Bill.com Q2 2025 Earnings Analysis

Dive into $BILL Bill.com’s Q2 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

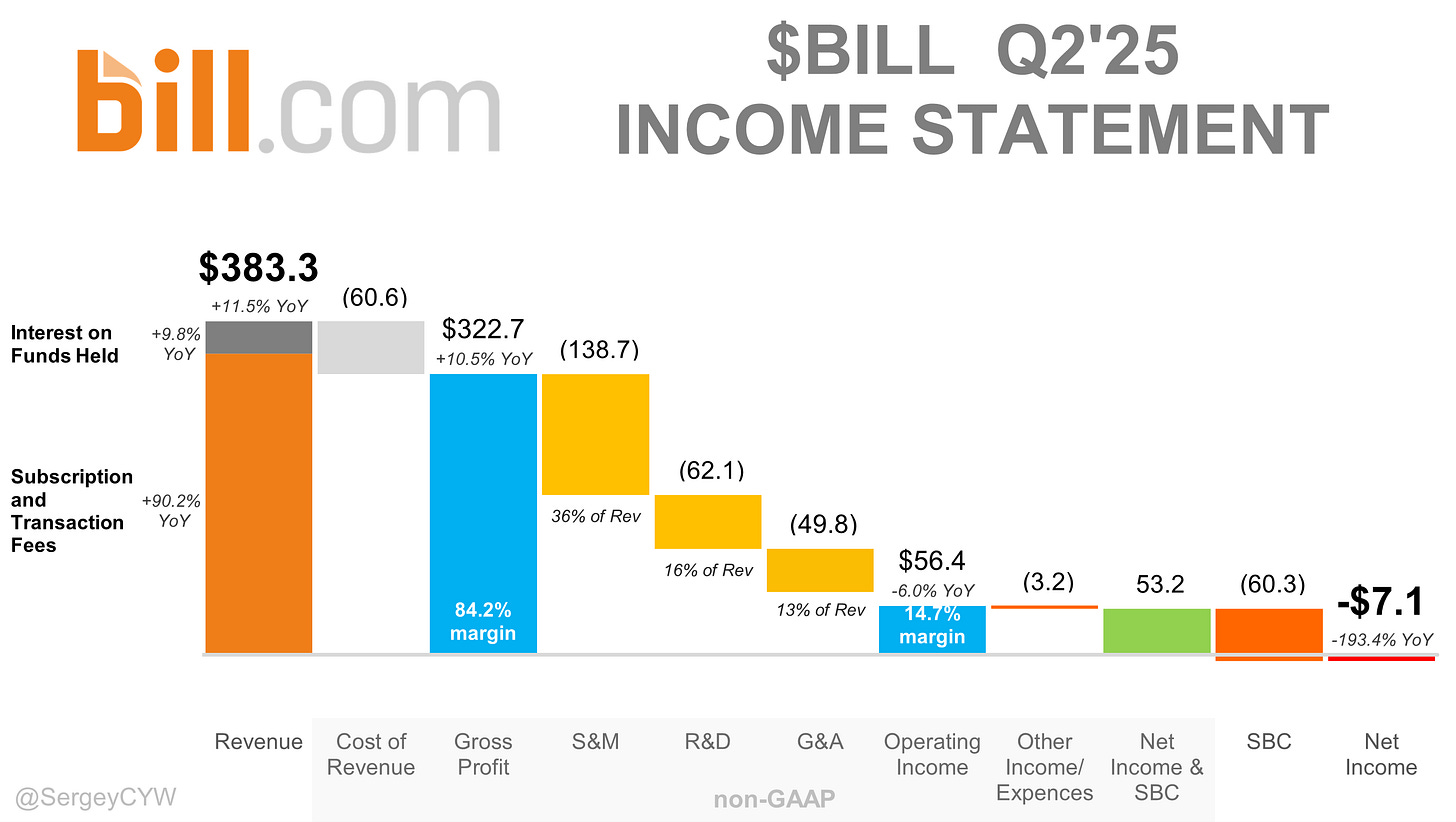

Financial Results:

