Axon Enterprise Q2 2024 Earnings Analysis

Dive into $AXON Axon’s Q2 2024 earnings with review of financial performance, key metrics, operating expenses, dilution, customer growth, future outlook

Financial Results:

↗️$504M rev (+34.6% YoY, +34.3% LQ) beat est by 5.5%

↘️GM (60.3%, -1.7 PPs YoY)🟡

↗️GM* (62.5%, +0.1 PPs YoY)

↗️Adj EBITDA Margin (24.5%, +2.7 PPs YoY)

↗️FCF Margin (14.2%, +6.3 PPs YoY)

↘️Net Income Margin* (18.5%, -3.9 PPs YoY)🟡

↗️EPS* $1.20 beat est by 17.6%🟢

*non-GAAP

Revenue By Segments

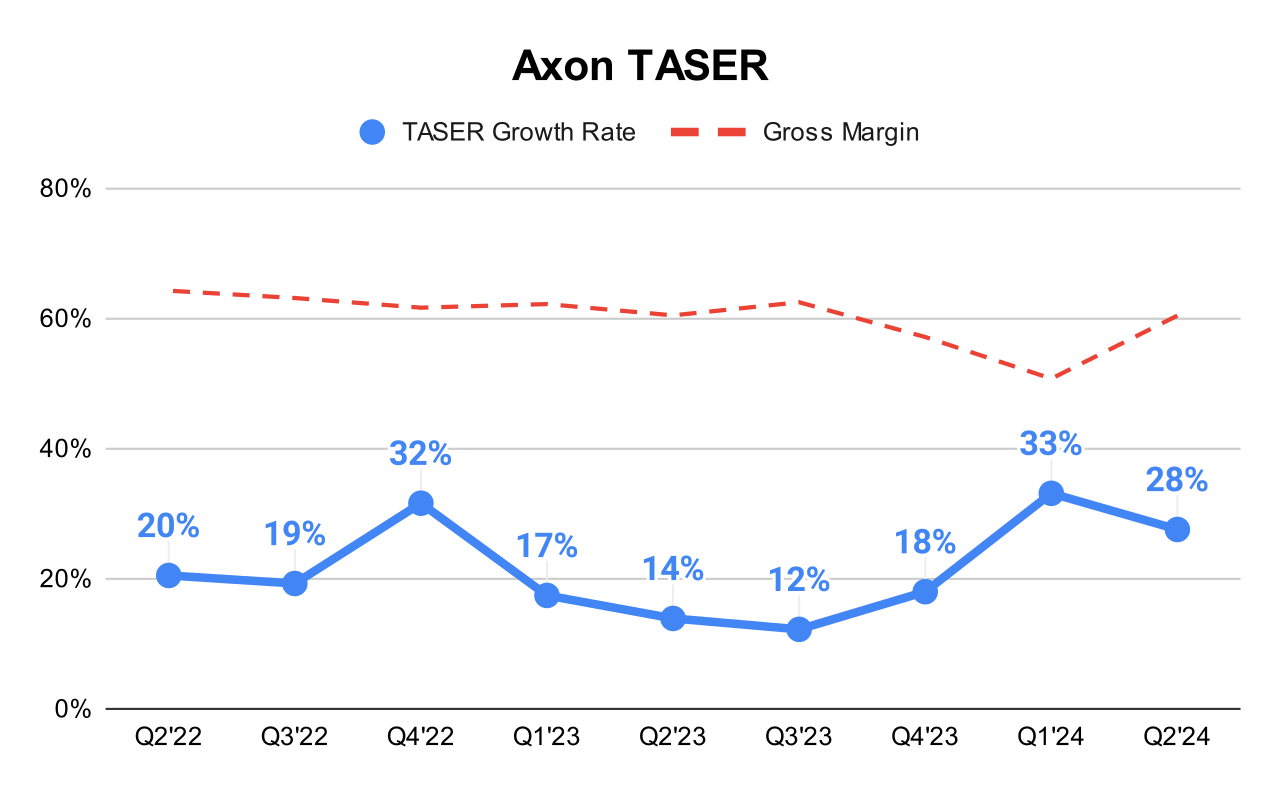

TASER

➡️$197.0M TASER rev (+27.6% YoY)

↘️GM (60.4%, 0.0 PPs YoY)

Sensors and other

➡️$112.4M Sensors and other rev (+28.4% YoY)

↘️GM (38.9%, -14.0 PPs YoY)

Axon Cloud

↗️$194.7M Axon Cloud rev (+46.8% YoY)

↗️GM (72.4%, +2.7 PPs YoY)

Key Metrics

➡️NRR 122% (122% LQ)

↗️Total company future contracted revenue $7.35B (+41.0% YoY)

↗️ARR $850M (+44.0% YoY)

Operating expenses

↘️SG&A*/Revenue 25.9% (-2.1 PPs YoY)

↘️R&D*/Revenue 14.6% (-0.5 PPs YoY)

Quarterly Performance Highlights

↘️Net New ARR $25M (-35.9% YoY)

Dilution

↘️SBC/rev 15%, -1.5 PPs QoQ

↘️Share count up 2.3% YoY, -2.07 PPs QoQ

Guidance

↗️Q3'24 $2,000.0 - $2,050.0M guide (+29.5% YoY) beat est by 2.3%

Key points from Axon’s Second Quarter 2024 Earnings Call:

Financial Performance:

The company reported a significant increase in revenue and bookings, with Q2 revenue surpassing $500 million and bookings over $1 billion, driven by strong demand across all business segments.

