Cloudflare: reacceleration, product velocity—yet is the valuation running ahead?

Deep Dive into $NET: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Is Cloudflare’s elevated valuation becoming its biggest risk despite accelerating growth?

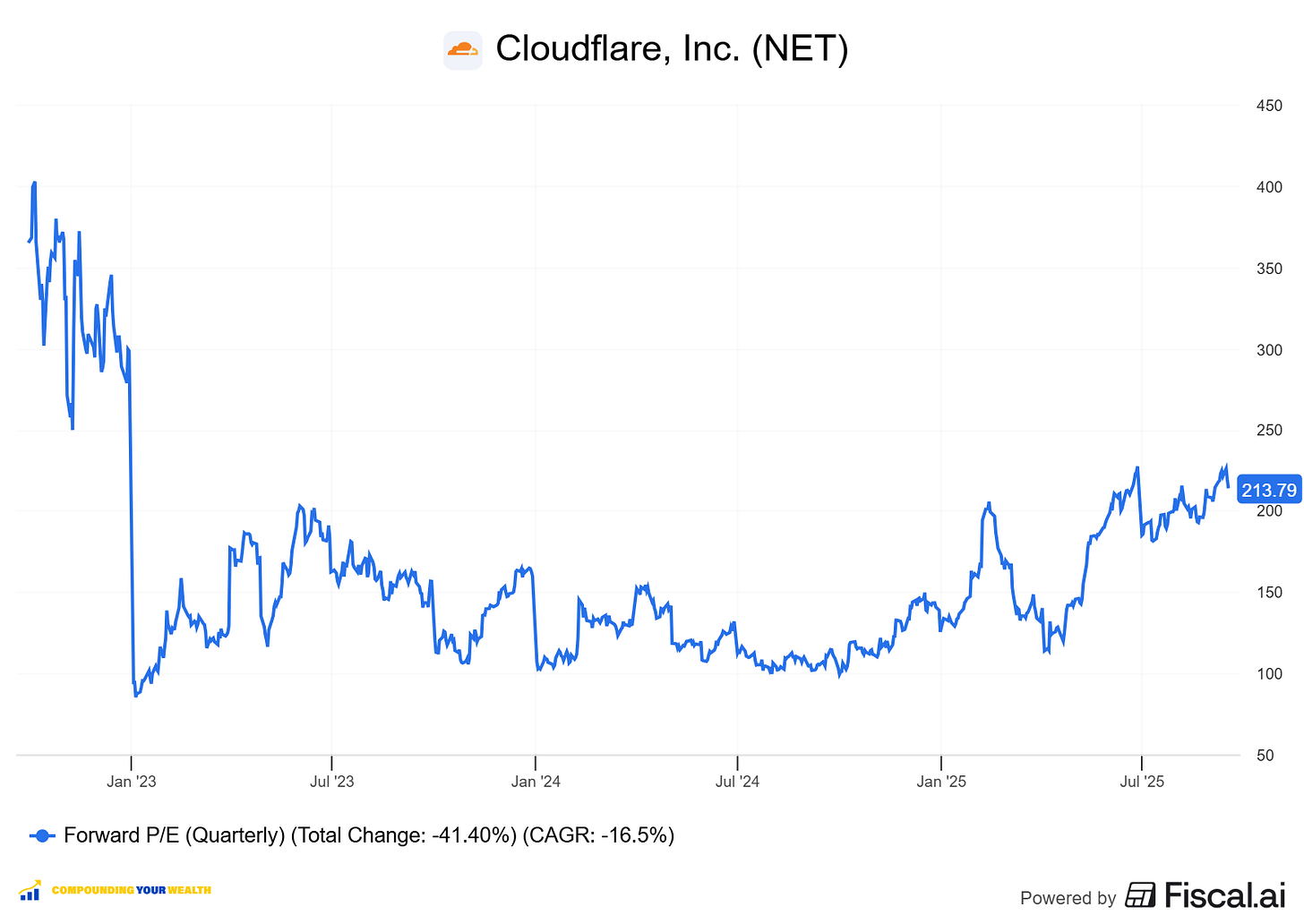

$NET trades at a Forward EV/Sales multiple of 31.1, far above the sector median of 18.1, and a Forward P/E of 213.8, equal to 7.7x its revenue growth rate. Enterprise momentum is strengthening, with revenue from customers spending >$1M and >$5M accelerating at the fastest pace since 2022. Guidance implies potential revenue acceleration to +29.5% YoY if Cloudflare beats expectations again. The tension lies between premium valuation and outstanding execution, raising the question of whether the premium remains justified.

Table of Contents:

1. Company Overview – A brief summary of the company, including its mission, sector, competitive advantage, and total addressable market (TAM).

2. Valuation – Analysis of changes in Forward EV/Sales and Forward P/E multiples, along with comparisons to peers within the same sector.

3. Economic Moat – Evaluation of the company’s moat across five key types: Economies of Scale, Network Effect, Brand, Intellectual Property, and Switching Costs.

4. Revenue Growth – Review of revenue growth dynamics over the past two years.

5. Segments and Main Products – Overview of the company’s business segments, latest quarterly performance by segment, product innovation.

6. Market Leadership – Assessment of the company’s leadership status in its segment, as recognized by reputable rating agencies like Gartner, The Forrester Wave, etc.

7. Customers – Analysis of customer growth trends, customer success stories, and major customer wins.

8. Key Performance Indicators (KPIs) – Review of Retention, net new ARR, CAC payback period, RDI score, profitability, operating expenses, balance sheet strength, and shareholder dilution.

9. Conclusion – Final thoughts and summary based on the above analysis.

1. Company overview

About Cloudflare

Cloudflare, is a global cloud services provider headquartered in San Francisco, California. Founded in 2009 by Matthew Prince, Lee Holloway, and Michelle Zatlyn, the company delivers key network infrastructure services, including Content Delivery Network (CDN), DDoS Protection, Web Security, Zero Trust Services, and DNS Services. Cloudflare operates in over 285 cities across 100 countries, managing daily network traffic of approximately 72 terabits per second.

Company Mission

Cloudflare’s mission is to "help build a better Internet", focusing on making the web faster, safer, and more reliable. The company optimizes website speed and performance, protects digital assets from cyber threats, and enhances global accessibility. Continuous innovation drives Cloudflare’s ability to meet evolving digital security and performance needs.

Sector Overview

Cloudflare operates in the Information and Communications Technology (ICT) sector, specializing in cloud infrastructure services. The company is positioned across multiple industry segments, including web performance optimization, cybersecurity, edge computing, and Zero Trust security frameworks. Businesses rely on Cloudflare to secure, accelerate, and optimize their digital presence.

Competitive Advantage

Cloudflare’s primary competitive advantage lies in its expansive global network infrastructure of 285+ data centers worldwide, ensuring low latency and high availability. The company integrates CDN, security, edge computing, and Zero Trust frameworks into a unified platform, reducing complexity for customers. Cloudflare’s scalable pricing model ranges from free plans to enterprise solutions starting at $2,000/month, making its services accessible to startups and large enterprises alike.

