFLT Confluent has been recognized as a Challenger in the Gartner Magic Quadrant for Data Integration Tools, moving up from its previous position as a Niche Player in 2023. The shift reflects Confluent’s growing relevance in enterprise-scale data integration.

Confluent’s platform extends beyond batch-oriented systems by enabling real-time streaming across hybrid and multicloud environments. Built on Apache Kafka and Apache Flink, the platform offers capabilities for streaming, processing, connecting, and governing data at scale.

Confluent Kora enhances Kafka with cloud-native optimizations and supports low-latency performance with features like Infinite Storage and Cluster Linking. The integration of Flink introduces real-time analytics and supports AI model inference directly within streaming pipelines. The Connect framework includes over 120 pre-built and 80 fully managed connectors, simplifying access to a broad range of data systems.

Customers

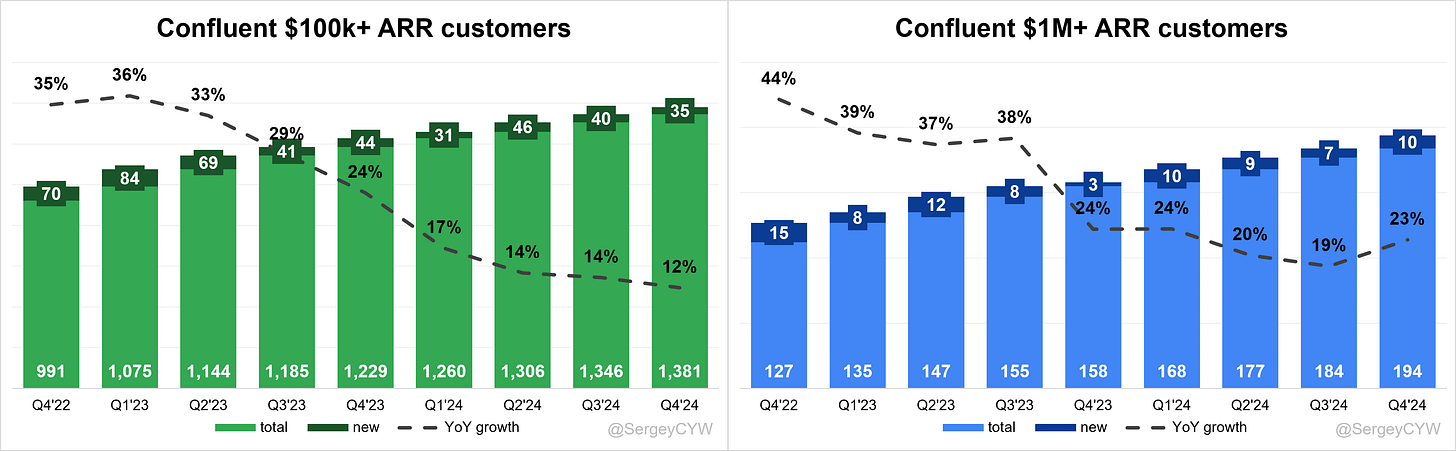

$CFLT Confluent added 35 customers with ARR over $100K, reflecting +12% YoY growth, though this addition is lower than the same period last year.

The company also added 10 customers with ARR over $1M, representing +23% YoY growth—a strong increase in large customer additions, with growth accelerating in Q4.

As the platform scales, Confluent is placing greater emphasis on attracting large enterprise customers.

Customer Success Stories

Zazzle implemented Confluent’s fully managed Flink to process massive clickstream data volumes and personalize recommendations. By moving stream processing earlier in the data pipeline—prior to loading into BigQuery—Zazzle cut storage and compute costs and increased relevance in product recommendations. The company plans to expand Flink usage to more data streams, enhancing real-time personalization capabilities.

A European grocery delivery service adopted Confluent Cloud with Flink to replace fragmented architectures based on open-source Kafka and REST APIs. The firm now aggregates and processes real-time grocery orders and warehouse locations to optimize end-to-end order management. The unified streaming architecture enabled faster delivery estimates, reduced downtime, and improved operational efficiency across its logistics network.

Citizens Bank, a top U.S. financial institution, migrated from open-source Kafka to Confluent Cloud. Previously requiring 20 FTEs to manage Kafka internally, the bank reduced IT costs by 30%, cut fraud false positives by 15%, and saved $1.2M annually. Confluent’s governance features enhanced data consistency and compliance. Business impact included a 20% increase in engagement, 40% faster loan processing, and a 10-point NPS lift.

A U.S. digital-native transportation tech firm leveraged Tableflow with Apache Iceberg to shift from batch loading into Snowflake to real-time analytics. The company improved insight delivery speed and cut data processing costs by allowing Confluent Cloud to manage preprocessing. The switch enabled more precise pricing and better customer booking experiences.

