Cloudflare Q2 2024 Earnings Analysis

Dive into $NET Cloudflare’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$401.0M rev (+30.0% YoY, +30.5% LQ) beat est by 1.6%

↗️GM* (79.0%, +1.3%pp YoY)

↗️Operating Margin* (14.2%, +7.6%pp YoY)🟢

↗️FCF Margin (9.6%, +3.1%pp YoY)

↗️EPS* $0.20 beat est by 42.9%🟢

*non-GAAP

Key Metrics

↘️DBNR 112% (115% LQ)

↗️RPO $1.42B (+42.1% YoY)🟢

➡️Billings $422M (+23.0% YoY)🟡

Customers

↗️210,166 customers (+21.0% YoY, +13028)🟢

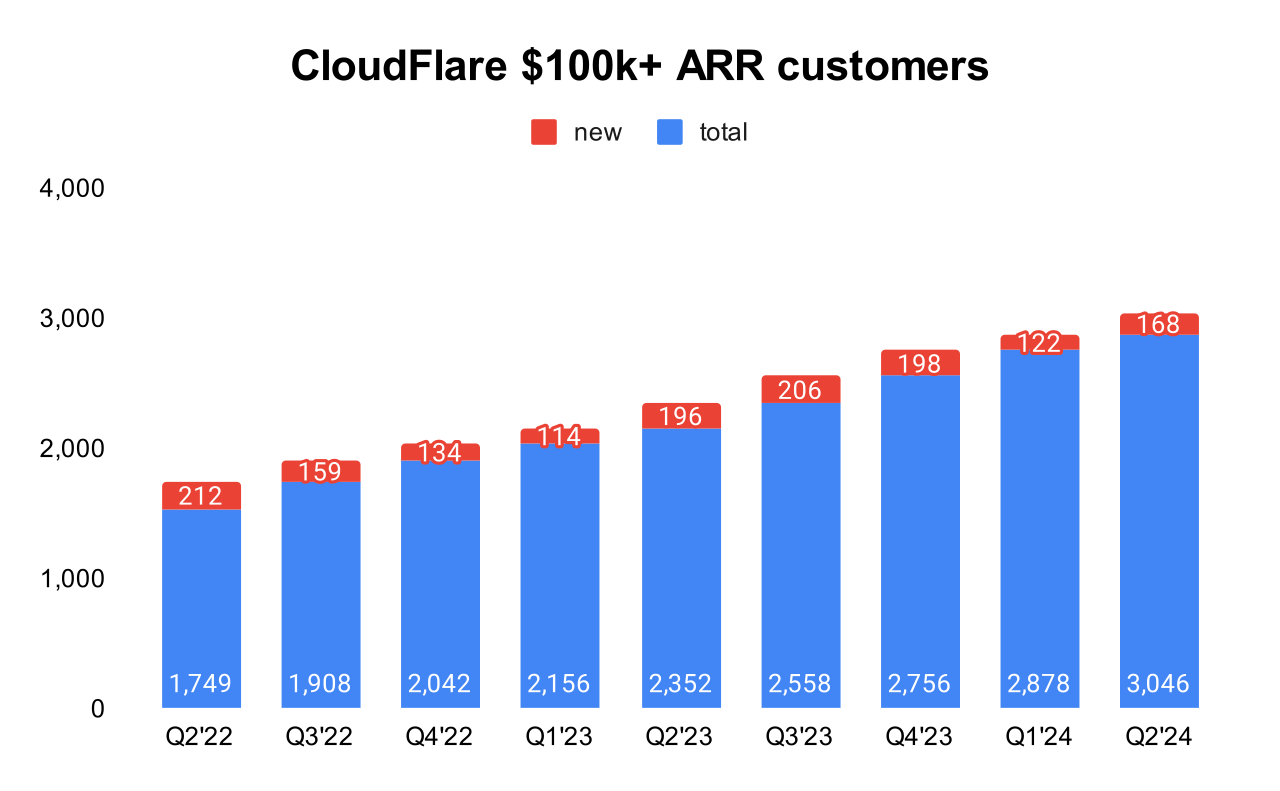

➡️3,046 $100k+ customers (+30.0% YoY, +168)

Operating expenses

↘️S&M*/Revenue 37.3% (41.4% LQ)

↗️R&D*/Revenue 16.3% (15.5% LQ)

↘️G&A*/Revenue 11.2% (11.4% LQ)

↗️Net New ARR $90M ($65 LQ)

↘️CAC* Payback Period 26.4 Months (34.0 LQ)

Dilution

↗️SBC/rev 22%, +2.0%pp QoQ

↗️Basic shares up 2.5% YoY, +0.0%pp QoQ

↘️Diluted shares up 3.8% YoY, -0.4%pp QoQ

Headcount

↗️3,902 Total Headcount (+15.0% YoY, +198 added)

Guidance

➡️Q3'24 $423.0 - $424.0M guide (+26.2% YoY) in line with est

↗️$1,657.0 - $1,659.0M FY guide (+27.9% YoY) raised by 0.4% beat est by 0.5%

Key points from Cloudflare’s Second Quarter 2024 Earnings Call:

Comprehensive Platform Approach:

Cloudflare emphasized their comprehensive platform approach, particularly mentioning the pool of funds deals which allow customers to access a broad range of services.

Workers Platform Growth:

The Cloudflare Workers developer platform was highlighted for its rapid growth and adoption, with the active developer accounts on the platform increasing by 20% in just four months. This platform allows developers to build and ship full-stack applications directly on Cloudflare’s network.

