Cloudflare: A Leader in Cloud Infrastructure and Cybersecurity

Deep Dive into $NET: Valuation, Segment Growth, Key Metrics, Profitability, Expenses, Product Launches, Customer Acquisition, Financial Stability, SBC/Revenue, and Shareholder Dilution.

Cloudflare: Company overview

About Cloudflare

Cloudflare, is a global cloud services provider headquartered in San Francisco, California. Founded in 2009 by Matthew Prince, Lee Holloway, and Michelle Zatlyn, the company delivers key network infrastructure services, including Content Delivery Network (CDN), DDoS Protection, Web Security, Zero Trust Services, and DNS Services. Cloudflare operates in over 285 cities across 100 countries, managing daily network traffic of approximately 72 terabits per second.

Company Mission

Cloudflare’s mission is to "help build a better Internet", focusing on making the web faster, safer, and more reliable. The company optimizes website speed and performance, protects digital assets from cyber threats, and enhances global accessibility. Continuous innovation drives Cloudflare’s ability to meet evolving digital security and performance needs.

Sector Overview

Cloudflare operates in the Information and Communications Technology (ICT) sector, specializing in cloud infrastructure services. The company is positioned across multiple industry segments, including web performance optimization, cybersecurity, edge computing, and Zero Trust security frameworks. Businesses rely on Cloudflare to secure, accelerate, and optimize their digital presence.

Competitive Advantage

Cloudflare’s primary competitive advantage lies in its expansive global network infrastructure of 285+ data centers worldwide, ensuring low latency and high availability. The company integrates CDN, security, edge computing, and Zero Trust frameworks into a unified platform, reducing complexity for customers. Cloudflare’s scalable pricing model ranges from free plans to enterprise solutions starting at $2,000/month, making its services accessible to startups and large enterprises alike.

Total Addressable Market (TAM)

Cloudflare operates across multiple high-growth markets, with a combined Total Addressable Market (TAM) exceeding $100 billion:

CDN Market: Valued at $20 billion, projected to reach $67 billion by 2031.

Secure Access Service Edge (SASE): Currently at $25 billion, expanding rapidly.

Security Service Edge (SSE): Expected to grow from $1 billion to $3 billion by 2028.

Wide Area Network (WAN): Valued at $8.2 billion in 2022.

Cloudflare’s broad product portfolio allows it to capture market share across multiple sectors, positioning it for sustained long-term growth.

Valuation

$NET Cloudflare is trading at a Forward EV/Sales multiple of 18.9, above the median of 15.24. The lowest Forward EV/Sales was recorded in March 2020 and January 2023, at 10. The company's valuation increased in early 2025 but has now declined closer to the median level.

$NET trades at a Forward P/E of 145.5, a very high level as the company heavily reinvests in future growth, particularly in R&D, and remains in an earlier stage of growth.

The EPS growth forecast for 2026 is 31.5%, with a 2026 PEG ratio of 4.6. From a PEG multiple perspective, the stock appears highly valued.

The PEG (Price/Earnings to Growth) ratio is a key tool for evaluating growth stocks, introduced by Peter Lynch.

PEG < 1: Undervalued – A ratio below 1 suggests the stock is undervalued. For example, if the P/E is 15 and earnings are expected to grow by 20%, the PEG would be 0.75, indicating a good buying opportunity.

PEG = 1: Fair Value – A PEG of 1 means the stock price matches its growth expectations, representing fair value.

PEG > 1: Overvalued – A PEG above 1 indicates the stock may be overvalued, as its price is higher than its projected growth rate, making it riskier.

Valuation comparison

Considering the P/S valuation relative to analysts' revenue growth forecasts for next year, $NET is trading at a premium, but its revenue growth is also expected to be among the highest in the cybersecurity sector.

Analysts expect strong revenue growth, so let's examine the key metrics to determine whether these expectations are justified.

We'll evaluate the company's economic moat, which supports long-term revenue growth, analyze revenue trends and the forecast for next quarter, and identify key factors that could help the company exceed expectations and sustain future growth.

