Financial Results:

↗️$323.0M rev (+18.5% YoY, +22.5% LQ) beat est by 5.6%

↗️GM* (87.1%, +0.1%pp YoY)🟢

↗️Operating Margin* (18.1%, +5.4%pp YoY)🟢

↗️FCF Margin (19.5%, +10.7%pp YoY)

↗️EPS* $0.74 beat est by 39.6%🟢

*non-GAAP

Customers

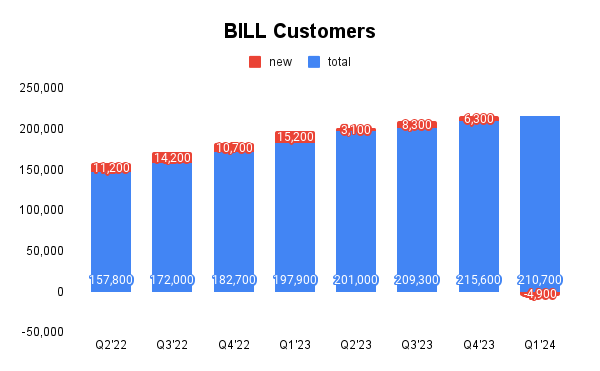

↘️464,900 Businesses Served (+2.0% YoY, -8,600)🔴

↘️210,700 BILL customers (+6.0% YoY, -4900)🔴

↗️147,300 BILL customers (without financial institutions) (+10.0% YoY, +4100)

➡️33,500 Divvy customers (+24.0% YoY, +1900)

Business metrics

➡️TPV (total payment volume) $71.0M (+10.0% YoY, +11.0% LQ) 🟡

➡️Transactions 26.0M (+21.0% YoY, +25.0% LQ) 🟢

➡️DBNR 111% (111% LQ)

Operating expenses

↘️S&M*/Revenue 33.0% (33.1% LQ)

↘️R&D*/Revenue 17.2% (18.8% LQ)

↘️G&A*/Revenue 18.8% (20.1% LQ)

Dilution

↘️SBC/rev 19%, -0.9%pp QoQ

↘️Share count down -1.1% YoY, -1.1%pp QoQ🟢

Guidance

↗️Q2'24$320.0 - $330.0M guide (+9.8% YoY) beat est by 3.3%

↗️$1,267.0 - $1,277.0M FY guide (+20.2% YoY) raised by 2.1% beat est by 2.6%

Key points from Bill’s First Quarter 2024 Earnings Call:

Focus on SMBs:

BILL remains dedicated to serving small and midsized businesses (SMBs), which are seen as key drivers of job creation and innovation.

The company's platform and suite of solutions are designed to digitize and automate the financial back office for SMBs, offering capabilities in accounts payable, accounts receivable, and spend and expense management.

AI and Product Innovations:

AI Engine. BILL has embedded AI across its platform to automate operations and accelerate payments, leveraging a database of over 300 million transactions and 0.5 billion documents.

Platform Enhancements. Enhancements include new capabilities in cash flow insight and forecasting through the integration of Finmark's FP&A tools, aimed at providing SMBs with tools to predict cash flows and make data-driven decisions.

Mobile App. Launch of a new mobile app for BILL AP and AR, enhancing automation workflows and payment solutions, and driving growth in mobile engagement.

TPV and Transactions Growth:

BILL reported a 9% year-over-year increase in standalone payment volume, totaling $67 billion, indicative of strong underlying business activity.

Processed nearly 100 million transactions in the last 12 months, representing about 1% of U.S. GDP, showcasing significant scale and reach.

Go-to-Market Strategy:

BILL continues to see a vast market opportunity to digitize financial operations for millions of SMBs who are currently relying on outdated methods like paper checks and manual processes.

Expansion of the partner ecosystem, including a new partnership with Xero to embed BILL’s onboarding workflows and ad valorem offerings into their platform.

Challenges:

Throughout the quarter, BILL experienced fluctuations in their take rate.

Monetization heavily depends on transaction processing volume (TPV) and the addition of new customers. The core BILL platform saw a moderate increase in TPV per customer, suggesting a neutral spend environment without significant expansion. The financial institution channel experienced a decline due to the removal of some inactive customers, which affects overall transaction volume and consequently, monetization.

The broader economic conditions, including inflation and interest rates, continue to influence customer spending behaviors. This macro uncertainty poses a challenge to predicting and boosting consistent TPV growth and customer acquisition.

Management comments on the earnings call.

Product Innovations

Rene Lacerte: "Our platform now includes cash flow insight and forecasting, leveraging the best-of-breed FP&A capability from our acquisition of Finmark. This powerful tool empowers SMBs to predict future cash flow, easily analyze trends and opportunities and make better data-driven decisions faster."

Go-to-Market Strategy

John Rettig: "For BILL, specifically, 4,100 adds in the quarter was an uptick from last quarter and I think was a good start to some of our areas of focus that I just mentioned."

Macro Environment

Rene Lacerte: "The neutrality I was referring to was just with respect to kind of the same-store sales, right? Just the businesses are kind of managing their spend. They're not decreasing their spend. They're not increasing their spend."

Challenges

John Rettig: "As expected with the choppy macro environment, we have seen an increase in credit and fraud loss rates, particularly among our smaller customer cohorts."