Cloudflare Q4 2024 Earnings Analysis

Dive into $NET Cloudflare’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$459.9M rev (+26.9% YoY, +28.2% LQ) beat est by 1.8%

↘️GM* (77.6%, -1.3 PPs YoY)🟡

↗️Operating Margin* (14.6%, +3.6 PPs YoY)

↘️FCF Margin (10.4%, -0.6 PPs YoY)🟡

↗️Net Margin (-2.8%, +4.9 PPs YoY)🟢

↗️EPS* $0.19 beat est by 5.6%

*non-GAAP

Key Metrics

↗️DBNR 111% (110% LQ)

↗️RPO $1.69B (+35.5% YoY)

↗️Billings $548M (+31.8% YoY)🟢

Customers

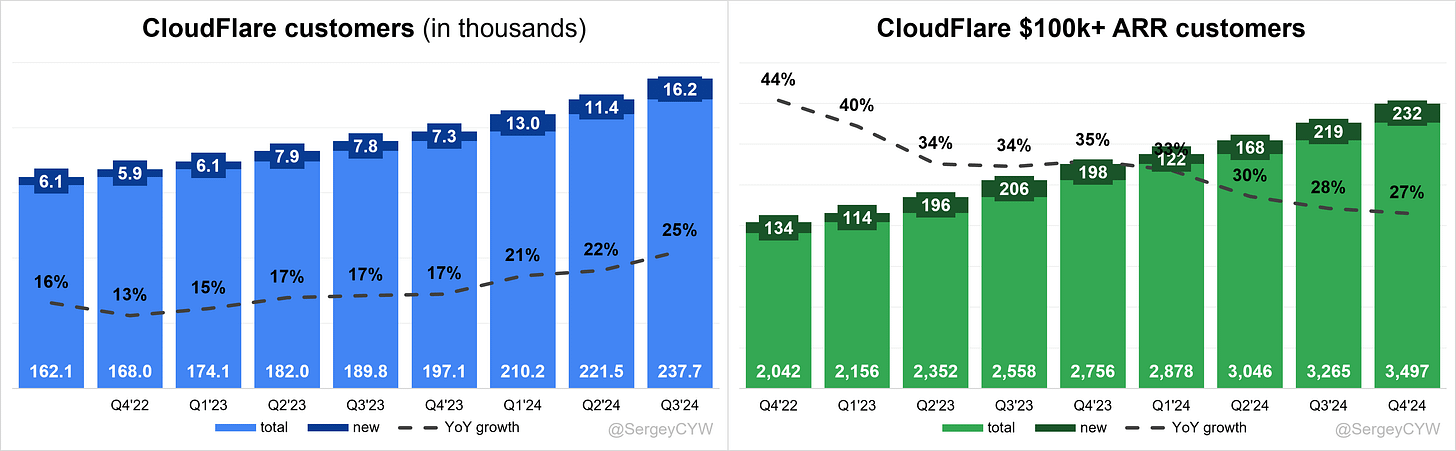

↗️237,714 customers (+25.3% YoY, +16174)🟢

↗️3,497 $100k+ customers (+26.9% YoY, +232)🟢

Operating expenses

↘️S&M*/Revenue 36.3% (-3.8 PPs YoY)

↘️R&D*/Revenue 16.3% (-0.1 PPs YoY)

↘️G&A*/Revenue 10.4% (-1.1 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $119M (+11.0% YoY)

↗️CAC* Payback Period 20.4 Months (+2.2 YoY)🟡

↘️R&D* Index (RDI) 1.60 (-0.11 YoY)🟡

Dilution

↗️SBC/rev 21%, +0.1 PPs QoQ

↘️Basic shares up 2.2% YoY, -0.1 PPs QoQ

↗️Diluted shares up 1.6% YoY, +0.1 PPs QoQ

Headcount

➡️4,263 Total Headcount (+15.8% YoY, +103 added)

Guidance

↘️Q1'25 $468.0 - $469.0M guide (+23.7% YoY) missed est by -1.2%🔴

➡️$2,090.0 - $2,094.0M FY guide (+25.3% YoY) in line with est

Key points from Cloudflare’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Cloudflare reported Q4 2024 revenue of $459.9 million, up 27% YoY. Large customers spending over $100,000 annually increased to 3,497, also up 27% YoY. Revenue contribution from large customers rose to 69% from 66% YoY.

Dollar-based net retention improved by one percentage point to 111%, indicating strong customer expansion. Gross margin stood at 77.6%, within the 75%-77% long-term target range, despite a 120-basis-point sequential decline. Operating profit was $67.2 million, with an operating margin of 14.6%, reflecting a 360-basis-point improvement YoY.