We'll assess the performance of key segments, the launch of new products and updates, customer acquisition growth, key financial metrics, financial stability, and margin trends.

Additionally, we'll review the SBC/Revenue ratio, shareholder dilution, and finally, draw conclusions on the company's outlook.

Economic Moat

Cloudflare maintains economic moat, primarily driven by strong economies of scale and network effects, supported by moderate brand recognition, intellectual property assets, and switching costs.

Economies of Scale

Cloudflare operates a global network of 300+ data centers across 100+ countries, positioned within 50 milliseconds of 95% of the world’s population. This scale enables rapid content distribution, reduced latency, and cost-efficient operations. The company’s ability to expand infrastructure while maintaining low per-user costs provides a significant competitive advantage over smaller rivals.

Network Effect

Approximately 20% of the internet’s most popular websites use Cloudflare’s reverse proxy services. As adoption increases, Cloudflare gathers more security and performance data, improving its threat detection and response capabilities. A self-reinforcing cycle emerges: higher adoption enhances service quality, attracting more users. The extensive network also secures preferential agreements with ISPs, reinforcing Cloudflare’s dominance.

Brand Strength

Cloudflare maintains strong brand recognition in cybersecurity and cloud services, particularly among developers and enterprise customers. Its reputation for speed, reliability, and security enhances customer trust. However, brand strength alone is not as substantial a barrier to competition as economies of scale or network effects.

Intellectual Property

Cloudflare leverages proprietary innovations, including its "Content Credentials" system for digital image authentication. Participation in Content Authenticity Initiative (CAI) and C2PA standards positions Cloudflare at the forefront of content authenticity and security markets. While valuable, IP protection plays a smaller role in Cloudflare’s competitive edge compared to its network scale and data intelligence.

Switching Costs

Cloudflare’s comprehensive service integration across CDN, Zero Trust security, edge computing, and content authentication increases switching costs. Customers face technical complexity and potential service disruption if transitioning to competitors. However, the presence of alternative CDN and cybersecurity providers makes switching feasible for determined enterprises.