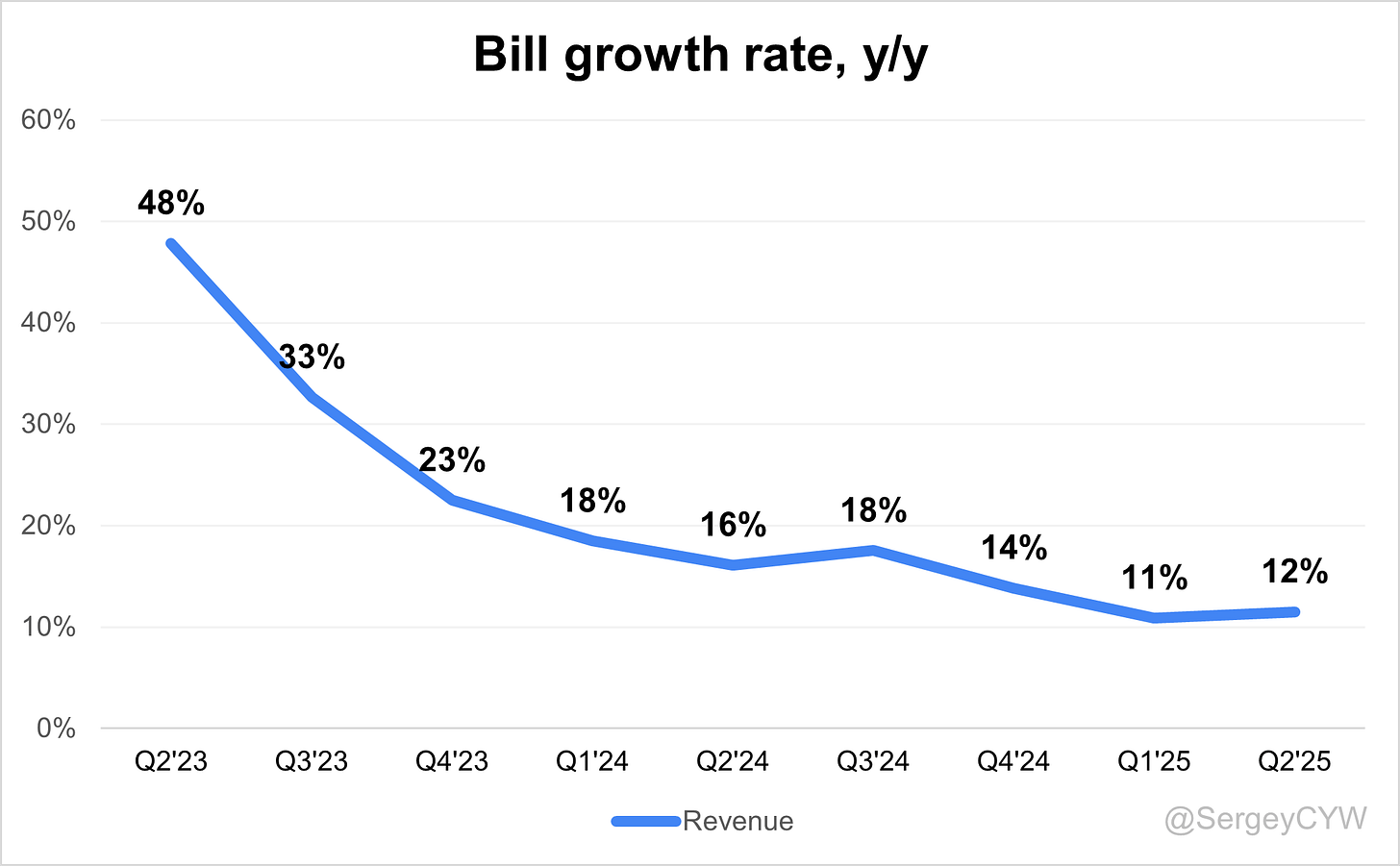

↗️$383.3M rev (+11.5% YoY, +7.0% QoQ) beat est by 1.9%

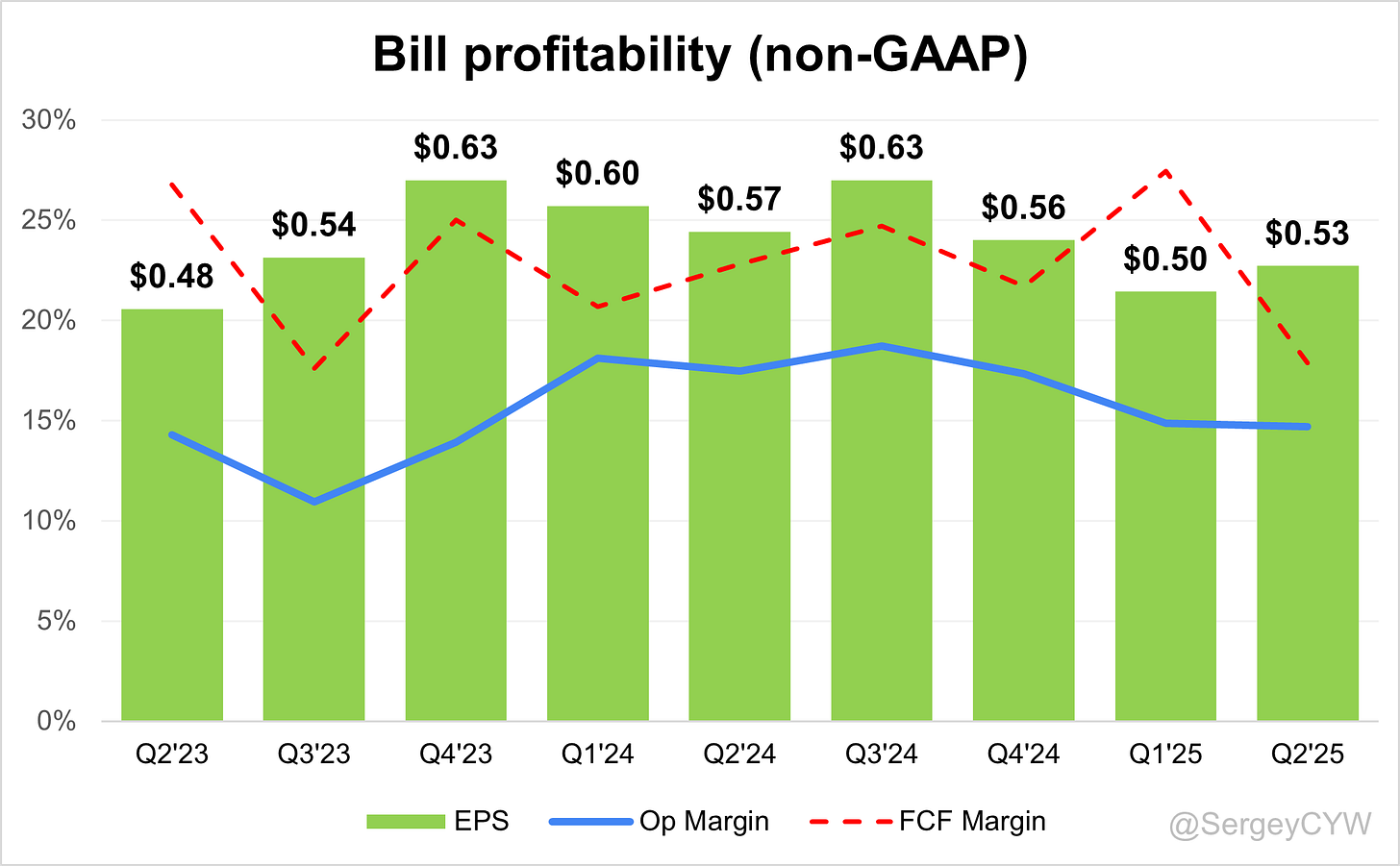

↘️GM* (84.2%, -0.8 PPs YoY)🟡

↘️Operating Margin* (14.7%, -2.7 PPs YoY)🟡

↘️FCF Margin (17.9%, -5.0 PPs YoY)🟡

↘️Net Margin (-1.9%, -4.1 PPs YoY)🟡

↗️EPS* $0.53 beat est by 29.3%

*non-GAAP

Revenue By Type

↗️Subscription and Transaction Fees $346M rev (+14.8% YoY, 90.2% Total rev)