Free cash flow was $47.8 million in Q4 and $166.9 million for the year. Cash reserves were $1.86 billion. Net income reached $68.8 million, translating to $0.19 diluted EPS. Excluding certain tax impacts, EPS would have been $0.22.

Remaining performance obligations (RPO) grew 36% YoY to $1.687 billion, with current RPO up 30% YoY, showing strong contract momentum.

Product Innovations

Cloudflare strengthened its AI, security, and developer tools portfolio. Cloudflare Workers and Workers.ai surpassed three million active developers, showing rapid adoption.

Sales cycles improved, increasing close rates and deal velocity. Cloudflare launched Cloudflare Calls, a real-time audio and video processing solution on the edge.

AI & Workers.ai

Cloudflare prioritized AI inference over training, leveraging its serverless Workers platform for efficiency. AI Gateway helped customers achieve 10x price-performance improvements by caching AI model responses instead of making direct calls.

GPU utilization peaked at 70%, significantly higher than the sub-10% industry averages. This efficiency reduces costs for customers and increases Cloudflare's margins. Workers.ai provides a usage-based billing model, avoiding the high infrastructure commitments of hyperscalers.

A leading financial institution built an AI-powered due diligence agent on Workers AI, improving M&A research. A healthcare startup used Workers AI to analyze clinical trial data.

Cloudflare is investing in AI-focused go-to-market initiatives, targeting key industries. AI adoption will be a major driver of long-term revenue, with continued focus on AI inference efficiency and enterprise expansion.

Zero Trust Growth

Cloudflare saw strong Zero Trust adoption, securing a $4 million, three-year contract with a major U.S. investment firm, replacing a legacy provider.

Customers cited better network performance, simpler deployment, and integrated security as key reasons for switching. Magic Firewall, Magic WAN, and Cloudflare One continued driving adoption.

Competitive pressure remains, with entrenched relationships among legacy vendors increasing customer acquisition costs. Cloudflare is focusing on sales enablement and customer success programs to ensure a smooth transition and cost benefits for new customers.

R2 and D1 Adoption

Cloudflare’s R2 storage platform gained traction, offering a zero-egress-fee model as a cost-effective alternative to hyperscalers. Large customers use R2 for high-volume storage without unpredictable data transfer fees.

Cloudflare D1, a serverless SQL database, is growing steadily. Developers prefer D1’s ease of integration within the Cloudflare ecosystem. Cloudflare is investing in developer outreach and enterprise partnerships to drive broader adoption.

International Expansion

Revenue from EMEA and APAC grew 27% YoY, with APAC accelerating at 39% YoY.

A $9.4 million, five-year contract with a Global 2000 aviation group showcased Cloudflare’s ability to secure large international deals. A $13.6 million, four-year contract with a global financial institution displaced a nine-year incumbent provider, improving security and efficiency.

Regulatory and compliance challenges persist in Europe and Asia. Achieving FedRAMP High certification was a milestone for U.S. government contracts, but similar regional certifications will be necessary for further market penetration.

Pool of Funds Model

Cloudflare’s Pool of Funds model contributed 9% of Q4 revenue, consistent with Q3. Enterprise customers allocate budgets upfront and dynamically deploy Cloudflare services over time.

Revenue from Pool of Funds deals will be more heavily weighted in H2 2025, driving revenue acceleration.

Enterprise Growth

Cloudflare signed its largest-ever contract, a $20 million, five-year deal with a Fortune 100 technology company. Other major wins included a $13.5 million AI company expansion, a $10.8 million global retail deal, and a $9.4 million aviation sector contract.

Total paying customers increased 25% YoY to 237,700. Large customers spending over $1 million annually grew 47% YoY to 173. Cloudflare added 55 new $1 million+ customers in 2024, with a record 232 large customers in Q4 alone.

Large Customer Wins

A Fortune 100 technology company signed a $20 million, five-year contract, selecting Cloudflare’s full product suite for multi-cloud security, AI integration, and data sovereignty.

A leading AI company signed a $13.5 million, one-year contract, using Cloudflare’s Pool of Funds model for flexibility across services.

A global retailer secured a $10.8 million, three-year contract, adopting Cloudflare’s application security, developer platform (Workers & R2), and network solutions. Cloudflare displaced a 20-year incumbent provider.

A major U.S. investment firm expanded its Cloudflare partnership with a $4 million, three-year contract, choosing Cloudflare over a first-generation Zero Trust vendor.

A Global 2000 aviation group signed a $9.4 million, five-year deal, selecting Cloudflare for cloud-first modernization and cost efficiency.

