Bill.com Q1 2025 Earnings Analysis

Dive into $BILL Bill.com’s Q1 2025 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$358.2M rev (+10.9% YoY, +13.8% LQ) beat est by 0.8%

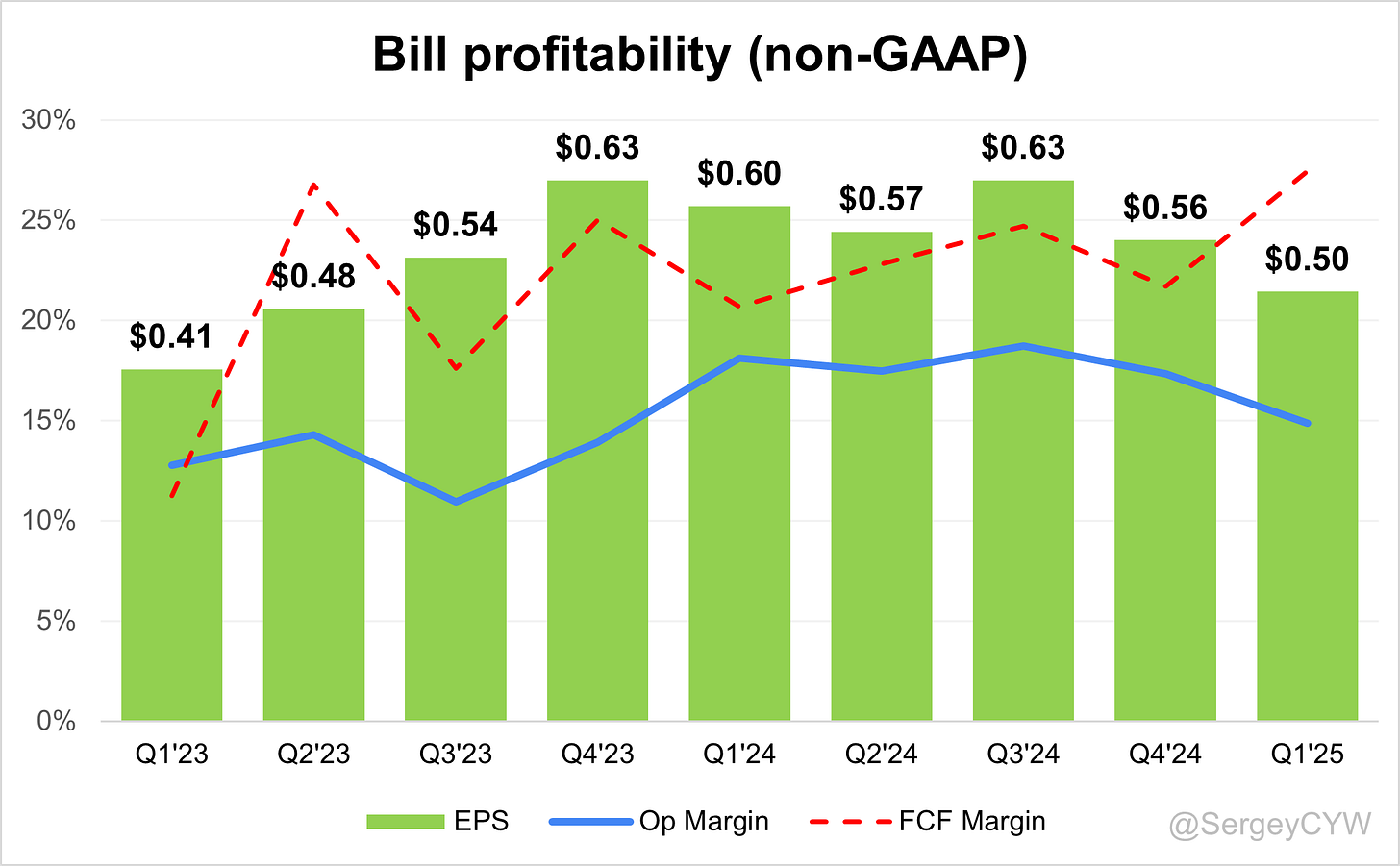

↘️GM* (84.9%, -2.3 PPs YoY)🟡

↘️Operating Margin* (14.9%, -3.2 PPs YoY)🟡

↗️FCF Margin (27.5%, +6.8 PPs YoY)🟢

↘️Net Margin (-3.2%, -13.1 PPs YoY)🟡

↗️EPS* $0.50 beat est by 35.1%

*non-GAAP

Revenue By Type

↗️Subscription and Transaction Fees $320M rev (+13.9% YoY, 89.4% Total rev)