Total Addressable Market (TAM)

Cloudflare operates across multiple high-growth markets. Investor materials show a projected TAM of $181B in 2025 and $231B by 2028.

The global CDN market is projected to grow at ~15–16% CAGR to 2035 (FMI) and around ~11% CAGR to 2029 (Technavio), indicating sustained double-digit growth aligned with Cloudflare’s application services footprint.

The SASE market is forecast at $15.5B in 2025, growing to $44.7B by 2030 at a 23.6% CAGR (ResearchAndMarkets). Another independent forecast projects a ~18.5% CAGR from 2024–2030, underscoring strong secular tailwinds for Cloudflare One.

Independent firms estimate Zero Trust security growth of ~16–17% CAGR from 2025 to the early 2030s, with SSE scaling rapidly as part of broader SASE consolidation. This supports Cloudflare’s security TAM expansion within its connectivity cloud.

The $231B 2028 TAM comes from Cloudflare’s Investor Day 2025 deck, derived using third-party market slices and internal segmentation.

2. Valuation

$NET Cloudflare is trading at a Forward EV/Sales multiple of 31.1, which is above the median of 18.1. The lowest Forward EV/Sales in 2025 was recorded in March 2025 at around 15. The company’s valuation has increased significantly over the past months.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$NET trades at a Forward P/E of 213.8, with revenue growth of 27.8% YoY in the last quarter. This forward P/E is 7.7x the anticipated revenue growth rate. The multiple remains elevated as the company reinvests heavily in R&D and S&M, reflecting its earlier stage of growth.

The EPS growth forecast for 2026 is 32.2%, with a P/E of 246 and a 2026 PEG ratio of 7.6. From a PEG perspective, the stock looks highly valued.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Analysts forecast $NET revenue growth at +28.1% in 2025 and +26.4% in 2026, the highest among the companies in Cybersecurity space. Considering the 2026 revenue forecast, Cloudflare’s valuation based on the EV/S multiple trades at a premium compared to other companies in the cybersecurity sector.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

3. Economic Moat

Cloudflare demonstrates moderate to strong economic moats across multiple defensive categories, with its strongest advantages stemming from economies of scale and variable switching costs depending on customer integration depth.

Economies of Scale

Cloudflare exhibits strong economies of scale that continue strengthening as the company grows. The company operates a massive global network spanning 335+ cities across 125+ countries, handling approximately 20% of global internet traffic and serving 95% of the world's Internet-connected population within 50 milliseconds. This scale enables significant cost advantages - Cloudflare achieved a 76.3% gross margin in Q2 2025, with revenue reaching $512.3 million representing 28% year-over-year growth. The company's single software stack deployed on commodity hardware allows it to offer services at substantially lower costs than competitors, with customers reporting over 80% cost savings when migrating from traditional cloud providers like AWS. Cloudflare's network processes 247 billion cyber threats daily, providing unmatched threat intelligence that scales with network size. The company holds a 28% market share in the CDN market, second only to Akamai's 34%, demonstrating its scale advantage in a consolidated industry.

Network Effects

Cloudflare benefits from strong network effects that create self-reinforcing value across its platform. As more businesses use Cloudflare's services, the platform becomes more robust through enhanced threat detection capabilities and performance optimization for all customers. The network effects are particularly evident in security offerings, where increased traffic volume provides better threat intelligence - Cloudflare blocks an average of 385 million daily cyber events in Japan alone and handles massive global attack volumes. However, these network effects are more limited compared to traditional platform businesses, as individual customer benefits don't create exponential value for other users directly. The company's growing developer ecosystem strengthens these effects - Cloudflare Workers has been adopted by over 3 million developers, creating a virtuous cycle where more developers attract additional users and vice versa.

Brand Strength

Cloudflare maintains strong brand strength within cybersecurity and web performance sectors. The company has established significant market recognition, with Gartner naming Cloudflare a Visionary in the 2025 SASE Magic Quadrant and including it in the SSE Magic Quadrant for three consecutive years. Fortune recognized Cloudflare as a Future 50 company for the second consecutive year, ranking #14 in 2024 for long-term revenue growth potential. The company's brand benefits from handling major global events and successfully defending against record-breaking DDoS attacks. In the CDN security market valued at $5.62 billion in 2025 and growing at 14.45% CAGR, Cloudflare's brand recognition helps it compete effectively against established players like Akamai, AWS, and Azure. The company's developer-friendly approach and transparent communication have built strong community trust, though it faces intense competition from hyperscale cloud providers.

Intellectual Property

Cloudflare demonstrates moderate intellectual property advantages through technological innovations and strategic patent defense. The company successfully defended against patent troll Sable Networks, ultimately forcing Sable to pay Cloudflare $225,000 and dedicate all its patents to the public domain. Cloudflare actively develops proprietary technologies, recently filing patents for unified network services connecting private networks with distributed cloud computing. The company's Project Jengo crowdsourced prior art initiative helps invalidate frivolous patent claims while building defensive IP strategies. Workers AI has experienced explosive 4,000% year-over-year growth in inference requests, demonstrating the value of Cloudflare's edge computing innovations. However, the software-defined nature of Cloudflare's business model means IP advantages are primarily process-based rather than product-based, making them somewhat easier for competitors to develop around.

Switching Costs

Cloudflare exhibits variable switching costs that range from low to high depending on customer integration depth and service usage. For basic CDN and DNS users, switching costs remain relatively low as these services can be migrated with minimal friction. However, enterprise customers using integrated solutions face meaningful switching barriers. The company signed its largest contract in history worth over $100 million in Q1 2025, primarily driven by the Workers platform, indicating high switching costs for deeply integrated customers. Enterprise customers using Cloudflare's Zero Trust solutions, Workers platform, or Magic WAN face significant migration complexity and costs. The company's R2 storage service offers zero egress fees but maintains S3 compatibility, reducing switching costs while creating stickiness through cost advantages. Cloudflare's 114% dollar-based net retention rate in Q2 2025 suggests strong customer expansion and low churn, indicating effective switching cost barriers for key customer segments

