Bill.com Q3 2024 Earnings Analysis

Dive into $BILL Bill.com’s Q3 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$358.5M rev (+17.5% YoY, +16.1% LQ) beat est by 2.7%

↘️GM* (85.6%, -0.5 PPs YoY)🟡

↗️Operating Margin* (18.7%, +7.8 PPs YoY)🟢

↗️FCF Margin (22.7%, +7.1 PPs YoY)

↗️EPS* $0.63 beat est by 26.0%🟢

*non-GAAP

Customers

➡️476,200 Businesses Served (+1.1% YoY, +1600)

↗️156,100 BILL AP/AR Customers ( +9.1% YoY, +4900)

Business metrics

➡️TPV (total payment volume) $80.0M (+14.3% YoY, +16.7% LQ) 🟡

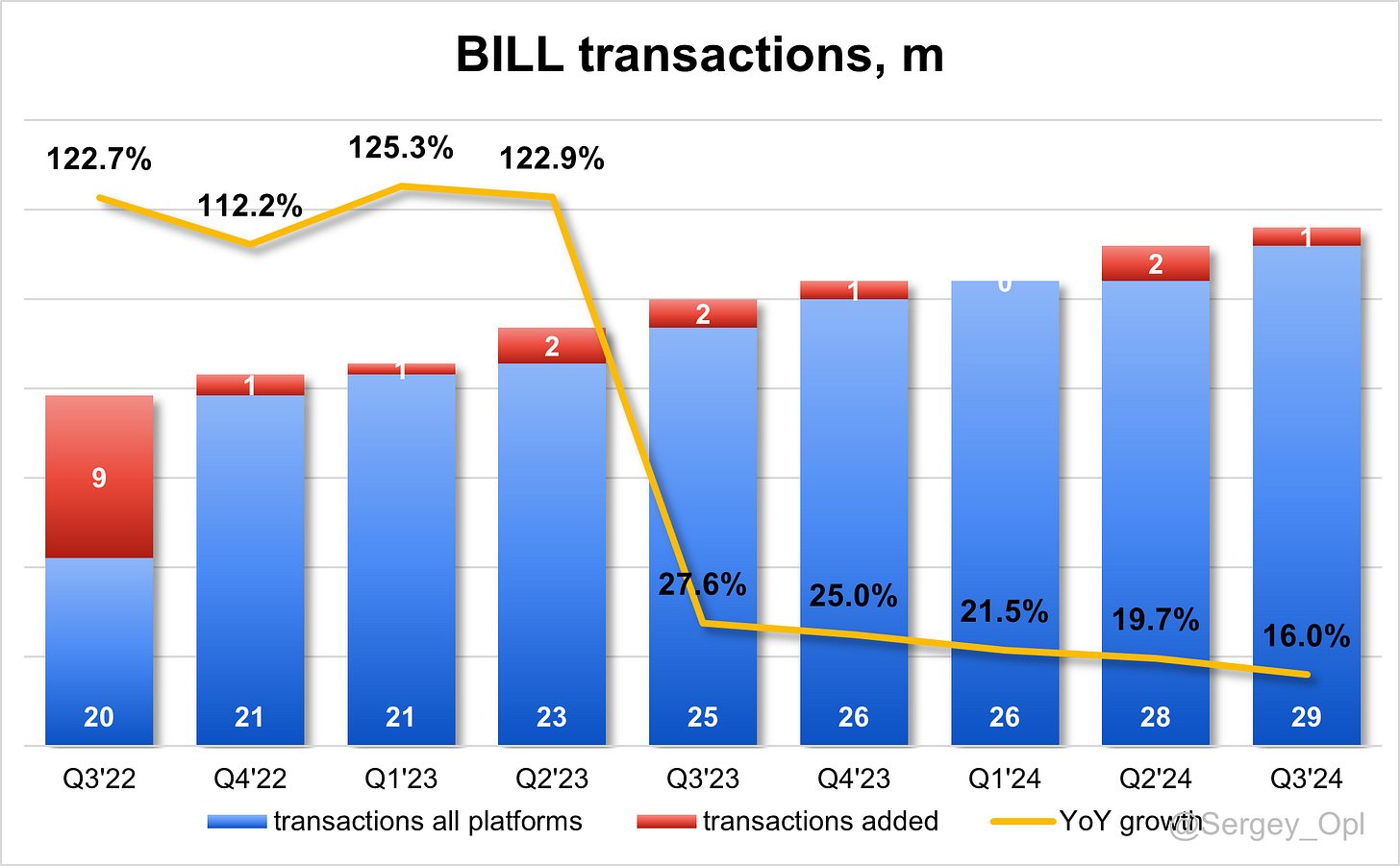

➡️Transactions 29.0M (+16.0% YoY, +19.7% LQ) 🟡

➡️DBNR 92% (92% LQ)

Operating expenses

↘️S&M*/Revenue 32.2% (-2.0 PPs YoY)

↘️R&D*/Revenue 15.3% (-4.8 PPs YoY)

↘️G&A*/Revenue 13.7% (-7.2 PPs YoY)

Quarterly Performance Highlights

↗️CAC* Payback Period 26.6 Months (18.2 LQ)

Dilution

↘️SBC/rev 15%, -1.9 PPs QoQ

↘️Basic shares down -1.1% YoY, -1.0 PPs QoQ🟢

↘️Diluted shares up 0.5% YoY, -0.4 PPs QoQ🟢

Guidance

↗️Q4'24 $355.5 - $360.5M guide (+12.4% YoY) beat est by 0.9%

➡️$1,439.0 - $1,464.0M FY guide (+12.5% YoY) raised by 1.0% in line with est

Key points from Bill’s Third Quarter 2024 Earnings Call:

Financial Performance

Bill.com reported strong financial performance for Q1 fiscal 2025, with core revenue rising 19% year-over-year (YoY), accelerating from the prior quarter's 16% growth. Total revenue reached $358 million, an 18% YoY increase, demonstrating Bill’s growing market share in SMB financial operations.