A top three Fortune Global 100 telecom provider streams data from 70,000 U.S. cell towers using Confluent’s complete platform. Replacing a legacy streaming service, the telco now captures real-time data for internal performance optimization and partner sharing. This supports data-driven investment decisions in 5G and fiber deployment based on granular network insights.

Large Customer Wins

Confluent added 840 new customers in FY24, nearly 2x the previous year’s total. Total customer count reached ~5,800 by year-end. The company grew its $100K+ ARR customer base to 1,381 (+12% YoY), representing 90% of subscription revenue. $1M+ ARR customers rose 23% YoY to 194.

New enterprise wins in Q4 included a top five global video game company, a major sports media outlet, a Fortune 100 pharmaceutical, a global cruise operator, and a leading European airline. Most were new to Confluent, contributing directly to land-and-expand momentum in large account segments.

Customers shifting from competitors also played a role in expansion. A digital-native company helping developers access real-time data replaced Redpanda with WarpStream due to cost and performance concerns. The switch resulted in ~10x cost savings and opened new use cases enabled by scalable, secure real-time data pipelines.

Confluent also deepened global penetration with a multiyear partnership with Jio Platforms, expanding access in India through Jio Cloud and managed Confluent Platform offerings. This agreement targets the development of GenAI and real-time applications across India's rapidly growing enterprise ecosystem.

Retention

$CFLT Confluent's Dollar-Based Net Retention Rate (DBNR) for the last quarter slightly decreased to 117%, but remains strong—ranking among the leaders in SaaS companies and in line with the median DBNR of 117% for the SaaS companies I monitor.

Net new ARR

$CFLT Confluent added $44 million in net new ARR in Q4 2024, which is 15% lower year-over-year.

This net new ARR addition is roughly in line with the two-year average.

CAC Payback Period and RDI Score

$CFLT Confluent's return on Sales & Marketing (S&M) spending stands at 35.8, with the CAC Payback Period significantly worse than the SaaS average (the median for the SaaS companies I track is 20.8 months).

The R&D Index (RDI Score) for Q4 is 0.94, also below the 1.2 median of the SaaS companies I monitor, but still above the broader industry median of 0.7, indicating a healthy level of investment.

An RDI Score above 1.4 is considered best-in-class, emphasizing the importance of efficient R&D allocation.

Profitability

Over the past year, $CFLT Confluent has experienced changes in its margins:

Gross Margin increased from 77.5% to 78.8%.

Operating Margin slightly decreased from 5.3% to 5.2%.

Free Cash Flow (FCF) Margin significantly improved from 3.2% to 11.1%.

