Axon Enterprise Q4 2024 Earnings Analysis

Dive into $AXON Axon’s Q4 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$575M rev (+33.1% YoY, +31.6% LQ) beat est by 1.5%

↘️GM (60.1%, -0.9 PPs YoY)🟡

↗️GM* (63.2%, +1.7 PPs YoY)

↘️Operating Margin (-2.7%, -13.6 PPs YoY)🟡

↗️FCF Margin (39.2%, +12.3 PPs YoY)🟢

↗️Net Margin (23.5%, +10.3 PPs YoY)

↗️EPS* $2.08 beat est by 48.6%🟢

*non-GAAP

Revenue By Segments

TASER

↗️$221.2M TASER rev (+37.1% YoY)

↗️GM (61.3%, +4.2 PPs YoY)

Sensors and other

➡️$123.6M Sensors and other rev (+15.3% YoY)

↘️GM (32.8%, -13.5 PPs YoY)

Axon Cloud

↗️$230.3M Axon Cloud rev (+40.8% YoY)

↘️GM (73.7%, -0.9 PPs YoY)

Key Metrics

➡️NRR 123% (123% LQ)

↗️Total company future contracted revenue $10.10B (+41.5% YoY)🟢

↗️ARR $1,001M (+36.7% YoY)🟢

Operating expenses

↘️ SG&A*/Revenue 26.7% ( -1.5 PPs YoY)

↗️ R&D*/Revenue 15.5% ( +0.2 PPs YoY)

Quarterly Performance Highlights

↗️Net New ARR $116M (+45.0% YoY)