↘️Interest on Funds Held for Customers $38M rev (-9.1% YoY, 10.6% Total rev)🟡

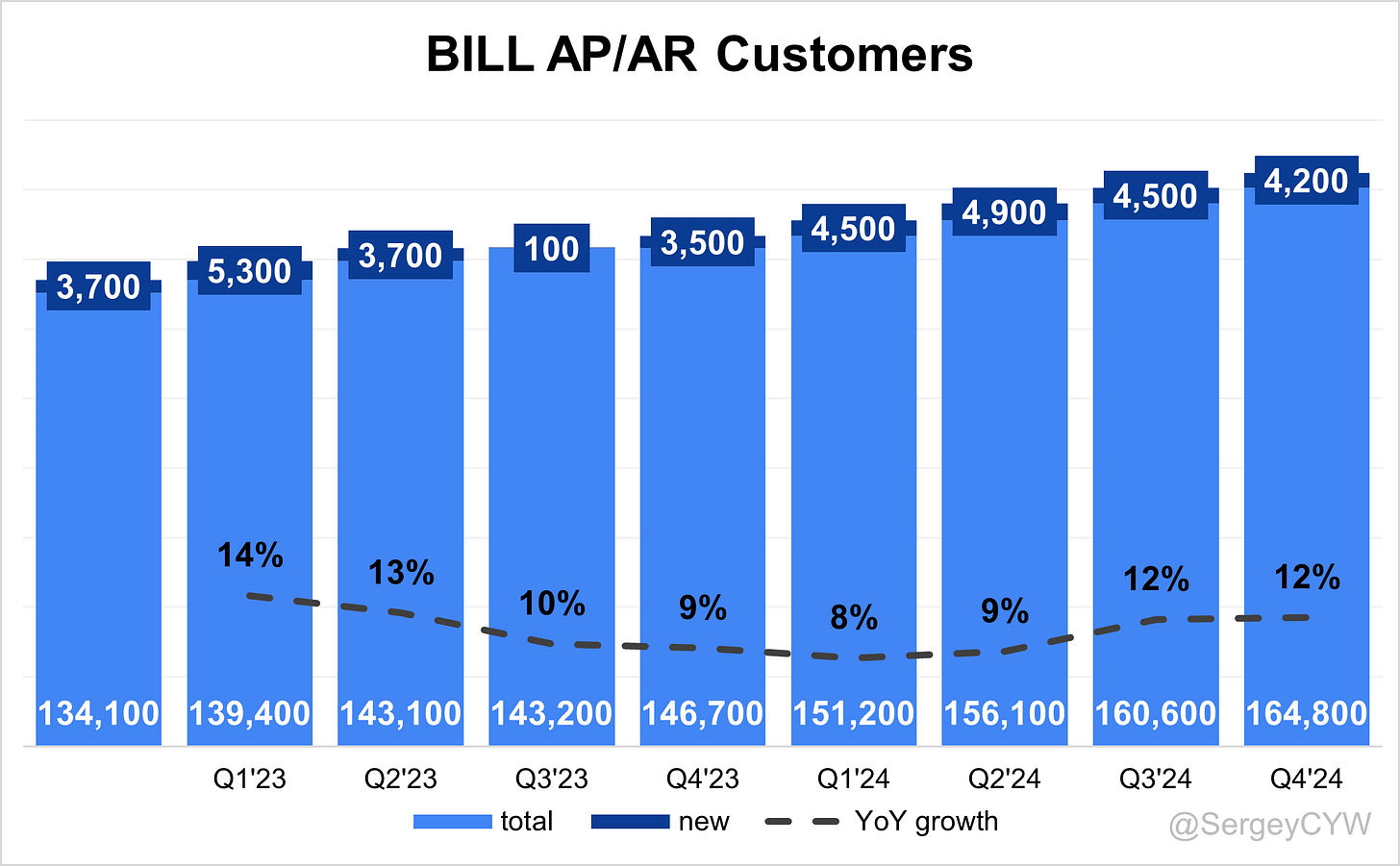

Customers

↗️488,600 Businesses Served (+5.1% YoY, +7300)

