Cloudflare: Building a Faster, Safer Internet at Global Scale

Deep Dive into $NET: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Cloudflare: Company overview

About Cloudflare

Cloudflare, is a global cloud services provider headquartered in San Francisco, California. Founded in 2009 by Matthew Prince, Lee Holloway, and Michelle Zatlyn, the company delivers key network infrastructure services, including Content Delivery Network (CDN), DDoS Protection, Web Security, Zero Trust Services, and DNS Services. Cloudflare operates in over 285 cities across 100 countries, managing daily network traffic of approximately 72 terabits per second.

Company Mission

Cloudflare’s mission is to "help build a better Internet", focusing on making the web faster, safer, and more reliable. The company optimizes website speed and performance, protects digital assets from cyber threats, and enhances global accessibility. Continuous innovation drives Cloudflare’s ability to meet evolving digital security and performance needs.

Sector Overview

Cloudflare operates in the Information and Communications Technology (ICT) sector, specializing in cloud infrastructure services. The company is positioned across multiple industry segments, including web performance optimization, cybersecurity, edge computing, and Zero Trust security frameworks. Businesses rely on Cloudflare to secure, accelerate, and optimize their digital presence.

Competitive Advantage

Cloudflare’s primary competitive advantage lies in its expansive global network infrastructure of 285+ data centers worldwide, ensuring low latency and high availability. The company integrates CDN, security, edge computing, and Zero Trust frameworks into a unified platform, reducing complexity for customers. Cloudflare’s scalable pricing model ranges from free plans to enterprise solutions starting at $2,000/month, making its services accessible to startups and large enterprises alike.

Total Addressable Market (TAM)

Cloudflare operates across multiple high-growth markets, with a combined Total Addressable Market (TAM) exceeding $100 billion:

CDN Market: Valued at $20 billion, projected to reach $67 billion by 2031.

Secure Access Service Edge (SASE): Currently at $25 billion, expanding rapidly.

Security Service Edge (SSE): Expected to grow from $1 billion to $3 billion by 2028.

Wide Area Network (WAN): Valued at $8.2 billion in 2022.

Cloudflare’s broad product portfolio allows it to capture market share across multiple sectors, positioning it for sustained long-term growth.

Valuation

$NET Cloudflare is trading at a Forward EV/Sales multiple of 28.5, which is above the median of 17.6. The lowest Forward EV/Sales was recorded in March 2025 at around 30. The company’s valuation has increased significantly over the past six months.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

$NET trades at a Forward P/E of 215.9, a very high level as the company heavily reinvests in future growth, particularly in R&D, and remains in an earlier stage of growth.

The EPS growth forecast for 2026 is 32.2%, with a 2026 PEG ratio of 6.7.

The EPS growth forecast for 2027 is 40.6%, with P/E of 172.7, 2027 PEG ratio of 4.2.

From a PEG multiple perspective, the stock appears highly valued.

Powered by Fiscal.ai — get 15% off with affiliate link for Compounding Your Wealth readers.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Considering the EV/Sales valuation relative to analysts' revenue growth forecasts for next year, $NET is trading at a premium, but its revenue growth is also expected to be among the highest in the cybersecurity sector.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Cloudflare has built a formidable economic moat by combining scale, network effects, integrated services, and ongoing innovation. Its infrastructure underpins roughly 20% of the web, giving it a structural advantage few competitors can replicate.

Economies of Scale

Cloudflare operates a global network in over 335 cities across 125+ countries, supported by 348 Tbps of capacity. Cloudflare's non-GAAP gross margin reached 77% in Q1 2025, driven by its single software stack, commodity hardware model, and strategic ISP partnerships. The network processes 247 billion cyber threats daily, and serves 95% of the world's Internet-connected population within 50 milliseconds, delivering both cost and performance advantages. Customer migrations from legacy cloud vendors report over 80% cost reductions, highlighting the economic efficiency of the platform.