↘️Interest on Funds Held for Customers $37M rev (-11.8% YoY, 9.8% Total rev)🟡

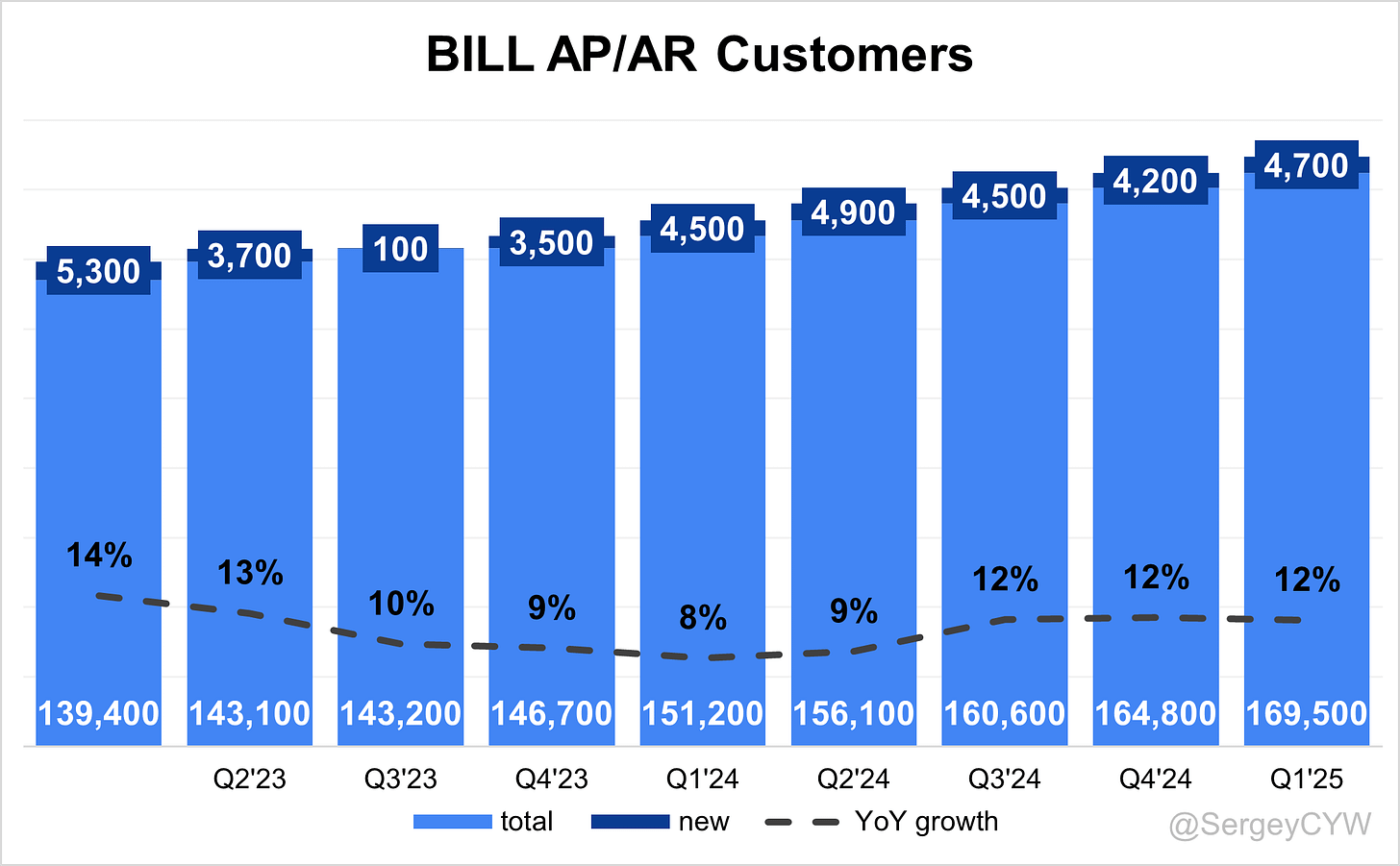

Customers

➡️493,800 Businesses Served (+4.0% YoY, +5200)

↗️169,500 BILL AP/AR Customers ( +12.1% YoY, +4700)

