Financial Results:

⬆️$362.5M rev (+32.0% YoY, +32.2% LQ) beat est by 2.7%

⬆️GM* (78.9%, +1.6%pp YoY)

⬆️Operating Margin* (11.0%, +4.9%pp YoY)

↘️FCF Margin 11.0%, -1.3%pp YoY)

⬆️EPS* $0.15 beat est by 25.0%

*non-GAAP

↘️DBNR 115% (116% LQ)

⬆️RPO $1.25B (+37.3% YoY)🟢

➡️Billings $416M (+28.0% YoY)🟡

Customers

➡️189,791 customers (+17.0% YoY, +7764)

➡️2,756 $100k+ customers (+35.0% YoY, +198)

Operating expenses

⬆️S&M*/Revenue 40.1% (38.4% LQ)

⬆️R&D*/Revenue 16.4% (16.2% LQ)

↘️G&A*/Revenue 11.5% (11.5% LQ)

↘️Net New ARR $107M ($108 LQ)

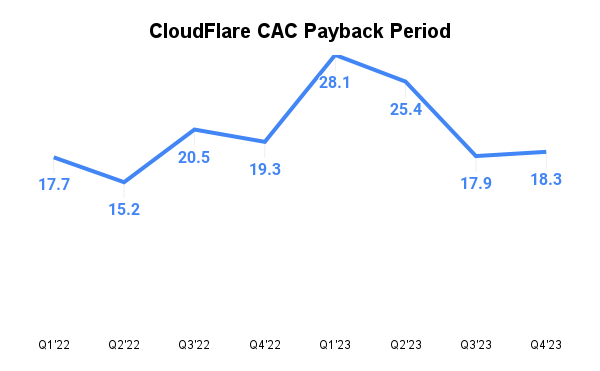

⬆️CAC* Payback Period 18.3 Months (17.9 LQ)

Dilution

↘️SBC/rev 21%, -1.6%pp QoQ)

⬆️Dilution at 2.5% YoY, +0.0%pp QoQ)

Headcount

⬆️3,682 Total Headcount (+14.0% YoY, +153 added)

Guidance

⬆️Q1'24 $373.5M guide (+28.7% YoY) beat est by 0.3%

➡️$1,652M FY guide (+27.4% YoY)

Key points from Cloudflare $NET Q4 2023 Earnings Call:

Cloudflare's growth rate:

Cloudflare achieved a strong fourth quarter in 2023, reflecting in a 32% year-over-year revenue increase to $362.5 million, driven by adding 198 new large customers.

They are marked records in customer spending growth, with notable contracts over $30 million and $60 million.

Q4 saw nearly 40% growth in new Annual Contract Value (ACV), the fastest since 2021, reflecting robust sales execution.

Sales pipeline and productivity improved, with significant growth in new sales programs.

Dollar-based net retention dipped slightly to 115%, but gross margin exceeded targets at 78.9%.

Leadership Changes and GTM Improvement:

Cloudflare's go-to-market efforts improved under Marc Boroditsky , now further accelerated with Mark Anderson (Chief Executive Officer of Alteryx) joining as the go-to-market leader.

This move was aimed at further accelerating Cloudflare's growth and market leadership, leveraging Anderson's experience in sales.

Zero Trust services:

The company sees increased demand for Zero Trust products, marking significant growth.

Cloudflare concluded large contracts, including a three-year $33 million contract with the US Department of Commerce and a five-year $4.3 million contract with a Fortune 500 hospitality company for Zero Trust services.

AI and Developer Platform Growth:

Cloudflare announced the deployment of GPUs in 120 cities globally, exceeding its target and planning for nearly universal deployment by the end of 2024. The company reported a 9x increase in daily workers' AI request from September to December, highlighting AI as a significant driver for the developer platform and future growth.

Macro Environment and Strategy:

Despite a strong quarter, Cloudflare remains cautious about the macroeconomic environment, with IT buyers still considered skittish. The company plans to continue its disciplined execution strategy, focusing on delivering value to customers and solving key internet challenges.

Management comments on the earnings call.

Cloudflare's global network:

Matthew Prince: "As of the end of 2023, we deployed GPUs in 120 cities globally, meaningfully ahead of our target of 100 cities. By the end of 2024, we plan to have inference tuned GPUs deployed in nearly every city that makes up Cloudflare's global network."

AI:

Matthew Prince: "The breadth and potential impact of the use cases we are seeing with workers AI are extraordinary. And we're super excited about the opportunity to establish workers' AI serverless model built on Cloudflare's trusted global network as the best infrastructure for running AI inference tasks."

Matthew Prince: "AI on workers platform is just getting started and there are exciting things on the road map that we look forward to sharing with you in the not-so-distant future."

Zero Trust:

Matthew Prince: "We saw particular strength in our largest customers with a record number of net new customers spending more than both $0.5 million a year and $1 million a year on an annualized basis. We signed our largest new logo with an expected total contract value over $30 million and our largest customer renewal with a total contract value of $60 million."

Go-to-Market Strategy:

Matthew Prince: "We added 198 new large customers, those that pay us more than $100,000 per year and now have 2,756 large customers, up 35% year-over-year."

Matthew Prince: "A Fortune 500 technology company signed a two-year $6 million contract for advanced application security."

Matthew Prince: "Our pipeline closed rates sales force productivity, average deal size, and linearity all improved markedly quarter-over-quarter."

Matthew Prince: "Key to that execution has been improvement in our go-to-market efforts. 15 months ago, we brought on Marc Boroditsky to execute effectively a turnaround of Cloudflare's go-to-market team."

Macro environment:

Matthew Prince: "As we talked about throughout the last year, the macro environment remains challenging. IT buyers are still skittish."

Thoughts on Cloudflare ER NET 0.00%↑ :

🟢Pros:

+ Revenue rose by +32.0% YoY, revenue grow is stabilizing

+ RPOs are growing faster than revenue, increasing by 13% QoQ

+ Company increasing margins and profitability

+ Beat Q4 revenue guidance by 2.7%

+ Strong number of total and $100k+ customers added

+ 2024 Full-year revenue growth rate guidance is 27.4% YoY

+ GTM (Go-To-Market) strategy improvement

+ Zero Trust secured several strong contracts

🔴Cons:

- Q1’24 revenue growth guidance is 3% QoQ

🟡Neutral:

+- DBNR at 115% slightly decrease from 115% in last quarter

+- SBC/rev 21%, dilution at 2.5% YoY

+- Billings are growing slower than revenue