AI and Edge Computing:

Cloudflare’s focus on AI and edge computing was evident with their inference-tuned GPUs deployed across 167 cities worldwide, making them a global leader in cloud inference solutions. The inference requests powered by Cloudflare AI increased by over 700% quarter-over-quarter, showcasing significant growth in this area.

Developer Engagement and Tools:

New AI functions was released on the Workers platform, noting a 67% quarter-over-quarter increase in developer accounts utilizing these AI functions. This indicates a strong engagement from the developer community and Cloudflare’s commitment to providing cutting-edge tools for development.

Zero Trust and Data Security:

Cloudflare has been expanding its data security offerings with comprehensive solutions that integrate Zero Trust architectures and Secure Access Service Edge (SASE) capabilities, which combine traditional security measures with modern Zero Trust approaches. This holistic security model is appealing to organizations looking to modernize and secure their operations.

Several key customer wins

Australian Technology Company: Signed a two-year $17.5 million contract, utilizing a wide range of Cloudflare products for applications such as remote access, serverless development, and bot management.

US University: Entered into a five-year $5.7 million contract, fully adopting Cloudflare’s SASE platform to modernize and scale their global network.

Global Research and Development Organization: Expanded their relationship with a two-year $846,000 contract for Cloudflare’s comprehensive SASE portfolio, which includes gateway, CASB, DLP, and browser isolation.

AI Company Utilization: A leading AI company expanded their relationship by signing a one-year $500,000 contract, leveraging Cloudflare for AI inference, storage, and application security to enhance performance and cost efficiency.

Go-To-Market (GTM) Improvements:

The appointment of Mark Anderson as President of Revenue was highlighted as a strategic move. Under his leadership, significant hiring in the GTM team occurred, including a new VP of Sales in the Americas and a Global Head of Customer Success. These improvements have led to enhanced close rates and shorter sales cycles.

Challenges:

Despite strong financial performance, Cloudflare noted the impact of ongoing macroeconomic uncertainty. The company acknowledged the challenges in the IT buying environment, emphasizing the need to fight for every deal and adapt to changing market conditions.

Dollar-Based Net Retention Rate (DNR):

Cloudflare reported a decrease in its dollar-based net retention rate to 112%, down 3 percentage points quarter-over-quarter. The CFO, Thomas Seifert, noted that the financial impact of pool of funds deals differs significantly from traditional contracts, particularly affecting revenue, deferred revenue, and current RPO (Remaining Performance Obligations). This can make the retention rate appear more volatile.

Future Outlook:

Cloudflare aims to continue its focus on driving higher productivity and greater efficiency across operations. This includes managing network capital expenditures, which are expected to increase in the second half of the year to reach 10-12% of revenue for the full year 2024.

Management comments on the earnings call.

Product Innovations

Matthew Prince, CEO: "Workers AI is growing even faster with developer accounts taking advantage of our AI functions increasing 67% quarter-over-quarter. Today, we have inference-tuned GPUs live in 167 cities worldwide, making us we believe the most global cloud inference solution."

Zero Trust and Cybersecurity

Matthew Prince, CEO: "One of the largest universities in the United States signed a five-year $5.7 million contract. This customer is going all in on Cloudflare's SASE platform with 20,000 seats of Zero Trust, CASB, DLP, email security, Magic WAN, and Magic Firewall."

Customers

Matthew Prince, CEO: "A leading Australian technology company expanded their relationship with Cloudflare, signing a two-year $17.5 million contract, $7.2 million of which is expansion. They started with Cloudflare back in 2016 as a free customer and today use nearly all our products."

Thomas Seifert, CFO: "We expect new customers to contribute a higher percentage of our overall year-over-year revenue growth, similar to the second quarter."

Dollar-Based Net Retention Rate (DNR):

Thomas Seifert, CFO: "Our dollar-based net retention was 112%, down 3 percentage points quarter-over-quarter. The decline in DNR was driven by slower net expansion in our larger customer cohorts and increased platform deals in the form of pool of funds contracts."

Thomas Seifert, CFO: "While the deals are very beneficial and healthy to the business, they generate some noise in this transition in our DNR and in other metrics. So very healthy trends, will make the business a little bit more lumpy."

Leadership

Matthew Prince, CEO: "As Mark continues to focus on operationalizing productivity at scale and building a world class go-to market engine, a key focus in the second quarter involved making changes to the composition of our organization and bringing on more stage-appropriate talent."

Challenges

Matthew Prince, CEO: "This wasn't an easy quarter, but we continue to execute and deliver strong results. While I think we benefit from being a must-have, not a nice to have, we still had to fight for every deal as the IT-buying environment continues to be challenging."

Thoughts on Cloudflare ER $NET:

🟢Pros:

+ Revenue rose by +30.0% YoY; according to Q3 guidance, revenue growth will slightly decrease to 28.4% YoY

+ RPOs are growing +42% YoY faster than revenue

+ Company increasing margins and profitability

+ Gross margin in record level

+ Record number of total customers added: +13,028

+ 168 new $100k+ customers added

+ Visible results from changes in GTM (Go-To-Market) strategy, with CAC Payback Period decreasing to 26 months from 34 last quarter

+ SASE platform secured several strong contracts

+ Beat revenue guidance by 1.6%.

+ FY revenue growth guidance increased by 0.4%

🔴Cons:

- Diluted shares count rose by 3.8% YoY

🟡Neutral:

+- DBNR decrease to 112%

+- SBC/rev 22%

+- Billings growth at 23% YoY, slower than revenue