Cloudflare Q1 2025 Earnings Analysis

Dive into $NET Cloudflare’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$479.1M rev (+26.5% YoY, +26.9% LQ) beat est by 2.2%

↘️GM* (77.1%, -2.4 PPs YoY)🟡

↗️Operating Margin* (11.7%, +0.5 PPs YoY)

↗️FCF Margin (11.0%, +1.6 PPs YoY)

↗️Net Margin (-8.0%, +1.3 PPs YoY)

➡️EPS* $0.16 in line with est

*non-GAAP

Key Metrics

➡️DBNR 111% (111% LQ)

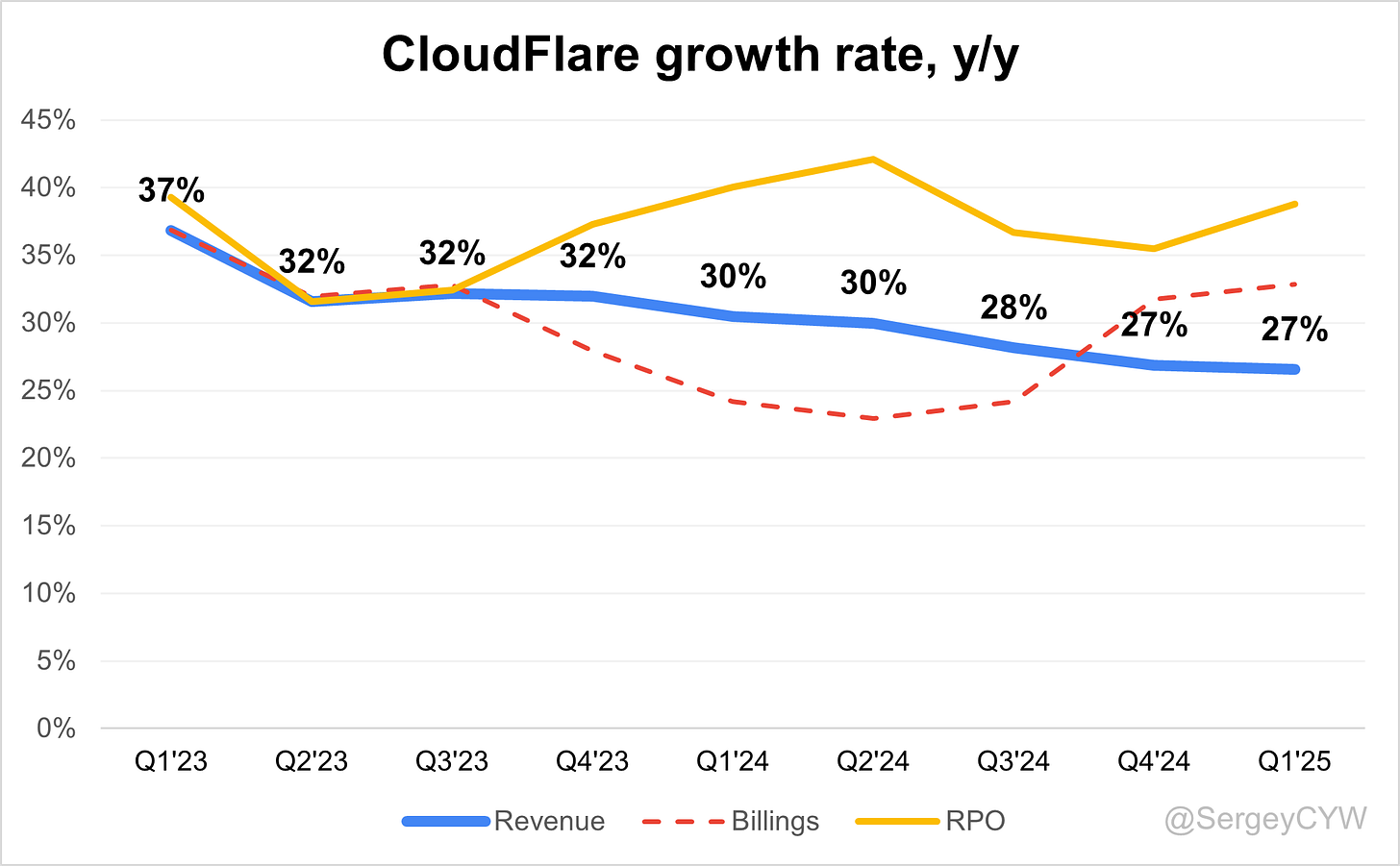

↗️RPO $1.86B (+38.8% YoY)🟢

↗️Billings $515M (+32.8% YoY)🟢

Customers

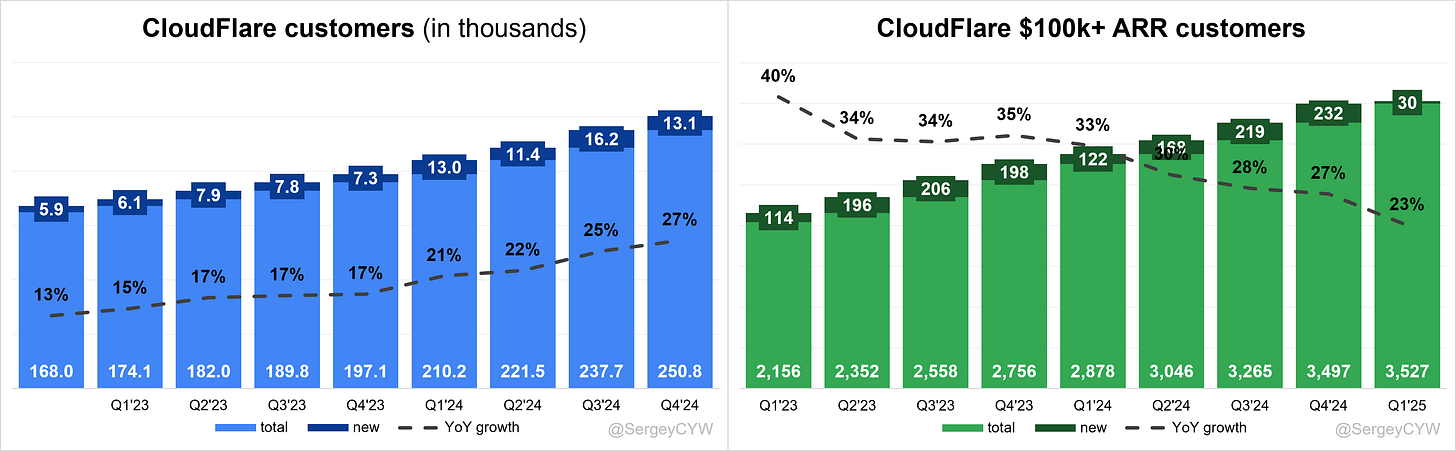

➡️250,819 customers (+27.2% YoY, +13105)

➡️3,527 $100k+ customers (+22.6% YoY, +30)