Business metrics

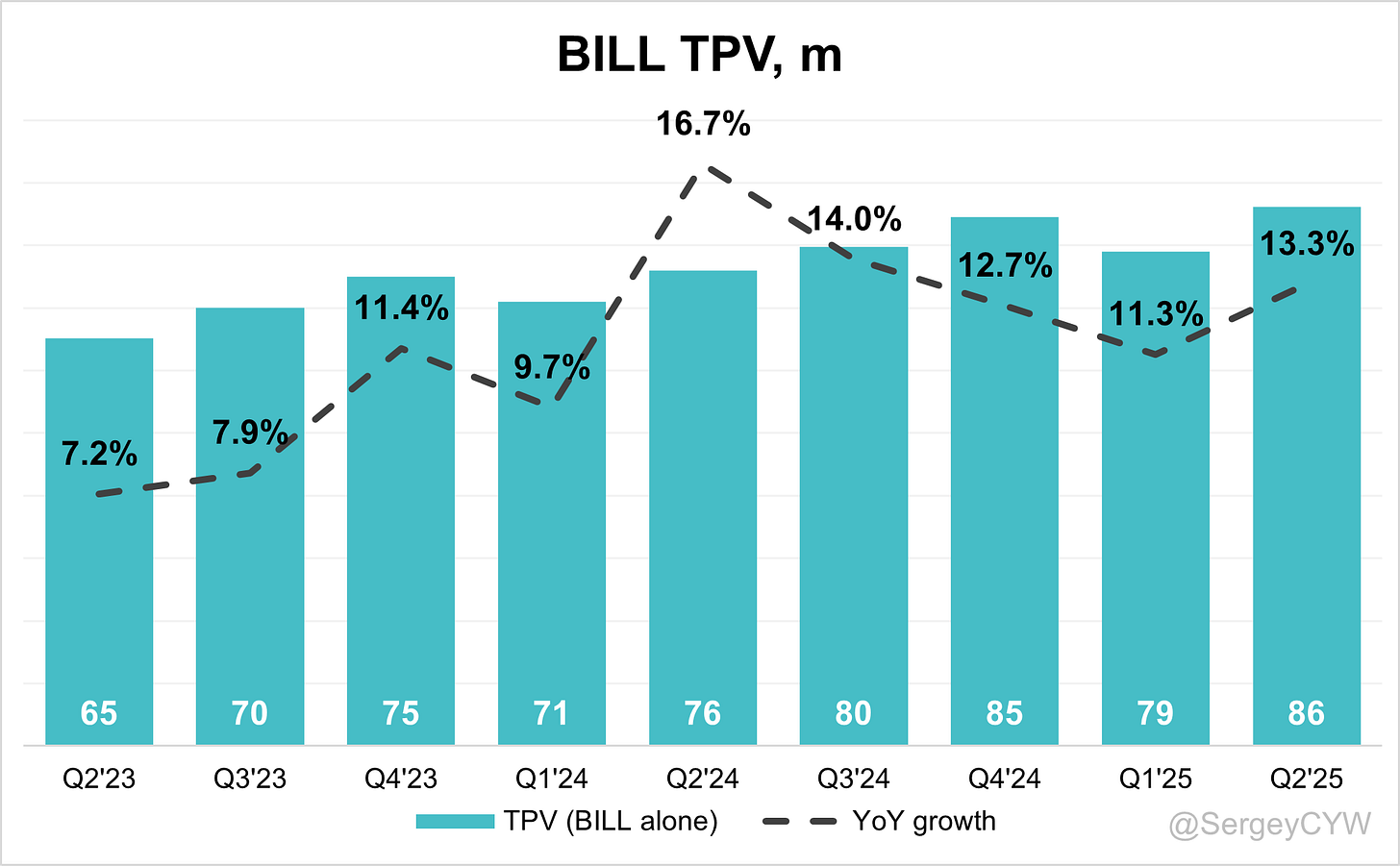

➡️TPV (total payment volume) $86.1M (+13.3% YoY, +11.3% LQ) 🟢

➡️Transactions 32.9M (+17.5% YoY, +14.2% LQ) 🟢

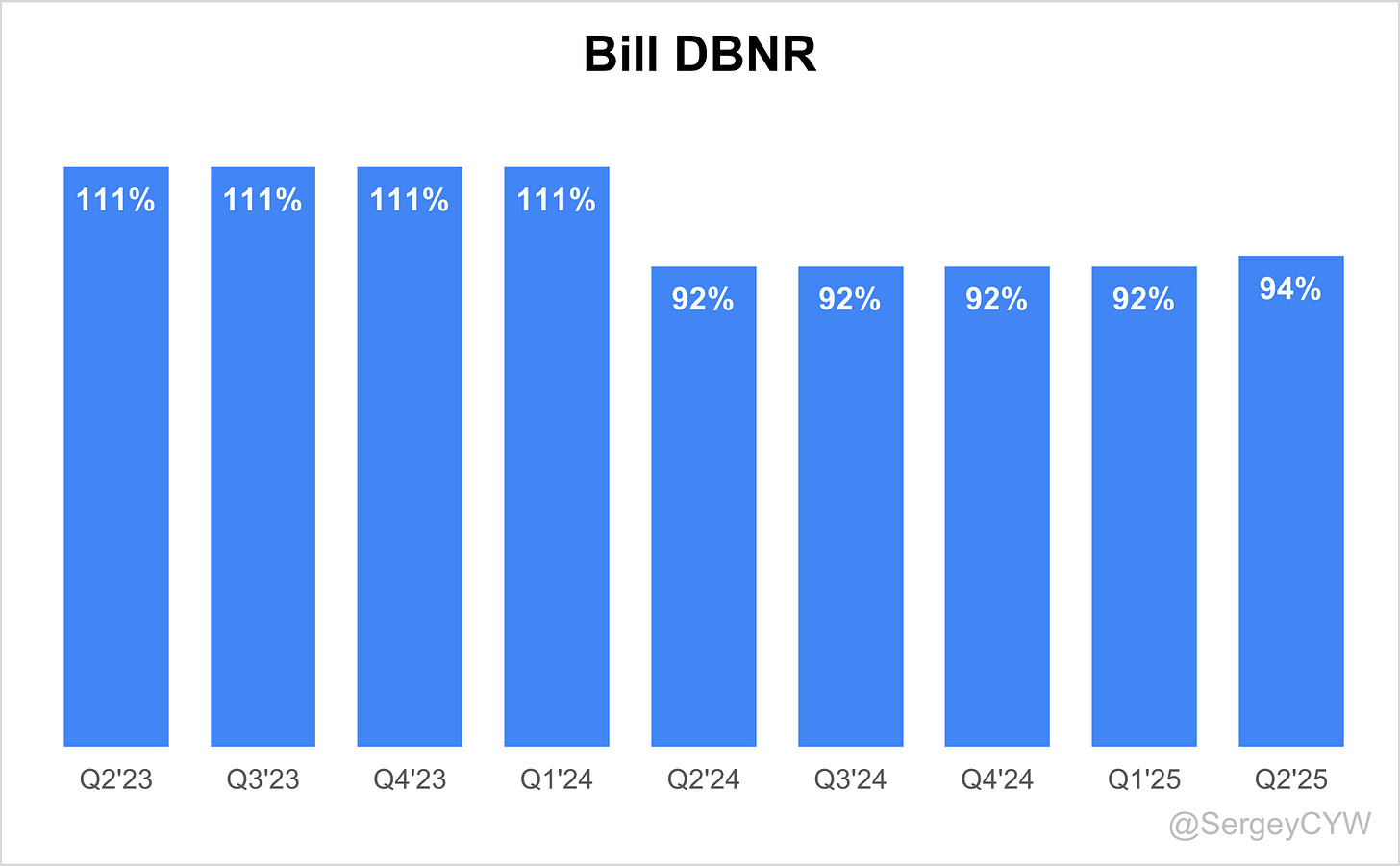

↗️DBNR 94% (92% LQ)🟢

Operating expenses

↗️S&M*/Revenue 36.2% (+3.6 PPs YoY)

↗️R&D*/Revenue 16.2% (+0.4 PPs YoY)

↘️G&A*/Revenue 13.0% (-1.8 PPs YoY)

Quarterly Performance Highlights

↘️CAC* Payback Period 18.0 Months (-0.2 YoY)🟢

↘️R&D* Index (RDI) 0.61 (-0.23 YoY)🟡

Dilution

↘️SBC/rev 16%, -1.6 PPs QoQ

↗️Basic shares down -2.9% YoY, +0.2 PPs QoQ🟢

↗️Diluted shares down -3.8% YoY, +4.2 PPs QoQ🟢

Guidance

↘️Q3'25 $385.0 - $395.0M guide (+8.8% YoY) missed est by -1.4%🔴

↘️$1,589.5 - $1,629.5M FY guide (+10.0% YoY) missed est by -1.8%🔴

Key points from Bill Com’s Second Quarter 2025 Earnings Call:

Financial performance

Bill.com closed fiscal 2025 with $1.5 billion in total revenue, a 16% year-over-year increase in core revenue despite muted SMB spending and card acceptance challenges. Fourth-quarter revenue reached $346 million, up 15%, while non-GAAP operating income was $56.4 million, 17% above guidance. Full-year non-GAAP operating income totaled $240 million, 23% above initial expectations, with operating margins expanding 345 basis points. Spend and expense revenue was $151 million in Q4, growing 19% on 22% card payment volume growth, supported by a 14 basis point reduction in credit and fraud losses.

Rene Lacerte, Chairman, CEO, and Founder

“More than 1% of U.S. GDP flows through our platform each year, a staggering number that reflects the trust customers and suppliers place in us.”

Divvy momentum

The Divvy debit card drove strong performance, with payment volume rising nearly 600% year over year. Q4 spend and expense revenue reached $151 million, reflecting 19% growth. AI-based underwriting enabled $200 million in proactive credit line increases, while improved portfolio management reduced fraud and credit losses by 14 basis points. Growth remains solid, though tariffs and shifting SMB budgets are pressuring high take-rate categories such as travel and advertising.