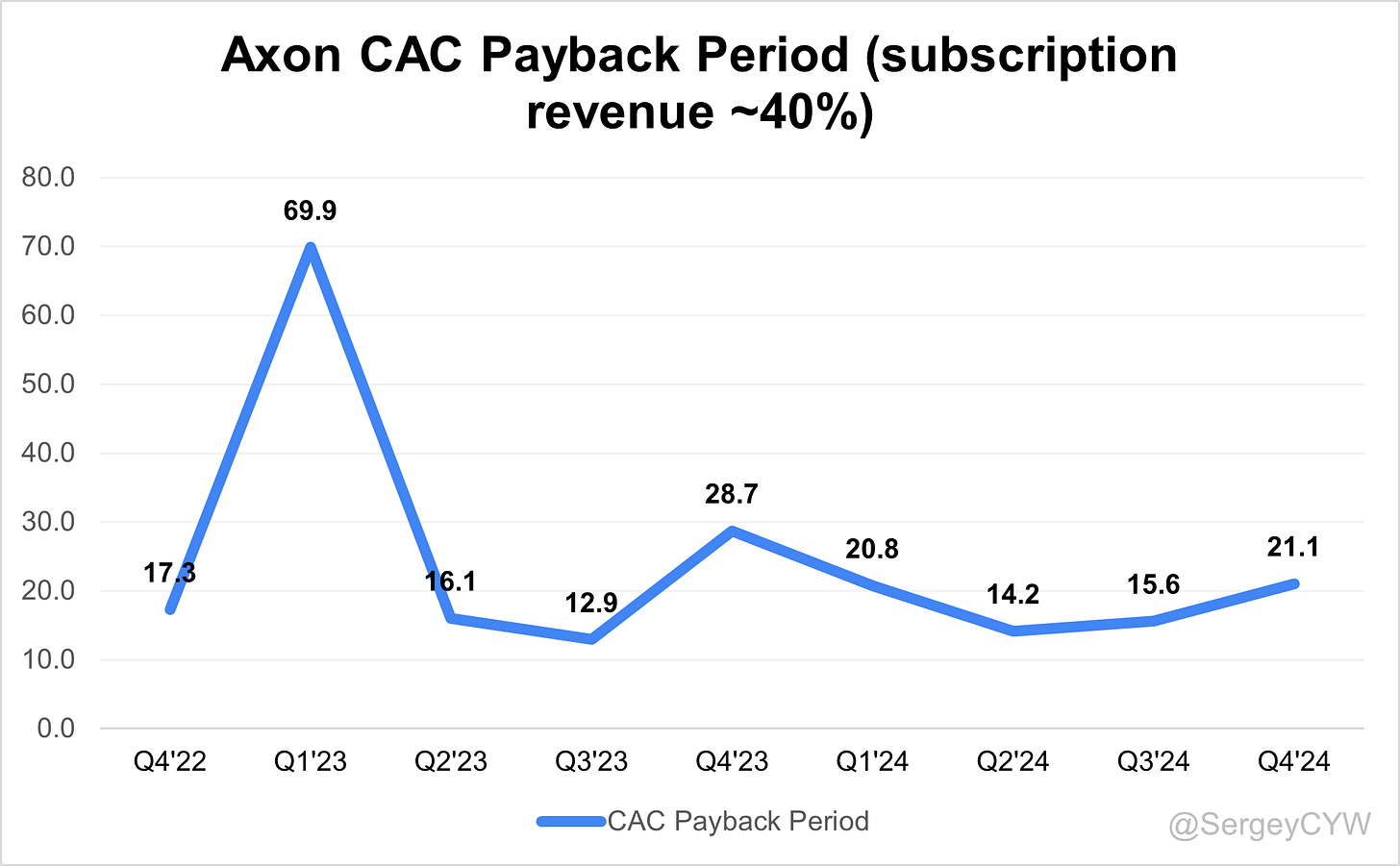

↗️ CAC* Payback Period 21.1 Months ( 15.6 LQ)

Dilution

↗️SBC/rev 23%, 4.1 PPs QoQ

↗️Basic shares up 1.7% YoY, 0.57 PPs QoQ

↗️Diluted shares up 6.4% YoY, +3.6 PPs QoQ🟡

Guidance

➡️$2,550.0 - $2,650.0M FY guide (+24.7% YoY) in line with est

Key points from Axon’s Fourth Quarter 2024 Earnings Call:

Financial Performance

Full-year revenue exceeded $2 billion, nearly doubling in two years. Q4 revenue was $575 million, up 34% YoY, marking the 12th consecutive quarter of 25%+ revenue growth.

TASER revenue grew 37% YoY, Sensors increased 18% YoY, and Software & Services surged 41% YoY. ARR reached $1 billion, up 37% YoY, with NRR at 123%, reflecting strong customer expansion.

Axon booked over $5 billion in contracts, with $2.5 billion in Q4 alone. Future contracted bookings exceeded $10 billion, ensuring multi-year revenue visibility. Adjusted gross margin remained stable at 63.2%, while adjusted EBITDA margin hit 25%, achieving the 2025 target a year early.

2025 revenue is projected between $2.55 billion and $2.65 billion, reflecting 25% growth. Adjusted EBITDA guidance is $640 million to $670 million, maintaining 25% margins. CapEx is forecasted at $140 million to $180 million, mainly for TASER 10 production expansion and R&D.

Product Innovations

Axon integrates AI, real-time operations, and robotics into its portfolio. New products are rapidly gaining adoption, with the DraftOne AI-powered report writing tool and AI Era Plan securing 10 customer deals within weeks.

The AI Era Plan increased Officer Safety Plan (OSP) pricing from $350 to $550 per officer per year, highlighting AI's premium value.

Axon Cloud, used by over 1 million active users, spans evidence management, real-time operations, AI-powered tools, and productivity software. Cloud revenue grew $35 million sequentially, the highest on record.

TASER 10 demand exceeds supply, with orders outpacing TASER 7 by 2x. Axon plans to expand manufacturing capacity in 2025 and is investing in VR training for TASER effectiveness.

AI and DraftOne

DraftOne AI automates report writing, cutting police departments' reporting time by up to 50%. AI Era Plan adoption was immediate, with law enforcement using AI for real-time translation, decision-making, and workflow automation.

Agencies leveraging AI gain 20% more officer time, addressing staffing shortages. Adoption remains strong across local, state, and federal agencies, as well as enterprise security teams.

TASER Expansion

TASER 10 orders exceed supply, with seven of the ten largest orders coming from international, federal, and corrections customers. The network effect strengthens adoption across Europe, Latin America, and Asia-Pacific.

Axon is expanding TASER 10 manufacturing capacity to meet demand. International growth faces regulatory hurdles, but early deployments show strong future potential.

Sensors Growth

The Sensors segment, including body-worn cameras and vehicle-based systems, grew 18% YoY, driven by AI-powered features like automated evidence tagging, real-time transcription, and incident categorization.

Enterprise adoption is accelerating, with corporate security teams and logistics firms deploying Axon’s connected sensors. Axon closed its largest-ever enterprise deal in Q4, including body cameras and FUSUS-powered surveillance solutions.

Federal agencies continue expanding Axon’s sensor deployments despite budget uncertainties. Scaling AI while maintaining compliance with privacy laws remains a challenge.

Axon Cloud

Cloud revenue surged $35 million QoQ, reflecting record software adoption rates. Evidence management, real-time operations, and AI-powered analytics now serve over 1 million users.