Non-GAAP operating income margin expanded to 19%, up 8 percentage points from the same period last year, with free cash flow margin climbing to 23%. Non-GAAP net income was $69 million, a 33% YoY increase, and diluted net income per share reached $0.63, up 43% YoY. The company’s aggressive share repurchase strategy led to a 7% reduction in non-GAAP diluted share count, reflecting confidence in long-term potential.

For the full fiscal year, Bill raised revenue guidance to $1.439 billion to $1.464 billion, with expected core revenue of $1.291 billion to $1.316 billion and anticipated float revenue of $148 million.

Product Innovations

Bill.com expanded its platform capabilities this quarter, focusing on enhanced features across accounts payable (AP), accounts receivable (AR), spend management, and working capital. Key product additions included real-time funding options for credit card, ACH, and real-time payments, providing customers with greater flexibility.

The Bill Divvy card’s expansion to AP customers creates a seamless upgrade path to the full spend and expense solution. Additionally, international payment options now span over two dozen countries, reducing FX volatility and processing times for global transactions. The launch of SyncAssist, an AI-driven tool for syncing with accounting systems, supports both SMBs and accounting firms, with adoption reaching tens of thousands of firms.

Strategic Initiatives

Bill committed $45 million this fiscal year to accelerate growth in high-ROI areas, specifically in virtual cards, international payments, and working capital solutions. Significant executive additions, such as Mary Kay Bowman as EVP of Payments and Financial Services, bring leadership experience from Visa, Block, and Amazon.

The company’s go-to-market expansion includes targeting larger SMBs and the beta launch of an embedded solution with Xero, underscoring Bill’s commitment to driving adoption through a distribution network of 8,500 accounting firms and 7 million network members. Management also reinforced confidence in growth with a $300 million share repurchase program, completing $200 million in repurchases this quarter.

Market Trends

SMBs displayed resilience amid economic uncertainty, with TPV per customer growing 2% YoY. Spending has risen in previously contracted categories like real estate and physical facilities, indicating optimism and renewed investments in growth. Demand for automation in SMBs remains high, with only 5% of larger SMBs fully automating AP and AR processes, representing a substantial opportunity for Bill’s solutions.

Customer Success Stories

Bill continues to make a meaningful impact on SMBs. For example, Fairwave, a client since 2023, uses Bill’s platform as the backbone for scaling its network of independent coffee brands. Bill has enabled Fairwave to streamline AP processes, yielding 50% workload reductions and saving $75,000 annually.

Accounting firms also benefit, with SyncAssist significantly improving workflow efficiency. Eisner Amper, a global firm, reports SyncAssist saves valuable time by automating sync-related troubleshooting for over 100 clients.

Challenges

While Bill’s growth trajectory is strong, the company remains cautious about the macroeconomic environment. Ongoing economic uncertainties pose potential risks to TPV growth and customer acquisition. Management emphasized the need for operational flexibility to adapt to these conditions while maintaining fiscal prudence.

Future Outlook

Bill remains focused on sustaining growth and profitability with a long-term target of 20%+ growth. Priorities include scaling hiring, advancing product innovations, and strengthening relationships with accounting and ecosystem partners.

For fiscal Q2, Bill expects core revenue between $316 million and $321 million, signaling continued momentum. With a solid balance sheet and strong cash flow, the company will invest in competitive strengths such as AP/AR and spend management solutions, as well as international expansion. These investments are expected to support sustained revenue growth, margin expansion, and shareholder value creation.

Management comments on the earnings call.

Product Innovations

Rene Lacerte, Chairman, CEO, and Founder

"Our integrated platform continues to be mission-critical for SMBs by automating complex, disconnected manual processes. We’re focused on innovation, adding functionality like real-time funding, AI-powered SyncAssist, and expanded international payment options to provide even greater value and flexibility for our customers."

Competitors

Rene Lacerte, Chairman, CEO, and Founder

"Our scale and breadth of payment products—12 different payment options and a comprehensive suite of capabilities—put us ahead of the curve. While competitors are investing to catch up, we’re leveraging our scale to push the limits, constantly widening the gap with new innovations and increased functionality."

Customers

Rene Lacerte, Chairman, CEO, and Founder

"Our platform is enabling SMBs to focus on what matters most: growing their business. We hear stories of businesses saving $75,000 a year with our solutions, which drive efficiencies by digitizing back-office functions. This is the real impact we bring to the SMB landscape—helping them serve their customers and scale with ease."

Macro Environment

John Redick, President and CFO

"Given the uncertainty in the current macroeconomic landscape, we are being prudent in our fiscal guidance. While we’re encouraged by positive indicators, such as upticks in customer spending, we remain cautious, especially as SMBs continue to navigate a ‘wait and see’ economy."

Challenges

John Redick, President and CFO

"The macro environment still presents some uncertainties, particularly around B2B spend, but our strategic investments in areas like virtual card and international payment capabilities position us well. We’re ensuring we maintain operational flexibility to adapt as market conditions evolve."

Future Outlook

Rene Lacerte, Chairman, CEO, and Founder

"We see a substantial growth runway ahead, underpinned by our unique platform and expanding distribution network. Our recent share repurchase reflects our confidence in long-term growth, as we continue to invest strategically in our platform, ecosystem, and team to capture the immense market opportunity before us."