Cloudflare Q3 2024 Earnings Analysis

Dive into $NET Cloudflare’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$430.1M rev (+28.2% YoY, +30.0% LQ) beat est by 1.4%

↗️GM* (78.8%, +0.1 PPs YoY)

↗️Operating Margin* (14.8%, +2.1 PPs YoY)🟢

↗️FCF Margin (10.5%, +0.1 PPs YoY)

↗️EPS* $0.20 beat est by 11.1%🟢

*non-GAAP

Key Metrics

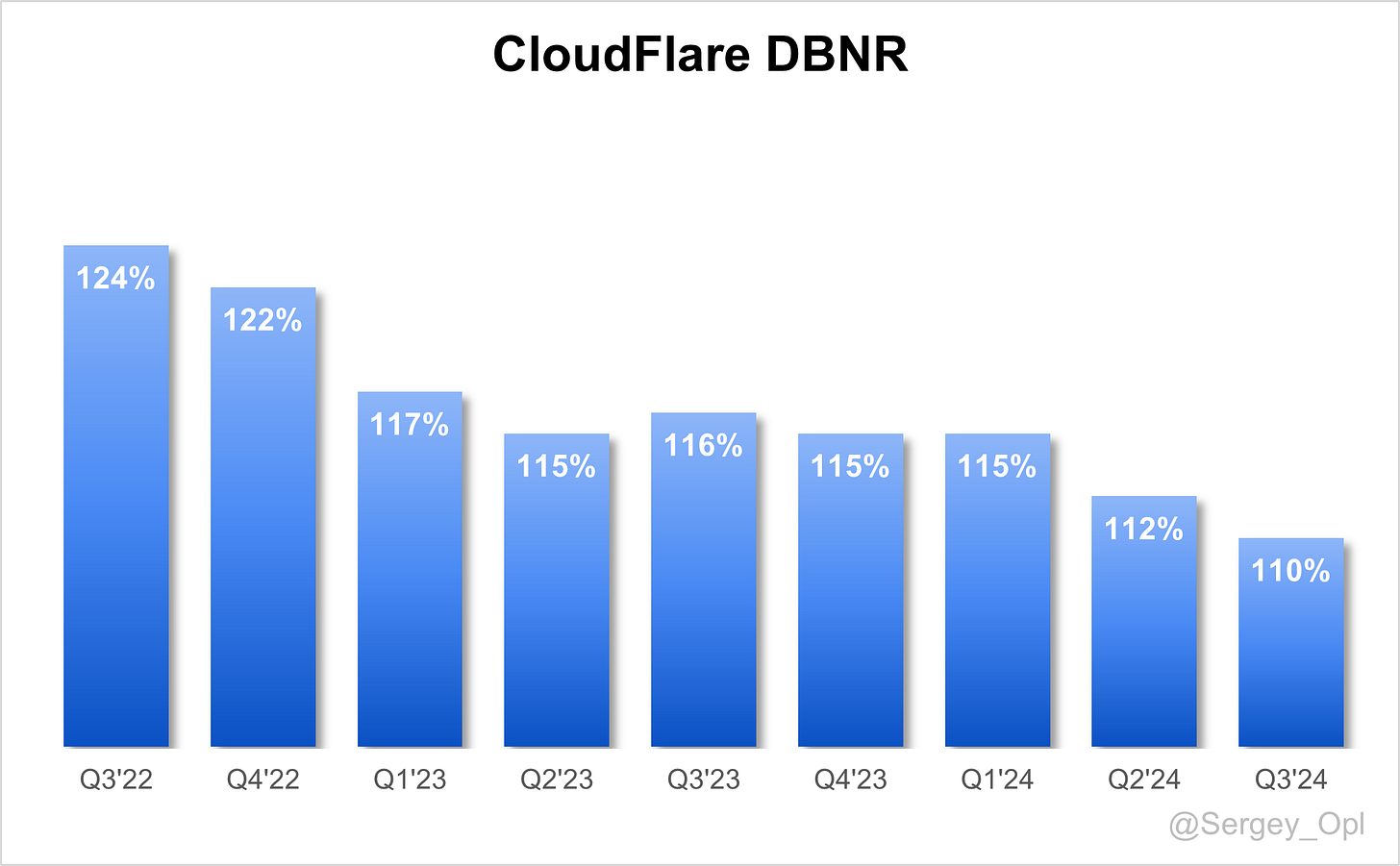

↘️DBNR 110% (112% LQ)

↗️RPO $1.50B (+36.7% YoY)

➡️Billings $447M (+24.2% YoY)🟡

Customers

➡️221,540 customers (+21.7% YoY, +11374)

↗️3,265 $100k+ customers (+27.6% YoY, +219)🟢

Operating expenses

↘️S&M*/Revenue 37.2% (-1.2 PPs YoY)