A global financial institution secured a $13.6 million, four-year contract, migrating from a nine-year incumbent provider. Cloudflare reduced website provisioning time from 14 weeks to 10 minutes.

Sales Execution

Under Mark Anderson’s leadership, Cloudflare achieved its fifth consecutive quarter of double-digit YoY sales productivity growth.

Enterprise sales team expanded, with 80% of new hires focused on large accounts. Enterprise AE hiring increased 84% YoY. 80% of Cloudflare’s 2025 sales plan is assigned to AEs already in place, enabling a faster ramp-up.

Sales compensation aligns with recognized revenue from Pool of Funds deals, ensuring deeper customer engagement.

Government & FedRAMP Expansion

Cloudflare achieved FedRAMP High certification, expanding its U.S. government business. Unlike hyperscalers, Cloudflare integrated FedRAMP requirements into its existing network without creating a separate government cloud.

Cloudflare deepened relationships with NATO and international government agencies, strengthening its global security footprint.

CapEx & Infrastructure Investment

CapEx for Q4 was 15% of revenue, with full-year CapEx at 10%. Increased investment in GPU infrastructure will drive CapEx to 12%-13% of revenue in 2025, supporting AI inference demand.

Cloudflare positions itself as a cost-effective alternative to hyperscalers for AI workloads.

2025 Outlook

Cloudflare guided Q1 2025 revenue at $468M-$469M, up 24% YoY. Full-year 2025 revenue is expected to reach $2.09B-$2.094B, reflecting 25% YoY growth.

Revenue weighting will increase in H2 2025, driven by enterprise sales ramp-up and Pool of Funds revenue recognition.

Operating income is projected at $272M-$276M, with a 21% tax rate. Cloudflare remains focused on balancing growth with profitability, leveraging expanding sales, AI adoption, and enterprise penetration for its next growth phase.

Management comments on the earnings call.

Product Innovations

Matthew Prince, Co-founder & CEO

"Cloudflare has always been great at engineering and product innovation. In 2025, we will prove that we can be world-class in go-to-market execution as well. Our product team's focus remains on delivering real ROI for customers through security, AI, and developer platform advancements."

Matthew Prince, Co-founder & CEO

"Cloudflare Calls is a direct response to customer needs for real-time audio and video processing at the edge. By leveraging our global network, we’re offering a solution that scales efficiently while maintaining high performance and security."

Workers.ai

Matthew Prince, Co-founder & CEO

"Inference is a bigger opportunity than training, and our team continues to find step-function breakthroughs that put us well ahead of any alternative. We are seeing real AI adoption across industries, from financial services to healthcare, leveraging Workers AI for cost-effective, scalable solutions."

Matthew Prince, Co-founder & CEO

"Unlike hyperscalers, where customers must commit to GPU resources upfront, we let customers pay only for what they use. Our GPU utilization peaked at 70%, compared to sub-10% industry averages, meaning we deliver better price performance without the burden of overprovisioning."

Competitors

Matthew Prince, Co-founder & CEO

"We are not limited by our total addressable market, by competitors, or by our pipeline. Our only constraint has been, and will continue to be, the capacity of our sales force. As we scale sales, we will capture even more market share in AI, security, and cloud infrastructure."

Matthew Prince, Co-founder & CEO

"DeepSeek reinforced what we have been saying—AI can be far more efficient than what the industry currently accepts. The notion that winning in AI requires spending hundreds of billions is outdated. Efficiency will define the leaders in AI infrastructure."

Customers

Matthew Prince, Co-founder & CEO

"Customers remain disciplined with their budgets, scrutinizing every dollar spent to ensure immediate ROI. Our ability to demonstrate cost savings and increased efficiency is driving stronger customer adoption across all verticals."

Matthew Prince, Co-founder & CEO

"Our enterprise customers are choosing Cloudflare over competitors because of our performance, ease of use, and unified architecture. We saw a record number of large customer additions, including our largest-ever $20 million deal with a Fortune 100 company."

Strategic Partnerships

Matthew Prince, Co-founder & CEO

"Many of the world’s most important AI companies are now Cloudflare customers. Sitting between AI model providers and content creators gives us a strategic advantage as we shape the post-search web and AI-driven internet economy."

Matthew Prince, Co-founder & CEO

"We continue to build deep, strategic partnerships with major enterprises looking for multi-cloud security, AI capabilities, and cost-efficient global networking. Our recent large-scale customer wins highlight the strength of our long-term partnerships."