John Rettig, President and COO

“In fiscal 2025, we significantly grew the use of our Bill debit card among AP customers, with volume increasing nearly 600% compared to fiscal 2024.”

Rohini Jain, CFO

“Our AI features helped us proactively identify when customers qualified for larger credit limits, enabling us to extend $200 million in proactive line increases for spend and expense customers.”

AP/AR expansion

AP/AR transaction revenue grew 15% year over year in Q4. The platform added 4,700 net new AP/AR customers, up from 4,200 in Q3. The Bill network surpassed 8 million members, an 18% increase, with 54% of payments completed fully within the network. Bill Procurement, a unified AP, AR, spend, expense, procurement, and forecasting solution, is gaining traction with mid-market firms. These customers transact at twice the TPV of average SMBs and use twice as many platform seats, driving greater monetization.

Rene Lacerte, Chairman, CEO, and Founder

“We recently hit a new milestone, surpassing 8 million members, an increase of 18% from the previous year. Today, 54% of payments on Bill occur seamlessly between the payer and the receiver on our network.”

John Rettig, President and COO

“In Q4, over 10,000 customers used our local transfer experience, accounting for approximately half of our international payment FX volume.”

Subscription and transaction

Subscription ARPU declined slightly as SMBs cut back on users. By year-end, 15,800 customers used both AP/AR and spend & expense products, a 40% increase. Transaction revenue remains the primary driver, with ad valorem penetration at 14.3% of payment volume in Q4, up from 13.8%. Supplier Payments Plus, which shifts ACH fees to suppliers and enables ad valorem monetization, is positioned to accelerate this trend.