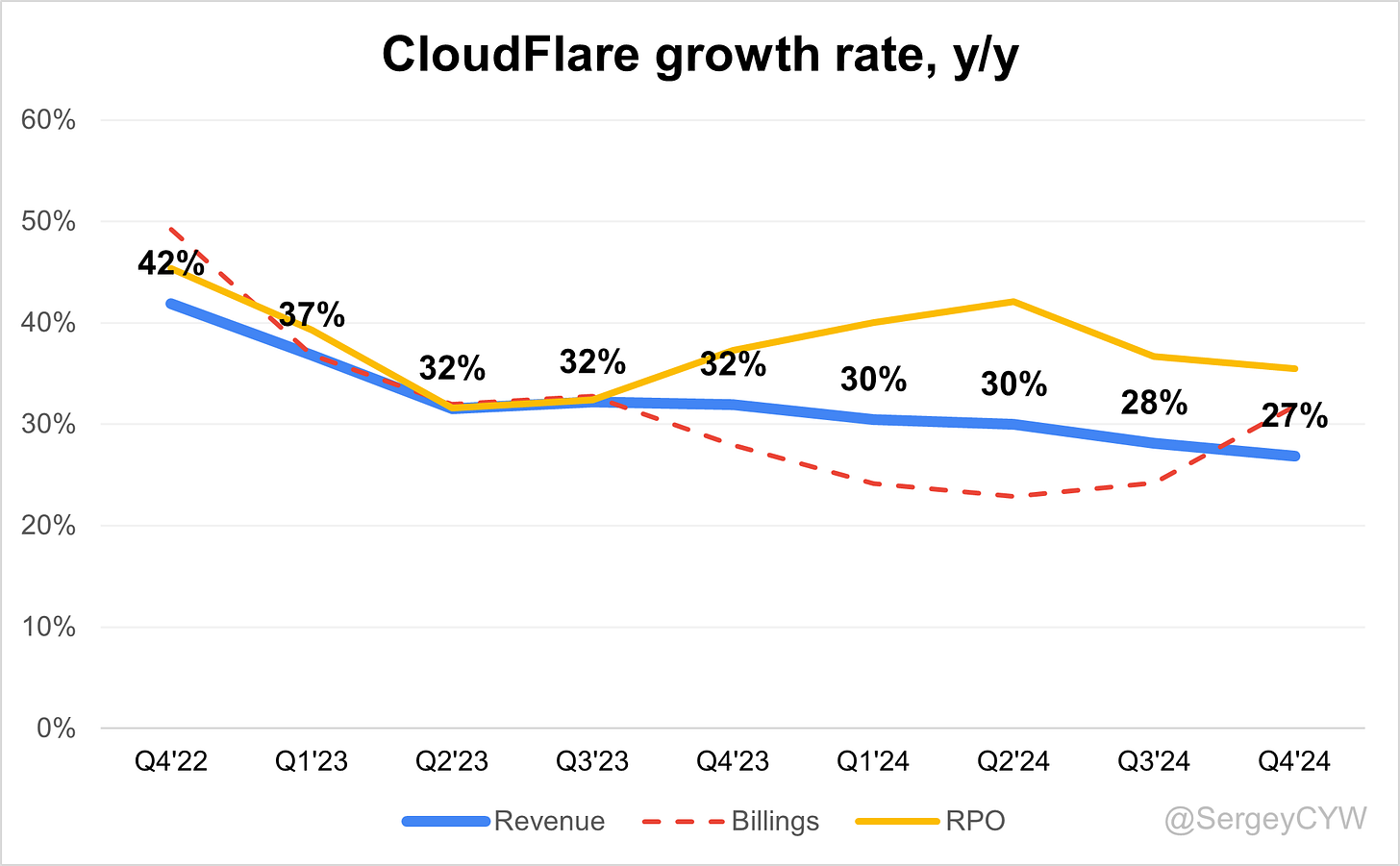

Revenue growth

The revenue growth of $NET Cloudflare has slightly slowed over the past two quarters, now at +27% YoY. Based on the forecast for the next quarter, if the company exceeds its guidance by 1.7%, as it did in Q4, growth would be around 26.0%, indicating a further slight slowdown in revenue growth.

RPO growth reached +35.5% YoY, significantly outpacing revenue growth, suggesting potential revenue stabilization in the future. Billings growth accelerated to +31.8%, exceeding revenue growth.

Segments and Main Products

Cloudflare operates across multiple segments, delivering solutions for security, performance, reliability, and developer capabilities.

In Security, Cloudflare offers Cloud Firewall for web protection, Bot Management using machine learning to block malicious bots, DDoS Protection with Unmetered Mitigation, IoT Protection via Cloudflare Orbit, SSL/TLS Services for encrypted traffic management, and Secure Origin Connection to shield internal systems.

The Performance segment includes a Content Delivery Network (CDN) for rapid content distribution, Argo Smart Routing for optimized internet paths, and Mobile Optimization for enhanced mobile speed.

Reliability solutions consist of Load Balancing to distribute workloads, Anycast Network for global traffic management, and Always Online to maintain website accessibility during outages.

Internal Infrastructure products include Magic WAN for enterprise connectivity, Cloudflare Warp for secure end-user traffic routing, Magic Transit for on-premise network protection, and Cloudflare Gateway to filter malware and threats.

Developer Solutions feature Cloudflare Workers for serverless computing, Cloudflare Pages for web app deployment, and a Data Localization Suite to comply with data residency regulations.

Cloudflare R2 is a globally distributed object storage platform, S3-compatible with no egress fees. It provides AES-256 encryption, TLS/SSL protection, event-driven workflows, and seamless integration with Cloudflare Workers for automation.

Cloudflare D1 is a serverless SQL database built on SQLite, supporting point-in-time recovery and JSON parsing. It integrates with Cloudflare Workers, enabling globally distributed applications with a cost-efficient billing model based on queries and storage.

Cloudflare One is a comprehensive networking and security solution, combining Magic Transit, WARP, Gateway, and Access. It applies consistent global security controls, reduces latency with Argo Smart Routing, and centralizes traffic logs and analytics.