Operating expenses

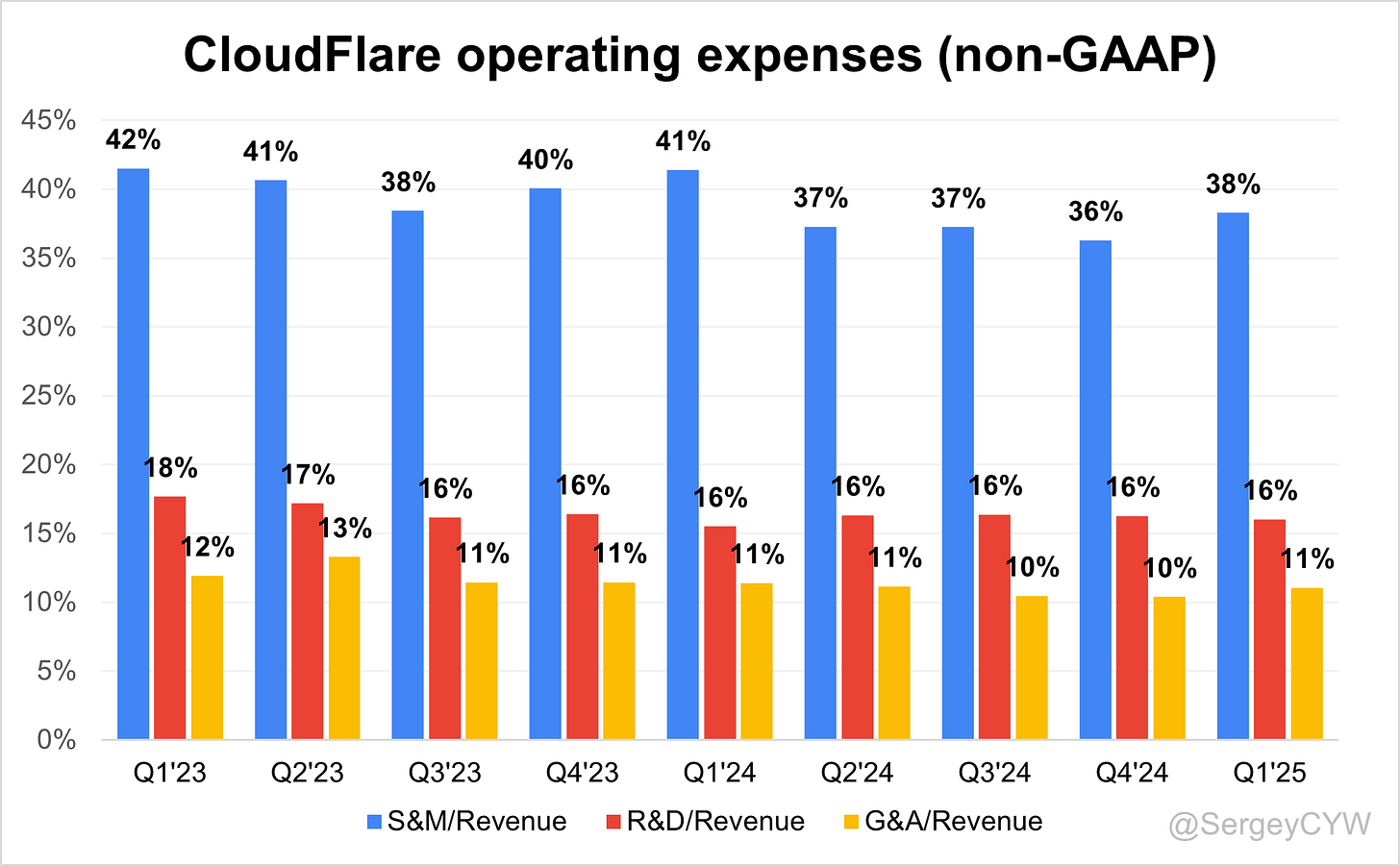

↘️S&M*/Revenue 38.3% (-3.1 PPs YoY)

↗️R&D*/Revenue 16.0% (+0.5 PPs YoY)

↘️G&A*/Revenue 11.1% (-0.3 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $77M (+19.1% YoY)