Rohini Jain, CFO

“In Q4, we accelerated market penetration, adding 4,700 net new Bill APAR customers, up from 4,200 in Q3. Our net revenue retention rate came in at 94%, reflecting a lower B2B spend environment.”

Product innovations

Supplier Payments Plus allows suppliers to reconcile faster, reduce manual effort, and access richer remittance data. Early adopters include a national law firm and a global environmental and waste management company. Bill also launched bulk payments, multi-entity workflows, and Embed 2.0 APIs, enabling partners to integrate workflows directly. A new partnership with a Fortune 500 software company is expected to extend reach to the lower mid-market and SMB segments.

Rene Lacerte, Chairman, CEO, and Founder

“In Q4, we launched Supplier Payments Plus, which streamlines millions of payment transactions from SMBs and simplifies incoming payments at scale for suppliers. Large suppliers can now do reconciliation at scale and convert thousands of paper checks directly into faster digital payments.”

John Rettig, President and COO

“We recently signed a strategic embed partnership with a Fortune 500 software company that underscores our embed opportunity. Over the long term, this could collectively translate into tens of thousands of mid-market businesses and hundreds of thousands of SMBs using our embedded products.”

Agentic AI

Bill has processed over 1.3 billion documents, with 500 million through AI-powered features. Since early 2025, fully automated bills increased 80%, while predictive AI stopped over 8 million fraud attempts. AgenTeq AI will launch in 2026, introducing finance agents that move from “do-it-with-you” automation to “do-it-for-you” execution. Agents will manage document intake, supplier onboarding, payments, and fraud prevention. Monetization will evolve from adoption to subscription pricing and eventually to transaction-based models.

Rene Lacerte, Chairman, CEO, and Founder

“Our first agents will transform how SMBs complete critical business tasks, paperwork, documentation, and onboarding of vendors. We firmly believe our AgenTeq AI initiative will further improve customer retention, accelerate multiproduct adoption, and fuel customer acquisition.”

Rohini Jain, CFO

“As we think about AI monetization, the first phase is to get these agents out and driving value. The second phase will be differentiated subscription pricing, and in the longer term, we want to have sophisticated agents monetized on a transaction basis.”

Addressable market

Bill is targeting 300,000 mid-market U.S. businesses, which transact at twice the TPV and support twice the number of users as SMBs. Features like international subsidiary management and global spend controls are designed for this segment. Embed 2.0 expands the market further by embedding Bill’s platform into partner ecosystems, unlocking access to hundreds of thousands of SMBs.

John Rettig, President and COO

“In fiscal 2025, mid-market customer growth outpaced our overall APAR customer growth by five points. Mid-market customers on our platform have two times more TPB than the average SMB and twice as many users.”

Take rate and monetization

Bill expanded AP/AR take rate by 0.4 basis points in FY2025 and expects a similar increase in FY2026. Ad valorem products—pay by card, invoice financing, instant transfer, Instapay, and Supplier Payments Plus—grew 37% in FY2025. ACH and check pricing adjustments continue to align with delivered customer value, providing further monetization upside.

Rohini Jain, CFO

“On the APAR side, we saw 0.4 basis points of take rate expansion in fiscal year 2025. Going into fiscal 2026, we would expect a similar level of expansion.”

John Rettig, President and COO

“We saw 37% growth across pay by card, instant transfer, and Instapay in fiscal 2025. With the addition of Supplier Payments Plus, we’re focused on accelerating adoption to drive ad valorem penetration.”

Leadership

The company appointed Rohini Jain as CFO, bringing global finance expertise, and Michael Cherry as EVP and GM of Software Solutions. Together with Mary Kay Bowman, EVP of Payments and Financial Services, leadership is aligned around software innovation and payments monetization.

Rene Lacerte, Chairman, CEO, and Founder

“Most recently, we welcomed Rohini Jain as CFO. She is a standout global finance leader and has a strong track record for enabling growth and scaling top technology in Fortune 5 companies.”

Buybacks and compensation

Bill repurchased $100 million of stock in Q4 FY2025 and early Q1 FY2026. The board authorized a new $300 million repurchase plan for FY2026, not included in guidance. Stock-based compensation will be reduced through lower grant values, tighter eligibility, and shorter vesting, significantly decreasing dilution.

Rohini Jain, CFO

“During Q4 2025 and earlier this quarter, we repurchased a total of $100 million of our stock. Reflecting our conviction, the board has approved a new $300 million share repurchase plan.”

Rohini Jain, CFO

“We have extensively reviewed our stock-based compensation. Our fiscal 2026 plan incorporates a significant reduction in grant value, tighter eligibility criteria, and a shorter vesting period compared to prior years.”