Cloudflare Zero Trust secures sensitive resources with granular access controls, multi-factor authentication, end-to-end encryption, and network segmentation. It ensures compliance with GDPR and HIPAA while integrating with third-party security tools for a unified IT security infrastructure.

Main Products Performance in the Last Quarter

Workers.ai

Cloudflare Workers continues to be a major driver of adoption. AI-related workloads are gaining momentum, with more companies leveraging Workers AI for inference tasks and agent development. Key customers include a financial services firm using AI for M&A due diligence, a healthcare startup analyzing clinical trials, and a CRM company enhancing sales intelligence. Cloudflare achieved 3 million active developers, highlighting rapid platform adoption. AI inference demand is increasing, with customers choosing Cloudflare's efficient pay-per-use model over costly hyperscaler solutions. The company is focused on optimizing GPU utilization, reaching 70% peak usage compared to competitors' sub-10% averages.

R2 Storage Platform

R2 adoption is expanding as part of broader pool of funds contracts, enabling frictionless access to Cloudflare’s platform. A Fortune 100 technology company signed a five-year $20M contract, including R2 for data sovereignty, multi-cloud strategies, and AI workloads. A global retailer signed a three-year $10.8M deal, leveraging R2 for scaling operations. Competitive advantage remains in low-cost object storage without egress fees, making it an attractive alternative to AWS S3.

Developers D1

Cloudflare is scaling investments in the developer ecosystem, with Workers, R2, and D1 forming a core stack for serverless applications. While specific D1 figures were not disclosed, growing adoption of Workers and R2 suggests increasing demand for Cloudflare’s database solution. Companies are adopting Workers AI and serverless computing for AI and automation workflows.

Cloudflare One

Enterprise adoption of Cloudflare One is increasing, particularly among large organizations seeking multi-cloud security and performance. A major US investment firm signed a $4M deal to deploy Zero Trust, DLP, Magic WAN, and Magic Firewall, replacing an incumbent provider. A global 2000 aviation group signed a $9.4M contract for security and performance solutions. Strength in unified security offerings is enabling Cloudflare to win business from long-standing competitors.

Zero Trust

Zero Trust is seeing strong momentum, particularly from enterprises replacing first-generation solutions. A global 2000 financial institution signed a $13.6M deal, reducing website provisioning time from 14 weeks to 10 minutes. The company is increasingly winning displacements over legacy Zero Trust vendors due to performance, network scale, and integrated security. Customers are prioritizing cost efficiency, better security posture, and vendor consolidation.

Innovations & Product Updates

Cloudflare is accelerating investments in AI, security, and developer tools. FedRAMP High certification opens new opportunities in U.S. federal contracts while maintaining a unified global network.

Cloudflare Calls is gaining traction, securing a $1M deal for real-time audio/video applications. AI inference demand now outpaces AI training, driving an aggressive GPU rollout. The AI Gateway is delivering 10x price-performance improvements for AI workloads.

Cloudflare launched One-Click Content Credentials, ensuring image authenticity and provenance. Built on C2PA standards, it integrates with Adobe’s Content Authenticity Initiative (CAI).

With AI-generated content proliferating, verifying digital authenticity is critical. Cloudflare Images now preserves metadata, enabling content verification through Adobe’s Inspect tool. CEO Matthew Prince emphasized trust as the foundation of the Internet’s future.

Cloudflare is securing FedRAMP High authorization in the U.S. and IRAP PROTECTED assessment in Australia, following ENS certification in Spain.

U.S. Federal Security: Cloudflare is advancing to FedRAMP High, the top security level for U.S. federal cloud services, allowing agencies to protect sensitive unclassified data.

Market Leader

$NET Cloudflare, has been named a Leader in the IDC MarketScape Worldwide Edge Delivery Services 2024 Vendor Assessment. The report highlights Cloudflare’s innovation in edge security, developer-focused tools, and advanced AI/ML technologies. Key strengths include its zero-trust security suite, customizable serverless developer platform, and focus on optimizing performance and reducing IT complexity. Cloudflare continues to empower organizations with secure, fast, and scalable solutions through one of the world’s largest interconnected networks.