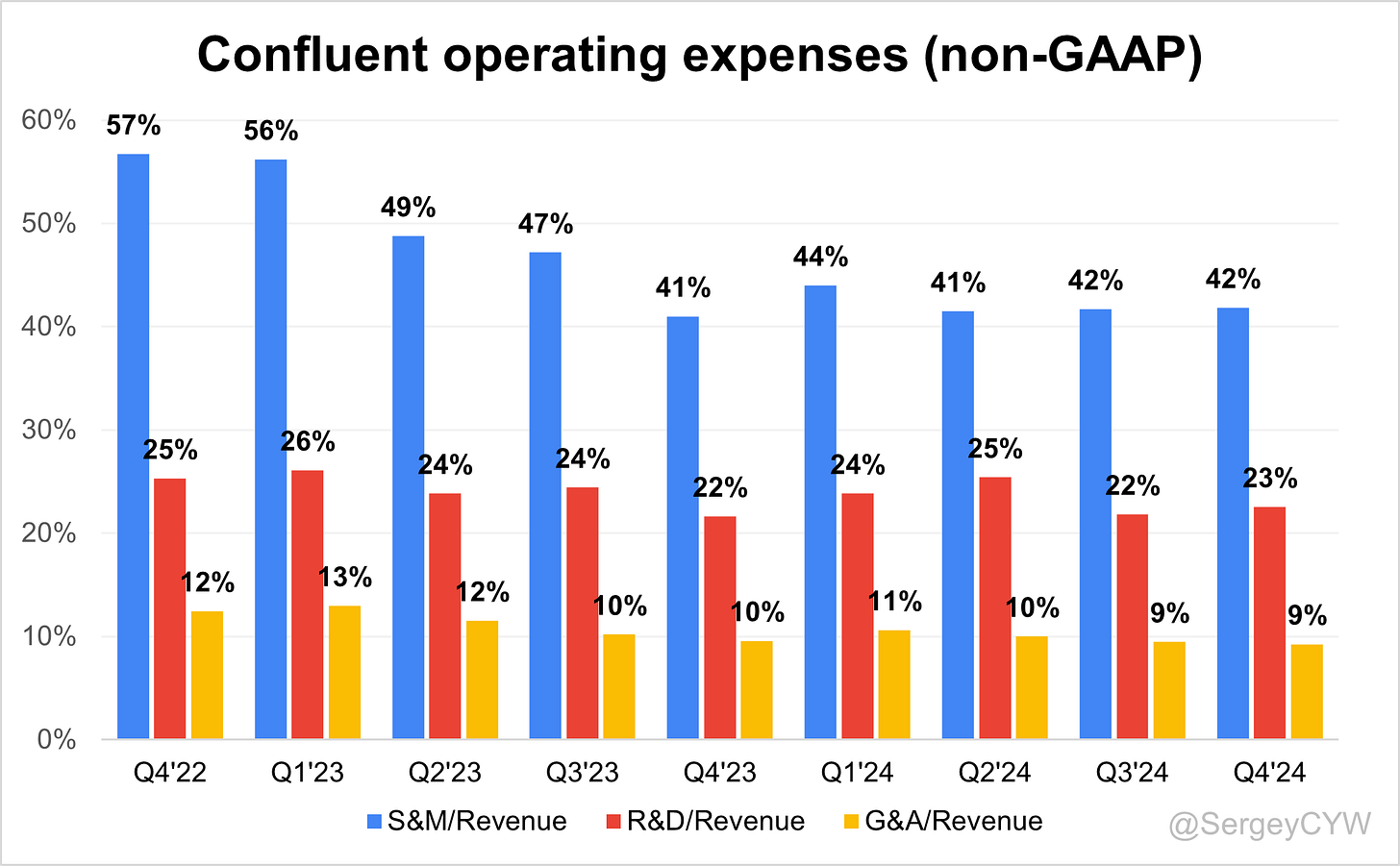

Operating expenses

$CFLT Confluent's non-GAAP operating expenses have gradually decreased, driven by reduced Sales & Marketing (S&M) spending. S&M expenses have significantly declined from 57% two years ago to 42%.

The R&D share remains high at 23%, reflecting the company’s continued investment in future growth through platform enhancements and updates.

General & Administrative (G&A) expenses have also dropped, from 12% two years ago to 9%.

Balance Sheet

$CFLT Balance Sheet: Total debt stands at $1,110 million, while Confluent holds $1,911 million in cash and cash equivalents, far exceeding its liabilities and reflecting a healthy balance sheet.

Dilution

$CFLT Shareholder Dilution: Confluent’s stock-based compensation (SBC) expenses are at a very high level—41% of revenue, significantly above the SaaS median and among the highest SBC levels in the sector.

Shareholder dilution is also elevated, with the weighted-average number of basic common shares outstanding increasing by 6.6% YoY.

Conclusion

$CFLT Confluent operates in the highly promising Data Streaming market, with a TAM estimated at $100B. Confluent's economic moat is anchored by very strong switching costs, driven by deep infrastructure integration, innovation, and high gross retention.

Leading Indicators:

RPO growth of +9.6% is significantly below revenue growth.

Billings growth of +22.1% also lags behind revenue growth.

Net new ARR additions are in line with the two-year average but declined -15% YoY.

A strong number of new large customer additions remains a positive highlight.

Key Indicators:

Net Dollar Retention (NDR) declined 3 percentage points YoY to 117%.

CAC Payback Period worsened to 35.8 months, significantly higher than the SaaS average.

RDI Score slightly declined to 0.98, below the median of the SaaS companies I track.

The revenue growth forecast for next quarter suggests acceleration, but the leading indicators do not yet confirm strong momentum. RPO and billings growth are significantly lower than revenue growth, net new ARR additions are weak, and overall customer additions were soft—though new large customer additions remained strong in Q4.

Management noted that 2025 will be “The Year of DSP,” as cloud DSP consumption begins to outpace overall cloud growth.

Valuation appears undervalued relative to projected revenue growth and compared to peers in the big data sector. The company is trading near historical valuation lows. It’s also worth noting that Confluent achieved non-GAAP profitability in 2023, with continued improvement in operating metrics.

However, SBC as a percentage of revenue remains one of the highest among SaaS companies I monitor. In 2021, this was justified by revenue growth above +60% YoY, and investors were willing to overlook dilution. But now, as growth slows, the dilution risk becomes harder to ignore.

Management maintains an optimistic outlook, expecting growth acceleration. I continue to keep $CFLT on my watchlist as I believe Data Streaming is a promising market, but I will wait for confirmation of that optimism through stronger leading indicators and consistent quarterly execution. It will also be critical for the company to control shareholder dilution and reduce the high SBC level.