4. Revenue growth

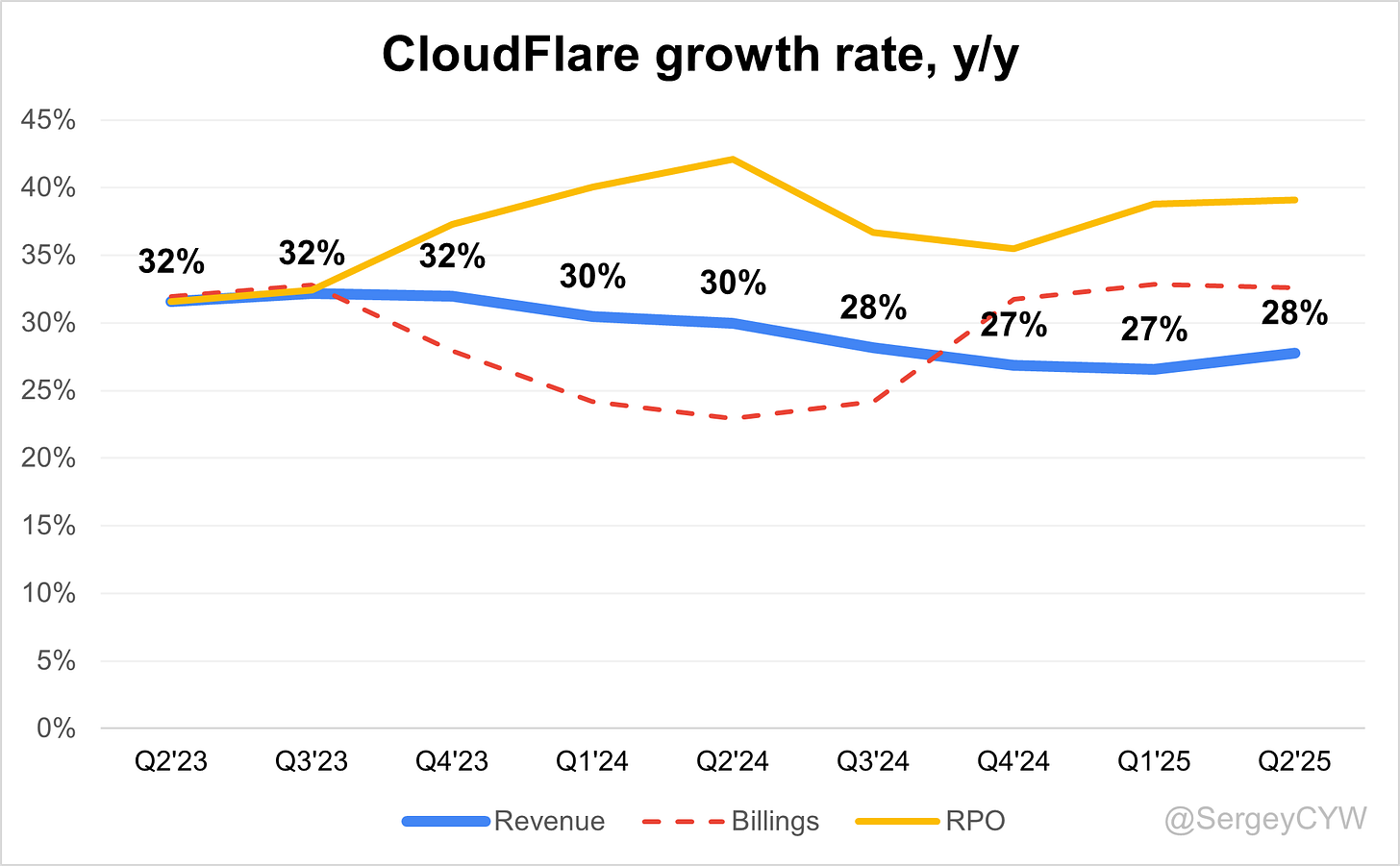

The revenue growth of $NET Cloudflare accelerates to +27,8% YoY in Q2. Based on the forecast for the next quarter, if the company beats its guidance by 2.3%, as it did in Q2, revenue growth would reach approximately 29.5%, indicating a potential acceleration.

RPO growth accelerated to +39.1% YoY, significantly outpacing revenue growth, which may signal future revenue acceleration. Billings growth at +32.6%, also surpassing revenue growth.

5. Segments and Main Products

Cloudflare operates across multiple segments, delivering solutions for security, performance, reliability, and developer capabilities.

In Security, Cloudflare offers Cloud Firewall for web protection, Bot Management using machine learning to block malicious bots, DDoS Protection with Unmetered Mitigation, IoT Protection via Cloudflare Orbit, SSL/TLS Services for encrypted traffic management, and Secure Origin Connection to shield internal systems.

The Performance segment includes a Content Delivery Network (CDN) for rapid content distribution, Argo Smart Routing for optimized internet paths, and Mobile Optimization for enhanced mobile speed.

Reliability solutions consist of Load Balancing to distribute workloads, Anycast Network for global traffic management, and Always Online to maintain website accessibility during outages.

Internal Infrastructure products include Magic WAN for enterprise connectivity, Cloudflare Warp for secure end-user traffic routing, Magic Transit for on-premise network protection, and Cloudflare Gateway to filter malware and threats.

Developer Solutions feature Cloudflare Workers for serverless computing, Cloudflare Pages for web app deployment, and a Data Localization Suite to comply with data residency regulations.

Cloudflare R2 is a globally distributed object storage platform, S3-compatible with no egress fees. It provides AES-256 encryption, TLS/SSL protection, event-driven workflows, and seamless integration with Cloudflare Workers for automation.

Cloudflare D1 is a serverless SQL database built on SQLite, supporting point-in-time recovery and JSON parsing. It integrates with Cloudflare Workers, enabling globally distributed applications with a cost-efficient billing model based on queries and storage.

Cloudflare One is a comprehensive networking and security solution, combining Magic Transit, WARP, Gateway, and Access. It applies consistent global security controls, reduces latency with Argo Smart Routing, and centralizes traffic logs and analytics.

Cloudflare Zero Trust secures sensitive resources with granular access controls, multi-factor authentication, end-to-end encryption, and network segmentation. It ensures compliance with GDPR and HIPAA while integrating with third-party security tools for a unified IT security infrastructure.

Main Products Performance in the Last Quarter

WAF and DDoS Mitigation

Act 1 products remain a pillar of growth. Revenue expansion driven by reliability and performance. Cloudflare blocked record-breaking DDoS attacks, using less than a few percent of network capacity while competitors burned through nearly half. Every server in its network runs every service—removing scrubbing centers and cost spikes. This architecture enables resilience, low latency, and strong customer wins. Act 1 continues to attract large enterprises that value both scale and efficiency.

Cloudflare One

Unified connectivity cloud narrative resonated in the public sector. A large U.S. state signed a 5-year, $5.1M deal for SWG, Magic WAN, DLP, CASB, consolidating multiple vendors and projecting ~60% cost savings. Strategy is partner-first, improving awareness and access to larger opportunities. Challenge is less technology and more market awareness as the company scales upmarket.

SASE

Wins include the $5.1M state deployment above and additional large financial-services expansions. Competitive edge: global footprint, unified stack, and edge-native performance. Hurdle: accelerate awareness and partner channel so sales capacity can consistently land $5M–$20M-scale SASE programs.

Zero Trust

Enterprise proof points are stacking. A Fortune 500 tech company reversed a prior loss and signed a 3-year, $2.4M Zero Trust contract after a first-gen vendor failed to meet requirements; customers cited rapid product maturity in 18 months, ease of deployment, and performance. A Fortune 100 financial firm bought a 1-year, $5M pool for email security, threat intel, Magic Transit, app services. Friction lies in displacement of incumbents and educating buyers on platform breadth.

