Financial Results:

⬆️$318.5M rev (+22.5% YoY, +32.7% LQ) beat est by 6.8%

↘️GM* (85.9%, -0.8%pp YoY)

⬆️Operating Margin* (13.9%, +2.1%pp YoY)

⬆️FCF Margin 23.3%, +5.0%pp YoY)

⬆️EPS* $0.63 beat est by 57.5%🟢

*non-GAAP

Customers

➡️473,500 Businesses Served (+9.0% YoY, +2300)🔴

➡️215,600 BILL customers (+18.0% YoY, +6300)

➡️143,200 BILL customers (without financial institutions) (+10.0% YoY, +100)🔴

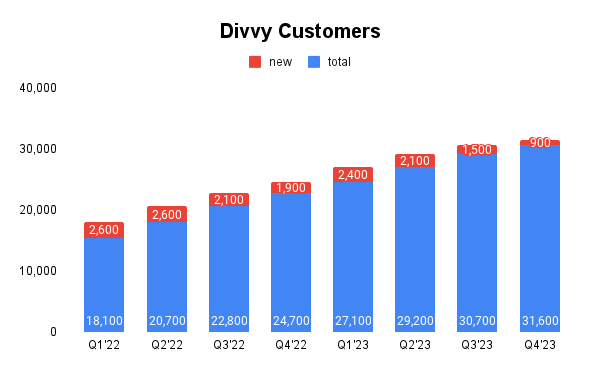

➡️31,600 Divvy customers (+28.0% YoY, +900)🔴

Business metrics

➡️TPV (total payment volume) $75.0M (+11.0% YoY, +8.0% LQ) 🟡

➡️Transactions 26.0M (+25.0% YoY, +28.0% LQ) 🟢

➡️DBNR 111% (111% LQ)

Operating expenses

↘️S&M*/Revenue 33.1% (34.2% LQ)

↘️R&D*/Revenue 18.8% (20.1% LQ)

↘️G&A*/Revenue 20.1% (20.9% LQ)

↘️CAC* Payback Period 27.0 Months (40.0 LQ)

Dilution

↘️SBC/rev 20%, -2.0%pp QoQ)

↘️Dilution at 0.0% YoY, -1.6%pp QoQ)🟢

Guidance

⬆️Q1'24 $309.0M guide (+13.4% YoY) beat est by 2.3%

⬆️$1,251M FY guide (+18.2% YoY) raised by 0.5%

Key points from Bill.com $BILL Q4 2023 Earnings Call:

Financial Performance Highlights:

In Q2 2024, BILL Holdings, Inc. reported a revenue growth of 22% year-over-year, with non-GAAP net income growth of 48% year-over-year, and a 23% non-GAAP net income margin.

Operational Achievements:

More than 470,000 businesses are using BILL's solutions, completing over $75 billion in payment volume on the platform in Q2.

Go-to-Market Ecosystem:

BILL launched a unified customer experience integrating BILL AP and Divvy Spend and Expense Solutions, aiming to drive adoption and enhance financial operations for SMBs.

The platform is trusted by over 7,000 accounting firms, recommending BILL to tens of thousands of clients.

BILL is expanding its ecosystem by leveraging API capabilities for embedded solutions, indicating a focus on the convergence of software and payments, and aiming to serve SMBs through third-party software platforms.

Bank of America Partnership:

BANK OF AMERICA's evolving payment strategy may impact BILL's expansion opportunity with the bank, particularly regarding serving BANK OF AMERICA's existing SMB customers.

Embedded Offerings and API Capabilities:

BILL is seeing opportunities to expand its ecosystem beyond accounting and financial institution channels, with increased interest in embedded finance solutions from various software companies.

BILL is expanding its ecosystem by leveraging API capabilities for embedded solutions, indicating a focus on the convergence of software and payments, and aiming to serve SMBs through third-party software platforms.

Restructuring and Operational Focus:

BILL Holdings undertook a restructuring initiative, reducing its workforce by 15% and closing its Sydney office to streamline operations and reallocate resources to key priorities.

Macro Environment Impact:

The challenging macro environment has led to cautious spending among SMBs, affecting payment volume growth and customer acquisition strategies. BILL is adapting its go-to-market approach to target businesses with a higher propensity to spend.

Management comments on the earnings call.

Product Innovations

John Rettig: "To capture more wallet share and drive payment adoption, we are improving the automation and reconciliation features of our virtual card supplier experience..."

Leadership

John Rettig: "The market we are pursuing is large and evolving rapidly. With our wide moat and talented team of employees, we are well positioned to capture the market..."

Macro Environment

John Rettig: "Our estimates for the rest of the year suggest that where we have still muted TPV growth and in an environment where we have short-term limited expansion on monetization."

Rene Lacerte: "We definitely see holding pattern for all but the largest of businesses, which are still declining, just not as much as they were."

Integrations, Bank of America

Rene Lacerte: "An accounting firm leveraged our API to automatically create e-mail and collect invoices for over 1,000 firm clients using the data from their practice management software."

Rene Lacerte: "Given our success in serving BofA's new small business customers, we were now working together to extend our solution to serve their installed base of SMB customers."

Go-to-Market strategy

John Rettig: "We continue to pull back on marketing spend that we referenced last quarter. This had an impact on acquisition and attrition mainly for smaller, lower credit quality prospects and led to lower net new customers for the quarter compared to historical averages."

Rene Lacerte: "We revised our go-to-market activities around the new solution and made many changes to our direct sales motion, rebranded Spend and Expense from Divvy to BILL and revised customer onboarding flows."