Growth will continue with expanded AI offerings and FUSUS integrations, as law enforcement shifts to cloud-based infrastructure.

The total addressable market (TAM) for Axon Cloud is expanding, fueled by demand for real-time translation, transcription, and predictive analytics.

Cybersecurity, privacy, and data compliance remain challenges as AI-powered services scale.

FUSUS & Drones

Axon’s FUSUS acquisition strengthens real-time surveillance and crime center integrations, connecting public and private cameras, body-worn sensors, and monitoring tools into a single cloud-based platform.

The Skydio partnership positions Axon as a leader in autonomous drone solutions, with early contracts in law enforcement, federal agencies, and border security.

Axon increased its TAM estimate for drones and robotics to $20 billion, reflecting growing demand for automated situational awareness.

Flock Safety Partnership Ends

Axon ended its Flock Safety partnership, shifting focus to FUSUS-based ALPR alternatives. The termination stemmed from data-sharing concerns, with Axon advocating for more transparency.

Axon is evaluating in-house ALPR solutions to enhance traffic enforcement, investigations, and surveillance.

Customer Success

Axon recorded over $5 billion in bookings, with half in Q4. The company secured its largest-ever enterprise contract with a global logistics provider, marking its expansion beyond law enforcement.

Enterprise bookings tripled YoY, with customers adopting body-worn cameras, FUSUS surveillance, and AI-powered security analytics.

International bookings grew 50% sequentially in Q4, after 40% in Q3, as Axon expanded into Europe, Latin America, and Asia-Pacific.

TASER 10 has already saved multiple lives, with agencies reporting successful de-escalations. AI-powered DraftOne tools are cutting report-writing time by half, improving officer efficiency.

Federal & Enterprise Growth

Federal demand remains resilient, with expanded body camera and TASER deployments. Axon expects no significant risk from budget constraints and sees federal, enterprise, and international customers as a $100 billion market opportunity.

Enterprise adoption is growing rapidly, with corporate security and logistics firms deploying Axon’s AI and surveillance solutions.

International Expansion

International bookings surged 50% sequentially in Q4, with law enforcement, military, and corporate security sectors driving demand. TASER 10 and AI-powered body cameras are accelerating global adoption.

Challenges

TASER 10 faces supply constraints, requiring increased manufacturing capacity. Axon is also navigating regulatory challenges in Arizona, considering relocating its headquarters to a business-friendly state.

Tariffs and restrictions on Chinese drone manufacturer DJI create opportunities for Axon’s Skydio partnership, though geopolitical risks remain a factor.

SBC & Shareholder Dilution

Axon’s Stock-Based Compensation (SBC) increased due to investments in AI, robotics, and cloud talent. While SBC attracts top engineers, it raises shareholder dilution concerns.

The company remains focused on balancing compensation incentives with shareholder value and expects revenue growth and profitability to counter dilution effects.

Future Outlook

Axon expects another record year in 2025, driven by strong bookings, AI adoption, and expansion in federal, enterprise, and international markets.

With $10 billion in future contracted bookings, long-term revenue visibility remains strong.

AI, robotics, and cloud-based law enforcement solutions will shape Axon’s continued growth in digital transformation and public safety.

Management comments on the earnings call.

Product Innovations

Rick Smith, Chief Executive Officer

"We are at a place where the benefits of adopting newer technologies are so clear, it's almost too impossible to imagine what the world would be like if they were never brought forward."

Josh Isner, Chief Operating Officer

"We run our team with a next-play mindset. What excites me most about our results is what they signal for the years ahead."

AI

Rick Smith, Chief Executive Officer

"These aren’t just buzzwords to us. These are our passions, and we’re making them real and real businesses."

Josh Isner, Chief Operating Officer

"AI-powered automation is driving measurable returns for our customers, with tools like DraftOne already reducing the administrative burden on law enforcement. The rapid adoption of AI in public safety is reshaping how agencies operate at scale."

Axon Cloud

Brittney Bagley, Chief Financial Officer

"Our software remains a driver of our overall growth and contributed 40% of our total revenue in Q4. ARR increased to $1 billion, up 37% year over year, reinforcing the visibility and predictability in our business."

Rick Smith, Chief Executive Officer

"We now have more than one million users of our software solutions spanning evidence management, real-time operations, productivity, and yes, artificial intelligence. This is where we differentiate ourselves for most with our customers."

Strategic Partnerships

Josh Isner, Chief Operating Officer

"A lot has been made of our decision to exit the Flock partnership, but the reality is we remain committed to offering best-in-class real-time surveillance solutions. Our focus is on ensuring data flows seamlessly for our customers, and we are actively working on a long-term strategy that aligns with our core mission."