Workers AI

Momentum turned into revenue. A rapidly growing AI company signed a 1-year, $15M pool-of-funds deal to move all inference from a hyperscaler to Workers AI, making Cloudflare its single inference cloud. A leading travel platform committed $3.8M over 4 years to build on Workers, citing “crazy” performance gains. Another AI firm inked $4.6M over 5 years spanning AI Gateway plus network security. Growth is being pushed by record ACV bookings and rising variable consumption. Success levers: GPUs across the global edge and inference executed close to users for latency and emerging data-residency rules. Constraint: Cloudflare isn’t yet the home for the largest multi-node LLMs; investment is underway to support progressively larger models.

Agentic Web (Act 4)

Cloudflare is building the payment and access rails between AI systems and publishers. Partnerships signed across top media, from Associated Press to Ziff Davis, to enable pay-per-crawl and usage clearing. Context is stark: Cloudflare data indicates it’s ~10× harder to get Google traffic than 10 years ago; some pure-AI referrers are up to 30,000× harder. Strategic position: ~20% of the web sits behind Cloudflare and ~80% of leading AI companies are customers. Monetization will likely be per-transaction or subscription-like, but management says it’s too early to model revenue. Priority is ubiquitous adoption, protocol neutrality (e.g., MCP and others), and a level playing field for buyers and sellers of content.

Innovation & Product Updates

Cloudflare is productizing the Agentic Web rails for content access, usage tracking, and settlement between AI agents and rights-holders. Workers AI continues global rollout of edge inference across distributed GPUs. AI Gateway adoption is expanding as AI firms prioritize cost control, abuse prevention, and performance visibility. The security stack is broadening with Firewall for AI now in active customer testing.

Foundational Act 1 services remain a core strength. The architecture has no scrubbing centers, every server runs every service. Massive DDoS events translate into minimal incremental cost while latency remains unchanged. FedRAMP progress is on track to meet requirements by year-end, unlocking broader federal opportunities.

Go-to-market has shifted to partner-first. The number of ramped account executives grew at the fastest pace in 2 years, improving coverage and execution of large deals.

Cloudflare introduced AI Security Posture Management (AI-SPM) within its Zero Trust platform. Capabilities include Shadow AI Reports for real-time usage insights, Gateway enforcement to block or restrict unapproved AI apps, AI Prompt Protection to prevent sensitive data leaks, and MCP Server Control for centralized monitoring of AI model interactions.

Cloudflare also became the first CASB to integrate with ChatGPT Enterprise, Claude, and Google Gemini, enabling real-time scanning, alerts, and data protection. Enterprises gain a unified framework to adopt AI securely while maintaining compliance, privacy, and operational efficiency.

6. Market Leadership

Cloudflare has been recognized by Gartner in the 2025 Gartner Magic Quadrant for Security Service Edge (SSE). This marks the third consecutive year that Cloudflare has been included in this specific report, placing them among an elite group of only nine vendors acknowledged in 2025.

Gartner's recognition highlights Cloudflare's rapid innovation and development of a mature SSE platform since first launching its Zero Trust Network Access (ZTNA) service in 2018. According to customer feedback mentioned in the announcement, the platform is valued for being fast, easy to deploy, and reliable.

Gartner recognizes Cloudflare as a Visionary in the 2025 SASE Platforms Magic Quadrant, positioning the company as a forward-thinking provider with approximately 400 active enterprise customers utilizing Cloudflare One. Cloudflare's fully integrated SASE solution combines SSE functions, Magic WAN, and Magic WAN Connector through a unified dashboard, with planned investments in post-quantum cryptography and AI expected to shape future market dynamics.

Cloudflare, has been named a Leader in the IDC MarketScape Worldwide Edge Delivery Services 2024 Vendor Assessment. The report highlights Cloudflare’s innovation in edge security, developer-focused tools, and advanced AI/ML technologies. Key strengths include its zero-trust security suite, customizable serverless developer platform, and focus on optimizing performance and reducing IT complexity. Cloudflare continues to empower organizations with secure, fast, and scalable solutions through one of the world’s largest interconnected networks.