Economies of Scale

Cloudflare demonstrates significant cost efficiency through scale. The company operates a global network spanning 335+ cities in 125+ countries, with 348 Tbps of capacity. In Q1 2025, it maintained a high non-GAAP gross margin of 77%, driven by a single software stack on commodity hardware and ISP partnerships that leverage idle capacity. The network blocks approximately 247 billion threats daily, reinforcing its scale advantage. With 95% of the world's Internet-connected population served within 50 milliseconds, Cloudflare achieves industry-leading speed and operational efficiency. Case studies report 80%+ cost savings when switching from traditional cloud providers like AWS to Cloudflare.

Network Effects

Cloudflare benefits from self-reinforcing network effects. With 20% of the web under its protection, the platform continuously improves its threat detection algorithms. Each new request strengthens machine learning capabilities for all users. Performance improves with each new Point of Presence (PoP), while direct connections to 13,000+ networks, including ISPs and cloud providers, add further routing and cost advantages. These data-driven advantages compound with growth, making the platform increasingly difficult to replicate.

Brand Strength

Cloudflare has earned a strong reputation in internet security and performance. Recognized in the 2025 Gartner Magic Quadrant for SSE, and rated 4.7/5 across 496 reviews, the company is a favorite among developers. However, some customers cite inconsistent support and cancellation friction. The free tier has been key in building mindshare, particularly among developers and startups, helping to fuel early-stage adoption and loyalty.

Intellectual Property

Cloudflare holds 291 patents globally, with 233 granted and 95%+ active. Its most cited patent, US8613089B1, has 284 citations, including from Microsoft, Snap, and HP. The IP portfolio has contributed to 790 patent rejections at the USPTO, signaling defensive strength. Cloudflare recently won a case against Sable, resulting in a $225,000 payment to the company. However, IP is a supporting layer—its moat relies more on execution and ecosystem scale.

Switching Costs

Switching costs vary by service depth. CDN and DNS users can move easily. But enterprise customers using Cloudflare Workers, custom APIs, or Magic WAN face meaningful friction. The more integrated the solution, the higher the cost and effort to leave. Cloudflare’s broad platform creates a sticky experience across performance, security, and networking. Still, its commitment to open standards and APIs reduces vendor lock-in compared to proprietary models, aligning with its performance-first, contract-light strategy.

Cloudflare's economic moat is primarily driven by economies of scale and network effects, which create a powerful combination that becomes stronger over time. The company's ability to serve such a large portion of internet traffic at scale creates both cost advantages and data advantages that are extremely difficult for competitors to replicate.

Revenue growth

The revenue growth of $NET Cloudflare stabilized at +27% YoY in Q1. Based on the forecast for the next quarter, if the company beats its guidance by 2.2%, as it did in Q1, revenue growth would reach approximately 27.6%, indicating a potential acceleration.

RPO growth accelerated to +38.8% YoY, significantly outpacing revenue growth, which may signal future revenue acceleration. Billings growth also accelerated to +32.8%, surpassing revenue growth.

Segments and Main Products

Cloudflare operates across multiple segments, delivering solutions for security, performance, reliability, and developer capabilities.

In Security, Cloudflare offers Cloud Firewall for web protection, Bot Management using machine learning to block malicious bots, DDoS Protection with Unmetered Mitigation, IoT Protection via Cloudflare Orbit, SSL/TLS Services for encrypted traffic management, and Secure Origin Connection to shield internal systems.

The Performance segment includes a Content Delivery Network (CDN) for rapid content distribution, Argo Smart Routing for optimized internet paths, and Mobile Optimization for enhanced mobile speed.

Reliability solutions consist of Load Balancing to distribute workloads, Anycast Network for global traffic management, and Always Online to maintain website accessibility during outages.

Internal Infrastructure products include Magic WAN for enterprise connectivity, Cloudflare Warp for secure end-user traffic routing, Magic Transit for on-premise network protection, and Cloudflare Gateway to filter malware and threats.

Developer Solutions feature Cloudflare Workers for serverless computing, Cloudflare Pages for web app deployment, and a Data Localization Suite to comply with data residency regulations.

Cloudflare R2 is a globally distributed object storage platform, S3-compatible with no egress fees. It provides AES-256 encryption, TLS/SSL protection, event-driven workflows, and seamless integration with Cloudflare Workers for automation.