↘️CAC* Payback Period 33.8 Months (-0.1 YoY)🟢

↘️R&D* Index (RDI) 1.63 (-0.03 YoY)🟡

Dilution

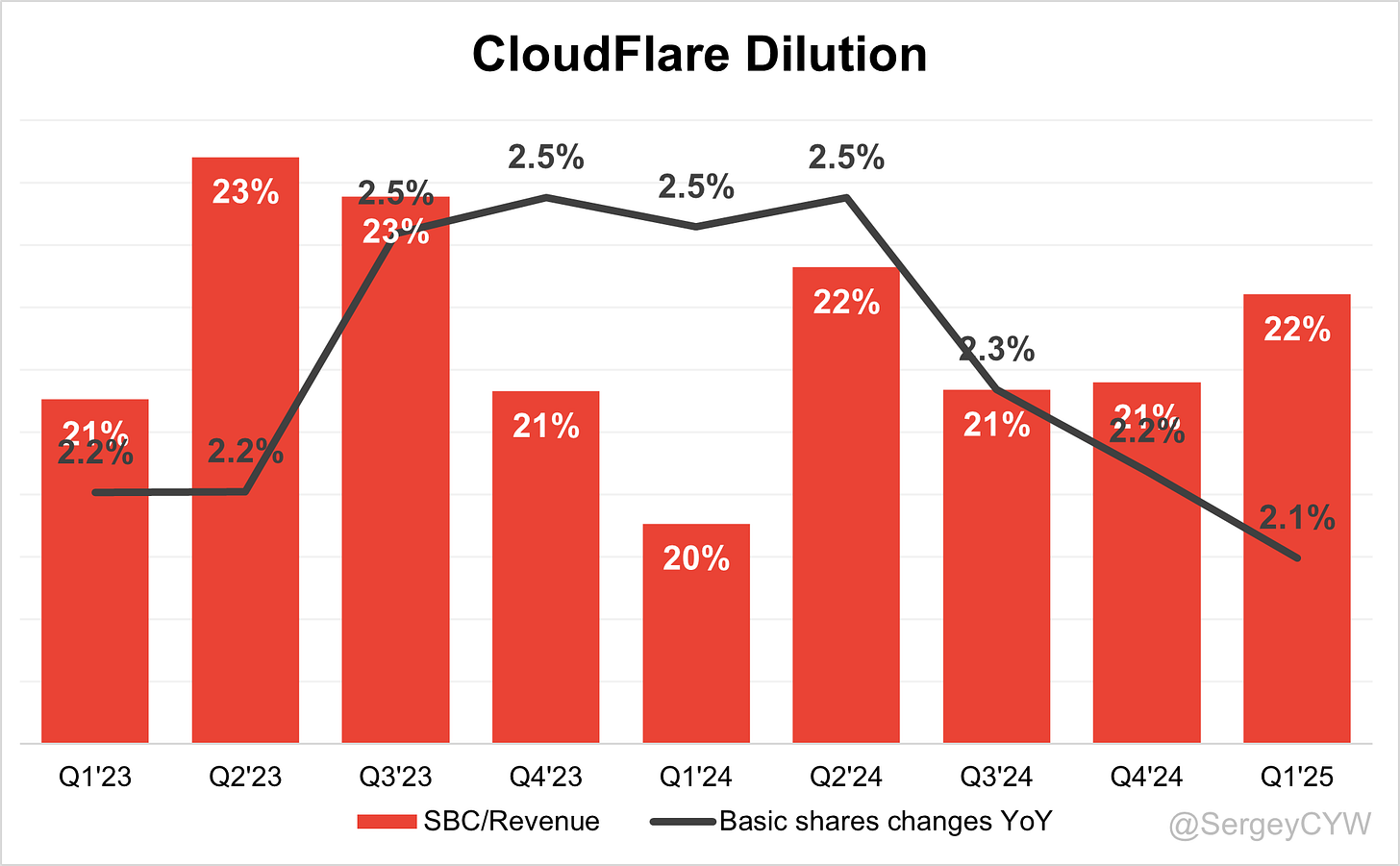

↗️SBC/rev 22%, +0.7 PPs QoQ

↘️Basic shares up 2.1% YoY, -0.1 PPs QoQ

↘️Diluted shares down -2.9% YoY, -4.6 PPs QoQ🟢

Headcount

↗️4,400 Total Headcount (+18.8% YoY, +137 added)

Guidance

↗️Q2'25 $500.0 - $501.0M guide (+24.8% YoY) beat est by 0.3%

➡️$2,090.0 - $2,094.0M FY guide (+25.3% YoY) in line with est

Key points from Cloudflare’s First Quarter 2025 Earnings Call:

Financial Performance

Cloudflare reported $479.1M in revenue for Q1 2025, up +27% YoY. Gross margin was 77.1%, above the long-term target of 75–77%, though down -240bps YoY due to traffic mix and cost reallocation from higher paid usage. Operating income reached $56M, up +32% YoY, with an operating margin of 11.7% (+50bps YoY). Free cash flow rose to $52.9M, representing 11% of revenue, compared to $35.6M and 9% in Q1 2024. Net income was $58.4M or $0.16 per share, with a $0.01 FX-related loss tied to lease liability remeasurement.