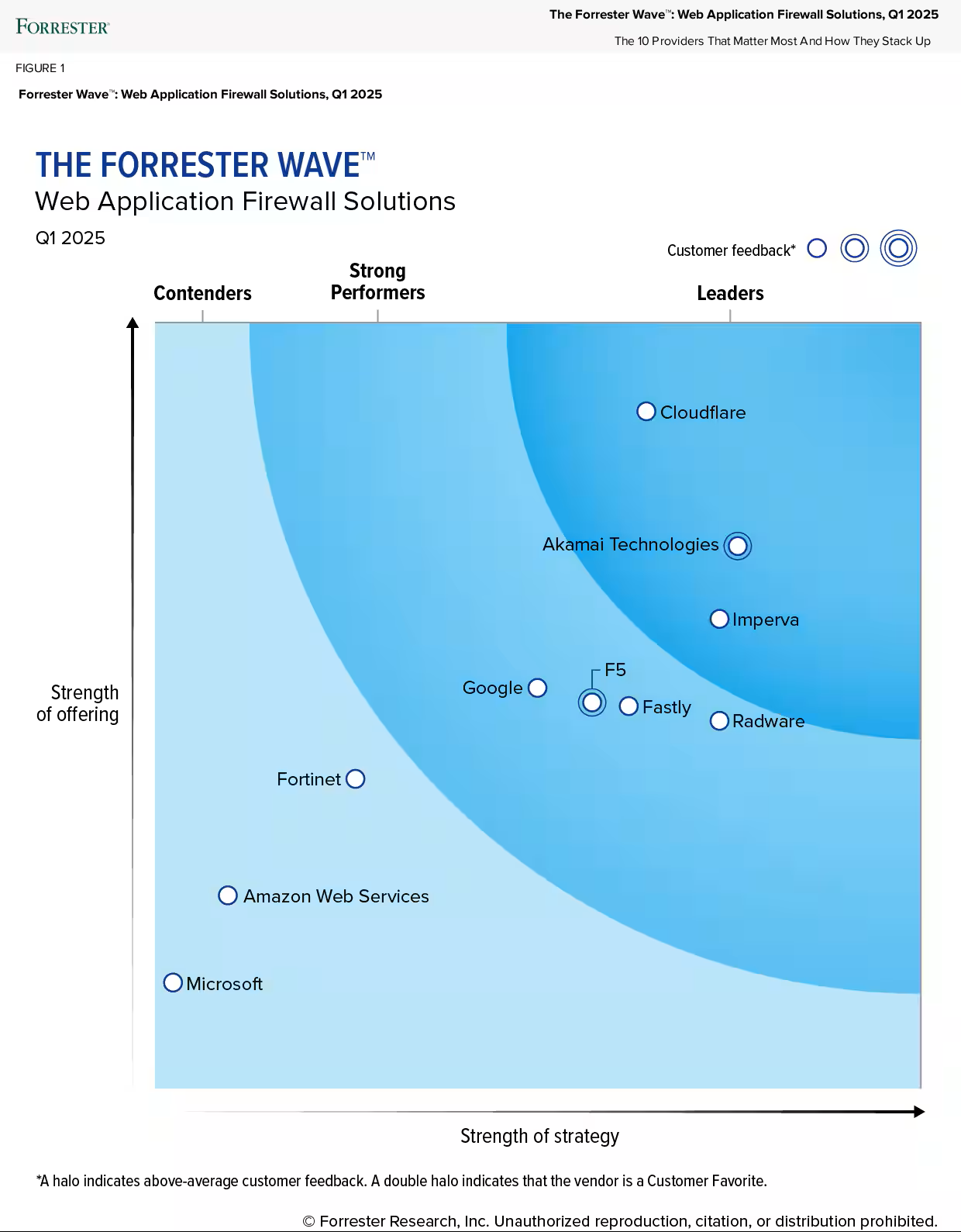

Forrester named Cloudflare a Leader in The Forrester Wave Web Application Firewall Solutions Q1 2025, achieving the highest scores among all WAF providers in the current offering category. Cloudflare received perfect 5.0/5.0 scores in 15 out of 22 criteria including Innovation, Detection models, Product security, Partner ecosystem, DevOps integrations, and Layer 7 DDoS protection. Forrester describes Cloudflare as "a strong option for customers that want to manage an easy-to-use, unified web application protection platform that will continue to innovate".

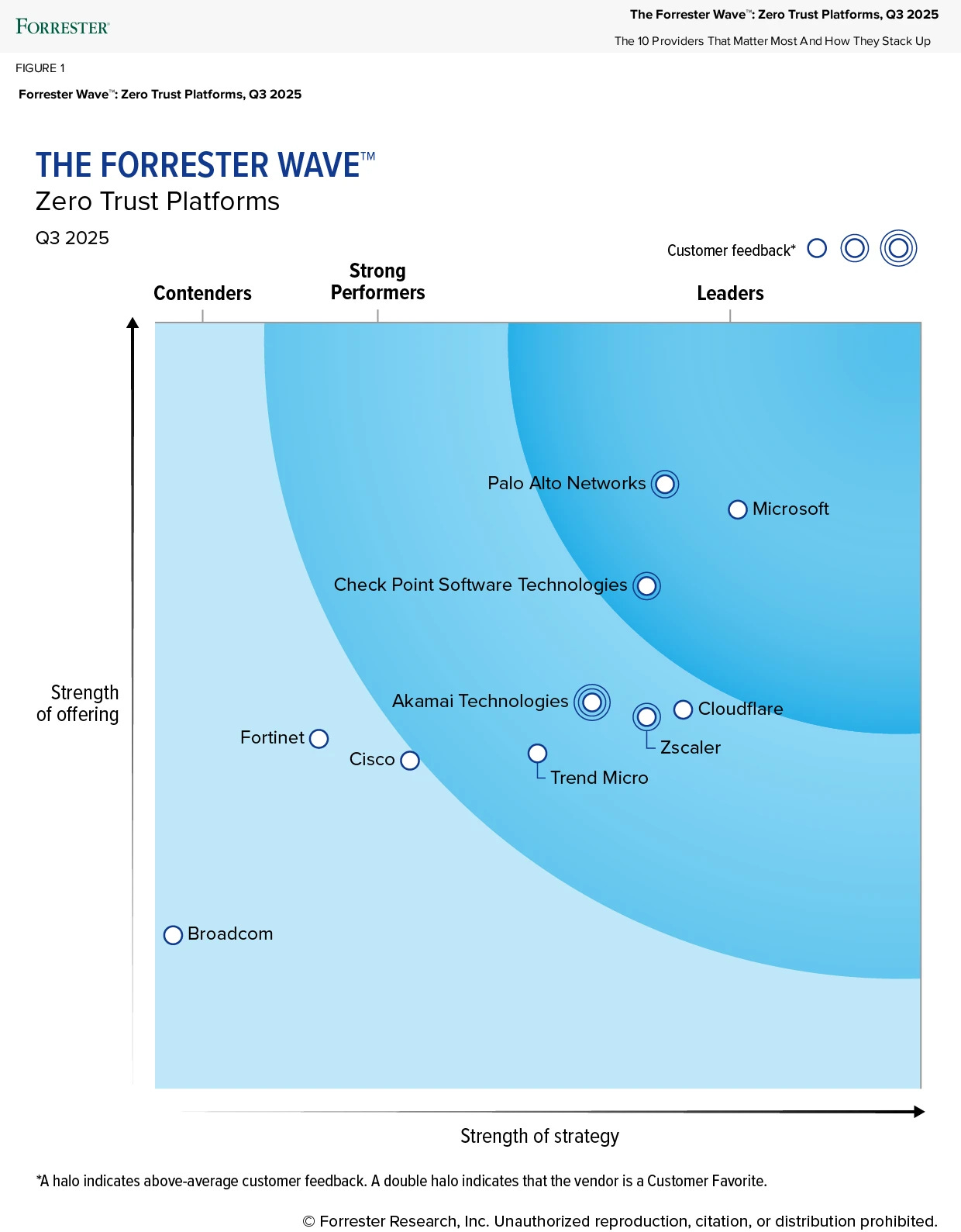

Forrester ranked Cloudflare second highest in the Strategy category for The Forrester Wave Zero Trust Platforms Q3 2025, noting customers view the platform as "technically intuitive and easy to implement, reducing complexity and improving operational efficiency". IDC cited Cloudflare's "aggressive product strategy to support enterprise security needs"