Go-To-Market Execution

Matthew Prince, Co-founder & CEO

"Mark Anderson continues to prove he is one of the best go-to-market leaders in the industry. Under his leadership, we have seen five consecutive quarters of double-digit year-over-year increases in sales productivity."

Thomas Seifert, CFO

"We are focused on scaling efficiently. Our enterprise account executive hiring increased 84% year over year, and 80% of our 2025 sales plan is already assigned to reps in their seats. This will drive meaningful acceleration in sales execution and revenue growth."

FedRAMP & Government Business

Matthew Prince, Co-founder & CEO

"We designed our FedRAMP High compliance strategy to maintain our existing network architecture, avoiding the fragmentation that hyperscalers have created. This allows us to offer the same level of security and performance to all customers, including federal agencies."

Matthew Prince, Co-founder & CEO

"We are protecting critical global infrastructure, including key government entities like NATO. Our presence in the public sector is growing as more agencies recognize the importance of Cloudflare’s unified security platform."

CapEx

Thomas Seifert, CFO

"The accelerating shift from AI training to AI inference gives us confidence to increase our investment in GPU infrastructure. As we provision greater capacity in 2025, we expect network CapEx to be between 12% and 13% of revenue."

Matthew Prince, Co-founder & CEO

"We are optimizing AI infrastructure investment to drive the highest efficiency possible. Our ability to increase GPU utilization while keeping CapEx low gives us a unique advantage in the AI space."

International Growth

Matthew Prince, Co-founder & CEO

"We are seeing strong international demand, with APAC revenue growing 39% year over year. Enterprises globally are shifting to a cloud-first model, and our security and performance solutions are at the center of that transition."

Matthew Prince, Co-founder & CEO

"Our expansion into regulated industries and international markets is accelerating. Winning a $13.6 million, four-year contract with a global financial institution over a nine-year incumbent vendor is a testament to our competitive advantage."

Challenges

Matthew Prince, Co-founder & CEO

"While Zero Trust adoption continues to grow, legacy vendors still have entrenched relationships with enterprises. Customer acquisition costs remain a challenge, which is why we are focused on educating customers about the long-term cost benefits of our unified platform."

Thomas Seifert, CFO

"Revenue from Pool of Funds deals will be more heavily weighted in the second half of 2025. While this creates short-term variability, it reflects growing enterprise confidence in our platform and strengthens long-term customer relationships."

Future Outlook

Matthew Prince, Co-founder & CEO

"We are confident in our ability to reaccelerate growth in 2025. AI, security, and go-to-market execution will be the three key levers driving Cloudflare’s next phase of expansion."

Thomas Seifert, CFO

"We expect full-year 2025 revenue to reach between $2.09 billion and $2.094 billion, representing 25% year-over-year growth. We are maintaining disciplined execution while making strategic investments to drive long-term shareholder value."

Thoughts on Cloudflare Earnings Report $NET:

🟢 Positive

Revenue: $459.9M, up 26.9% YoY and 28.2% QoQ, beating estimates by 1.8%

Billings: $548M, up 31.8% YoY

Operating Margin: 14.6%, up 3.6 PPs YoY

Net Margin: -2.8%, improved by 4.9 PPs YoY

EPS: $0.19, beat estimates by 5.6%

Dollar-Based Net Retention (DBNR): 111%, up 1 PP QoQ

RPO: $1.69B, up 35.5% YoY

Large Customers: 3,497, up 26.9% YoY

Enterprise Growth: $20M, five-year deal with a Fortune 100 tech company, multiple $10M+ contracts in AI, retail, and finance

Sales Productivity: Fifth consecutive quarter of double-digit YoY growth, 84% YoY increase in Enterprise AE hiring

🟡 Neutral

Gross Margin: 77.6%, down 1.3 PPs YoY

FCF Margin: 10.4%, down 0.6 PPs YoY

CAC Payback Period: 20.4 months, increased by 2.2 months YoY

R&D Index (RDI): 1.60, down 0.11 YoY

Stock-Based Compensation (SBC): 21% of revenue, up 0.1 PPs QoQ

Headcount: 4,263, up 15.8% YoY, added 103 employees in Q4

FY 2025 Revenue Guidance: $2.09B-$2.094B, in line with expectations

🔴 Negative

Q1 2025 Revenue Guidance: $468M-$469M, up 23.7% YoY, but missed estimates by -1.2%

SBC impact: Basic shares up 2.2% YoY, diluted shares up 1.6% YoY

Customer Acquisition Costs: Rising due to entrenched legacy vendor relationships in Zero Trust

Regulatory Compliance: Need for regional certifications in Europe and Asia to match U.S. FedRAMP High certification