Cloudflare D1 is a serverless SQL database built on SQLite, supporting point-in-time recovery and JSON parsing. It integrates with Cloudflare Workers, enabling globally distributed applications with a cost-efficient billing model based on queries and storage.

Cloudflare One is a comprehensive networking and security solution, combining Magic Transit, WARP, Gateway, and Access. It applies consistent global security controls, reduces latency with Argo Smart Routing, and centralizes traffic logs and analytics.

Cloudflare Zero Trust secures sensitive resources with granular access controls, multi-factor authentication, end-to-end encryption, and network segmentation. It ensures compliance with GDPR and HIPAA while integrating with third-party security tools for a unified IT security infrastructure.

Main Products Performance in the Last Quarter

Workers.ai

Cloudflare Workers.ai posted record growth, led by a $130 million, five-year deal with a major tech firm—the largest in company history. Inference requests surged nearly 4,000% year-over-year, while AI Gateway requests jumped over 1,200%. The win came by displacing a hyperscaler late in the evaluation cycle, citing better performance, faster developer velocity, and lower cost. Companies like Stripe, Atlassian, and PayPal are building AI agents on Workers, attracted by its combination of compute, security, and global performance.

R2 Storage Platform

R2 is a critical piece of Cloudflare’s full-stack serverless platform. Though no specific metrics were provided, it’s actively used in large deals alongside Workers and Durable Objects to cut costs and modernize infrastructure. R2 is positioned as a strategic alternative to hyperscaler storage, embedded in bundled platform adoption.

Developers D1

D1 continues gaining traction as part of the Workers stack. While numbers weren’t disclosed, it’s appearing in enterprise-scale contracts, particularly those driven by the developer-focused “speedboat” go-to-market team. That team is now tied to multiple $100 million+ pipeline opportunities, reflecting growing demand for a unified serverless database and compute offering.

Cloudflare One

Cloudflare One is winning in large enterprises shifting from on-premise hardware, driven by tariff risks and supply chain constraints. A seven-year, $12.7 million contract with a critical infrastructure provider is now the longest in company history. The deal includes full SASE adoption—Access, Gateway, DLP, Magic WAN, and Magic Firewall—validating the demand for integrated network and security services on a single platform.

Zero Trust

Zero Trust continues to scale, securing major wins including a $9.4 million, two-year deal with a large tech firm that consolidated three vendors and included a $2 million Workers upsell. A $6.2 million, two-year agreement with a U.S. federal entity reflected success in regulated sectors, with FedRAMP-ready infrastructure seen as a major differentiator.

Innovation & Product Updates

Cloudflare is now powering the backend for the Model Context Protocol (MCP), a standard introduced by Anthropic for AI agent interoperability. The company built the first cloud-native, high-performance MCP server, adopted by firms like Stripe, Block, and Atlassian. The AI-driven internet shift is altering traffic patterns—Google traffic is now 15 crawls for every visitor, up from 6 just six months ago—pushing media companies toward Cloudflare for control and monetization.

Cloudflare’s architectural advantage is evident in hyper-volumetric DDoS mitigation. The network absorbed attacks 300% higher year-over-year without cost escalation or degradation in service. Unlike peers, Cloudflare uses every server for all functions—security, performance, compute—without separate “scrubbing centers,” enabling unmatched resilience and scalability.

Cloudflare continues to scale with $52.9 million in free cash flow, 11.7% operating margin, and 27% year-over-year revenue growth to $479.1 million. Large customer count grew 23% to 3,527, with $1 million+ customers increasing 48%. Record sales productivity and improved sales cycles reflect a maturing, high-efficiency go-to-market engine that is now chasing multiple $100 million+ opportunities.

Cloudflare and TD SYNNEX expanded partnership across Latin America to deliver managed security services through Cloudflare’s unified Zero Trust and network stack. Cloudflare blocked 30 billion daily threats in Q1 2025, up 27% from Q4. MSSP customers report up to 50% cost savings versus multi-vendor stacks. Infrastructure now spans 64 cities across Latin America and the Caribbean. A Forrester study calculated a 238% ROI over three years for Cloudflare deployments.