↗️R&D*/Revenue 16.4% (+0.2 PPs YoY)

↘️G&A*/Revenue 10.5% (-1.0 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $116M (+7.3% YoY)

↗️CAC* Payback Period 19.5 Months (+1.7 YoY)🟡

↘️R&D* Index (RDI) 1.64 (-0.06 YoY)🟡

Dilution

↘️SBC/rev 21%, -1.0 PPs QoQ

↘️Basic shares up 2.3% YoY, -0.2 PPs QoQ

↘️Diluted shares up 1.5% YoY, -2.3 PPs QoQ

Headcount

↗️4,160 Total Headcount (+17.9% YoY, +258 added)

Guidance

↘️Q4'24 $451.0 - $452.0M guide (+24.6% YoY) missed est by -0.9%🔴

↗️$1,661.0 - $1,662.0M FY guide (+28.1% YoY) raised by 0.2% beat est by 0.1%

Key points from Cloudflare’s Third Quarter 2024 Earnings Call:

Financial Performance

Cloudflare reported Q3 2024 revenue of $430.1 million, marking a 28% increase year-over-year despite a cautious IT spending climate. The operating margin rose to 14.8%, driven by cost efficiency, while the gross margin held strong at 78.8%, above the target range of 75%-77%. Free cash flow reached $45.3 million, up from prior periods, as Cloudflare invested in advanced GPUs to support AI growth. A cash position of $1.8 billion underscores the company’s financial stability.

Product Innovations

Q3 saw significant advancements in Cloudflare’s technology, especially in AI. The company’s Workers AI platform gained traction, landing a $7 million annual contract with a leading AI firm. This move highlights Cloudflare’s ability to deliver efficient, high-performance AI solutions globally. HyperDrive and durable objects also enhanced the platform’s capacity for real-time global data synchronization, attracting clients in data-heavy industries like gaming.

Net Retention Rate

Cloudflare’s dollar-based net retention rate (NRR) for Q3 was 110%, down 2 percentage points sequentially, influenced by the rise in "pool of funds" contracts. These flexible contracts, which reached 10% of new ACV in Q3 from just 1% a year ago, allow clients to adopt multiple Cloudflare services. Despite short-term NRR impact, Cloudflare maintains low customer churn, showing strong loyalty.

Go-to-Market Transformation

Cloudflare’s go-to-market strategy has advanced significantly under new sales leader Mark Anderson. The company prioritized enterprise sales, with 70% of new hires focused on this segment, up from 40% previously. This shift has led to larger, high-value contracts and notable productivity gains in Europe (22%) and APAC (40%) over recent quarters.

Workers AI Expansion

Workers AI emerged as a critical growth driver as clients shift from training to inference workloads on Cloudflare’s platform. This shift resulted in the company’s first multimillion-dollar Workers AI contract. Cloudflare’s distributed network provides high GPU utilization, reducing costs while boosting performance, positioning Workers AI as a competitive alternative to traditional public clouds.

International Expansion

Cloudflare’s global presence expanded, with APAC revenue up 38% and EMEA revenue rising 31% year-over-year. APAC, with the company’s highest productivity, showcases Cloudflare’s international market potential. These regional gains provide a foundation for growth in North America, where Cloudflare aims to enhance sales productivity by focusing on enterprise accounts.

Federal Sector Performance

Cloudflare's federal sector business, supported by FedRAMP certification, remains a growth area. Through its Athenian Project, Cloudflare provided critical cybersecurity services during the recent U.S. election, solidifying its standing among government agencies and bolstering its position for future federal sector growth.

Product Line Expansion: R2 and D1

The R2 and D1 products support AI and high-data-transfer workloads. R2 facilitates large-scale data transfers essential for training and inference, while D1 offers SQL database solutions. Together, these products strengthen Cloudflare’s platform, supported by the addition of durable objects and improved synchronization features.

Zero Trust Platform Expansion

Cloudflare’s Zero Trust platform continues to attract large enterprises looking to modernize and secure their IT infrastructure. In Q3, Zero Trust contributed to significant contracts, including a $2.4 million, three-year contract with a Global 2000 manufacturer. This client, previously reliant on multiple vendors, benefited from the enhanced visibility and security of Cloudflare’s unified platform.

Customer Growth and Enterprise Adoption

Cloudflare’s customer base expanded, adding 219 large customers in Q3 and bringing the total to 3,265, a 28% increase year-over-year. Large clients now represent 67% of total revenue, up from 65% last year, with Cloudflare serving 35% of the Fortune 500. This growth underscores Cloudflare’s appeal to enterprise clients seeking comprehensive, scalable solutions.

Pool of Funds Contracts

"Pool of funds" contracts accounted for 10% of new ACV in Q3, up from 1% a year ago. This flexible structure allows large clients broader access to Cloudflare’s platform, though it temporarily impacts NRR. Over time, these contracts deepen customer relationships and expand service adoption.