Customer growth

Bill ended fiscal 2025 with nearly 500,000 SMBs on the platform and 9,000 accounting firm partners, including almost 90% of the top 100 U.S. firms. Net adds from accounting partners increased 24% year over year. The Bill network grew to over 8 million members, up 18%, enhancing transaction flow and visibility.

Rene Lacerte, Chairman, CEO, and Founder

“Bill.com serves more SMBs and accounting firms than anyone in our category. We are the trusted platform of choice for nearly half a million SMBs and over 9,000 accounting firms, including nearly 90% of the top 100 across the U.S.”

Customer success

Supplier Payments Plus is being used by large enterprises such as a national law firm and a global waste management firm to streamline reconciliation and accelerate collections. On the spend side, Divvy adoption surged, with AP customer usage up 600% year over year, underscoring strong product-market fit.

Mid-market adoption outpaced overall AP/AR growth by five percentage points. These businesses bring twice the TPV and user counts of SMBs, amplifying revenue potential. A strategic partnership with a Fortune 500 software company and a second recently signed embed deal are expected to bring access to hundreds of thousands of SMB clients.

Macro and challenges

Tariff-driven cost pressures are constraining SMB discretionary budgets, reducing spend on travel, entertainment, and advertising. This creates take-rate pressure in the spend and expense portfolio. Leadership noted that some Q4 strength may have been demand pulled forward ahead of tariffs, prompting cautious FY2026 guidance.

Rohini Jain, CFO

“As SMBs try to absorb tariff costs, their spend on discretionary areas like advertising and travel is reducing, which is suppressing take rate within the spend and expense portfolio. We are being prudent and assuming flat volume per customer year over year across the portfolio.”

Future outlook

For FY2026, Bill projects revenue of $1.59–$1.63 billion (+9–11% YoY), with core revenue of $1.45–$1.49 billion (+12–15%). Non-GAAP operating income is expected at $240–$270 million, with margins of 15–17%, nearly 200 basis points of ex-float expansion. EPS is guided to $2.00–$2.20. Growth is expected to accelerate in the second half as headwinds ease and AI agents begin adoption. Over 1% of U.S. GDP already flows through the Bill platform, positioning it as the leader in intelligent financial operations for the “Fortune 5,000,000.”

Rene Lacerte, Chairman, CEO, and Founder

“In FY ’26, we’ll leverage our investments in AI to continue to transform the market. More than 1% of U.S. GDP flows through our platform annually, and we are shaping the future of financial operations for millions of SMBs.”

Rohini Jain, CFO

“For fiscal 2026, we expect total revenue of $1.59 to $1.63 billion, which reflects 9% to 11% growth, and non-GAAP operating income of $240 to $270 million with margins of 15% to 17%.”

Thoughts on Bill Com Earnings Report $BILL:

🟢 Positive

$383.3M revenue (+11.5% YoY, +7.0% QoQ) beat estimates by 1.9%

EPS $0.53 beat estimates by 29.3%

Subscription & transaction revenue $346M (+14.8% YoY), now 90.2% of total revenue

TPV $86.1B (+13.3% YoY, +11.3% QoQ) and 32.9M transactions (+17.5% YoY, +14.2% QoQ)

DBNR 94% (up from 92% prior quarter)

4,700 AP/AR net new customers, total 169,500 (+12.1% YoY)

CAC payback 18 months, improved by 0.2 YoY

SBC/revenue down to 16%, -1.6 PPs QoQ

Basic shares -2.9% YoY, Diluted shares -3.8% YoY

Non-GAAP operating income FY25 $240M, +23% above initial expectations

🟡 Neutral

Gross margin 84.2%, down 0.8 PPs YoY

R&D/revenue 16.2%, flat YoY

G&A/revenue improved to 13.0%, -1.8 PPs YoY

R&D Index 0.61, down 0.23 YoY

Customers served 493,800 (+4.0% YoY, +5,200 sequentially)

Spend & expense revenue $151M Q4, +19% YoY but pressured by tariffs in discretionary spend categories

🔴 Negative

Operating margin 14.7%, down 2.7 PPs YoY

Free cash flow margin 17.9%, down 5.0 PPs YoY

Net margin -1.9%, down 4.1 PPs YoY

Interest revenue $37M, down 11.8% YoY, now only 9.8% of revenue

S&M/revenue 36.2%, +3.6 PPs YoY

Q3’25 revenue guide $385–395M (+8.8% YoY) missed estimates by -1.4%

FY25 revenue guide $1.59–1.63B (+10.0% YoY) missed estimates by -1.8%

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.

Bill.com’s customer service is absolutely miserable. I wouldn’t spend a nickel on this company.