Cloudflare is among the first companies certified under Global CBPR and Global PRP, covering 39 jurisdictions. Standards are backed by governments from the US, Japan, Australia, Mexico, and Singapore, ensuring privacy alignment with 50+ data protection laws. This cements Cloudflare's position as a global, privacy-first infrastructure provider.

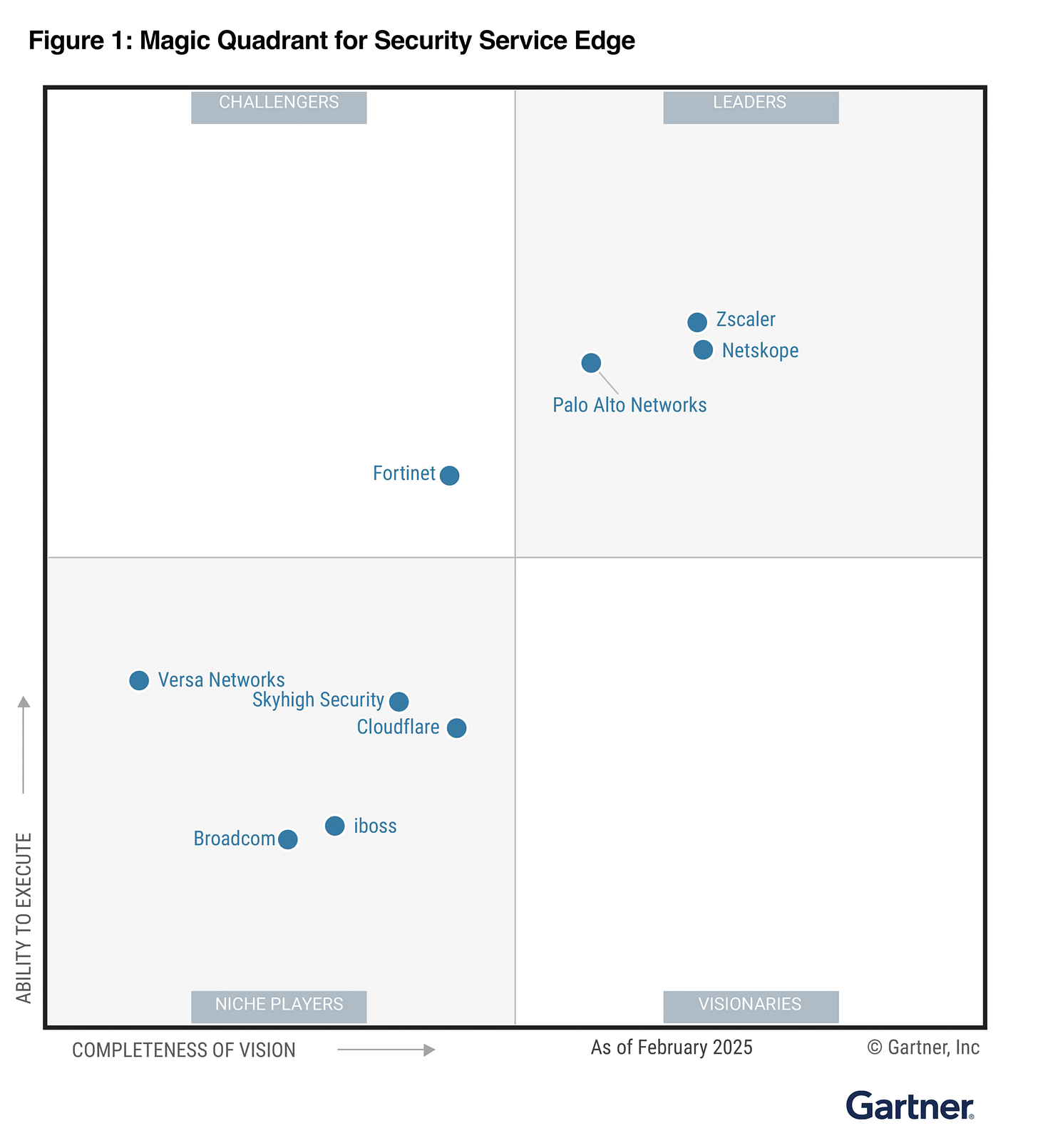

Market Leader

Cloudflare has been recognized by Gartner in the 2025 Gartner Magic Quadrant for Security Service Edge (SSE). This marks the third consecutive year that Cloudflare has been included in this specific report, placing them among an elite group of only nine vendors acknowledged in 2025.

