Bill.com Q2 2024 Earnings Analysis

Dive into $BILL Bill.com’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$343.7M rev (+16.1% YoY, +18.5% LQ) beat est by 5.5%

↘️GM* (85.0%, -1.9 PPs YoY)🟡

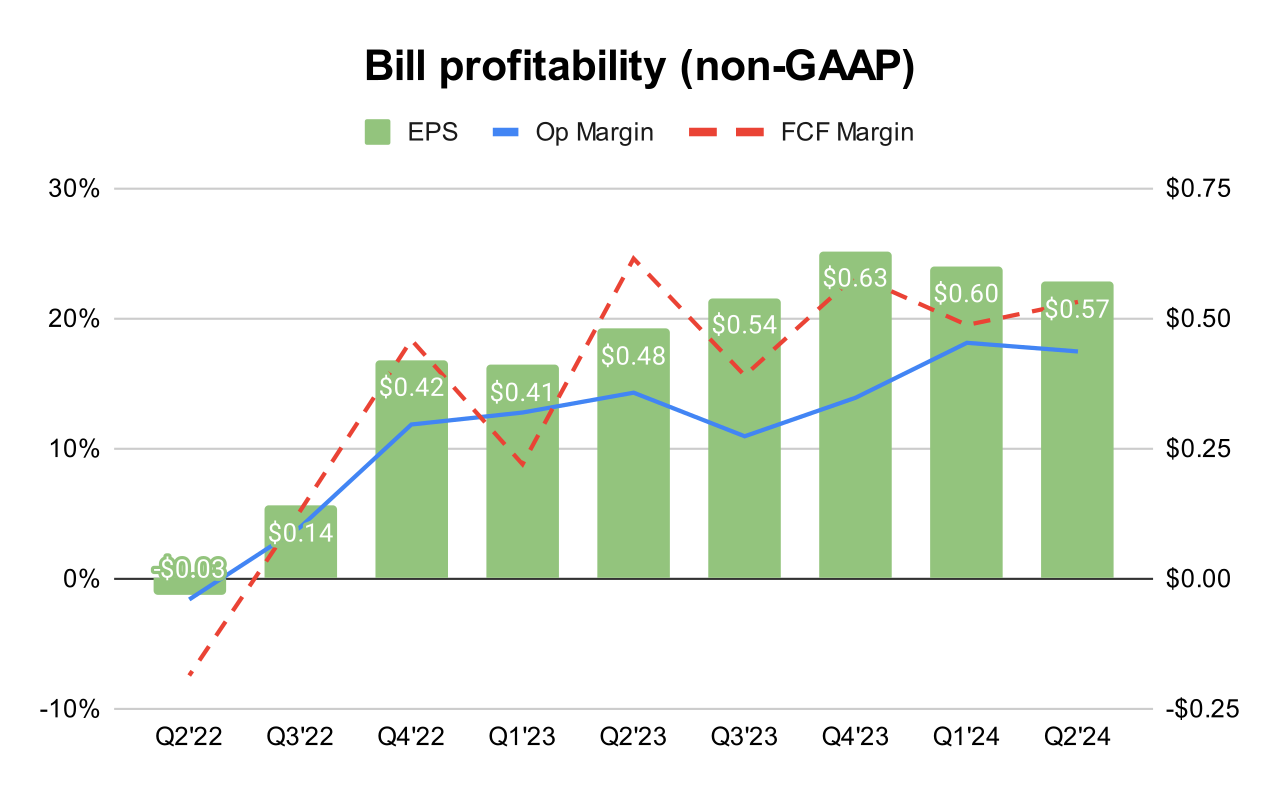

↗️Operating Margin* (17.5%, +3.2 PPs YoY)

↘️FCF Margin (21.3%, -3.3 PPs YoY)🟡

↗️EPS* $0.57 beat est by 23.9%

*non-GAAP

Customers

↗️474,600 Businesses Served (+3.0% YoY, +9700)

➡️151,200 BILL AP/AR Customers (+8.0% YoY, +4500)