Customers

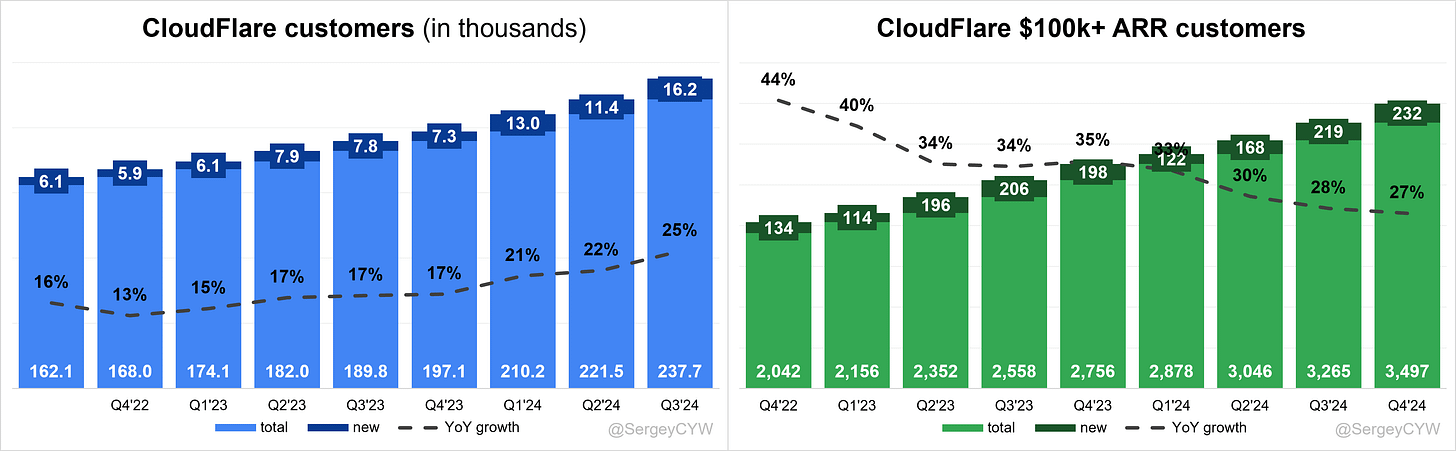

$NET Cloudflare added a record total of 16,200 customers, with customer growth accelerating to +25% YoY. The company also added a record number of large customers with ARR over $100K, increasing by 232. Large customer growth reached +27% YoY.

Customer Success Stories

A Fortune 100 technology company signed the largest new customer deal in Cloudflare’s history—a five-year, $20M contract for full-platform access. Key focus areas include multi-cloud security, AI, and data sovereignty.

A leading AI company expanded its relationship with a one-year, $13.5M contract, enabling seamless AI-driven innovation with transparent pricing. Cloudflare was described as a model partner.

A major US investment firm signed a three-year, $4M SaaS contract, deploying Zero Trust, Data Loss Prevention (DLP), Magic WAN, and Magic Firewall. The firm switched from a first-generation Zero Trust provider, citing Cloudflare’s superior network performance.

A global 2000 aviation group signed a five-year, $9.4M contract to adopt a cloud-first model and reduce costs. Cloudflare was selected over 12 competing vendors, replacing a long-time incumbent.

A global 2000 financial institution signed a four-year, $13.6M contract, cutting website provisioning time from 14 weeks to 10 minutes. The institution sought faster digital transformation and a more transparent security framework.

A leading global retailer signed a three-year, $10.8M contract, integrating Application Services, Workers, R2, Magic Firewall, and Magic Transit. Cloudflare’s developer platform and global reach displaced a 20-year incumbent.

A major international financial institution migrated from a hyperscaler to Cloudflare under a three-year, $6.1M contract, implementing a multi-cloud strategy for regulated global operations.

Large Customer Wins

Cloudflare added 55 new $1M+ customers in 2024, bringing the total to 173. Over half of these were added in Q4 alone, demonstrating strong momentum among enterprise clients.