Gartner's recognition highlights Cloudflare's rapid innovation and development of a mature SSE platform since first launching its Zero Trust Network Access (ZTNA) service in 2018. According to customer feedback mentioned in the announcement, the platform is valued for being fast, easy to deploy, and reliable.

Cloudflare, has been named a Leader in the IDC MarketScape Worldwide Edge Delivery Services 2024 Vendor Assessment. The report highlights Cloudflare’s innovation in edge security, developer-focused tools, and advanced AI/ML technologies. Key strengths include its zero-trust security suite, customizable serverless developer platform, and focus on optimizing performance and reducing IT complexity. Cloudflare continues to empower organizations with secure, fast, and scalable solutions through one of the world’s largest interconnected networks.

Cloudflare was recognized as a Strong Performer in The Forrester Wave: Serverless Development Platforms, Q2 2025. The report highlights Cloudflare’s edge-first, developer-friendly platform as ideal for APIs and performance-critical apps. Cloudflare Workers earned 7 perfect scores (5.0/5.0), validating its fully integrated, zero-downtime serverless approach—built for scale, speed, and simplicity.

Customers

$NET Cloudflare added a strong total of 13,100 new customers, with customer growth accelerating to +27% YoY. After a record number of large customer additions (with ARR over $100K) in Q4 2024, Q1 additions were weak at only +30. Management explained that the $100K+ cohort grew modestly QoQ due to revenue timing and fewer account upgrades.

Nonetheless, large customer growth remains strong at +23% YoY.

Customer Success Stories

Cloudflare secured a multi-year contract with a Fortune 500 technology company, valued at $9.3 million over three years. This deal centers on application services and includes a strategic migration from a traditional hyperscaler to Cloudflare due to enhanced security capabilities and automation potential. Discussions are underway for further expansion, underlining customer confidence in Cloudflare’s unified, scalable approach.

A Global 2000 international business services company committed to a $6.4 million deal over 5.5 years for Cloudflare’s full Zero Trust portfolio. This customer is consolidating from three security vendors to one, using Cloudflare to address latency, security gaps, and operational complexity. The decision reinforces the efficiency gains and ROI potential from Cloudflare’s integrated architecture.

A large US government entity finalized a two-year $6.2 million Zero Trust deal. Cloudflare was selected over several competitors to meet evolving federal compliance standards. The partner-led nature of the deal reflects growing traction in Cloudflare’s channel strategy and the strength of its public sector security offerings.

A government agency in APAC entered a three-year, $4.8 million agreement for Magic Transit and Application Services. This deal supports the modernization of their security stack with a cloud-first strategy targeting both Layer 3 DDoS protection and Layer 7 application security. Cloudflare’s network visibility and intelligence were cited as major differentiators.

Large Customer Wins

Record-Breaking Developer Platform Contract

Cloudflare signed the largest contract in its history — a five-year, $130 million agreement with a major technology company. The deal was driven by Cloudflare’s Workers developer platform, including durable objects, containers, and real-time products. The customer switched from a hyperscaler late in the sales cycle, citing superior performance, lower development costs, and global network proximity. Cloudflare’s ability to improve end-user experience was pivotal.

SASE-led Contract with Critical Infrastructure Provider

An international critical infrastructure organization signed a seven-year, $12.7 million contract — the longest in Cloudflare’s history. The customer adopted the full SASE portfolio: Access, Gateway, DLP, Magic WAN, and Magic Firewall. Cloudflare displaced first-gen Zero Trust providers by offering a comprehensive, programmable platform with seamless product integration.

Technology Expansion in Cloud-Native Security

A leading technology firm signed a two-year $9.4 million contract, including a $2 million Workers upsell and expanded usage of Zero Trust and application services. The customer cited Cloudflare’s international FedRAMP presence and network performance as key advantages. The deal involved displacement of three incumbent vendors.