Business metrics

➡️TPV (total payment volume) $76.0M (+17.0% YoY, +10.0% LQ) 🟢

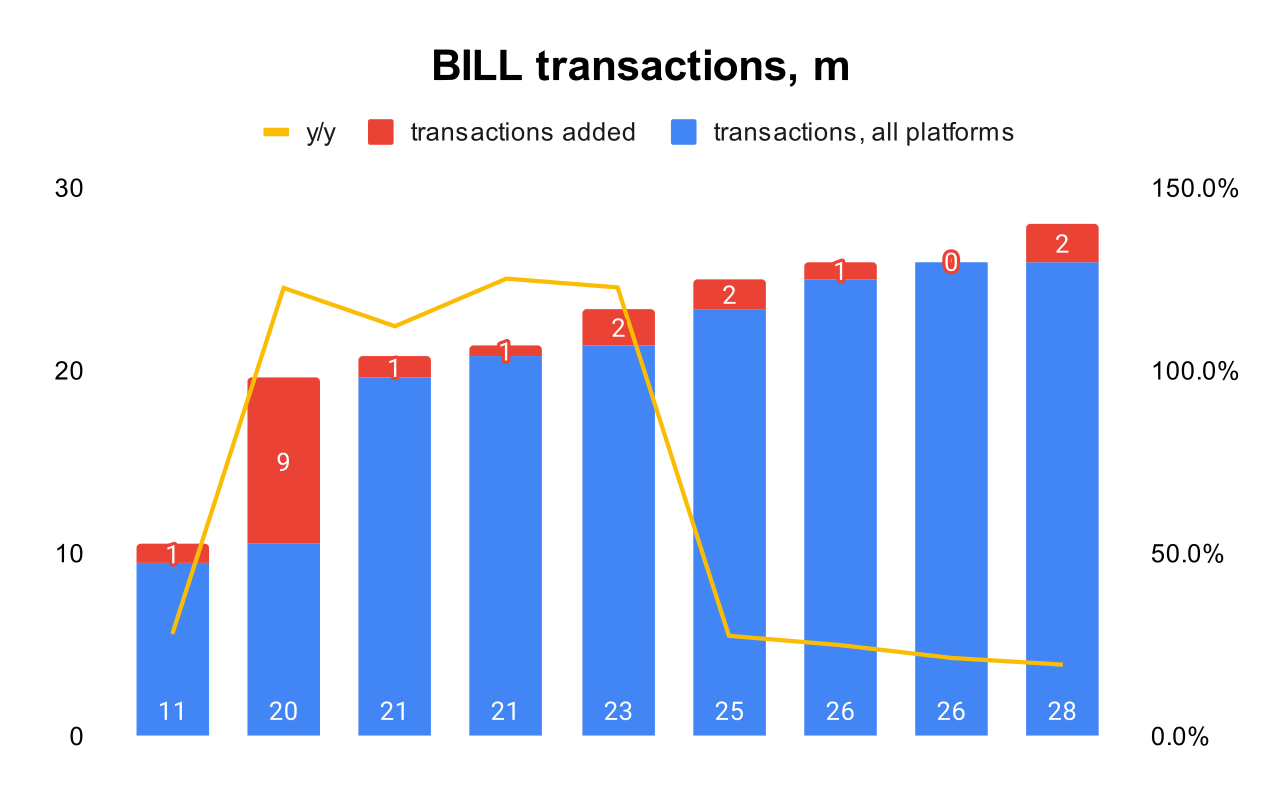

➡️Transactions 28.0M (+20.0% YoY, +21.0% LQ) 🟢

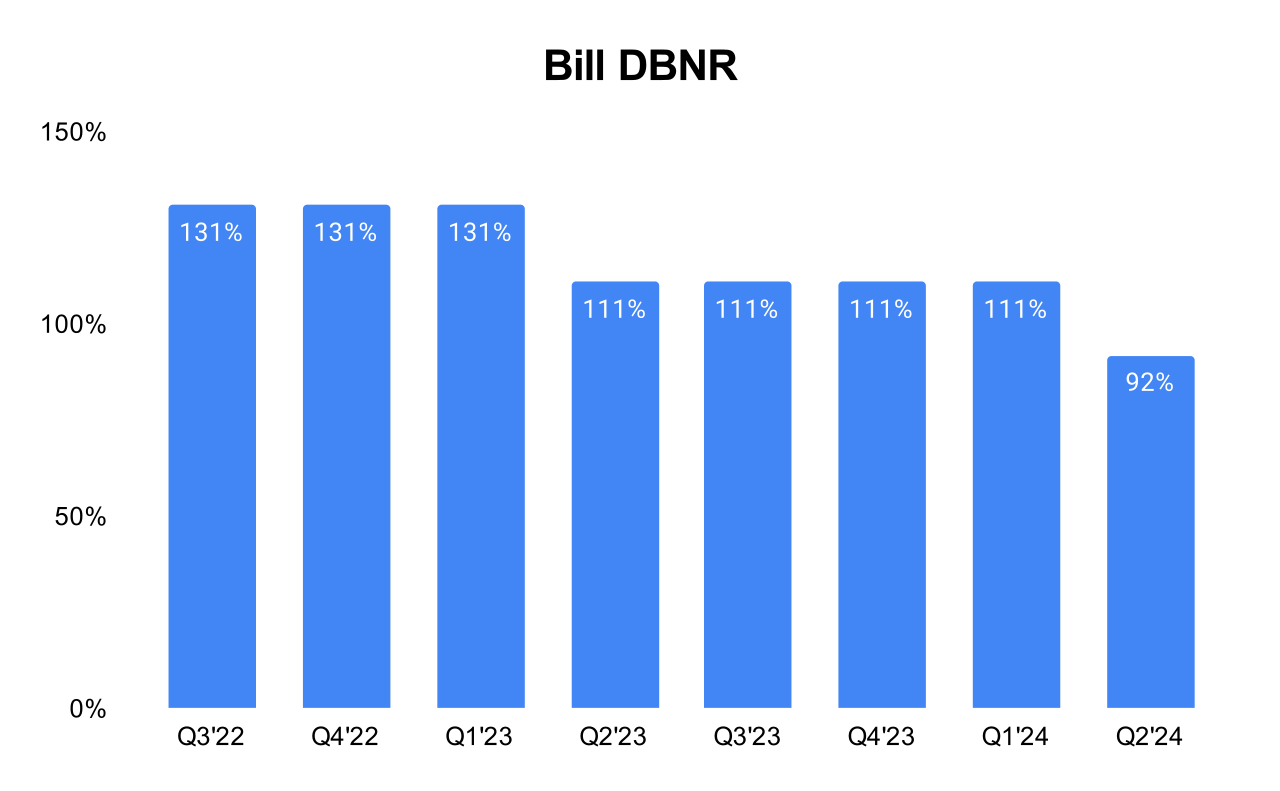

↘️DBNR 92% (111% LQ)

Operating expenses

↘️S&M*/Revenue 32.6% (-2.3 PPs YoY)

↘️R&D*/Revenue 15.8% (-3.7 PPs YoY)

↘️G&A*/Revenue 14.8% (-3.3 PPs YoY)

Quarterly Performance Highlights

↘️CAC* Payback Period 18.2 Months (80.6 LQ)

Dilution

↘️SBC/rev 17%, -1.6 PPs QoQ

↗️Basic shares down -0.1% YoY, +1.0 PPs QoQ🟢

↘️Diluted shares up 0.9% YoY, -3.4 PPs QoQ🟢

Guidance

↗️Q3'24 $346.0 - $351.0M guide (+14.3% YoY) beat est by 4.0%

➡️$1,415.0 - $1,450.0M FY guide (+11.0% YoY) in line with est

Key points from BillCom’s Second Quarter 2024 Earnings Call:

Financial Highlights and Growth:

Total revenue for fiscal 2024 reached $1.3 billion, a 22% increase year-over-year.

Non-GAAP operating income grew by 68% year-over-year to nearly $200 million, showing substantial profitability expansion.

The board of BILL Holdings authorized a new $300 million share repurchase program.

Integrated Platform Launch:

BILL launched an integrated platform that consolidates the strengths of its accounts payable (AP) and Spend and Expense solutions. This integration is designed to streamline financial operations for small and mid-sized businesses (SMBs), providing them with a unified tool for better visibility and control over their finances.