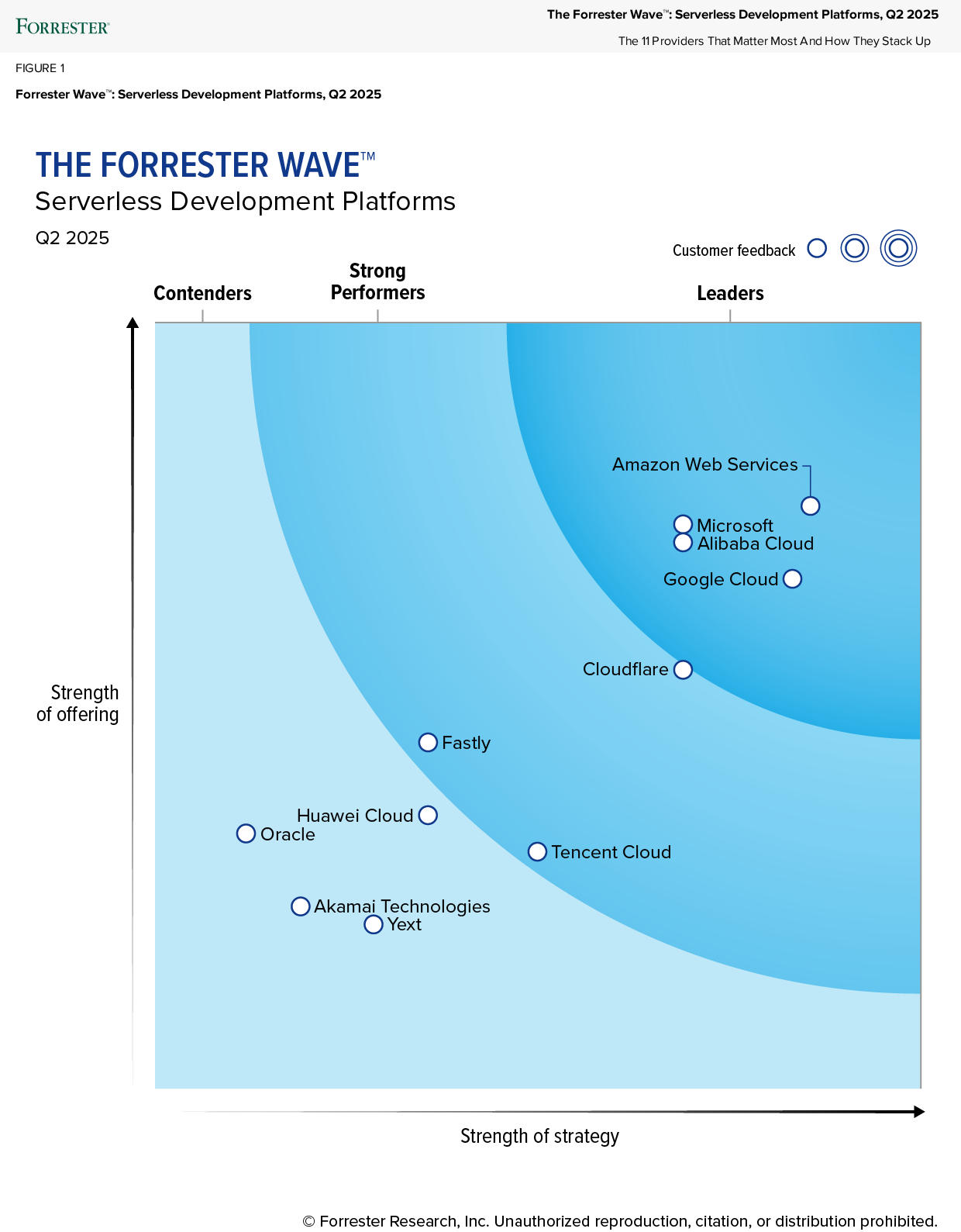

Cloudflare was recognized as a Strong Performer in The Forrester Wave: Serverless Development Platforms, Q2 2025. The report highlights Cloudflare’s edge-first, developer-friendly platform as ideal for APIs and performance-critical apps. Cloudflare Workers earned 7 perfect scores (5.0/5.0), validating its fully integrated, zero-downtime serverless approach—built for scale, speed, and simplicity.

7. Customers

$NET Cloudflare added a record 15,100 new customers, with customer growth accelerating to +27% YoY. Large customer additions (ARR over $100K) in Q2 were also strong at +185, higher than last year, and large customer growth remains solid at +22% YoY.

Customer Success Stories

A rapidly growing AI firm signed a $15M, 1-year pool-of-funds for Workers AI, moving all inference from a hyperscaler to Cloudflare as a single inference platform. Scale, efficiency, and speed drove the consolidation.

A Fortune 500 financial services company executed two 3-year contracts totaling $11.4M for Application Services and Magic Transit. Cloudflare entered as the secondary vendor, then became primary within a month due to reliability and performance.

A Fortune 500 multinational financial services company signed a 3-year, $7.1M deal across Application Services, Magic Transit, and Workers, shifting 50% of traffic off a long-time incumbent to eliminate single-vendor risk.

A Fortune 100 global financial services company committed $5M over 1 year via a pool-of-funds for Magic Transit, email security, threat intelligence, and application services, elevating resiliency and security posture with network-level intelligence.

A large U.S. state government chose Cloudflare SASE (Secure Web Gateway, Magic WAN, DLP, CASB) via a $5.1M, 5-year agreement. Architecture simplification and roughly 60% cost reduction anchored the award.

A Fortune 500 technology company returned after an RFP loss 18 months prior, signing a $2.4M, 3-year Zero Trust contract. Rapid product maturity, ease of deployment, and superior performance changed the outcome.

Another fast-growing AI company signed a $4.6M, 5-year agreement for AI Gateway, Magic Firewall, Magic Transit, and Application Services. Initial scope covers security and connectivity; evaluation of Firewall for AI is underway.

A leading digital travel platform expanded to the Workers developer platform with a $3.8M, 4-year commitment after migrating workloads from a hyperscaler; reported performance gains were “crazy,” with global latency improvements.

Publishing leaders, including Associated Press and Ziff Davis, partnered to pilot new AI-era monetization on Cloudflare’s rails. Commercial value today is modest, strategic value is high as web discovery shifts from search to AI.

Large Customer Wins

Enterprise expansion accelerated. Revenue from customers spending >$1M and >$5M grew at the fastest pace since 2022, aided by pool-of-funds structures and rising variable consumption.

Pool-of-funds deals with largest customers reached low double-digit revenue share, versus <3% a year earlier, with consumption tracking on or slightly ahead of plan. Variable revenue from existing customers supported outperformance.

Go-to-market capacity and productivity improved for a second consecutive quarter, enabling larger multi-product awards across Application Services, Magic Transit, Zero Trust/SASE, Workers, and AI workloads. A first $100M deal closed in the prior quarter, illustrating ceiling lift for platform-level commitments.