AI-Ready Infrastructure for Strategic Accounts

Cloudflare’s AI infrastructure strategy is gaining adoption from companies like Asana, Atlassian, Block, PayPal, Sentry, and Stripe. These firms are building AI agents and platforms on top of Cloudflare Workers. Workers AI inference requests surged nearly 4,000% YoY, and AI Gateway usage grew more than 1,200% YoY, reflecting strong developer adoption and the platform’s central role in modern compute workloads.

Retention

$NET Cloudflare’s Dollar-Based Net Retention Rate (DBNR) declined to 110% in Q3 2024, driven by the increasing adoption of "pool of funds" contracts. These flexible agreements, which accounted for 10% of new ACV in Q3, up from just 1% a year ago, allow clients to adopt multiple Cloudflare services.

However, in Q4 2024, Cloudflare’s DBNR (Dollar-Based Net Retention) increased to 111% and remained stable at 111% in Q1 2025, indicating stabilization in customer retention and expansion trends.

Net new ARR

$NET Cloudflare added $77M in net new ARR in Q1 2025, with growth of +19% YoY. Q1 is seasonally weak quarter for the company.

If Cloudflare exceeds its Q2 forecast by a similar 2.2%, the net new ARR added in Q2 could reach $130,8M – record for Cloudflare, representing +46% YoY growth.