➡️164,800 BILL AP/AR Customers ( +12.3% YoY, +4200)

Business metrics

➡️TPV (total payment volume) $79.0M (+11.3% YoY, +12.7% LQ) 🟢

➡️Transactions 30.0M (+15.4% YoY, +15.4% LQ) 🟢

➡️DBNR 92% (92% LQ)

Operating expenses

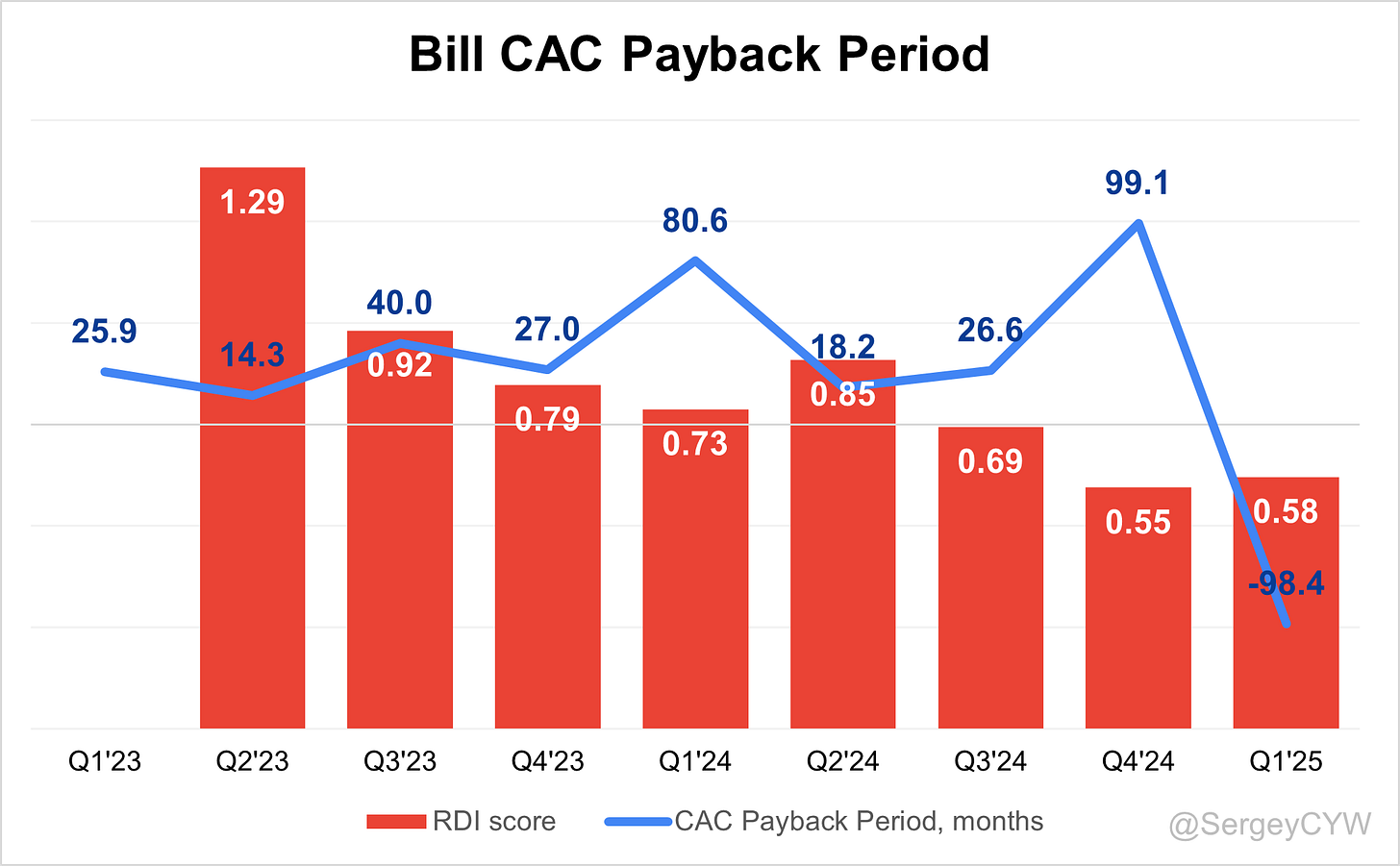

↗️S&M*/Revenue 35.4% (+2.4 PPs YoY)