8. KPI

Retention

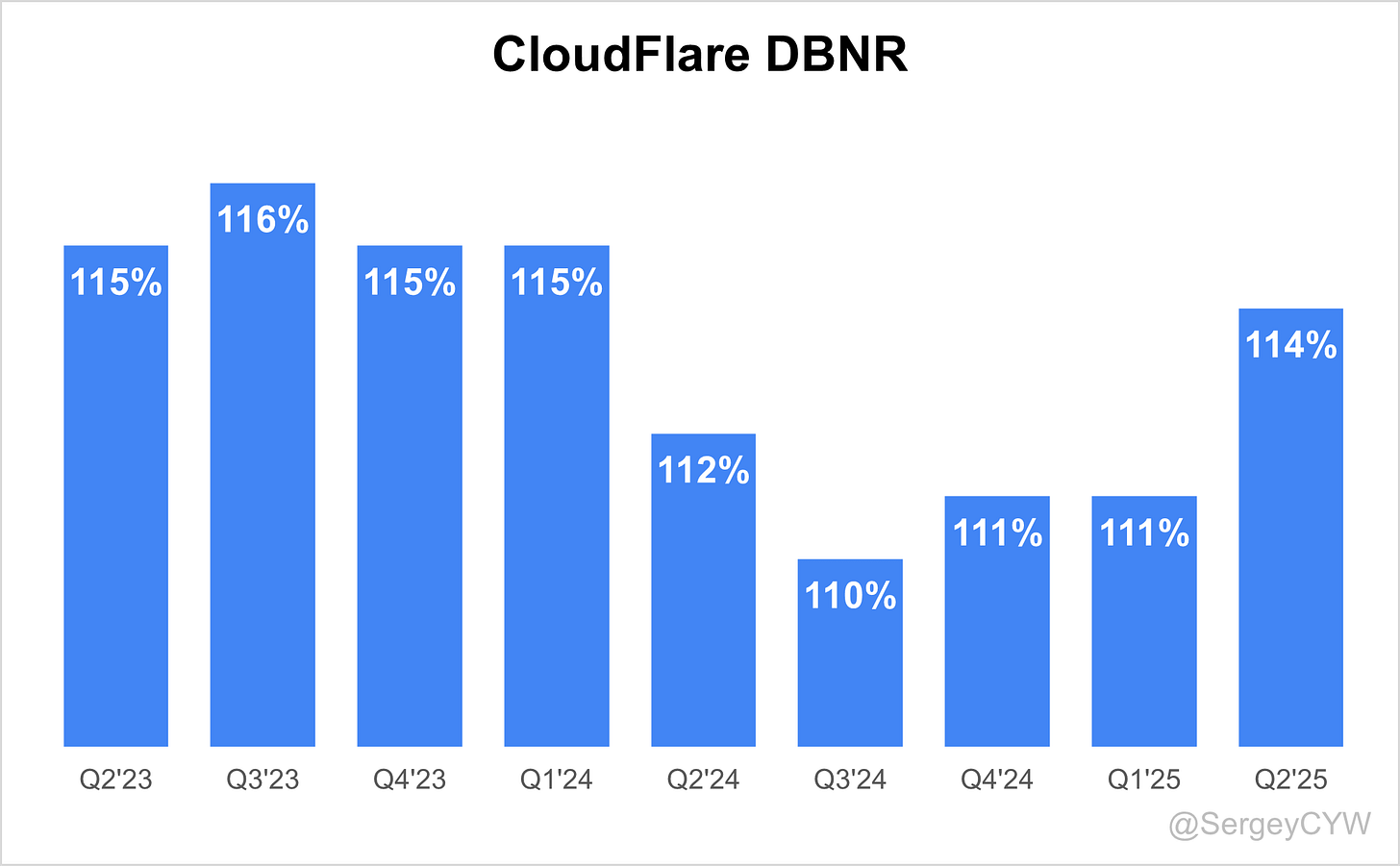

$NET Cloudflare’s Dollar-Based Net Retention Rate (DBNR) declined to 110% in Q3 2024, driven by the increasing adoption of "pool of funds" contracts. These flexible agreements, which accounted for 10% of new ACV in Q3, up from just 1% a year ago, allow clients to adopt multiple Cloudflare services.

However, in Q2 2025, Cloudflare’s DBNR (Dollar-Based Net Retention) increased to 114%, recovering almost to last year’s level.

Net new ARR

$NET Cloudflare added a record number $133M in net new ARR in Q2 2025, with growth of +48% YoY.

If Cloudflare exceeds its Q2 forecast by a similar 2.2%, the net new ARR added in Q2 could reach $177.9M – new record for Cloudflare, representing +53% YoY growth.

CAC Payback Period and RDI Score

$NET Cloudflare's return on S&M spending is 21.5, which is at the 21.5 median level for the SaaS companies I track.

The R&D Index (RDI Score) for Q2 stands at 1.72, up from 1.63 in Q1, and is a strong value compared to the 1.2 median for SaaS companies I monitor. An RDI Score above 1.4 is considered indicative of best-in-class performance.

Profitability

Over the past year, $NET Cloudflare's margins have changed:

• Gross Margin decreased from 78.9% to 76.2%.

• Operating Margin slightly decreased from 14.2% to 14.1%.

• FCF Margin slightly decreased from 9.5% to 6.5%.

Operating expenses

$NET Cloudflare's operating expenses have decreased over the past two years, primarily due to reduced S&M spending. S&M expenses declined from 41% to 36% of revenue.

R&D remains high at 16%, reflecting continued investment in product innovation and expansion into the zero-trust cybersecurity market.

G&A expenses have also decreased to 10%, as the company scales its infrastructure while maintaining operational efficiency.

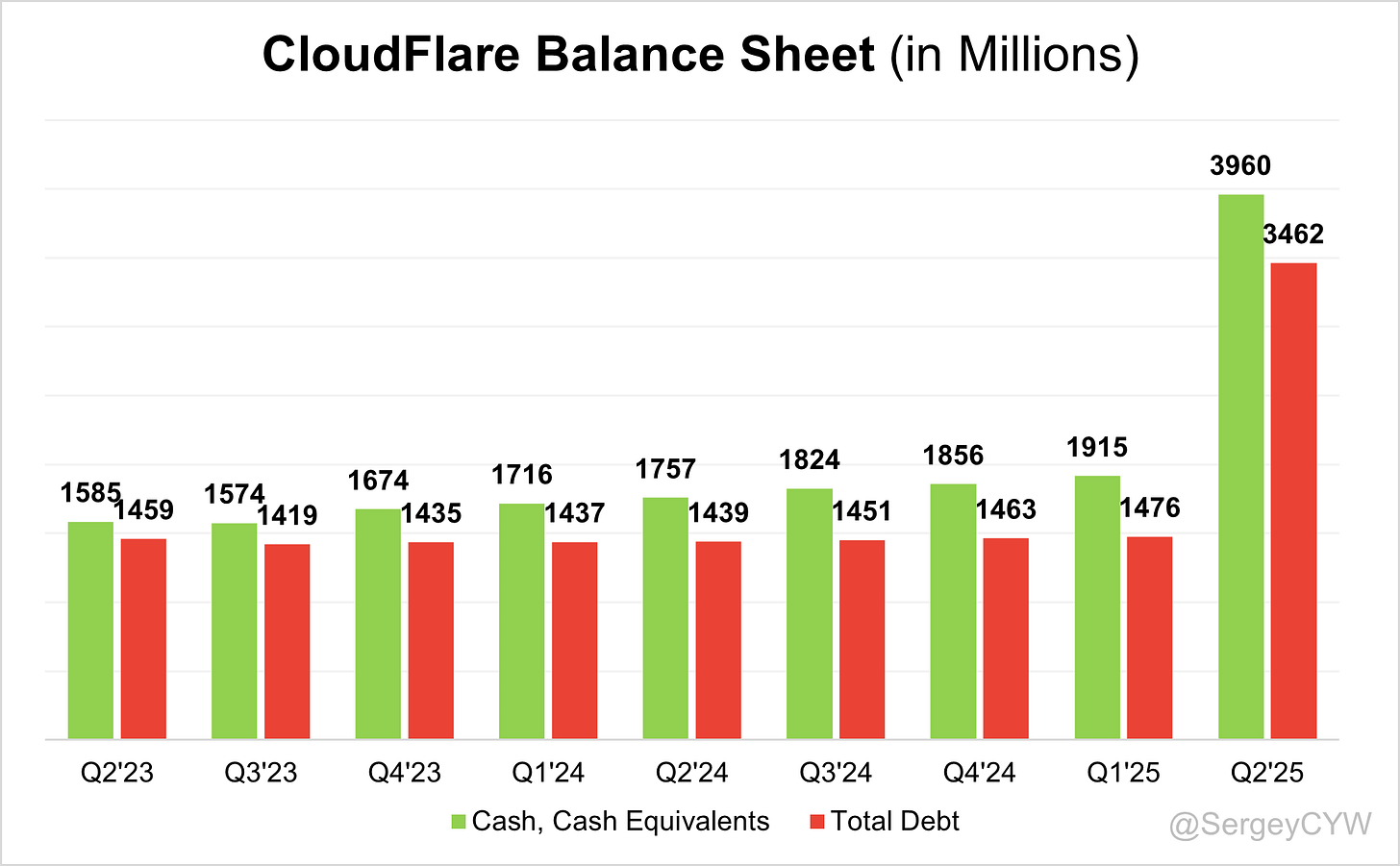

Balance Sheet

$NET Balance Sheet: Total debt stands at $3,462M, while Cloudflare holds $3,960M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

During the second quarter of 2025, Cloudflare increased its debt by issuing $2 billion of 0% convertible senior notes due June 2030. This issuance was accompanied by a capped call option transaction, designed to protect against dilution up to a share price of $469.73 per share, based on a cap price of 175% over the last reported sale price on June 12, 2025.