Workers.ai

Cloudflare signed a $130M, five-year contract led by Workers.ai, the largest deal in its history. The customer replaced a hyperscaler due to better developer experience, performance, and platform cost-efficiency. Workers now offers compute, storage, GPU, durable objects, and real-time services, positioning Cloudflare as a full-stack platform. AI inference activity on Workers surged +4,000% YoY and AI Gateway requests increased +1,200% YoY. Companies including Stripe, Atlassian, PayPal, and Block are actively building on the platform.

R2 Storage

R2 was bundled in major enterprise contracts, including the $130M deal, serving as the persistent, low-latency storage layer alongside Workers and D1. Integration with Cloudflare's edge network enables faster and cheaper data access compared to centralized cloud providers. R2 strengthens Cloudflare’s ability to compete with AWS, Azure, and GCP in developer infrastructure.

D1 Database

D1 is progressing into enterprise readiness. Though figures were not disclosed, D1 appeared in multiple large deals, paired with Workers and R2. Designed as a serverless SQL database, it supports emerging AI and agent-based workloads. Cloudflare’s developer GTM team accelerated D1’s adoption through direct support and proof-of-concept delivery.

Zero Trust

Cloudflare closed a $12.7M, seven-year contract with a critical infrastructure provider—the longest-duration agreement in its history—adopting the full Zero Trust suite: Access, Gateway, DLP, Magic WAN, and Magic Firewall. Additional wins included a $9.4M, two-year contract with a Fortune 500 tech company, including $2M Workers upsell and vendor consolidation, and a $6.2M, two-year federal deal focused on FedRAMP-certified Zero Trust services. Multiple vendors were displaced in each deal.

Cloudflare One

Cloudflare One, the unified SASE platform, is gaining traction in both private and public sectors. Notable contracts include those with U.S. federal agencies, EMEA government infrastructure, and APAC regulators. Cloudflare’s cloud-first, globally distributed network and integrated architecture are key to replacing legacy on-prem hardware.

AI Protocol Innovation

Cloudflare introduced support for the Model Context Protocol (MCP), allowing secure interaction between AI agents and third-party platforms via Workers. Cloudflare is acting as a "universal adapter" for OpenAI, Anthropic, and Google variants, becoming foundational to the AI agent layer of the internet. MCP servers are already used by enterprise customers to enable agentic integration.

International Growth

U.S. revenue rose +20% YoY and accounted for 49% of total. EMEA revenue increased +27% YoY (28% of mix), while APAC led growth with +54% YoY, now representing 15% of total revenue. Go-to-market execution and local infrastructure drove regional performance, particularly in APAC.

Pool of Funds Model

Cloudflare's “Pool of Funds” contracts, including the record $130M deal, provide precommitted spend to be drawn down over time. This model impacts revenue recognition timing and contributes to flat NRR at 111% QoQ, despite underlying customer growth. Management emphasized the long-term value of these commitments.

Enterprise Growth

Large customer count rose to 3,527, up +23% YoY, now contributing 69% of total revenue (up from 67%). Customers spending over $1M and $5M annually grew +48% and +54% YoY, respectively. Sales productivity improved by double digits YoY. Sales cycles shortened, and pipeline attainment exceeded expectations.

Customer Base

Cloudflare ended Q1 with 251,000 paying customers, adding 13,000 net new sequentially, a +27% YoY increase. The $100K+ cohort grew modestly QoQ due to revenue timing and fewer account upgrades. Churn declined, contributing to customer stability.

Large Customer Wins

Major wins included a $130M, 5-year hyperscaler displacement, a $9.4M, 2-year deal with a Fortune 500 firm with three vendor consolidations, and a $6.2M federal deal driven by Zero Trust mandates. Also secured were a $12.7M, 7-year deal in EMEA, a $4.8M, 3-year APAC government contract, and a $6.4M, 5.5-year consolidation deal with a Global 2000 enterprise. Each emphasized Cloudflare’s value as a performance and security-driven platform.