Customer Success in AI and Security

In a notable Q3 contract, a major AI company signed a $7 million, one-year pool of funds agreement with Cloudflare. Starting as a $500,000 contract, the partnership rapidly expanded as the client adopted Workers AI, achieving nearly double the performance of conventional cloud providers through Cloudflare’s pay-per-inference model.

Strategic Wins with High-Security Clients

Cloudflare secured a $4 million, three-year contract with a satellite internet operator needing FedRAMP-compliant services. This contract highlights Cloudflare’s appeal in regulated sectors, enhancing its standing as a reliable aerospace and defense partner.

Fortune 100 and Global 2000 Partnerships

A Fortune 100 company selected Cloudflare for its Zero Trust services in a $4.2 million, two-year contract aimed at enhancing resiliency and security. Additionally, a Global 2000 manufacturing company signed a $2.4 million, three-year contract for Zero Trust, Magic WAN, and Magic Firewall, consolidating its security on Cloudflare’s platform.

European Technology Sector Growth

In Europe, Cloudflare secured a $5.3 million, one-year contract with a technology company for Access, Gateway, and Data Loss Prevention. This client, focused on engineering, recognized the value of Cloudflare’s Zero Trust roadmap for infrastructure modernization.

Future Outlook

Cloudflare projects Q4 2024 revenue between $451 million and $452 million, a 25% year-over-year growth at the midpoint. Full-year revenue is expected to range from $1.661 billion to $1.662 billion, up 28% year-over-year. With anticipated increases in sales capacity by early 2025 and strategic investments in AI, federal sector, and global expansion, Cloudflare is well-positioned to reach its $5 billion revenue target over the long term.

Management comments on the earnings call.

Product Innovations

Matthew Prince, Co-Founder and CEO

"Our Workers AI platform is driving real value for customers, especially as they shift from training to inference workloads. By enabling high-performance, cost-efficient solutions globally, we’re providing an alternative to traditional cloud providers and tapping into critical growth areas like AI."

Revenue Retention

Thomas Seifert, CFO

"Our net retention rate reflects both strong customer loyalty and the positive impact of our pool of funds deals. While these deals introduce short-term pressure on retention metrics, they represent a deeper, long-term commitment to our platform that we believe will drive sustained growth over time."

Customers

Michelle Zatlyn, Co-Founder, President, and COO

"We’re thrilled to see our large customer base grow to over 3,200 accounts, including many of the Fortune 500. This growth demonstrates our ability to serve enterprise clients seeking secure, scalable solutions, and it reinforces our commitment to being a trusted partner to leading organizations worldwide."

International Growth

Matthew Prince, Co-Founder and CEO

"The productivity gains we’re seeing in APAC and EMEA underscore the effectiveness of our go-to-market strategy in these regions. With revenue growth of 38% in APAC and 31% in EMEA, we’re proving our potential to capture market share globally and setting a foundation to replicate these gains in North America."

Challenges

Thomas Seifert, CFO

"Achieving sales capacity in the current market is always a challenge, but our focus on ramping enterprise-focused hires and enhancing productivity is paying off. The bottoming of our sales capacity and the steady productivity gains in key regions tell us that we’re turning the corner and can expect capacity to improve in 2025."

Future Outlook

Matthew Prince, Co-Founder and CEO

"As we approach 2025, our focus is clear: expanding capacity, strengthening customer relationships, and maintaining momentum in strategic areas like AI and international growth. With these elements in place, we’re on track to meet our $5 billion revenue target and continue delivering long-term value to our stakeholders."

Thoughts on Cloudflare ER $NET:

🟢Pros:

+ Revenue rose by +28.2% YoY. According to Q3 guidance, if the company beats the forecast by 1.4%, as it did in Q3, revenue growth in Q4 is expected to decline to 26.5% YoY.

+ RPOs are growing +36.7% YoY faster than revenue.

+ Company increasing margins and profitability.

+ Gross margin remains at a high level.

+ Strong number of total customers added: +11,374.

+ Record addition of 219 new $100K+ customers.

+ Visible results from changes in GTM (Go-To-Market) strategy, with CAC Payback Period decreasing to 19,5 months from 26,4 last quarter.

+ The SASE platform secured a strong $4.2 million contract.

+ Beat revenue guidance by 1.4%.

+ FY revenue growth guidance increased by 0.2%.

🟡Neutral:

+- Weighted-average number of common shares increased by 2.3% YoY.

+- Dollar-Based Net Retention (DBNR) decreased to 110%; management explains this decline was influenced by an increase in “pool of funds” contracts with large customers.

+- Stock-Based Compensation (SBC) as a percentage of revenue is 21%.

+- Billings growth is 24.2% YoY, which is slower than revenue growth.