Mobile App Redesign:

The mobile application was completely redesigned to leverage the capabilities of the evolving integrated platform. This redesign enables customers to manage their financial operations effectively, whether they are in the office or on the go, enhancing the usability and accessibility of BILL's services.

Data Analytics Layer:

A significant addition to the platform is a data and analytics layer, which provides businesses with comprehensive insights into their cash flow. This feature aims to empower SMBs with better decision-making tools by offering deeper visibility into their financial status.

New Payment Engine:

BILL introduced a new payment engine that leverages the company’s vast experience and data from processing over $1 trillion in transactions. This engine is designed to enhance payment speed and improve risk management across various payment offerings, further solidifying BILL’s role as a leader in B2B payment solutions.

Expansion of Payment Options:

The company expanded its payment capabilities to include local transfer options for international payments and support for instant transfers via FedNow. These additions are part of BILL’s commitment to providing fast and secure payment experiences, offering more choices to meet the diverse needs of its customers.

Increase in Dual Solution Usage:

Approximately 11,500 businesses were using both BILL’s AP and Spend and Expense Solutions by the end of fiscal 2024, a significant increase from 7,200 the previous year. This surge indicates a successful cross-utilization of BILL’s integrated offerings, enhancing customer retention and engagement.

Strengthening Accountant Partnerships:

BILL continues to strengthen its relationships with accounting firms, now working with over 8,000 firms, a growth of 14% year-over-year. These firms represent the largest channel of customer acquisition for BILL, underscoring the strategic importance of this partnership.

Accountant relationships have proved to be highly stable and contribute to high retention rates, highlighting their role as a critical asset in BILL’s ecosystem.

Engagement with Financial Institutions:

The earnings call detailed efforts to engage more deeply with financial institutions, including banks. For example, one of BILL’s large bank partners successfully migrated thousands of customers onto BILL's white-label pay platform following an acquisition. This demonstrates BILL’s capabilities in managing large-scale customer integrations and providing tailored solutions to institutional clients.

Challenges:

BILL faced moderated business-to-business (B2B) spending and shifts in payment method preferences due to economic factors.

Macro Environment:

The uncertain economic environment was a recurrent theme, influencing customer and market behaviors. Despite this, BILL managed to deliver strong growth by adjusting its operations and focusing on core strategic priorities.

Strategic Investments:

BILL plans targeted investments in enhancing and expanding the value proposition for virtual cards, international payments, and working capital solutions. This includes augmenting supplier experiences and deepening relationships with accounting firms.

BILL intends to increase hiring, particularly in R&D and go-to-market teams, to support its growth initiatives and enhance operational capabilities.

Future Outlook:

The company is focused on becoming a multi-billion dollar, highly profitable business. Investments made in fiscal 2025 are intended to support a core revenue growth of 20% or greater in fiscal 2026, laying the foundation for long-term sustainable growth and profitability.

Management comments on the earnings call.

Product Innovations:

Rene Lacerte, CEO:

"We launched our integrated platform, incorporating the combined strength of our category-defining BILL AP and Spend and Expense solutions... We continue to simplify and personalize user experiences by leveraging AI throughout the platform."

Customers:

Rene Lacerte, CEO:

"In fiscal 2024, we served nearly half a million businesses, moved and safeguarded nearly $300 billion in payment volume and facilitated more than $100 million payment transactions... Our network members increased to 7.1 million, up 21% year-over-year as we further built platform capabilities for our suppliers."

Challenges:

John Rettig, President & CFO:

"During fiscal 2024, we acted decisively when cyclical headwinds caused moderated B2B spend and a shift in payment method preferences. We responded quickly by adapting our go-to-market initiatives, improving product experiences and working diligently with partners."

Macro Environment:

Rene Lacerte, CEO:

"Fiscal 2024 was an important year for BILL. We delivered more innovations to SMBs... These and future innovations are especially valuable for SMBs as they face an uncertain economic environment. In a world of change, BILL is the constant that they can rely on."

Future Outlook:

Rene Lacerte, CEO:

"In summary, we built a growing billion-dollar business and we're just scratching the surface of the market potential... We are focused on growing into a multi-billion dollar, highly profitable business. In fiscal 2025, we intend to capitalize on the momentum we created in fiscal 2024 and widen our leadership position in the market."