↘️R&D*/Revenue 16.2% (-1.0 PPs YoY)

↘️G&A*/Revenue 14.2% (-4.6 PPs YoY)

Quarterly Performance Highlights

↘️CAC* Payback Period -98.4 Months (-178.9 YoY)🟢

↘️R&D* Index (RDI) 0.58 (-0.16 YoY)🟡

Dilution

↘️SBC/rev 17%, -0.8 PPs QoQ

↘️Basic shares down -3.1% YoY, -0.4 PPs QoQ🟢

↘️Diluted shares down -8.1% YoY, -6.7 PPs QoQ🟢

Guidance

➡️Q2'25 $370.5 - $380.5M guide (+9.3% YoY) in line with est

↘️$1,450.0 - $1,460.0M FY guide (+12.8% YoY) lowered by -0.6% missed est by -0.4%🔴

Key points from Bill Com’s First Quarter 2025 Earnings Call:

Financial Performance

BILL reported $358M in total revenue for Q3 FY25, up 11% YoY. Core revenue, which includes subscription and transaction fees, grew 14% YoY to $320M. Non-GAAP operating income reached $53M with a 15% margin, while free cash flow surged 44% YoY to $91M, yielding a 25% FCF margin. Non-GAAP net income was $59M, and EPS of $0.50 exceeded guidance by $0.12. Gross margin held steady at 85%, reflecting strong operational leverage.

Divvy Momentum

Spend and expense revenue rose 21% YoY to $138M, supported by 22% card volume growth and a 3% increase in card spend per customer. Interchange yield was 258 bps, while rewards absorbed 50% of segment revenue. Divvy added 1,800 net new customers, bringing the total to 39,500. Growth was led by strong activity in travel, entertainment, and retail, though management signaled caution due to reduced discretionary SMB spending. Nearly half of Divvy cross-sells originated from the accounting channel, highlighting effective partner-led expansion.

AP/AR Platform Expansion

AP/AR revenue reached $164M, up 10% YoY. Total payment volume rose 10% YoY, slightly below expectations. TPV per customer declined 2% YoY due to spending cuts in construction, wholesale, real estate, and payroll/PEO. BILL added 4,200 net new AP/AR customers, totaling 164,800, with over 60% YoY growth in adds from the accountant channel.

New capabilities launched include multi-entity management, procurement automation, and mass payments, targeting mid-market complexity. Customers like AdvicePeriod and Rehmann implemented these tools to increase visibility, productivity, and compliance.

Subscription and Transaction Revenue

Core revenue reached $320M, up 14% YoY. Transaction revenue benefitted from expanded adoption of Instant Transfer, Pay-by-Card, and Invoice Financing. BILL introduced pricing changes, including an ACH fee increase from $0.49 to $0.59, effective for existing customers in May. These adjustments are expected to support monetization uplift in FY26.

Management outlined plans to shift more revenue toward subscriptions, aiming to drive more predictable ARPU growth through packaging optimization and bundling strategies. Transaction monetization improved despite pressure on volume due to disciplined product mix expansion.

Product Innovation

BILL launched enhancements for larger SMBs, including procurement automation, mass payment capabilities, and multi-entity management. These features aim to reduce friction and improve financial operations for complex businesses. Clients such as AdvicePeriod and Rehmann validated their impact, citing material gains in efficiency and client service delivery.

Agentic AI

BILL accelerated its investment in AI-powered finance agents to automate AP, AR, procurement, and cash management. The company leverages a proprietary dataset built from billions in payment volume and millions of documents. AI tools are designed to reduce manual workload, improve accuracy, and provide real-time insights. Management views agentic AI as a long-term differentiator and value creator for SMBs.

Take Rate and Monetization

Sequential take rate expansion was driven by increased usage of ad valorem products, improved FX hedging (losses down ~65%), and seasonal mix. Products like Invoice Financing, Instant Transfer, and Advanced ACH (in beta) contributed to this improvement. Q4 take rate is expected to remain stable QoQ due to ongoing macro softness, though management remains confident in long-term monetization scalability.