CapEx and Network Efficiency

Network CapEx was 17% of revenue, expected to normalize to 12–13% for FY25. Cloudflare’s multi-vendor hardware strategy and global supply chain flexibility continue to support efficient network expansion. The extension of server life from 4 to 5 years further reduces depreciation impact.

Competitive Advantage

Cloudflare's edge architecture allows every server to run every service, giving it an advantage in absorbing large-scale DDoS attacks at no extra cost. Competitors rely on scrubbing centers with limited bandwidth, creating bottlenecks. Customers are turning to Cloudflare to replace firewall vendors and traditional cloud players due to lower latency and greater flexibility.

Macro Conditions

Cloudflare maintained execution discipline despite global volatility, tariffs, and geopolitical tension. The company leveraged supply chain optionality—such as NAFTA-based component assembly in Mexico—to navigate risk. Hardware-based competitors face growing tariff exposure, which is accelerating cloud-first adoption.

Guidance and Outlook

Q2 2025 revenue is projected at $500–501M (+25% YoY), with operating income of $62.5–63.5M and EPS of $0.18. Full-year guidance remains at $2.090–2.094B in revenue (+25% YoY), $272–276M in operating income, and EPS of $0.79–0.80. Management reaffirmed its commitment to the Rule of 40, with plans to reinvest in GTM execution, R&D, and long-term platform innovation.

Management comments on the earnings call.

Product Innovations

Matthew Prince, Co-Founder and Chief Executive Officer

“We invest early and are able to develop quickly with nimble teams because of the power and flexibility of our platform.”

Matthew Prince, Co-Founder and Chief Executive Officer

“We're not bolting AI security through haphazard acquisitions, but instead building the unified platform that supports the future.”

Workers.ai

Matthew Prince, Co-Founder and Chief Executive Officer

“We landed the largest contract in Cloudflare's history, a milestone deal of more than $100 million driven by our Workers developer platform.”

Matthew Prince, Co-Founder and Chief Executive Officer

“They chose Workers, Durable Objects, Containers, and our real-time products. The customer was well down the line with a traditional hyperscaler, but made the decision to switch to Cloudflare when they saw our better performance, lower development costs, and more modern platforms.”

Matthew Prince, Co-Founder and Chief Executive Officer

“It may well turn out that the killer app for Cloudflare Workers is going to be around AI and the interconnection.”

Matthew Prince, Co-Founder and Chief Executive Officer

“Today when the developer platform is as robust as it is, that speedboat and those efforts around it are yielding really significant results.”

Zero Trust Growth

Matthew Prince, Co-Founder and Chief Executive Officer

“A government agency in Asia-Pacific signed a three-year $4.8 million contract for Magic Transit and Application Services… They view Cloudflare as a key enabler to their digital transformation.”

Matthew Prince, Co-Founder and Chief Executive Officer

“Cloudflare Zero Trust products were significantly more performant than our first-generation competitor due to our expansive global presence, including distributed international FedRAMP points of presence.”

Matthew Prince, Co-Founder and Chief Executive Officer

“In head-to-head comparisons versus first-generation SASE providers, Cloudflare is just a better solution, and that's causing us to win in these situations.”

Cloudflare One

Matthew Prince, Co-Founder and Chief Executive Officer

“This customer is going all-in on Cloudflare's SASE portfolio with Access, Gateway, DLP, Magic WAN, and Magic Firewall along with application services.”

Matthew Prince, Co-Founder and Chief Executive Officer

“Customers say they don't want to have to think about who is their reverse proxy versus their forward proxy… they really want one solution.”

Competitors

Matthew Prince, Co-Founder and Chief Executive Officer

“What we're seeing is… some of the hyperscalers, some of our competitors are actually referring customers to us when their systems aren't able to stay in front of these [DDoS] attacks.”