Dilution

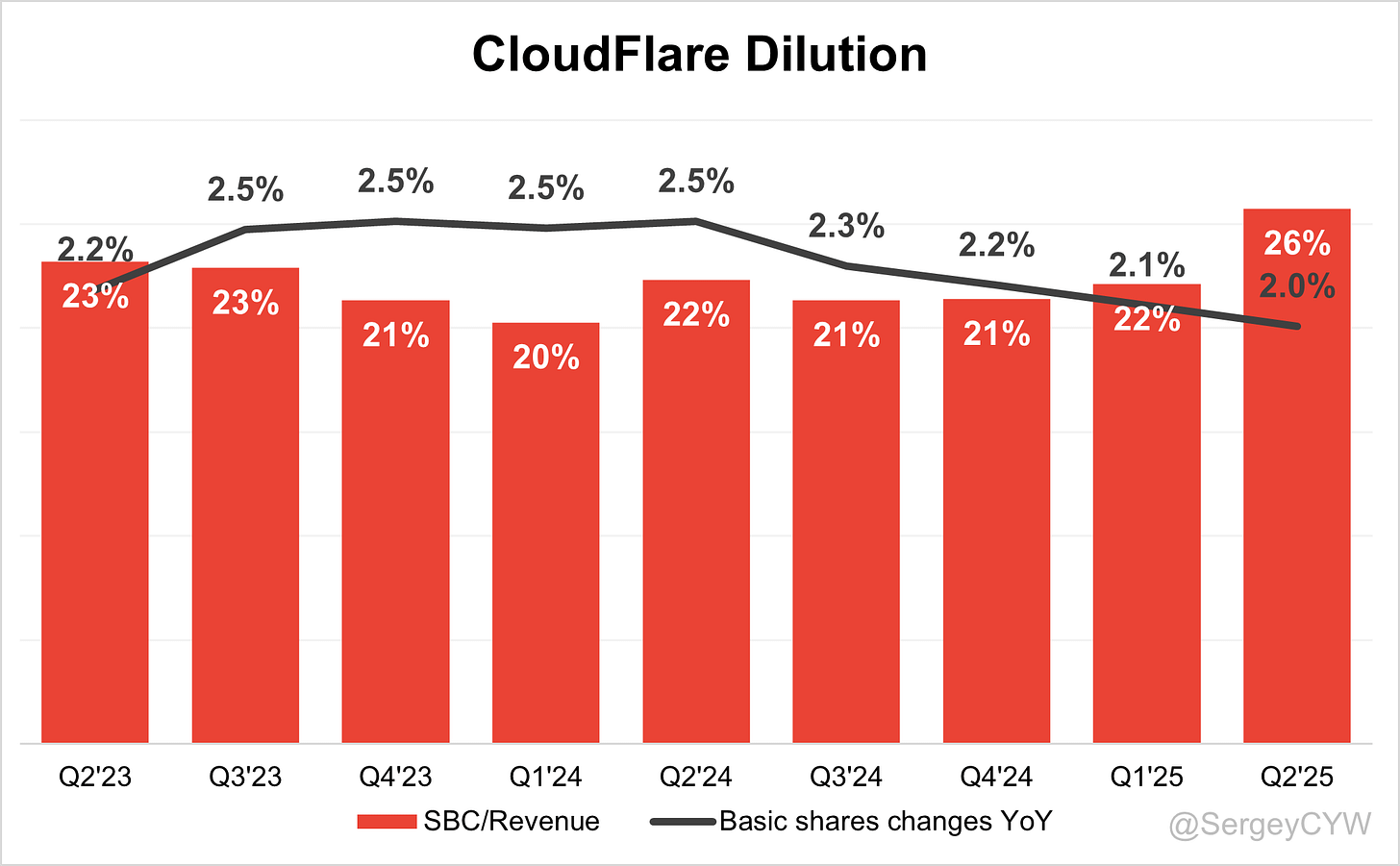

$NET Shareholder Dilution: Cloudflare's stock-based compensation (SBC) expenses slightly increased in the last quarter to 26% of revenue.

Shareholder dilution remains under control, with the weighted-average number of basic common shares outstanding increasing by only 2.0% YoY, lower than 2.5% in the previous year.

9. Conclusion

Q2 was a strong quarter for $NET. Cloudflare continues to innovate, launching significant product updates.

Leading Indicators:

RPO growth of +39.1% exceeded revenue growth.

Record net new ARR was added in Q2, increasing +48% YoY.

Record number of total and strong large customers added.

Key Indicators:

Net Dollar Retention (NDR) rose to 114%. The previous decline was attributed by management to increased volatility in this metric and the rise in "pool of funds" contracts.

CAC Payback Period improved to 21.5 months compare to 26.4 in Q2 2024.

RDI Score stood at 1.72, above the median compared to other SaaS companies I track.

Management issued a strong forecast for the next quarter. If the company beats guidance at the same level as in Q2, revenue growth would accelerate to +29.5% YoY, supported by strong leading indicators.

Customer additions were strong, and enterprise expansion accelerated. Revenue from customers spending >$1M and >$5M grew at the fastest pace since 2022. Pool-of-funds deals with the largest customers reached a low double-digit revenue share. Go-to-market capacity and productivity also improved for the second consecutive quarter.

Zero Trust is scaling successfully despite being a relatively new area. Forrester ranked Cloudflare second highest in the Strategy category in The Forrester Wave Zero Trust Platforms Q3 2025. Another new direction, the Agentic Web (Act 4), positions Cloudflare to build the payment and access rails between AI systems and publishers, which could become an additional growth driver in the future.

The main concern is the elevated valuation multiples, though they are currently justified by strong execution and accelerating revenue growth. In 2025, I trimmed my $NET position several times — in February, July, and August — due to valuation.

While $NET still trades at a premium, I believe the premium is justified by world-class management and outstanding execution. At present, $NET remains my largest portfolio position, accounting for 10.3%.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.

Excellent breakdown and in-depth analysis!

Titanic work, Sergey! Now you will be more convinced on security names!

Super super interesting article, didn't look at cloudflare that much, thank you !