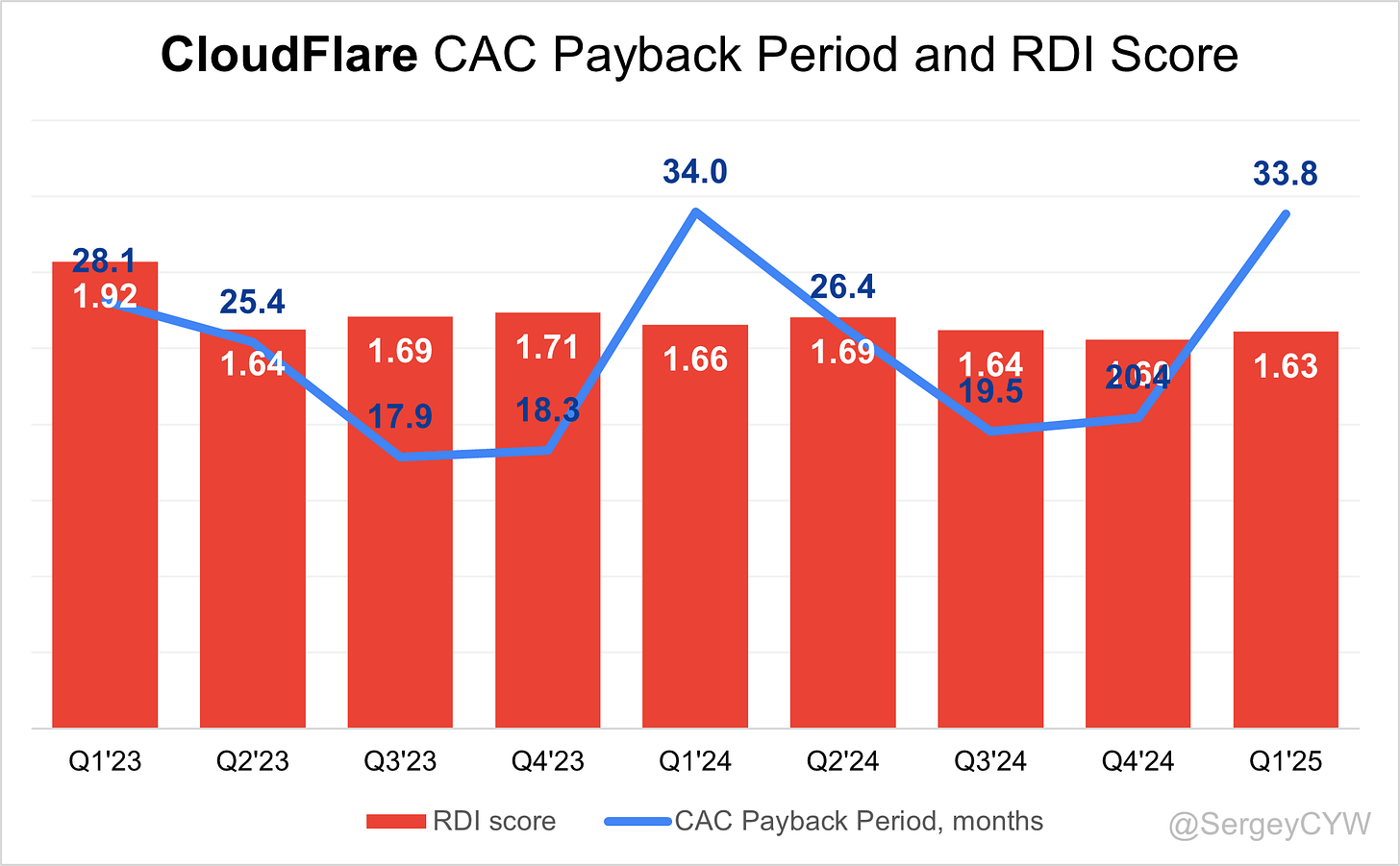

CAC Payback Period and RDI Score

$NET Cloudflare's return on S&M spending is 23.8, which is above the 20.8 median for the SaaS companies I track. Q1 is typically a seasonally weak quarter.

The R&D Index (RDI Score) for Q1 stands at 1.63, up from 1.6 in Q4, and is a strong value compared to the 1.2 median for SaaS companies I monitor. An RDI Score above 1.4 is considered indicative of best-in-class performance.

Profitability

Over the past year, $NET Cloudflare's margins have changed:

• Gross Margin decreased from 79.5% to 77.1%.

• Operating Margin increased from 11.2% to 11.7%.

• FCF Margin slightly increased from 9.4% to 11.1%.

Operating expenses

$NET Cloudflare's operating expenses have decreased over the past two years, primarily due to reduced S&M spending. S&M expenses declined from 42% to 38% of revenue.

R&D remains high at 16%, reflecting continued investment in product innovation and expansion into the zero-trust cybersecurity market.

G&A expenses have also decreased to 11%, as the company scales its infrastructure while maintaining operational efficiency.

Balance Sheet

$NET Balance Sheet: Total debt stands at $1,476M, while Cloudflare holds $1,915M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