Matthew Prince, Co-Founder and Chief Executive Officer

“This is unique compared with some of our on-prem hardware competition, where we're seeing the last potential customer holdouts begin to migrate away from them because of tariff uncertainty.”

Matthew Prince, Co-Founder and Chief Executive Officer

“Cloudflare is unique in being able to deliver both DDoS mitigation and SASE in one continuous bundle.”

Customers

Matthew Prince, Co-Founder and Chief Executive Officer

“In the words of this customer, ‘The scale and performance of Cloudflare's network and its proximity to our user base was the most powerful driver to doing more with Cloudflare.’”

Matthew Prince, Co-Founder and Chief Executive Officer

“In the words of this customer, Cloudflare has by far the broadest and most programmable cloud security and connectivity platform on the market.”

Matthew Prince, Co-Founder and Chief Executive Officer

“Great companies like Asana, Atlassian, Block, PayPal, Stripe, and many more are building the interface for AI agents to work with their own platform on top of Cloudflare Workers.”

Pool of Funds Model

Thomas Seifert, Chief Financial Officer

“These results reinforce our belief that DNR is stabilizing at these levels, despite continued near-term headwinds from increased traction with pool-of-fund contracts, which can impact the shape of revenue recognition.”

International Growth

Thomas Seifert, Chief Financial Officer

“We were pleased to see continued robust growth in APAC as key go-to-market initiatives in the region continued to produce strong results.”

Challenges

Matthew Prince, Co-Founder and Chief Executive Officer

“Even without our privileged view, it's clear to everyone the world is a more volatile place today than it was even a quarter ago.”

Thomas Seifert, Chief Financial Officer

“We are cognizant of the broader global business environment in which we are operating, and therefore taking a prudent approach to our outlook for the remainder of the year.”

Future Outlook

Matthew Prince, Co-Founder and Chief Executive Officer

“We're going to keep a firm grip on the levers of our business, stay prudent with how we forecast, and invest in what we know works: an incredible go-to-market team, world-class engineering, and innovative products that reinvent the future of the Internet.”

Thomas Seifert, Chief Financial Officer

“Our first quarter results underscore that this formula is working despite the highly volatile external business environment.”

Thoughts on Cloudflare Earnings Report $NET:

🟢 Positive

Revenue grew to $479.1M, up +26.5% YoY, beating estimates by 2.2%

Operating margin expanded to 11.7%, up +0.5pp YoY

Free cash flow margin improved to 11.0%, up +1.6pp YoY

Net new ARR reached $77M, up +19.1% YoY

Billings grew to $515M, up +32.8% YoY

RPO increased to $1.86B, up +38.8% YoY

13,105 net new customers added, reaching 250,819 total, up +27.2% YoY

$130M 5-year contract closed via Workers.ai, the largest in company history

$1M+ customers up +48% YoY, $5M+ customers up +54% YoY

APAC revenue rose +54% YoY, strongest regional performance

Diluted shares down -2.9% YoY, reducing dilution

Q2 revenue guidance of $500–501M (+24.8% YoY) beat estimates

Zero Trust and SASE deals secured across U.S., EMEA, and APAC

🟡 Neutral

Gross margin at 77.1%, above long-term target but down -2.4pp YoY

EPS of $0.16, in line with estimates

Dollar-based net retention (DBNR) remained flat at 111% QoQ

$100K+ customer cohort added only +30, modest sequential growth

SBC as % of revenue rose to 22%, up +0.7pp QoQ

R&D spend increased to 16% of revenue, up +0.5pp YoY

R&D index (RDI) slightly decreased to 1.63, down -0.03 YoY

Headcount increased to 4,400, up +18.8% YoY

Net margin at -8.0%, though improved +1.3pp YoY

🔴 Negative

Gross margin decline of -240bps YoY, impacted by mix and cost allocation

Pool of Funds contracts created visibility challenges for revenue recognition

Sales & marketing expense remains high at 38.3% of revenue, despite -3.1pp YoY reduction

Basic shares increased +2.1% YoY, slightly dilutive

FX loss of $0.01/share impacted net income

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.