Customer Growth

BILL added 4,200 AP/AR customers and 1,800 Divvy customers in Q3. The accounting channel drove over 60% YoY growth in customer acquisition and contributed to half of cross-sells into spend products. Over 9,000 accounting firms now use BILL’s platform, reinforcing its network effect and scalability in client onboarding and retention.

Large Customer Wins

AdvicePeriod, a wealth management firm, adopted BILL’s multi-entity functionality to support over 30 client entities, reporting significant productivity and visibility improvements.

Rehmann, a Top 100 accounting firm, adopted procurement automation to streamline client operations, helping evolve its role into a strategic advisory partner.

SMB Spending Behavior

TPV per customer fell 2% YoY as SMBs pulled back on discretionary spend. Spending slowed across wholesale trade, construction, real estate, and payroll/PEO categories. Management cited this as the highest level of uncertainty since early COVID, with businesses hesitant to invest or spend. Despite caution, long-term confidence in SMB digital adoption remains intact, with current platform penetration estimated at only ~4% of the addressable market.

Macro Risks

Ongoing macroeconomic and geopolitical uncertainty—particularly around tariffs and trade policy—is impacting SMB behavior. Spend moderation and transaction volume softness were most visible in sectors tied to goods movement. However, most cross-border volume remains service-based. The adoption of local transfer capabilities across markets supported FX margin stability and improved international payment performance.

Guidance and Outlook

Q4 guidance was revised down due to spending softness. Core revenue is forecast at $335–345M (+11–15% YoY), with total revenue at $370.5–380.5M. Operating income is expected between $43–48M, with EPS of $0.39–0.43. FY25 revenue outlook was maintained at $1.45–1.46B, and EPS at $2.06–2.09.

Management reaffirmed long-term confidence. FY25 investments in AI, product enhancements, and pricing repositioning are expected to support accelerated revenue growth and margin expansion in FY26.

Management comments on the earnings call.

Product Innovations

Rene Lacerte, Chief Executive Officer and Founder

“We recently launched a suite of new advanced solutions for large businesses to help them with their more complex needs such as multi-entity management, procurement and mass payments.”

“Our expansion into procurement is an important step on our product innovation roadmap. This new capability gives businesses the ability to manage, approve and track purchase orders with speed, precision and control.”

“We are bringing the same simplicity and ease of use that redefined the core AP processes for hundreds of thousands of businesses to the painful, disconnected procurement process that most SMBs use today.”

John Rettig, President and Chief Financial Officer

“We enhanced our card portfolio capabilities. We are deploying our comprehensive card portfolio to drive broader adoption, in addition to traditional virtual cards; we are enabling the Divvy card for use by our AP customers.”

Bill Divvy Growth

John Rettig, President and Chief Financial Officer

“We observed good growth in card spend on travel, entertainment and retail in Q3, though we are somewhat cautious that near-term uncertainty could introduce headwinds to these spend categories.”

“Our focus on accountants is working and contributing to growth in net adds. In Q3, accounting firms accounted for nearly half of spend and expense cross-sells.”

Rene Lacerte, Chief Executive Officer and Founder

“We see the ability to actually drive cross-sell as an important indicator of the overall opportunity that we have with accountants as we continue to knit our solutions together.”

BILL AP/AR Expansion

Rene Lacerte, Chief Executive Officer and Founder

“Our increased focus on serving larger businesses created another significant increase in time savings and accuracy. This solution not only strengthens our position with existing customers, but it also opens doors to serve larger mid-market companies.”

John Rettig, President and Chief Financial Officer

“We now have 164,800 customers using our AP/AR solution. Customers began to moderate spend in the wholesale trade, real estate, payroll and PEO and construction categories.”

Agentic AI

Rene Lacerte, Chief Executive Officer and Founder

“We are building a team of AI-powered finance agents. We are uniquely positioned to direct these agents at the payables, receivables, procurement, and cash management processes that have always been a challenge for SMBs.”

“Our scale, deep experience, and diverse payments ecosystem will provide SMBs with a competitive advantage on day one. This vision is realized through two foundational assets: advanced data-driven understanding of customer behavior and the rich granular data context we possess.”

“What we see is a world where SMBs are free to get back to what they love. It's why anyone starts a business; it's not to do the stuff that we take care of under the hood.”