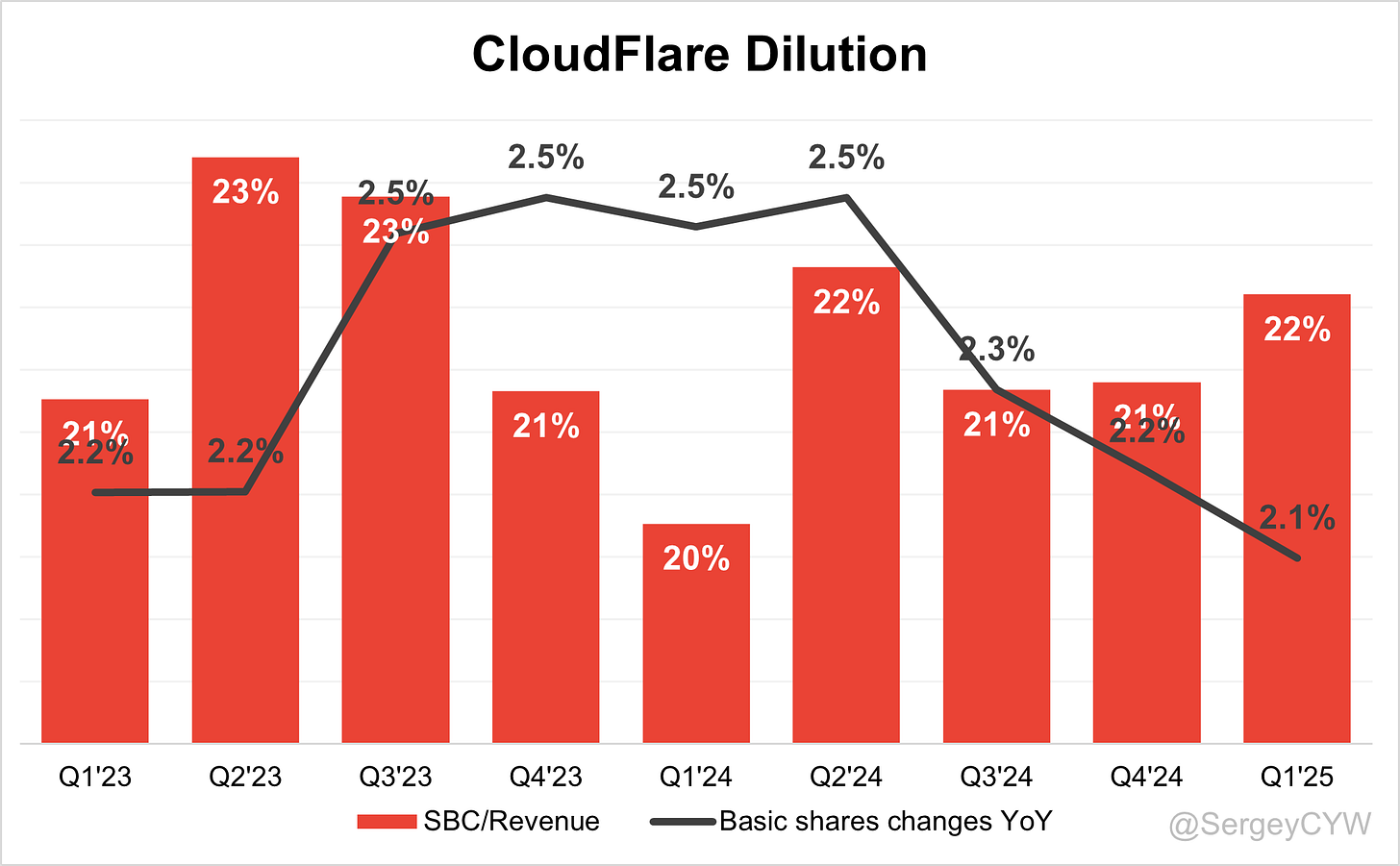

Dilution

$NET Shareholder Dilution: Cloudflare's stock-based compensation (SBC) expenses slightly increased in the last quarter to 22% of revenue.

Shareholder dilution remains under control, with the weighted-average number of basic common shares outstanding increasing by only 2.1% YoY, lower than 2.5% in the previous year.

Conclusion

It was a strong quarter for $NET. Cloudflare continues to innovate, launching significant product updates and improving its go-to-market strategy.

Leading Indicators:

RPO growth of +38.8% exceeded revenue growth.

String net new ARR was added in Q1, increasing +19% YoY.

Strong number of total but weak large customers added.

Key Indicators:

Net Dollar Retention (NDR) stabilized at 111%. The previous decline was attributed by management to increased volatility in this metric and the rise in "pool of funds" contracts.

CAC Payback Period slightly improved to 33.8 months compare to 34 in Q1 2024.

RDI Score stood at 1.62, above the median compared to other SaaS companies I track.

The forecast for the next quarter suggests an acceleration in revenue growth, supported by strong leading indicators.

Despite weak additions in large customers, which management explained by saying the $100K+ cohort grew modestly QoQ due to revenue timing and fewer account upgrades, the overall customer additions were near record levels.

Zero Trust is a relatively new area for the company, and it continues to scale successfully. This is supported by the Gartner 2025 report, which highlights customer feedback praising the platform for being fast, easy to deploy, and reliable.

It’s worth noting that valuation—excluding the elevated levels of 2020–2021—has now reached a record high.

Back in February 2025, I slightly reduced my position due to the significantly higher valuation based on multiples. Now, as valuation multiples have risen again, I reduced my position for the second time in 2025.

That said, while $NET still trades at a premium, I believe this premium is justified by world-class management and strong execution metrics.

At present, $NET remains my largest portfolio position, accounting for 10.6%.

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.

Thanks for the great write-up Sergey!