Adjusted EBITDA for Q2 was reported at $123 million, with a 24.5% margin, marking the highest level in over three years.

Product Innovations:

Draft One - new AI-driven software that automatically generates the first draft of police reports from Axon Body camera recordings. Launched in April, it has been highly successful, generating a $100 million pipeline in just three months.

TASER:

TASER 10 device is the fastest-selling in Axon’s history, with demand pacing at more than twice the rate of TASER 7. It has been particularly popular outside the traditional U.S. state and local customer base, including federal, international, and corrections customers.

Axon booked its largest-ever contract with a U.S. state and local customer and its largest-ever corrections deal, with international bookings doubling year-to-date.

Sensors:

Alongside TASER 10, Axon shipped the most body cameras ever in a single quarter. The adoption of Axon Body 4 and related premium software continues to grow.

Axon's sensor products are increasingly integrated with AI capabilities and real-time operational tools, enhancing their utility and effectiveness.

Axon Cloud:

Cloud and Services segment grew by 47% year-over-year, with software revenue driving a significant mix shift—39% of total revenue in Q2, up from 35% last year.

The acquisition of Fusus is being leveraged to enhance the Axon cloud ecosystem, particularly in mapping software and real-time operations.

Axon's future contracted revenue stands at approximately $7.4 billion, up 41% year-over-year, and Annual Recurring Revenue (ARR) at $850 million, up 44% year-over-year.

Acquisitions:

Axon is focusing on enhancing its real-time operations and drone capabilities through strategic acquisitions. Fusus, acquired for its advanced real-time operations platform, integrates multiple data streams into a unified system. Axon plans to complete the acquisition of Dedrone later in the year, expanding its footprint in the drone and robotic security market.

These acquisitions are aimed at integrating and enhancing Axon's existing product suite, particularly in real-time data management and drone as a first responder technologies.

International Growth:

Axon reported a 100% increase in international bookings year-to-date, indicating significant growth and acceptance of its products outside the U.S.

The growth is attributed to strategic leadership changes and product introductions like TASER 10, which has been particularly well-received internationally.

The focus has been on regions where Axon sees strong potential for growth, leveraging new leadership in Europe and other international markets to drive expansion.

Economic Impact:

Axon's business model and essential service offerings tend to insulate it from significant impacts of macroeconomic fluctuations. Historically, economic downturns have not significantly affected Axon’s operations, as the company provides critical services that remain in demand regardless of economic conditions.

During economic downturns, while agencies might tighten budgets, they also seek productivity enhancements, which Axon can provide through its technology solutions. Products like Draft One can save significant time for law enforcement agencies, offsetting potential budget cuts by increasing efficiency.

Much of Axon’s revenue comes from long-term contracts, which provide financial stability and predictability even during uncertain economic times.

Future Outlook:

Axon raised its full-year 2024 revenue and adjusted EBITDA guidance based on strong performance and positive business momentum.

The company remains optimistic about its innovative pipeline and upcoming products, particularly in areas like AI, real-time operations, and drone technology.

Management comments on the earnings call.

Draft One:

Rick Smith, CEO: "Our customers' response to Draft One is better than anything I've seen, better than we could have imagined. They want to put more data into the cloud with Axon, they want to better access that data, and they trust us to protect their data."

TASER 10:

Josh Isner, President: "TASER 10 is the fastest selling TASER device in our history. Not only is demand pacing at over 2x the rate of TASER 7, but we've been able to scale shipments each quarter since launch."

Axon Cloud:

Brittany Bagley, COO & CFO: "Cloud and Services remains the fastest-growing segment at 47% year-over-year. Our software growth stands out and has continued to drive mix shift with 39% of revenue coming from software and services in Q2."

Customers:

Rick Smith, CEO: "We work tirelessly. For decades we have to earn our customers' trust. We've led three major tech revolutions: TASER energy weapons, wearable cameras, and cloud software. And we have several more in progress."

International Growth:

Josh Isner, President: "Our international bookings are up 100% year-to-date versus last year. This is really the convergence of a couple things that we've been working on for a couple years now... The strongest international team we've had."

Challenges:

Rick Smith, CEO: "AI is a hot topic right now. And there's concern about the commoditization of the underlying models. Some major tech companies are investing billions of dollars and then open sourcing their models, making some of the LLMs, these foundational models, free and potentially demonetizing the foundation model layer of the AI ecosystem."

Thoughts on Axon Enterprise ER $AXON:

🟢 Pros:

+ Revenue accelerates to +34.6% YoY.

+ FY 2024 guidance increased by 3.0%.

+ Axon Cloud revenue growth rate +46.8% YoY.

+ Dollar-Based Net Retention (DBNR) is stabilizing at 122%.

+ Annual Recurring Revenue (ARR) is growing +44.1% faster than revenue.

+ Total company future contracted revenue is growing +41% faster than revenue.

+ The company is increasing margins and profitability.

+ Non-GAAP Gross Margin strong at 62.5%, up from Q2 last year 62.4%.

+ TASER 10 has shown robust demand.

+ Management noted that the customer response to Draft One is better than anything in the company’s history.

🔴Cons:

- Weak number of +25 net new ARR added, -36% YoY.

🟡 Neutral:

+- SBC/rev at 15% decreased from 16% in the last quarter.

+- Weighted-average number of common shares up 2.3% YoY.