Take Rate & Monetization

John Rettig, President and Chief Financial Officer

“We delivered solid AP/AR payment monetization expansion in Q3, primarily fueled by the strength of our emerging ad valorem products including instant transfer, pay by card and invoice financing.”

“Our payment portfolio strategy is proving effective. The newer ad valorem offerings are contributing to monetization and are important levers as we navigate virtual card acceptance friction and cross border trade uncertainty.”

“We have shifted our expectations for Q4 to be similar to Q3. That’s primarily related to changing behaviors in AP customer industries and early signals around trade policy impacts.”

“We haven’t adjusted pricing for a while now. I would look at this as the beginning of changes with a more holistic approach to optimize the combination of the value we’re delivering and how we’re monetizing it.”

Customers

Rene Lacerte, Chief Executive Officer and Founder

“We provide solutions that enable these suppliers to get paid faster, sometimes weeks in advance. Instant transfer and invoice financing continue to show strong receptivity with suppliers.”

John Rettig, President and Chief Financial Officer

“We have relationships with suppliers as it exists today. We’ve seen good progress, interest and early results from those interactions and from usage of the product.”

International Growth

John Rettig, President and Chief Financial Officer

“We enabled local transfer capabilities in dozens of countries, which is a notable enhancement to our international payment solution. This new feature allows near real-time delivery of cross border payments.”

“We are observing solid adoption of local transfer, which is driving wallet share gains with customers leveraging our international payment product for their cross-border transactions.”

Challenges

Rene Lacerte, Chief Executive Officer and Founder

“I don’t think SMBs have seen this much uncertainty since the beginning of COVID. Instead of setting sail, they’re just battening down the hatches.”

“We saw fewer transactions per customer and slightly decreased spend per customer. The opportunity for us is to continue to make sure our platform makes it easy for businesses to manage their operations in this environment.”

Future Outlook

John Rettig, President and Chief Financial Officer

“Taking recent trends and increased uncertainty into consideration, we have adjusted our near-term outlook to account for the more challenging environment.”

“We are confident in our ability to successfully execute in the current environment and that our fiscal 2025 investments provide the levers to accelerate revenue growth as conditions improve.”

Rene Lacerte, Chief Executive Officer and Founder

“There are a lot of knowns across the business that are super valuable… our massive market, deep customer understanding, strong ecosystem, and 1% of GDP flowing through our platform all point to long-term opportunity.”

Thoughts on Bill Com Earnings Report $BILL:

🟢 Positive

$358.2M revenue, up +10.9% YoY, beat estimates by 0.8%

Free cash flow margin rose to 27.5%, up +6.8pp YoY

EPS (non-GAAP) of $0.50, beat estimates by 35.1%

Subscription and transaction fees revenue grew +13.9% YoY to $320M

TPV rose to $79.0B, up +11.3% YoY

Transactions increased +15.4% YoY to 30.0M

Divvy revenue grew +21% YoY, with 22% card volume growth

4,200 net new AP/AR customers added; total now 164,800

1,800 new Divvy customers; total now 39,500

SBC/revenue declined to 17%, down -0.8pp QoQ

Basic shares down -3.1% YoY, diluted shares down -8.1% YoY

🟡 Neutral

Gross margin at 84.9%, down -2.3pp YoY

Operating margin at 14.9%, down -3.2pp YoY

R&D/revenue declined to 16.2%, down -1.0pp YoY

Net margin fell to -3.2%, down -13.1pp YoY

Customer base grew to 488,600, up +5.1% YoY

DBNR remained flat at 92%

Interest revenue on held funds declined -9.1% YoY to $38M

Spending trends cautious across discretionary SMB categories

Advanced ACH in beta, not yet material to revenue

🔴 Negative

FY25 revenue guidance of $1.45–1.46B, cut by -0.6%, misses estimate by -0.4%

Q4 guide indicates growth deceleration: $370.5–380.5M, up +9.3% YoY

TPV per customer declined -2% YoY

Spending slowdown in verticals: wholesale, construction, real estate, PEO/payroll

Macro risks from tariffs and trade policy creating SMB uncertainty

Thank you for reading!

Follow me for more frequent updates on X/Twitter and Threads, and on LinkedIn. For visual infographics, check out Instagram, and for portfolio changes, follow me on SavvyTrader.

Disclaimer: This earnings review is for informational purposes only and does not constitute financial, investment, or trading advice.