Federal Business

Josh Isner, Chief Operating Officer

"I certainly don’t think, in terms of our future, there’s any real cause for concern about what’s happening with funding cuts. If anything, we could come out of this with more opportunity as federal agencies continue to prioritize technology that enhances operational efficiency and officer safety."

Rick Smith, Chief Executive Officer

"Once federal officers start using our technology, they realize it protects them—not just physically but legally. In today’s world, having a video that shows you are a professional doing the job the right way gives them great confidence."

Enterprise Business

Josh Isner, Chief Operating Officer

"Enterprise represents one of our biggest long-term growth opportunities. We closed the largest deal in our history with a global logistics provider, and we continue to see strong demand from companies prioritizing security and operational transparency."

Rick Smith, Chief Executive Officer

"We believe this will be a major part of our business, maybe even the biggest part in the long term. The opportunity in enterprise, alongside federal and international markets, is massive, and we’re just getting started."

Flock Safety & ALPR Alternative

Josh Isner, Chief Operating Officer

"We did exit a partnership with Flock. However, I think both sides have an interest in getting back to that partnership. We proposed new terms, and we are working toward a solution that benefits our customers and their ability to use their own data effectively."

International Growth

Josh Isner, Chief Operating Officer

"Our international bookings grew nearly 50% sequentially in Q4, and that’s on top of 40% sequential growth in Q3. We are seeing strong adoption in new markets, and the expansion of our product portfolio is creating even more opportunities to land and expand with customers globally."

Brittney Bagley, Chief Financial Officer

"We refreshed our total addressable market estimates, and the expansion of AI, real-time operations, and drones and robotics has roughly doubled our overall opportunity set. The momentum in international markets reinforces this outlook."

Challenges

Rick Smith, Chief Executive Officer

"Unfortunately, Arizona has a political and legal environment that is making it challenging for businesses like us to invest here. If we can fix it, it’ll keep us here and help the state attract other businesses. If we can’t, well, then we’re going to have to move on."

Future Outlook

Rick Smith, Chief Executive Officer

"I’ve never felt more confident about our position or more insanely excited and motivated by what we’re doing. The long-term vision for Axon is bigger than just The United States—it’s a worldwide transformation in how we apply technology to public safety and operational efficiency."

Brittney Bagley, Chief Financial Officer

"We are entering the new year in the strongest and cleanest inventory position we've been in for the last three years. We expect another record bookings year in 2025 with line of sight into several years of exciting growth ahead."

Thoughts on Axon Earnings Report $AXON:

🟢 Positive

Revenue: $575M (+33.1% YoY, +31.6% QoQ) beat estimates by 1.5%.

Profitability: Net margin 23.5% (+10.3 PPs YoY), FCF margin 39.2% (+12.3 PPs YoY).

EPS: $2.08 beat estimates by 48.6%.

Axon Cloud: Revenue up 40.8% YoY to $230.3M.

TASER Growth: Revenue up 37.1% YoY to $221.2M, gross margin expanded 4.2 PPs.

ARR & Future Revenue: ARR hit $1.00B (+36.7% YoY), future contracted revenue exceeded $10.1B (+41.5% YoY).

Net New ARR: $116M, up 45.0% YoY.

Strong Enterprise Growth: Largest contract in company history secured in Q4.

NRR: 123%, +1 PPs YoY.

🟡 Neutral

Guidance: FY 2025 revenue guidance of $2.55B - $2.65B (+24.7% YoY) in line with estimates.

Operating Expenses: SG&A/Revenue 39.5% (+7.7 PPs YoY), R&D/Revenue 23.4% (+4.0 PPs YoY).

CAC Payback Period: 21.1 months, up from 15.6 months last quarter (subscription revenue ~40% of Revenue).

Axon Cloud Margin: 73.7% (-0.9 PPs YoY).

TASER 10 Supply Constraints: Demand outpacing supply, requiring manufacturing expansion.

🔴 Negative

Operating Margin Decline: -2.7% (-13.6 PPs YoY).

Sensor Segment Margin Decline: Revenue up 15.3% YoY, but gross margin dropped 13.5 PPs to 32.8%.

Stock-Based Compensation (SBC): SBC/Revenue 23%, up 4.1 PPs QoQ.

Share Dilution: Basic shares up 1.7% YoY, diluted shares up 6.4% YoY (+3.6 PPs QoQ).

Regulatory Risks: Arizona legal challenges may impact headquarters expansion.

Tariffs & Trade Restrictions: DJI import restrictions create risks, despite Skydio partnership gains.