Large customers contributed 69% of total revenue, up from 66% in Q4 2023. Total large customers grew 27% YoY to 3,497.

A leading technology company structured a strategic pool of funds agreement for frictionless adoption of Cloudflare’s entire product suite.

Sales execution improved for the fifth consecutive quarter, with a double-digit YoY increase in sales productivity. Nearly 80% of new hires were focused on enterprise sales, growing AE hiring by 84% YoY.

Cloudflare’s AI-driven solutions, network performance, and multi-cloud capabilities continue to drive large-scale customer adoption across industries.

Retention

$NET Cloudflare’s Dollar-Based Net Retention Rate (DBNR) declined to 110% in Q3 2024, driven by the increasing adoption of "pool of funds" contracts. These flexible agreements, which accounted for 10% of new ACV in Q3, up from just 1% a year ago, allow clients to adopt multiple Cloudflare services.

However, in Q4 2024, Cloudflare’s DBNR increased to 111%, indicating stabilization in customer retention and expansion trends.

Net new ARR

$NET Cloudflare added $119M in net new ARR in Q4 2024, marking the highest addition in the company's history, with growth of +11% YoY. Q3 and Q4 are seasonally strong quarters for the company.

If Cloudflare exceeds its Q1 forecast by a similar 1.7%, the net new ARR added in Q1 could reach $69M, representing +7% YoY growth.

CAC Payback Period and RDI Score

$NET Cloudflare's return on S&M spending is 20.4, close to the 20.8 median for the SaaS companies I track, returning to normal after a seasonally high 34 in Q1 2024. Improvements in the management team and significant hiring within the GTM team have led to higher close rates and shorter sales cycles.

The R&D Index (RDI Score) for Q4 stands at 1.6, a strong value compared to the 1.2 median for SaaS companies I monitor. An RDI Score above 1.4 is considered indicative of best-in-class performance.

Profitability

Over the past year, $NET Cloudflare's margins have changed:

Gross Margin decreased from 78.9% to 77.6%.

Operating Margin increased from 10.9% to 14.6%.

FCF Margin slightly declined from 10.9% to 10.4%.

Operating expenses

$NET Cloudflare's operating expenses have decreased over the past two years, primarily due to lower S&M spending. R&D remains high at 16%, reflecting continued investment in product innovation and expansion into the zero-trust cybersecurity market. G&A expenses have also declined to 10%, as the company scales its infrastructure while maintaining operational efficiency.

Balance Sheet

$NET Balance Sheet: Total debt stands at $1,463M, while Cloudflare holds $1,856M in cash and cash equivalents, exceeding total debt and ensuring a healthy balance sheet.

Dilution

$NET Shareholder Dilution: Cloudflare's stock-based compensation (SBC) expenses decreased in the last quarter to 21% of revenue.

Shareholder dilution remains under control, with the weighted-average number of basic common shares outstanding increasing by only 2.2% YoY, lower than 2.5% in the previous year.

Conclusion

It was a very strong quarter for $NET. The company continues to innovate, launching significant product updates and improving its go-to-market strategy.

Leading Indicators:

RPO growth of +35.5% exceeded revenue growth.

Record net new ARR was added in Q4, increasing +11% YoY.

Record number of total and large customers added.

Key Indicators:

Net Dollar Retention (NDR) increased by 1 percentage point QoQ to 111%. The previous decline was attributed by management to increased volatility in this metric and the rise in "pool of funds" contracts.

CAC Payback Period improved to 20.4 months, better than the average level.

RDI Score stood at 1.6, above the median compared to other SaaS companies I track.

The forecast for next quarter suggests a slight slowdown in revenue growth. However, given the strong leading indicators, revenue growth is likely to stabilize. Notably, the company achieved a record number of new customer additions.

In February 2025, I slightly reduced my position due to the significantly higher valuation based on multiples. Now, the company’s valuation has returned to a healthy level. While $NET still trades at a premium, this premium is justified by high-class management and strong execution metrics.

At present, $NET remains my largest portfolio position, accounting for 10.3%.